Review Article: 2023 Vol: 27 Issue: 1

IOS & Android Smartphones In India-Pricing and Marketing Strategy

Jaskaran Singh Saini, Manipal University Jaipur

Dinesh Kumar Saini, Manipal University Jaipur

Citation Information: Singh Saini, J., & Kumar Saini, D. (2023). Ios & Android Smartphones In India-Pricing And Marketing Strategy. Academy of Marketing Studies Journal, 27(1), 1-17.

Abstract

The smartphone industry in India has been witnessing double-digit growth in recent years, becoming the fastest smartphone market globally. The saga of evolution began with the dyads, i.e., Apple and Samsung, in the initial years and are now dominated by new entrants viz, Xiaomi, Realme, Oppo, Vivo & others. The flagships from Apple and Samsung touted as stark rivals, also exhibit a deep sense of coopeitition when it comes to pricing. The paper dives into the pricing strategies of the Apple and Samsung flagships considering their Indian and Global prices. The research clears the main doubt in the end user's mind if importing a product (especially Apple products) can be viable. Among the plethora of smartphone brands flooding the Indian markets, customers need to be cautious when making purchase decisions. Simultaneously, besides profiteering, smartphone manufacturers should prioritize high ethical standards to make their products environmentally sustainable. The paper aims to help consumers better understand the difference or similarities in the pricing strategy of the dyads. The trendsetters in the smartphone industry are outsmarting the competition by attaching astronomical price tags each year. When the ownership cost of a smartphone is more than the national per capita income, consumers are advised to make a sensible choice without falling into the trap of consumerist conglomerates.

Keywords

Ios & Android Smartphones, Marketing Strategy.

Introduction

The number of mobile users in India is estimated to be 106 crores in 2020. With 50% internet penetration, India is fast moving ahead on the path of Digital India. Simon Kemp (2020). India boasts of being one of the fastest-growing emerging developing economies (ignoring the pandemic slump), with growth prospects of 5% to 8% per year. The emerging New Middle Class sets the promising fertile ground for global giants to target the Indian market and make double-digit profit growth. Although the economist and intellectuals debate around the exact definition of the middle class, assuming the middle class represents the households/individuals with income less than Rs. 20 lakh per annum, we can safely take 20% of the Indian population to be middle class in 2021 The Census of India (2011).

There were 81 crore smartphone users in India in 2020, and it is expected to reach 120 crore by 2026 Ericsson Mobility Report (2021). By this estimate, roughly 58% of Indians are smartphone owners, indicating a reasonable income status of most citizens enough to afford smartphones. Hence it shows that our assumption of 20% of the middle class may be valid in the given scenario. Our hypothesis may be contrary to the government's estimates as only 1.46 crore out of 135 crores paid tax in the financial year 2019-20. By any yardstick, India is not a third-world nation anymore. India ranks third in the world with 177 Billionaires (after the USA and China). Despite Covid-19, 55 Billionaires in the global rich list were Indians Hurun Report (2021). In other words, India produced a new billionaire every week.

Today's smartphone is approximately 1300 times more potent than ENIAC (the world's first computer) and 1,20,000x lighter (ENIAC weighed whooping 30 tons, priced at $6 million). Owning a smartphone is not a luxury anymore; instead, it has become a necessary tool for consuming essential public services. Imagine how one would access the CoWIN portal in India to register for Covid-19 vaccination via Nokia 3660? The answer is a nightmare. Of late, the smartphone market has become very competitive, especially the flagship arena, dominated by the duopoly of Apple and Samsung. Sometimes the duo intimidates or perhaps imitates quite often (Samsung jumped on the bandwagon of eliminating the 3.5 mm headphone jack and mobile charger, following the footsteps of Apple). However, gullible customers are often caught up in their crossfire of market dominance outreach. At the outset, both try to build an image of environmentally friendly and customer-centric corporate houses in their launch events. (we don't question their environmental strategies and objectives in any way). However, their pricing strategies and marketing approach deserve deeper scrutiny by the Indian customers to understand their business model better and make an informed purchasing decision in the future.

In 2011, a Chinese citizen Wang Shangku sold one of his kidneys to become a proud owner of the iPhone 4 and iPad 2. Unfortunately, according to the latest reports in 2020, he is undergoing dialysis and is likely to be bedridden throughout his life. That said, according to Piper Sandler Survey, 88% of US teens own an iPhone and 90% expect their next phone to be an iPhone Piper Sandler Survey (2021). A similar wave of iPhone ownership is catching India like wildfire, especially amongst the college-going youth, thus indicating solid growth prospects for Apple in India.

Literature Review

Industry Perspective

The quest to be the technology leader has pushed the technological giants in smartphone manufacturing to come up with new models every year. More than the competition, such technology giants tend to gain more from the coopetition Ansari et al. (2016). The ultimate objective is to gain a competitive advantage over the others and set industry standards by virtue of being the earliest entrants in the technological realm Gnyawali & Park (2011). The innovation shock caused by the invention of the Ford Model T in 1908 is akin to the Apple introducing iPhones in 2007, Samsung Galaxy S in 2010 (in India), and Apple's indigenous M1-chip-based MacBooks in 2020 (Nicholas Argyes, Luda Bigelow A, 2015). Although the dyadic relationship between Apple and Samsung seems to compete with each other at the outset, instead, the coopetitive spirit often dominates their business strategies. Samsung is the leading OLED panel (Organic LED) manufacturer and acts as a supplier for most of the leading smartphone companies, including Apple Rusko (2014).

Both competition and coopetition characterize the complex relationship among the competitors at different levels. While competition is more concerned with market dominance, and the winner gets the opportunity to set the rule of the game. In contrast, coopetition is more of a mutual benefit stance dictating the informal standards of the smartphone industry, such as pricing, features, durability, etc. Bengtsson & Kock (2000). In the competitive arena, it is vital to maintain an edge over the rivals in the positioning of the products. The timing of the actions by the companies is one of the primary tools for gaining market share Ferrier et al. (1999). The theory of Hyper-competition emphasizes the creative destruction of the strategies with time by the leaders. This way, the rivals are always caught in targeting the moving target. E.g., for decades, Apple has produced its MacBooks in collaboration with Intel. With the introduction of the M1 chip, the dynamics have changed completely. As the smartphone market matures, especially in India due to its large consumer base, new entrants in the smartphone industry try to create their own resources. The giant entrants may not have all the resources and depend on external resources Gnyawali & Park (2011). Such circumstances make more avenues for collaboration than competition. For instance, the Operating System (OS) of the majority of smartphones is either iOS (by Apple) or Android (by Google). Hence every smartphone manufacturer collaborates with Google to provide seamless software services. Taiwan Semiconductor Manufacturing Company (TSMC) is one of the sole chip manufacturers in the smartphone industry today. Apple, Samsung, and Huawei are the only (major) companies indigenously making their SoCs (System on Chip). Other smartphone manufacturers source their chips from either Qualcomm or Snapdragon. Hence despite the cutthroat competition, the rivals tend to cooperate and collaborate away from the public gaze Argyres et al. (2015).

Every month in India, new smartphones are introduced, mostly with incremental changes. Due to the proliferation of new budget smartphones, Samsung (including rival brands) often start launching lite versions of their flagships to fulfill the needs of budget customers. Such a strategy leads to cannibalization, wherein flagship companies start losing elite flagship customers to budget customers Fan & Yang (2020). Kabeyi (2018) suggests the best-value focus strategy, as widely adopted by Apple, wherein the company tries to offer services or products with more features so that customers find more value. The market around the Apple Ecosystem works on the same principle. The Product Lifecycle Model explains the evolution of dominant design. In this model, the dominant design is categorized into three phases viz; the fluid phase, the transition phase, and the specific phase Cecere et al. (2015). The smartphones in India are under the specific phase, wherein the competitors imitate the widely accepted dominant design, and there is a minimal or low scope of innovation in design per se. As soon as Apple's notch design in 2016 gained acceptance (although with initial criticism), the rival firm immediately jumped on the bandwagon of notched-display.

Consumer Perspective

The sales volume of smartphones is intricately linked to the brand value of the product Stokburger-Sauer et al. (2012) and the perceived benefits of the product by the consumers Sweeney & Soutar (2001). The brand consciousness among the consumers has drastically helped Apple strengthen its revenues from iPhones sale in India. On the other hand, in the perceived benefit approach, the consumers evaluate the value of a product according to the sacrifices made (mental, physical and financial) and the benefits accrued Cronin et al. (2000). Consumer value for a product is composed of functional, emotional, and social values Sweeney & Soutar (2001). The functional value corresponds to the direct benefits offered by the product and the value for money. The emotional value is the hedonic value or the value perceived based on the experience of using the product. The social value is the extent to which the individual's social well-being is enhanced just by using a particular product.

Research Methodology

The research specifically focuses on the Indian pricing of smartphones by Apple and Samsung in the last decade. Our analysis is based on the secondary data available in the public domain. Although the new entrants offering budget smartphones dominate the smartphone market in India, the dyads (Apple & Samsung) still play a pivotal role in swinging the market dynamics due to their dominant position. The price arbitrage in smartphones (especially Apple) is enormous, and our research aims to explore if the Indian consumer can leverage the same to their advantage. The flagship smartphones are not affordable anymore and cost upwards of Rs. 1 lakh (on average) in the Indian scenario. Indian consumers need to know how smartphone companies are working as cartels when it comes to pricing.

Global Price Comparison-Apple Vs. Samsung

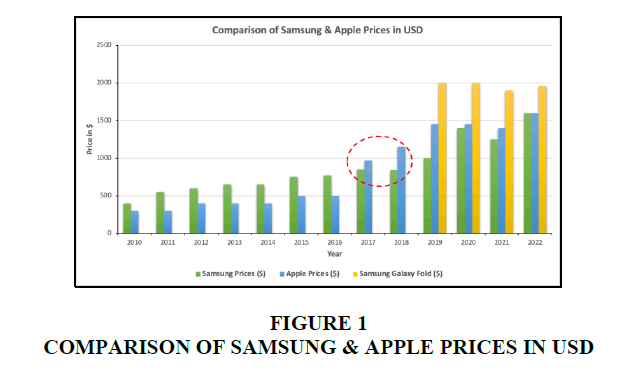

In late 2010, Apple phones were an extreme luxury, and Nokia dominated the Indian smartphone market (remember Nokia 6600, one turns nostalgic). And then came Android in the form of the Samsung Galaxy S. This was an era of Apple launching locked and unlocked versions of their phones in the USA and later charging a premium for unlocked versions in other countries. In the early 2010s, a general assumption was that Apple's phones were way more costly than the Samsung flagships (Galaxy S series). Our analysis of global prices of Apple and Samsung phones (only flagships) has revealed the opposite. Figure 1.

The bar chart shows that the global prices of Samsung were much higher than the Apple counterparts each year until 2017. The Apple and Samsung prices in the bar chart do not represent Indian prices because they set their Indian prices unilaterally, even much higher than prevailing USD-INR Exchange Rates. We will discuss this issue later in the article. What happened in 2017? In June 2017, Apple launched iPhone X, priced at $1149 (the highest specification model). Before 2017, Apple concentrated on serving the domestic and European markets; hence, most phones were locked versions bundled with a particular telecom operator at a much lower price.

In contrast, Samsung launched unlocked phones with a universal dollar price tag across the globe. For instance, Apple priced the locked iPhone 6s Plus at $499 and the unlocked version at $949. Hence the notion that Samsung phones were cheaper and iPhones were costly, being a luxury products, was incorrect. Moreover, even the wedge between Samsung flagship and iPhone prices is negligible in 2020-21(Appendix-1). For example, the S21 Ultra 5G (512 GB) unlocked version in the USA is $1379, just short of $20 compared to the iPhone 12 Pro Max (512 Gb).

The launch of the Galaxy Fold series (in 2019) has provided leeway to Samsung`s pricing strategy, even outsmarting Apple's price tag with a considerable margin. There are no competitors for Samsung in the foldable smartphone market, thus providing a definite competitive advantage in extracting a high premium for a specialized niche product. Consequently, it has given Samsung enough room to price their S series flagships on par with Apple flagships. Samsung`s sole presence in the foldable arena has enabled it to diversify the product portfolio and extent its outreach to premium customers previously not interested in its flagship S and Note series.

Indian Prices - Apple VS. Samsung

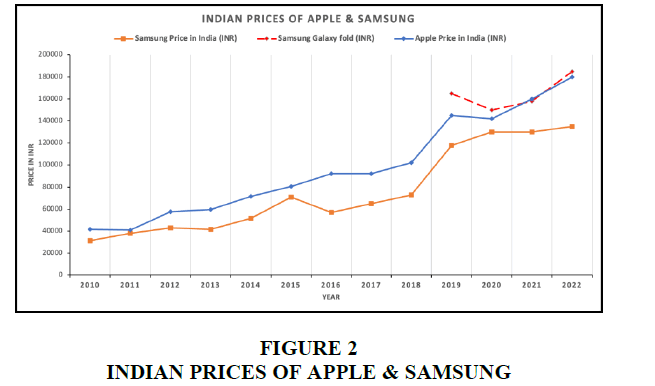

When it comes to Indian Prices, both companies can be alleged for exploiting the Indian users for a decade in the same length and breadth. However, the setting of regional prices is the company's prerogative, and the methodology adopted in determining the Indian prices is ambiguous. Figure 2 depicts that Apple Indian Prices were consistently higher than Samsung Indian Prices (flagships). This trend has let us assume that Apple was always costlier than Samsung. However, as Figure 1 shows, the assumption was false in the scenario of Samsung Global Prices. The story in the graph is quite interesting; both iPhone 4S and Galaxy S2 in 2011 were priced similarly at Rs. 40,900 and Rs. 38000, respectively (Appendix-2). Apple adopted an aggressive pricing policy, whereas Samsung went on with a gradual price increase in its next flagships.

But in 2012, Apple increased the price of the iPhone 4s (Rs. 57,500) to the iPhone 5 (Rs. 59,500). Similarly, in the same period, Samsung lowered the price from S3 (Rs.43,000) to S4 (Rs. 41,500). The discount offered by Samsung might be a deliberate marketing strategy to woo Indian customers as Apple was upping the ante (aggressive pricing), or Samsung achieved economies of scale due to good sales volumes of S3 (seven crore units were sold). However, as Apple gradually increased its prices each year, this created a wedge between Samsung's and Apple's Indian prices. To overcome the price gap, Samsung responded with a huge price jump from S5 (Rs. 51,500) to S6 Edge (Rs. 70,900) Figure 2.

The iPhone X launch in the Indian market with a price tag of Rs.1,02,000 changed the market realities dramatically. It was the first smartphone in India to cost as much as a Tata Nano car. Surprisingly the price hike by Apple did not backfire and was well received despite the criticism from various segments of society and competitors. The tag of Rs. One lakh made Apple phones more exclusive and helped it reach celebrity status in India. Apple hereon positioned itself as Rolls Royce of Indian Smartphones. The following year in 2019, Samsung imitated Apple by pricing their Galaxy S10 Plus at Rs. 1,17,900. It can be seen from Figures 2 & 3 that since 2020, Apple has been pricing their smartphones aggressively in India, whereas Samsung embarked on a wait-and-watch strategy due to falling demand during the Covid-19 pandemic. However, their global prices (USD) have reached a similar level.

As discussed earlier in the previous section, the Galaxy Fold series has put Samsung in a much more comfortable position and ahead of the competition in pricing its flagships. In 2022, the highest specification Galaxy Fold 4 costs Rs. 1,84,999 ($1959 in USA), nearing Apple`s newly launched iPhone 14 pro max (@Rs.1,89,900). From a technological perspective per se, iPhone`s exorbitant pricing seems unjustified in India, as the difference between the price of Fold 4 and iPhone 14 pro max is $400 (approx. Rs. 25000) in the USA and merely Rs. 4000 in India. Such a high amount of arbitrage by Apple is often overlooked by an average Indian consumer.

What About The Exchange Rate Charged?

Our focus is mainly on Samsung and Apple only for our ease of understanding. Samsung generally launches regional-specific phones/products with tailored specifications to avail tax benefits or address local demands. For instance, the Samsung Galaxy S Series launched in the USA uses a Snapdragon microprocessor, whereas Indian and European markets come with a slower (indigenous) Exynos Chip. On the contrary, Apple launches a global product with universal specifications but at different regional prices. Hence the moot question arises, what exchange rate both Samsung and Apple have charged Indian customers in the past?

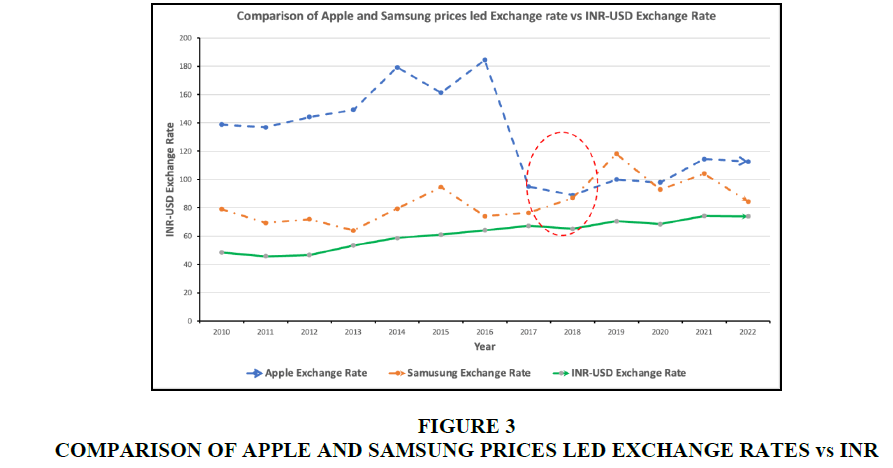

Indian customers need to know how much premium is charged from offshore customers by these global giants. Figure 3

Usd Exchange Rate

Figure 3 gives us a fascinating insight into how both companies have kept their virtual exchange rates to astronomical heights. A massive wedge between the rates until 2017 is because Apple used to charge less in the USA market, whereas Samsung kept their global prices higher than Apple. In 2017, iPhone X was the first phone in the USA to breach the $1000 limit; this led to a massive slump in the Apple Exchange rates, as shown in Figure 3 (red circle). Post-2017, Samsung drastically copied Apple's footsteps by increasing its Flagship prices, further entrenching its duopoly in the Indian market. But one can safely observe that Samsung priced their Indian phones somewhat near the market prevailing exchange rate (ignoring the trend after 2017). Due to inflationary pressure in the domestic Indian market and supply-side constraints in the wake of the ongoing Russia-Ukraine crisis, the Indian rupee has weakened to a new low (the rupee touched an all-time low of Rs. 80.15 on 5th September 2022). This is the main reason for the shrinking wedge between the Apple and Samsung price-led exchange rate vis-à-vis the real INR-USD exchange rate.

As the smartphone market is reaching saturation, the only silver lining is the decline in the externally charged rate by the dyads (Apple and Samsung) and gradually approaching the natural rupee-dollar exchange rate. It also proves (discussed in section 3.5) that importing smartphones from abroad, especially post-2017, may not yield higher dividends in the long run. Instead, the customers may be forced to run pillar-to-post by the smartphone service center in case their imported product needs servicing in India. A sudden plunge in Apple's price-led exchange rate in 2017 is seen because Apple started eliminating the massive price differential between their locked and unlocked version. This led to an abrupt increase in their global price, thus allowing all iPhone users to freely use their smartphones with other telecom carriers of their choice.

Comparision of Indian Prices In Usd and Global Prices

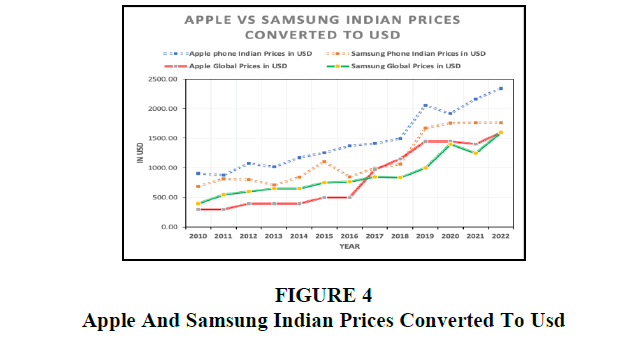

Another interesting observation from our analysis points toward the sink and swim together relationship between the duo. We converted the Indian Prices of both phones to USD with the prevailing exchange rates to illustrate the gap between Indian and Global prices (in USD) (Appendix 3). Figure 4 shows a critical observation; both are the culprit for charging double their global price in the Indian markets. Apple from iPhone 4s started charging Indian consumers more than $1000. On the other hand, Samsung began to charge more than $1000 in 2015 with the launch of the S6 Edge but immediately reverted to less than $1000 price (with the launch of the S7 Edge) after seeing low sales volumes in the Indian market Figure 4.

As discussed earlier, the iPhone X effect on the Indian market provided fertile ground for Samsung to enter into the $1000 club again with the launch of the S9 Plus model in 2018. Although Indian consumers continue to pay high prices in USD (@ current exchange rate), with the increasing cost of iPhones (and Samsung phones) in the US market, the wedge between Indian prices (in USD) and USA prices have decreased substantially.

It can be seen from figures 4 & 2 that Indian consumers were paying a very high premium (more than double) on iPhones before 2017. There is no direct correlation between the iPhone pricing strategies for India and global models (priced in USD), and often divergence is observed. For instance, there was a substantial jump in the price of the iPhone 7 from its predecessor model, but the Indian price registered no change, i.e., the launching price of iPhone 6s plus and iPhone 7 plus were the same. On the contrary, the USD prices of iPhones were somewhat constant during 2019 and 2021, but Indian prices appreciated substantially. The graph in figure 4 merely represents dollar prices of Indian units based on prevailing exchange rates (refer Appendix 4) and cannot provide conclusive results.

Effect of Importing an Apple Device

This question is disturbing many Indian college-going students who happen to be tech freaks. To make our analysis more nuanced and practical, we would target only Apple products for the sake of comparison. As Apple products throughout the globe come with the same specifications and software support; hence there is a high degree of anticipation of saving some dollars by importing a product. Table 1 gives an exhaustive analysis of the pricing of current Apple products Table 1.

| Table 1 Comparison Prices Of Apple Products In India And The Usa |

|||||||

|---|---|---|---|---|---|---|---|

| Products | USA price ($) |

Indian Rates (INR) | USA price in INR (as per exchange rate @ Rs. 76.78) |

Difference (INR) | INR-USD Exchange rate as per Apple prices (INR) |

Cost of importing Apple products from the USA (inclusive of custom, freight & other charges) (INR) |

Difference between Imported price with the Indian rates (INR) |

| iPad M1 (12.9`) | 1,099 | 99,900 | 84,383.75 | 15,516.25 | 90.90 | 1,16,933.60 | 17,033.60 |

| iPad M1 (12.9`) with Keyboard | 1,448 | 1,42,700 | 1,11,180.77 | 31,519.23 | 98.55 | 1,54,067.20 | 11,367.20 |

| Magic Keyboard | 349 | 31,900 | 26,797.02 | 5,102.98 | 91.40 | 37,133.60 | 5,233.60 |

| MacBook M1 13` (1 TB, 16 GB) |

1,899 | 1,89,900 | 1,45,809.59 | 44,090.41 | 100.00 | 2,02,053.60 | 12,153.60 |

| iMac 24` M1 (with magic and trackpad, 1 TB, 16 GB) |

2,228 | 2,12,400 | 1,71,070.96 | 41,329.04 | 95.33 | 2,37,059.20 | 24,659.20 |

| iMac Pro (highest specs) |

52,948 | 51,90,200 | 40,65,469.22 | 11,24,730.78 | 98.02 | 56,33,667.20 | 4,43,467.20 |

| iPhone 14 pro max (1 TB) |

1,599 | 1,89,900 | 1,22,774.90 | 67,125.10 | 118.76 | 1,70,133.60 | (19,766.40) |

| XDR Pro Display | 7,197 | 6,44,400 | 5,52,602.21 | 91,797.79 | 89.54 | 7,65,760.80 | 1,21,360.80 |

| AirPods Max | 549 | 59,990 | 42,153.48 | 17,836.52 | 109.27 | 58,413.60 | (1,576.40) |

| Magic Mouse 2 | 99 | 9,500 | 7,601.45 | 1,898.55 | 95.96 | 10,533.60 | 1,033.60 |

| AirPods Pro | 249 | 26,900 | 19,118.79 | 7,781.21 | 108.03 | 26,493.60 | (406.40) |

| AirTag (Pack of 4) | 99 | 11,900 | 7,601.45 | 4,298.55 | 120.20 | 10,533.60 | (1,366.40) |

| AirTag Red Loop keyring | 39 | 4,500 | 2,994.51 | 1,505.49 | 115.38 | 4,149.60 | (350.40) |

| MagSafe charger | 39 | 4,500 | 2,994.51 | 1,505.49 | 115.38 | 4,149.60 | (350.40) |

| 20W USB-C Power Adapter |

19 | 1,900 | 1,458.86 | 441.14 | 100.00 | 2,021.60 | 121.60 |

| Lightning to USB-C cable (2m) |

29 | 2,900 | 2,226.69 | 673.31 | 100.00 | 3,085.60 | 185.60 |

| Apple Tv 4K (64 GB) | 199 | 20,900 | 15,279.68 | 5,620.32 | 105.03 | 21,173.60 | 273.60 |

| Apple watch Ultra | 799 | 89,900 | 61,349.06 | 28,550.94 | 112.52 | 85,013.60 | (4,886.40) |

After reviewing the Indian custom rates and other charges applicable to importing foreign products, we found that, on average, one has to shell 35% extra on imports. Conservatively we assumed the all-inclusive import charges at @40% for accurate estimation of our calculations. Firstly, one can save only on limited products (marked in red, namely, iPhone 14 Pro max, AirPod Max, AirTags, etc.), not by a considerable margin. Secondly, Apple charges the highest exchange rates on iPhones, AirTags, and AirPod Max, respectively, whereas the lowest exchange rate premium is set on the already very expensive XDR Pro display. Thirdly, most products have no exchange rate consistency; however, most accessories are charged at the flat "1$=Rs.100" exchange rate (encircled red in the table). An enthralling savings of approx. Rs.20,000 on the import of iPhone might seem to be an attractive venture, but the customers need to remember that Apple does not offer an international warranty on the products anymore Apple Inc (2021). Hence there will be limited servicing options available on the imported Apple products.

According to the analysis, importing Apple products might not be wise in the Indian scenario. For instance, on importing the MagSafe charger, one can only save Rs. 350; additionally, a flat pin to round pin power adapter (around Rs. 1500) will be required to use the product seamlessly in India. Above all, regular follow-ups from the customs department, filling the customs forms, and a time delay of at least 3-4 days might become harassment. It would be wise to visit the Apple store and pay what it demands rather than indulging in the avoidable imports option. As per Indian laws, illegal imports attract 3 to 4 times the cost of the product as a penalty but can also invite jail terms. The table clarifies that Apple tries to set the price of products on the higher side, which are in high demand in the Indian market. The Apple annual reports put its revenue from the iPhone business at 54% of its total revenue Apple Inc (2022). Maximizing profits in the shortest possible time has led them to remove the charger for their newer phones. However, it defies the logic that if everyone starts ordering a new charger on e- commerce platforms, how the amount of plastic & paper required in the packaging (including other logistics costs) make the world more environmentally sustainable? Today's end consumer is more aware and intelligent enough to differentiate between marketing gimmicks and genuine environmental concerns.

Components Of Making A Wise Purchase Decision

The companies are there with the objective of wealth maximization. There is nothing wrong with it if done ethically and sustainably. India is home to many potential customers, with 65% of the population in 15-59 years. Hence every company wants its presence on Indian soil to extract dividends from the growing middle-class. India is home to 138 crore people in 2021, with a per capita income of Rs. 1,43,116. The average cost of Samsung and Apple flagship phones is Rs. 1,44,950, equivalent to 114% of the income of each Indian household.

On the contrary, the average cost of the duo in 2011 was Rs. 36,500, or 44% of the individual's income (Appendix-5). It is clear how the affordability parameter is simply going through the roof. Companies are on the bandwagon of increasing the price yearly by providing redundant incremental features without practical usability in real life. The availability of easy credit nowadays allows the company to justify any price tag in the name of customers' trust and brand experience. Otherwise, how would Apple justify the cost of Rs. 95,000 for the stand of the XDR Pro display? Spending money can be easy these days, but availing credit for fulfilling desires (not needs) can be dangerous. According to Global Wealth Report 2020 released by Credit Suisse, having $10 of earnings in the USA without any debt makes any individual richer than more than 25% of Americans. Shorrocks et al. (2020). Even in India, as per the Oxfam report, 1% of people hold approximately 73% of total wealth. Oxfam International (2020). Under such circumstances, it is imperative to prioritize affordability and necessity parameters while making a purchase decision eschewing the yearning towards going with the trend.

After analyzing the cutthroat competition in the smartphone market, which follows mercurial characteristics, we suggest three broad parameters under which one may consider:

1. Features- The Universal Selling Proposition (USP) of a smartphone is the ability to offer more features in lesser size. The System on a Chip (SoC) has made the capabilities of smartphones at par with modern-day computers. For instance, Apple's M1 chip is groundbreaking in smartphones, tablets, and computing industries, redefining SoC usability in modern-day computing devices. These days Xiaomi, Realme, Oppo, and Vivo are offering more feature-packed smartphones at affordable prices. When launched, the in-display fingerprint sensor feature was limited to only a few flagships; it reached every nook and corner of the smartphone industry in months. While considering features, one needs to keep in mind its practical usability. For instance, 100x zoom or a 5x zoom hardly makes any difference in actual usage, but a company like Samsung may market it as Space Zoom with a heavy price tag. Features are constantly updated, and companies tend to offer more features at a low budget over time. It is advisable to go for budget smartphones of Xiaomi, Realme, Oppo, Vivo, etc., which offer more practical features at a reasonable price.

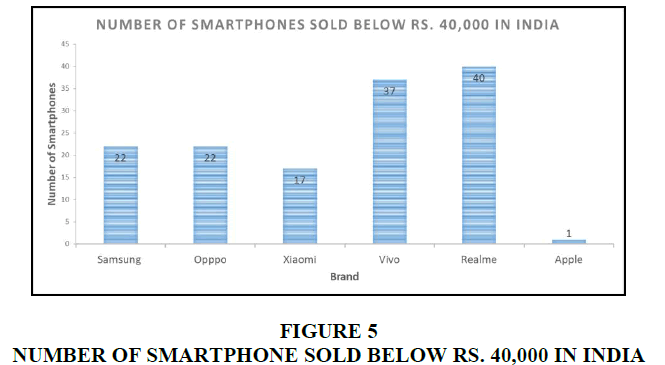

2. Budget- On average, Apple and Samsung are doubling the rates of their flagships every 5th year (Appendix- 4. On the other hand, the world's top 2000 billionaires have more wealth than the cumulative wealth of 60% of the population. Oxfam International (2020). The fast-changing technology trend in the smartphone arena necessitates consideration for mid-range smartphones. It helps to avail 90% of the features of flagships at half the price. For instance, Samsung Note 10 lite offers 90% of Note 10 Plus features at Rs. 35,000 (the price of Note 10 Plus is Rs. 80,000). Our analysis shows that Samsung has championed offering class-leading features from their flagship phones in their A, M, and F series. The below graph shows the company-wise data of the number of smartphones below the Rs. 40,0000 price range. Figure 5 indicates a growing trend towards mid-range phones. It is interesting to note that Apple offers only one phone, viz. iPhone SE (2020 model), priced at Rs. 39,990, which is a featureless, dated, and bland phone. One can say it is like Old Wine in Older Bottle. Apple has just rebranded its five-year-old iPhone 7 with the new Apple SoC (A13 Bionic processor). All low- budget phones, even of reputed brands, need to have some essential features Figure 5.

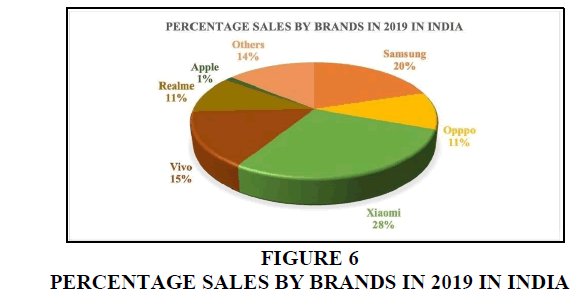

3. Longevity- This is a parameter where Apple goes all out as a winner. No other smartphone can match the software and hardware support that Apple offers. Samsung only offers security patch updates for only two years, although their smartphones are as expensive as iPhones. On the contrary, Apple (in 2020) provided iOS 14 updates to their 2015 flagship, i.e., the iPhone 6s. Apple is the sole provider of hardware and software services that helps improve its phones' longevity and stability. Apple is selling their mid-rangers at Rs. 50,000 +, with no high-end features; for example, iPhone 11 pro and iPhone Xr use an LCD panel for the display. The competition offers high- density LED AMOLED panels in the price range of Rs. 10,000-20,000. Apple is not known for favoring kneejerk eyeball-catching features at their launch events and suddenly backtracking the same the following year. For instance, Samsung launched an iris scanner in S8 Plus, S9 Plus and shockingly discontinued it in their next year's flagship (S10 series), and Samsung uses Exynos and Snapdragon processors in different regions at the same price, etc. That said, becoming a member of Apple's Longevity Club may be attractive, but it comes with a very high price tag. We suggest that only those who can afford it should go for Apple without getting into the cobweb of credit card EMI payment cycles Figure 6.

Mid-range smartphones in India can offer equivalent performance (if not more) to various expensive flagships. Figure 6 shows the dominance of Chinese players in the Indian smartphone market. As per the data published by the International Data Corporation (IDC), in 2019, India's smartphone market shipped 15 crore units, which is approximately 27% of global smartphone sales (Appendix-6). The data is new oil today. All these sales hint toward a considerable amount of data flowing into the hands of foreign players. Nowadays, a smartphone is not just a phone but a bank, a navigator, a contacts record, a teacher, an entertainer, and whatnot. Unfortunately, India lacks a robust Data Protection law to safeguard consumer data on a predictable basis PACE (2019).

Discussion and Conclusion

Nowadays, powerful SoCs make smartphones more capable than computers, thus improving the years of ownership and providing impetus to the second-hand smartphone market. The deliberate slowing of phones by pushing mischievous and frivolous updates to increase the sales figures of new phones is a new practice adopted by smartphone manufacturers these days (including Apple and Samsung). Every coin has two sides; the same goes for the smartphone industry. We cannot neglect the rising carbon footprint due to dumping older phones and converting launching events into annual rituals. The paper's purpose was to highlight the recent trends in the smartphone market, considering two major global Industry giants, i.e., Apple and Samsung. It may not be an anomaly to refer to duos as trendsetters in the smartphone industry. The analysis has enlightened how to use pricing strategies and the price arbitrage mechanism to their advantage. Apple is at the zenith of its computing prowess, especially with the launch of the M1 chip; it is likely that Apple to become a new market trendsetter in the applicability of SoCs in different computing devices. Apple has been the trendsetter in the smartphone industry. The competition widely imitates at some point or another (though with some resistance initially, case-in-point is removing a 3.5 mm headphone jack by Apple). Every company has the liberty to determine the price of the product in any market of their choice. We endeavor to make people aware of the economics of their business model that indirectly impacts the country's citizens. Apple was the first company to achieve a market capitalization of $2 trillion in 2020. In terms of GDP rankings, Apple is even ahead of Italy, Brazil, and Canada, with the 8th global rank.

India has the 2nd largest number of smartphone users in the world. As responsible consumers, we must prioritize our purchase decisions to make the world more sustainable and habitable for future generations. It is a cause of great concern that only 20% of e-waste is formally recycled, and the smartphones & computing industries are the significant sources of generation of e-waste. The UN (United Nations) estimates that 100 tonnes of e- waste contain more gold than the equivalent tonnes of gold ore. Today's smartphones are based on SoCs that can last long. Smartphone manufacturers can launch the new models biennially or delay the launches. This way, consumers can get a more innovative product, and companies may provide substantial technological advancements and polished products. E.g., the hurried launch of 1st generation Galaxy Fold embarrassed Samsung on a global platform. More than 90% of smartphone users in India prefer a budget smartphone priced below Rs. 40,000, catered by Xiaomi, Realme, Vivo, Oppo, and others. Today smartphones are the banks too; Indian policymakers need to legislate robust Data Privacy Law to protect the data leaks and set the ground rules for exchanging data among app developers, software providers, and hardware manufacturers. The prices of smartphones have skyrocketed after 2016, even more than India's per capita income growth. Now the need is to choose the product of your choice with caution, meeting your needs, not necessarily falling prey to consumerist tendencies fueling the smartphone market.

Appendices

| Appendix 1 Apple vs. Samsung global prices |

|||||

|---|---|---|---|---|---|

| Year | Samsung S series Phones | Apple iPhones | Samsung Price ($)) | Apple Price ($) | Samsung Galaxy Fold ($) |

| 2010 | S1 | iPhone 3GS | 399 | 299 | - |

| 2011 | S2 | iPhone 4 | 549 | 299 | - |

| 2012 | S3 | iPhone 4S | 599 | 399 | - |

| 2013 | S4 | iPhone 5 | 649 | 399 | - |

| 2014 | S5 | iPhone 5s | 649 | 399 | - |

| 2015 | S6 Edge | iPhone 6 Plus | 749 | 499 | - |

| 2016 | S7 Edge | iPhone 6s Plus | 769 | 499 | - |

| 2017 | S8+ | iPhone 7 Plus | 849 | 969 | - |

| 2018 | S9+ | iPhone X | 839 | 1149 | - |

| 2019 | S10+ | iPhone XS Max | 999 | 1449 | 2000 |

| 2020 | S20 ultra | iPhone 11 pro max | 1400 | 1449 | 2000 |

| 2021 | S21 Ultra | iPhone 12 pro max | 1249 | 1399 | 1899 |

| 2022 | S22 Ultra | iPhone 13 pro max | 1599 | 1599 | 1959 |

| Appendix-2 Apple Vs Samsung Indian Prices |

|||||

|---|---|---|---|---|---|

| Year | Samsung S series Phones | Apple iPhones | Samsung Price (INR) | Apple Price (INR) | Samsung Galaxy Fold Price (INR) |

| 2010 | S1 | iPhone 3GS | 41500 | 31500 | - |

| 2011 | S2 | iPhone 4 | 40900 | 38000 | - |

| 2012 | S3 | iPhone 4S | 57500 | 43000 | - |

| 2013 | S4 | iPhone 5 | 59500 | 41500 | - |

| 2014 | S5 | iPhone 5s | 71500 | 51500 | - |

| 2015 | S6 Edge | iPhone 6 Plus | 80500 | 70900 | - |

| 2016 | S7 Edge | iPhone 6s Plus | 92000 | 56900 | - |

| 2017 | S8+ | iPhone 7 Plus | 92000 | 64900 | - |

| 2018 | S9+ | iPhone X | 102000 | 72900 | - |

| 2019 | S10+ | iPhone XS Max | 144900 | 117900 | 164999 |

| 2020 | S20 ultra | iPhone 11 pro max | 141900 | 130000 | 149999 |

| 2021 | S21 Ultra | iPhone 12 pro max | 159900 | 130000 | 157999 |

| 2022 | S22 Ultra | iPhone 13 pro max | 179900 | 134999 | 184999 |

| Appendix 3 Comparison Of Exchange Rates |

|||||

|---|---|---|---|---|---|

| Year | Samsung S series Phones | Apple iPhones | Exchange Rate as per Apple Rates | Exchange rate as per Samsung Prices | INR-USD Exchange Rate |

| 2010 | S1 | iPhone 3GS | 138.80 | 78.95 | 45.73 |

| 2011 | S2 | iPhone 4 | 136.79 | 69.22 | 46.67 |

| 2012 | S3 | iPhone 4S | 144.11 | 71.79 | 53.44 |

| 2013 | S4 | iPhone 5 | 149.12 | 63.94 | 58.60 |

| 2014 | S5 | iPhone 5s | 179.20 | 79.35 | 61.03 |

| 2015 | S6 Edge | iPhone 6 Plus | 161.32 | 94.66 | 64.15 |

| 2016 | S7 Edge | iPhone 6s Plus | 184.37 | 73.99 | 67.20 |

| 2017 | S8+ | iPhone 7 Plus | 94.94 | 76.44 | 65.12 |

| 2018 | S9+ | iPhone X | 88.77 | 86.89 | 68.39 |

| 2019 | S10+ | iPhone XS Max | 100.00 | 118.02 | 70.42 |

| 2020 | S20 ultra | iPhone 11 pro max | 97.93 | 92.86 | 74.10 |

| 2021 | S21 Ultra | iPhone 12 pro max | 114.30 | 104.08 | 73.93 |

| 2022 | S22 Ultra | iPhone 13 pro max | 112.51 | 84.43 | 76.78 |

| Appendix 4 Prices Of Apple And Samsung Indian Units In Usd |

||||||

|---|---|---|---|---|---|---|

| Year | Samsung S series Phones | Apple iPhones | Samsung Price (S) | Apple Price ($) | Apple iPhone Indian Price in $ | Samsung Phone Indian Price in $ |

| 2010 | S1 | iPhone 3GS | 399 | 299 | 907.58 | 688.88 |

| 2011 | S2 | iPhone 4 | 549 | 299 | 876.32 | 814.19 |

| 2012 | S3 | iPhone 4S | 599 | 399 | 1076.02 | 804.68 |

| 2013 | S4 | iPhone 5 | 649 | 399 | 1015.40 | 708.22 |

| 2014 | S5 | iPhone 5s | 649 | 399 | 1171.56 | 843.85 |

| 2015 | S6 Edge | iPhone 6 Plus | 749 | 499 | 1254.83 | 1105.19 |

| 2016 | S7 Edge | iPhone 6s Plus | 769 | 499 | 1369.14 | 846.79 |

| 2017 | S8+ | iPhone 7 Plus | 849 | 969 | 1412.74 | 996.60 |

| 2018 | S9+ | iPhone X | 839 | 1149 | 1491.46 | 1065.95 |

| 2019 | S10+ | iPhone XS Max | 999 | 1449 | 2057.65 | 1674.23 |

| 2020 | S20 ultra | iPhone 11 pro max | 1400 | 1449 | 1914.99 | 1754.40 |

| 2021 | S21 Ultra | iPhone 12 pro max | 1249 | 1399 | 2162.96 | 1758.50 |

| 2022 | S22 Ultra | iPhone 13 pro max | 1599 | 1599 | 2342.99 | 1758.20 |

| Appendix 5 Per Capita Income & Other Parameters Used In The Analysis. |

|||||||

|---|---|---|---|---|---|---|---|

| Year | India GDP (Lakh Crore) |

Population (crore) | Per capita income (INR) | Per year increase in per capita income | Average Price of iPhone & Samsung each Year in India (INR) | Cost of Phones as a percentage of per capita income | Percentage increase in the cost of phone each year |

| 2010 | 72.67 | 120 | 60558.3 | 11% | 36500 | 44% | |

| 2011 | 87.3 | 123 | 70975.6 | 17% | 39450 | 46% | 8% |

| 2012 | 99.4 | 126 | 78888.9 | 11% | 50250 | 56% | 27% |

| 2013 | 112.3 | 128 | 87734.4 | 11% | 50500 | 41% | 0% |

| 2014 | 124.7 | 129 | 96666.7 | 10% | 61500 | 55% | 22% |

| 2015 | 137.8 | 131 | 105190.8 | 9% | 75700 | 60% | 23% |

| 2016 | 154.1 | 133 | 115864.7 | 10% | 74450 | 58% | -2% |

| 2017 | 170.1 | 134 | 126940.3 | 10% | 78450 | 54% | 5% |

| 2018 | 188.9 | 135 | 139925.9 | 10% | 87450 | 73% | 11% |

| 2019 | 203.5 | 136 | 149632.4 | 7% | 131400 | 95% | 50% |

| 2020 | 197.5 | 138 | 143115.9 | -4% | 135950 | 120% | 3% |

| 2021 | 232.14 | 139 | 167007.2 | 17% | 144950 | 114% | 7% |

| Appendix 6 Number Of Units Sold |

||

|---|---|---|

| Brands | Number of Sales in 2019 (Crore) | Percentage of Total Sales (%) |

| Samsung | 3.1 | 20.7 |

| Oppo | 1.63 | 10.9 |

| Xiaomi | 4.36 | 29.1 |

| Vivo | 2.38 | 15.9 |

| Realme | 1.62 | 10.8 |

| Apple | 0.19 | 1.3 |

| Others | 2.16 | 14.4 |

| Appendix 7 Units Of Iphone Sales |

|

|---|---|

| Apple iPhone Sales | Units (in Lakhs) |

| 2020 | 32 |

| 2019 | 19 |

| 2018 | 17 |

| 2017 | 32 |

| 2016 | 26 |

| 2015 | 33 |

Note- All the models considered in the analysis are the highest specifications models launched by the company in the particular year. The data used in Appendix-5 is collated from the official website of the Ministry of Statistics and Program Implementation. For accurate estimation, the INR-USD Exchange rate used in Appendix 7 is sourced from the official publication by the Reserve Bank of India (RBI). All the exchange rates are representative of annual rates in the respective years.

References

Ansari, S., Garud, R., & Kumaraswamy, A. (2016). The disruptor's dilemma: TiVo and the US television ecosystem.Strategic management journal,37(9), 1829-1853.

Indexed at, Google Scholar, Cross Ref

Apple Inc. (2021). Apple inc. Condensed consolidated statements of operations (Unaudited)

(In millions, except number of shares which are reflected in thousands and per share amounts). 26–28.

Apple Inc. (2022). Apple Warranty Document.

Argyres, N., Bigelow, L., & Nickerson, J. A. (2015). Dominant designs, innovation shocks, and the follower's dilemma.Strategic Management Journal,36(2), 216-234.

Indexed at, Google Scholar, Cross Ref

Bengtsson, M., & Kock, S. (2000). Business Networks—to Cooperate and Compete simultaneously.Industrial marketing management,29(5), 411-426.

Cecere, G., Corrocher, N., & Battaglia, R.D. (2015). Innovation and competition in the smartphone industry: Is there a dominant design?.Telecommunications Policy,39(3-4), 162-175.

Indexed at, Google Scholar, Cross Ref

Cronin Jr, J.J., Brady, M.K., & Hult, G.T.M. (2000). Assessing the effects of quality, value, and customer satisfaction on consumer behavioral intentions in service environments.Journal of retailing,76(2), 193-218.

Indexed at, Google Scholar, Cross Ref

Ericsson Mobility Report. (2021). Mobility Report

Fan, Y., & Yang, C. (2020). Competition, product proliferation, and welfare: A study of the US smartphone market.American Economic Journal: Microeconomics,12(2), 99-134.

Indexed at, Google Scholar, Cross Ref

Ferrier, W.J., Smith, K.G., & Grimm, C.M. (1999). The role of competitive action in market share erosion and industry dethronement: A study of industry leaders and challengers.Academy of management journal,42(4), 372-388.

Indexed at, Google Scholar, Cross Ref

Gnyawali, D.R., & Park, B.J.R. (2011). Co-opetition between giants: Collaboration with competitors for technological innovation.Research policy,40(5), 650-663.

Indexed at, Google Scholar, Cross Ref

Hurun Report. (2021). Hurun Global Rich List 2021.

Kabeyi, M.J.B. (2018). Michael porter’s five competitive forces and generetic strategies, market segmentation strategy and case study of competition in global smartphone manufacturing industry.IJAR,4(10), 39-45.

Oxfam International. (2020). Time to care.

PACE. (2019). A New Circular Vision for Electronics Time for a Global Reboot. World Economic Forum, January, 1–24.

Piper Sandler Survey. (2021). Piper Sandler Survey 2021.

Rusko, R. (2014). Mapping the perspectives of coopetition and technology-based strategic networks: A case of smartphones.Industrial Marketing Management,43(5), 801-812.

Indexed at, Google Scholar, Cross Ref

Shorrocks, A., Davies, J., & Lluberas, R. (2020). The Global wealth report 2020.

Simon Kemp. (2020). Digital 2020: India — DataReportal – Global Digital Insights.

Stokburger-Sauer, N., Ratneshwar, S., & Sen, S. (2012). Drivers of consumer–brand identification.International journal of research in marketing,29(4), 406-418.

Indexed at, Google Scholar, Cross Ref

Sweeney, J.C., & Soutar, G.N. (2001). Consumer perceived value: The development of a multiple item scale.Journal of retailing,77(2), 203-220.

Indexed at, Google Scholar, Cross Ref

The Census of India. (2011). The Census of india 2011 report .

Received: 22-Sep-2022, Manuscript No. AMSJ-22-12600; Editor assigned: 12-Sep-2022, PreQC No. AMSJ-22-12600(PQ); Reviewed: 26-Oct-2022, QC No. AMSJ-22-12600; Revised: 03-Nov-2022, Manuscript No. AMSJ-22-12600(R); Published: 18-Nov-2022