Research Article: 2024 Vol: 28 Issue: 3S

Linking Sustainable Finance and Environmental, Social, and Governance (ESG): A Systematic Literature Review & Sentiment Analysis

Priyanka Aggarwal, Delhi Technological University

Archana Singh, Delhi Technological University

Deepali Malhotra, Delhi Technological Universityt

Citation Information: Aggarwal, P., Singh, A., Malhotra, D. (2024). Linking sustainable finance and environmental, social, and governance (esg): a systematic literature review & sentiment analysis. Academy of Marketing Studies Journal, 28(S3), 1-26.

Abstract

Sustainable finance refers to the integration of environmental, social, and governance (ESG) factors into decision-making processes, with the aim of promoting sustainable development and addressing long-term societal and environmental challenges. As regulatory demands and investor preferences drive ESG considerations to the forefront of the agenda, the phrase “sustainable finance” is becoming increasingly important. The present research work aims to undertake a comprehensive evaluation of 147 papers (2005-2022) in the field of sustainable finance and ESG. A three-step technique has been adopted for the purpose of conducting the systematic review of 147 publications. This methodology consists of the Scientific Procedures and Rationales for Systematic Literature Reviews (SPAR-4-SLR) protocol, bibliometric analysis, and sentiment analysis. The bibliometric study reveals that the number of academic papers published on the topic of "ESG and Sustainable Finance" is increasing at an exponential rate. China is the major contributor, with the highest number of articles. Word Cloud analysis using Biblioshiny revealed that the most commonly used keywords are “sustainable finance,” “ESG investing,” “esg,” “climate change,” and “climate finance.” Thematic analysis using Biblioshiny revealed that “conscious capitalism” and “sustainable finance education” are the most under-represented areas in the underlying field. Furthermore, keyword co-occurrence analysis using VOSviewer helped in identifying emerging themes and clusters, namely, “Corporate Social Responsibility/ESG and Corporate Sustainability,” “Innovation in sustainable finance,” “Sustainable Finance Policies” and “Climate Finance.” Sentiment analysis traced positive sentiments in the field. This literature review contributes to a better knowledge of the current state of research and piques the interest of sustainable finance and ESG academics. The research offers a comprehensive framework of "Barriers, Mitigation Strategies, and Opportunities" related with the implementation of Sustainable Finance and ESG. This study's findings will be an invaluable resource for future researchers, managers, and legislators.

Keywords

Systematic Literature Review, Bibliometric Analysis, Sustainable Finance, ESG, Text Analysis, Sentiment Analysis, SPAR-4-SLR.

Introduction

The world faces great social, environmental, and economic challenges. Eliminating poverty, combating climate change, reducing economic inequalities, and, more recently, mitigating pandemic threats all require massive financial resources and investments (Gulseven et al., 2020; Cunha et al., 2020; Pizzi et al., 2021). Businesses, investors, financial institutions, governments, and other players have been pushing for sustainable financing initiatives as a means of addressing the challenges that are linked with sustainability. This is because sustainable financing initiatives are seen as one of the most effective ways to address these challenges. Thus, the market for sustainable finance is growing globally. Sustainable finance is closely connected to the Sustainable Development Goals (SDGs) established by the United Nations. The SDGs provide a comprehensive framework for addressing global challenges and achieving sustainable development by 2030. Sustainable finance acts as a critical enabler in supporting the implementation of the SDGs by directing capital towards activities and investments that contribute to their achievement (Kumar et al., 2022). More than $400 billion of new funds have been raised on capital markets in 2020, which includes $357.5 billion from sustainability bonds and $76.5 billion from green bonds (Refinitiv, 2020; United Nations, 2020). Sustainable finance encompasses a diverse range of activities aimed at promoting a more sustainable financial system. These activities include sustainable funds, green bonds, impact investing, microfinance, active ownership, credits for sustainable projects, and the development of the entire financial system in a more sustainable way. Sustainable funds are designed to invest in companies or projects with strong ESG performance, generating both financial returns and positive societal and environmental impacts. Green bonds raise capital for environmentally beneficial projects, such as renewable energy or sustainable transport. Impact investing focuses on investments that generate measurable positive social or environmental impact alongside financial returns. Microfinance provides financial services to low-income individuals and underserved communities, fostering financial inclusion and poverty alleviation. Active ownership involves engaging with companies to influence their ESG practices through voting rights and collaboration with other investors. Credits for sustainable projects are tailored loans for initiatives like renewable energy installations or sustainable agriculture. Lastly, sustainable finance aims to develop the financial system itself by promoting responsible lending practices, integrating ESG factors into risk management, and encouraging transparency and disclosure of sustainability-related information. Through these activities, sustainable finance channels capital towards investments that have positive impacts, fostering a more sustainable and inclusive economy (Swiss Sustainable Finance, n.d.). According to the European Union, sustainable finance refers to the process of taking ESG considerations into account when making investment decisions in the financial sector, leading to more long-term investments in sustainable economic activities and projects (European Commission, n.d.; Tang, 2021). Swiss Sustainable Finance defines sustainable finance as “any form of financial service integrating ESG criteria into the business or investment decisions for the lasting benefit of both clients and society at large” (Swiss Sustainable Finance, n.d.). In the past, philanthropic finance, venture philanthropy, mission and program-related financing, charity asset finance, development finance, ethical finance, social finance, green finance, and impact finance, among other terms, have been used to classify and refer to sustainable finance. Sustainable finance involves making investment decisions that consider not only financial returns but also environmental, social and governance factors. It is a wide phrase that can have many meanings depending on the context in which it is used. "Green finance" and "sustainable finance" are often used interchangeably. Despite the numerous definitions and variations, a common framework has emerged around the concept of sustainable finance in terms of a set of ESG factors that are important in investor asset allocation decisions: “Sustainable finance generally refers to the process of taking due account of environmental, social, and governance (ESG) considerations when making investment decisions in the financial sector, leading to increased longer-term investments into sustainable economic activities and projects.” ESG aims to establish an evaluation of companies’ social and environmental responsibilities. Energy, waste, climate change, gender equality, product safety, and stakeholder rights are all examples of issues that fall under the ESG umbrella.

In spite of the extensive history and ongoing expansion of sustainable finance studies around the world, it has only been in relatively recent times that a market of finance has emerged that are specifically aimed at creating social and environmental impact in addition to a financial return. Therefore, raising sustainable funds and channelling available assets toward more sustainable investments are both crucial and challenging (Cunha 2021; Gottschalk & Poon, 2020). The study employs a three-step methodology to comprehensively review 147 publications over a period of eighteen years (2005–2022). First, in order to systematically select the research articles from various fields, the study employs Scientific Procedures and Rationales for Systematic Literature Reviews (SPAR-4-SLR) protocol. Second, bibliometric analysis has been conducted using the VOSviewer and Biblioshiny software to analyse the descriptive statistics of the research articles. Finally, using RStudio, sentiment analysis was performed on the future scope of selected articles to trace the sentiments for the arena. By conducting a thorough analysis of the literature, this study aims to answer the following research questions (RQs):

RQ 1: What is the current state of research in the field of Sustainable Finance and ESG?

RQ 2: What are the emerging themes associated with the adoption of Sustainable Finance and ESG?

RQ 3: What are the various barriers, mitigating strategies and emerging opportunities associated with Sustainable Finance and ESG?

Methodology

The research endeavours to utilize the three-step methodology encompassing SPAR-4-SLR protocol, Bibliometric Analysis and Sentiment Analysis for systematically reviewing the research articles. Systematic literature reviews (SLRs) offer a stringent process for the search and appraisal of literature. The systematic approach characterizes limited bias while synthesizing the literature’s contents (Tranfield et al., 2003). SLRs are touted to be a reproducible, transparent, objective, unbiased and rigorous, and 'standardized technique' for conducting literature reviews (Boell & Cecez-Kecmanovic, 2015). A systematic literature review provides a state-of-the-art understanding in the underlying research stream, identifies research gaps, and provides future research avenues (Tranfield et al. 2003; Paul & Criado, 2020). We use the systematic literature review method (Tranfield et al., 2003) to ensure a systematic, replicable, transparent and analytical process that increases the reliability of the findings. At the first stage, the study employs SPAR-4-SLR protocol to systematically select research articles from Web of Science database (WoS). Web of Science is considered the greatly reputable resource for bibliometric investigations because it is free of bias toward any publisher (Gu, 2004; Falagas et al., 2007), as well as further, ensures the inclusion of the most influential journals (Kullenberg & Kasperowski, 2016; Leydesdorff et al., 2014). The second step involved bibliometric analysis through VOSviewer (version 1.6.8) and Biblioshiny softwares. The bibliometric review was especially appropriate for this study because it highlights statistics and trends in a review domain (Castillo-Vergara et al., 2018). Finally, using RStudio, text analysis was performed on the future scope of selected articles to trace the sentiments for the arena.

SPAR-4-SLR Protocol

The SPAR-4-SLR protocol, which was proposed by Paul et al. (2021), provides the structure for the methodology and consists of the following three stages and six substages:

Assembling

Identification: The study designated the area as Sustainable finance and ESG, the review’s focus, i.e., domain. The research questions (RQs 1-3) listed at the end of the introduction will guide the discovery of bibliometrics, characteristics, relationships, themes and agendas in the domain. Published documents on sustainable finance and ESG were retrieved from the WoS database.

Acquisition

We used WoS as a search engine as part of the search mechanism and material acquisition because of the comprehensiveness of the results, even though some academic publications may have a time lag (Paul et al., 2021). The papers related to Sustainable finance and ESG in management literature were collected from the WoS database in December, 2022. The collection covered a time span of 2005 to 2022. We used operators such as Boolean; for example, several keywords were chosen with the word “OR” – rather than “AND” because it is too restrictive (Paul et al., 2021). The keywords used were "Environment" or "social" or "governance" or "ESG" OR "Environment Social Governance" OR "Environmental Social Governance" or "csr" or "corporate social responsibility" or “E, S and G” or "environment* OR ecology*” or “eco” OR sustainab* or “green” or “social* AND govern*” or “Corporate social AND responsibility OR performance” and "sustainable finance" or "carbon finance" or "carbon credit" or "carbon tax" or "climate finance" or "conscious capitalism" or "ESG investing" or "green bond" or “green finance" or "impact investing" or "sri" or "socially responsible investing" or "impact investing" or "SDG financing" or "green bond" or "green finance" or "sustainability financing". We left the time period criterion open-ended, and we received publications over eighteen years (2005–2022). The search was matched for similarity in abstracts, paper titles and keywords with the recognized search terms (n=5,912) (Paul et al., 2021).

Arranging

Organization: The code book was prepared to code and record each article returned from the search in the manner described by Paul et al. (2021). The following data were coded: citation, reference, journal title, article type, year, number of citations, keywords, and country.

Purification: Standards for selection were established according to the relevance of the documents. Manual inspection revealed no duplicate articles. The following inclusion-exclusion criterions were applied: (i) Document Types: Articles, Review, Editorial; (ii) Web of Science Categories: Economics, Management, Business, Business Finance, and Law; (iii) Documents in English, and (iv) Documents unrelated to sustainable finance and ESG (off-topic articles) were excluded by assessing the title, keywords, abstract, and, in some cases, introduction (where applicable). These inclusion-exclusion criterions allowed us to exclude 5,329 publications. Finally, 147 articles were selected after reading the complete papers. Thus, the purification process resulted in 147 documents (illustrated in Table 1).

| Table 1 Purification Process | ||

| Search Criteria | Entry | Results |

| Search Field | Article title, Abstract, Keywords | |

| Articles identified through Keywords and boolean terms search (Web of Science Database) | "Environment" or "social" or "governance" or "ESG" OR "Environment Social Governance" OR "Environmental Social Governance" or "csr" or "corporate social responsibility" or “E, S and G” or "environment* OR ecology*” or “eco” OR sustainab* or “green” or “social* AND govern*” or “Corporate social AND responsibility OR performance” and "sustainable finance" or "carbon finance" or "carbon credit" or "carbon tax" or "climate finance" or "conscious capitalism" or "ESG investing" or "green bond" or “green finance" or "impact investing" or "sri" or "socially responsible investing" or "impact investing" or "SDG financing" or "green bond" or "green finance" or "sustainability financing" | 5,912 |

| Filter 1 | Document type: Articles, Review, Editorial | 5,849 |

| Filter 2 | Web of Science Categories: Economics, Management, Business, Business Finance, Law | 1,339 |

| Filter 3 | Language: English | 1,333 |

| Filter 4 | Documents unrelated to Sustainable finance and ESG (off-topic papers) – based on reading title, keywords, abstract, and, in some cases, introduction (where applicable) | 583 |

| Full-text Articles included in qualitative analysis | Articles were selected after reading the complete papers | 147 |

Assessing

Evaluation: As described by Paul et al. (2021), the methods used to analyze the articles under review relied on bibliometric analysis. In addition, the methodology includes techniques for topic modelling, including bibliographic coupling, cluster analysis, and keyword co-occurrence analysis. Finally, sentiment analysis using R software was also performed to trace the future sentiments in the underlying field.

Reporting

The findings of the systematic literature study are then presented in the form of discussions and graphical summaries, with an emphasis on the categorization of the current literature. Discussion of the study's methodological flaws is included at the end of the article.

Bibliometric Analysis

The current study adopted the bibliometric approach for a systematic review of sustainable finance and ESG research using VosViewer and biblioshiny software packages. Bibliometric analysis has gained immense popularity in business research in recent years (Donthu et al., 2021), and its popularity can be attributed to the advancement, availability, and accessibility of bibliometric software such as Gephi, Leximancer, VOSviewer, and scientific databases such as Scopus and Web of Science, and the cross-disciplinary pollination of the bibliometric methodology from information science to business research. In this study, VOSviewer and Biblioshiny softwares were used to produce descriptive statistics like publication trend, leading countries, three-fields plot, most productive journals, most influential publications, country bibliographic coupling, document bibliographic coupling, keyword co-occurrence analysis, trend analysis, WordCloud, and thematic analysis.

Sentiment Analysis

The process of analysing sentiment, whether content is favourable, negative, or neutral, can be performed through sentiment analysis. At its foundation, sentiment analysis includes assessing the emotions linked with a piece of writing on any given topic. It allows authors to gauge the opinions, preferences, attitudes, and interests of individuals from many angles, such as celebrities, politics, food, places, or any other subject of interest (Srivastava et al., 2022). In this particular research article, the authors apply the R software to do sentiment analysis on the future research directions mentioned in the selected papers (Bifet & Frank, 2010). Examining and interpreting the mood underlying future research trends and topics is vital for making educated judgements and projecting the future direction of research in a certain field. By applying sentiment analysis, one can acquire insights into the prevailing attitudes and expectations among the academic community, helping them shape their understanding of new study topics.

Findings

Publication Trend

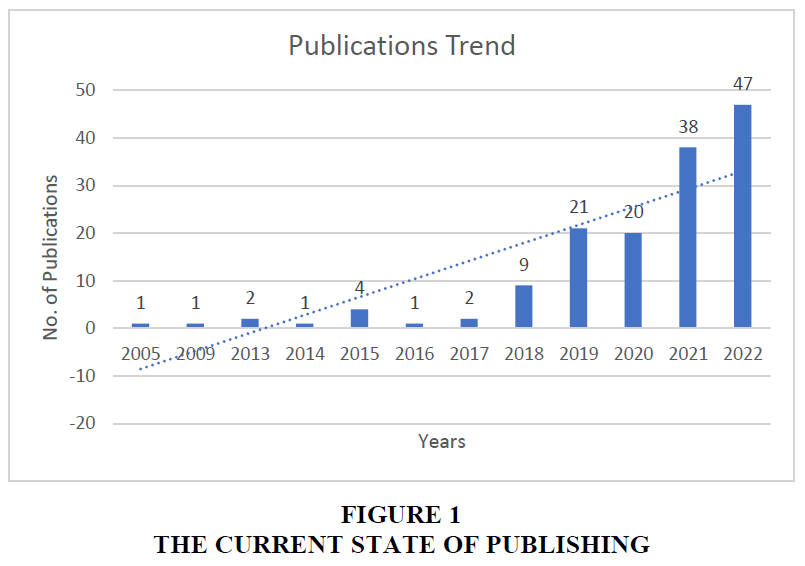

The WoS database search revealed 147 papers on the topic of sustainable finance and ESG, the earliest of which was published in 2005. Based on the examination of the publications' structures, it is clear that the output of literature has exploded in the past two years (Figure 1). The highest output year was 2022, with 47 papers published that year. The growing body of literature demonstrating sustainable finance and ESG's legitimacy as a field of study.

Most Productive Regions and Countries

Between the years 2005 and 2022, a number of countries made significant contributions to the fields of sustainable finance and ESG. For measuring Country Scientific Production he number of "authors appearances by country affiliations" is used. In this, each article is attributed to the countries of all its co-authors and will therefore be counted as many times as there are authors. Table 2 illustrates that China is the most prolific nation with 36 publications; this indicates that Chinese academics give the greatest attention to sustainable finance among all the scholars. The United States of America is in second place with 29 publications, while England comes in third with 22 publications. It’s worth noting that China is the only Asian country having higher number of publications in the ranking table. The bulk of top contributors are industrialised/developed countries, implying that developing countries like India have the potential to contribute to the underlying research stream.

| Table 2 Country Scientific Production | |

| Country | Frequency |

| Peoples R China | 74 |

| USA | 45 |

| UK | 32 |

| Italy | 30 |

| Australia | 17 |

| Spain | 16 |

| Brazil | 12 |

| Canada | 12 |

| India | 10 |

| Netherlands | 10 |

In order to further gain insights on the most productive countries, we analyzed the countries that had minimum three documents with minimum three citations (Chakma et al., 2022) in the underlying domain; and out of 46 countries, 22 have fulfilled this criterion. For each of these 22 countries, the strength of citation relationships with other countries was assessed. China was the most influential country in terms of citations, with 36 documents and 634 citations. In terms of citation output, the United States, England, the Netherlands, Sweden, and Italy were among the leading countries (see Table 3).

| Table 3 Most Productive Countries (Based on Number of Citations) | |||

| Country | Documents | Citations | Total Link Strength |

| Peoples R China | 36 | 634 | 52 |

| USA | 29 | 631 | 35 |

| England | 22 | 469 | 16 |

| Netherlands | 7 | 315 | 22 |

| Sweden | 5 | 244 | 15 |

| Italy | 16 | 183 | 25 |

| Australia | 11 | 181 | 5 |

| Spain | 10 | 143 | 10 |

| Germany | 4 | 120 | 12 |

| Canada | 6 | 116 | 5 |

| Austria | 4 | 99 | 4 |

| Japan | 3 | 84 | 0 |

| Hungary | 3 | 68 | 4 |

| India | 8 | 53 | 5 |

| France | 5 | 49 | 6 |

| Pakistan | 3 | 36 | 0 |

| Brazil | 4 | 31 | 7 |

| Norway | 3 | 28 | 5 |

| Romania | 3 | 19 | 3 |

| South Korea | 6 | 13 | 6 |

| Singapore | 3 | 11 | 3 |

| Russia | 3 | 2 | 2 |

Three-Fields Plot

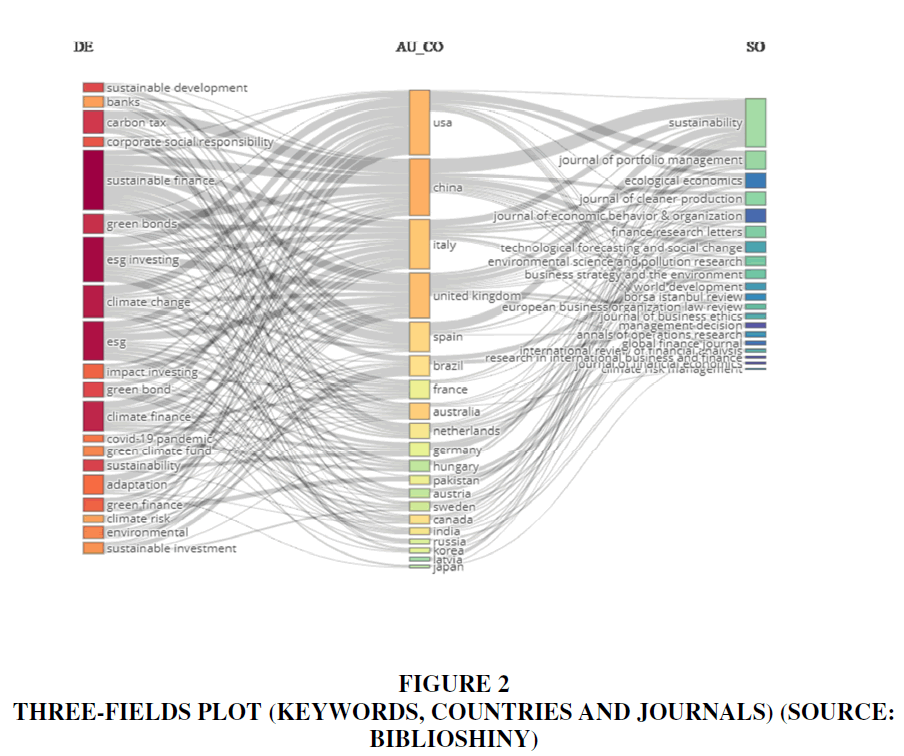

The three fields plot depicted below depicts three elements: a list of keywords, countries, and journals (Figure 2). This diagram is based on the most often used Sankey diagrams. The three elements are represented with grey links that demonstrate their relationship to one another, beginning with the keywords and continuing to the countries and journal names. The size of the boxes is proportional to the frequency of occurrences (Riehmann et al., 2005). As a result, the size of each rectangle in each list reflects how many papers are related with that element. Figure 2 reveals that the United States and China lead in terms of the number of publications in the field, indicating that researchers from these countries are actively contributing to the topics of "sustainable finance," "ESG investing," "green bonds," "climate change," and "ESG." Moreover, the journals "Sustainability" and "Journal of Portfolio Management" have emerged as the most productive platforms for disseminating research in this domain.

Most Productive Journals

Citation is recognized as an important metric measuring the impact of an article and of a journal in the scientific community (Svensson, 2010; Aksnes et al., 2019). Citation metrics are used in this study to investigate the most influential journals in the field of sustainable finance and ESG. The 147 articles extracted from the WoS database appeared in 75 journals. The journals with the most sustainable finance and ESG publications are listed in Table 4. Sustainability and Journal of Cleaner Production have the most published and referenced papers, with 260 and 210 citations respectively. These results demonstrate that these publications are at the forefront of Sustainable Finance and ESG research.

| Table 4 Most Productive Journals | ||

| Source | Documents | Citations |

| Sustainability | 27 | 260 |

| Journal Of Cleaner Production | 8 | 210 |

| Journal Of Corporate Finance | 1 | 161 |

| Journal Of Business Ethics | 3 | 158 |

| Journal Of Financial Economics | 2 | 154 |

| Finance Research Letters | 7 | 133 |

| Journal Of Portfolio Management | 9 | 98 |

| Environmental & Resource Economics | 1 | 97 |

| World Development | 3 | 74 |

| Research In International Business And Finance | 2 | 67 |

Most Influential Publications

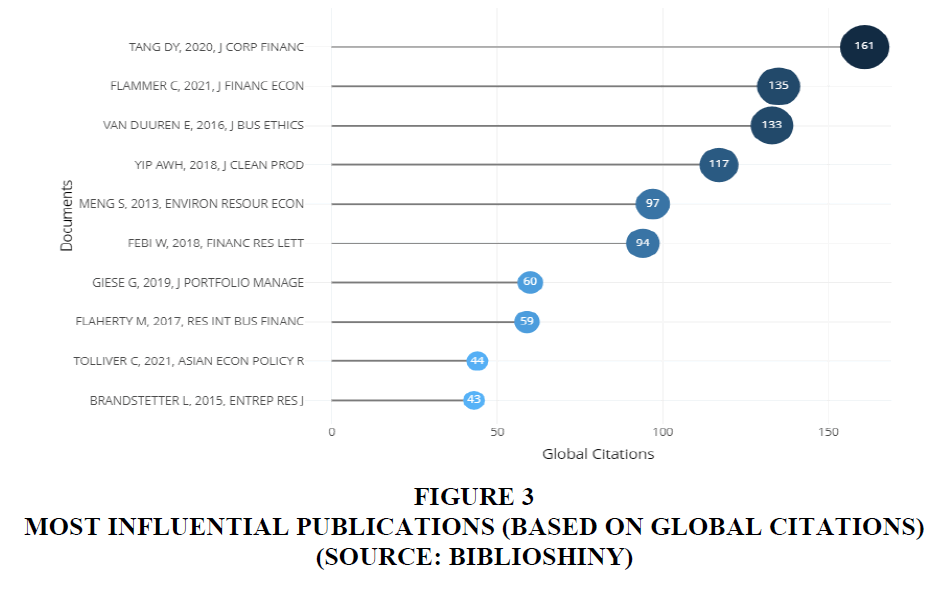

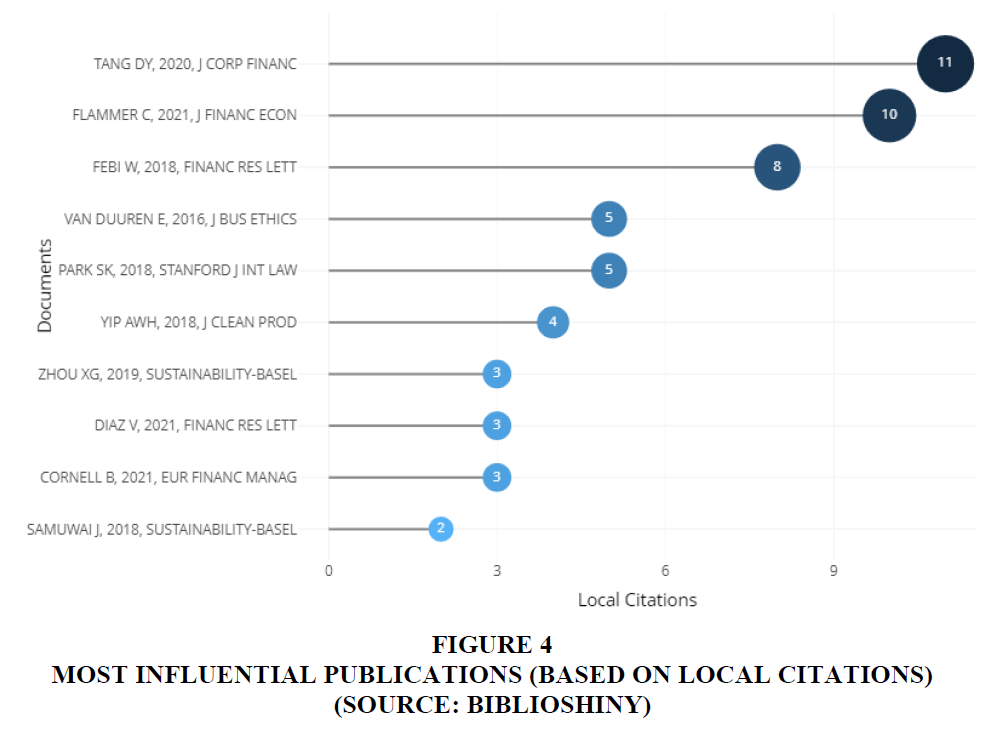

In Figures 3 and 4, a listing of the most influential publications based on global and local citations respectively is provided. The global citation is a metric for determining how many citations an article receives from the entire database, i.e, WoS. Local citation, on the other hand, quantifies the number of citations a document obtained from other publications inside the same data set A local citation also assesses the document's impact within the studied collections (Aria & Cuccurullo, 2017). Thus, while local citation limits itself to citations within a certain field of study, global citation examines citations from a global viewpoint in terms of disciplines. This investigation found that the 2020 publication “Do shareholders benefit from green bonds?” by Tang, Dragon Yongjun and Zhang, Yupu with 161 global and 11 local citations and published in Journal of Corporate Finance is the most influential publication.

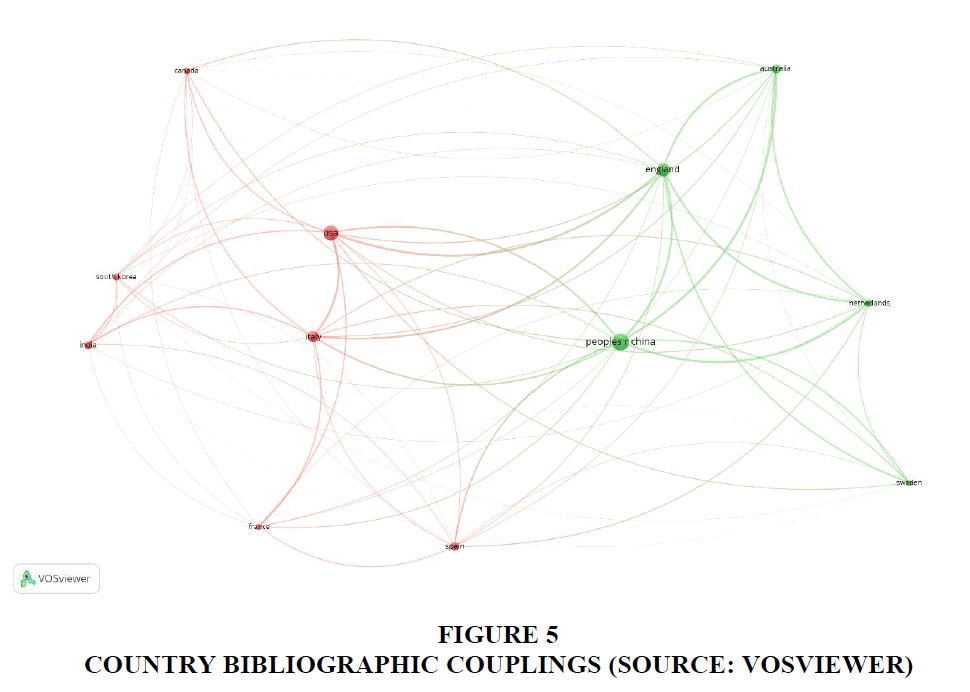

Countries Bibliographic Coupling

In terms of countries, bibliographic coupling happens when a manuscript from two nations refers to the third manuscript in their journals (Jarneving, 2007). This demonstrates how numerous regions utilize identical publications and emphasise a similar subject in their publications (Jarneving, 2007). In other words, bibliographic coupling of countries shows how different countries are focusing on similar research topics and are using similar literature in their publications. Figure 5 depicts the bibliographic coupling among different countries undertaking research in the area of sustainable finance and ESG. These data have been analysed by filtering 5 documents per country. There are a total of two clusters formed, each of which depicts the group of countries facing similar kinds of issues. For example, the ‘green’ cluster formed in Figure 5 shows that nations like China, England, Australia, Sweden, and Netherlands are facing similar kinds of issues. Similarly, the ‘red’ cluster formed in Figure 5 shows that USA, India, France, Italy, South Korea, Canada, and Spain are facing similar kinds of issues.

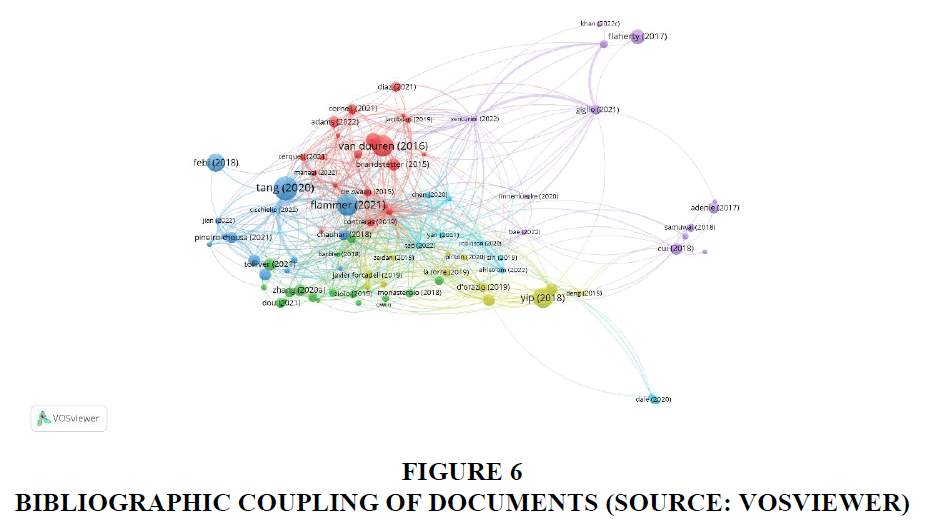

Documents Bibliographic Coupling

Thematic structure of a journal can be determined by bibliographic coupling analysis. Two documents citing one (or more) common other document form bibliographic couples and, thus, these document pairs tend to share common intellectual content (Kessler, 1963). In this vein, bibliographic coupling analysis categorises articles that form bibliographic couples. If two articles refer to a third article, the two are bibliographically related (Kessler, 1963). In simple words, it relates to the crossover in the reference list (Donthu et al., 2021). Hence more references two publications share, the closer their relationship. The default value set by VOSviewer is of five publications (van Eck & Waltman, 2014). Newer and specific publications may benefit from this analysis when subgroups are established by referring articles. Thus, this analysis is great for academics who want to investigate a diverse variety of fields and their most recent advancements (Donthu et al., 2022; Bhandari, 2022). The study undertook a threshold of default five citations for a document (Martínez-López et al., 2018) and got 147 documents out of which only 94 consisted of the largest set of connected items. The unit of analysis was document. We finally got 6 clusters as in figure for network visualization. Figure 6 presents a summary of the documents bibliographic coupling. The size of the circle symbolises the document's citation score. Each circle represents a separate document that is interconnected with the same-colored links. The wider the circle, the greater the number of citations to its credit. In Figure 6, for example “Adams & Abhayawansa, 2022” in red colour is coupled to “Brandstetter & Lehner, 2015,” “Cornell, 2020,” “de Zwaan et al., 2015,” while “Cheng et al., 2019” in green color is linked to “,Khan, 2022,” “Monasterolo et al., 2018,” and “Adekoya et al., 2021” in blue couples with “Chauhan & Kumar, 2018,” “Febi at al., 2018,” “Flammer, 2021” and so on.

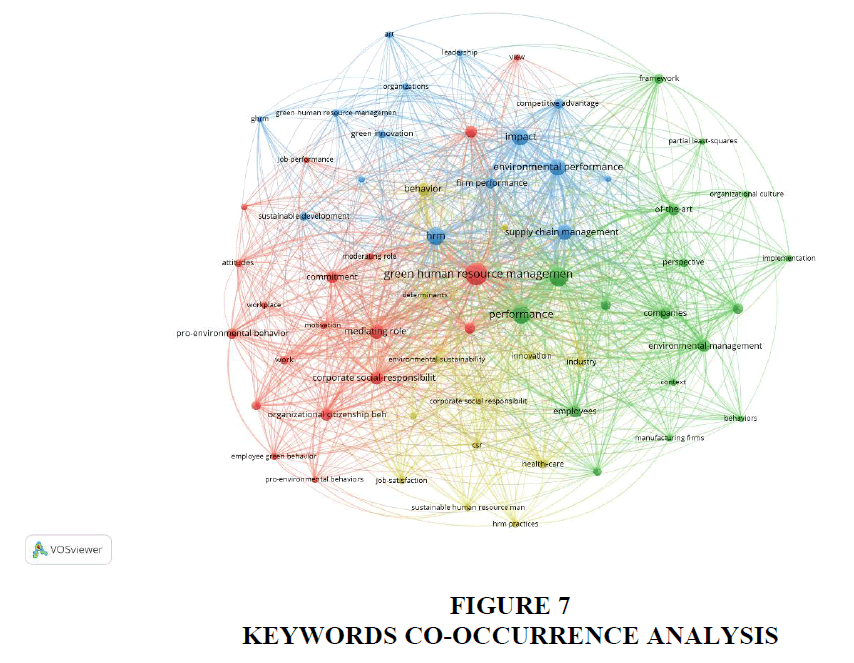

Keywords Co-occurrence Analysis

The keyword co-occurrence analysis is used for mapping the thematic development of the SDGs and Digital technologies field, because keywords are great pointers of the central focus or content of an article (Strozzi et al., 2017). Bibliometric Co-occurrence analysis of Keywords using VosViewer helped in identifying major themes and clusters as well as future research directions. The primary themes identified in the underlying literature were divided into the following categories:– “Corporate Social Responsibility/ESG and Corporate Sustainability,” “Innovation in sustainable finance,” “Sustainable Finance Policies” and “Climate Finance” Figure 7.

Cluster 1: Corporate Social Responsibility/ESG and Corporate Sustainability

This cluster examines the factors that encourage and motivate businesses to adopt ESG activities, as well as the effects those initiatives may have on their bottom line (Garcia et al., 2017; Rezaee & Tuo, 2017). Corporate social responsibility (CSR) and ESG programmes are integral parts of a company's efforts to maintain its long-term viability and make a beneficial impact on society and the natural world (Saetra, 2021; Lokuwaduge & Heenetigala, 2016; Friede et al., 2015; Ketter et al., 2020; van Duuren et al., 2016; Azapagic, 2003). Managing the economic, social, and environmental risks and opportunities that businesses confront is at the heart of the concept of corporate sustainability, which prioritises the long-term success of businesses (Eweje, 2011). Due to a number of motivating factors like value creation for shareholders, compliance with rules and regulations, brand value creation, and stakeholders value creation, more and more businesses are launching ESG and corporate sustainability programmes. Companies with strong ESG performance have been found to have better long-term financial performance and lower risk, and sustainable practises can lead to cost savings, improved reputation, and increased employee engagement, according to studies examining the relationship between ESG factors and corporate sustainability (Wong et al., 2021; Bhaskaran et al., 2020; Zahid et al., 2020; Atif & Ali, 2021).

Cluster 2: Innovation in Sustainable Finance

This cluster examines the connections between innovation and sustainable finance, with a particular emphasis on the ways in which innovations in digital solutions and financial technology have contributed to the creation of new sustainable finance projects and offerings (Kumar et al., 2022; Schulz & Feist, 2021). According to Merton (1992), financial innovations include those products, processes, and business models that have been invented with the purpose of making the financial system more efficient. Financial innovations in this context range from technological (such as credit cards, ATMs, Fintech, blockchain) to new ways of gaining access to finances (such as crowdsourcing) to new types of financial instruments (e.g., CDO, CDS, securitization) (Quatrosi, 2022). Fintech, or financial technology, has emerged as a key component of sustainable finance (Chueca Vergara & Ferruz Agudo, 2021; Nassiry, 2019; Macchiavello & Siri, 2022). Key developments in sustainable finance include green deposits, socially responsible investing, climate financing, green trade loans, green guarantees and letters of credit, and sustainable supply chain financing (Sustainalytics, 2021; Ari & Koc, 2021; Sinha et al., 2021; Chen et al., 2021, Manaswi et al., 2023). The advancements in financial technology have the potential to expand access to these financial products, inspire creativity among financial institutions, and ultimately boost the economic growth (Abad-Segura et al., 2020; Kagan, 2022). Financial institutions may improve their understanding of their ESG exposure and risks through the use of big data and analytics. In conclusion, when it comes to creating sustainable financial projects and solutions, innovation and fintech are playing an increasingly crucial role.

Cluster 3: Sustainable Finance Policies

As governments, financial institutions, and investors all around the globe work to guarantee the implementation of ESG principles, sustainable finance regulations are gaining prominence (Nicholls, 2021). As a result of differences in political, cultural, and economic systems, countries took varied approaches for implementing sustainable finance policies. Sustainable finance practises are often supported but not mandated by financial institutions in the United States and other nations. However, some regions take a more formal approach, with the European Union implementing legally enforceable measures to guarantee the realisation of sustainable finance goals. Sustainable finance policies also differ from country to country in terms of their aims and metrics. Comparatively, some nations, like the United States, put more effort into promoting environmental preservation, while others, like India, put more effort into promoting financial inclusion and poverty reduction. Furthermore, regulators and financial institutions are pressing forward the sustainable finance agenda to accomplish the Sustainable Development Goals across all markets (Dikau & Volz, 2021; Taghizadeh-Hesary & Yoshino, 2019). Past research has shown that integrating green financial systems into traditional financial systems can lead to sustainability controls and cleaner production, and that green governance structures can help lower financing constraints, suggesting that regulators and financial institutions should establish sustainability performance policies and frameworks (Jan et al., 2021).

Cluster 4: Climate Finance

Within the scope of this cluster, researchers have concentrated on the consequences of climate change as well as the necessity of climate funding to reduce emissions of greenhouse gases (Dam & Scholtens, 2015; Gutiérrez & Gutiérrez, 2019), among others. Finance has a critical role to play in enabling a transition to a low-carbon, climate-resilient economy (Bhandari et al., 2021). Climate finance is defined by the United Nations Framework Convention on Climate Change (UNFCCC) as "local, national, or transnational financing—drawn from public, private, and alternative sources of financing that strives to support mitigation and adaptation efforts to address climate change" (Hong et al., 2020). There are various regulations, policies, and initiatives in place across the world to help promote the flow of climate finance which include the UNFCCC, the Paris Agreement, and the Green Climate Fund (Buchner et al., 2019; Hong et al., 2019; United Nations Climate Change, n.d.; United Nations, n.d.), as well as national and local initiatives such as carbon taxes, renewable energy incentives, and emissions trading schemes.

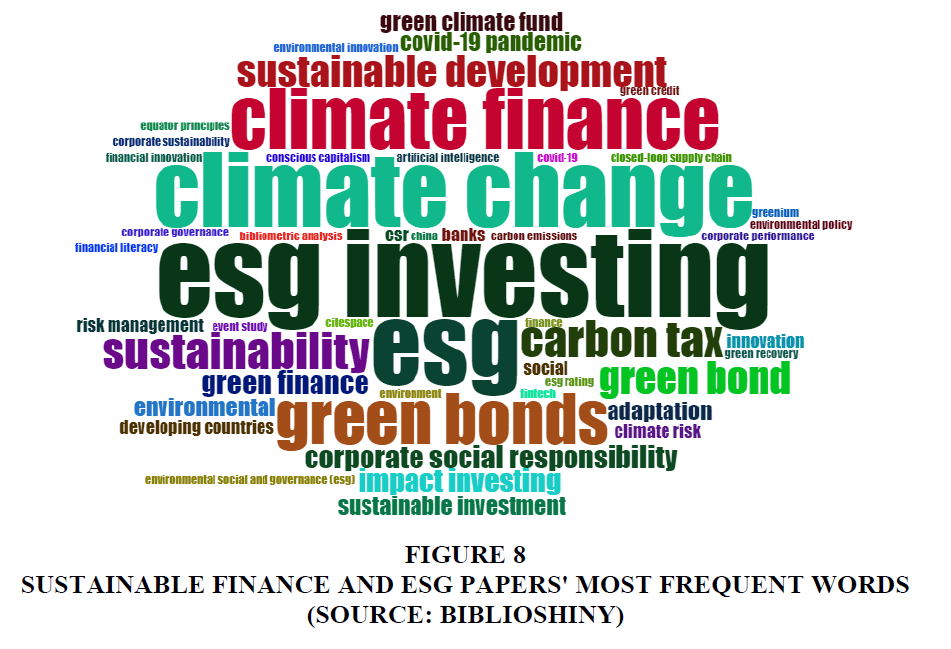

Word Cloud

Figure 8 is a word cloud representing the most commonly used terms in academic articles discussing sustainable finance and ESG issues. A word's size in the cloud represents how often it appears in the text. The word order is relatively arbitrary, but the most important ones are clustered in the middle and are emphasised with larger font sizes. Word Cloud analysis using Biblioshiny revealed that the most commonly used keywords are “sustainable finance,” “ESG investing,” “esg,” “climate change,” and “climate finance.”

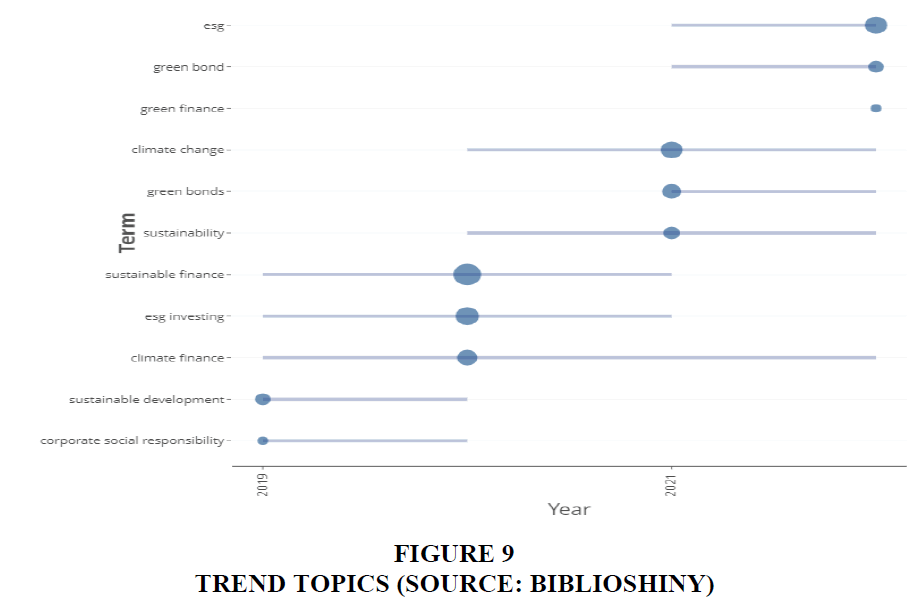

Trend Topics

In this section, trending topics were analysed using the author's keywords. Article keywords, which authors define, are usually connected to such article and are sufficient to derive topical aspects of a field (Song et al., 2019). This study provides more insight into the most often occurring keywords in sustainable finance and ESG over the years. Despite the fact that various authors' keywords are displayed in the word cloud (Figure 8), the analysis in Figure 9 demonstrates a hierarchical organisation of sustainable finance and ESG issues addressed by researchers each year. For instance, in 2019, corporate social responsibility and sustainable development were the most discussed topics. Similarly, in 2020, ESG investing and sustainable finance were the leading topics; in 2021, sustainability and green bonds were on the top of the list; and in 2022 also ESG and green bonds are the most trending topics.

The Thematic Map: A Co-Word Analysis

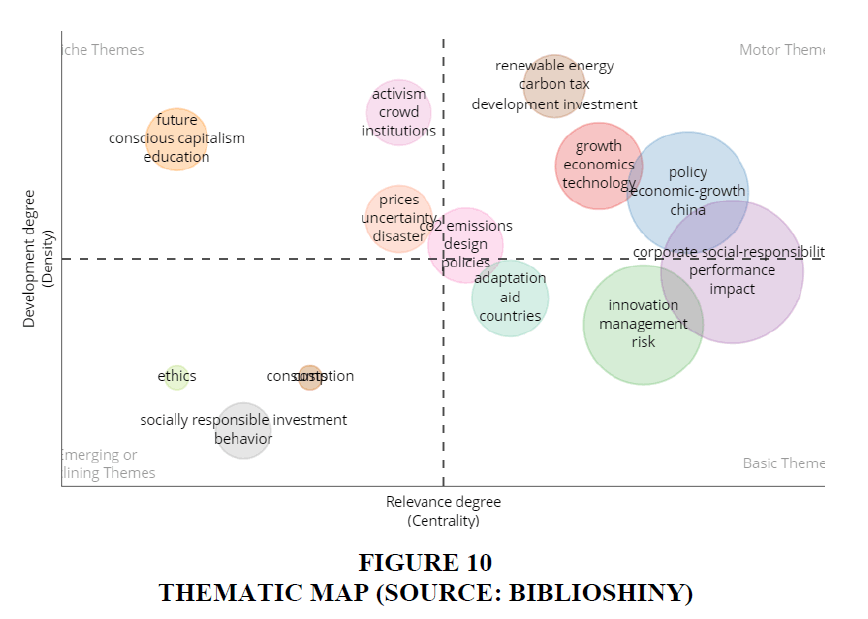

Thematic analysis is useful in providing knowledge to researchers and stakeholders regarding the potentials of future research development of thematic areas within a field (Agbo et al., 2021). The clustering and linking of authors’ abstracts provide the basis for the thematic analysis. There are two properties that define these themes: (i) centrality and (ii) density. Centrality (horizontal axis) measures the degree of correlation among different topics, whereas density (vertical axis) measures the cohesiveness among the nodes (Jelvehgaran Esfahani et al., 2019). These two aspects are what ultimately decide how developed and consequential a given theme is. A node's centrality and relevance in a theme network are proportional to the number of edges connecting it to other nodes in the network. A node's cohesiveness, representing the density of a research field, is indicative of the field's ability to grow and endure. See Figure 10 for a topical breakdown of the sustainable finance and ESG field (Quad 1 to Quad 4). The upper right quadrant (Quad 1) represents driving themes, the lower right quadrant (Quad 4) is basic themes, the upper left quadrant (Quad 2) is the very specialized themes, and the lower left quadrant (Quad 3) is emerging or disappearing themes:

1. Motor Themes (Quad 1): The upper right quadrant shows “motor” or “driving” topics, indicated by high density and centrality; these topics, which included “renewable energy,” “carbon tax,” “policy,” “economic growth,” “emissions policies” and to some extent “China’s sustainable finance policies” should be developed further given their importance for future research.

2. Specialized Themes (Quad 2): The themes in Quad 2 have developed internal connections, but their contribution to the growth of sustainable finance and ESG is still small. This study indicates that themes in Quad 2 such as the “conscious capitalism,” and “sustainable finance education” may require a stronger connection to sustainable finance and ESG as these are most under-represented areas. Scholars in this field may explore the linkages between sustainable finance and conscious capitalism that may further help in achieving Sustainable Development Goals 2030.

3. Emerging/ Declining Themes (Quad 3): "Socially responsible investment" and "ethics" appear to be emerging themes, indicating that they are necessary for the development of the field of sustainable finance.

4. Basic Themes (Quad 4): Finally, the lower right quadrant contains basic topics, indicated by high centrality but low density; these topics are important for research as general topics, and included “innovation,” “risk management,” “performance,” and “impact”.

Sentiment Analysis Using R

Data cleaning and mining operations were done on 53 articles from 2020 to 2022, or 36% of the selected 147 publications, to anticipate the future feelings for sustainable financing and ESG. For sentiment analysis, we read the future research orientations of the selected papers from 2020 to 2022. Then, following data cleaning operations were performed: (i) erasing special characters like /, @, |, and replacing them with a space, (ii) eliminating white spacing, (iii) converting the text to lower case, and finally (iv) removing stopwords. The sentiment analysis indicates a relatively favourable attitude for the underlying field with quite limited negative sentiment (Tables 5 & 6).

| Table 5 Clusters Formed Through Keywords Co-Occurrence Analysis | |||

| Clusters | Colour | Important items (VOSviewer) |

Cluster Name |

| Cluster 1 | Red | Corporate Social Responsibility, CSR, companies, ESG, ESG Investing, sustainability, business, performance, green bond, financial performance, fintech, disclosure, risk, return, sustainable finance, risk management | Corporate Social Responsibility/ ESG and Corporate Sustainability |

| Cluster 2 | Green | Innovation, climate risk, conscious capitalism, corporate sustainability, sustainable development, socially responsible investment, mutual funds, market, determinants | Innovation in Sustainable Finance |

| Cluster 3 | Blue | Policy, policies, carbon emissions, decisions, transition, research and development, strategies, system, eco-innovation, growth, China, carbon tax, coordination, decisions, environment, renewable energy | Sustainable Finance Policies |

| Cluster 4 | Yellow | Climate change, climate finance, adaptation, challenges, green climate fund, green finance, mitigation, resilience, developing countries | Climate Finance |

| Table 6 Sentiment Analysis Using R (Source: R) | |

| Sentiment | Number of Sentiments |

| Sarcasm | 7 |

| Negative | 120 |

| Very Negative | 35 |

| Neutral | 345 |

| Positive | 340 |

| Very Positive | 339 |

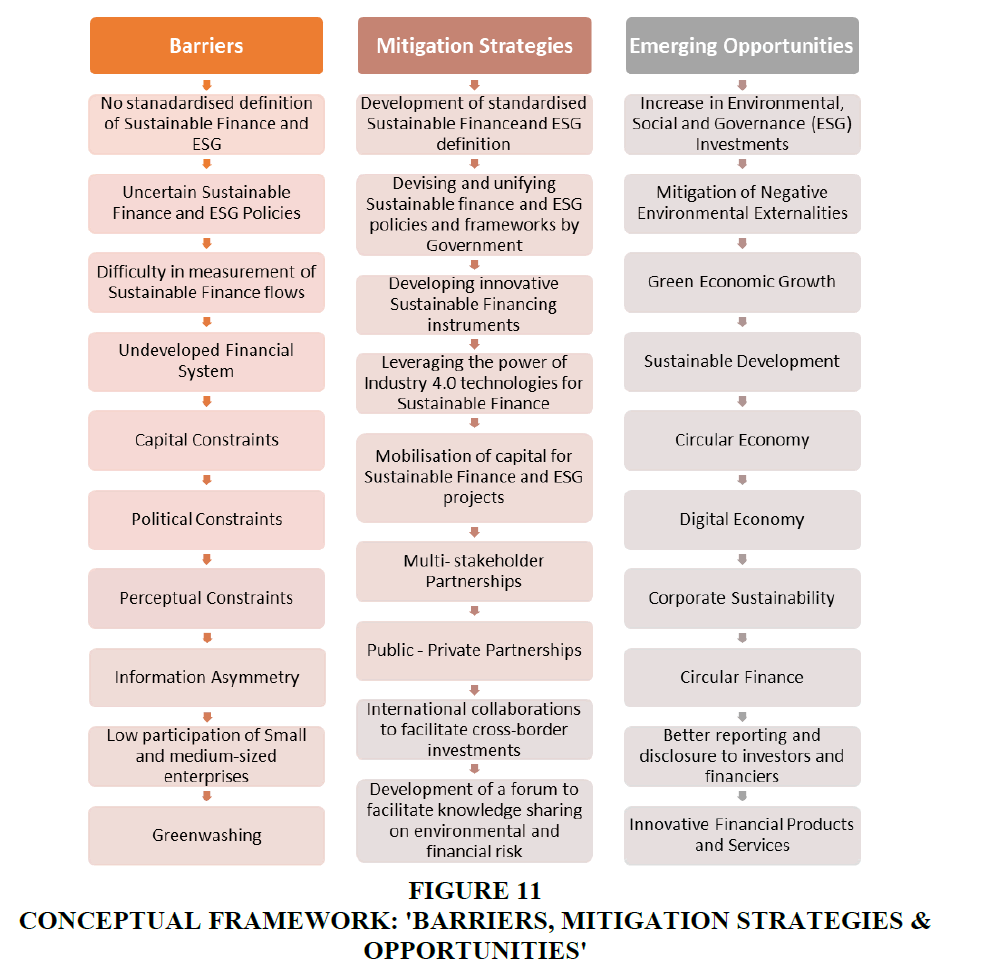

Conceptual Framework

The authors present a comprehensive framework in the form of "Barriers, Mitigation Strategies, and Opportunities" to assist readers in gaining a deeper understanding of the sustainable finance and ESG field (Aggarwal & Kumar, 2022).

Barriers Associated with the Implementation of Sustainable Finance and ESG

In this part, authors identify 10 impediments to the effective implementation of Sustainable financing and ESG (Figure 11). Despite the long history and continuous expansion of sustainable finance and ESG research worldwide, it is only recently that a financial market has emerged that is expressly geared toward achieving social and environmental benefit in addition to financial gain. However, today, this market remains somewhat confused and under-institutionalized, lacking a consistent terminology (Saxena, 2022; Coleton et al., 2020; Zetzsche & Anker-Sørensen, 2022), uncertain policies (World Economic Forum, 2022; Ahsan et al., 2022; Ahlström & Sjåfjell, 2022 & Svartzman, 2021), difficulty in measuring sustainable finance flows (López-Portillo et al., 2022; Phillips, 2022; Avgouleas, 2021), undeveloped financial system (Zakari, 2022), capital constraints (World Economic Forum, 2022), political constraints (World Economic Forum, 2022), perceptual constraints (World Economic Forum, 2022), information asymmetry (Qin et al., 2022; Alhadhrami & Nobanee, 2019; Piispa, 2022), low participation of small and medium-sized enterprises (Chien et al., 2021), and greenwashing (Zeidan, 2022; Yu et al., 2020).

Mitigation Strategies for the Effective Implementation of Sustainable Finance and ESG

A review of literature on mitigation strategies for the effective implementation of sustainable finance and ESG highlights several key findings. Integrating ESG factors into financial decision-making is essential for identifying and managing sustainability-related risks and opportunities. Development of standardised sustainable finance and ESG definition (Saxena, 2022; Coleton et al., 2020; Chiu et al., 2022; Kumar et al., 2022), devising and unifying sustainable finance and ESG policies and frameworks by government (Saxena, 2022; Kumar et al., 2022; Wang et al., 2022), developing innovative sustainable financing instruments (Nassiry, 2018; Irfan et al., 2022; Panagopoulos, 2022), leveraging the power of Industry 4.0 technologies for sustainable finance (Saxena et al., 2022); mobilisation of capital for sustainable finance and ESG projects (Reichelt, 2010; Scatigna, 2021), multi-stakeholder partnerships, public-private partnerships and international collaborations to facilitate cross-border investments (Bhattacharya et al., 2015), and development of a forum to facilitate knowledge sharing on environmental and financial risk are important mitigating strategies (Volz, 2018) (Figure 11). Sustainable finance must standardise to increase quality and catalyse more capital, while also increasing its accessibility and impact (Hanna, 2022).

Emerging Opportunities Associated with Sustainable Finance and ESG

Literature suggests that sustainable finance and ESG can lead to positive outcomes such as increase in ESG investments (Zamfiroiu & Pinzaru, 2021; Chiu et al., 2022), mitigation of negative environmental externalities (Liang & Renneboog, 2020), green economic growth (Ziolo et al., 2016), sustainable development (Ziolo et al., 2016; Ziolo et al., 2020), circular economy, digital economy, corporate sustainability (Rao et al., 2022), circular finance (Goncalves et al., 2020), better reporting and disclosure to investors and financiers, and innovative financial products and services (Coleton et al., 2020; Rao et al., 2022). Sustainable finance and ESG investment may also help achieve the SDGs set by the United Nations. The latest developments in the sustainable finance field have further included the interrogation of circular economy as a paradigm, and its relationship with finance (Goncalves et al., 2020). Many people believe that the time has come to move this idea of "circular finance" forward by one step, to investigate the opportunities it presents for corporations and economies, and to provide the groundwork for its eventual implementation. In addition, sustainable finance can include actions such as the issuance of green bonds, which can aid in addressing climate change and other environmental challenges.

Future Research Directions

In this subsection, the authors have provided theme wise future research directions. For this, the authors have thoroughly analysed the future research scope and implications of the selected set of research papers. The future research directions depicted in table 7 have been segregated in the form of clusters (Wallin, 2005).

| Table 7 Future Research Directions | ||

| S.No | Cluster | Future Research Directions |

| 1 | Cluster 1 - Red : Corporate Social Responsibility/ ESG and Corporate Sustainability | Research can focus on building improved procedures and indicators for assessing and reporting ESG performance. This entails creating unique tools to quantify the social and environmental effect of organisations, defining important indicators, and building standardized reporting frameworks that correlate with shareholder value and risk management considerations Research might focus on the role of government authorities and financial experts in examining and managing standardized ESG reporting systems. This comprises researching the efficacy of regulatory interventions, analysing the effects of government policies and incentives on ESG integration, and measuring the abilities and competencies of financial professionals in recognising ESG risks and opportunities. Future study can address effective techniques for engaging and partnering with numerous stakeholders, including employees, consumers, communities, investors, and NGOs, to improve CSR/ESG practices. |

| 2 | Cluster 2 - Green: Innovation in Sustainable Finance | Research can explore the potential of emerging technologies, including as artificial intelligence (AI), machine learning, and blockchain, in improving ESG data collecting, administration, and analysis. This includes investigating the application of AI and machine learning algorithms to enhance data accuracy and reliability, developing blockchain-based platforms for secure and transparent ESG data management, and exploring the integration of technology-driven solutions in sustainable finance practices (Musleh Al-Sartawi et al., 2022). Research might focus on the creation and evaluation of innovative financial structures and products that support sustainable finance. This comprises exploring the design and impact of green bonds, sustainability-linked loans, impact investment funds, and other creative mechanisms that reward investments in ecologically and socially responsible ventures. Furthermore, evaluating the scalability and efficiency of these instruments in mobilizing resources towards sustainable development can be an important research avenue (Kumar et al., 2022). |

| 3 | Cluster 3 - Blue: Sustainable Finance Policies | Research can explore the development and evaluation of standardized ESG reporting frameworks and measures. This includes tackling the complexity and disparities in ESG reporting requirements, providing a common grasp of ESG vocabulary, and identifying and prioritizing critical ESG concerns for reporting. Additionally, research might focus on strengthening the quality and reliability of corporate sustainability reporting metrics to enhance transparency and comparability (Minutiello & Tettamanzi, 2021; Arouri et al., 2021; Huang, 2020). Future research can analyse and propose strategies to fight unethical practices, such as greenwashing, in sustainable finance. This includes exploring the effectiveness of current regulations and guidelines in preventing greenwashing, identifying indicators and methodologies to assess the credibility of ESG claims made by companies, and proposing strategies to enhance the transparency and integrity of ESG reporting and communication. Research can assess the regulatory frameworks and mechanisms in place for sustainable finance policy. This includes examining the effectiveness of extant rules in supporting sustainability goals, identifying regulatory gaps and difficulties, and making improvements to facilitate the alignment of financial systems with sustainable development objectives. Additionally, research can analyse the influence of regulatory acts on financial markets, investor behavior, and firm practices (Volz, 2018). |

| 4 | Cluster 4 - Yellow: Climate Finance | Research can address the absence of private-sector data on climate finance by exploring strategies to improve data availability and transparency (Chawla & Ghosh, 2019; Bhandary et al., 2021). Research can investigate into the connection between green bonds and the implementation of sustainable financing. This involves assessing the impact and utility of green bonds in funding projects that aim to reduce carbon emissions and promote renewable energy sources. Studies can study the effects of green bond investments, explore the scalability of green bond markets, and highlight potential obstacles and prospects in utilising green bonds for sustainable development. Research can focus on the creation of comprehensive methodology for evaluating and reporting the impact of climate funding initiatives. |

Conclusion

In order to examine the sustainable finance and ESG literature, we conducted a systematic literature review that included 147 articles written by 421 authors and published in 75 journals over a period of eighteen years (2005-2022). A 3-step process consisting of: Systematic article selection using SPAR-4-SLR guidelines, Bibliometric analysis and Sentimental analysis was being employed that helped in uncovering emerging research themes and trends in the underlying research area. This systematic review using bibliometric analysis helped in identifying the most influential viewpoints in the current sustainable finance and ESG literature, publication trend, leading countries, three-fields plot, most productive journals, most influential publications, country bibliographic coupling, document bibliographic coupling, WordCloud, keyword co-occurrence analysis, trend analysis and thematic analysis allowing us to improve our knowledge regarding the underlying field. The findings of the bibliometric investigation demonstrate that sustainable finance and ESG is an emerging research area where considerable number of publications have increased. China is the major contributor, with the highest number of articles. Word Cloud analysis using Biblioshiny revealed that the most commonly used keywords are “sustainable finance,” “ESG investing,” “esg,” “climate change,” and “climate finance.” Thematic analysis using Biblioshiny revealed that “conscious capitalism” and “sustainable finance education” are the most under-represented areas in the underlying field. In addition to this, the use of VOSviewer for keyword co-occurrence analysis assisted in the identification of emerging themes and clusters, namely, “CSR/ESG and Corporate Sustainability,” “Innovation in sustainable finance,” “Sustainable Finance Policies” and “Climate Finance.” Furthermore, developing nations except China have made a very little contribution in the area. As a result, it emphasises the need for researchers’ scholars from emerging countries to make more noteworthy contributions to fundamental works on sustainable finance and ESG. Finally, using RStudio, sentiment analysis was performed on the future scope of selected articles to trace the sentiments for the arena. Positive sentiments were identified by sentiment analysis in the field. This work contributes to the current body of knowledge by providing key insights from earlier research on sustainable finance and ESG and by proposing avenues for subsequent research. In addition, to the best of the authors' knowledge, this is the first attempt at a literature review on the topic of sustainable finance and ESG that provides a comprehensive framework in the form of "Barriers, Mitigation Strategies, and Opportunities" to help readers better understand the underlying field.

Theoretical Implications

The SLR assists researchers in comprehending the present state of research and stimulates their interest in sustainable finance and ESG. This research gives a thorough framework of "Barriers, Mitigation Strategies, and Opportunities" associated with the implementation of Sustainable Finance and ESG, which will aid in the comprehension of sustainable finance and ESG. This research can serve as a springboard for more investigations based on the identified barriers, mitigating strategies and opportunities, illuminating avenues for future investigation in this dynamic and expanding field.

Practical Implications

The findings of the study are significant for regulators, upcoming scholars, environmentalists, companies, and investors because they provide an effective framework for adopting sustainable strategies and for generating value from sustainable avenues of research and practice. The results of the study would further push sustainable finance and ESG practitioners, policymakers, and think tanks to rethink and prioritise as to which sustainable finance areas are to be addressed first. They should develop such norms or codes for best sustainable finance and ESG practices that would respond to the expanding need for good sustainable finance structures.

Limitations

This study, like all others, has caveats that point to new avenues for investigation. The data was obtained first through the Web of Science database, primarily from journals and other scholarly articles (as opposed to books and other conference proceedings). Due to the limitations of the research, other studies leading to alternative conceptualizations may be analysed in future research that collects data from additional relevant databases such as Scopus and EbscoHost. Second, only studies written in English were included in the data set that was gathered by using certain keywords in the Web of Science database. More thorough findings could be attained in the future by using alternative keywords and studies published in other languages. Finally, this study's framework is derived entirely from previously published materials. Therefore, substantial empirical work, like a survey or a case study, is needed for statistical validation of the suggested framework. Potentially corroborated by future research, the hypotheses could further establish the validity of the proposed connection.

References

Abad-Segura, E., González-Zamar, M.-D., López-Meneses, E., & Vázquez-Cano, E. (2020). Financial Technology: Review of Trends, Approaches and Management. Mathematics, 6, 951.

Indexed at, Google Scholar, Cross Ref

Adams, C. A., & Abhayawansa, S. (2022). Connecting the COVID-19 pandemic, environmental, social and governance (ESG) investing and calls for ‘harmonisation’ of sustainability reporting. Critical Perspectives on Accounting, 102309.

Indexed at, Google Scholar, Cross Ref

Adekoya, O. B., Oliyide, J. A., Asl, M. G., & Jalalifar, S. (2021). Financing the green projects: Market efficiency and volatility persistence of green versus conventional bonds, and the comparative effects of health and financial crises. International Review of Financial Analysis, 101954.

Indexed at, Google Scholar, Cross Ref

Agbo, F. J., Oyelere, S. S., Suhonen, J., & Tukiainen, M. (2021). Scientific production and thematic breakthroughs in smart learning environments: a bibliometric analysis. Smart Learning Environments, 1.

Aggarwal, P., & Manaswi, K. (2022). Role of Circular Economy, Industry 4.0 and Supply Chain Management for Tribal Economy: A Systematic Review. Journal of the Anthropological Survey of India, 2, 265–280.

Ahlström, H., & Sjåfjell, B. (2022). Chapter 2 Complexity and uncertainty in sustainable finance: An analysis of the EU taxonomy. In De Gruyter Handbook of Sustainable Development and Finance (pp. 15–40). De Gruyter.

Ahsan, T., Al-GAMRH, B., & Mirza, S. S. (2022). Economic policy uncertainty and sustainable financial growth: Does business strategy matter? Finance Research Letters, 102381.

Indexed at, Google Scholar, Cross Ref

Aksnes, D. W., Langfeldt, L., & Wouters, P. (2019). Citations, Citation Indicators, and Research Quality: An Overview of Basic Concepts and Theories. SAGE Open, 1, 215824401982957.

Indexed at, Google Scholar, Cross Ref

Alhadhrami, A., & Nobanee, H. (2019). Sustainability Practices and Sustainable Financial Growth. SSRN Electronic Journal.

Indexed at, Google Scholar, Cross Ref

Ari, I., & Koc, M. (2021). Philanthropic-crowdfunding-partnership: A proof-of-concept study for sustainable financing in low-carbon energy transitions. Energy, 222, 119925.

Indexed at, Google Scholar, Cross Ref

Aria, M., & Cuccurullo, C. (2017). bibliometrix : An R-tool for comprehensive science mapping analysis. Journal of Informetrics, 4, 959–975.

Arouri, M., El Ghoul, S., & Gomes, M. (2021). Greenwashing and product market competition. Finance Research Letters, 42, 101927.

Indexed at, Google Scholar, Cross Ref

Atif, M., & Ali, S. (2021). Environmental, social and governance disclosure and default risk. Business Strategy and the Environment, 8, 3937–3959.

Indexed at, Google Scholar, Cross Ref

Avgouleas, E. (2021). Resolving the sustainable finance conundrum: activist policies and financial technology. Law & Contemp. Probs., 84, 55.

Azapagic, A. (2003). Systems Approach to Corporate Sustainability. Process Safety and Environmental Protection, 5, 303–316.

Bhandari, A. (2022). Design Thinking: from Bibliometric Analysis to Content Analysis, Current Research Trends, and Future Research Directions. Journal of the Knowledge Economy.

Bhandary, R. R., Gallagher, K. S., & Zhang, F. (2021). Climate finance policy in practice: a review of the evidence. Climate Policy, 4, 529–545.

Indexed at, Google Scholar, Cross Ref

Bhaskaran, R. K., Ting, I. W. K., Sukumaran, S. K., & Sumod, S. D. (2020). Environmental, social and governance initiatives and wealth creation for firms: An empirical examination. Managerial and Decision Economics, 5, 710–729.

Indexed at, Google Scholar, Cross Ref

Bhattacharya, A., Oppenheim, J., & Stern, N. (2015). Driving sustainable development through better infrastructure: Key elements of a transformation program. Brookings Global Working Paper Series.

Bifet, A., & Frank, E. (2010). Sentiment Knowledge Discovery in Twitter Streaming Data. In Discovery Science (pp. 1–15). Springer Berlin Heidelberg.

Indexed at, Google Scholar, Cross Ref

Boell, S. K., & Cecez-Kecmanovic, D. (2015). On being ‘Systematic’ in Literature Reviews in IS. Journal of Information Technology, 2, 161–173.

Indexed at, Google Scholar, Cross Ref

Brandstetter, L., & Lehner, O. M. (2015). Opening the Market for Impact Investments: The Need for Adapted Portfolio Tools. Entrepreneurship Research Journal, 2.

Indexed at, Google Scholar, Cross Ref

Buchner, B., Clark, A., Falconer, A., Macquarie, R., Meattle, C., & Wetherbee, C. (2019). Global landscape of climate finance 2019.

Castillo-Vergara, M., Alvarez-Marin, A., & Placencio-Hidalgo, D. (2018). A bibliometric analysis of creativity in the field of business economics. Journal of Business Research, 1–9.

Indexed at, Google Scholar, Cross Ref

Chakma, R., Paul, J., & Dhir, S. (2022). Organizational Ambidexterity: A Review and Research Agenda. IEEE Transactions on Engineering Management, 1–17.

Indexed at, Google Scholar, Cross Ref

Chauhan, Y., & Kumar, S. B. (2018). Do investors value the nonfinancial disclosure in emerging markets? Emerging Markets Review, 32–46.

Chawla, K., & Ghosh, A. (2019). Greening new pastures for green investments. Issue Brief. Council on Energy, Environment and Water.

Chen, Y., & Ma, Y. (2021). Does green investment improve energy firm performance? Energy Policy, 153, 112252.

Cheng, C., Hua, Y., & Tan, D. (2019). Spatial dynamics and determinants of sustainable finance: Evidence from venture capital investment in China. Journal of Cleaner Production, 1148–1157.

Indexed at, Google Scholar, Cross Ref

Chien, F., Ngo, Q.-T., Hsu, C.-C., Chau, K. Y., & Iram, R. (2021). Assessing the mechanism of barriers towards green finance and public spending in small and medium enterprises from developed countries. Environmental Science and Pollution Research, 43, 60495–60510.

Indexed at, Google Scholar, Cross Ref

Chiu, I. H., Lin, L., & Rouch, D. (2022). Law and Regulation for Sustainable Finance. European Business Organization Law Review, 1-7.

Chueca Vergara, C., & Ferruz Agudo, L. (2021). Fintech and Sustainability: Do They Affect Each Other? Sustainability, 13, 7012.

Indexed at, Google Scholar, Cross Ref

Coleton, A., Font Brucart, M., Gutierrez, P., Le Tennier, F., & Moor, C. (2020). Sustainable Finance: Market Practices. European Banking Authority Research Paper, (6).

Cornell, B. (2020). ESG preferences, risk and return. European Financial Management, 1, 12–19.

Indexed at, Google Scholar, Cross Ref

Cunha, F. A. F. de S., Meira, E., & Orsato, R. J. (2021). Sustainable finance and investment: Review and research agenda. Business Strategy and the Environment, 8, 3821–3838.

Indexed at, Google Scholar, Cross Ref

Dam, L., & Scholtens, B. (2015). Toward a theory of responsible investing: On the economic foundations of corporate social responsibility. Resource and Energy Economics, 41, 103–121.

Indexed at, Google Scholar, Cross Ref

de Zwaan, L., Brimble, M., & Stewart, J. (2015). Member perceptions of ESG investing through superannuation. Sustainability Accounting, Management and Policy Journal, 1, 79–102.

Indexed at, Google Scholar, Cross Ref

Dikau, S., & Volz, U. (2021). Central bank mandates, sustainability objectives and the promotion of green finance. Ecological Economics, 184, 107022.

Indexed at, Google Scholar, Cross Ref

Donthu, N., Kumar, S., Pattnaik, D., & Lim, W. M. (2021). A bibliometric retrospection of marketing from the lens of psychology: Insights from Psychology & Marketing. Psychology & Marketing, 38(5), 834-865.

Indexed at, Google Scholar, Cross Ref

European Commission. (n.d.). Overview of sustainable finance. Finance.

Eweje, G. (2011). A Shift in corporate practice? Facilitating sustainability strategy in companies. Corporate Social Responsibility and Environmental Management, 3, 125–136.

Falagas, M. E., Pitsouni, E. I., Malietzis, G. A., & Pappas, G. (2007). Comparison of PubMed, Scopus, Web of Science, and Google Scholar: strengths and weaknesses. The FASEB Journal, 2, 338–342.

Indexed at, Google Scholar, Cross Ref

Febi, W., Schäfer, D., Stephan, A., & Sun, C. (2018). The impact of liquidity risk on the yield spread of green bonds. Finance Research Letters, 53–59.

Indexed at, Google Scholar, Cross Ref

Flammer, C. (2021). Corporate green bonds. Journal of Financial Economics, 2, 499–516.

Friede, G., Busch, T., & Bassen, A. (2015). ESG and financial performance: aggregated evidence from more than 2000 empirical studies. Journal of Sustainable Finance & Investment, 4, 210–233.

Indexed at, Google Scholar, Cross Ref

Garcia, A. S., Mendes-Da-Silva, W., & Orsato, R. J. (2017). Sensitive industries produce better ESG performance: Evidence from emerging markets. Journal of Cleaner Production, 150, 135–147.

Indexed at, Google Scholar, Cross Ref

Gottschalk, R., & Poon, D. (2020). Scaling up Finance for the Sustainable Development Goals. Southern-Led Development Finance: Solutions from the Global South.

Gu, Y. (2004). Global knowledge management research: A bibliometric analysis. Scientometrics, 2, 171–190.

Indexed at, Google Scholar, Cross Ref

Gulseven, O., Al Harmoodi, F., Al Falasi, M., & ALshomali, I. (2020). How the COVID-19 Pandemic Will Affect the UN Sustainable Development Goals? SSRN Electronic Journal.

Gutiérrez, M., & Gutiérrez, G. (2019). Climate finance: Perspectives on climate finance from the bottom up. Development, 62(1), 136–146.

Indexed at, Google Scholar, Cross Ref

Hanna, D. (2022). Innovation in sustainable finance will maximise impact | Standard Chartered. Standard Chartered.

Hong, H., Karolyi, G. A., & Scheinkman, J. A. (2020). Climate Finance. The Review of Financial Studies, 3, 1011–1023.

Indexed at, Google Scholar, Cross Ref

Huang, H., Xing, X., He, Y., & Gu, X. (2020). Combating greenwashers in emerging markets: A game-theoretical exploration of firms, customers and government regulations. Transportation Research Part e: Logistics and Transportation Review, 140, 101976.

Indexed at, Google Scholar, Cross Ref

Irfan, M., Razzaq, A., Sharif, A., & Yang, X. (2022). Influence mechanism between green finance and green innovation: Exploring regional policy intervention effects in China. Technological Forecasting and Social Change, 182, 121882.

Indexed at, Google Scholar, Cross Ref

Jan, A. A., Lai, F. W., & Tahir, M. (2021). Developing an Islamic Corporate Governance framework to examine sustainability performance in Islamic Banks and Financial Institutions. Journal of Cleaner Production, 315, 128099.

Indexed at, Google Scholar, Cross Ref

Jarneving, B. (2007). Bibliographic coupling and its application to research-front and other core documents. Journal of Informetrics, 4, 287–307.

Indexed at, Google Scholar, Cross Ref

Kagan, J. (2022). Financial Technology (Fintech): Its Uses and Impact on Our Lives. Investopedia; Investopedia.

Kessler, M. M. (1963). Bibliographic coupling between scientific papers. American Documentation, 14(1), 10–25.

Indexed at, Google Scholar, Cross Ref

Ketter, W., Padmanabhan, B., Pant, G., & Raghu, T. S. (2020). Special Issue Editorial: Addressing Societal Challenges through Analytics: An ESG ICE Framework and Research Agenda. Journal of the Association for Information Systems, 5, 1115–1127.

Indexed at, Google Scholar, Cross Ref

Khan, M. A. (2022). ESG disclosure and Firm performance: A bibliometric and meta analysis. Research in International Business and Finance, 101668.

Kullenberg, C., & Kasperowski, D. (2016). What Is Citizen Science? – A Scientometric Meta-Analysis. PLOS ONE, 1, e0147152.

Indexed at, Google Scholar, Cross Ref

Kumar, S., Sharma, D., Rao, S., Lim, W. M., & Mangla, S. K. (2022). Past, present, and future of sustainable finance: insights from big data analytics through machine learning of scholarly research. Annals of Operations Research.

Indexed at, Google Scholar, Cross Ref

Leydesdorff, L., Carley, S., & Rafols, I. (2012). Global maps of science based on the new Web-of-Science categories. Scientometrics, 2, 589–593.

Indexed at, Google Scholar, Cross Ref

Liang, H., & Renneboog, L. (2020). Corporate Social Responsibility and Sustainable Finance: A Review of the Literature. SSRN Electronic Journal.

Lokuwaduge, C. S. D. S., & Heenetigala, K. (2016). Integrating Environmental, Social and Governance (ESG) Disclosure for a Sustainable Development: An Australian Study. Business Strategy and the Environment, 4, 438–450.

Indexed at, Google Scholar, Cross Ref

López-Portillo, V., Gómez, S., & Rodríguez, S. E. (2022). Scaling Nature Based Solutions in Latin America. World Resources Institute.

Macchiavello, E., & Siri, M. (2022). Sustainable Finance and Fintech: Can Technology Contribute to Achieving Environmental Goals? A Preliminary Assessment of ‘Green Fintech’and ‘Sustainable Digital Finance’. European Company and Financial Law Review, 19(1), 128-174.

Manaswi, K., Singh, A., & Gupta, V. (2023). Building a Better Future with Sustainable Investments: Insights from Recent Research. Indian Journal of Human Development.

Indexed at, Google Scholar, Cross Ref

Martínez-López, F. J., Merigó, J. M., Valenzuela-Fernández, L., & Nicolás, C. (2018). Fifty years of the European Journal of Marketing: a bibliometric analysis. In European Journal of Marketing (Vol. 52, Issues 1–2, pp. 439–468). Emerald Group Holdings Ltd.

Merton, R. C. (1992). Financial innovation and economic performance. Journal of Applied Corporate Finance, 4, 12–22.

Minutiello, V., & Tettamanzi, P. (2021). The quality of nonfinancial voluntary disclosure: A systematic literature network analysis on sustainability reporting and integrated reporting. Corporate Social Responsibility and Environmental Management, 1, 1–18.

Indexed at, Google Scholar, Cross Ref

Monasterolo, I., Zheng, J. I., & Battiston, S. (2018). Climate Transition Risk and Development Finance: A Carbon Risk Assessment of China’s Overseas Energy Portfolios. China & World Economy, 6, 116–142.

Indexed at, Google Scholar, Cross Ref

Nassiry, D. (2018). The role of fintech in unlocking green finance: Policy insights for developing countries(No. 883). ADBI Working Paper.

Nassiry, D. (2019). The role of fintech in unlocking green finance. In Handbook of Green Finance (pp. 315-336). Springer, Singapore.

Nicholls, A. (2021). Policies, Initiatives, and Regulations Related to Sustainable Finance. This background paper was prepared for the report Asian Development Outlook.

Oman, W., & Svartzman, R. (2021). What Justifies Sustainable Finance Measures? Financial-Economic Interactions and Possible Implications for Policymakers. In CESifo Forum (Vol. 22, No. 03, pp. 03-11). München: ifo Institut-Leibniz-Institut für Wirtschaftsforschung an der Universität München.

Panagopoulos, A. (2022). The Use of Sustainable Financial Instruments In Relation To The Social Impact Investment. ESG Policies, Capital Markets’ Approach and Investors’ Protection. An Innovative Perspective. ESG Policies, Capital Markets’ Approach and Investors’ Protection. An Innovative Perspective (May 25, 2022).

Paul, J., & Criado, A. R. (2020). The art of writing literature review: What do we know and what do we need to know? International Business Review, 4, 101717.

Indexed at, Google Scholar, Cross Ref

Paul, J., Lim, W. M., O’Cass, A., Hao, A. W., & Bresciani, S. (2021). Scientific procedures and rationales for systematic literature reviews (SPAR‐4‐SLR). International Journal of Consumer Studies, 4.

Indexed at, Google Scholar, Cross Ref

Phillips, G. (2022). Mobilising climate finance for adaptation through the Adaptation Benefits Mechanism. In Handbook of International Climate Finance (pp. 420-444). Edward Elgar Publishing.

Piispa, I. (2022). Impact of the Sustainable Finance Disclosure Regulation (SFDR) on information asymmetry between investment service providers and end investors.

Pizzi, S., Corbo, L., & Caputo, A. (2021). Fintech and SMEs sustainable business models: Reflections and considerations for a circular economy. Journal of Cleaner Production, 125217.

Indexed at, Google Scholar, Cross Ref

Qin, M., Su, C.-W., Zhong, Y., Song, Y., & Lobonț, O.-R. (2022). Sustainable finance and renewable energy: Promoters of carbon neutrality in the United States. Journal of Environmental Management, 116390.

Indexed at, Google Scholar, Cross Ref

Quatrosi, M. (2022). Financial Innovations for Sustainable Finance: An Exploratory Research. SSRN Electronic Journal.

Refinitiv. (2020). Sustainable finance review. Refinitiv. Available at

Reichelt, H. (2010). Green bonds: a model to mobilise private capital to fund climate change mitigation and adaptation projects. The EuroMoney environmental finance handbook, 2010, 1-7.

Rezaee, Z., & Tuo, L. (2017). Voluntary disclosure of non-financial information and its association with sustainability performance. Advances in Accounting, 39, 47–59.Return to ref 2017 in article

Indexed at, Google Scholar, Cross Ref

Riehmann, P., Hanfler, M., & Froehlich, B. (2005). Interactive Sankey diagrams. IEEE Symposium on Information Visualization, 2005. INFOVIS 2005.

Sætra, H. S. (2021). A Framework for Evaluating and Disclosing the ESG Related Impacts of AI with the SDGs. Sustainability, 15, 8503.

Indexed at, Google Scholar, Cross Ref

Saxena, A., Singh, R., Gehlot, A., Akram, S. V., Twala, B., Singh, A., Montero, E. C., & Priyadarshi, N. (2022). Technologies Empowered Environmental, Social, and Governance (ESG): An Industry 4.0 Landscape. Sustainability, 1, 309.

Indexed at, Google Scholar, Cross Ref

Scatigna, M., Xia, F. D., Zabai, A., & Zulaica, O. (2021). Achievements and challenges in ESG markets. BIS Quarterly Review, December.

Schulz, K., & Feist, M. (2021). Leveraging blockchain technology for innovative climate finance under the Green Climate Fund. Earth System Governance, 100084.

Indexed at, Google Scholar, Cross Ref

Sinha, A., Mishra, S., Sharif, A., & Yarovaya, L. (2021). Does green financing help to improve environmental & social responsibility? Designing SDG framework through advanced quantile modelling. Journal of Environmental Management, 292, 112751.

Indexed at, Google Scholar, Cross Ref

Song, Y., Chen, X., Hao, T., Liu, Z., & Lan, Z. (2019). Exploring two decades of research on classroom dialogue by using bibliometric analysis. Computers & Education, 12–31.

Indexed at, Google Scholar, Cross Ref

Srivastava, A., Singh, V., & Drall, G. S. (2022). Sentiment Analysis of Twitter Data. In Research Anthology on Implementing Sentiment Analysis Across Multiple Disciplines (pp. 1905–1922). IGI Global.

Strozzi, F., Colicchia, C., Creazza, A., & Noè, C. (2017). Literature review on the ‘Smart Factory’ concept using bibliometric tools. International Journal of Production Research, 22, 6572–6591.

Indexed at, Google Scholar, Cross Ref

Sustainalytics. (2021). Infographic | 5 Breakout Innovations in Sustainable Finance for Banks. Sustainalytics.Com.

Svensson, G. (2010). SSCI and its impact factors: a “prisoner’s dilemma”? European Journal of Marketing, 1/2, 23–33.

Indexed at, Google Scholar, Cross Ref

Swiss Sustainable Finance. (n.d.). What is Sustainable Finance. Swiss Sustainable Finance.

Taghizadeh-Hesary, F., & Yoshino, N. (2019). The way to induce private participation in green finance and investment. Finance Research Letters, 31, 98–103.

Indexed at, Google Scholar, Cross Ref

Tang, M. C. (2021). What is sustainable finance? [2021 Update]. Landscape News;

Tranfield, D., Denyer, D., & Smart, P. (2003). Towards a Methodology for Developing Evidence-Informed Management Knowledge by Means of Systematic Review. British Journal of Management, 3, 207–222.

Indexed at, Google Scholar, Cross Ref

United Nations Climate Change. (n.d.). United Nations Climate Change.

United Nations. (2020). The sustainable development agenda.

United Nations. (n.d.). Financing Climate Action. United Nations.

van Duuren, E., Plantinga, A., & Scholtens, B. (2016). ESG Integration and the Investment Management Process: Fundamental Investing Reinvented. Journal of Business Ethics, 3, 525–533.

van Eck, N. J., & Waltman, L. (2014). Visualizing Bibliometric Networks. In Measuring Scholarly Impact (pp. 285–320). Springer International Publishing.

Volz, U. (2018). Fostering green finance for sustainable development in Asia. In Routledge handbook of banking and finance in Asia (pp. 488-504). Routledge.

Wallin, J. A. (2005). Bibliometric methods: pitfalls and possibilities. Basic & clinical pharmacology & toxicology, 97(5), 261-275.

Wang, K. H., Zhao, Y. X., Jiang, C. F., & Li, Z. Z. (2022). Does green finance inspire sustainable development? Evidence from a global perspective. Economic Analysis and Policy, 75, 412-426.

Indexed at, Google Scholar, Cross Ref

Wong, W. C., Batten, J. A., Ahmad, A. H., Mohamed-Arshad, S. B., Nordin, S., & Adzis, A. A. (2021). Does ESG certification add firm value? Finance Research Letters, 101593.

World Economic Forum. (2022). 7 sustainable finance challenges to fix global inequality | World Economic Forum. World Economic Forum.

Yu, E. P., Luu, B. V., & Chen, C. H. (2020). Greenwashing in environmental, social and governance disclosures. Research in International Business and Finance, 101192.

Indexed at, Google Scholar, Cross Ref

Zahid, M., Rahman, H. U., Khan, M., Ali, W., & Shad, F. (2020). Addressing endogeneity by proposing novel instrumental variables in the nexus of sustainability reporting and firm financial performance: A step‐by‐step procedure for non‐experts. Business Strategy and the Environment, 8, 3086–3103.

Indexed at, Google Scholar, Cross Ref

Zakari, A. (2022). The role of green finance in promoting sustainable economic and environmental development. Studies of Applied Economics, 40(3).

Zamfiroiu, T. P., & Pinzaru, F. (2021). Advancing strategic management through sustainable finance. Management dynamics in the knowledge economy, 9(2), 279-291.

Zeidan, R. (2022). Obstacles to sustainable finance and the covid19 crisis. Journal of Sustainable Finance & Investment, 12(2), 525-528.

Zetzsche, D. A., & Anker-Sørensen, L. (2022). Regulating Sustainable Finance in the Dark. European Business Organization Law Review, 1, 47–85.

Indexed at, Google Scholar, Cross Ref