Research Article: 2021 Vol: 25 Issue: 1

Managing Local and International Challenges Faced by SMEs of Island States Economies in The Midst of the Covid-19 Pandemic- Evidence from Mauritius

Rajesh Sannegadu, University of Mauritius

Abstract

The Covid-19 coronavirus outbreak continues to affect negatively the global economy, industries and corporations. In many countries, Small and Medium Enterprises (SMEs) are severely hit by the pandemic as they are not prepared to face the unimagined and unprecedented changes in the global economic activities. This situation is more daunting for SMEs in Small Island Developing States (SIDS) who are resource constrained in overcoming the pandemic challenges. Therefore, SMEs should be supported to ensure their survival in this completely new and disruptive business climate. Against this backdrop, this paper aims at suggesting ways to help SMEs overcome local and international challenges in the midst of the COVID-19 pandemic. The suggestions are drawn from existing body of knowledge on the challenges faced by SMEs during the outbreak of the COVID-19 pandemic, the policies implemented by governments to tackle this unprecedented situation as well as recommendations made by international institutions such as the Organisation for Economic and Cooperation Development (OECD) and the International Trade Centre (ITC) to overcome the COVID-19 challenges. These suggestions represent useful inputs for policy makers in their ongoing consideration of policy development and program improvement for assisting SMEs to overcome the COVID-19 challenges. Building resilience to the COVID-19 pandemic will help in safeguarding, protecting and sustaining the visibility of SME in 2020 and beyond.

Keywords

Smes Growth, Internationalisation Challenges, Small Island Developing State, COVID-19, Global Pandemic.

Introduction

As SMEs play a significant role in the socio economic development of a country, governments strive to provide the right ecosystem for their growth both at the national and international level. Due to the COVID-19 pandemic, SMEs around the world are at a critical point of their survival. This largest public health crisis has led to a major economic crisis that has halted production in many countries and reduced consumption and confidence among SMEs’ owners. A study conducted by the International Labour Organisation (ILO) (2020) among 1,000 companies surveyed from eight countries across four continents revealed that 70% of them have had to shut down operations, half (50%) have temporarily closed their business by following direct instructions from the authorities, while the other 50% have closed temporarily due to a reduction in orders or cases of staff COVID-19 infection. Moreover, Cepel, et al. (2020) note that small and mid-sized enterprises from OECD member countries, operating in the transport, travel, agriculture production, fashion and services industry, are likely to suffer from the negative effects of COVID-19 due to their limited number of vendors and short delivery times. Furthermore, the World Bank (2020) reports that the Sub-Saharan region is the worst hit economically with 2020 growth forecasted to fall to between -2.1% to -5.1% coming from a low growth 2.5% in 2019. This forecast implies small scale businesses in the Sub-Saharan economies will be negatively affected (Mukosa, et al., 2020). Mauritius as an island state has also not been spared by the global pandemic. During the lock down period (March-May 2020), most of the businesses have suffered economic losses due to a sharp decrease in business activities. These businesses are more vulnerable since they depend a lot on countries affected by COVID-19 such as Europe and the United States (US). As the country is likely to contract by 13% (Statistics Mauritius, 2020) SMEs which contribute to 40% of the country's GDP and 54.6% of total employment will be severely hit.

As the COVID-19 pandemic is daunting the survival and internationalisation of SMEs due to various sanitary measures and international movement protocols, this article intends to suggest ways to help SMEs overcome local and international challenges in the midst of the COVID-19 pandemic. Moreover, it is imperative that these enterprises are able to adapt to the new normal when international demand resumes. This paper responds to the call from the Organisation for Economic Cooperation Development (OECD) for an inventory of policy responses to foster SMEs’ resilience in the post COVID-19 situation. A review of the existing policies adopted by different countries to support SMEs in the COVID-19 context will serve as guide in building resilience of local SMEs to the global pandemic now and in the post-pandemic context.

The growing number of publications on SMEs over the years demonstrates that it is a field that has gained the attention of the academicians and researchers. Existing literature on SMEs covers different issues such as the growth strategies (Aguilera-Castro & Virgen-Ortiz, 2016), the internationalisation of SMEs (Morais, & Ferreira 2020) and the factors affecting the international growth of these businesses (Rahman & Mendy, 2019). However, the unprecedented COVID-19 global pandemic being a game changer calls for a completely different approach to build the resilience of SMEs. This paper is an investigation into the challenges that Mauritian SMEs are faced with in the midst of the COVID-19 pandemic and how these challenges can be managed in 2020 and beyond.

Literature Review

Global COVID-19 Pandemic

The new type of corona virus (COVID-19) which was first detected in Wuhan City, Hubei Province of China in December 2019 has expanded to touch every corner of the globe. On top of affecting the public health with over 69 million cases diagnosed globally and more than 1.5 million fatalities (Public Health, 2020), the new corona virus has also impacted nearly all businesses worldwide. According to Donthu & Gustafsson (2020), the COVID-19 outbreak has had severe economic consequences on many countries across the globe. For example, this largest public health crisis has halted production in affected countries, led to a collapse in consumption and confidence, and a negative response on stock exchanges which are responding negatively to heightened uncertainties (OECD, 2020). It has put a lot of pressure on Government to boost healthcare systems, secure businesses, maintain jobs and education, and stabilise financial markets and economies.

The COVID-19 pandemic has also impacted global trade which dropped significantly following the lock down and subsequent prohibitive sanitary measures imposed by different countries. By far, the travel and tourism industry has been one of the mostly hit industries. According to the World Tourism Organisation, the international tourist arrivals will drop 60%-80% in 2020 from 2019. This decline will seriously affect the small island states such as Mauritius that mostly depends on travel exports (ITC, 2020). The tourist industry remains an important pillar of the Mauritian economy by generating income of Rs 63 billion and creating 40,000 direct and indirect jobs.

The situation is more alarming for SMEs as they are resource constrained to adapt to a changing context. A survey conducted by ITC (2020) on 4467 SMEs in 132 countries revealed that 55 % of the respondents were strongly affected by the global pandemic and one-fifth of them were on the verge of closing down their operations permanently in the near future. In Mauritius, on top of being economically affected by the lock down, SMEs are facing problems to import raw materials due to the international supply chain disruption by COVID-19.

Given the socio economic costs associated with the global pandemic, many studies have been carried out to address some of the pandemic-related issues affecting society and business at large. For example, since the outbreak of the pandemic several papers have been published which cover different industry sectors (e.g., tourism, retail, and higher education), changes in consumer behaviour and businesses, ethical issues, and aspects related to employees and leadership (Donthu & Gustafsson, 2020).

Impact of COVID 19 on SMEs

SMEs, by virtue of their size, face lot difficulties to ensure their survival and growth as well as to engage in international markets. It is an undeniable fact that SMEs are more vulnerable to global economic crisis caused by the COVID 19 global pandemic. Drawing from the experience of the 2008 economic crisis, SMEs are more likely face similar challenges such as closures, downsizing, and reduced the number of new ventures (Chowdhury 2011; Sannajust 2014).

As SMEs are deeply affected by the current COVID-19 pandemic, empirical studies about the impact of the crisis on SMEs are ongoing in different countries around of the world. One of the main objectives of these studies is to make recommendations to the government on supportive measures for the SMEs’ survival and growth. For example, a study by Lu et al. (2020) on 4807 SMEs in Sichuan, China to assess the impact of the COVID-19 on SMEs, revealed that several factors such as disrupted supply chains, reduced market demand and cash flow problems put unprecedented pressures on the survival of many SMEs. Another study by Ratnasingam et al. (2020) among 748 Malaysian SMEs showed that these businesses were faced with tight financial management and supply chain disruptions. Furthermore, a qualitative study conducted by Nyanga & Zirima (2020) among Zimbabwean SMEs indicated that SMEs were negatively affected by the lockdown due to discontinued production. In a similar vein, results of a survey carried out by Bartik, et al. (2020) on over 5800 small businesses in the United States revealed that 43% of responding businesses were closed due restrictive cash flows. On a global basis, a survey conducted by the International Trade Centre (ITC) (2020) among SMEs in 132 countries showed that the global pandemic strongly affected the business operations of two-thirds of micro and small firms.

The impact of the global COVID-19 pandemic will be more felt among SMEs in small island states like Mauritius as these businesses depend a lot on foreign suppliers of raw materials as well foreign markets for exports. Moreover, their internationalisation depends a lot on the financial resources which have been negatively affected by lock down period.

The main impacts of COVID 19 global pandemic of the performance of SMEs in the local and international contexts are summarised in the following paragraphs.

Lower Revenue for SMEs

Due to the movement control, lockdown, confinement and social distancing amongst other measures, SMEs’ revenue from both the local and international markets have significantly decreased. According to ILO (2020), out of 1,000 companies, 75% of them has been suffering from reduced demand and one-third (33%) experiencing a more than 50% drop in customer orders. From the lock down period till date SMEs in Mauritius have been under extreme pressures and experienced devastating decrease in demand and revenues. According to MCB Focus (2020), the economy will contract by 14.3 % this year. This contraction implies huge financial challenges for the SME sector. As the global economy is also projected to contract by 4.4% this year, many local SMEs will face a lot of difficulties to secure international markets. Moreover, the control at the borders level will increase the transaction costs. According to International Trade Division (ITD), 2020), many businesses in Mauritius, in particular SMEs, are under significant cost pressure and may face potential closure and bankruptcy.

SMEs’ Cash Flow Shortages

As the economic situation worsens, many firms will be faced with cash flow shortages to honour their financial obligations. According to Wehinger (2014) & Karadag (2016), SMEs are more vulnerable to an economic crisis due low equity reserves, limited adaptation potential and flexibility for downsizing, liquidation problems, too much dependency on external financial resources, tightened credit lines, payment delays on receivables and lack of resources amongst others. A study by COMESA (2020) identified “lack of operational cash flow” as one of the key challenges faced by African businesses, particularly SMEs.

Reduction in SMEs’ International Orders

Due to borders restrictions, international orders have decreased considerably. According to the World Trade Organisation (WTO) (2020), world merchandise trade is set to drop by between 13% and 32% in 2020 due to the COVID-19 pandemic. For example, the economic recession in the US due to the COVID-19 (contraction of 2.8%) will have a direct impact on the Mauritian exports of textile and apparel products which make up some 70% of our exports to the US (ITD, 2020). On the other hand, as SMEs rely a lot on international suppliers, they may not receive the raw materials on a timely basis due to global sanitary policies enforced at the borders.

Measures to Mitigate the Impact of COVID-19 on SMEs

Recognising that SMEs face a bigger risk than larger firms of collapsing or being unable to compete, most governments have taken steps to assist SMEs in the midst and post COVID-19 era. Most of the support comes in the form of tax waivers, temporary tax relief, wage assistance scheme and other financial programmes.

For example, in Korea, an emergency fund has been established to provide direct financial support to SMEs and self-employed while in Portugal payments on all contributions by self-employed people have been deferred (OECD, 2020).

In a similar vein, several cooperative non-profit guarantee consortia in Italy are working together with fintech companies in providing finance to SMEs. In Mauritius, government is providing assistance to SMEs through the wage assistance scheme to safeguard employment. Moreover, enterprises with annual turnover of up to Rs 50 million are benefiting from a reduced interest rate of 2.5% instead of 3.9% under the SME Factoring Scheme by Ministry of Finance, Economic Planning and Development (MOFED). Some countries have stepped up direct lending to SMEs through public institutions (OECD, 2020). Other forms of financial assistance include grant and subsidies to SMEs in financial difficulties. Moreover, to avoid erosion of SMEs’ liquidity OECD countries have put in place measures that enable SMEs to postpone payments (OECD, 2020). These measures include deferrals in corporate and income tax payments; value added tax (VAT), social security and pension contributions, property tax and rent and utility costs.

Other countries such as Belgium are supporting SMEs in recovering markets or finding new or alternative markets. Similarly, China is encouraging large enterprises to cooperate with SMEs, by increasing their support in supply chains, in terms of raw material supply and project outsourcing while Indonesia is trying to boost SME exports by virtual business match making events. Other countries such as Italy, New Zealand and Slovenia are also offering aid for internationalisation and measures to diversify export markets. In South Africa, government is promoting the participation of SMEs in supply value-chains, in particular those who manufacture or supply various products that are in demand, emanating from the current shortages due to COVID-19 pandemic.

Policies to assist SMEs in the midst and in the post COVID-19 era are not limited to financial assistance only. Many countries including Argentina, France, Japan, Slovenia and Spain are also assisting SMEs to adopt new work processes and speed up digitalisation. As people are not able to travel abroad due to containment measures, SMEs are resorting to digitalisation and teleworking to increase sales, lower costs and improve their relationship with customers and providers. For example, the Chinese government is supporting SMEs’ cloud computing and purchase of cloud technology and for online working such as remote office, home office to accelerate the adoption of digital technologies among SMEs. Moreover, to ensure competitiveness of SMEs at international level, the right business framework has been set in place in Denmark and Finland to support start-ups and SMEs find innovative solutions to the COVID-19 outbreak.

Mauritius – An Economic summary

After independence, Mauritius was perceived as a frail island in the Indian Ocean with unravelling uncertainties and dangers from cyclonic weathers, lack of educated workforce, no natural resources and over dependence on the singular agricultural sector. However, over the years the island has been successful in challenging all the predictions and vulnerabilities and established itself as an economically and politically strong country in the African continent and the Indian Ocean. Mauritius provided such a remarkable path of success during the momentums of crises that economists and analysts around the globe labelled it as an “economic miracle”. Although having no natural resources, Mauritius has been dynamic and forward looking when it comes to the formulation of its socio economic development strategy. From reinforcing the sugar sector to a motivating textile sector, then to a highly dominant tourism sector and lately the emergence of the services sector, Mauritius has successfully outclassed its performance in the international markets.

In order to sustain the international pressures, Mauritius developed five main pillars including Sugar, Textile, Tourism and Hospitality, ICT and BPO Sector and Financial Services. These five pillars invigorated the investment and growth engine of the Mauritian economy.

In July 2020, Mauritius reached the threshold of high-income economies for the first time in its history with a Gross National Income per capita of $12,740 in 2019, up 3.5% from 2018. However, based on the historical experience and empirical evidence, Larson, Loayza and Woolcock (2016) note that the transition from middle-income to high-income levels takes time, and requires countries to pursue consistently sound but evolving policies to maintain the fundamental drivers of economic growth. Since SMEs are considered as an engine of economic growth, government should, therefore, take concrete measures to resolve key issues concerning the growth and sustainability of SMEs. The global pandemic is yet another factor impacting negatively on the performance of SMEs both in the local and international markets. Therefore, it becomes important for the governments to take decisive policy actions to help SMEs overcome these challenges.

SMEs in Mauritius

In Mauritius an enterprise or business is considered to fit the category of Small Medium Enterprise (SME) if it fulfils any one of the criteria given below (SMEDA Act, 2017):

1. A Small Enterprise is defined as an enterprise which has an annual turnover of not more than 10 million MUR (250,000 USD).

2. A Medium Enterprise is defined as an enterprise which has an annual turnover of more than 10 million MUR but not more than 50 million MUR (1,250,000 USD).

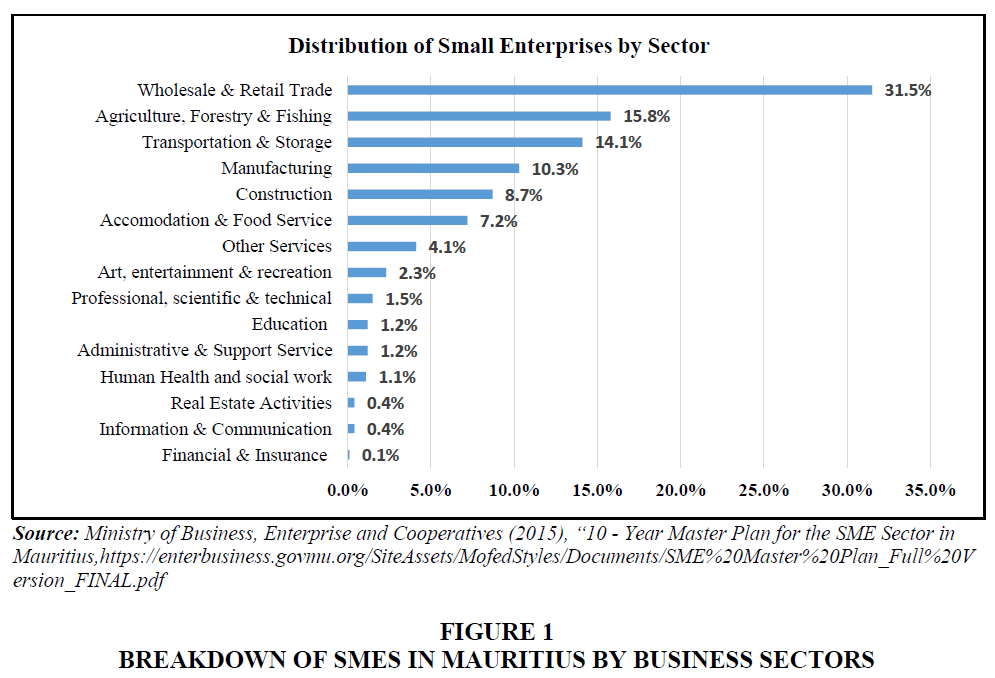

The contribution of SMEs to the Mauritian economy is significant and has been growing to reach one quarter of its economic output. In 2015, SMEs accounted for around 99% of all establishments operating in different sectors of the economy (Statistics Mauritius, 2015). As per the last Census Economic Activities (CEA) (2013) the numbers of SMEs have spurred from 92,400 in 2007 to 125,543 in 2013. This represents a rise of 36%. These businesses were mainly engaged in the wholesale and retail trade (31.5%); agriculture, forestry and fishing (15.8%), transportation and storage (14.1%), manufacturing (10.3%), construction (8.7%) and accommodation and food service activities (7.2%) (Refer to Figure 1).

Considering the SME sector as a growth engine, the Ministry of Business Enterprise and Cooperatives worked on a roadmap for the inclusive development of SMEs in Mauritius in the years to come (10-year Master Plan for SMEs in Mauritius, 2015). Moreover, in the spirit of creating a nation of entrepreneurs, the Government of Mauritius together with the stakeholders have been encouraging more young people to develop entrepreneurial spirit and put their ideas into viable and successful projects. An entrepreneurial spirit among young people is not only a challenging alternative to the routine work of employees, but also a powerful driver of innovation, performance, job creation and wealth, social and economic independence. Government together with the private stakeholders aim to project the SME sector as another pillar of the Mauritian economy. The sector presents unique opportunities for the country to create quality jobs, diversify and democratize the economy, leverage innovation and increase export earnings (10-year Master Plan for SMEs in Mauritius, 2015).

However, experts believe that Mauritius stands at a crossroad faced with numerous challenges ahead in the economic, social and political morale. Accompanied by international pressures and uncertainties in the global arena (due to the global COVID-19 pandemic) as well as challenges in the local level such as high public debt ratio, rising labour costs and so on, Mauritius still needs to fuel and find new development and growth paths.

Methodology

In this study, secondary data was used to develop a thorough understanding of the impact of the COVID-19 pandemic on SMEs and the policies being adopted by other countries and international institutions to cope with these challenges.

The desktop analysis of various internet sources regarding the topic was applied to extract and evaluate pertinent findings and issues which emerged from previous works by other authors on the same issue. The literature study was conducted by using accredited and scholarly journal articles, relevant books, subject-specific journals and websites such as business journals and research methodology sites. Scholarly articles and journals were obtained from different databases such as EbscoHost, Emerald, Elsevier and Research gate. Electronic search engines such as Google and Google Scholar (www.google.com) were used to familiarise the researcher with current informal trends regarding the evolution of global COVID-19 pandemic. Books and relevant and applicable conference proceedings covering a wide range of subjects that are pertinent to this study, such as business strategy, international marketing, SMEs and internationalisation, COVID-19 global pandemic were also referred to.

Secondary data was also retrieved from private and public agencies that are directly or indirectly involved in the development and promotion of the SMEs in Mauritius. These institutions include:

1. The Mauritius Export Association (MEXA) which is responsible for supporting export activities of its members by extending valuable advice, facilitating logistics activities, and implementing training programmes

2. Statistics Mauritius, which is the official organisation responsible for collection, compilation, analysis, and dissemination of the official statistical data relating to the economic and social activities of the country

3. SME Mauritius which acts as a promoter and facilitator of SMEs in Mauritius.

4. The Mauritius Chamber of Commerce and Industry (MCCI), which is a platform to promote the interests of the business community at large.

5. Reports on SMEs developed by Commercial Banks and the Central Banks.

Official websites of international institutions that are actively involved in supporting the SME sector globally have also been consulted. These institutions include:

1. The International Trade Centre (ITC),

2. The Organisation for Economic Co-operation and Development (OECD) (2020), and

3. The World Trade Organisation (WTO).

Discussion

In Mauritius, SMEs are considered as the main drivers of socio-economic development due to their important role in GDP growth, new job creation and developing an entrepreneurial nation. However, during the recent years, the local SMEs have been facing various challenges such as trade liberalization and an upsurge of cheap substitutes. The limited size of the local market in SIDS also constraint SMEs to benefit from economies of scale. The COVID-19 pandemic has further added to the existing vulnerability of the SMEs in Mauritius as they are generally less resilient compared to larger firms. Indeed, the lockdown, confinement, limited movement order and social distancing amongst other measures to contain the virus has negatively impacted on the survival of SMEs in Mauritius. For example, the lock down period (March to May 2020) has been fatal for these businesses as they had to remain closed and did not derive any income.

On the other hand, the SMEs had to pay their fixed costs such as rental fees and utility bills. They also suffered financial loss as they could not complete orders which were started prior to the lock down period. On the other hand, government has requested companies not to terminate the contract of workers. Although, the wage assistance scheme was provided to SMEs, it is clear that they could still not honour other committed expenses such as payment of loans.

At the international level, there are not a lot of dealings due to border restrictions imposed by other countries. Similarly, these businesses are faced with the delay in the delivery of imported raw materials. The challenges faced by the SMEs sector are very similar to the problems faced by the foreign counterparts. Given that international transactions are halted, the SMEs are more inclined to explore local markets. As SMEs are at a turning point that they have not been prepared to deal with, it is important that they are supported by appropriate policy measures to ensure survival in the short term and their growth in the medium to long term. Table 1 below highlights the policy measures to mitigate the impact of COVID-19 on SMEs in OECD countries.

| Table 1 Summary of Policy Measures to Mitigate the Impact of Covid-19 on SMES in OECD Countries | ||

| Policy Measures | Brief Description | Purpose |

| Financial Support | Wage and income support for employees temporarily laid off, or for companies. | To safeguard employment among SMEs. |

| Deferral of tax, social security payments, debt payments and rent and utility payments. Moratorium on debt repayments. | To ease liquidity constraints faced by SMEs. | |

| Grants and subsidies to SMEs and other companies to bridge the drop in revenues. | ||

| Extended or simplified the provision of loan guarantees. | To ease SMEs’ access to finance. | |

| Direct lending to SMEs through public institutions. | ||

| Policy Measures | Brief Description | Purpose |

| Structural Policies | Adoption of new working methods and (digital) technologies. | To strengthen the resilience of SMEs in a more structural way by addressing urgent short-term challenges. |

| Specific schemes | Meant to support the self-employed | To monitor the impact of the crisis on SMEs and enhance the governance. |

SWOT Analysis of the SMEs Sector in Mauritius

SWOT analysis is a widely used tool that helps in understanding the strengths, weaknesses, opportunities and threats involved in a project or business activity (Gachuhi, 2020). It can also be carried out for a product, place, industry or sector. Strengths and weaknesses are internal to an organisation and opportunities and threats are external. Table 2 presents a SWOT analysis of the SME sector in Mauritius.

| Table 2 SWOT Analysis of the SME Sector in Mauritius | |

| Strengths | Weaknesses |

| Flexible to small orders. Skilled and trained labour force. Wide experience. Global recognition in specific field. Direct contact with customers. Wide acceptance of “Made in Mauritius” products amongst local customers. |

High labour cost (minimum wages legislation). Risk averse. Fear of using technology. Over dependence on foreign suppliers. Increase in lead time due to strict border control. Over dependence on selected markets. High number of enterprises with low value addition. Difficulties in accessing the financial resources for start–up firms. |

| Opportunities | Threats |

| Digitalisation. Regional markets (Trade facilitation under regional trade agreements). Closure of borders (Focus more on local market). Government incentives and institutional support for the establishment of new businesses. Diversification. |

Rising logistics cost (global). Appreciation of the dollar. Poor economic condition (Local and Global). Difficulty to comply with international sanitary measures. Closure of borders. New variant of coronavirus leading to prolonged closure of borders. Disruption in supply chain following the global pandemic. |

A vibrant SME sector is a vital ingredient for a healthy economy. In Mauritius, the SME sector contributes significantly to the socio economic development of the country. According to Statistics Mauritius (2018), around 172 200 SMEs on the island contribute 40% to the GDP, produce some MUR 120 million worth of outputs annually and employ around 283 000 people (197 000 males & 86,000 females). It is evident from the Table 2 that the survival of the Mauritian SME sector is at stake due to the global economic recession, increase in the logistic cost, depreciation of the Mauritian rupee against the US dollar, disruption in supply chain, difficulty to comply with international sanitary measures and the closure of borders. Coupled with these external challenges, these businesses are faced with internal challenges such as difficulties in accessing financial resources, increase in labour cost and over dependence on selected markets (such as Europe and US). Nevertheless, the availability of a skilled and educated labour, the wide acceptance of the “Made in Mauritius” products amongst local customers and global recognition in specific field such as the textile manufacturing sector can help the sector to overcome the challenges associated with the global economic recession and the COVID-19 pandemic. Moreover, various opportunities exist to assist SMEs in these difficult times as well as to bring them to a higher level in the long run such as the digitalisation of the business, government incentives and institutional support for the establishment of new businesses as well as the regional market.

Based on the above analysis, it is apparent that the Mauritian SMEs sector is at a turning point. Therefore, it is important that government’s policy is targeted on the development of an environment that could support SMEs to face the pressures of the global pandemic. On the other hand, these businesses should also consider establishing pandemic-specific policies and procedures to build resilience to the global COVID-19 pandemic.

Measures to Manage Local and International Challenges Faced by Mauritian SMEs In The Midst of the COVID-19 Pandemic

Financial Support: In any business, revenue is important to meet current and long term expenditures. Since dramatic and sudden loss of demand and revenue for SMEs (due to COVID-19) severely affects their ability to function and causes severe liquidity shortages, it is important that government provides financial support to these businesses to ensure their survival. Several countries are providing financial assistance to SMEs affected by the COVID-19 outbreak including Malaysia (SMEcorp, Malaysia, 2020), Singapore (Mae, 2020); Fiji (KPMG, 2020 a), Seychelles (Central Bank of Seychelles, 2020), Bahamas (IMF, 2020) and Trinidad and Tobago (First Citizen Bank, 2020).

These supports aimed at sustaining business operations take the form of wage assistance scheme (KPMG, 2020 b), bridging loans to finance short term obligations (IMF, 2020) and deferral of tax and other committed expenses such as debt payments and rent and utility payments (OECD, 2020). Moreover, the government can request commercial banks to give moratorium on debt repayment on existing and new contracted loans by SMEs (Xinhua, 2020). Furthermore, government can provide grants and subsidies to SMEs. Presently, the government is providing financial assistance to big firms through the Mauritius Investment Company (Bank of Mauritius, 2020). Specific financial schemes should also be designed to finance the operations of the small and medium-sized businesses. To ease the access to finance, the government should guarantee the loans contracted by the SMEs. For example, State-owned Thai Credit Guarantee Corporation (TCG) has approved 57 billion baht (USD$1.8 billion) worth of loan guarantees for SMEs who are struggling under the weight of COVID-19 (Liew, 2020).

Support to Introduce Innovative Solutions In SMEs

The new normal requires an innovative approach of managing the business. According to Zao & Qiu (2020), the way SME responds to the new normal will dictate their survival. As online business will determine sustainability of the SMEs, SMEs owners need to change their mindset in running their business by using technology transformation (Indriastuti & Fuad, 2020). Technology can assist in overcoming challenges related to social distancing and physical distancing which limits travel and consumption. For example, the traditional marketing is giving way to digital marketing where a lot of the activities are supported by technology. On the demand side, people have also changed their shopping patterns and are fulfilling their basic needs online. However, SMEs are reluctant to adopt technology based system due to financial constraints. Therefore, measures can be put in place to encourage SMEs to adopt technology based system to increase operational efficiency of the businesses. Several areas of the business can be digitalised including procurement and inventory, accounting and taxes, digital marketing, E-commerce, Electronic Point of Sales (EPOS) and contactless payment system. In a similar vein, SMEs may be provided with special schemes to support the adoption of green initiatives such as the implementation of renewal energy in their operations. This will decrease the operating costs as well as the heavy dependence on non-renewable sources of energy. For example, to accelerate the development of affordable and high-quality digital infrastructure among SMEs in Malaysia, Tong & Gong (2020) proposed that (i) the price of basic digital infrastructure be reduced through a public-private partnership, (ii) SMEs’ employees be trained to improve their technical competencies, (iii) SMEs’ owners are made aware of the existing government initiatives and incentives for digitalisation and (iv) digitalisation incentives are extended to all SMEs nationwide.

Encourage Collaboration between SMEs, Big Firms & Government

Government can also encourage large enterprises to cooperate with SMEs by increasing their support in supply chains, in terms of raw material supply as well as project outsourcing (OECD, 2020). In a similar vein, government can guarantee a minimum threshold to competent SMEs in government funded project.

Since a one size fits all policy is not advisable for all the SMEs, it is recommended that these businesses are divided in clusters and tailor made schemes are set in place to meet the specificities of each cluster. Furthermore, to facilitate the internationalisation of SMEs government can provide financial and non-financial assistance to these businesses so that they meet specific conditions (for example sanitary measures) imposed by the importing countries.

Conclusion

This paper has recommended a series of measures to ensure the survival of SMEs in Mauritius. These measures can serve as input for policy decisions aim at helping SMEs to overcome the COVID-19 challenges. Since these recommendations are based on secondary data and are derived from different international contexts, it is recommended that future research employs primary data collected from the SMEs owners through semi structured interviews. The qualitative approach is considered appropriate as the reality is unique that is COVID-19 and a small island developing state. The author also acknowledges the limitations regarding the generalisation of the recommendations in similar contexts (i.e. small island developing states) given that not all of them are at the same level of socio economic development.

References

- Aguilera-Castro, A., & Virgen-Ortiz, V. (2016). Model for developing strategies specific to sme business growth. Entramado, 12(2), 30-40.

- Bank of Mauritius (2020), COVID-19 Support Programme: Supporting Systemic Economic Operators and Financial Stability, retrieved from https://www.bom.mu/media/covid19-actions/covid-19-support-programme-supporting-systemic-economic-operators-and-financial-stability on 30.12.2020

- Bartik, A.W., Bertrand, M., Cullen, Z.B., Glaeser, E.L., Luca, M., & Stanton, C.T. (2020). How are small businesses adjusting to covid-19? early evidence from a survey (No. w26989). National Bureau of Economic Research.

- Cepel, M., Gavurova, B., Dvorský, J., & Belas, J. (2020). The impact of the COVID-19 crisis on the perception of business risk in the SME segment. Journal of International Studies.

- Chowdhury, S.R. (2011). Impact of global crisis on small and medium enterprises. Global Business Review, 12(3), 377-399.

- Donthu, N., & Gustafsson, A. (2020). Effects of COVID-19 on business and research. Journal of business research, 117, 284.

- First Citizen Bank (2020), An initiative of the Government of Trinidad and Tobago Coronavirus (COVID -19) business support, retrieved from https://www.smeloan.tt/help/ on 30.12.2020

- Gachuhi, L. (2020). SME’s Agribusiness Challenges & Solutions in Africa. Exceller Books.

- Indriastuti, M., & Fuad, K. (2020). Impact of Covid-19 on Digital Transformation and Sustainability in Small and Medium Enterprises (SMEs): A Conceptual Framework. In Conference on Complex, Intelligent, and Software Intensive Systems (pp. 471-476). Springer, Cham.

- International Labour Organisation (ILO) (2020) MSME Day 2020: the COVID -19 pandemic and its impact on small business, retrieved from https://www.ilo.org/empent/whatsnew/WCMS_749275/lang--en/index.htm, on 19.11.2020

- KPMG (2020 a), Fiji- Government and Institution measure in response to COVID-19, retrieved from https://home.kpmg/xx/en/home/insights/2020/04/fiji-government-and-institution-measures-in-response-to-covid.html on 30.12.2020

- KPMG (2020 b), Malaysia- Measures in response to COVID-19, retrieved from https://home.kpmg/xx/en/home/insights/2020/04/malaysia-government-and-institution-measures-in-response-to-covid.html on 30.12.2020

- Liew, S. (2020). Thai SMEs to receive loan assistance to tide over COVID-19, retrieved from https://hrmasia.com/thai-smes-to-receive-loan-assistance/, on 30.12.2020

- Lu, Y., Wu, J., Peng, J., & Lu, L. (2020). The perceived impact of the Covid-19 epidemic: evidence from a sample of 4807 SMEs in Sichuan Province, China. Environmental Hazards, 1-18.

- Mae, C.S. (2020), Guide to SME Grants and COVID-19 Measures to Support Businesses in Singapore, retrieved from https://www.singsaver.com.sg/blog/guide-to-sme-grants on 30.12.2020

- Morais, F., & Ferreira, J.J. (2020). SME internationalisation process: Key issues and contributions, existing gaps and the future research agenda. European Management Journal, 38(1), 62-77.

- Mukosa, F., Mweemba, B., Mwitumwa, L., Sikazwe, W., Mbewe, S.B., Katebe, M. & Sinkala, N.K. (2020). The impact of covid-19 on small scale businesses in Zambia. Banking and Insurance Academic Journal. 2 (6): 1-7

- Nyanga, T., & Zirima, H. (2020) Reactions of small to medium enterprises in Masvingo, Zimbabwe to Covid-19: implications on productivity, Business Excellence and Management, 10 (1): 22-32

- Organisation for Economic Co-operation and Development (OECD) (2020), Coronavirus (COVID-19): SME policy responses, retrieved from https://www.oecd.org/coronavirus/policy-responses/coronavirus-covid-19-sme-policy-responses-04440101/#section-d1e158 on 17.12.20

- Rahman, M., & Mendy, J. (2019). Evaluating people-related resilience and non-resilience barriers of SMEs’ internationalisation. International Journal of Organizational Analysis.

- Ratnasingam, J., Khoo, A., Jegathesan, N., Wei, L.C., Abd Latib, H., Thanasegaran, G., & Amir, M.A. (2020). How are small and medium enterprises in Malaysia’s furniture industry coping with COVID-19 pandemic? Early evidences from a survey and recommendations for policymakers. BioResources, 15(3), 5951-5964.

- Sannajust, A. (2014). "Impact of the World Financial Crisis to SMEs: The determinants of bank loan rejection in Europe and USA," Working Papers 2014-327, Department of Research, Ipag Business School.

- SMEcorp, Malaysia (2020), Additional Measures to Support SMEs Affected by the COVID-19 Outbreak, retrieved from https://www.smecorp.gov.my/index.php/en/initiatives/2020-03-31-00-53-27/additional-measures-to-support-smes-affected-by-the-covid-19-outbreak on 31.12.2020

- Tong, A., & Gong, R. The impact of COVID-19 on SME digitalisation in Malaysia.

- Wehinger, G. (2014). SMEs and the credit crunch: Current financing difficulties, policy measures and a review of literature. OECD Journal: Financial Market Trends, 2013(2), 115-148.

- World Bank, (2020). The COVID-19 (coronavirus) outbreak has set off the first recession in the SubSaharan Africa region in 25 years, with a growth forecast between -2.1 and -5.1 in 2020, from a modest 2.4% in 2019. Geneva: World Bank.

- Xinhua (2020). Thai central bank prolongs debt moratorium for SMEs amid COVID-19, retrieved from http://www.xinhuanet.com/english/2020-10/18/c_139448009.htm on 30.12.2020

- Zao, S. & Qiu, J. (2020), COVID-19 Innovation Strategies for the New Normal: Impact & Opportunities, retrieved from https://www.brighttalk.com/webcast/18230/408250/covid-19-innovation-strategies-for-the-new-normal-impact-opportunities, (Webinar) on 30.12.2020