Research Article: 2022 Vol: 26 Issue: 3S

Marketing of Products and Services by Commercial Banks for Financial Inclusion In India -A Decennium Study

Chatla UD, Yogi Vemana University

Saritha P, Yogi Vemana University

Citation Information: Chatla, U.D., & Saritha, P. (2020). Marketing of products and services by commercial banks for financial inclusion in india - a decennium study. Academy of marketing studies journal, 26(S3), 1-13.

Abstract

In the economic development of a nation, banks occupy an important place. Commercial banks as financial institutions have also emerged as significant sources of funds to industry by virtue of which they constitute an important element of the institutional structure of the capital market in India. Banks assist the establishment and development of well-economic infrastructure for better living standards and are a good source for the procurement of credit to vulnerable groups. They initiated varied financial products and services for inclusive growth at affordable costs. The main purpose of the study is to identify the specific role played by commercial banks in India for achieving financial inclusion. In this research, Firstly, the authors will talk about the significance of financial inclusion in detail; later, the focal point is on the initiatives and role of commercial banks to achieve financial inclusion. The study is based on a systematic review of the literature. The researchers have reviewed the literature of the last decade to realize the financial inclusion growth through the banks. A longitudinal manner literature review has been carried out. The findings of this review paper suggested that various significant contributions rendered by the Indian banking sector towards inclusive growth and to the unbanked populace are Bank branch penetration, Setting up of BC/BF outlets to a large extent, no-frill accounts opening with nil or no balance, Expansion of ATM density in rural and semi-rural areas, Rendering flexible credit facility to MSMEs, SHGs and Villagers to make them economically strong, the introduction of technology-based initiatives such as online banking, Mobile banking, telebanking, Kiosks, and smart cards, simplified KYC norms, distributing General credit cards and Kisan credit cards, and enhancing the financial literacy among the public. The study also concentrates on the performance of banks for financial inclusion before and after the adoption of ICT technology in India.

Keywords

Commercial Banks, Financial Inclusion, Specific Role, Literature Review.

Introduction

At present, the whole world is moving ahead towards such a society where the poverty level should be minimum, good entrepreneurship, sustainable social welfare and improvement in the usage of financial services as well. Commercial banks are the backbone of sound economic infrastructure and the development of a nation’s trade and industry. The government and RBI can keep up the banks and are indispensable for progress. Commercial banks can assist the nation in the development of the industrial sector as well as the agriculture field. The entire hardship of economic growth is not only in the hands of the government of India but also in big transnational enterprises. Commercial banks can play a critical role by providing employment through the setting up of new branches, the wherewithal for needy people and companies.

On the other side, banks also have different products and services available for the varied financial requirements of the public. These are all a part of financial inclusion.

Financial inclusion the term that describes a bank’s offerings and financial services to the public. It is a method of creating the provision of savings as well as credit services to the people who are penurious in an affordable and easy-to-use way. It directs to ensure that poverty-stricken and disadvantaged make the optimum use of their monetary resources and obtain financial literacy. Advancements in financial technology, smartphone usage, and digital transactions, and other start-ups in this sector at present, make financial inclusion easier to accomplish. It strengthens the availability of economic resources and inculcates the habit of savings among weaker sections. Especially in developing economies like India to see unprecedented economy and up liftment of the deprived and marginalized population financial inclusion is really needed and is benefited in the following ways:

1. It opens up a financial resource foundation in the formal economic system by inculcating and progressing the savings habit among the huge rural public. Consequently, financial inclusion safeguards financial health as well as other financial resources in this facile situation by getting low-income category customers into the perimeter of the regular financial system.

2. Financial inclusion protects the weaker sections from the dacoity of local money lenders by creating easy and quick access to obtain loan facilities from regular banking.

3. The rural segments will obtain easy entry to banking operations like cash receipts and payments, account statements, and balance inquiries through fingerprint authentication which will enhance rural masses overall welfare.

4. It is possible to have direct cash transfers to the beneficiary accounts.

5. Mitigation of cash in the economy as much of the money will bring into the banking system.

6. It inculcates the habit of savings among the public that results in increasing capital generation in the country for the economic boost.

7. It enhances that the financial benefits directly outreach to the actual recipients in spite of being drawn off along the way.

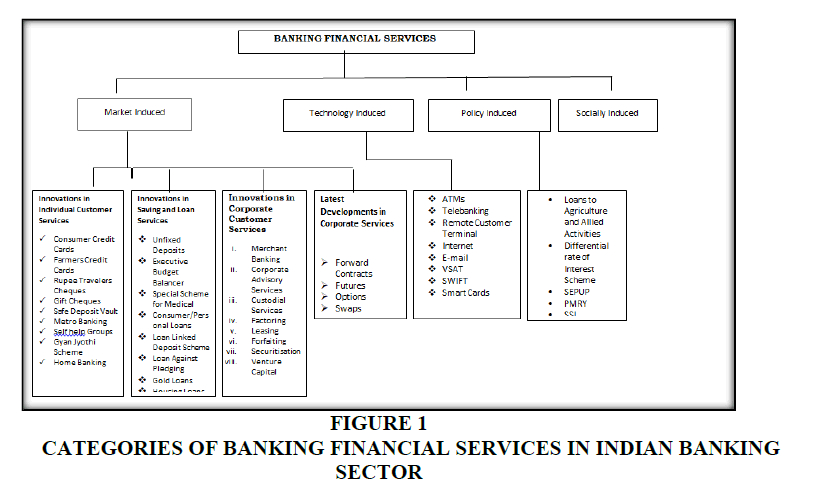

Classification of Marketing of Banking Services and Products

Financial services of banks are classified into four categories:

1. Market induced.

2. Technology induced.

3. Policy induced.

4. Socially induced.

Major Initiatives and Contributions of Banks for Financial Inclusive Growth

The Central bank of India as the apex and regulatory institution of the nation has initiated certain measures and policies to accomplish financial inclusion (Figure 1). These policies and measures help to clear roadblocks in the process of achieving financial inclusion targeted goals. RBI through the healthy and regulatory environment has been giving support to the banking institutions towards inclusive growth. In January 2020, “National strategy for financial inclusion 2019-2024” was released by RBI, in order to set key objectives and vision for the financial inclusion policies of India. By taking inputs from the Indian government, banking officials and other regulators from the financial sector this strategy was prepared by the central bank. There are several initiatives of the central bank of India are:

1. Launching of ‘Jan Dhan Yojana scheme (PMJDY)’ to make avail the opening of savings bank accounts, access to the credit facility, remittance facility, and insurance etc.,

2. Launching of ‘No frill accounts’ with an aim to offer basic banking services to low-income backgrounds with zero balance savings accounts.

3. To offer various financial services without any restrictions on income and age, introduced Basic Savings Deposit Account (BSDA). The offering services include unlimited deposits to the bank account, no charges on ATM cards or debit cards, and zero charges for inactive accounts.

4. To mitigate unbanked and unreached society RBI has launched a ‘Lead bank scheme’, according to this strategy a lead bank which is allocated to each district meets the credit requirements of tiny borrowers, skint people from rural segments, and small businessmen.

5. Another revolutionary step initiated by the RBI in the banking system is the introduction of the Business Correspondent Model, as India is traditionally an under-banked country BC model acts as an agent to taking banking to the public. It renders doorstep banking services through door-to-door or at convenient locations loan disbursements and recovery.

6. Furthermore, implementation of user-friendly KYC norms immensely helps to open small accounts, revised guidelines regarding ‘Financial literacy canters’ to enhance financial literacy efforts through financial awareness campaigns once a month.

7. Through digitalization, linking Jan Dhan bank accounts with Aadhaar numbers and mobile numbers to create a digital infrastructure for encouraging digital payments using ‘Rupay’ cards. Initiation of ‘Jan Dhan Darshak’ a mobile app to identify the touchpoints of financial services anywhere in the country at a given location.

8. In addition, various other schemes such as Atal Pension Yojana to offer pension at retirement, Pradhan Mantri Vaya Vandana Yojan to buy life insurance policy either online or offline, Stand Up India Scheme, Pradhan Mantri Mudra Yojana to disburse loans to entrepreneurs, Pradhan Mantri Suraksha Bima Yojana accident insurance coverage scheme, Sukanya Samriddhi Yojana exclusively for girl child accept small deposits and Jeevan Suraksha Bandhan Yojana a fixed deposit scheme launched to boost up the economy through financial inclusion.

Subsequently, commercial banks also play a paramount role in accelerating inclusive growth by serving all segments of the economy with adequate and appropriate financial products and services. Indeed, banks endeavor to drive away from penury and support capital creation. Thus, the banking system laid hold of a forefront performance in fostering inclusive growth. As of October 2021, worth Rs 1.46 lakh crore deposited in without frills bank deposit accounts of 43.7 crores is a big achievement of inclusion. Most of these accounts are operating in rural regions and semi-urban areas with state-owned banks, regional rural banks (RRBs), and partly by private sector banks (PSBs). The number of commercial bank branches per 1 lakh adults soared from 13.5 to 14.7 during 2010- 2020. Furthermore, the number of deposit accounts with banks and loan accounts significantly increased. Public sector banks have opened the sum of 44 crore non-frill accounts and private sector banks have 1.3 crore accounts. In fact, the role of commercial banks towards inclusion and significance of inclusive growth for the development of a country has been discussed by various academicians, many researchers, and research scholars’ pre-pandemic covid-19, during pandemic covid-19, and it is continually discussed post-pandemic as well. In this research paper, the researchers will intend to know the authentic functions of commercial banks to progress the inclusive growth of the unbanked populace.

Objective

The principal objective of this paper is to review the studies related to banks, which are providing products and services for financial inclusion process in India in last one decade.

Methodology

The research methodology in this research is focused on a systematic literature review. A series of published research papers and articles concentrated on the contributions of commercial banks for getting financial inclusion have been reviewed in a longitudinal manner. Snyder (2019), argued that a systematic literature review could be used as a methodology for research. The researchers can collect the papers and articles on their subject domain and afterward can do a structured review by making (Table 1). In this research, the authors have searched the previous ten years of literature to know the common criteria that banks performed for financial inclusion. The various data sources used for collecting research papers are Elsevier, Google Scholar, research gate, EBSCO etc.

Literature Review

| Table 1 DecenniumLiterature Review |

|||

|---|---|---|---|

| S. No. | Year | Authors | Function of Banks in Financial Inclusion |

| 1 | 2011 | (Chakrabarty, 2011) | As per this report, banks have covered 1.07 villages to open bank branches from March 2010 to June 2011. Up to June 2011, more than Seven Crores, without frills accounts opened with very less minimum balance or nil balance to make accessibility to wide segments of the public. General credit cards (GCC) and Kisan credit cards have been issued to rural and urban people and farmers. |

| 2 | 2012 | The achievements of commercial banks in financial inclusion are wide coverage of villages by the opening of banking outlets, the opening of no-frill accounts with a balance of Rs. 5,944.73 cr, permitted small ODs in No frill accounts, the initiation of general-purpose credit cards as well as Kisan credit cards. | |

| 3 | 2012 | (Anjum & Rajeshtiwari, 2012) | Public sector banks contribute services to both semi-urban and urban populations. Branch penetration and ATM density are comparatively good in India. The geographical distribution of ATMs results in benefits for the semi-urban population. Indeed, to render microfinance to most of the beneficiaries technology will booster the banks. |

| 4 | 2012 | (Chakrabarty, 2012) | This speech revolves around the role of banks and other industry associations to empower the MSMEs for financial inclusion. Bank finance is the primary financial source for the MSMEs and an outstanding credit of Rs 4,785.27 billion was rendered by all the scheduled commercial banks in 2011. To provide timely access to credit, banks are given targets to reach a 20 percent increment year to year in providing credit to micro-enterprises and small enterprises. Banks are advised to serve MSMEs through financial products and services not only traditional basis but also on ICT-based models. As India’s economic growth largely depends on MSMEs, banks and other financial agencies take pride in servicing this sector and play a significant role. |

| 5 | 2012 | (Anand & Saxena, 2012) | Based on advancements in computer technology, the internet, and distribution channels various initiatives are introduced by commercial banks for financial inclusion. Net banking or internet banking or online banking, mobile banking, telebanking, biometric ATMs, mobile ATMs, Kiosks, smart cards, and BC/BF centres are some initiatives. It helped a lot to reach the maximum untapped market in the rural areas. Banks have taken the uphill task to inclusive growth in villages and to understand the customer behaviour to expand in the rural market. |

| 6 | 2013 | (Srikanth, 2013) | To reach out to the unbanked and backward areas, Indian banks with the support of the government and RBI have taken various initiatives. Banks have taken responsibility towards rural areas and specific wards in urban areas ensuring at least a single bank account for one household. Under the financial inclusion campaign- “Swabhimaan”, banks have rendered branchless banking through Business Correspondents Agents (BCAs) and Ultra Small Branches (USBs). By identifying unbanked blocks banking facilities are provided either through Mobile van or Brick and Mortar Branch. For easy and simple payment mechanism encouraged USSD based mobile banking. |

| 7 | 2013 | (Reddy & Noorbasha, 2013) | Commercial banks have contributed a lot to the financial inclusion program. Banks have been covered 1.07 lakh villages through opening banking outlets, brick & Mortar branches, BC outlets, and mobile vans, etc., Banks facilitated to open 7.91 crores no-frills accounts as of June 2011 with the amount of Rs. 5,944.73 crore. Through a General-Purpose Credit Card (GCC) facility up to Rs. 25,000/- render liquidity for agriculture purpose at their rural and semi-urban branches too. As of June 2011, 202.89 lakh Kisan credit cards were issued with an outstanding amount of 1,36,122.32 crore. |

| 8 | 2014 | (Raihanath & Pavithran, 2014) | The study revealed that as a part of financial inclusion the banks have performed various functions such as financial literacy, Credit counselling, BC/BF model, KYC norms, KCC/GCC, No-frill accounts financial literacy, Bank branch expansion, and (M- banking) Mobile banking, etc. In this regard, they render services at an affordable cost. |

| 9 | 2014 | (Kolloju, 2014) | To ensure greater financial inclusion and banking outreach RBI introduced a technology-based agent banking model called the Business correspondent model (BC)/ Business facilitators (BF). Primarily this model intended to reach out to the geographically diversified, particularly rural areas and financially excluded from the banking mainstream. This model ensures to render doorstep delivery of bank’s products and services as bank’s agent named as the branchless banking. |

| 10 | 2014 | (Ghosh & Ghosh, 2014) | To attain financial inclusion various strategies were formulated by the banks. Adoption of bank-led model technology-based branchless banking to serve financial products and services. Integration of financial literacy with financial inclusion as financial literacy transcend the financial inclusion. Adoption of technology to render doorstep services liberalized KYC norms, simplified authorization norms for branch setup and floating of required new branches in unreached rural segments are some steps implemented by the banks. |

| 11 | 2014 | Favourable regulatory circumstances were created to attain the financial inclusion goals. According to the directions of RBI, banks have introduced no-frill accounts, with easier KYC norms opening of bank accounts under PMJDY, initiation of BC/BF model, the introduction of electronic payment channels and mobile banking etc. Hence, the progress of banks in terms of total banking outlets from 2011 to 2014 was 267,596, 138.3 millions accounts opened from 2011 to 2014, and KCC, as well as GCC, improved 12.79 and 5.7 million respectively in the same period. | |

| 12 | 2014 | (Mustafi & Chakraborty, 2014) | In addition to the public sector banks(PSB), private owned banks also came forward to attain inclusive growth, a study has been carried out in West Bengal. To promote banking products and services in remote corners and unbanked areas as well banks penetrated at large by opening accounts, Issue of GCC and KCC, BC and BF outlets etc. |

| 13 | 2015 | As per the directions of RBI towards the banking sector, banks implemented various initiatives for inclusive growth in India. There are no-frill accounts, simplified KYC norms, low-cost and mobile ATMs, BC/BF model, and setting up of ultra-small branches. Furthermore, an extension of rural credit, loans to weaker sections, SC/STs, minorities and SHG-bank linkage program, etc, to make their financial condition strong. | |

| 14 | 2015 | (Rajput, 2015) | As a part of availing banking access to all the corners, from 1969 to 2015 the proportion of bank branches increased from 1833 to 48498 in rural areas. Correspondingly, per branch population declined to 10300 from 60000 people per branch. Banks made a considerable increase in ATM penetration in rural corners to avail easy accessibility. |

| 15 | 2015 | Various financial inclusion parameters such as branch penetration, employee penetration, business per employee penetration, profit per employee penetration, deposits penetration, advances penetration, and investments penetration are tested among public, private and foreign banks. Foreign banks and private sector banks are dominating in profit per personnel and business per personnel whereas government undertaking banks are doing good at all the parameters pertaining to financial inclusion. | |

| 16 | 2015 | Expansion of bank branches in rural, semi-urban, and urban and metropolitan cities and inclusive index increased from 2006 to 2011. The distribution of Kisan credit cards increased that enhanced ICT-based transactions. | |

| 17 | 2016 | RBI has taken various measures to financial inclusive growth and all the commercial banks have implemented these policies. Majorly, banks penetrated their services in the form of branch expansion and expanding ATM networks in semi-urban and rural areas. | |

| 18 | 2016 | This research paper described the functions performed by the banks for financial inclusion. Merely, banks allowed to open no-frill accounts, encouraged simplified KYC norms, availing mobile banking, adoption of technology and BC model, distribution of GCC and KCC, simple branch authorization, and expansion of branches in rural centres are initiated for inclusion that helps for rural masses to avail and access the banking services cost-effectively. | |

| 19 | 2016 | (Trivedi & Nagar, 2016) | The study was carried out in Gujarat state to know the bank’s performance on the road to reach inclusion. Product-based, fund-based knowledge-based, regulator-based, technology-based, and bank-led approaches were initiated and implemented. |

| 20 | 2016 | (Mala & Vasanthi, 2016) | Technology-led innovations in the banking sector for financial inclusion were majorly discussed in the article. They are deposit machines, ATMs, Handheld devices, kiosks, mobile banking, and internet banking. These technology initiatives in the financial system enhanced financial transactions at an affordable cost. |

| 21 | 2017 | (Singh, 2018) | Banks taken an important responsibility in the implementation of direct benefit transfer (DBT) to clients by the opening of bank accounts, rendering adequate banking infrastructure to withdraw money at ease and convenience as a part of financial inclusion. Important areas where banks worked for financial inclusion are branch expansion, BC/BF model, credit counseling, financial literacy, mobile/E- banking, etc. |

| 23 | 2017 | (Bhuvana & Vasantha, 2017) | The study revealed that attitude, ease of use, usefulness, trust, and perceived risk are the determinants of rural customers to accessing mobile banking services. Through structural equation modelling, it is identified that these factors influence the use of mobile banking services for achieving financial inclusion. Banks implementing mobile banking strategy for financial inclusion. |

| 24 | 2017 | (Begum, 2017) | Towards inclusive growth commercial banks have expanded the greater number of new bank branches in the different population groups of the country like rural area, semi-urban places, urban region, and metropolitan cities during 2015-2016. In addition to the bank branches, banks have collected more deposits from rural areas. The lumpsum amounts of credit have been sanctioned to metropolitan cities than the rest of the population groups. |

| 25 | 2017 | (Jose & Mani, 2017) | The authors investigated the contributions of banks in the Kerala state. Banks’ contributions in Kerala state are indispensable in the marathon of financial inclusion. As per CRISIL inclusix, 2015 report branch penetration; ATM spreading; SC, ST, and weaker section advances; advances to priority sector and agriculture sector (KCC) and financial literacy are progressive for the unbanked. |

| 26 | 2018 | Banks moved towards setting up an improved new banking outlets in villages, significant increment in the number of business correspondence outlets and a good number of basic savings bank deposit accounts (BSBDAs) were extended for including people into the formal financial system. | |

| 27 | 2018 | The significant function of banks for financial inclusion is creating financial awareness about financial products and services through an awareness campaign, establishment of bank branches close to homes, comfortable working hours, and rendering easy loans to account holders. | |

| 28 | 2018 | During 2011-2017 scheduled commercial banks performed on the road to financial inclusive growth with an increasing trend of the establishment of banking outlets, availing overdraft facilities, a number of savings bank accounts, Kisan credit accounts, ICT accounts, and General credit cards. These instruments have helped a lot to serve to the financial requirements of farmers and the underprivileged customers as well. ICT-based accounts and transactions created momentum in the banking sector to enlarge banking’s ability to reach every corner in the country. This shows the brighter side of financial inclusion in this period. | |

| 29 | 2019 | (Kumar, 2019) | It has been identified that the number of ATMs, aggregate deposits, and credit levels of commercial banks increased from 2011 to 2015. The study recognized that banks opened more branches in rural and semi-urban areas in order to include unbanked and rural people in the formal financial system. |

| 30 | 2019 | (Singh, 2019) | The authors clearly focused on main role and responsibility of banks in promoting financial inclusion. As per the study discussion commercial banks have performed various functions such as enhancing financial literacy, formulating easy KYC norms, BC/BF model, the opening of no-frill accounts, mobile banking, simplified credit facilities, etc. This fetched to increase the number of bank branches in unreached areas to bring unbanked people into the regular banking system. |

| 31 | 2019 | (Agarwal, 2019) | He conducted a study as ‘Twin pillars of Indian banking: financial literacy and financial inclusion. The study revealed that financial literacy and financial inclusion are the win-win opportunity for the poor to include in the formal financial system. Financial literacy impacts the opening of a number of bank accounts. Hence this situation can improve by the banks through more banking outlets and using IT tools to render financial services. |

| 32 | 2019 | (Uzma & Pratihari, 2019) | This research highlighted the importance of the Business Correspondence model for financial inclusion progress in India. Even though it has experienced long break-even, with the currently available products and services in BCs, this model is a really beneficial tool for the banks in different regional segments towards achieving the financial inclusion goal. Furthermore, new business opportunities can also be explored through the BC channel by the market penetration and expansion of the new market for different banking products and services. |

| 33 | 2019 | The authors discussed the role of scheduled commercial banks for financial inclusion and its impact on GDP. The bank branches and credit deposit ratio as financial inclusion components and these have a significant impact on GDP. Consequently, the study suggested that banks spread branches and expand the credit deposit ratio for financial inclusiveness. | |

| 34 | 2020 | (Maity & Sahu, 2020) | Public sector banks played a major role in the implementation of PMJDY towards financial inclusion. There was a greater growth efficiency of public sector banks from 2014 to 2018 with the introduction of the PMJDY scheme which resulted in the opening of more bank accounts and a substantial number of deposits from puthe blic and rendering loans to a huge number of account holders. |

| 35 | 2020 | (Meghana, 2020) | Through an empirical investigation, a comparative study has been carried out between Canara Bank and Corporation banks’ role to achieve financial inclusion. Canara bank is good at branch penetration, ATM density, higher rate of deposits, credits rendering, and setting up of financial literacy centres compared to corporation bank during 2014-2019 towards financial inclusion. Apart from that Canara bank has opened more PMJDY accounts than corporation bank during the study period 2014-19. |

| 36 | 2021 | (Lourdunathan, 2021) | The biggest function performed by the banks for financial inclusion is identified by the empirical study. To promote the culture of saving, to improve access to credit for entrepreneurs and individuals and to enable strong payment mechanism banks strengthening the resource base as factors of financial Inclusion like Total Deposits, Loans & Advances and Investments. These factors have a positive and significant impact on Commercial banks’ financial performance. |

| 37 | 2021 | (Gunaseelan & kalaiselvi, 2021) | The biggest contribution of scheduled commercial banks to inclusive growth is the establishment of bank branches as bank penetration and ATM outlets throughout the nation. The growth rate in branches and ATM centres are 26.456 % and 17.344% respectively per 100000 adults by 2020. |

| 38 | 2021 | (Nair & Sreejith, 2021) | On the road to achieving financial inclusion, it has been found a greater gap between accepting deposits and rendering credit in rural and semi-urban areas. Even though banks are offering loans, involving lengthy legal formalities leads to keeping the needy people away from formal banking. Hence govt and RBI have to simplify the legal formalities for procurement of credit formally. |

| 39 | 2021 | (Rajendra Suryawanshi et al., 2021) | As a growth parameter, there was a tremendous increment in branch expansion especially in rural and semi-urban areas in the inclusion period. It have been increased credit accounts along with that credit penetration to enhance consumption capability as well as a productive activity. Bank-led model and branch expansion are the major concomitants initiated for inclusion. |

| 40 | 2021 | (Ray, 2021) | Through the study, it has been identified that commercial banks ensure financial inclusion by assisting SHGs. For the problem of financial inclusion, SHG and the bank link program will work as a relevant solution. Financial assistance rendered by banks to SHGs members in the form of a lump sum number of deposits, loans, and advances, increasing branch percentile results in better living standards and made them economically strong. It is identified that all the financial products and services can be reached to the vast majority weaker sections through effective SHGs. |

Discussion

According to the ten years literature review, the following functions were identified as more common functions performed by the banks towards financial inclusion in India (Table 2).

From the above analysis of all the functions, it can be revealed that the significant five functions performed by the commercial banks in achieving financial inclusive growth are Penetration of bank branches, BC/BF Model, Bank Finance (or) Credit Facility, Technology-based Initiatives, No frill Accounts through PMJDY Scheme.

Penetration of Bank Branches

It is fact that, by the assistance of the Reserve Bank of India, the banking sector built its new branches to the great extent in rural and semi-urban areas to reach the unbanked masses. This helps customers have more interactive and personalized experiences to do financial transactions. Refitting current ones are more retail-like environments and more accessible to deal proactively with the clients. This removes a few hurdles to render customer services and facilitates financial access to customers for economic growth.

BC/BF Model

Business correspondent and Business facilitator channels are other new approaches adopted in the Indian banking system. These channels performed an overwhelming role in doorstep banking to the connectivity and to extend not only credit facility but loan recovery at the doorstep of the clients also. Potentially, this model helps to enable banking outlets to reach clients at a faster rate and at affordable cost. But, at the ground level, these are not succeeded; however, regulators are required to take necessary actions for reviving these channels.

Bank Finance (or) Credit Facility

Another indestructible service rendered by the banks is availing of credit facilities. It helps to fulfil the liquidity crunch of the MSMEs. As this sector has great employment opportunities and acts as an economic growth engine, this promotes and booster the financial inclusive growth in rural areas.

Technology-based Initiatives

Another strong promoter for financial inclusion is the adoption of technology. To enhance bank reach and affordability, IT and mobile telephony combinations along with other IT-enabled services have become the optimum solutions for greater financial inclusion. Various technologies enabling financial inclusion are discussed by the different authors. These are kiosks, biometric ATMs, smart cards, mobile banking, mobile payments, POS terminals, online banking etc.

No Frill Accounts through PMJDY Scheme

It is another unprecedented initiative in banking by the central bank to render all banking and financial facilities to the clients at no charges with no-frill accounts under PMJDY. Offering universal access to banking services at zero charges such as withdrawals, debit cards, and ATM facilities prominent objective of this. As of August 2021, total PMJDY accounts were 44.44 crores opened and these beneficiaries were banked. This is a revolutionary step for financial inclusion in India.

Conclusion

As per the above reviews and discussion, it can be revealed and concluded the Indian Banks contributed a lot to financial inclusion and to bringing the destitute into the authorized financial system.

Due to the Covid-19 pandemic, even the public is interested to use technology to carry out their financial transactions at a high. A decade review of literature analysis identified various endeavours of banks for inclusion such as an expansion of bank branches, opening up of no-frill accounts through PMJDY scheme, Expansion of ATM network, credit/loan facility, the establishment of BC/BF Model, the introduction of technology-based initiatives to offer financial products and services, simplified KYC norms, KCC and GCC and enhancing financial literacy and awareness. But the high-frequency contributions are penetration of bank branches, BC/BF model, bank finance or credit facility, ICT-based initiatives, and no-frill accounts with nil balance.

Limitations and Scope for Further Research

The research was carried out especially in Indian commercial banks, not representing the cooperative bank’s services for inclusive growth. But these are mainly scattered and served in villages, their scope is high for inclusion in the entire banking system. According to the earlier studies literature, only a few contributions were majorly identified. Future researchers can study cooperative bank functions by primary data also.

References

Agarwal, T. (2016). Twin Pillars of Indian Banking: Financial Literacy and Financial Inclusion. SIES Journal of Management, 12(2).

Anand, S., & Saxena, D. (2012). Recent initiatives by Indian commercial banks towards financial inclusion. Journal of Internet Banking and Commerce, 17(2), 1.

Anjum, B., & Tiwari, R. (2012). Role of Private Sector Banks for Financial Inclusion. International Journal of Multidisciplinary Research, 2(1).

Begum, D.E. (2017). Initiatives by Indian Commercial Banks towards Financial Inclusion for Sustainable Growth. International Journal of Engineering and Management Research, 7(4), 451–456.

Bhuvana, M., & Vasantha, S. (2017). A structural equation modeling (SEM) approach for mobile banking adoption - A strategy for achieving financial inclusion. Indian Journal of Public Health Research and Development, 8(2).

Google Scholar, Cross Ref

Chakrabarty, K.C. (2011). Financial Inclusion and Banks: Issues and Perspectives. Reserve Bank of India Bulletin, 1831–1838.

Chakrabarty, K.C. (2012). Empowering MSMEs for Financial Inclusion and Growth–Role of Banks and Industry Associations‖. change, 9(4785.27), 32-08.

Gunaseelan, S (2021). Financial Inclusion Commercial Bank Branch and Atms in India an-Analysis. Turkish Journal of Computer and Mathematics Education (TURCOMAT), 12(10), 3862–3865.

Ghosh, M.M., & Ghosh, A. (2014). Financial inclusion strategies of banks: study of Indian States. International Journal of Applied Financial Management Perspectives © Pezzottaite Journals, 3(2), pp.990-996.

Iqbal, B.A., & Sami, S. (2017). Role of banks in financial inclusion in India. Contaduría y Administración, 62(2), 644–656.

Indexed at, Google Scholar, Cross Ref

Jose, J., & Mani, A. (2017). Original Research Paper Commerce “ A study on the importance of banking penetration in financial inclusion “ with special reference to kerala state .” I(12), 2015–2018.

Kolloju, N. (2014). Business Correspondent Model vis-à-vis Financial Inclusion in India : New practice of Banking to the Poor. International Journal of Scientific and Research Publications, 4(1), 1–7.

Kumar, A. (2019). Impact of Commercial Banks on Financial Inclusion and Indian Economy. International Journal of Management and Humanities, 3(10), 23–26.

Lourdunathan, M.F. (2021). An Empirical Analysis On Impact Of Financial Inclusion With Special Reference To Commercial Banks In Bengaluru. Turkish Journal of Computer and Mathematics Education (TURCOMAT), 12(11), 3793-3798.

Maity, S., & Sahu, T.N. (2020). Role of public sector banks towards financial inclusion during pre and post introduction of PMJDY: a study on efficiency review. Rajagiri Management Journal, 14(2), 95–105.

Indexed at, Google Scholar, Cross Ref

Mala, M., & Vasanthi, G. (2016). Role of Banking Sector in Financial Inclusion. International Journal of Computational Research and Development (IJCRD) Impact, I(1), 172–176.

Meghana, P.S. (2020). Role of Commercial Banks in Achieving Financial Inclusion – A Comparative Study of Canara Bank and Corporation Bank. 25, 1–11.

Mustafi, S.D., & Chakraborty, J. (2014). Role of Private Sector Banks in Financial Inclusion: A Case Study on West-Bengal. International Journal of Research in Engineering and Science, 2(3), 38-45.

Indexed at, Google Scholar, Cross Ref

Nair, M.S., & Sreejith, A. (2021). Financial Inclusion of Scheduled Commercial Banks in India. 26(4), 58–63.

Raihanath, M., & Pavithran, K. (2014). Role Of Commercial Banks In The Financial Inclusion Programme. Journal of Business Management & Social Sciences Research, 3(5), 75–81.

Rajendra Suryawanshi, S., Dutta Nayak, Y., Prasad Sahu, D., & Professor, A. P. (2021). Role of Indian Banks for Financial Inclusion. International Journal of Recent Research Aspects, 8(1), 1–5.

Rajput, B. (2015). Role of Commercial Banking Sector in Financial Inclusion Process in India.

Ray, P. (2021). Financial Inclusion: The Role of Scheduled Commercial Banks in assisting and influencing the Self Help Groups of India.

Reddy, K., Ch, V., & Noorbasha, A. (2013). Global J. of Arts & Mgmt., 2013: 3 (3). 3(3), 107–112.

Singh, P. (2019). Financial Inclusion and Economic Development in India : Role of Banks and the Government Prerna Singh Introduction : Review of Literature, 4, 1847–1856.

Singh, S.K. (2018). Impact Of Indian Commercial Banks In Financial Inclusion. The International Research Journal of Social and Management..

Srikanth, R. (2013). A Study on - Financial Inclusion - Role of Indian Banks in Reaching Out to the Unbanked and Backward Areas. International Journal Of Business Management, 2(9), 1–20.

Trivedi, M.A.S., & Nagar, V.V. (2016). Role Of Banks For Financial Inclusion In Gujarat. 1–18.

Uzma, S.H., & Pratihari, S.K. (2019). Financial Modelling for Business Sustainability: A Study of Business Correspondent Model of Financial Inclusion in India. Vikalpa, 44(4), 211–231.

Indexed at, Google Scholar, Cross Ref

Received: 05-Feb-2022, Manuscript No. AMSJ-22-11287; Editor assigned: 07-Feb-2022, PreQC No. AMSJ-22-11287(PQ); Reviewed: 21-Feb-2022, QC No. AMSJ-22-11287; Revised: 23-Feb-2022, Manuscript No. AMSJ-22-11287(R); Published: 25-Feb-2022