Research Article: 2021 Vol: 25 Issue: 2

Influence of Promotions and Change In Buyer Behaviour Due to Covid 19 on the Intent to Increase Usage of Digital Payment Systems

Mark David Devanesan, VIT Business School

Deepa Ittimani Tholath, Loyola Institute of Business Administration

Sunil Vakkayil, Loyola Institute of Business Administration

Abstract

The study is concerned with assessing the impact of changes in buyer behaviour on the usage of digital payment systems (DPS). The framework considers promotions associated with DPS and changes in buyer behaviour associated with DPS to be determinants of the intent to increase usage of DPS. The analysis is based on the responses of 100 respondents through a 17-item questionnaire. Changes in buyer behaviour (associated with DPS due to Covid 19 and the intent to increase the usage of DPS during the Covid 19 crisis are segmented based on demographic factors such as age group (Generation X, Millennials, Gen Z), preferred mode of digital payments (credit & debit cards, internet banking, mobile payment systems, digital wallets) and residential location (urban, suburban, rural). The current usage of DPS is analysed through descriptive statistics and the relationship between demographic variables and various uses/services under DPS are assessed using non parametric tests. The findings reveal that there is a significant association between promotions associated with DPS and the intent to increase usage of DPS, although the combination of influencing factors vary among demographics. Furthermore, there is a significant association between changes in buyer behaviour associated with DPS and the intent to increase usage of DPS.

Keywords

Digital Payment Systems, Buyer Behaviour, Mobile Payment Systems, Covid-19, Digital Payments.

Introduction

The Coronavirus (Covid-19) strain has resulted in the deadliest pandemic of the 21st century and has had a far-reaching impact on perceptions regarding public health, social norms and the global economy. The global economy was expected to shrink by 5% in 2020 in terms of real GDP (World Bank, 2020), due to disruptions in supply chains, public consumption and lockdowns. The Indian economy also contracted by 23.9% in Q1 2021 (Mishra, 2020), due to centre and state-imposed lockdowns to contain the spread of the virus. The temporary closure of business providing non-essential items and services severely impacted the micro, small and medium enterprises (MSME) sector, further affecting the production of goods and services in India. Although the Indian government did not place any curbs on exports and the movements of essential goods within the country, it was reported that the lockdown lead to over 50,000 containers piling up at ports in India (IFC, 2020). The resulting disruption in the supply chain along with government mandated lockdowns led to changes in consumer buyer behaviour and the adoption of alternative payment channels to cope with the crisis.

This paper proposes a framework for assessing the behavioural intent of consumers to increase their usage of digital payment systems (DPS), based on their changes in buyer behaviour due to the Covid 19 pandemic and existing promotions offered by DPS applications. The novelty of this study is the assessment of intent to increase usage of digital payment systems, while existing research is entirely concerned with the adoption of digital payment systems.

Research Background

Digital Payments in India

The mass adoption of digital payments in India occurred in 2016 when the Narendra Modi led government conducted a demonetization effort to root out fake currencies and tax evaders within the country. The country which originally relied on cash-based payments for over 86% of its transactions found its legal tender (500 and 1000 denominations) void (RBI., 2016) and led to the adoption of digital payment channels in Table 1.

| Table 1 Types of Digital Payment Systems | ||

| S.No. | Types of Digital Payment Systems | Description |

| 1 | Unstructured supplementary service (USSD) | Relevant for GSM service providers and handsets |

| 2 | Credit card/Debit card | Fund transfers using cards (payment gateways) |

| 3 | Immediate Payment system (IMPS) | Relevant to mobile phones, smartphones, internet and ATM’s |

| 4 | Real time gross settlement (RTGS) | Large value transactions |

| 5 | National Electronic Fund Transfer (NEFT) | Transfer of funds by individuals, corporates and organizations across different bank branches |

| 6 | Aadhar enabled payment system (AEPS) | Payment system based on Aadhar authentication |

| 7 | Prepaid payment instruction (PPI) | Mechanisms of pre-paid payment mechanisms for purchase of services, goods and financial services |

| 8 | Bharat Interface for Money (BHIM) | Unified Payment Interface (UPI) System based on mobile number |

| 9 | Mobile banking | Access to banking via internet browser or a mobile application |

| 10 | Mobile payment applications | Smartphone digital payment systems such as Paytm, HDFC PayZapp |

| 11 | Unified Payment Interface (UPI) | Interconnection between banks for fund transfers |

However, the adoption of digital payments post demonetization was met with limited success. Many sectors such as real estate, film making & distribution, grocers and taxi services still rely primarily on cash transactions (Chittineni, 2018). Furthermore, usage fees charged to merchants availing digital payment tools, the lack of a bank account and identification documents required for registering on the platform, poor network infrastructure and low broadband speed discouraged small retailers from offering digital payment systems to their customers (Ligon et al., 2019). India currently ranks 132 out of 188 nations with respect to mobile broadband speed (Sengupta, 2020), while analysts expect mobile payments to drive the adoption of digital payments in India. The above challenges ensured that most small transactions remained in cash and India still remains a largely cash driven economy in Table 2.

| Table 2 Factors Determining Adoption of Digital Payment Systems | |||

| S.No | Authors | Payment System | Factors |

| 1 | Dabholkar & Bagozzi, (2002) | Self Service technologies | Need/Avoidance of service personnel, social influence |

| 2 | Bhatti, (2007) | Mobile payment systems | Personal innovativeness |

| 3 | Srivastava, Chandra, & Theng, (2010) | Mobile payment systems | Perceived reputation |

| 4 | Schierz, Schilke,, & Wirtz, (2010) | Mobile -payment systems | Perceived ease of use |

| 5 | Mallat, 2007; Zhou, (2013) | Electronic payment systems | Perceived trust in vendors/service providers |

| 6 | Zhou, (2013) | Mobile payment systems | Quality of service |

| 7 | Patil, (2014) | Self Service technologies | Complexity, Convenience charges |

| 8 | Cliquet, Coupey, Hur, & Gahinet, (2014) | Digital wallets | Time Convenience |

| 9 | Singh, (2014) | Mobile payment systems | Reliability, User friendliness |

| 10 | Thakur & Srivastava, (2014) | Mobile payment systems | Privacy |

| 11 | Yadav & Chauhan, (2015) | Internet banking | Perceived risk |

| 12 | Shaw, (2014) | Mobile payment systems | Point of Sale Discounts |

| 13 | Taheam, Sharma, & Goswami, (2016) | Digital wallets | Perceived risk, complexity in usage, pricing, security concerns, service usefulness, societal usefulness |

| 14 | Laukkanen, (2016) | Mobile payment systems | Traditional habits |

| 15 | BCG & Google, (2016) | Digital payment systems | Rewards and personalized promotions |

In the current scenario, the penetration of smartphone devices in India is below 30%, as compared to developed nations such as the UK and the US, which have smartphone penetration levels of 77% and 82% respectively. This low penetration of smartphones devices in India offers ample scope for the expansion of digital payment services through the growth in the smartphone market which is poised to grow at 20% annually (KPMG, 2019).

Since the onset of the Covid-19 pandemic, the volume of digital payments in India has substantially declined due to lower economic activity and state-imposed lockdown. The sectors that have witnessed lower digital payment usage include non-essential retail outlets, hotels & restaurants, tourism and hospitality, aviation, electronics and consumer durables. Furthermore, cross-border payments (B2B and C2B) have declined due to supply chain uncertainties and trade barriers. International remittances also declined as the wages of Indian workers declined due to the slowdown in the world economy. However, essential retail outlets, e-commerce, healthcare & pharmaceuticals, educational technology, insurance and telecommunications witnessed a significant increase in usage of digital payment systems.

The RBI anticipates an increase in share of digital transactions of total GDP from 10% now to 15% in 2021 (Bloomberg, 2020). With regard to payment channels, though the usage of ATM’s is expected to decline due to the fears associated with cash/ATM’s being a potential reservoir for pathogens, credit & debit cards remain a prominent mode of digital payments with over 90,000 crores worth of transactions in June 2020 (Shetty, 2020). The use of UPI is expected increase substantially through person to person (P2P) and person to merchant (P2M) payments for essential services. Mobile payment systems are growing in popularity since the launch of the Unified Payment Interface (UPI) in 2016 and has facilitated over 1.2 billion transactions per month in 2020 (S&P, 2020). Immediate Payment Services (IMPS) is also expected to grow as people opt for fund transfers digitally. The Bharat Bill Payment system (BBPS) is also expected to grow as physical avenues for paying bills are being avoided. QR/link-based payments are also poised to grow among small merchants to avoid usage of cash (PWC, 2020). However, the use of digital payment technologies could alter or diminish perceptions of service quality, value and customer loyalty as compared to interactions with service personnel (Parasuraman & Grewal, 2000; Sinha et al., 2019). Retailers need to strike a balance between use of digital payments and interactions with service personnel to retain customers.

Influence of Demographics on the Adoption of Digital Payment Systems

Among age groups, Generation Z and Millennials are likely to drive the adoption of emerging financial technologies/digital payment systems. Millennials have greater intent to use digital banking services (Daqar et al., 2020). Among regions in India, urban residents have dramatically increased their adoption and usage of digital payment systems, with the extensive usage of mobile payments systems & digital wallets such as Paytm, Phone Pe, Amazon Pay and Paypal. Rural residents have also increased their usage of digital payments through use of mobile ATMs, bill payment kiosks and Aadhar enabled payment services (Nasscom, 2020).

Buyer Behaviour during Crises

The shopping attitudes and behaviours of consumers are sensitive to economic recessions (Hampson & McGoldrick, 2013) and consumers reduce their consumption levels, while opting for cheaper options (Lichtenstein et al., 1993). Consumers also switch from national brands to store brands during periods of economic slowdown (Lamey et al., 2012), as they offer cheaper alternatives for price conscious customers (Sinha & Batra, 1999). Customers also opt for bulk purchases of store brands during economic crises (Jones, 2014). However, most firms increase in promotional features and displays (Tellis & Tellis, 2009) to increase brand awareness, create brand associations and result in perceived positive brand quality (Balachander & Ghose, 2003). Furthermore, promotional activities reinforce brand beliefs (Yoo et al., 2000) and create brand differentiation (Lemon & Nowlis, 2002) leading to brand choice.

The adoption of alternate payment channels and e-commerce during the Covid-19 lockdown will likely alter consumer behaviour as customers become more price conscious, are less likely to make impulsive purchases (Mukherjee & Mukherjee, 2020), more inclined to buy local produce, make large purchases (Gupta, 2020), reduce out of home consumption, increase demand for independent services/avoid shared services (Biswas, 2020) spend less on discretionary items, prioritize availability and quality over brand choice (Nielsen, 2020) and forego brand loyalty (EY, 2020).

The largest gainers within product categories during the Covid 19 pandemic are utilities, education, banking & insurance products, health products, home entertainment and direct to home services; while apparel, out of home entertainment, construction, sin goods (tobacco) and automobiles have taken a major hit in sales.

The shift in buyer behaviour has also been accompanied by a shift in retail footprint, as more consumers are opting for online stores as compared to physical retail. While consumers prefer physical retail for FMCG goods, they are likely to prefer online/e-commerce platforms for apparel, electronics and communication gadgets (BCG, 2020).

Influence of Demographics on Buyer Behaviour

There are distinctive differences in buyer behaviour across demographics. With regard to age, Generation Z consumers are likely to reduce their spending levels due to the economic disruption, while Millennials and Gen X consumers are likely to maintain or increase spending levels due to their economic resilience (BCG, 2020). Generation Z consumers are also likely to make smaller purchases of groceries and household goods, while the majority of their consumption is associated with digital media and in-home entertainment (Inmobi, 2020).

Other Factors Influencing Buyer Behaviour

Buyer behaviour is also influenced by customer citizenship behaviour (the voluntary behaviour of customers to offer help to fellow customers, provide feedback to store employees regarding their perception regarding goods and services, tolerating deficiencies in their buying experience at the store and recommending goods and services to friends, family members and co-workers) (Shamim & Ghazali, 2014) and customer participation behaviour (seeking information while making buying decisions, abiding by the company’s norms to ensure better quality of products or service, sharing information with store employees as needed and engaging in personal interactions with other customers or store employees) (Nambisan & Nambisan, 2009; Yi & Gong, 2013). Studies have revealed that customer citizenship behaviour and customer participation behaviour contribute to the development of innovative services, with regard to social media platforms (Moghadamzadeh etal., 2020).

Shopping emotions can also influence Buyer Behaviour, with regard to impulse purchases (Lee & Yi, 2008; Soodan & Pandey, 2016). Among low income consumers, lack of brand awareness and communication barries such as interpretation of brand elements in advertising can impact buyer behaviour (increased price sensitivity, suspicious of new products (Gupta & Pirsch, 2014; Seng et al., 2015). Buyer behaviour is also influenced by in-store factors (number of product displays/facings, visual display of products on shelves – vertically & horizontally and product pricing) and out of store factors (customer demographics, brand visibility and past usage of the product/brand) (Chandon, Hutchinson, Bradlow, & Young, 2009). However, these factors have not been considered for the study as the determinants of buyer behaviour during economic crises differ, as opposed to te normal functioning of retail formats.

Objectives and Framework

Research Objectives

The onset of the Covid-19 pandemic has altered the buyer behaviour of consumers in India and lead to the adoption of digital payment systems (DPS). The research questions explored in this study are

1) To determine the differences in adoption of digital payment systems and its utility based on demographic factors.

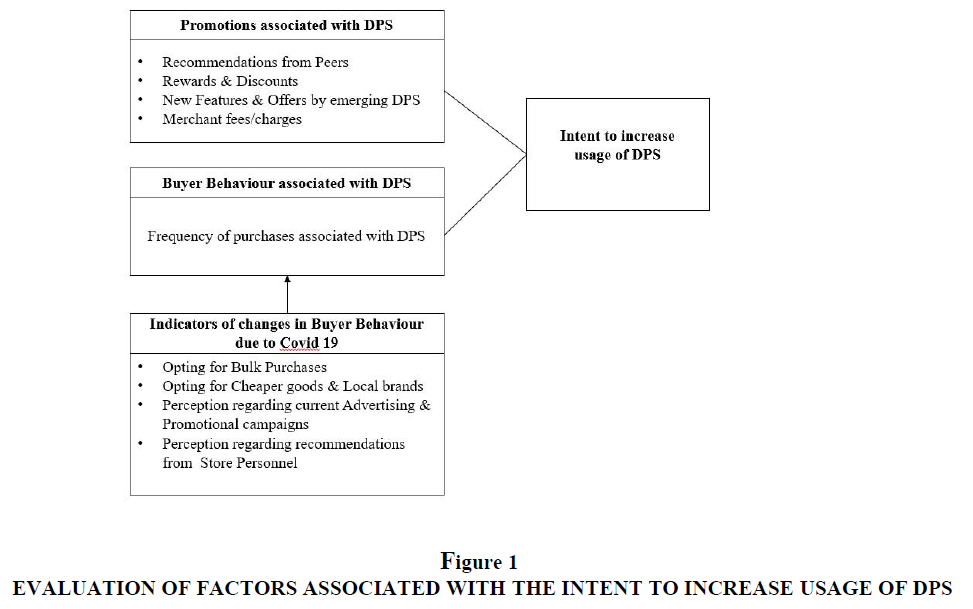

2) To assess the impact of buyer behaviour associated with digital payment systems on the intent to increase the usage of digital payment systems in Figure 1.

Research Model

Previous research explores the determinants of adoption of digital payment systems, however there is little or no research associated with the intent to increase usage of various services offered through digital payment systems due to the Covid-19 pandemic. The framework adopted bases the intent to increase the usage of DPS on promotions associated with DPS and buyer behaviour associated with DPS. The promotions associated with DPS considered for this study are merchant fees and charges (Patil, 2014), reward programs & discounts (Shaw, 2014), recommendations by peers (Bagozzi & Dabholkar, 2002), novel features and offers provided by emerging DPS (BCG & Google, 2016). The change in buyer behavior is interpreted based on the reducation in frequency of visits to physical stores. The indicators of change in buyer behavior due to the Covid 19 pandemic considered for this study are opting for bulk purchases (Jones, 2014), opting for cheaper/local brands (Lamey et al., 2012), perception regaarding current advertising & promotional campaigns (Yoo et al., 2000) and perception regarding recommendations by store personnel (Sinha et al., 2019).

The research tool utilized in this study consists of a 17 item questionnaire capturing demographic and response data. The instrument was tested for reliability and the results are summarized as follows in Table 3.

| Table 3 Factors Affecting the Intent to Increase Usage of DPS (Alpha=0.72) | |

| Alpha | |

| Merchant fees/charges | 0.71 |

| Rewards & Discounts | 0.64 |

| Recommendations from peers | 0.69 |

| Intent to increase usage of various services offered by DPS | 0.73 |

| Factors affecting Buyer Behaviour (alpha = 0.67) | |

| Opting for Bulk Purchases | Alpha 0.61 |

| Opting for Cheaper/Local brands | 0.67 |

| Buyer behaviour associated with DPS | 0.55 |

| Perception regarding current advertising & promotional campaigns | 0.67 |

| Perception regarding recommendations by store personnel | 0.67 |

Findings reveal that all items/variables chosen, with the exception of buyer behaviour associated with DPS are significant (>0.6).

Methodology

Descriptive Statistics

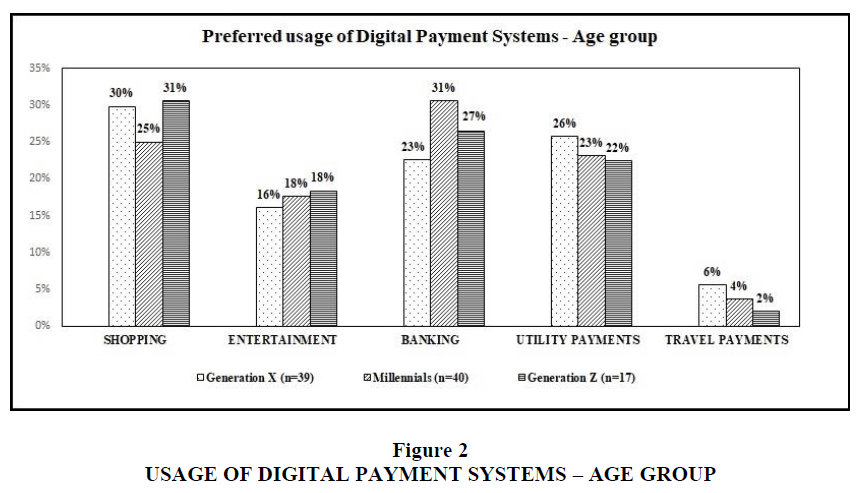

Descriptive statistics is performed to reveal insights into key differences in adoption of specific services offered by digital payment systems among different age groups (Generation X, Millennials, Generation Z). The classification of utilities are shopping (point of sale purchases, e-commerce), entertainment (movie tickets, eating out, social events etc.), banking (fund transfers, insurance premiums, deposit payments, tax payments, loan payments etc.), utilities (power, water, internet, LPG/cooking gas, FASTtag etc.), travel in Figure 2 (domestic travel- taxis, autos; long distance travel – bus, rail, air).

Respondents falling under the Generation X category are the largest segment using digital payment systems for utility payments (26%) compared to other groups, considering their familial responsibilities. Millennials are the largest segment using digital payment systems for banking applications (31%) which could be an indicator that this group was the early adopter of basic services offered through digital payment systems. Generation Z is the largest segment utilizing digital payment systems for shopping and entertainment purposes, which reflects the interests of the younger generation. Across utility of digital payment systems, travel payments are the least adopted utility which is an indicator that travel payments in India are mostly cash based in Figure 2.

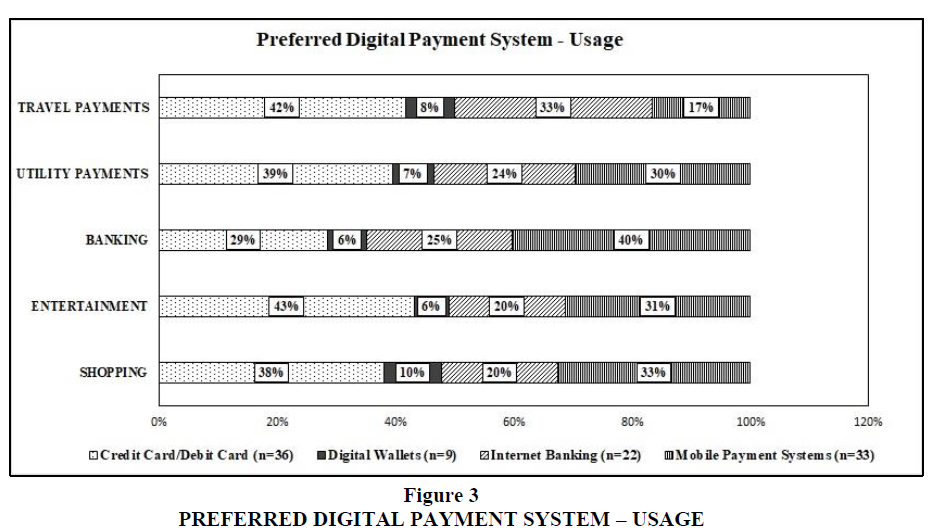

Credit card/Debit card is the most widely used DPS for shopping (38%), entertainment, utility payments (39%) and travel payments (42%), followed by Mobile Payment Systems which is the preferred DPS for banking services (40%). Internet Banking is preferred over Mobile Payment Systems (MPS) only for travel payments (33%), while is still limited in usage. Digital wallets are the least preferred DPS with low adoption/usage. This is an indicator that consumers still prefer using traditional DPS for most services, but the usage of MPS is still expanding. The low usage of digital wallets in Figure 3 can be attributed to the reluctance of users to maintain balance on digital wallets for enabling transactions in Table 4.

| Table 4 Relationship Between Demographic Variables | ||||

| Categorical Variable 1 | Categorical Variable 2 | Chi-square Value | Degrees of freedom | Level of Significance |

| Respondent demographics | ||||

| Age | DPS Usage – Banking | χ2 = 39.627 | df = 9 | 8.875e-06 |

| Age | Preferred mode | χ2 = 24.22 | df = 9 | 0.003967 |

| Residence | DPS Usage – Banking | χ2 = 24.984 | df = 6 | 0.0003438 |

| Preferred mode of DPS | ||||

| Preferred mode | DPS Usage - Shopping | χ2 = 14.675 | df = 6 | 0.02294 |

| DPS Usage | ||||

| DPS Usage - Shopping | DPS Usage - Entertainment | χ2 = 23.665 | df = 2 | 7.264e-06 |

| DPS Usage - Shopping | DPS Usage – Utility Payments | χ2 = 6.9981 | df = 2 | 0.03023 |

| DPS Usage - Banking | DPS Usage – Utility Payments | χ2 = 17.295 | df = 3 | 0.0006146 |

| DPS Usage – Banking | DPS Usage - Travel | χ2 = 8.728 | df = 3 | 0.03313 |

Statistical Analysis

There is a significant relationship between the age of the respondent and preferred mode of digital payments, as highlighted in Table 4. Furthermore, there is a significant relationship between the age of the respondent and usage of DPS for banking services as highlighted in Table 4. There is also a significant association between the usage of DPS for shopping and entertainment, which could lead to a bundling of promotional offers and rewards. Similarly, rewards and promotional offers for utility payments could be bundled with banking services. To increase adoption of DPS for travel payments, reward programs could be bundled with banking services.

Factors Influencing Increased Usage of DPS and Change in Buyer Behaviour – By Age Group

Generation X

Findings reveal that there is a weak association between opting for bulk purchases and buyer behaviour associated with Digital payment systems (τb = 0.37, p < 0.05). Furthermore, there is no association between buyer behaviour associated with DPS and the intent to increase usage of DPS (p > 0.05).

Generation Y/ Millennials

The buyer behaviour of millennials associated with DPS is moderately associated with opting for bulk purchases (τb = 0.43, p < 0.01), while being weakly associated with the behaviour of store personnel (τb = 0.30, p < 0.05), opting for cheaper/local brands (τb = 0.31, p < 0.05) and perception regarding current advertising & promotional campaigns (τb = 0.35, p < 0.01). It can be inferred that millennials are likely to use DPS during their visits to physical retail outlets and are responsive to the inputs of store personnel. Furthermore, there is a weak association between novel offers and features offered by emerging DPS (τb = 0.31, p < 0.05), rewards & discounts offered by DPS applications (τb = 0.31, p < 0.05), merchant fees (τb = 0.23, p < 0.05) and the intent to increase the usage of DPS. However, there is no association between buyer behaviour associated with DPS among millennials and the intent to increase usage of DPS (p < 0.05).

Generation Z

The youngest generation’s intent to increase their usage of DPS is moderately associated with rewards & discounts provided by the DPS application/platform (τb =0.66, p<0.01) and novel features/offers provided by emerging DPS applications (τb = 0.48, p<0.05), while it is weakly associated with merchant fees (τb = 0.40, p<0.05). Generation Z consumers are most likely to switch DPS applications or adopt emerging DPS at ease and their use of DPS is influenced by rewards, discounts and novel features. Furthermore, their buyer behaviour associated with DPS is moderately associated with their intent to increase the usage of DPS (τb = 0.57, p<0.5). Traditional advertising and promotional campaigns are ineffective in influencing buyer behaviour among Gen Z customers.

Factors Influencing Increased Usage of DPS and change in Buyer Behaviour – By Gender

Male

The buyer behaviour associated with DPS of male consumers is moderately associated with their preference for bulk purchases (τb = 0.51, p<0.01) and very weakly associated with preference local or cheaper brands (τb = 0.18, p<0.05). As a result, male consumers were likely to make bulk purchases during the lockdown. The influence of novel features/offers associated with emerging DPS (τb = 0.22, p<0.05) and rewards & discounts (τb = 0.31, p<0.01) provided by DPS applications are weakly associated with the intent to increase usage of DPS. Therefore, these additional incentives are not likely to increase the usage of DPS among male users. There is also a weak association between male buyer behaviour associated with DPS and the intent to increase usage of DPS (τb = 0.26, p<0.05).

Female

The influence of rewards & discounts offered by DPS applications is weakly associated with intent to increase the usage of DPS (τb = 0.31, p<0.05), while their buyer behaviour is weakly associated with advertising & promotional campaigns (τb = 0.30, p<0.05).

Factors Influencing Increased Usage of DPS and Change in Buyer Behaviour – By Mode of DPS.

Credit/Debit card

There is no significant association between promotions (recommendations from peers, rewards & discounts, novel features and offers by emerging credit card services) and intent to increase usage of credit cards (p>0.05). This could indicate that promotions offered on credit/debit cards have no influence on desire to increase usage. On the other hand, buyer behaviour associated with credit cards is weakly associated with opting for bulk purchases (τb = 0.26, p<0.05) and advertising & promotional campaigns (τb = 0.25, p < 0.05). It can be inferred that credit & debit cards are among the preferred DPS for bulk purchases. However, there is no association between buyer behaviour associated with credit cards and the intent to increase usage of credit cards (p>0.05).

Internet Banking

Buyer behaviour associated with internet banking is moderately associated with opting for bulk purchases (τb = 0.55, p < 0.1) and is a significant determinant of change in buyer behaviour. However, buyer behaviour associated with internet banking is not related to the intent to increase usage of internet banking (p > 0.05).

Mobile Payment Systems (MPS)

The intent to increase usage of MPS is moderately associated with by novel features and offers from emerging MPS (τb = 0.43, p<0.05) and weakly associated with merchant fees (τb = 0.32, p < 0.05). MPS applications can enhance usage by introducing new features or services. Furthermore, buyer behaviour associated with MPS is moderately associated with the intent to increase usage of MPS (τb = 0.47, p<0.01), but has limited impact. Therefore, MPS can be regarded as a suitable platform for enhancing usage of DPS.

Digital Wallets

The intent of customers using Digital Wallets to increase usage is strongly associated with rewards and discounts (τb = 0.75, p < 0.05), while buyer behaviour is moderately associated with opting for bulk purchases (τb = 0.75, p < 0.05). It can be inferred that rewards & discounts are integral in enhancing the usage of digital wallet applications. However, buyer behaviour associated with Digital Wallets is not associated with the intent to increase usage of digital wallets (p >0.05).

Factors Influencing Increased usage of DPS and Change in Buyer Behaviour – By Residence

Urban Residents

Urban residents are opting for bulk purchases (τb = 0.44, p < 0.01), which indicates a change in buyer behaviour associated with the adoption of DPS. The influence of rewards & discounts offered by DPS applications is weakly associated with the intent to increasing usage of DPS (τb = 0.27, p < 0.05). However, there is no association between buyer behaviour of urban residents and the intent to increase the usage of DPS (p > 0.05).

Suburban Residents

The intent to increase the usage of DPS among suburban residents is moderately associated with novel features and offers provided by emerging DPS (τb = 0.47, p < 0.01) and weakly associated with rewards & discounts offered by DPS applications (τb = 0.29, p < 0.05). Furthermore, buyer behaviour associated with DPS is weakly associated with opting for bulk purchases (τb = 0.32, p < 0.05) and opting for cheaper & local brands (τb = 0.30, p < 0.05). The buyer behaviour associated with DPS is weakly associated with the intent to increase usage of DPS among suburban residents (τb = 0.33, p < 0.05). This is an indicator that suburban residents are likely to increase their usage of DPS and adoption of new services could depend on available rewards & discounts.

Rural Residents

The buyer behaviour of rural residents is associated with cheaper & local brands (τb = 0.49, p < 0.05). There is also a weak association between novel features and offers provided by emerging DPS (τb = 0.34, p < 0.01) and a weak association with rewards & discounts offered by DPS applications (τb = 0.38, p < 0.05). Unlike their urban counterparts, rural consumers are opting for cheaper/local brands, while avoiding bulk purchases (p > 0.05). This could be an indicator of the economic impact of the lockdown on rural residents, who lack the purchasing power of urban residents. Furthermore, there is a weak association between buyer behaviour associated with DPS and the intent to increase usage of DPS (τb = 0.33, p > 0.05). It can be inferred that rural residents are likely to increase their usage of DPS.

Discussion

Descriptive Statistics

The average adoption of DPS for various services does not exceed 32% across age groups, which indicates that cash is still the preferred mode of transaction in India (Chittineni, 2018). Generation Z consumers priority spending areas are related to shopping and entertainment (Inmobi, 2020) and are mostly likely to adopt novel features offered and expand usage of DPS. Millennials are the largest segment adopting banking services via DPS (Daqar, Arqawi, & Karsh, 2020). Though credit/debit cards are currently the preferred mode of DPS, the rapid adoption of mobile payment systems will lead to a decrease in use of credit/debit cards (Dorotic, 2019; S&P, 2020).

Statistical Analysis

The adoption of digital payment systems is led by mobile payment systems. There is a need of specific/personalized bundling of promotions & rewards associated with the use of specific services in DPS (shopping & entertainment, banking & utility payments, banking & travel payments), where the adoption of a new service on DPS is rewarded.

Mobile payment systems are identified to be the only DPS where consumers have indicated their intent to increase usage, due to the provision of novel features and offers such as loyalty benefits, cash benefits etc as highlighted in existing research (Rowland & Shrauger, 2013). Furthermore, the study reveals that merchant fees have an impact on the adoption of mobile payment systems and market reports reveal that merchant fees/merchant discount rate has been scrapped for mobile payment systems, which could further accelerate its usage among small merchants/vendors (S&P, 2020). Credit/debit cards are still the preferred mode of digital payments for in-store/physical retail payments (Shetty, 2020).

Both male and female users are receptive to rewards & discounts offered by DPS and published studies indicate that they can be classified as offer junkies, who seek out the best price via comparison shopping and discount coupons (McKinsey, 2019).

Among various age groups, the findings of the study are similar to published research on the age group, where Generation Z users are most likely to increase their usage of DPS (ABA, 2019) and are not impacted by traditional advertising & promotions (Patel, 2017). Furthermore, the study reveals that Generation Z users are highly influenced by novel features offered by emerging DPS applications and can be classified as techy savy, as they are active adopters of new technology and prefer applications (McKinsey, 2019). Millennials were identified in the study as the leading users of banking services and published market research identifies mobile payment systems as the preferred DPS among this age group (Pepes, 2018).

The study also reveals that recommendations of store personnel impacts the buyer behaviour of millennials and published market research indicates that millennials still prefer to visit physical stores and look for a customer centric experience (Donnelly & Scaff, 2013).

Urban and suburban residents were likely to opt for bulk purchases during the Covid crisis, while rural residents opted for cheaper options due to lower purchasing power. The buyer behaviour of rural residents is supported by existing research that highlights the influence of price sensivity on consumers during economic crises or recessions (Ang et al., 2000; Mckenzie et al., 2011; Pärson & Vancic, 2020).

Limitations, Conclusion & Implications

The findings of this study are only an indicator of buyer behaviour and behavioural intent due to the low sample size and results may vary if a large sample were to be chosen. Furthermore, the study does not consider technological enablers or constraints associated with the usage of DPS. Based on the chosen variables, findings reveal that the Covid-19 pandemic lockdown has altered the buyer behaviour of consumers and increased usage of DPS for procuring various goods and services.

While the usage of DPS has increased due to the constraints placed by the crisis, a sustained increased in usage can only be ensured through careful bundling of promotions for untapped services on DPS and personalized reward programs for specific age groups. On the other hand, buyer behaviour associated with DPS could remain unchanged post pandemic, but digital payments will continue to grow.

References

- ABA. (2019). Payments, Trends to Watch in 2019. American Bankers Association.

- Ang, S.H., Leong, S.M., & Kotler, P. (2000). The Asian Apocalypse: Crisis Marketing for Consumers and Businesses. Long Range Planning, 33 (1), 97-119.

- Bagozzi, R., & Dabholkar, P. (2002). An Attitudinal Model of Technology-Based Self-Service: Moderating Effects of Consumer Traits and Situational Factors. Journal of the Academy of Marketing Science, 30 (3), 184-201.

- Balachander, S., & Ghose, S. (2003). Reciprocal spillover effects: a strategic benefit of brand extensions. Journal of Marketing, 67(1), 4-23.

- BCG & Google. (2016). Digital payment 2020: the making of a $500 ecosystem in India. Mumbai: Boston Consulting Group.

- BCG. (2020). BCG Covid 19 Consumer Sentiment Survey. Boston Consulting Group.

- Bhatti, T. (2007). Exploring factors influencing the adoption of mobile commerce. Journal of Internet Banking and Commerce.

- Biswas, V. (2020). Coronavirus Impact: How consumer behaviour will change post lockdown. Retrieved from Financial Express: https://www.financialexpress.com/brandwagon/coronavirus-impact-how-consumer-behaviour-will-change-post-lockdown/1954443/

- Bloomberg. (2020). Virus boosts digital payments in India where cash ban failed. Retrieved from Economic Times: https://telecom.economictimes.indiatimes.com/news/virus-boosts-digital-payments-in-india-where-cash-ban-failed/76932279

- Chandon, P., Hutchinson, J.W., Bradlow, E.T., & Young, S.H. (2009). Does in-store marketing work? Effects of the number and position of shelf facings on brand attention and evaluation at the point of purchase. Journal of marketing, 73(6), 1-17.

- Chittineni, J. (2018). Perceived Barriers for the adoption of digital payment services: A Study on South Indian customers. Gavesana Journal of Management , 51-58.

- Cliquet, G., Picot-Coupey, K., Huré, E., & Gahinet, M.C. (2014). Shopping with a smartphone: A French-Japanese perspective. Marketing: ZFP–Journal of Research and Management, 36(2), 96-106.

- Daqar, M., Arqawi, S., & Karsh, S. (2020). Fintech in the eyes of Millennials and Generation Z (the financial behavior and Fintech perception). Banks and Bank Systems, 15(3), 20-28.

- Donnelly, C., & Scaff, R. (2013). Who are the Millennial shoppers? And what do they really want? Chicago: Accenture. (2020). COVID-19 and emergence of a new consumer products landscape in India. Kolkata: EY.

- Gupta, S. (2020). Explained: How the Covid-19 pandemic has changed consumer behaviour. Retrieved from The Indian Express: https://indianexpress.com/article/explained/explained-how-the-covid-19-pandemic-has-changed-consumer-behaviour-6510354/Explained: How the Covid-19 pandemic has changed consumer behaviour

- Gupta, S., & Pirsch, J. (2014). Consumer Evaluation of Target Marketing to the Bottom of the Pyramid. Journal of International Consumer Marketing, 26 (1), 58-74.

- Hampson, D., & McGoldrick, P. (2013). A typology of adaptive shopping patterns in recession. Journal of Business Research, 66(7), 831-838.

- IFC. (2020). The Impact of Covid-19 on Logistics. Washington D.C: International Finance Corporation.

- Inmobi. (2020). The Shift In The Indian Consumer Behavior Since Lockdown. Retrieved from Inmobi: https://www.inmobi.com/blog/2020/05/13/the-shift-in-the-indian-consumer-behavior-since-lockdown

- Jones, E. (2014). Consumer preferences for national brands and private labels: do business cycles matter? In J. Gazquez-Abad, F. Martinez-Lopez, I. Esteban-Millat, & J. Mondejar-Jimenez, National Brands and Private Labels in Retailing (pp. 91-101). Cham: Springer.

- KPMG. (2019). Fintech in India - powering mobile payments . KPMG.

- Lamey, L., Deleersnyder, B., Dekimpe, M., & Steenkamp. (2012). The effect of business-cycle fluctuations on private-label share: what has marketing conduct got to do with it? Journal of Marketing, 71(1), 1-19.

- Laukkanen, T. (2016). Consumer adoption versus rejection decisions in seemingly similar service innovations: The case of the Internet and mobile banking. Journal of Business Research, 69(7), 2432-2439.

- Lee, G., & Yi, Y. (2008). The Effect of Shopping Emotions and Perceived Risk on Impulsive Buying: The Moderating Role of Buying Impulsiveness Trait. Seoul Journal of Business, 14(2), 68-92.

- Lemon, K., & Nowlis, S. (2002). Developing synergies between promotions and brands in different price-quality tiers. Journal of Marketing Research, 39(2), 171-185.

- Lichtenstein, D., Ridgway, N., & Netemeyer, R. (1993). Price perceptions and consumer shopping behavior: a field study. Journal of Marketing Research, 30(2), 234-245.

- Ligon, E., Malick, B., Sheth, K., & Trachtman, C. (2019). What explains low adoption of digital payment technologies? Evidence from small scale merchants in Jaipur, India. PLOS One, 14(7), 1-22.

- Mallat, N. (2007). Exploring consumer adoption of mobile payments–A qualitative study. The Journal of Strategic Information Systems, 16, 413-432.

- Mckenzie, D., Schargrodsky, E., & Cruces, G. (2011). Buying Less but Shopping More: The Use of Nonmarket Labor during a Crisis. Economía, 11(2), 1-43.

- McKinsey. (2019). Are convenience and rewards leading to a digital flashpoint? San Francisco: McKinsey .

- Mishra, N. (2020). An Expert Explains: Decoding India’s GDP contraction by 23.9%. Retrieved from Indian Express: https://indianexpress.com/article/explained/decoding-gdp-contraction-economy-rbi-6585775/

- Moghadamzadeh, A., Ebrahimi, P., Radfard, S., Salamzadeh, A., & Khajeheian, D. (2020). Investigating the Role of Customer Co-Creation Behavior on Social Media Platforms in Rendering Innovative Services. Sustainability, 12 (17), 6926.

- Mukherjee, K., & Mukherjee, P. (2020). Coronavirus impact: How consumer behaviour will change post-COVID-19 lockdown. Retrieved from Business Today: https://www.businesstoday.in/opinion/columns/ coronavirus-lockdown-impact-consumer-behaviour-post-covid-19-shopping-malls/story/406126.html

- Nambisan, P., & Nambisan, S. (2009). Models of consumer value cocreation in health care. Health Care Manag. Rev., 34 (4), 344–354.

- Nasscom. (2020). #Digital Payments India – Short to Medium Term Effects of COVID 19. Retrieved from Community by Nasscom Insights: https://community.nasscom.in/communities/digital-transformation /fintech/digital-payments-india-short-to-medium-term-effects-of-covid-19.html

- Nielsen. (2020). Consumers to spend less on discretionary items: Nielsen India. Retrieved from The Hindu - Business Line: https://www.thehindubusinessline.com/economy/consumers-to-spend-less-on-discretionary-items-nielsen-india/article31368334.ece

- Parasuraman, A., & Grewal, D. (2000). The impact of technology on the quality value loyalty chain: a research agenda. Academy of Marketing Science Journal, 28, 168-174.

- Pärson, G., & Vancic, A. (2020). Changed Buying Behavior in the COVID-19 pandemic - The influence of Price Sensitivity and Perceived Quality. Kristianstad: Kristianstad University.

- Patel, D. (2017). Gen Z Hates TV, And What That Means For Traditional Advertising. Retrieved from Forbes: https://www.forbes.com/sites/deeppatel/2017/05/30/gen-z-hates-tv-and-what-that-means-for-traditional-advertising/?sh=317f558032ed

- Patil, S. (2014). Impact of Plastic Money on Banking Trends in India. International Journal of Management Research and Business Strategy, 3(4), 1249-1254.

- PWC. (2020). Impact of Covid 19 ouτbreak on digital payments . Bengaluru: PricewaterHouseCoopers.

- RBI. (2016). Annual Report. Retrieved from Reserve Bank of India: https://rbidocs.rbi.org.in/rdocs/ AnnualReport/PDFs/

- Rowland, K., & Shrauger, S. (2013). The coming new way to pay. Foster City: Aba Bank Marketing.

- S&P. (2020). 2020 India Mobile Payments. New Delhi: Standard & Poor. Retrieved from https://bfsi.economictimes.indiatimes.com/news/fintech/upi-imps-electric-toll-transactions-fall-in-march-2020/74949017#:~:text=The%20United%20Payments%20Interface%20(UPI,of%20Rs%202.06%20lakh%20crore.

- Schierz, P.G., Schilke, O., & Wirtz, B.W. (2010). Understanding consumer acceptance of mobile payment services: An empirical analysis. Electronic commerce research and applications, 9(3), 209-216.

- Seng, L., Sum, L., & Mahfar, M. (2015). Creating Product Visibility to the Bottom of the Pyramid: Integration of Marketing Mix and Human Value Ecosystem Approach. Journal of Entrepreneurship, Business and Economics, 3(1), 1–30.

- Sengupta, A. (2020). India Drops Two Places to 132 in Ookla's Mobile Broadband Speed Index. Retrieved from NDTV: https://gadgets.ndtv.com/internet/news/india-mobile-internet-download-upload-speed-rank-fixed-broadband-speed-april-ookla-2233472

- Shamim, A., & Ghazali, Z. (2014). A Conceptual Model for Developing Customer Value Co-Creation Behaviour in Retailing. Glob. Bus. Manag. Res., 6(3), 185–196.

- Shaw, N. (2014). The mediating influence of trust in the adoption of the mobile wallet. Journal of Retailing and Consumer Services, 21(4), 449–459.

- Shetty, M. (2020). Lockdown forces shift from credit to debit cards. Retrieved from Times of India: https://timesofindia.indiatimes.com/business/india-business/lockdown-forces-shift-from-credit-to-debit-cards/articleshow/78096686.cms

- Singh, S. (2014). Customer perception of mobile banking: an empirical study in National Capital Region Delhi. Journal of Internet Banking and Commerce, 19 (3), 1-23.

- Singh, S. (2016). Here is why ‘the flavour of the season’, mobile wallets will die.

- Retrieved from Economic Times : http://economictimes.indiatimes.com/articleshow/56341815.cms?

- utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst November 30 2016.

- Sinha, I., & Batra, R. (1999). The effect of consumer price consciousness on private label purchase. International Journal of Research in Marketing, 16 (3), 237-251.

- Sinha, M., Majra, H., Hutchins, J., & Saxena, R. (2019). Mobile payments in India. International Journal of Bank Marketing, 37, 192-209.

- Soodan, V., & Pandey, A. (2016). Influence of Emotions on Consumer Buying Behaviour: A Study on FMCG Purchases IN Uttarakhand, India . Journal of Entrepreneurship, Business and Economics, 4(2), 163–181.

- Srivastava, S.C., Chandra, S., & Theng, Y.L. (2010). Evaluating the role of trust in consumer adoption of mobile payment systems: An empirical analysis. Communications of the Association for Information Systems, 27, 561-588.

- Taheam, K., Sharma, R., & Goswami, S. (2016). Drivers of Digital Wallet Usage: Implications for leveraging Digital marketing. International Journal of Economic Research, 13, 175-186.

- Tellis, G., & Tellis, K. (2009). A critical review and synthesis of research on advertising in a recession. Journal of Advertising Research, 49(3), 304-327.

- Thakur, R., & Srivastava, M. (2014). Adoption readiness, personal innovativeness, perceived risk, and usage intention across customer groups for mobile payment services in India. Internet Research, 24 (3), 369-392.

- World Bank. (2020). Global Economic Prospects. Washington D.C: World Bank.

- Yadav, R., & Chauhan, V. (2015). Intention to adopt internet banking in an emerging economy: a perspective of Indian youth. International Journal of Bank Marketing, 33 (4), 530-544.

- Yoo, B., Donthu, N., & Lee, S. (2000). An examination of selected marketing mix elements and brand equity. Journal of the Academy of Marketing Science, 28(2), 195-211.

- Zhou, T. (2013). An empirical examination of continuance intention of mobile payment services. Decision Support Systems, 54 (2), 1085-1091.