Research Article: 2024 Vol: 28 Issue: 3

Inflation's Ripple Effect on Bank Shareholder Returns: Unveiling the Role of Credit Risk and Operating Margin through Structural Equation Modelling

Purushottam Naidu, Woxsen University

Gowri Lakshmi, Gitam School of Business

G.V.K.Kasthuri, Gitam School of Business

Syed Hasan Jafar, Woxsen University

Kattamuri Satish, CMR university, Bangalore

Narasimha Swamy, Woxsen University

Sheela, Gitam School of Business, Gitam deemed to be University

Citation Information: Naidu, P., Lakshmi, G., Kasthuri, GV.K., Hasan Jafar, S., Satish, K., Swamy, N., & Sheela (2024). Inflation's ripple effect on bank shareholder returns: unveiling the role of credit risk and operating margin through structural equation modeling. Academy of Marketing Studies Journal, 28(3), 1-18.

Abstract

Relevance: Inflation profoundly affects various sectors, including banking, and understanding its impact on financial performance holds significant potential for enhancing shareholder returns. Purpose : This study pursues a threefold objective. It investigates the influence of inflation on earnings in Indian public sector commercial banks, explores the mediating roles of credit risk and operating profit margin, and ultimately addresses the impact of inflation on financial stability and shareholder returns. Methods: Employing structural equation modelling with predictive capabilities, this research assesses data from ten Indian public sector commercial banks over a decade (2013-2022). A multi-group approach is used to evaluate how inflation levels affect return on equity, with operating profit margin and credit risk as mediators. Results: The results point to a complex relationship under different inflationary settings (below and above 5.1%). Inflation has a positive impact on the operating profit margin (β from 0.383 to 0.581).However, it also has a negative effect on gross non-performing assets ((β from -0.037 to -0.430)), consequently leading to a decrease in return on equity. Furthermore, the operating profit margin negatively influences credit risk, with a decrease (β: from -0.579 to -0.252) observed at higher inflation levels. Conclusion: This study provides an original contribution by examining inflation's impact on shareholder returns in Indian public sector commercial banks, while considering the mediating roles of gross non-performing assets and operating profit margin. The insights offer valuable guidance to bank management and policymakers for mitigating inflation's effects and maximizing shareholder returns across varying inflation levels

Keywords

Investor Profit; Financial Metric; Predictive Analysis; Mediation Analysis; Operating Efficiency; Non-Performing Assets; Economic Indicator; Commercial Banks.

Introduction

Inflation is a key component because all economies are susceptible to macroeconomic variations that decrease purchasing power and country competitiveness. The banking industry is especially sensitive to changes in inflation and interest rates due to their direct impact on borrowing costs and lending rates. Banks are adopting more cautious measures, leading to a narrowing of the cross-sectional distribution of their loan-to-asset ratios (Mustafa et al., 2002). Bank interest income is the only source that boosts market-to-book value and solvency (Piyadasa et al., 2015). Research indicates that there exists a substantial and economically consequential inverse correlation between inflation and financial progress. The aforementioned phenomenon has a detrimental impact on overall performance, particularly through slowing the functioning of markets and negatively affecting stakeholders. Shareholder returns are crucial for investors and stakeholders in the banking industry, and understanding how inflation affects these returns is essential for making informed investment decisions. Additionally, it could mention that inflation is a macroeconomic factor that can have wide-ranging effects on the economy, and studying its impact on shareholder returns in Indian public banks can provide insights into the overall financial stability of the banking sector. In recent times, India has had an upward rise in its inflation rate, reaching a peak of 6.95%, the highest level observed in the past 17 months. Banks and their stakeholders are becoming increasingly concerned with inflation, making it all the more important to examine how this phenomenon affects shareholder returns in Indian public sector banks. Inflationary pressures have increased in India due to volatile financial markets, while the Russian invasion of Ukraine has raised global food and gas costs, leading to research on the relationship between macroeconomic factors and bank performance. This research aims to examine the relationship between inflation and shareholder returns, with profit margin serving as a mediating variable, to further explore the mechanisms through which inflation affects bank profitability and ultimately shareholder returns. According to studies (Moguillansky, 2002; Demir, 2009), the goal of analysis is to help policymakers and industry stakeholders understand how to manage risk and make banks more financially stable when inflation affects their profits, loan quality, and stability. In this context, analysts predict that the Reserve Bank of India (RBI) will proceed with plans to raise the repo rate despite the ongoing financial crisis. Unfortunately, banks' funding costs have increased as a result of falling returns caused by industry-wide issues. Lending could be restrained as a result. Inflation has been shown to have a consistently negative association with key performance metrics of banks, such as return on assets and return on equity (Saeed, 2014; Bourke, 1989). Banks' operational actions, often extending loan maturities beyond borrowing, may expose them to the potential influence of inflation as a macroeconomic event (Bordeleau et al., 2010). Recent research highlights the significant role of profitability, effective management, inflation, and government performance in forming financial vulnerability concerns (Kanapiyanova et al., 2023). According to cross-country studies (Chaibi et al., 2015), macroeconomic conditions have a significant impact on nonperforming loans (NPLs) in emerging markets like the BRICS (Brazil, Russia, India, China, and South Africa) countries. The policy recommendations emphasize boosting banking industry competition, improving asset quality, and improving nonperforming loan management (Brahmaiah & Ranajee, 2018). Inflation has been demonstrated to have nonlinear linkages with finance (Tan, 2012), with a breakdown in the performance of the financial system occurring above a specific inflation threshold that can have far-reaching consequences for resource allocation and economic activity. As a result, inflation has had a negative effect on profitability, asset quality, and risk management in the Indian banking sector. This cumulative effect has a direct impact on shareholder returns (Almaqtari, 2018).

To achieve success, businesses must maximize operational efficiency (Lotto, 2018; Buchory, 2021). This means cutting costs without sacrificing quality in the areas of people, processes, and technology. Inflation offers a substantial barrier to maintaining cost control, which is essential to improving profits (Athanasoglou et al., 2008).Although some research has been done on the effects of inflation on return on equity(Demirguç et al., 1999; Abreru et al., 2001), no previous study has looked into how the level of inflation affects shareholder profits with a mediating effect in commercial banks. Studies on inflation's impact on bank performance and shareholder profits in the Indian banking sector are limited, largely due to mediating roles of operating effectiveness and credit risk. The profitability of commercial banks' shareholders is explored in this essay, along with the detrimental effects of inflation. The present study aims to achieve three distinct objectives. This study examines the impact of inflation on earnings at Indian public-sector commercial banks. It also analyses the potential mediating effects of credit risk and operational profit margin. Furthermore, the study aims to analyse the overall impact of inflation on financial stability and shareholder returns. In order to quantify significant differences among India's public sector banks, this study used multi-group analyses of a structural equation model of targeted inflation rates.

These research questions will serve as our roadmap for collecting, analysing, and interpreting data as we attempt to gain a deeper understanding of the risks and rewards that inflation presents for the Indian public banking sector.

1) How does inflation influence the profitability of public commercial banks in India?

2) To what extent does inflation erode the profitability of public commercial banks in India?

3) When it comes to the link between inflation and shareholder returns in Indian public banks, how much of a role do credit risk and OPM play as mediators?

The above research questions will serve as the framework for our study and lead us to investigate the influence of inflation on shareholder returns, the mediating function of credit risk (GNPAs) and operating profit margin (OPM), and the impact of inflation on shareholder returns and financial stability. Inflation in India's banking industry poses both obstacles and opportunities, and these questions will serve as guides for our data gathering, analysis, and interpretation.

Our study's goals are established on the basis of these research questions.

The Goals of the Study;

1) To analyse and predict the relationship between inflation and shareholder returns in Indian public-sector commercial banks.

2) Inflation and shareholder returns in Indian public sector commercial banks are analysed alongside the mediating functions of gross non-performing assets and operating margin.

3) Investigate the relationship between inflation, gross non-performing assets, operational profit margin, and return on equity in Indian public sector commercial banks using a multi-group analysis at different inflation levels (mean).

This analysis investigates the impact of inflation on shareholder returns in Indian public-sector commercial banks, focusing on gross non-performing assets and operating margin mediating functions. It examines the correlation between inflation, gross non-performing assets, operational profit margin, and return on equity at different inflation rates to understand their financial performance. Current studies are narrow in scope, examining only a few major variables and the results of public-limited banks.

Literature Review

Inflation is a crucial macroeconomic factor that can have a significant impact on banks' bottom lines. There is a direct correlation between financial inclusion and economic growth (Allen et al., 2016). Inflation refers to the sustained increase in the general price level of goods and services over time. It erodes the purchasing power of money and affects various aspects of the economy, including investment, consumption, and savings. A large amount of literature has Indian bank returns and Indian Inflation Rate been extensively published regarding the topics of inflation and bank performance. These studies focus primarily on the overall performance of banks rather than examining individual factors that may influence their performance or the profits received by shareholders. For the purpose of guiding future research, several systematic literature reviews have been conducted to identify patterns, gaps, and methodologies employed in previous studies.

Inflation and Profit

There are a number of ways in which inflation's increase impacts businesses' bottom lines. In addition, low corporate profits might affect stock returns because the long-term returns of market indexes are usually consistent with the earnings growth of member companies. Additionally, profit margin plays a crucial role in mediating this relationship as it reflects a bank's ability to generate profits relative to its operating costs. Historically, research has consistently shown a negative correlation between inflation and bank profitability (Berger et al., 1995). On the other hand, Haris and Tariq (2018) found a positive correlation between inflation and return on equity. Multiple studies (Jara-Bertin et al., 2014; Pasiouras & Kosmidou, 2007; Petria et al., 2015; Saona, 2016) have found that higher annual inflation rates lead to higher bank returns. In developing nations, financial inclusion is directly tied to bank performance metrics like return on equity, return on assets, and operational profit margin (Kaya, 2022).

Inflation and Credit risk

Inflation can influence bank credit risk in ways like increased funding costs and negative effects on bank profitability. Inflation can have both positive and negative outcomes. In order to stabilize the business cycle, the ideal monetary policy plan can unbalance banks' credit risk, as Kurowski and Smaga (2018) point out. Inflation rates in the Mexican banking sector have both short-term and long-term effects on bank credit, with short-term positive impacts and long-term negative effects (Charles et al., 2023). A study on Axis Bank in India found a correlation between credit risk ratios and inflation rates, indicating a potential risk in the banking sector (Uravashi et al., 2012).

Inflation and Operating Profit Margin

Numerous variables and the general economic environment can have an impact on how much inflation affects a bank's operating profit margin, with both positive and negative results. Inflation has the potential to result in increased operational expenditures. The potential consequences of inflation include an increase in employee compensation, administrative expenses, and other overhead costs. In the event that a bank is unable to transfer these amplified expenses to its clientele, there is a possibility that its operational profit margin could experience a decline. Inflation has an adverse effect on bank performance, which includes a decrease in operating profit margin (Mohammed et al., 2012). Reduced purchasing power and higher costs are two ways in which inflation can hurt operating profit margins for banks (David &Alhadef, 1976). A subsequent investigation into inflation has revealed its adverse impact on the development of the banking sector. The research paper by John et al. (2001) further posits that this negative effect may extend to the operating profit margins of banks. In general, the majority of studies have consistently found that inflation has a detrimental influence on operating profit margins.

Risk management and return on assets in Omani banks were found to have a highly significant link by Mamari et al. (2022); return on equity was not an area where they saw a substantial impact. Furthermore, inflation is known to reduce the operating profit margins and return on equity of banks. Athanasoglou et al. (2008) note, however, that in the short run, it can have a beneficial impact by increasing interest rates and net interest revenue. The public's faith in a bank has a direct bearing on the bank's operational and credit risk. Dys (2017) stresses the significance of this connection and its bearing on the bottom line of financial institutions. In a follow-up study, efficiency in operations has been shown to have a sizable and favorable effect on bank profitability (Jara-Bertin et al., 2014; Salike et al., 2017). Conflicting findings about the effect of operating profit margin on profitability are found in studies by Francis (2013), Yahya et al. (2017), and Naeem et al. (2017). Paradoxically, the literature on inflation and its effects on banks' credit scores is mostly unfavourable.

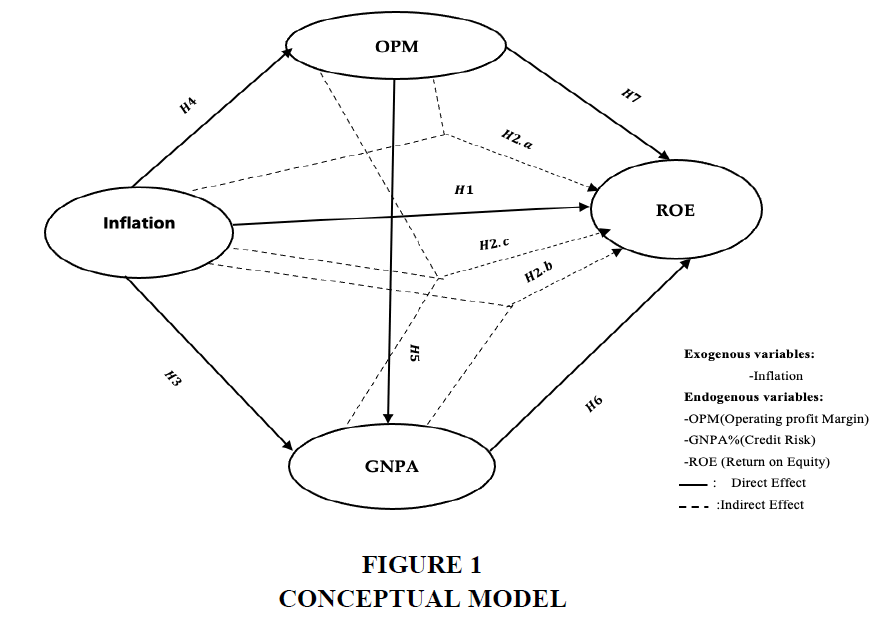

The evidence presented in this section suggests that inflation's effect on shareholder profits has been underreported in previous studies of Indian public-sector commercial banks. Inflation, credit risk (GNPA), and overall bank earnings or return on equity (ROE) have all been studied extensively in the past, but the sensitivity and impact of inflation on shareholder returns have been largely ignored. Moreover, previous studies have failed to explore the potential mediating factors of operating profit margin (OPM) and GNPA in this relationship. Inflation and shareholder returns are two important economic variables, but little has been done to examine their causative and predictive relationship using structural equation modeling (SEM). Filling this knowledge gap will help us understand how inflation affects stockholders. To predict the connections between various types of data, researchers use structural equation modelling (SEM) Figure 1.

A research hypothesis is a statement that proposes a relationship or difference between variables that will be tested by empirical investigation. Based on an extensive examination of the existing literature, careful consideration of the research questions, and a clear delineation of the study objectives, the following hypotheses were formulated:

H1: Inflation has a negative impact on shareholders' financial returns in Indian public-sector commercial banks.

H2: The mediating effects of credit risk and operational profit margin on the connection between inflation and shareholder returns are observed in Indian public-sector commercial banks.

H3: The impact of inflation on credit risk is stronger in periods of high inflation.

H4: The impact of inflation on operating profit margins is more prominent in periods of high inflation.

H5: The impact of operational profit margins on credit risk is more substantial in periods of low inflation.

H6: The impact of credit risk on return on equity is more severe in the presence of high levels of inflation.

H7: The relationship between operating profit margin and return on equity exhibits a greater positive effect in periods characterized by low levels of inflation.

Materials and Methods

The effect of inflation on return on equity, operational profit margin, and credit risk as mediators was specifically examined in the study. To facilitate the analysis, the study selected banks that were listed on the Bombay Stock Exchange (BSE) throughout a span of 10 years, specifically from 2013 to 2022. In order to achieve the study's goals, the availability of data guided the choice of the time period. The research study employed a sample of ten publicly owned commercial banks listed on the Bombay Stock Exchange in India. For the purpose of multi-group casual analysis, this data is divided into two groups based on inflation mean levels. The study utilized annual economic and financial market data, which were then matched with the banks' annual stock returns data Table 1.

| Table 1 Quantitative Variables | ||||

| Quantitative variable | Proxy | Formula | Variable | Data Source |

| Inflation | INFL | Inflation factor | Independent & influence | External |

| Bank Profitability | Return On Equity (ROE) | Net profit/ Total Assets | Dependent & Control | Bank Financial data |

| Bank credit Risk | % of Credit risk on total assets (GNPA%) | GNPA/Total Assets | Mediator/endogenous | Bank Financial data |

| Bank operating efficiency |

Operating Profit Margin(OPM) | Profit/Total Interest Income | Mediator/endogenous | Banks Financial data |

Structural Model

Many researchers have used regression models, which struggle with error, model fit, and multiple hypotheses. The current study utilized equation modelling (SEM) for complex relationships, mediation, moderation, measurement errors, and comprehensive hypothesis testing, offering a more nuanced understanding. Structural equation modelling (SEM) was used to look at the relationships between what could be seen and what could not be seen. All indicators in the measurement models for predictive scores were given the same weights. (Hair et al., 2022). When evaluating the ability to make predictions on new data, the evaluation of statistical modelling and estimation involves two separate concepts: explanation and prediction (Hair et al., 2019). Researchers use multigroup analysis as a technique to spot significant changes in outer weights, loadings, and path coefficients by comparing parameter estimates across pre-established data groups.

Descriptive Statistics

A technique like partial least square structural modelling is important when working with formative structures (Hair et al., 2012), the kurtosis and skewness values should ideally fall within the range of ±3 for a normal distribution. The results presented in

Table 2 shows acceptable skewness and kurtosis values, with moderate response variables, indicating normal distribution. Parametric statistical approaches suitable for investigation, with normalcy assessment prior to SEM analysis.

| Table 2 Descriptive Statistics | ||||

| Variables | OPM | INFL | GNPA | ROE |

| Observations | 100 | 100 | 100 | 100 |

| Missing | 0 | 0 | 0 | 0 |

| Mean value | -16.8 | 0.0587 | 9.33 | -1.51 |

| Median value | -14.0 | 0.0505 | 8.29 | 4.20 |

| SD | 13.2 | 0.0222 | 5.35 | 17.1 |

| Skewness | -1.30 | 0.772 | 0.767 | -2.79 |

| Kurtosis | 2.43 | -0.687 | -0.105 | 2.81 |

Multicollinearity (f test)

Collinearity difficulties may arise if the variance inflation factor (VIF) falls within the range of 3 to 5. When the variance inflation factor (VIF) exceeds a value of 5, it indicates the presence of significant collinearity problems.

According to the findings presented in Table 3, it can be observed that multicollinearity was not a concern, as all values recorded were below the threshold of 3.

| Table 3 Inner VIF Value | ||||

| Factors | GNPA | INFL | OPM | ROE |

| GNAP | 2.630 | |||

| INFL | 1.000 | 1.929 | 2.083 | |

| OPM | 1.929 | 2.308 | ||

Results

Studies use simple regression analysis to identify inflation's impact on stock returns, but a casual predictive analysis is needed to understand the mediation factors. Initial scores assign latent variables; variance and t-tests are used. Aguirre-Urreta and Ronkko (2018) discussed how the procedure is similar to the evaluation of indicator weights in formative assessment. The bootstrapping method, incorporating 6,000 additional samples from the original dataset, significantly improved structural equation path modelling performance, enabling the identification and estimation of standard errors and confidence interval.

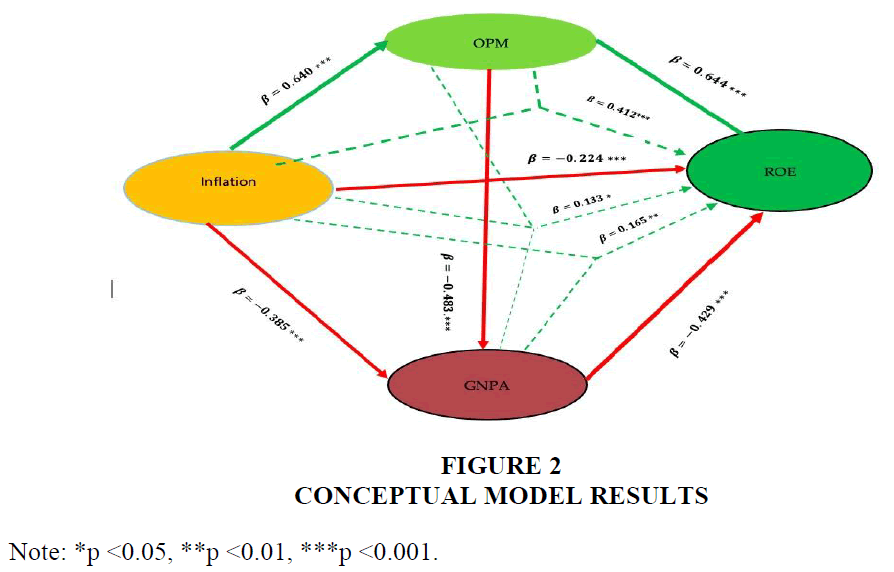

What is striking about the figures in this table (4) is that a rise in inflation is associated with a fall in shareholders' returns by means of a negative direct effect between inflation and return on ROE; however, it is worth noting that GNPAs and OPM had positive mediating effects on this relationship, with table (5) suggesting that they act as mediators between inflation and shareholder profits. The figures in Table 4 show that inflation is associated with a decrease in shareholders' returns. However, Table 5 suggests that GNPAs and OPM mediate this relationship and have a positive effect on shareholder profits.

| Table 4 Direct Relationship | |||||

| Hypothesis | Beta -value | T-value | P-value | Decision | |

| H1 | INFl -> ROE | -0.224 | 3.692 | 0.000 | S*** |

| Table 5 Indirect Relationship | |||||

| Hypothesis | β | T | P | Decision | |

| H2.a | INFl -> OPM-> ROE | 0.412 | 4.260 | 0.000 | S*** |

| H2.b | INFl -> GNPA-> ROE | 0.165 | 2.383 | 0.009 | S** |

| H2.c | INFl ->OPM-> GNPA-> ROE | 0.133 | 1.976 | 0.024 | S* |

In sample predictive power (R-Square)

Our study used these regressions to find the outer weights, path coefficients, R-square values, and outer loadings of endogenous latent variables. We also looked for correlations between indicators and latent variables (Lohmoller, 1989). After that, the model's ability to predict outcomes within the sample was evaluated; (Bentler & Bonett, 1980) proposed that an R-squared value of 0.3 or above indicated a "good" model fit. Values of R2 between 0.75 and 0.50 are generally considered strong; values between 0.25 and 0.25 are considered moderate; and values below 0.25 are considered weak (Henseler et al., 2009; Hair et al., 2011). These criteria are commonly used to assess the goodness of fit of structural equation models. Additionally, it is important to note that these thresholds may vary depending on the specific research context and field of study.

As can be seen from the Table 6, the endogenous latent variables OPM (41%), GNPA (62%), and ROE (73.3%) have moderate to high in-sample predictive power. It is context-dependent what R2 value is considered acceptable. Some fields consider an R2 value of 0.10 to be sufficient for making predictions, such as stock returns (Raithel et al., 2012).

| Table 6 R-Square Value | |||

| Endogenous variable | R-Square | T-value | P |

| GNPA | 0.620 | 9.098 | <0.001 |

| OPM | 0.409 | 9.153 | <0.001 |

| ROE | 0.733 | 11.434 | <0.001 |

Overall Model Fit

SRMR is a crucial measure that evaluates the model fit by comparing the observed correlation matrix with the reproduced correlation matrix. The difference matrices between our model and the reference distribution (observed and model-implied) were all smaller than their HI95 and HI99 values, as shown in Table 7. In other words, the model was not rejected at the 5% or 1% level of significance.

| Table 7 Total Fit Measures | ||||

| Total model fit measures | ||||

| Variance | Estimated | HI95 | HI99 | Result |

| SRMR | 0.000 | 0.000 | 0.000 | Accepted |

| d_ULS | 0.000 | 0.000 | 0.000 | Accepted |

| d_G | 0.000 | 0.000 | 0.000 | Accepted |

Multi Group Analysis

A comparison of the estimates for the PLS parameter across the detected latent segments (Rigdon et al.2010; Ringle et al, 2010). Therefore, there is a need for PLS-based techniques to multigroup analysis, regardless of whether heterogeneity is seen or not. The sample divided into two groups equally at inflation median value(average) at 5.1%, It can be seen from the data table 8 that, all endogenous constraints R square value in sample predictive power is valid.

| Table 8 In Sample Predictive Power | ||||||

| Inflation<5.1%(inflation) | Inflation ≥5.1%(inflation) | |||||

| Endogenous latent variable | R2 value | T -value | P-value | R2 value | T value | P-value |

| GNPA | 0.353 | 3.204 | <0.001 | 0.374 | 3.792 | <0.001 |

| OPM | 0.147 | 1.959 | <0.025 | 0.338 | 4.182 | <0.001 |

| ROE | 0.717 | 9.872 | <0.001 | 0.433 | 4.033 | <0.001 |

By utilizing multigroup analysis found that the investigation of potential significant discrepancies in parameter estimates, such as outer weights, outer loadings, and path coefficients, among pre-defined data groups(Sarstedt et al., 2011 and Hair et al., 2017). The findings of the study showed that 6000 bootstraps were conducted for each group and the R -square results were presented in a table 9. Because of its non-parametric nature, strong statistical strength, and ability to handle intricate models with several components and indications. Using a non-parametric significant test, our study tested multigroup analysis above and below the level of inflation mean.

| Table 9 Direct Relationship | ||||||||||||

| Inflation<5.1% | Inflation³5.1% | Complete | ||||||||||

| Hypothesis | β | T | P | R | β | T | P | R | β | T | P | R |

| H1: INFl -> ROE | -0.123 | 2.067 | 0.019 | s | -0.293 | 1.963 | 0.048 | s | -0.224 | 3.692 | 0.000 | s |

| H3: INFl -> GNPA | -0.037 | 0.286 | 0.387 | ns | -0.430 | 3.692 | 0.000 | s | -0.385 | 5.467 | 0.000 | s |

| H4: INFl -> OPM | 0.383 | 3.870 | 0.000 | s | 0.581 | 8.295 | 0.000 | s | 0.640 | 3.061 | 0.002 | s |

| H5: OPM-> GNPA | -0.579 | 5.149 | 0.000 | s | -0.252 | 2.011 | 0.033 | s | -0.483 | 6.030 | 0.000 | s |

| H6: GNPA -> ROE | -0.230 | 1.227 | 0.110 | ns | -0.684 | 6.024 | 0.000 | s | -0.429 | 2.468 | 0.007 | s |

| H7: OPM -> ROE | 0.730 | 4.968 | 0.000 | s | 0.201 | 1.615 | 0.053 | ns | 0.644 | 4.389 | 0.000 | s |

The findings of our investigation, as presented in Table 9, indicate a statistically significant negative correlation between inflation and return on equity (ROE), both below and above the average inflation rate of 5.1%. Notably, this inverse link was more pronounced (β: -0.123** to -0.293***) at higher levels of inflation. There was a clear negative relationship between inflation and gross non-performing assets (GNPA). The negative relationship was stronger (β: -0.037 to -0.430***) when the average (median) inflation value went above a certain level. In contrast, it was determined that the link lacked statistical significance in instances where inflation fell below the mean value. Nevertheless, a significant association was observed between inflation and operational profit, with the magnitude of this relationship increasing from a coefficient of +0.383*** to 0.581*** as inflation levels rose. Furthermore, a notable adverse relationship was seen between the operational profit margin and credit risk. The coefficient (β) declined from -0.579*** to -0.252 as the degree of inflation increased. Moreover, it is worth noting that the gross non-performing assets (GNPA) exhibited a noteworthy adverse effect on the return on equity (β: -0.230 to -0.684*), surpassing the median inflation rate. The operating profit margin's impact on the return on equity (ROE) was found to be highly significant and positive (β: 730*** to +0.201), but only when it exceeded the inflation rate. Overall, the study found a significant negative correlation between inflation and return on equity (ROE), both below and above the average inflation rate of 5.1%. This inverse link was stronger at higher levels of inflation. However, a significant association was observed between inflation and operational profit, with the magnitude increasing as inflation levels rose. The operational profit margin had a notable adverse effect on return on equity, surpassing the median inflation rate.

Group mean difference: The study utilized non-parametric tests and bootstrap analyses to examine group differences, ensuring the validity of the findings, especially in small sample sizes or non-normal data distributions.

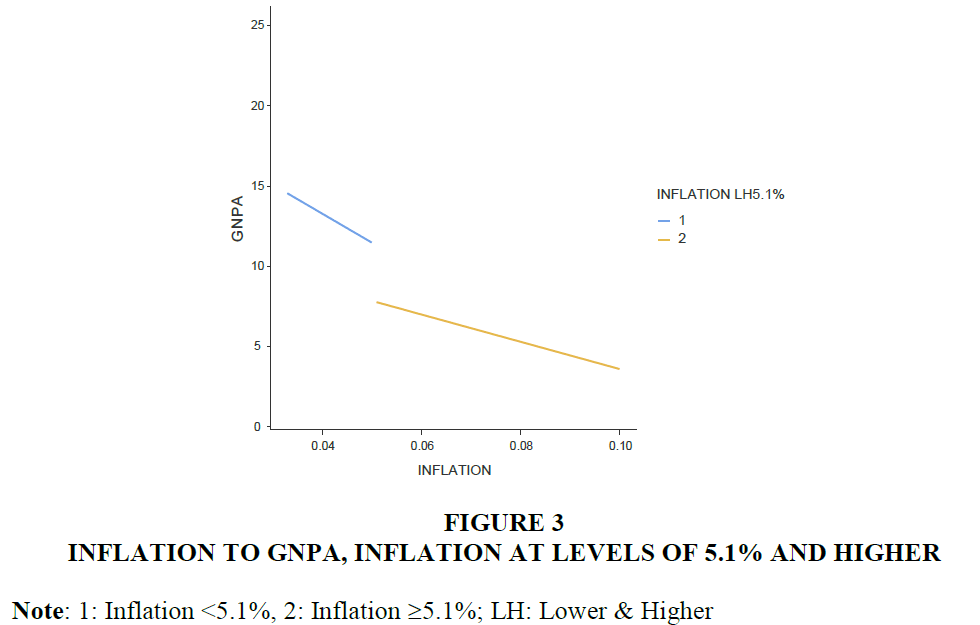

The above table (10) and graph (Figure 3) reflected that, the correlation between inflation and GNPA showed a slight negative correlation when inflation was below the average level, contrasting with an increased correlation when inflation exceeded the average.

Figure 3 Inflation to GNPA, Inflation at Levels of 5.1% and Higher

Note: 1: Inflation <5.1%, 2: Inflation ≥5.1%; LH: Lower & Higher

The above table (10) and graph (Figure 3) reflected that, the correlation between inflation and GNPA showed a slight negative correlation when inflation was below the average level, contrasting with an increased correlation when inflation exceeded the average.

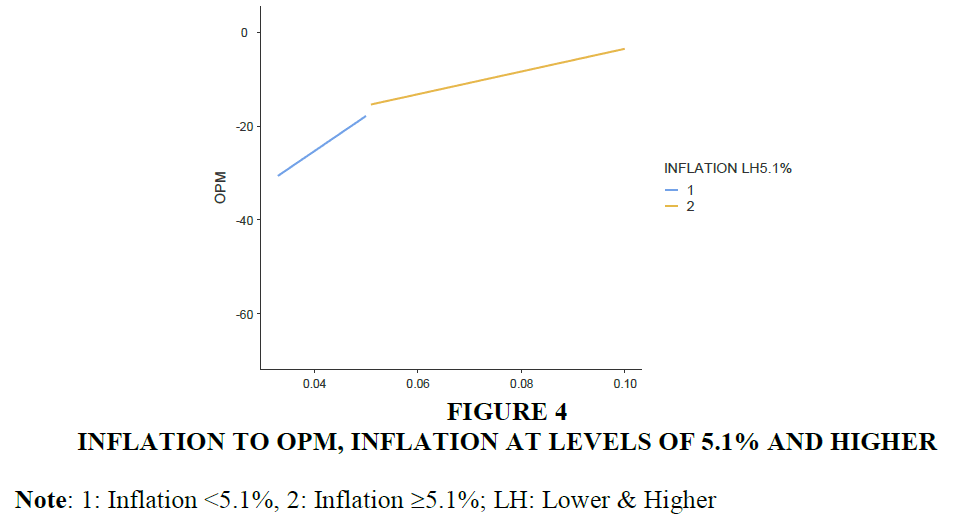

Table 10 and Figure 4 reveal significant variability in the association between inflation and OPM across various inflation rates.

| Table 10 Multi-Group Result | ||||

| Paths | value Inflation (<5.1% ->5.1%)mean difference | P-Value original (1-tailed) ( <5.1% - >5.1%) |

P-Value(New) (<5.1% - >5.1%) | Results |

| INFl -> GNPA | 0.393 | 0.013 | 0.013 | Accepted |

| INFl -> OPM | -0.198 | 0.952 | 0.048 | Accepted |

| INFl -> ROE | 0.169 | 0.190 | 0.190 | Rejected |

| OPM-> GNPA | -0.327 | 0.971 | 0.029 | Accepted |

| OPM -> ROE | 0.530 | 0.006 | 0.006 | Accepted |

| GNPA -> ROE | 0.454 | 0.024 | 0.024 | Accepted |

Figure 4 Inflation to OPM, Inflation at Levels of 5.1% and Higher

Note: 1: Inflation <5.1%, 2: Inflation ≥5.1%; LH: Lower & Higher

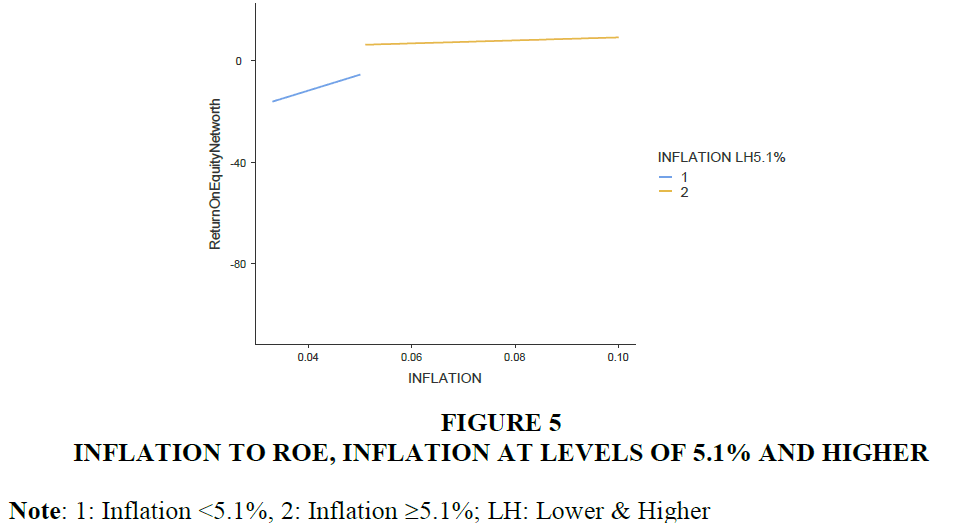

The Table (10) and graphs (Figure 5) above indicate that the level of inflation had no significant impact on the relationship between inflation and ROE.

Figure 5 Inflation to Roe, Inflation at Levels of 5.1% and Higher

Note: 1: Inflation <5.1%, 2: Inflation ≥5.1%; LH: Lower & Higher

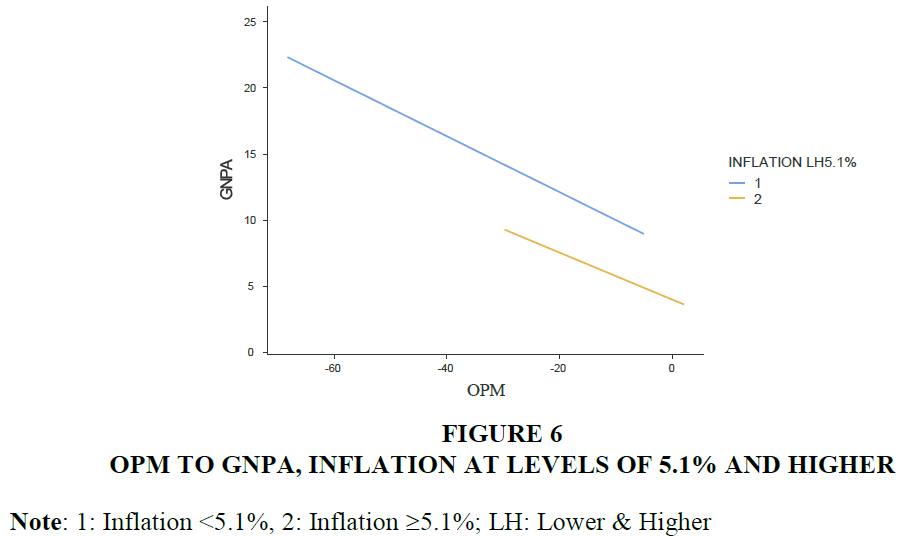

The table (10) and graphs (Figure 6) revealed that, Inflation significantly influences the relationship between OPM and GNPA, with a significant adverse impact observed at levels below the mean value.

Figure 6 Opm to GNPA, Inflation at Levels of 5.1% and Higher

Note: 1: Inflation <5.1%, 2: Inflation ≥5.1%; LH: Lower & Higher

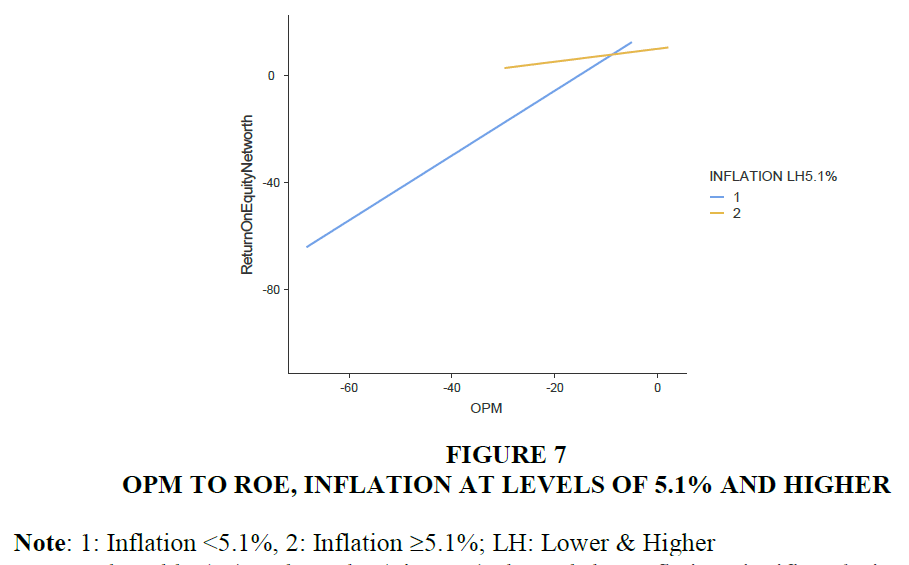

The table (10) and graphs (Figure 7) showed that Inflation significantly impacts the relationship between Operating Profit Margin (OPM) and Return on Equity (ROE), with the effect being more pronounced for lower inflation rates.

Figure 7 OPM to ROE, Inflation at Levels of 5.1% and Higher

Note: 1: Inflation <5.1%, 2: Inflation ≥5.1%; LH: Lower & Higher

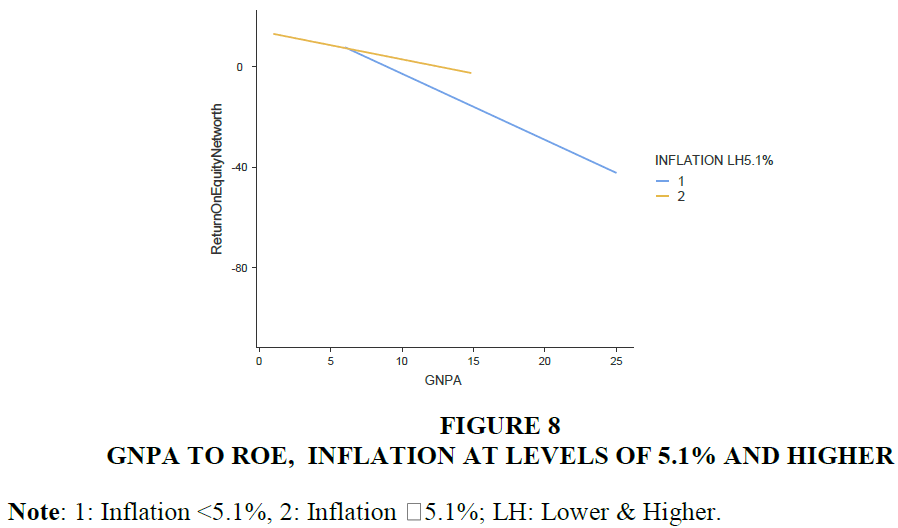

The table (10) and graphs (Figure 8) above reflected that inflation significantly impacts the correlation between GNPA and ROE, with levels below the mean value having less adverse effects.

Figure 8 GNPA to ROE, Inflation at Levels of 5.1% and Higher

Note: 1: Inflation <5.1%, 2: Inflation ≥5.1%; LH: Lower & Higher.

Discussion

The literature indicates a significant negative correlation between inflation and return on equity, but no data exists on inflation behaviour and return on equity with OPM and GNPA mediating. The present study was designed to determine the impact of inflation on shareholder returns in Indian public-sector commercial banks, revealing that GNPAs and OPM play a crucial role in influencing this relationship. With respect to the previous questions, the study found that inflation has a negative and statistically significant effect on return on equity. Inflation expectations and macroeconomic uncertainty have a major impact on bank performance, especially return on equity (Abaidoo & Anyigba, 2020). Our study found that inflation has a negative and statistically significant impact on return on equity, although the multi-group analysis's direct effect (Table 9) did not show a discernible mean difference at the inflation rate. Inflation significantly impacts commercial banks' financial well-being, particularly shareholder returns. This highlights the need for bank management and policymakers to reduce inflation's impact and control credit risk for stable profits. Our results suggest that as inflation rises, there is a greater inverse link between inflation and credit risk (Table 10 and Figure 2). Credit risk (GNPAs) was also found to have a considerable impact on ROE, as well as an upward trend with inflation (Table 10 and Figure 7). China's commercial banks are more profitable when they take on more credit risk, have robust capitalization, and have a larger total asset base, while higher overhead costs and liquidity levels lower profits (Sufian, 2009). Our findings suggest that inflation may have a beneficial influence on ROE, with credit risk serving as a mediating element. The research reveals that cost effectiveness and inflation impact operating profit margin, which positively impacts ROE. Nepalese banks' efficiency has a significant positive effect on ROE (Pradhan et al., 2017). Table 10, Figure 3, and Figure 6 demonstrate our research's findings that the link between inflation, operating profit margin, and shareholder profitability is statistically significant, suggesting that bank management should consider inflation while maintaining profit margins.

The findings show that inflation has a significant impact on banks' profitability and asset quality. Gaining market share and increasing profits are two outcomes of improved management and production technologies at a financial institution (Berger, 1995). Inflation is bad for business; thus, factors including capitalization, credit risk, productivity growth, and operating expenditure management all have a role in the profitability of Greek banks (Athanasoglou et al., 2008). Table 10 and Figure 5 from our analysis showed that inflation had a sizable mean effect on the gap between OPM and GNPA. The study reveals that inflation's impact on the relationship between OPM and GNPAs can vary depending on inflation levels. Banks can mitigate this by incorporating inflation data into risk management and loan portfolio management. Inflation can both benefit and negatively affect a bank's operating profit margin and return on equity. Although inflationary interest rate increases and associated increases in net interest revenue are beneficial in the short term, they can have a chilling effect on a bank's safety and long-term profitability. Our research shows that there is a sizable advantage at inflation rates below the median compared to inflation rates beyond the median. Increasing a bank's exposure to risk has been shown in the literature to have a negative impact on its bottom line (Miller & Noulas, 1997). Since the cost of debt and the cost of credit both increased, banks saw a decline in their profitability. Several studies (Musyoki & Kadubo, 2012; Nawaz & Munir, 2012) support this theory. Credit risk is generally reduced when inflation rates are adjusted annually. As can be seen in Table 10, our research shows that credit risk has a substantial and negative effect on ROE. The mean difference study also revealed that the negative impact was smaller for inflation rates below the mean than for rates above the mean.

Increasing a bank's exposure to risk has been shown in the literature to have a negative impact on its bottom line (Miller & Noulas, 1997). Since the cost of debt and the cost of credit both increased, banks saw a decline in their profitability. Several studies (Musyoki & Kadubo, 2012; Nawaz & Munir, 2012) support this theory. Credit risk is generally reduced when inflation rates are adjusted annually. As can be seen in Table 10, the current investigation found that credit risk has a substantial and negative effect on ROE. The mean difference study also revealed that the negative impact was smaller for inflation rates below the mean than for rates above the mean.

Table 10 Summary of support for the study's hypothesis

Hypothesis Explanation Level of support

H1 Inflation has a negative impact on shareholders returns in Indian public sector commercial banks. supported

H2(a,b & c) GNPAs and OPM mediate the relationship between inflation and shareholders returns in Indian public Supported

H3 The negative effect of inflation on GNPAs is stronger when inflation is above average. supported

H4 The positive effect of inflation on OPM is stronger when inflation is above average. supported

H5 The negative effect of OPM on GNPAs is stronger when inflation is below average. supported

H6 The negative effect of GNPAs on ROE is stronger when inflation is above average. supported

H7 The positive effect of OPM on ROE is stronger when inflation is below average. supported

Practical Implications

In order to optimize risk management and loan portfolio management, it is imperative for banks to engage in vigilant monitoring of inflation rates, thereby mitigating adverse effects on their financial performance. Effective management of credit risk plays a vital role in ensuring the success of financial institutions, as it is closely tied to the assessment of gross non-performing assets, which serve as indicators of credit risk. Delis and Karavias (2016) emphasize the significance of effectively managing credit risk in order to sustain financial stability within the banking sector. The authors highlight the importance of banks taking into account inflation rates, effectively managing credit risk, and recognizing the interdependencies among various financial indicators

Consequences for Decision Makers

Currently, policymakers in developing nations are faced with a significant challenge pertaining to the implementation of inflation targeting (Rizvi et al., 2020). The study emphasizes the need for policymakers to develop strategies to mitigate the negative impact of inflation on India's public sector commercial banks' financial performance and profitability. This includes reducing credit risk vulnerability, monitoring inflation rates, implementing efficient portfolio management strategies, and improving risk management systems. The government should also encourage financial institutions to adopt these strategies.

Conclusion

In summary, we have reached several key conclusions based on the information presented.This study uses structural equation modelling (SEM) to examine the impact of inflation on return on equity (ROE) and gross non-performing assets (GNPAs) and operating profit margins. The research shows that inflation negatively affects ROE, but incorporating GNPAs and OPM as mediators may improve ROE. The study highlights the importance of managing credit risk and maintaining a strong OPM. The impact varies between low-inflation and high-inflation contexts, with higher effects observed in high-inflation contexts. The findings suggest that efficient inflation management strategies are crucial for the long-term viability of India's public sector banks and agricultural societies.

Constraints and Future Research: The study's limitations include its focus on Indian inflation, which requires further research in various economic settings. Future research should include additional variables like net interest rates, growth, advances, deposits, operational profit margin, and gross non-performing assets. The model developed in the study also needs further investigation to guide future studies on sustainable and profitable banking. This will help create well-informed strategies and policies for long-term success in the industry.

References

Abaidoo, R., & Anyigba, H. (2020). Bank performance variability and strands of inflationary conditions. European Journal of Management and Business Economics, 29(3), 235-253.

Indexed at, Google Scholar, Cross Ref

Aguirre-Urreta, M. I., & Rönkkö, M. (2018). Statistical inference with PLSc using bootstrap confidence intervals. MIS quarterly, 42(3), 1001-1020.

Alhadeff, D. A. (1976). Bank Management and Inflation. California Management Review, 18(3), 14-20.

Allen, F., Demirguc-Kunt, A., Klapper, L., & Peria, M. S. M. (2016). The foundations of financial inclusion: Understanding ownership and use of formal accounts. Journal of financial Intermediation, 27, 1-30.

Indexed at, Google Scholar, Cross Ref

Almaqtari, F. A., Al?Homaidi, E. A., Tabash, M. I., & Farhan, N. H. (2019). The determinants of profitability of Indian commercial banks: A panel data approach. International Journal of Finance & Economics, 24(1), 168-185.

Indexed at, Google Scholar, Cross Ref

Athanasoglou, P. P., Brissimis, S. N., & Delis, M. D. (2008). Bank-specific, industry-specific and macroeconomic determinants of bank profitability. Journal of international financial Markets, Institutions and Money, 18(2), 121-136.

Bentler, P. M., & Bonett, D. G. (1980). Significance tests and goodness of fit in the analysis of covariance structures. Psychological bulletin, 88(3), 588.

Indexed at, Google Scholar, Cross Ref

Berger, A. N., Kashyap, A. K., Scalise, J. M., Gertler, M., & Friedman, B. M. (1995). The transformation of the US banking industry: What a long, strange trip it's been. Brookings papers on economic activity, 1995(2), 55-218.

Berger, A. N. (1995). The relationship between capital and earnings in banking. Journal of money, credit and Banking, 27(2), 432-456.

Bordeleau, É., & Graham, C. (2010). The impact of liquidity on bank profitability(No. 2010-38). Bank of Canada.

Bourke, P. (1989). Concentration and other determinants of bank profitability in Europe, North America and Australia. Journal of Banking & Finance, 13(1), 65-79.

Indexed at, Google Scholar, Cross Ref

Boyd, J. H., Levine, R., & Smith, B. D. (2001). The impact of inflation on financial sector performance. Journal of monetary Economics, 47(2), 221-248.

Indexed at, Google Scholar, Cross Ref

Brahmaiah, B. (2018). Factors influencing profitability of banks in India. Theoretical Economics Letters, 8(14), 3046.

Indexed at, Google Scholar, Cross Ref

Buchory, H. A. (2021). Analysis of funding strategy, credit performance, and banking profitability.(Case study of CIMB-NIAGA bank in Indonesia). Studies of Applied Economics, 39(4).

Indexed at, Google Scholar, Cross Ref

Chaibi, H., & Ftiti, Z. (2015). Credit risk determinants: Evidence from a cross-country study. Research in international business and finance, 33, 1-16.

Indexed at, Google Scholar, Cross Ref

Charles, Goodhart., Dimitrios, P., Tsomocos., Xuan, Wang. (2023). Bank credit, inflation, and default risks over an infinite horizon. Journal of Financial Stability.

Indexed at, Google Scholar, Cross Ref

Demir, F. (2009). Financialization and manufacturing firm profitability under uncertainty and macroeconomic volatility: Evidence from an emerging market. Review of Development Economics, 13(4), 592-609.

Indexed at, Google Scholar, Cross Ref

Demirgüç-Kunt, A., & Huizinga, H. (1999). Determinants of commercial bank interest margins and profitability: some international evidence. The World Bank Economic Review, 13(2), 379-408.

Edirisuriya, P., Gunasekarage, A., & Dempsey, M. (2015). Bank diversification, performance and stock market response: Evidence from listed public banks in South Asian countries. Journal of Asian Economics, 41, 69-85.

Indexed at, Google Scholar, Cross Ref

Francis, M. E. (2013). Determinants of commercial bank profitability in Sub-Saharan Africa. International journal of economics and finance, 5(9), 134-147.

Hair Jr, J. F., Hult, G. T. M., Ringle, C. M., Sarstedt, M., Danks, N. P., & Ray, S. (2021). Partial least squares structural equation modeling (PLS-SEM) using R: A workbook(p. 197). Springer Nature.

Indexed at, Google Scholar, Cross Ref

Hair, J. F., Ringle, C. M., & Sarstedt, M. (2011). PLS-SEM: Indeed a silver bullet. Journal of Marketing theory and Practice, 19(2), 139-152.

Indexed at, Google Scholar, Cross Ref

Hair, J. F., Sarstedt, M., & Ringle, C. M. (2019). Rethinking some of the rethinking of partial least squares. European journal of marketing, 53(4), 566-584.

Indexed at, Google Scholar, Cross Ref

Hair, J. F., Sarstedt, M., Pieper, T. M., & Ringle, C. M. (2012). The use of partial least squares structural equation modeling in strategic management research: a review of past practices and recommendations for future applications. Long range planning, 45(5-6), 320-340.

Indexed at, Google Scholar, Cross Ref

Hair, J., Hair Jr, J. F., Sarstedt, M., Ringle, C. M., & Gudergan, S. P. (2023). Advanced issues in partial least squares structural equation modeling. saGe publications.

Henseler, J., Ringle, C. M., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the academy of marketing science, 43, 115-135.

Henseler, J., Ringle, C. M., & Sinkovics, R. R. (2009). The use of partial least squares path modeling in international marketing. In New challenges to international marketing (Vol. 20, pp. 277-319). Emerald Group Publishing Limited.

Jara?Bertin, M., Arias Moya, J., & Rodriguez Perales, A. (2014). Determinants of bank performance: evidence for Latin America. Academia Revista Latinoamericana de Administración, 27(2), 164-182.

Indexed at, Google Scholar, Cross Ref

Kanapiyanova, K., Faizulayev, A., Ruzanov, R., Ejdys, J., Kulumbetova, D., & Elbadri, M. (2023). Does social and governmental responsibility matter for financial stability and bank profitability? Evidence from commercial and Islamic banks. Journal of Islamic Accounting and Business Research, 14(3), 451-472.

Indexed at, Google Scholar, Cross Ref

Kaya, E. (2022). How does financial performance affect financial inclusion for developing countries?. Journal of Sustainable Finance & Investment, 1-20.

Indexed at, Google Scholar, Cross Ref

Kurowski, ?., & Smaga, P. (2018). Monetary policy and cyclical systemic risk-friends or foes?. Prague Economic Papers, 2018(5), 522-540.

Indexed at, Google Scholar, Cross Ref

Lohmöller, J. B. (2013). Latent variable path modeling with partial least squares. Springer Science & Business Media.

Lotto, J. (2018). The empirical analysis of the impact of bank capital regulations on operating efficiency. International Journal of Financial Studies, 6(2), 34.

Indexed at, Google Scholar, Cross Ref

Mamari, S. H. A., Al Ghassani, A. S., & Ahmed, E. R. (2022). Risk management practices and financial performance: The case of sultanate of Oman. Journal of Accounting Science, 6(1), 69-83.

Indexed at, Google Scholar, Cross Ref

Miller, S. M., & Noulas, A. G. (1997). Portfolio mix and large-bank profitability in the USA. Applied economics, 29(4), 505-512.

Indexed at, Google Scholar, Cross Ref

Moguillansky, G. (2002). Investment and financial volatility in Latin America. Cepal Review.

Musyoki, D., Pokhariyal, G. P., & Pundo, M. (2012). The impact of real exchange rate volatility on economic growth: Kenyan evidence. Business & Economic Horizons, 7(1).

Indexed at, Google Scholar, Cross Ref

Naeem, M., Baloch, Q.B. and Khan, A.W. (2017). Factors affecting banks’ profitability in Pakistan. International Journal of Business Studies Review, 2(2), pp.33-49.

Petria, N., Capraru, B., & Ihnatov, I. (2015). Determinants of banks’ profitability: evidence from EU 27 banking systems. Procedia economics and finance, 20, 518-524.

Indexed at, Google Scholar, Cross Ref

Pradhan, P., Shyam, R., & Shrestha, A. (2017). The impact of capital adequacy and bank operating efficiency on financial performance of Nepalese commercial banks. Radhe Shyam and Pradhan, Prof. Dr. Radhe Shyam and Shrestha, Amrit, The Impact of Capital Adequacy and Bank Operating Efficiency on Financial Performance of Nepalese Commercial Banks (September 27, 2017).

Indexed at, Google Scholar, Cross Ref

Raithel, S., Sarstedt, M., Scharf, S., & Schwaiger, M. (2012). On the value relevance of customer satisfaction. Multiple drivers and multiple markets. Journal of the academy of marketing science, 40, 509-525.

Indexed at, Google Scholar, Cross Ref

Rigdon, E.E., Ringle, C.M., & Sarstedt, M. (2010). Structural modeling of heterogeneous data with partial least squares. Review of marketing research, 255-296.

Rizvi, S. A. R., & Sahminan, S. (2020). Commodity price and inflation dynamics: Evidence from Briics. Bulletin of Monetary Economics and Banking, 23(4), 485-500.

Indexed at, Google Scholar, Cross Ref

Saeed, M.S., (2014). Bank-related, industry-related and macroeconomic factors affecting bank profitability: A case of the United Kingdom. Research journal of finance and accounting, 5(2), 42-50.

Saona, P. (2016). Intra-and extra-bank determinants of Latin American Banks' profitability. International Review of Economics & Finance, 45, 197-214.

Indexed at, Google Scholar, Cross Ref

Sufian, F., & Habibullah, M. S. (2009). Bank specific and macroeconomic determinants of bank profitability: Empirical evidence from the China banking sector. Frontiers of Economics in China, 4(2), 274-291.

Indexed at, Google Scholar, Cross Ref

Umar, M., Maijama’a, D., & Adamu, M. (2014). Conceptual exposition of the effect of inflation on bank performance. Journal of World Economic Research, 3(5), 55-59.

Received: 30-Aug-2023, Manuscript No. AMSJ-23-13947; Editor assigned: 31-Aug-2023, PreQC No. AMSJ-23-13947(PQ); Reviewed: 29-Dec- 2023, QC No. AMSJ-23-13947; Revised: 29-Feb-2024, Manuscript No. AMSJ-23-13947(R); Published: 05-Mar-2024