Research Article: 2021 Vol: 25 Issue: 2

Indian Retail Entrepreneurs and International Marketers: A Viable Business Ecosystem For Indian Start-Ups

Pranav Kumar, School of Business, Skyline University College, University City of Sharjah

Usha Seshadri, VIT-AP University

Abstract

India has become one of the largest and fastest growing e-commerce markets in the world. This unprecedented growth has been spurned by India’s large population (17.7 % of the world's population live in India), its young population demographic, and the government's recent policies to open their e-commerce market to foreign investment. The government has started programs to promote Indian entrepreneurism as a means to grow the Indian economy. As a result of large foreign e-platform firms skirting India’s retail competition laws, stricter e-trade regulations have been put in place by India’s government. Liberalization of the e-commerce market in India has brought prosperity and risk. Along with the benefits, there are changes in the narrative about economic growth that can have long-term effects on how individuals and governments approach change. Change on the order of magnitude required for implementing the “Digital India” program is hard to comprehend; how India’s diverse population deals with this change will depend on how it is perceived. “Digital India” has already generated a number of billionaire unicorn platform entrepreneurs— it has also generated thousands of informal sector, platform dependent, “independent contractor” entrepreneurs. This review and synthesis of the literature discusses how words like “entrepreneur”, “ecosystem”, “co-creation” and “partner” take on new meanings with respect to e-platforms and their complementors. The changing meaning of words has an impact on the perception of what change brings to governments and communities. For this reason, the language of “economic growth” discourse is important and should be discussed and debated in ways that respect the powerful nature of narrative in the process of change— the framing of discourse will affect issues of distributive justice.

Keywords

Platform Entrepreneur, Distributive Justice, E-commerce, Foreign Direct Investment.

Introduction

Retail entrepreneurs building global businesses on e-marketing platforms are given the opportunity to generate personal wealth through their access to a pool of customers from around the world; their successes can resonate-providing opportunities for others and improving economic conditions in their local communities (Schumpeter, 2006; Etemad, 2017; Vellody & Bahl, 2019). Recently, India’s brick-and-mortar retailers have accused Amazon and Flipkart (both giant American e-commerce marketing platforms) of skirting India’s competition laws by undercutting Indian retailers and small sellers-through engaging in exclusive contracts with brand retailers (Choudhury, 2015). The controversy has resulted in the Indian government imposing new Foreign Direct Investment (FDI) regulations on foreign owned e-commerce marketing platforms (Dutta & Roy, 2011; Choudhury, 2015; DIPP, 2017; Kamble & Walvekar, 2017). The purpose of this study is to gain insight into the various contextual layers through which governments and stakeholders view the relationships between e-marketing foreign owned e-platforms and local start-up entrepreneurs who build their businesses on them. The study will focus on India.

There is a plethora of studies that readily acknowledge power gradients exist that favor e-platform firms over all other complementors - including retail entrepreneurs operating within the e-platform ecosystems these platforms foster (Kapoor & Agarwal, 2017; Cennamo, 2019; Cutolo & Kenney; 2019; Miric, et al., 2019). Despite this asymmetry, in many studies the term “partnership” is used to describe the relationships between the platform firm and the complementors (Gawer & Cusumano, 2014; Zhu & Liu, 2018; Vellody & Bahl, 2019). Cutolo & Kenney (2019) have challenged this use of the term “partnership”; they have identified a gap in the literature with respect to the cause and extent of asymmetries between e-platforms and their complementors. They suggested the term “Platform Dependent Entrepreneurs” (PDEs) might better reflect the restrictions e-platforms impose on the retail entrepreneurs’ autonomy. This work will try to address sources of this asymmetry and the contextual issues around the use of terms such as “ecosystem”, “partner” “co-creation” and “entrepreneur” in describing these imbalanced relationships between the platform firm and the complementors.

Research questions

1. Have India’s new FDI regulations challenged the narrative that firms which provide dominant, self-regulated, e-marketplace platforms foster ecosystems that provide fair opportunities for all complementors, regardless of their geographic location, to compete in international markets as independent, autonomous, entrepreneurs?

2. Do ecosystems fostered by technology platforms supported by e-marketplace firms change the nature of entrepreneurship for Indian retail entrepreneurs - creators, sellers and vendors all of whom are considered (platform complementors)?

Materials and Methods

This study is a qualitative literature review and integrative synthesis which incorporates both qualitative and quantitative studies. The design uses narrative analysis which focuses on the research questions regarding - whether or not unregulated / self-regulated e-marketplace platforms foster entrepreneurship.

Purposive sampling was used. The selected studies were from peer-reviewed papers. Books and articles from news sources, government publications, and white papers were also included. The selection of literature was cross-disciplinary. An initial keyword search was used based on the keywords deemed appropriate for the research in several databases [viz. Springer, Elsevier, Web of Science, Ebsco, Emerald, Proquest, etc.]. Abstracts were read and evaluated for scope. Purposive sampling was used to narrow the data set to a manageable size for analysis (Ames, et al., 2019). Additional searches were generated through an iterative process of reflective, inductive, purposive sampling based on the articles initially retrieved; internal references and cross-referencing were used.

Qualitative review and evidence syntheses are often composed of qualitative literature studies only (Grant & Booth, 2009). However, in complex cases, quantitative studies may be used in conjunction with the qualitative studies; in such cases, quantitative studies must be qualitized - treated as qualitative without reference to any statistical results (Snyder, 2019). Integrative review and synthesis is a methodology that is frequently chosen to study complex, diverse, topics which may be subject to a broad range of interpretation.

The methodology surrounding the qualitative review and synthesis is relatively new and continues to evolve (Ring, 2011). The research paradigm underpinning the theoretical approach to this work follows the ontological assumption of constructivism and the epistemological stance of subjectivism.

Literature Review

The Indian Government is aware of the opportunities that e-platforms present (Bhattacharya, 2019; Thomas, 2019; Vellody & Bahl, 2019; CCI, 2020); they are less aware of the risks because platform technology is relatively new - there are known and speculated risks (ESCAP, 2018) as well as unimagined, incalculable risks that will only come to light over time (Beck, 2006). The Indian government is currently involved in the large-scale promotion of Indian entrepreneurship as an avenue for attracting foreign investment and promoting economic growth (Dhoot, 2015).

The potential for development of digital entrepreneurism in India is undeniable; India has an online population of ~ 650 million which is expected to rise to over 800 million by 2021 (Vijay, 2020). However, the e-commerce market remains largely untapped - comprising only 5% of India's retail market - currently estimated at ~ USD $600 billion (Jiang, 2019). India’s e-commerce sector has risen over USD $7 billion in private equity and venture capital funding (“E-commerce, Consumer Internet Cos Raised Over $7 bn”, 2020). India had ~ 425 million internet users as of January 2018 - with the number expected to reach over 650 million by 2023; India is second only in the Asia-Pacific market to China - with roughly 750 million online users in January, 2018 (Kalyani, 2019; "Internet users in India Statista", 2020). India makes up 17.7% of the world’s population; it is this huge potential market for e-commerce that is attracting big league players like Amazon and Walmart who have been investing heavily in bringing India online (Choudhury, 2018; "India Population (2020); Worldometer", 2020).

Bhattacharya (2019) notes the close connection between the digitization of India and the rising start-up culture that has taken root there. Inspired by Silicon Valley start-up successes, Indian entrepreneurs have joined with Multinational Enterprises (MNEs) to tap the social capital of existing business networks - allowing start-ups to link product sources with customer preferences and demands. India’s entrepreneurs have created culturally Indian “X-as-service” model solutions - examples include (Ola Cab, Flipkart, Zomato, and Paytm).

The Indian Government: Protectionism and E-Platforms Amazon and Flipkart

The Indian government put new FDI regulations in place on February 1, 2019 (DIPP, 2017; ESCAP, 2018; Choudhury, 2018). The regulations came in response to complaints by domestic retailers regarding e-marketing platform firms offering deep discounts to retail customers as a result of exclusive trade agreements they had forged with global brand marketers (Choudhury, 2015; DIPP, 2017; Kamble & Walvekar, 2017). The government asserts that the FDI rules are intended to ensure a “level playing field” for all Indian retailers (“CCI defends its Probe Order”, 2020).

The new policy prohibits foreign e-marketing companies from selling products exclusively online. Online marketing platform firms with foreign investments cannot allow retail firms in which they hold equity stake to sell products or services on their marketing platform (DIPP, 2017; Choudhury, 2018). Foreign e-marketing platforms must operate as either inventory sellers or marketplaces (facilitators for non-related vendor transactions only) - but not both (DIPP, 2017 5.2.15.2.3 and 5.2.15.2.4). Foreign marketing firms are prohibited from stocking over 25% of the total inventory of a single vendor - or offering deep customer discounts obtained through exclusive vendor contracts (DIPP, 2017). Finally, data collected from Indian users through e-commerce, social media, search engines, or the internet of things, will be stored on servers within India under Sri Krishna commission recommendations (Choudury, 2018).

The rules changed just months after Walmart Inc. paid $16 billion for 77% controlling interest in Flipkart Online Services Pvt. Ltd. which was started by two IIT Delhi graduates and former Amazon employees, Sachin Bansal and Binny Bansal (Sachitanand, 2013; "Walmart acquires Flipkart", 2018). Walmart has since lobbied the US government to confront the Indian government regarding unfair, protectionist, and regressive FDI regulations which may hurt trade between the two countries (Kalra, 2019). Opinions are divided between whether the Indian government has made a grave error by passing protectionist regulations - or if regulation is indeed needed to curtail the opportunities for abuse of power that result from the proprietary nature of e-platform technologies (Choudhury, 2018).

The Technology Platform: Ecosystem or Rentier Platform?

In the case of technology platforms: - the ecosystem comprises the platform’s sponsor plus all providers of complements that make the platform more valuable to consumers (Jacobides, et al., 2018).

The ecosystem metaphor (adopted from biology and used to depict traditional business situations) (Moore, 1993), implies a symbiotic relationship among the actors that results in mutual benefit and a shared fate for all involved - the platform firm and the sellers it facilitates (as well as all other complementors) work together with the same objective - providing the best value to their customers (Tiwana, et al., 2010; Jacobides, et al., 2018). While most studies describe the interdependence between the e-platform firm and its complementors as a circumstantial one - based solely on the consequence of their shared goals and shared fate, some researchers, and many platform firms, go so far as to assert the relationship constitutes a business partnership (Montag, 2018; Zhu & Liu, 2018; “Swiggy Partners”, 2019; “Zomato for Business”, 2019). Cutolo & Kenny (2019) question the use of the term “partnership” in this context - given the well-established, significant power gradient between the firm that controls the e-platform and the many complementors that use it. Sadowski (2020) points out that the platform extracts “rents” from complementors that use it.

Digital platforms: “Entrepreneurs” and “Sharing economies”

E-platforms are often presented in altruistic terms by the firms that operate them as “spaces” which provide support and assistance to new and inexperienced entrepreneurs (Ramaswamy & Gouillart, 2010; Shandrow, 2015; Zipkin, 2015; "Amazon Launchpad", 2020). E-platforms are also credited for supporting environmentally sustainable futures by fostering political “economies of sharing” (Frenken, 2017). Indeed, PDEs are necessary in order to disrupt entrenched businesses and co-create the ostensibly more environmental-friendly sharing ecosystem which supports innovations such as Airbnb, Uber, Ola Cab, etc. - generating profit while saving the planet by commodifying unused asset

Platforms, Ecosystems, and Dependency of Entrepreneurs

E-platforms are first and foremost businesses with a goal of maximizing profit (Cutolo & Kenny, 2019). They operate to foster “ecosystems” in the sense that they require the attachment of complementors to the platform in order to succeed; Amazon cannot operate without sellers, Ola Cab cannot operate without drivers, etc. The platform owner is free to “regulate” the platform by implementing and altering rules unilaterally; entrepreneurs must contractually relinquish autonomy to the platform owner to join the platform - this is necessary to ensure the platform operates smoothly (Ceccagnoli, et al., 2012; Rossotto et al., 2018). In exchange, the platform provides an array of benefits to the entrepreneurs who join.

An important feature of the e-platform “ecosystem” model is that the complementors be “independent entrepreneurs” and not employees. On-demand platforms include: Swiggy, Zomato, Ola Cab, and Uber. Mishra (2019) notes, that for instance, food delivery platforms define themselves as “apps” and not employers - these firms assert that they function only to connect customers, restaurants, and “delivery executives” with each other. This shields the platform firm from liability. Delivery executives work long hours for little compensation - as “independent contractors” they have no benefits, and no job security (Sen, 2019). They also face difficulty using traditional avenues of redress when labor disputes occur between the platform firm and PDEs (Joseph, 2019; Mishra, 2019; Mishra, 2019).

A group of delivery partners in Kochi publicly protested against the delivery platform, Swiggy, for changing the terms of partnership between the platform and the delivery executives. Executives had been receiving Rs.25 for delivering food within 4 km - with payment of an additional Rs.5 for each extra kilometer; Swiggy unilaterally adjusted the delivery partners’ pay - eliminating the compensation for extra distance over 4 km (Joseph, 2019). In addition, Swiggy changed incentive pay from Rs.1000 for working a minimum 12 hour day to only incentivizing after 16 hrs. Some of the partners decided to protest on their off hours; many of those who participated found they were unable to logon to the app and work the next day.

Internet of Landlords (IoL)

Sadowski (2020) asserts the e-platform fosters a new form of rentier capitalism which he refers to as the “Internet of Landlords”; most e-platform types are some form of technology designed to supply a good or service and/or a technological space and the tools necessary for creating a good or service. In either case, the main purpose of the primary platform involved is to control access and collect rents. Platforms attract entrepreneurs by lowering opportunity costs which can present entry barriers for start-up businesses and new entrepreneurs (Cutolo & Kenny, 2019). New ventures require capital, customers, advertising, employees and so forth - that many start-ups do not have means to obtain (Ceccagnoli, et al., 2012; ESCAP, 2018). Platform ecosystems attract entrepreneurs and other complementors by providing interface-access, matching algorithms, and other necessary software - along with advertising and other support - often for free (Cutolo & Kenny, 2019). These are large scale investments that carry risk; these sunk costs are borne by the platform to incentivize complementors to join (Thomas, 2019), when a platform becomes dominant (such as google or Amazon), the incentives to join are high, and the lock-in for complementors is also high (Srinivasan & Venkatraman, 2017; Cutolo & Kenny, 2019; Hsieh & Wu, 2019). If a retail entrepreneur builds a thriving business on Amazon’s platform, moving the business is not a viable option.

Once the PDEs are securely entrenched within the ecosystem, customers' access to their businesses is strictly through the platform portal. Regardless of the product or service the PDE provides, platforms allow the commodification of everything from unused rooms in a house (Airbnb) to unused seats in a car (Ola Cab) to X-as a service options such as food delivery (Swiggy and Zomato) - taking a cut of all transactions that cross the platform (Sadowski, 2020).

The Risk of Private Equity Funding for Indian Platform Entrepreneurs

Choudhury elucidates the risk involved for India in allowing unregulated private equity (PE) to be used to fund Indian e-start-ups (ESCAP, 2018). Currently, the e-commerce segment is the largest recipient of private equity funds for the service sector ("Services Sector in India: IBEF", 2020). This has certainly contributed to growth in the sector; however, PE has been detrimental to new start-ups (ESCAP, 2018).

After PE investors acquire stakes in newly established firms, they frequently sell the shares high after a short period of time often ~ 5 years. Once PE firms have sufficient controlling shares they force mergers and speculate on the outcomes (Choudhury, 2015). Although entrepreneurs are frequently aware of the harmful nature of taking PE, they are often left without recourse - bank loans are difficult to obtain - particularly for young Indian entrepreneurs with no collateral (ESCAP, 2018). While the government of India has done much to provide funding to Indian start-ups through its programs such as “Stand Up India” and “Start Up India” ("Stand Up India", 2020), more must be done to keep PE funding for speculative investment from interfering with the stability and trajectories of India’s start-up companies (ESCAP, 2018).

India is one of the largest, fastest growing, e-commerce markets in the world. The e-commerce market in India is expected to reach USD $200 billion by 2026 - up from a reported USD $38.5 billion in 2017 (“E-commerce in India: IBEF”, 2020). The incredible growth rate of India’s e-commerce sector has been driven by the increasing number of mobile subscribers and subsequent high internet penetration; these changes, in combination with demonetization - followed by an increase in the use of credit cards among India’s young population, are all factors in the rise in India’s e-commerce segment (ESCAP, 2018). While the Indian government has indicated that “Digital India” is designed to grow the economy, economic growth is just one aspect of improving the conditions of the people of India. I will give you a talisman. Whenever you are in doubt, or when the self becomes too much with you, apply the following test. Recall the face of the poorest and the weakest man [woman] whom you may have seen, and ask yourself, if the step you contemplate is going to be of any use to him [her]. Will he [she] gain anything by it? Will it restore him [her] to a control over his [her]own life and destiny?

Subramanian (2019) invokes the above quote in discussing the need to examine not just the extent but the nature of economic growth in India. Looking at inequality in the distribution of consumption and household wealth reflects the very diverse geographical, cultural, political, and social fabric of India. Using the GDP of India as the main metric for determining economic growth belies the complex nature of poverty and ignores the effect of poverty reduction measures that have been instituted since liberalization (Kaul, 2015; Balaji, 2020). The household consumer expenditure survey is most often used to estimate poverty in India ("Household Consumer Expenditure Survey", 2019). The Indian government’s FDI regulations are important in relation to addressing issues regarding the effects of bringing India online from the many perspectives of the Indian people - including the position of India’s entrenched, offline small sellers and informal retail networks. The Indian government must consider the greater good of all Indian people. Internet has brought about an increase in the awareness of self-identity and aspirations across India. Kaul (2015) notes: If not managed and fulfilled constructively, these aspirations of the younger generation may put Indian society in chaos (p.2). While India has great strength in its diversity - Kaul believes that India faces such unique challenges that any developmental model must be internally derived and implemented.

Economies Advance by Experiencing Periods of Creative Destruction

Capitalism produces cycles where static economies will eventually encounter periods of disruptive, non-equilibrium (Schumpeter, 2006). These periods of “creative destruction” cause the real long-term economic change that brings great benefit to society. Schumpeter’s theory asserts that significant economic change is driven by the periodic appearance of disruptor “entrepreneurs” (Schumpeter, 1983). These “heroic”, “risk taking”, visionaries manage to succeed in seeing beyond entrenched perspectives - and somehow manage to find the materials, and forge the connections necessary to create innovative new technologies and processes (?ledzik, 2013). The contributions of these successful entrepreneurs disrupt incumbent firms and entrenched patterns of business organization - producing further opportunities for rapid, high levels of socioeconomic growth that will last until economic equilibrium is reestablished. Schumpeter (2006) refers to this as: “ - the perennial gale of creative destruction…… (p. 84).”

If disruption is part of the process of economic growth, the Indian government must weigh the cost of regulatory interference in what may be a normal yet painful, process of disruption - eliminating many small on- and offline vendors - against the prosperity that will come to a fully online India. This must be examined with respect to the extent and nature of the spread of that prosperity.

Results

1. There is an asymmetric power relationship between proprietary platforms and those who engage them either as complementors or end users.

2. The platform firm takes on significant sunk costs and provides start-up e-platform entrepreneurs with interface-access, matching algorithms, advertising, and other necessary tools which significantly lower entry costs for e-retail entrepreneurs and their start-ups.

3. Platform technology is most often proprietary; complementors and clients receive only what data and technology the platform firm decides they see.

4. The platform controls the regulations of the “ecosystem” - often capturing then storing and controlling data use? data ownership effectively occurs by default; “ecosystem regulation” is done by the platform firm - which may remove PDE’s for rules infractions for which the PDEs will have no recourse.

5. Platform firms are often a source of Private Equity for funding other platforms or PDE start-ups.

6. PE from foreign sources (whether equity or portfolio investment) often provides funds for Indian start-ups that may not be able to obtain funds from banks due to lack of collateral.

7. PE investment is usually venture capital aimed at short-term profit; exits from the market after short times as well as forced mergers can be damaging to India’s entrepreneurs and their start-ups.

8. There has been a steady loss of contextual meaning around words such as “partner”, “ecosystem”, “co-create” and even “entrepreneur”. This loss of context in the narratives about FDI can confound the dangers startups face by confusing start-up entrepreneurs, the public, and other stakeholders about the nature of market transactions and investments.

9. The term entrepreneur implies some independence, and platform entrepreneurs have little to no independence; the platform can remove the entrepreneur partner - replicating and producing his or her product. The PDE is left without redress.

Discussion

E-commerce has transformed business in India which has become one of the largest and fastest growing e-markets in the world ("Services Sector in India: IBEF", 2020). Walmart’s buyout of Flipkart for 16 billion is the world’s largest acquisition of an e-commerce firm (Kalra, 2019). Jeff Bezos, founder, CEO, and president of Amazon.com, recently pledged to invest a billion dollars in India to help bring more SMEs in India online (Au-Yeung, 2020). It is this unprecedented growth and potential as well as India’s young population demographic, and the success of Indian e-entrepreneurs such as Bhavish Aggarwal (Ola Cabs), Vijay Shekhar Sharma (Paytm), Binny Bansal and Sachin Bansal (founders of Flipkart) and others that have made Indian e-commerce attractive to private investors both foreign and domestic (Singh & Goswami, 2019). India has fostered some of the youngest billionaire entrepreneurs in the world today - women entrepreneurs such as Ankiti Bose (Zilingo) (Gilchrist, 2019) are appearing on the scene as well. Internet success stories such as that of Div Turakhia Div (Huddleston, 2018) and Binny Bansal and Sachin Bansal (Sachitanand, 2013) support Schumpeter’s theory of creative destruction bringing beneficial change.

The purpose of the Digital India program is to transform India into a knowledge economy. The aim is to foster increased economic growth through pushing digitization and internet connectivity throughout India (Choudhury, 2018). The conditions for fostering a knowledge economy are particularly good considering the age demographic of the Indian population; In 2018, India entered a 37 year period of demographic dividend (where the working age group exceeds that of the dependent age group) (Thakur, 2019). E-platform technology, like all technologies, is inherently neither good nor evil. This integrative review of the literature has identified within the literature, some considerations for India’s support of entrepreneurs going forward:

1) The new FDI regulations appear reasonable:

a) Regulations protect India’s retailers and start-ups from unfair market competition.

b) Regulations address proprietary data handling technologies that allow platform capture and commodification of user data (whereby the platform firm assumes “ownership” of data by default). The policy leaves the matter of data handling and ownership open to further consideration and restricts the location of Indian users’ data to servers in India. This caution acknowledges Beck’s work on unknown risk (Beck, 2006).

c) The FDI rules take into consideration the need to further investigate and potentially regulate mergers and acquisitions (which is reasonable based on the power asymmetries of the platform and on the high level of PE investment in India’s start-ups that is serving to generate speculative short-term gain at the expense of the start-ups). Choudhury discusses these problems in detail (Choudhury, 2015, 2018; ESCAP, 2018).

2) Many young entrepreneurs are aware of the dangers of turning to PE for financial support - they do so out of necessity. Further education on the potential outcomes of using such channels for support should be provided through India’s entrepreneurial support programs so that all learners are aware of the possible rewards and pitfalls.

3) There is a need for further financial support through India’s government and banking channels to counter the damaging effects of PE on Indian start-ups.

4) ndia is now home to many of the world’s youngest billionaire entrepreneurs. This creates an atmosphere among young people that regulation may interfere with maintaining such avenues for their own potential successes. In addition, words like “partnership”, “entrepreneur”, “co-creation” and “independent contractor” are being used liberally to obfuscate immense job growth in the informal sector - where thousands of India’s youths are taking on jobs such as “delivery executive” without appropriate benefits and protections established under Indian labor law. This is a problem that the Indian government needs to continue to address.

5) The use of language in economic studies, which describes all human interaction in terms of market transactions, creates barriers to important conversations that consider the economic changes occurring as India comes online in larger contexts of social, political, and ethical complexities. The use of neoliberal language may exclude avenues for India’s young entrepreneurs to explore their vision for tomorrow’s India in these richer contexts. Such conversations could take place in many different settings including the classroom (Massey, 2013; Monbiot, 2016; Grant, 2016; Shukla, 2020).

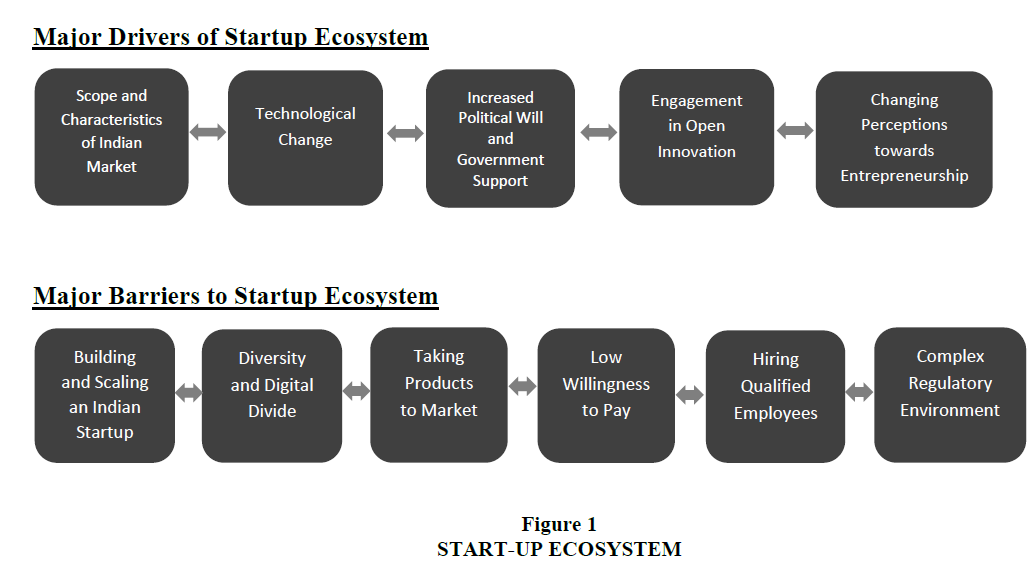

Additionally, looking at the current Indian context, following are the major driving forces and barriers to start-up ecosystem in Figure 1.

Despite having multiple barriers, the Indian startup ecosystem has come a long way ahead, and it has been contributing effectively to the growth story of India. Following Table 1 provides a comprehensive picture of India’s top performing startup sectors (NASSCOM & Zinnov, 2019).

| Table 1 Comprehensive Picture of India’s Top Performing Startup Sectors | |||||

| S.No. | Sectors | Percentage of Total Startups | Technologies Involved | Web Platforms Utilized | Key Drivers |

| 1 | Education Sector | 6% | Big Data and Analytics, AR/VR | Drupal, Magento | Horizontal and vertical solutions for school integration, online LMS, digital learning & assessment, etc. |

| 2 | Financial Sector | 10% | Blockchain, Artificial Intelligence | Drupal | Financial inclusion, lending, wealth management, banking & insurance, etc. |

| 3 | Mobility | 3% | Artificial Intelligence, Big Data and Analytics | Weebly, Wordpress | New business models for improving connectivity, payment integration, etc. |

| 4 | Automotive | 4% | Internet of Things, AR/VR | Joomla, Wordpress | Enhanced features, comfortable drive, technological solutions, etc. |

| 5 | Healthcare | 14% | Blockchain, Big Data and Analytics | Drupal, Magento | Addressing awareness, accessibility, affordability, preventive care, curative care, etc. |

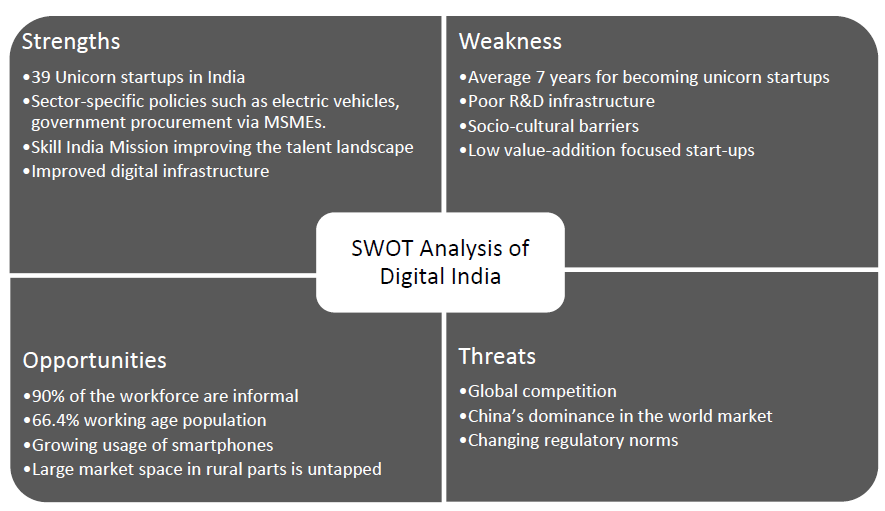

Furthermore, from the overall discussion presented above, SWOT (strengths, weaknesses, opportunities and threats) analysis of digital India can be portrayed as such

Conclusion

The changing landscape of Indian startup ecosystem is fueled with strong sector-specific economic and technological interventions. There is a narrative building among the internet users, academia, private and social sectors on the growth potential and multiplier effect of startups in India. Consequently, several policies or schemes are developed around this such as Atmanirbhar Bharat, Production-Linked Incentives, India stack development initiative, etc. Indeed, the rise of gig economy in India has opened up the market of leveraging the online platforms for providing services to large consumer base. However, a stringent regulation is required to protect such a huge start-up ecosystem from big corporates using unfair means to compete, or purchasing equities in start-ups which can be rewarding as well as full of risks imperiling aspirations of millions of young entrepreneurs. Moreover, the internet spreads opportunity and also narrative; language and phrases such as “entrepreneurial independence”, “co-creation of sharing economies”, and “ecosystems that foster entrepreneurs” - that are frequently used to discuss “Digital India”, need to be examined and publicly discussed and debated by the academic community. Finally, using only utilitarian language to discuss change alters social conversations in ways that effectively exclude the consideration of many stake-holders from the narrative. The use of market language to describe all aspects of life discourages the consideration of the potential long-term outcomes of changes, such as bringing India online - as they may affect the wellbeing of individuals and communities throughout the larger society.

References

- Ames, H., Glenton, C., & Lewin, S. (2019). Purposive sampling in a qualitative evidence synthesis: A worked example from a synthesis on parental perceptions of vaccination communication. BMC Medical Research Methodology, 19(1).

- Au-Yeung, A. (2020). Jeff Bezos Announces Amazon Will Invest $1 Billion In India As Negative Sentiment Grows Towards The E-Commerce Retailer. Retrieved from: https://www.forbes.com/sites/angelauyeung /2020/01/15/jeff-bezos-announces-amazon-will-invest-1-billion-in-india-as-sentiment-turns-increasingly-negative-towards-the-e-commerce-retailer/#48aad9794946.

- Amazon Launchpad. (2020). Retrieved from: https://www.amazon.in/gp/launchpad/signup.

- Balaji, M. (2020). Negotiating poverty line-study on density effect along poverty line for Indian states. The Singapore Economic Review, 1-22.

- Bhattacharya, J. (2019). The story of Indian business: The great transition into the new millennium. Education about Asia 24(2), 22-27.

- Beck, U. (2006). Living in the world risk society. Economy and Society, 35(3), 329Á-345.

- Ceccagnoli, M., Forman, C., Huang, P., & Wu, D. (2012). Cocreation of value in a platform ecosystem! The case of enterprise software. MIS Quarterly, 36(1), 263.

- Cennamo, C. (2019). Competing in digital markets: A platform-based perspective. Academy of Management Perspectives.

- Choudhury, R. (2015). India’s FDI policy on E-commerce: Some Observations, Discussion Note No., DN2015/03. Institute for Studies in Industrial Development, New Delhi.

- Choudhury, R. (2018). India’s National Policy Framework on e-commerce: Issues and Concerns. Retrieved from: https://www.ideasforindia.in/topics/governance/india-s-national-policy-framework-on-e-commerce-issues-and-concerns.html.

- Cutolo, D.& Kenney, M. (2019). The emergence of platform-dependent entrepreneurs: Power asymmetries, risk, and uncertainty. (BRIE Working Paper 2019-3). Retrieved from https://brie.berkeley.edu/recent-publications/current-publications.

- Dhoot, V. (2015). Government to Set Up Startup Network to Support Young Entrepreneurs. Retrieved 14 February 2020, from: https://economictimes.indiatimes.com/news/economy/policy/government-to-set-up-startup-network-to-support-young-entrepreneurs/articleshow/47240975.cms.

- Dutta, N., & Roy, S. (2011). Foreign Direct Investment, Financial development and political risks. The Journal of Developing Areas, 44(2), 303-327.

- E-commerce in India: Industry Overview, Market Size & Growth| IBEF. (2020). Retrieved from: https://www.ibef.org/industry/ecommerce.aspx.

- E-commerce, Consumer Internet Cos Raised Over $7 bn in PE/VC capital in 2018: EY. (2019). Retrieved 14 February 2020, from https://economictimes.indiatimes.com/tech/internet/e-commerce-consumer-internet-cos-raised-over-7-bn-in-pe/vc-capital-in-2018-ey/articleshow/68318002.cms

- Etemad, H. (2017). The emergence of online global market place and the multilayered view of international entrepreneurship. Journal of International Entrepreneurship, 15(4), 353-365.

- Frenken, K. (2017). Political economies and environmental futures for the sharing economy. Philosophical Transactions of the Royal Society A: Mathematical, Physical and Engineering Sciences, A 375:20160367, 1-15.

- Gandhi, M. (2020). Gandhi's Talisman - Gandhi's Famous Quotes | Mkgandhi.org: [Last Phase, Vol. II (1958), P. 65]. Retrieved from: https://www.mkgandhi.org/gquots1.htm.

- Gawer, A., & Cusumano, M.A. (2014). Industry platforms and ecosystem innovation: Platforms and innovation. Journal of Product Innovation Management, 31(3), 417–433.

- Grant, C. (2016). Depoliticization of the language of social justice, multiculturalism, and multicultural education. Multicultural Education Review, 8(1), 1-13.

- Grant, M., & Booth, A. (2009). A typology of reviews: An analysis of 14 review types and associated methodologies. Health Information & Libraries Journal, 26(2), 91-108.

- Gilchrist, K. (2019). Meet the 27-year-old Set to Be India's First Woman to Co-found a $1 Billion Start-up. Retrieved from: https://www.cnbc.com/2019/05/23/zilingo-ankiti-bose-to-be-indias-first-1-billion-female-founder.html.

- Household Consumer Expenditure Survey Cancelled. (2019). Retrieved from: https://pib.gov.in/Pressreleaseshare.aspx?PRID=1591792.

- Hsieh, Y., & Wu, Y. (2019). Entrepreneurship through the platform strategy in the digital era: Insights and research opportunities. Computers in Human Behavior, 95, 315-323.

- Huddleston., T. (2018). This 36-year-old Self-made Billionaire Started His First Business at 16 With a $500 Loan From His Dad - Here's His Best Advice. Retrieved from: https://www.cnbc.com/2018/07/30/how-div-turakhia-became-indias-youngest-self-made-billionaire.html.

- India Population (2020) - Worldometer. (2020). Retrieved from: https://www.worldometers.info/world-population/india-population/.

- Internet users in India. (2020). Retrieved from: https://www.statista.com/topics/2157/internet-usage-in-india/

- Jacobides, M., Cennamo, C., & Gawer, A. (2018). Towards a theory of ecosystems. Strategic Management Journal, 39(Electronic Journal), 2255–2276.

- Jiang, E. (2019). Amazon has a massive opportunity in a $600 billion market (AMZN) | Markets Insider. Retrieved from: https://markets.businessinsider.com/news/stocks/amazon-stock-price-huge-opportunity-in-india-2019-2-1027981222.

- Joseph, N. (2019). Swiggy Delivery Partners in Kochi Say They’re Being Forced to Resign For Protesting. Retrieved from: https://www.thenewsminute.com/article/swiggy-delivery-partners-kochi-say-they-re-being-forced-resign-protesting-102871.

- Kalyani, P. (2019). FDI directive 2019 and impact on E-commerce market a case study with special reference to Amazon, Walmart-Flipkart and others with new entry Reliance into the market. Information Technology and Management, 6(1), 7-18.

- Kamble, A., & Walvekar, S. (2017). Policy regulations in E-commerce sector – Critical analysis of FDI guidelines for market place model. Journal of Commerce and Management Thought, 8(3), 409. doi: 10.5958/0976-478x.2017.00024.6

- Kapoor, R., & Agarwal, S. (2017). Sustaining superior performance in business ecosystems: Evidence from application software developers in the iOS and Android smartphone ecosystems. Organization Science, 28(3), 531-551.

- Kalra, A. (2019). Exclusive: Walmart Told U.S. Government India e-commerce Rules Regressive, Warned of Trade Impact. Retrieved from: https://www.reuters.com/article/us-walmart-india-exclusive/exclusive-walmart-told-u-s-government-india-e-commerce-rules-regressive-warned-of-trade-impact-idUSKCN1U620R.

- Kaul, V. (2015). India’s diversity: From conflict To innovation. World Affairs: The Journal of International Issues, 19(4), 10-43. Retrieved February 18, 2020, from www.jstor.org/stable/48505245.

- Massey, D. (2013). Neoliberalism has Hijacked Our Vocabulary | Doreen Massey. Retrieved from: https://www.theguardian.com/commentisfree/2013/jun/11/neoliberalism-hijacked-vocabulary.

- Monbiot, G. (2016). Neoliberalism – The Ideology at the Root of All Our Problems. Retrieved from: https://www.theguardian.com/books/2016/apr/15/neoliberalism-ideology-problem-george-monbiot.

- Montag, A. (2018). Amazon Says This Business Opportunity Could Make You up to $300K a Year - Here's How to Get into the Program. Retrieved from: https://www.cnbc.com/2018/06/28/how-to-apply-for-amazons-new-delivery-service-partners-business.html.

- Miric, M., Boudreau, K.J., & Jeppesen, L.B. (2019). Protecting their digital assets: The use of formal & informal appropriability strategies by app developers. Research Policy, 48(8), [103738]. https://doi.org/10.1016/j.respol.2019.01.012.

- Mishra, A. (2019). How Do Zomato, Other Apps Actually Treat Their ‘Informal’ Workers?. Retrieved from: https://www.thequint.com/voices/opinion/zomato-swiggy-internet-based-third-party-apps-informal-gig-economy-labour-rights.

- Mishra, D. (2019). Gig Economy Weighs Impact of Social Security for workers. Retrieved from: https://economictimes.indiatimes.com/small-biz/startups/newsbuzz/gig-economy-weighs-impact-of-social-security-for-workers/articleshow/71875167.cms?from=mdr.

- Moore J. (1993). Predators and prey: A new ecology of competition, Harvard Business Review, 71, 75-86.

- NASSCOM & Zinnov. (2019). Indian Tech Start-up Ecosystem. Retrieved from http://10000startups.com/

- frontend/images/Indian-Tech-Start-up-Ecosystem-2019-report.pdf

- Ramaswamy, V., & Gouillart, F. (2010). Building the Co-Creative Enterprise. Retrieved from: https://hbr.org/2010/10/building-the-co-creative-enterprise.

- Ring N. (2011). A Guide to Synthesising Qualitative Research for Researchers Undertaking Health Technology Assessments and Systematic Reviews (pp. 1-32). Edinburgh: NHS Quality Improvement Scotland.

- Rossotto, C., Lal Das, P., Gasol Ramos, E., Clemente Miranda, E., Badran, M., Martinez Licetti, M., & Miralles Murciego, G. (2018). Digital platforms: A literature review and policy implications for development. Competition and Regulation in Network Industries, 19(1-2), 93-109.

- Sachitanand, R. (2013). How Flipkart's Sachin and Binny Bansal revolutionised e-commerce in India. Retrieved from: https://economictimes.indiatimes.com/how-flipkarts-sachin-and-binny-bansal-

- revolutionised-e-commerce-in-india/articleshow/26938800.cms?from=mdr.

- Sadowski, J. (2020). The internet of landlords: Digital platforms and new mechanisms of rentier capitalism. Antipode, 52(2), 562-580.

- Services Sector in India: Overview, Market Size, Growth, Companies...IBEF. (2020). Retrieved 16 February 2020, from https://www.ibef.org/industry/services.aspx.

- Schumpeter, J. (1983). The Theory of Economic Development (pp. 1-264). New Brunswick: Transaction Publishers.

- Schumpeter, J. (2006). Capitalism, Socialism and Democracy (pp. 1-430). New York: Routledge.

- Shandrow, K. (2015). Amazon Launches New Storefront for Shark Tank and Kickstarter Successes. Retrieved from: https://www.entrepreneur.com/article/243835.

- Shukla, K. (2020). Kavita Shukla, Inventor Designer Entrepreneur. Retrieved from: https://www.kavitashukla.com/.

- Singh, L., Kumar, S., & Goswami, C. (2019). Top Entrepreneurs in India | Successful Indian Entrepreneurs [2019 Exhaustive List]. Retrieved from: https://startuptalky.com/top-entrepreneurs-of-india/.

- ?ledzik K., (2013), Schumpeter’s view on innovation and entrepreneurship (in:) Management Trends in Theory and Practice, (ed.) Stefan Hittmar, Faculty of Management Science and Informatics, University of Zilina & Institute of Management by University of Zilina.

- Snyder, H. (2019). Literature review as a research methodology: An overview and guidelines. Journal of Business Research, 104, 333-339. doi: 10.1016/j.jbusres.2019.07.039.

- Srinivasan, A., & Venkatraman, N. (2017). Entrepreneurship in digital platforms: A network-centric view. Strategic Entrepreneurship Journal, 12(1), 54-71.

- Stand Up India. (2020). Retrieved from: https://www.startupindia.gov.in/content/sih/en/government-schemes/stand-up-india.html.

- Subramanian, S. (2019). Inequality and Poverty: A Short Critical Introduction (pp. 1-92). Singapore: Springer.

- Swiggy Partners - What Is The Concept Of Swiggy Partner, How It Works?. (2019). Retrieved from: https://www.businessinsider.in/business/startups/article/what-is-the-concept-of-swiggy-partner-how-it-works/articleshow/72486713.cms.

- Thakur, A. (2019). India enters 37-year period of demographic dividend. Retrieved from: https://economictimes.indiatimes.com/news/economy/indicators/india-enters-37-year-period-of-demographic-dividend/articleshow/70324782.cms.

- Thomas, P. (2019). Infrastructure and Platform Anxieties in India. In A. Athique & E. Baulch, Digital Transactions in Asia Economic, Informational, and Social Exchanges (pp. 44-62). New York: Routledge.

- Tiwana A., Konsynski B., Bush, A. (2010). Research commentary- platform evolution: Coevolution of platform architecture, governance, and environmental dynamics. Information Systems Research 21(4):675–687.

- Vellody, A., & Bahl, K. (2019). Impact of E-commerece on SMEs in India. Retrieved 9 February 2020, from: https://assets.kpmg/content/dam/kpmg/pdf/2015/10/Snapdeal-Report_-Impact-of-e-Commerce-on-Indian-SMEs.pdf.

- Vijay, N. (2020). View: The Biggest Challenge Facing e-commerce Sector in India & How to Overcome it. Retrieved from: https://economictimes.indiatimes.com/industry/services/retail/view-the-biggest-challenge-facing-ecommerce-sector-in-india-how-to-overcome-it/articleshow/73076390.cms?from=mdr.

- Zipkin, N. (2015). Amazon Rolls Out New Marketplace for Startups. Retrieved from: https://www.entrepreneur.com/article/248945.

- Zomato for Business: How to start business with Zomato?. (2019). Retrieved 16 February 2020, from: https://legaldocs.co.in/blog/zomato-for-business-how-to-start-business-with-zomato.

- Zhu, F., & Liu, Q. (2018). Competing with complementors: An empirical look at Amazon.com. Strategic Management Journal, 39(10), 2618-2642.