Research Article: 2025 Vol: 29 Issue: 5

Mapping the Drivers of Mergers and Acquisitions in the Banking Industry: A Causal-Effect Framework

Nikunj Chaudhary, ABV – Indian Institute of Information Technology and Management, Gwalior, Madhya Pradesh

Rajendra Sahu, ABV – Indian Institute of Information Technology and Management, Gwalior, Madhya Pradesh

Vaibhav Agarwal, Sharda School of Business Studies, Sharda University, Agra, Uttar Pradesh

Citation Information: Chaudhary, N., Sahu, R., & Agarwal, V. (2025). Mapping the drivers of mergers and acquisitions in the banking industry: a causal-effect framework". Academy of Marketing Studies Journal, 29(5), 1-17.

Abstract

This study aims to explore interdependencies among the key determinants influencing mergers and acquisitions (M&As) in the banking sector. It addresses the need to understand these interrelationships to identify the possible causes and effects of M&As, which can help subsequently in improving functioning and performance of banks. Key factors related to mergers and acquisitions were identified from a literature review and expert consultation. Then, the causal relationship among them were empirically analyzed through DEMATEL analysis. The findings reveal that global competitiveness is the most important criterion, having mutual interrelationships with income, synergy, risk diversification, growth, size, capitalization, and financial diversification. Synergy, growth, capitalization, financial diversification, and global competitiveness were found to be net cause factors, while income, survival position, risk diversification, NPA, and bank size were identified as net effect factors for M&As.

Keywords

Merger and Acquisition, DEMATEL, Banking, Determinants, Cause-Effect Analysis, India.

Introduction

The Indian banking sector has seen significant transformation recently in terms of mergers and acquisitions (M&As) which play a critical role in restructuring banking industry in India (Chaudhary et al., 2024). M&A refers to restructuring of two or corporate entities into a unified organization. M&As aims to enhance capital adequacy, bolstering financial stability, and broadening operations (Darayseh & Alsharari, 2023). Such consolidations are often derived by goals like achieving cost efficiencies, expanding market presence, and improving competitive positioning (Lootah et al., 2024). As of now, M&As have been extensively studied and practiced in advanced economies like the United States and Europe, but a little scholarly focus is bestowed on emerging economies like India (Zhu et al., 2021), which is now needed considering the recent number of M&As in Indian banking sector.

Since nationalization and liberalization in early 1990s, and now with recent efforts to consolidate, the Indian banking sector has seen many strategic mergers, usually driven by government rules, market needs, and operational inefficiencies (Adhikari et al., 2023). These consolidations aim to enhance operational efficiency, financial resilience, competitiveness, and to achieve economies of scale (Lootah et al., 2024). Notable examples of M&As in India include the 2019 merger of Bank of Baroda with Dena Bank and Vijaya Bank, and the year 2020 amalgamation of ten public sector banks into four major entities. These developments highlight the growing role and importance of M&As in the strategic realignment of India’s banking landscape (Chaudhary et al., 2024).

As of 2023, India’s banking system includes 21 private, 12 public, 43 regional rural sector banks, and numerous cooperative and small finance institutions, serving over 1.4 billion people (Reserve Bank of India, 2023). Public sector banks (PSBs) alone account for nearly 60% of total banking assets. The Reserve Bank of India (RBI) supervises, regulates, and maintains the stability of the banking system. The 2020 merger drive, which reduced the number of PSBs from 27 in 2017 to 12, was part of a broader strategy to build banks with stronger governance, larger balance sheets, and robust risk management practices (Kumar et al., 2024). Government policy support and regulatory oversight have been instrumental in driving these initiatives to improve the efficiency, stability, and international competitiveness of Indian banks (Chaudhary et al., 2024). However, M&As also involve complex challenges related to integrating systems, organizational cultures, and operational procedures, which must be carefully managed to maintain stakeholder trust and ensure smooth transitions (Rani et al., 2023).

The existing literature on banking M&As in India and around the world covers a broad range of themes. Much research has focused on post-merger performance, such as evaluating profitability (Darayseh & Alsharari, 2023), efficiency (Kaur & Sharma, 2024), market share (Hassan et al., 2016), and stakeholder value (Rani et al., 2023). Other studies have analyzed success factors such as managerial synergy (Adhikari et al., 2023), technological integration (Smirnova, 2014), and asset quality (Andrieș et al., 2021). Regulatory dimensions, particularly the RBI’s role in facilitating consolidations (Chaudhary et al., 2024) have also been explored.

While banking M&As have been extensively studied, a critical gap remains in the literature regarding the pre-merger phase, especially the core factors that necessitate or drive to a merger (Darayseh & Alsharari, 2023). While aspects such as financial distress, weak capitalization, and regional overlap are often acknowledged, there is a lack of structured framework that evaluate these factors in a causal manner (Zhu et al., 2021). Additionally, the interrelationships among these variables are not well understood. For example, it remains unclear whether poor governance contributes to financial instability or whether financial instability exacerbates governance challenges (Alsharif, 2023).

To address this gap, this study focuses on identifying and analyzing the key conditions that can lead to a merger or acquisition in the Indian banking sector. Instead of looking only at past outcomes, it uses the Decision-Making Trial and Evaluation Laboratory (DEMATEL) method to explore how different factors are connected through cause-and-effect relationships. This approach helps to highlight the main driving forces and their effects, allowing policymakers and bank leaders to view M&As not just as reactions to problems, but as outcomes of underlying systemic issues. Thereby, encourage them to take timely action before a merger becomes necessary.

Following this, the Section 2 reviews extant literature and discusses a pool of key factors important for M&As. Methodology of DEMATEL is presented in Section 3. Case analysis is conducted in Section 4. In Section 5, results are discussed with interpretation, and Section 6 discusses theoretical contributions. Section 7, conclusions are presented.

Review of Extant Literature

Review of Recent Studies on Banking M&A

The existing body of literature offers a in-depth exploration of the factors driving M&As in the banking sector across various global contexts. These studies cover firm-level, industry-level, and macroeconomic factors, but they often overlook the causal interrelationships among these factors a key lacuna in the comprehension of how and why M&As occur. Andrieș et al. (2021), in the Central and Eastern European context, highlighted bank size, profitability, and macroeconomic stability as key drivers, observing that weaker, less efficient banks are more likely acquisition targets. A similar pattern is observed in the UAE by Darayseh & Alsharari (2023), who report that larger banks typically initiate mergers, influenced by growth prospects, income levels, and regulatory frameworks. Similarly, Lee (2013) stands out by proposing an integrated evaluation model for banking M&As in Taiwan, underscoring the value of multidimensional analytical frameworks to assess merger effectiveness and strategic alignment. The study advances M&A evaluation practices and offers practical insights for financial decision-makers. Meanwhile, research by Rani et al. (2023); Alsharif (2023) evaluates stock performance and post-merger efficiency in India and Saudi Arabia, respectively, highlighting that M&A success is highly contigent on management quality and integration processes. In terms of technology and sustainability, Singhal et al. (2022) emphasize the role of regulatory support and institutional readiness in driving technology adoptation in Indian banks. Sharma & Kumar (2024) extend the knowledge by including sustainability, examing how environmental and fiancial performance affect banking operations in a post-merger setting.

While these studies provide valuable insight, most tend to assess M&A factors in isolation, without adequately exploring their interdependencies. For instance, although Juranek et al. (2022), Andrieș et al.(2021), and Hernando et al. (2009) offer important perspectives on firm-level and macroeconomic variables, they do not examine how these elements causally influence one another. Only a few studies, such as Lee (2013) and Singhal et al. (2022), employ structured causal methodologies, but even these are limited to specific themes like merger evaluation or technology adoption, rather than providing a comprehensive causal analysis of M&A drivers.

While many studies have explored M&As in the banking industry through different methods, such as financial analysis or case-based approaches, they often examine factors separately. This limits a clear understanding of how various elements work together to influence M&A decisions. Important aspects like non-performing assets, capital strength, governance, competition, and policy guidelines are rarely studied in a connected way. Without a proper framework showing how these factors relate to each other, decision-making tends to be reactive and less effective. To address this gap, the next section examines key factors shaping mergers and acquisitions decisions.

Initial Pool of Merger Determinants Based on Literature

An extensive review of existing studies led to the identification of more than 50 factors related to M&As. Many of these factors were found to be repetitive or similar in meaning. To refine the list, two experts from the banking sector were consulted. Based on their practical experience and understanding of the current economic context, the experts helped in narrowing down the list to 25 key factors. Table 1 shows this refined list for further analysis.

| Table 1 Factors Relevant to Banking M&As | ||

| S. NO. | Factors | Studies |

| 1 | Increasing revenue and achieving economies of scale (INCOME) | Dinesh, Baniya, Manjeela (2016); Darayseh & Alsharari (2023); Novickytė & Pedroja (2015); Kaur & Sharma (2024); Smirnova (2014) |

| 2 | Growth, expansion, and increasing sales of services (GROWTH) | Alam & Ng (2014); Beccalli & Frantz (2013); Darayseh & Alsharari (2023); Pasiouras et al. (2011); Smirnova (2014) |

| 3 | Reducing costs and increasing efficiency (COST) | Dinesh, Baniya, Manjeela (2016); Darayseh & Alsharari (2023); Novickytė & Pedroja (2015) |

| 4 | Securing a stronger market position by ensuring survival, competitive advantage, and driving growth of banks (SURVIVAL POSITION) | Darayseh & Alsharari (2023) |

| 5 | Improving branding of banks (BRANDING) | Dinesh, Baniya, Manjeela (2016); Darayseh & Alsharari (2023) |

| 6 | Increasing financial Diversification in banks (FINANCIAL DIVERSIFICATION) | Dinesh, Baniya, Manjeela (2016); Darayseh & Alsharari (2023); Focarelli, Dario, Panetta, Fabio and Salleo (2002) |

| 7 | Achieving security and reducing risks in banks (RISK DIVERSIFICATION) | Hassan et al.(2016); Ariff, Mohamed(2007) |

| 8 | Fulfilling regulatory requirements from regulatory authorities (LEGAL) | Andrieș et al.(2021); Dinesh, Baniya, Manjeela(2016); Beccalli & Frantz (2013); Darayseh & Alsharari (2023); Smirnova (2014) |

| 9 | Fulfilling capital requirements of banks (CAPITALIZATION) | Alam & Ng (2014); Dinesh, Baniya, Manjeela (2016); Hernando et al. (2009); Huhtilainen et al. (2022); Pasiouras et al. (2011); (Smirnova, 2014) |

| 10 | Increasing the total assets of banks (SIZE) | Alam & Ng (2014); Andrieș et al. (2021); Beccalli & Frantz (2013); Hernando et al. (2009); Huhtilainen et al. (2022); Pasiouras et al. (2011); Smirnova (2014) |

| 11 | Increasing return on average assets (PROFITABILITY) | Alam & Ng (2014); Andrieș et al. (2021); Hassan et al. (2016); Huhtilainen et al. (2022); Pasiouras et al. (2011) |

| 12 | Increasing interbank ratio and liquid assets (LIQUIDITY) | Alam & Ng (2014); Andrieș et al. (2021); Pasiouras et al. (2011) |

| 13 | Reducing inefficiency in the banking system and increasing efficiency and synergy among banks (EFFICIENCY) | Alam & Ng (2014); Ariff, Mohamed (2007); Huhtilainen et al. (2022); Kaur & Sharma (2024); Pasiouras et al. (2011) |

| 14 | Seeking new markets through geographical overlapping networks (MARKET POWER SYNERGY) | Hassan et al. (2016); Novickytė & Pedroja (2015) |

| 15 | Managing non-performing assets (NPA) | Kaur & Sharma (2024) |

| 16 | Increasing usage of advanced technological and financial innovations to enhance the quality of products and services (QUALITY OF PRODUCTS AND SERVICES) | Kaur & Sharma (2024); Smirnova (2014) |

| 17 | Achieving combined benefits (SYNERGY) | Hassan et al. (2016); Kaur & Sharma (2024); Novickytė & Pedroja (2015) |

| 18 | Making banks globally competitive by enhancing their size through diversified loan and asset portfolio (GLOBALLY COMPETETIVE) | Kaur & Sharma (2024); Smirnova (2014) |

| 19 | Introducing and implementing updated technological and financial innovations to enhance the quality of services and products of banks (TECHNOLOGY) | Smirnova (2014); Blonigen & Taylor (2000) |

| 20 | Strengthening strategic resources and capabilities through patents and R&D initiatives (STRATEGIC RESOURCES) | Smirnova (2014) |

| 21 | Gaining access to enhanced skills, knowledge, abilities, and greater resources in banks (COMPETENCIES) | Smirnova (2014); Morris (2004) |

| 22 | Establishing a monopoly through the emergence of a new bank entity with larger geographical and products markets (MONOPOLY INTENTION) | Lambkin & Muzellec (2008) |

| 23 | Increasing due diligence through a comprehensive analysis of the anticipated revenues, costs, and risks, along with the cultural and strategic aspects of the target bank (DUE DILIGENCE) | Kaur & Sharma (2024) |

| 24 | Becoming more competitive by exploring strategic opportunities through synergies and the convergence of industries (COMPETITIVE) | Smirnova (2014); Hassan et al. (2016) |

| 25 | Adapting efficiently and quickly to evolving economic conditions within the bank's environment (ECONOMIC ENVIRONMENT) | Smirnova (2014); Morris (2004) |

These 25 expert-validated factors will now be evaluated through an additional expert survey to identify the most critical ones, which will then be used for further cause-effect analysis.

Methodology

Dematel

This method is a structured approach developed to understand and visualize complex relationships among different factors in a system. Based on graph theory, DEMATEL uses causeeffect diagrams to show how factors influence each other and how strong these influences are. It groups the factors into two categories: those that cause other factors and those that are affected (Shieh et al.,2010). Unlike traditional methods that treat factors as independent, DEMATEL captures the dynamic interactions between them (Singhal et al., 2022). This makes it especially useful for identifying key issues and prioritizing actions in complex fields like banking and strategic planning (Lin et al., 2020). This study followed the DEMATEL steps as suggested by Shieh et al. (2010), which are as follows:

Steps 1: Average Matrix Computation

Each participant is asked to assess the direct influence of one factor on another using linguistic scale having score ranging from 1, 2, 3, 4, and 5 corresponding to “no influence”, “very low influence”, “low influence”, “high influence”, and “very high influence” respectively. Let ynm represent the extent to which a respondent perceives that factor m influences factor n. The diagonal elements, where m = n, are assigned a value of one.

For each individual respondent, p x p non-negative matrix is constructed as where:

where:

• g is the respondents index, with 1 ≤ g ≤ G and

• p is the total number of factors.

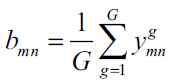

Thus, Y1, Y2, Y3, ...... YG represent the matrices obtained from G respondents. To integrate all respondent perspectives, the average matrix B= bnm is computed using the following formula:

(1)

(1)

Step 2: Computation of the Normalized Direct-Relation Matrix

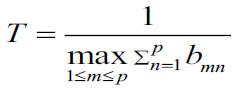

The initial direct-relation matrix is normalized to ensure that its elements fall within the range of 0 to 1. The normalized direct-relation matrix, denoted as E, is obtained by multiplying the average matrix B by a scaling factor T, as expressed below:

E = B x T (2)

Where the scaling factor T is calculated as:

(3)

(3)

In this expression:

• p is the number of factors

• bmn is the element in the mth row nth column of the average matrix B.

• The denominator represents the maximum row sum of matrix B.

As a result, each element in matrix E lies within the interval [0,1]

Step 3: Total Relation Matrix Computation

The total relation matrix, represented by F, accounts for both the direct and indirect effects among the factors. It is computed using the following formula:

F = E(I-E)-1 (4)

Where:

• E is the normalized direct-relation matrix

• I is the identify matrix of size p x P

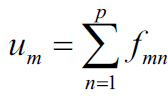

• Subsequently, define:

• u as a p x 1 vector, where each element um represents the sum of the elements in the mth row of matrix F

• v as a 1 x p vector, where each element vn represents the sum of the elements in the nth column of matrix F

Mathematically:

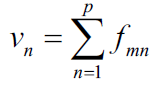

(5)

(5)

And

(6)

(6)

Where:

• um represents the total (direct and indirect) effects exerted by factor m on all other factors.

• vn represents the total (direct and indirect) effects received by factor n from all other factors. The sum um + vm reflects the overall importance of factor m in the system, indication how central it is to the network of relationships. Conversely, the difference um - vm signifies the net effect of factor m in the system:

• A positive value of um - vm suggests that factor m is a net cause (a driving factor).

• A negative value indicates that it is a net receiver (an outcome factor) These relational indicators help identify the role and significance of each factor in the overall system structure (Shieh et al. 2010).

Step 4: Establishing a Threshold to Construct the Digraph

Since matrix F reveals the extent to which one factor influences another, it is essential for decision-makers to define a threshold value in order to filter out insignificant influences. This helps in simplifying the system by retaining only significant relationships.

In this approach, the threshold value θ is determined by calculating the average value of all elements in matrix F

(7)

(7)

Where:

• p is the total number of factors

• fmn is the element at the mth row and nth column of matrix F

After determining θ, only those effects in F greater than this threshold are retained to form the directed graph (digraph).

Finally, the digraph can be illustrated by plotting the dataset pairs (u + v,u - v) for each factor,

where:

• u is the vector of row sums of matrix F (total effects given by each factor)

• v is the vector of column sums of matrix F (total effects received by each factor)

This graphical representation effectively highlights the position and role of each factor within the overall system by mapping both its overall importance (u + v) and net effect (u - v).

Case Analysis of Banking M & AS

Preparation of Initial Questionnaire for Reduction of Items

In Section 2.2, an initial pool of 50 factors influencing banking M&As were reduced down to 25 key factors through expert opinion. To further bring down the number of factors to run the cause-effect analysis, a structured survey was circulated among 50 banking experts to rate their importance on a five-point Likert scale, where 1 denoted ‘very unimportant’ and 5 denoted ‘very important’. The average importance scores obtained from 35 experts for each factor are presented in Table 2. Based on these importance scores, the top 10 most important factors were selected for the cause-effect analysis.

| Table 2 Average Importance Ratings of the 25 Key Factors Influencing Banking M & AS | ||

| S. NO. | Criterion | Importance |

| 1 | Increasing revenue and achieving economies of Scale (INCOME) | 4.5714 |

| 2 | Securing a stronger market position by ensuring survival, competitive advantage, and driving growth of banks (SURVIVAL POSITION) | 4.5429 |

| 3 | Achieving combined benefits (SYNERGY) | 4.5143 |

| 4 | Achieving security and reducing risks in banks (RISK DIVERSIFICATION) | 4.4857 |

| 5 | Managing Non-Performing Assets (NPA) | 4.4571 |

| 6 | Growth, expansion, and increasing sales of services (GROWTH) | 4.4286 |

| 7 | Increasing the total assets of banks (SIZE) | 4.4286 |

| 8 | Fulfilling capital requirements of banks (CAPITALIZATION) | 4.3714 |

| 9 | Increasing financial Diversification in banks (FINANCIAL DIVERSIFICATION) | 4.3429 |

| 10 | Making banks globally competitive by enhancing their size through diversified loan and asset portfolios (GLOBALLY COMPETITIVENESS) | 4.3143 |

| 11 | Increasing return on average assets (PROFITABILITY) | 4.2857 |

| 12 | Reducing inefficiency in the banking system and increasing efficiency and synergy among banks (EFFICIENCY) | 4.2571 |

| 13 | Fulfilling regulatory requirements from regulatory authorities (LEGAL) | 4.2286 |

| 14 | Introducing and implementing updated technological and financial innovations to enhance the quality of services and products of banks (TECHNOLOGY) | 4.2286 |

| 15 | Reducing costs and increasing efficiency (COST) | 4.1714 |

| 16 | Increasing usage of advanced technological and financial innovations to enhance the quality of products and services (QUALITY OF PRODUCTS AND SERVICES) | 4.1429 |

| 17 | Seeking new markets through geographical overlapping networks (MARKET POWER SYNERGY) | 4.1143 |

| 18 | Gaining access to enhanced skills, knowledge, abilities, and greater resources in banks (COMPETENCIES) | 4.0857 |

| 19 | Becoming more competitive by exploring strategic opportunities through synergies and the convergence of industries (COMPETITIVE) | 4.0571 |

| 20 | Increasing due diligence through a comprehensive analysis of the anticipated revenues, costs, and risks, along with the cultural and strategic aspects of the target bank (DUE DILIGENCE) | 4.0286 |

| 21 | Improving branding of banks (BRANDING) | 3.9714 |

| 22 | Strengthening strategic resources and capabilities through patents and R&D initiatives (STRATEGIC RESOURCES) | 3.9714 |

| 23 | Increasing interbank ratio and liquid assets (LIQUIDITY) | 3.9429 |

| 24 | Adapting efficiently and quickly to evolving economic conditions within the bank's environment (ECONOMIC ENVIRONMENT) | 3.9143 |

| 25 | Establishing a monopoly through the emergence of a new bank entity with larger geographical and product markets (MONOPOLY INTENTION) | 3.8857 |

Table 2 exhibits the average importance scores for the 25 criteria in decreasing order. The scores range from 3.89 to 4.57. This indicates that all the criteria were considered fairly important by the experts. The small difference in scores suggests a general agreement among experts about the relevance of these factors for M&As in the banking industry. However, in practice, especially when decisions are guided by the government or central banks, it may not be possible to address all factors at once due to limited financial and administrative resources. Based on Table 2, the final 10 key factors are – increasing revenue and achieving economies of scale (Income), securing a stronger market position by ensuring survival, competitive advantage, and driving growth of bank (Survival Position), achieving combined benefits (Synergy), achieving security and reducing risks in banks (risk diversification), managing Non-Performing Assets (NPA), growth, expansion, and increasing sales of services (Growth), increasing the total assets of banks (Size), fulfilling capital requirements of banks (Capitalization), increasing financial diversification in banks (Financial Diversification), and making banks globally competitive by enhancing their size through diversified loan and asset portfolios (Globally Competitiveness).

Data Collection for Cause-Effect Analysis

After finalizing the ten most important factors, viz. (A) Income, (B) Survival Position, (C) Synergy, (D) Risk Diversification, (E) NPA, (F) Growth, (G) Size, (H) Capitalization, (I) Financial Diversification, and (J) Global Competitiveness, a separate questionnaire was designed to examine how these factors influence one another. Experts evaluated the direct impact of each factor on the others using a five-point scale, where 1 = no influence, and 5 = very high influence, as shown in Table 3. The survey was administered to 18 experienced banking professionals, out of which 15 valid responses were received. The experts are middle level administrators in public and private banking who have an average work experience of 15 years and have been involved in key decision making and data analysis for their banks. The feedback from these experts formed the basis for conducting the DEMATEL analysis.

| Table 3 Linguistic Comparison Scale for Dematel | |

| Linguistic Scale | DEMATEL Value |

| No influence | 1 |

| Very low influence | 2 |

| Low influence | 3 |

| High influence | 4 |

| Very high influence | 5 |

Data Analysis

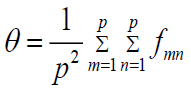

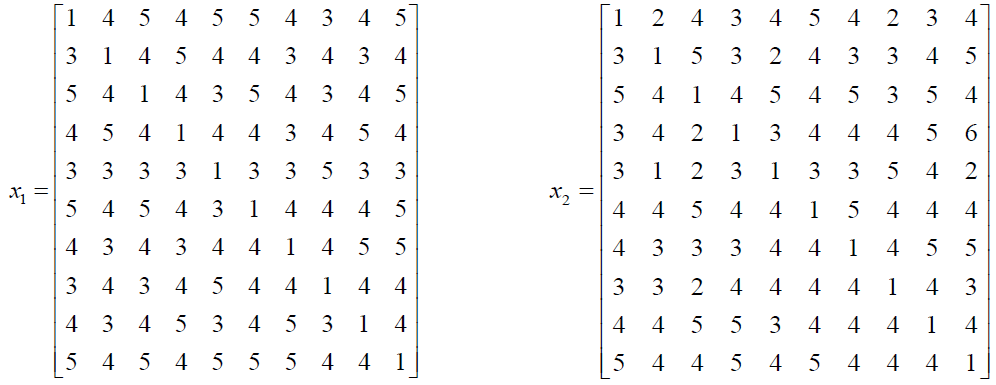

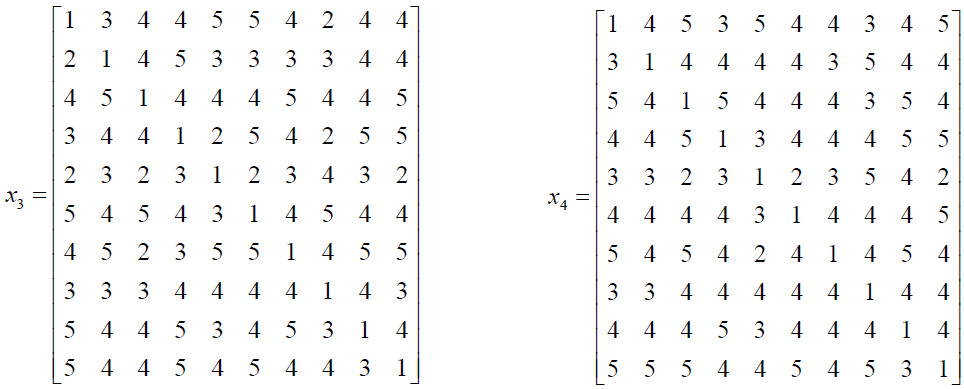

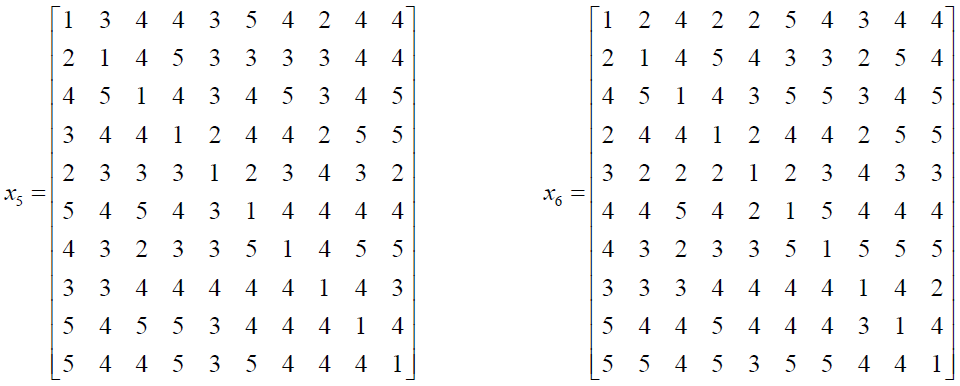

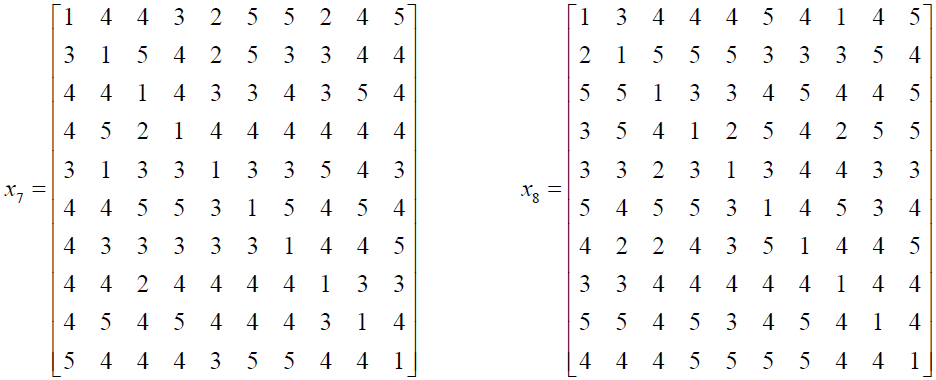

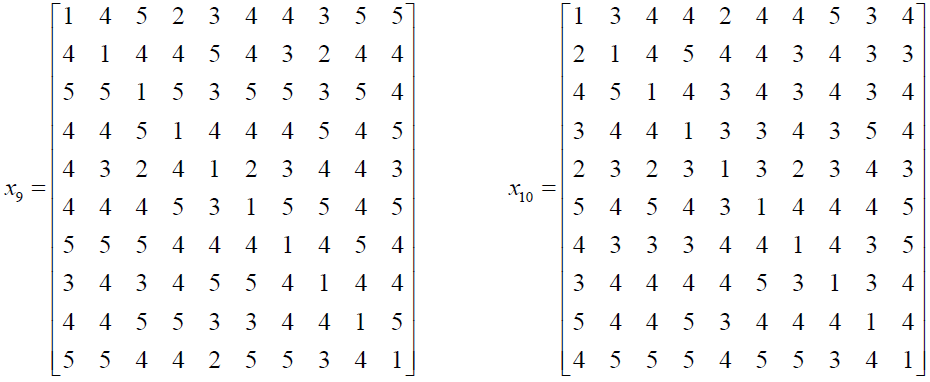

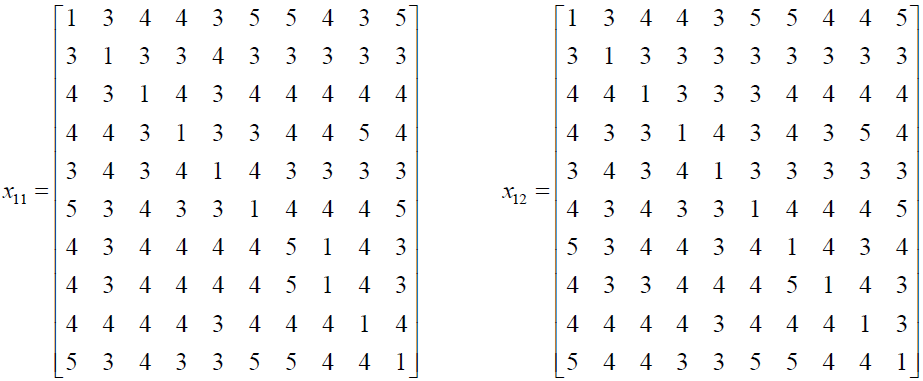

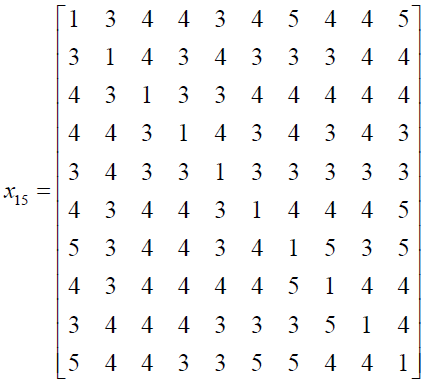

Now, in accordance with the DEMATEL methodology as proposed by (Shieh et al., 2010a), fifteen expert responses are represented in fifteen 10×10 non-negative direct-relation matrices, representing one for each expert. These initial response matrices x1 to x15 are shown below.

Now the formal DEMATEL steps are followed as illustrated below:

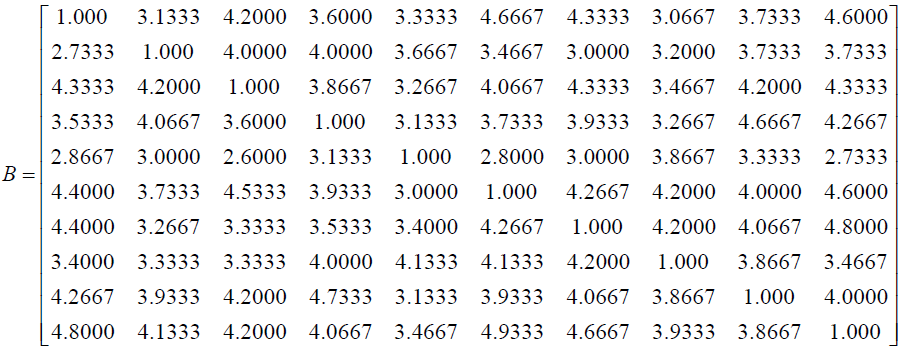

Step 1: After constructing 15 individual matrices, the Aggregated Response Matrix [B] is computed using Equation (1).

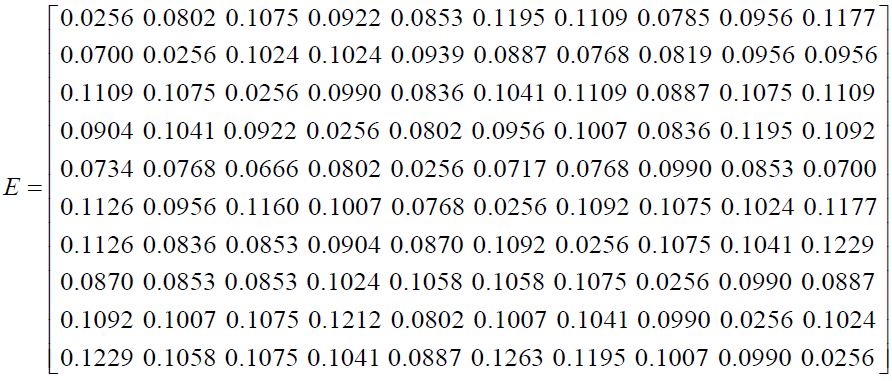

Step 2: Then the normalized Initial Direct-Relation Matrix [E] is computed using Equation (2) and (3).

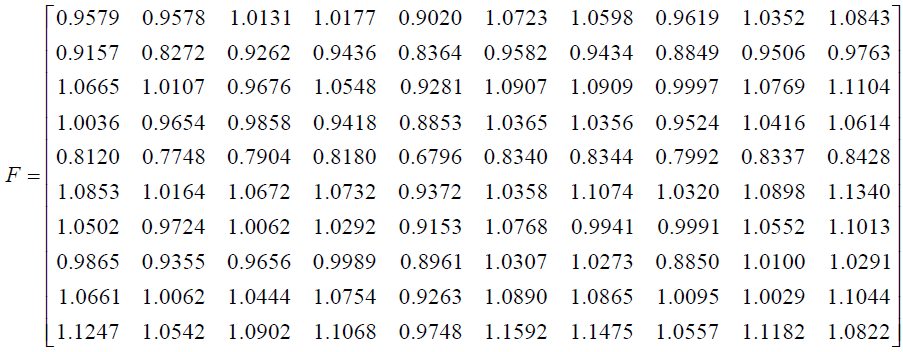

Step 3: Further, the Total Relation Matrix [F] is computed using Equation (4).

Then values of vector u and v is computed using Equation (5) and (6), where u is the vector summation of rows of matrix F, while v is the vector summation of column of matrix F. Vector u represents total effects given by each factor, and vector v represents total effects received by each factor.

Furthermore, u + v and u - v is computed for each dimension, as depicted in Table 4. u + v represents the overall importance of the factors in the system, while u - v represents the net effect of factors in the system.

| Table 4 Influences Caused and Effected Among the Dimensions | ||||

| Factor Symbol | Dimensions | Orientation | ||

| A | Income | 20.1303 | -0.0065 | Effect |

| B | Survival Position | 18.6831 | -0.3579 | Effect |

| C | Synergy | 20.2528 | 0.5396 | Cause |

| D | Risk Diversification | 19.9691 | -0.1501 | Effect |

| E | NPA | 16.9000 | -0.8622 | Effect |

| F | Growth | 20.9617 | 0.1951 | Cause |

| G | Size | 20.5266 | -0.1271 | Effect |

| H | Capitalization | 19.3442 | 0.1851 | Cause |

| I | Financial Diversification | 20.6247 | 0.1965 | Cause |

| J | Globally Competitive | 21.4398 | 0.3874 | Cause |

A positive value of u - v suggests that the concerned factor is a net cause (driving factor), while negative value of u - v represents that it is a net receiver (outcome factor).

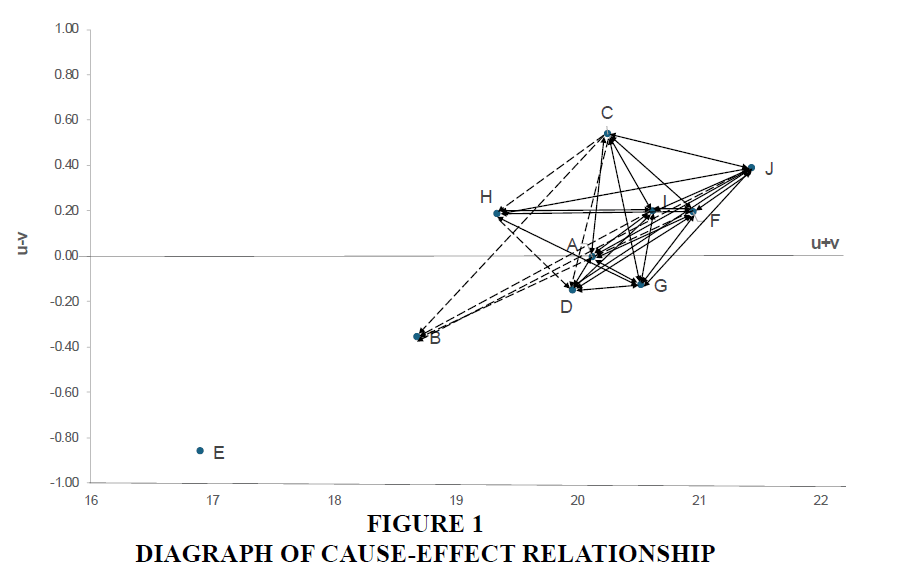

Step 4: Lastly, a threshold value is identified to filter out insignificant influences. For that, the average value of all elements in matrix F is computed using Equation (7), which comes out to be 0.9942. Now, those effects in F which are greater than this threshold value are retained to form the directed graph (diagraph). For diagraph, plot the (u + v, u - v) for each factor, indicating position and role of each factor within the overall system by mapping its overall importance (u + v) and net effect (u - v). The digraph showing inter-relationship of ten criteria is shown in Figure 1.

In Figure 1, solid arrows signify a mutual influence between two variables, indicating that each variable affects the other. Conversely, dotted arrows represent a unidirectional influence, where one variable impact another without a reciprocal effect.

Discussion and Interpretations

Based on the values of (u + v) as shown in Table 4, the significance of the ten dimensions can be outlined as J > F > I > G > C > A > D > H > B > E. As per the outcomes, Global Competitiveness is relatively most important reason with the value of 21.4398, while NPA is relatively least but independently important among these ten criteria for M&A decision in banks. In contrast to the importance, Synergy (C), Growth (F), Capitalization (H), Financial Diversification (I), and Global Competitiveness (J) are net causes, whereas Income (A), Survival Position (B), Risk Diversification (D), NPA (E), and Size (G), are net receivers based on (u - v) values. Figure 1 indicates that Growth (F), Size (G), Financial Diversification (I), and Global Competitiveness (J) is mutually influenced by each other. Finally, NPA (E) appears to be more independent than other criteria, suggesting that it alone can justify M&A decision. It does not necessarily act a cause for another factor, nor it is significantly influenced by them. In summary, banking sector should emphasize on five causes (C, F, H, I, and J) compared to receivers (A, B, D, E, and G) before M&A decisions. Notably, Increasing Market Capitalization is a significant factor since it is both cause and effect. The improvement of capitalization (H) would result in better Risk Diversification (D), Growth (F), Size (G), Financial Diversification (I), and Global Competitiveness (J). Making banks globally competitive by enhancing their size through diversified loan and asset portfolios is the most important criterion (based on (u + v) see Table 4, and mutually affects Income (A), Synergy (C), Risk Diversification (D), Growth (F), Bank Size (G), Capitalization (H), and Financial Diversification (I). This indicates that the interaction of globally competitive factors with other variables indicates a central, dynamic role in shaping the financial structure and strategic development of banks.

Theoretical Contributions and Practical Implications

Theoretical Contributions

This study enriches the ongoing research on bank M&As by shifting focus from post-merger outcomes to pre-merger determinants. While extant studies revolve around financial ratios or regulatory issues, this paper explores the underlying interdependencies among key factors influencing M&A decisions. Using DEMATEL method, this study executed a cause-effect perspective which is largely absent in current literature, particularly in the Indian context.

A major theoretical contribution is in demonstrating how factors, such as Synergy, Growth, Capitalization, Financial Diversification, and Global Competitiveness act as net causes, while Income, Survival Position, Risk Diversification, NPA, and Size function as net receivers. Thereby, offering a more systematic understanding of M&A drivers.

Additionally, the surprising insight that NPA functions independently of other criteria provides novel angle. Unlike conventional views where NPA is treated as an effect or consequence, this study identifies it as a standalone trigger capable of justifying an M&A decision on its own.

Practical Implications

This findings provide relevant knowledge for policymakers in the Indian Banking sector by identifying and ranking ten most important M&A factors. By classifying them into cause and effects, it helps policymakers and bank leaders focus on right areas to avoid reactive and forced mergers.

The cause-effect analysis can be used along with financial ratio analysis to derive a better M&A decision. Factors such as Global Competitiveness, Financial Diversifications, and Growth should be strengthened early, as they play a leading role in M&A decisions. The findings support better risk management by showing how different factors are connected.

Conclusion

Baking sector is going through a lot of restructuring these days as the dynamics of performance have changed. M&A being one of the methods to drag banks out of misery and consolidating them to become a bigger better entity. This study aimed to explore the interdependence among key factors influencing M&As in the Indian Banking Sector. Global Competitiveness emerged as the most influential criterion, while factors like Growth, Synergy, Capitalization, and Financial Diversification were identified as the major causes of M&As. NPA was found to be independently important factor for M&As. Theoretically, the study fills the gap in M&A literature by applying a cause-and-effect perspective to pre-merger decision phase, often overlooked in majority of studies. Practically, understanding the factors driving M&As and theory interaction help in timely strategic planning and interventions. This research offers a valuable framework for identifying, prioritizing, and strategically addressing the factors that shape M&A decisions in banking, supporting more data-driven consolidations in future.

Conflict of Interest

“The authors have no known competing financial interests or personal relationships that could have influenced the work of this paper”.

Funding Acknowledgement

This research received no specific grant from public, commercial, or non-profit funding agencies.

References

Adhikari, B., Kavanagh, M., & Hampson, B. (2023). Analysis of the pre-post-merger and acquisition financial performance of selected banks in Nepal. Asia Pacific Management Review, 28(4), 449–458.

Indexed at, Google Scholar, Cross Ref

Alam, N., & Ng, S. L. (2014). Banking mergers - An application of matching strategy. Review of Accounting and Finance, 13(1), 2–23.

Alsharif, M. (2023). Short- and long-term impacts of merger activities in the banking industry: evidence from an emerging market. Journal of Financial Economic Policy, 15(6), 628–644.

Andrieș, A. M., Cazan, S. and, & Sprincean, N. (2021). Determinants of Bank M&As in Central and Eastern Europe. Journal of Risk and Financial Management, 14(12), 621.

Ariff, Mohamed, S. M. T. and A. R. (2007). Factors determining mergers of banks in Malaysia’s banking sector reform. Multinational Finance Journal, 11, 1–31.

Beccalli, E., & Frantz, P. (2013). The Determinants of Mergers and Acquisitions in Banking. Journal of Financial Services Research, 43(3), 265–291.

Indexed at, Google Scholar, Cross Ref

Blonigen, B. A., & Taylor, C. T. (2000). R&D Intensity and Acquisitions in High-Technology Industries: Evidence from the US Electronic and Electrical Equipment Industries. The Journal of Industrial Economics, 48(1), 47–70.

Chaudhary, N., Sahu, R., & Agarwal, V. (2024). Long and Short-Term Performance Analysis of Government Initiated Merger of Indian Banks: An Event Study and Ratio Analysis Approach. Academy of Marketing Studies Journal, 28(5), 1–20.

Darayseh, M., & Alsharari, N. M. (2023). Determinants of merger and acquisition in the banking sector: an empirical study. Meditari Accountancy Research, 31(4), 1093–1108.

Dinesh, Baniya, Manjeela, S. (2016). A study on the factors affecting merger and acquisition decision in Nepalese banking sector. Master’s Thesis Business Administration- University of Agder, 1–102.

Focarelli, Dario, Panetta, Fabio and Salleo, C. (2002). Why Do Banks Merge? Journal of Money, Credit and Banking, 34, 1047–1066.

Indexed at, Google Scholar, Cross Ref

Hassan, A., Bashir, R., & Shakir, R. (2016). Analysis of factors causing merger and acquisition: case study of banking sector in pakistan. Journal of Business Studies, 12(1), 328–346.

Hernando, I., Nieto, M. J., & Wall, L. D. (2009). Determinants of domestic and cross-border bank acquisitions in the European Union. Journal of Banking & Finance, 33(6), 1022–1032.

Huhtilainen, M., Saastamoinen, J., & Suhonen, N. (2022). Determinants of mergers and acquisitions among Finnish cooperative and savings banks. Journal of Banking Regulation, 23(3), 339–349.

Juranek, S., Nilsen, Ø. A., & Ulsaker, S.A. (2022). Bank Consolidation, Interest Rates, and Risk: A Post-Merger Analysis Based on Loan-Level Data from the Corporate Sector*. Journal of Competition Law & Economics, 18(4), 771–794.

Indexed at, Google Scholar, Cross Ref

Kaur, G., & Sharma, R. K. (2024). Developing the Framework for Mergers and Acquisitions Success: Evidence from the Indian Banking Sector. Journal of the Knowledge Economy, 16(1), 3–3.

Kumar, S., Kataria, R., & Kalia, S. (2024). Press Release:Press Information Bureau. Ministry of Finance.

Lambkin, M., & Muzellec, L. (2008). Rebranding in the banking industry following mergers and acquisitions. International Journal of Bank Marketing, 26(5), 328–352.

Lee, W. S. (2013). Merger and acquisition evaluation and decision making model. The Service Industries Journal, 33(15–16), 1473–1494.

Lin, W. R., Wang, Y. H., & Hung, Y. M. (2020). Analyzing the factors influencing adoption intention of internet banking: Applying DEMATEL-ANP-SEM approach. PLOS ONE, 15(2), e0227852.

Indexed at, Google Scholar, Cross Ref

Lootah, A. M. A. N., Al Tamimi, H. A. H., & Zervopoulos, P. D. (2024). Assessing the Impact of M&As’ Motives Influencing the M&A Decision Making Process in the UAE Banking Sector. International Journal of Economics and Financial Issues, 14(3), 192–205.

Morris, T. (2004). Bank mergers under a changing regulatory environment. Sociological Forum, 19(3), 435–463.

Novickytė, L., & Pedroja, G. (2015). Assessment of mergers and acquisitions in banking on small open economy as sustainable domestic financial system development. Economics & Sociology, 8(1), 72–88.

Indexed at, Google Scholar, Cross Ref

Pasiouras, F., Tanna, S., & Gaganis, C. (2011). What Drives Acquisitions in the EU Banking Industry? The Role of Bank Regulation and Supervision Framework, Bank Specific and Market Specific Factors. Financial Markets, Institutions & Instruments, 20(2), 29–77.

Rani, N., Sangeeta, Rani, N., & Sangeeta. (2023). The Consequences of Mergers and Acquisitions on the Value of Stocks Performance in India’s Banking Sector. WSEAS Transactions on Business and Economics, 20, 2557–2566.

Reserve Bank of India - Publications. (2023). Reserve Bank of India. https://www.rbi.org.in/Scripts/PublicationsView.aspx?id=22350

Sharma, D., & Kumar, P. (2024). Prioritizing the attributes of sustainable banking performance. International Journal of Productivity and Performance Management, 73(6), 1797–1825.

Indexed at, Google Scholar, Cross Ref

Shieh, J. I., Wu, H. H., & Huang, K. K. (2010b). A DEMATEL method in identifying key success factors of hospital service quality. Knowledge-Based Systems, 23(3), 277–282.

Singhal, A., Dube, P., & Jain, V. K. (2022). Evaluating Factors for Successful Technological Implementation in the Indian Banking Industry Using DEMATEL. International Journal of Information Systems in the Service Sector (IJISSS), 14(1), 1–23.

Indexed at, Google Scholar, Cross Ref

Smirnova, Y. V. (2014). Motives for mergers and acquisitions in the banking sector of Kazakhstan. Economics Questions, Issues and Problems: Proceedings of IRI Economics Conference 2014, 79–98.

Yazo-Cabuya, E. J., Herrera-Cuartas, J. A., & Ibeas, A. (2024). Organizational Risk Prioritization Using DEMATEL and AHP towards Sustainability. Sustainability (Switzerland), 16(3).

Zhu, Q., Li, X., Li, F., & Amirteimoori, A. (2021). Data-driven approach to find the best partner for merger and acquisitions in banking industry. Industrial Management and Data Systems, 121(4), 879–893.

Indexed at, Google Scholar, Cross Ref

Received: 03-Jun-2025, Manuscript No. AMSJ-25-15985; Editor assigned: 04-Jun-2025, PreQC No. AMSJ-25-15985(PQ); Reviewed: 18- Jun-2025, QC No. AMSJ-25-15985; Revised: 12-Jul-2025, Manuscript No. AMSJ-25-15985(R); Published: 20-Jul-2025