Research Article: 2023 Vol: 27 Issue: 2

Meta Analysis on Factors Influencing Mobile Payment Continuance Intention among Consumers

Praful Vijay More, NMIMS (Deemed-to-be-University)

Ashu Sharma, NMIMS (Deemed-to-be-University)

Christine D'Lima, NMIMS (Deemed-to-be-University)

Citation Information: Vijay More, P., Sharma, A., D'Lima, C. (2023). Meta-analysis on factors influencing mobile payment continuance intention among consumers. Academy of Marketing Studies Journal, 27(2), 1-9.

Abstract

Despite its growth potential, there is a lack of consensus on factors influencing the continuance intention for using mobile payment systems. A detailed review of the existing literature showed majority of the studies using existing theoretical models of adoption or usage without offering any newer insights on factors influencing mobile payment continuance intention. This study aims to provide a comprehensive synthesis and analysis of the related literature using meta-analysis for building consensus upon which factors influence mobile payment continuance intention among consumers. Drawing from our meta-analysis, we identified and classified factors from 61 relevant papers, the results showed that there is a high degree of consensus on factors such as perceived usefulness, perceived ease of use, trust, social influence, and perceived risk influencing continuance intention for mobile payments. This is one of the scant reviews providing systematic methodology by structuring the existing knowledge with implications for future research and practice.

Keywords

Consumers, Mobile Payments, Continuance Intention, Meta-Analysis.

Introduction

With the rise of digital penetration through the low-cost availability of the internet, mobile phones have emerged as a new form of making payments digitally using wireless technologies like 4G LTE, Near Field Communication (NFC), etc. This facilitated the development of mobile payment apps or payment platforms installed in smartphones or mobile devices for initiating, authorizing, and confirming payment for completing any commercial transaction, such as making payments to merchant or transferring funds to a payee. These developments led to the creation of many mobile payment apps like Gpay, along with mobile wallets like Paytm, and payment functions in messaging apps like Whatsapp.

The term mobile banking refers to the use of banking apps installed on smartphones or mobile devices to manage traditional banking services like transferring funds, paying utility bills, etc. Although mobile payment and mobile banking both involve making payments digitally using the internet, the difference lies in their source of provision for the same. In the case of mobile payments, the services are offered by non-financial third-party entities or fintech start-ups, whereas in mobile banking, digital payment services are typically provided by banks or financial institutes. Since mobile payment service providers are mainly responsible for innovative payment solutions for their customers, we will only consider mobile payments for this study.

There are numerous empirical studies on factors influencing mobile payment continuance intention and use among consumers; however, there exists a lot of inconsistency or inconclusiveness among them. Most of these studies highlight the significant relationship between perceived usefulness and mobile payment continuance intention and use among consumers. Still, at the same time, there are also studies indicating that perceived ease of use may not be significantly related to the mobile payment continuance intention and use among consumers leading to scope for further inquiry Di Pietro (2015).

The study identified 284 pairs having significant relationships, but out of which almost 252 pairs were disqualified or eliminated, left with only 32 pairs of valid relationships for consensus building. Since meta-analysis is an effective tool for analyzing individual-level studies and integrating them, it uses meta-analysis to identify the variance in the existing literature on mobile payment continuance intention among consumers.

In the following sections, we review the existing literature and identify multiple factors explained through significant findings. We explain the research methodology and describe data collection along with the results from the meta-analysis. Lastly, the factors significantly influencing mobile payment continuance intention among consumers are identified, and future research directions are provided for subsequent studies.

Literature Review

In the past, many factors influencing mobile payment continuance intention have been studied; some studies have shown that perceived usefulness significantly affects consumers' intention to use mobile payments Kim et al. (2010); Upadhyay & Jahanyan (2016) and continuance intention to use mobile payments determines the actual use. There is a positive relationship between perceived usefulness and continuance intention. However, other studies indicate that the perceived ease of use does not significantly affect consumers' mobile payment continuance intention, and further verification may be needed Ooi & Tan (2016); Cheng & Huang (2013). However, it is also shown that perceived usefulness is affected by perceived ease of use, compatibility, consumers' needs, and attitudes (Di Petro et al., 2015).

Factors that have a significantly positive impact on perceived ease of use and perceived usefulness could also have a significant negative impact on perceived risk Yang et al. (2012); Ozturk (2016). Perceived risk does not directly affect the mobile payment continuance intention, but it indirectly reduces the effect of perceived usefulness on consumers’ actual use Cheng & Huang (2013). It is shown that consumers’ attitudes and intention to use are affected by perceived risk and trust Khalilzadeh et al. (2017); Shin (2009). A study conducted in China indicates that trust reduces perceived risk Yang et al. (2015). However, perceived security and perceived ease of use significantly positively impact initial trust, which determines perceived usefulness and continuance intention to use (Zhou, 2011). This confirms that initial trust directly or indirectly affects consumers’ continuance intention to use Lu et al. (2011).

The factors that affect consumers' intention to use mobile payments include social influence and personal innovativeness Yang et al. (2012); Tan et al. (2014). Social influence, personal innovativeness, compatibility, and relative advantage have a significantly positive influence on consumers’ continuance intention to use mobile payments Yang et al. (2012); Cheng & Huang (2013). However, when analyzing how consumers use smartphones to transfer money, the impact of personal innovativeness over mobile payment continuance intention is insignificant, as revealed in Upadhyay & Jahanyan (2016).

As discussed above, multiple factors influence consumer mobile payment continuance intention, including perceived usefulness, performance expectation, perceived ease of use, effort expectancy, compatibility, personal innovativeness, and social influence. However, the findings from such studies are often inconsistent as to whether the effects are significant/insignificant, direct/indirect, or positive/negative. This study aims to provide a comprehensive synthesis and analysis of the related literature using meta-analysis to build consensus upon which factors influence consumer mobile payment continuance intention.

Research Methodology

We use meta-analysis derived from Fisher z-transformation for statistical analysis of individual-level studies with the purpose of evaluating the overall results synthetically using the integration of studies. The reasons for choosing meta-analysis are three-fold, firstly, there are numerous quantitative studies on mobile payment continuance intention among consumers; secondly, multiple research models show multiple different conclusions in the present empirical research; and lastly, the studies show inconsistency in results even with the use of similar measurement dimensions.

Data Collection

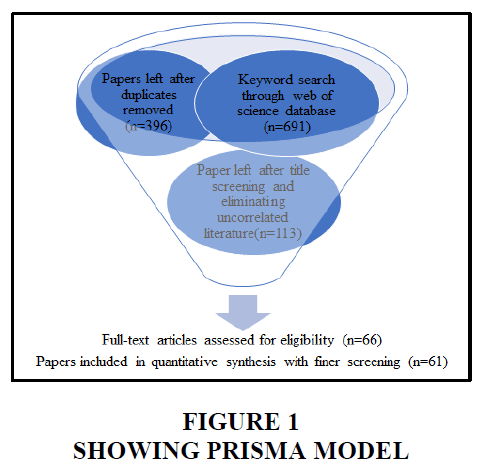

The research methodology for the study starts with literature screening from web of science database using keywords like mobile payment, m-payment, mobile wallet, electronic payment, e-payment, adoption, intention, continuance intention, and consumers. The screening process was done using the Preferred Reporting Items for Systematic Reviews and Meta-Analyses (PRISMA) analysis from 2008 to 2018. The results from the screening process are shown in the figure below, Figure 1.

After screening and filtering, the data is extracted and collected to calculate the effect size by converting the correlation coefficient into Fisher's Z value. Further, we calculate the weighted-average value of β associated with each group of relationship. The effect size reflects the intensity value of the relationship between two variables and is commonly used in meta-analysis.

Calculating the Effect Size

The 61 papers eventually selected consists of representation from 22 countries with publications in 33 journals having more than 15 research models with sample sizes ranging from 80 to 2500. The total number of studies, sample size, weighted-average value of β, and meta- analysis results (P value, I2 value and Z-value) of the 22 relationships are summarized in the table given below Table 1 and Table 2. Metadata about each paper, such as the author name, year of publication, topic, journal name, the model used, sample size, place where sample is from, the relationship among the variables, the path coefficient, standardized beta coefficient, and T value of each relationship, are extracted from EndNote and entered to an Excel file. If the β value is missing in a study, then the weighted-average value of β of the path coefficient of the relationship is calculated by the formula given below. In our study, standardized beta coefficient (β)is used to directly substitute for correlation coefficients (r), based on suggestions made in previous studies. While some authors thought using Fisher's Z transformation may reduce the bias, Hunter and Schmidt (2004) found that using Fisher's Z can enlarge the bias. We use standardized beta coefficient in Fisher's Z transformation to calculate the effect size. where Z represents the unit of the Fisher z-transformation (different from z-value in the statistical test); r represents standardized beta coefficient for the sample.

| Table 1 Showing Relationship Between Factors | |||||||

| Relationship | No. of studies | No. of significant studies | Total size | Average | I2(%) | Estimated P | Fisher's Z-value |

| PU-CI | 21 | 20 | 10606 | 0.283 | 99.1 | 0 | 7.55 |

| PR-CI | 20 | 15 | 11237 | − 0.115 | 98.2 | 0 | 7.45 |

| SI-CI | 20 | 17 | 11341 | 0.307 | 98.3 | 0 | 7.32 |

| PEOU-PU | 19 | 19 | 11586 | 0.324 | 99.4 | 0 | 8.31 |

| TR-CI | 19 | 16 | 8007 | 0.432 | 99.9 | 0 | 3.85 |

| PEOU-CI | 15 | 12 | 4096 | 0.209 | 92.7 | 0 | 9.43 |

| AT-CI | 13 | 13 | 11502 | 0.295 | 100 | 0.004 | 2.85 |

| PS-CI | 13 | 11 | 7048 | 0.39 | 99.7 | 0.003 | 2.94 |

| PE-CI | 11 | 9 | 3314 | 0.299 | 97.3 | 0 | 6.92 |

| PI-CI | 10 | 10 | 3264 | 0.219 | 96.7 | 0 | 5.79 |

| PI-PEOU | 8 | 7 | 1853 | 0.291 | 98.3 | 0 | 4.15 |

| COM-PU | 7 | 6 | 3396 | 0.379 | 99.5 | 0 | 3.56 |

| PI-PU | 6 | 3 | 1388 | 0.083 | 96.4 | 0.001 | 3.32 |

| COM-AT | 5 | 4 | 2476 | 0.4226 | 99.7 | 0.094 | 1.68 |

| PR-TR | 5 | 4 | 5656 | − 0.236 | 98.2 | 0 | 5.27 |

| SN-PU | 4 | 4 | 3700 | 0.540 | 99.9 | 0.050 | 1.96 |

| SN-PEOU | 3 | 3 | 3306 | 0.22 | 98.6 | 0 | 4.16 |

| TR-PEOU | 3 | 3 | 4286 | 0.387 | 99.1 | 0 | 3.7 |

| PR-AT | 3 | 3 | 4740 | − 0.130 | 98 | 0 | 4.06 |

| TR-AT | 3 | 2 | 4024 | 0.1573 | 91.4 | 0 | 6.62 |

| RA-CI | 3 | 3 | 1923 | 0.246 | 90 | 0 | 7.95 |

| US-CI | 3 | 3 | 718 | 0.357 | 96 | 0 | 4.33 |

| Table 2 Acronym Full Form | |||

| Acronym | Full form | Acronym | Full form |

| PU | perceived usefulness | SN | Subjective norm |

| PEOU | perceived ease of use | TR | trust |

| PE | performance expectant | COM | compatibility |

| EE | effort expectancy | US | use satisfaction |

| FC | facilitating condition | AT | Attitude |

| SI | social/external influence | CI | Continuance Intention |

Meta-analysis is conducted in this paper with a single group rather than the classical binary classification due to the lack of a control group. The same method is used by Hunter and Schmidt (2004) to convert the beta coefficient into effect size through Fisher Z-transformation. The selection of the relationship among variables in this study is based on three criteria: the beta coefficient is revealed by at least three papers, more than three datasets must report the same direction (either positive or negative) beta coefficient, and finally, the value of effect sizes needs to be at least three to be valid. Only the relationship with the above three conditions simultaneously satisfied can be selected for meta-analysis.

Metadata values such as sample size and effect sizes are entered into the Stata input editor. The equation sqrt (Z*(1 − Z)/n) is used to calculate the SE value before the meta-analysis results are generated.

The Effect Model Selection

The effect models of meta-analysis include fixed effect models and random effects models. Before using STATA software for meta-analysis, the type of effect model must be determined according to the heterogeneity between studies. The degree of heterogeneity is determined by qualitative Q Test and quantitative I2 test. The values of P and I2 measure the degree of heterogeneity. In the Q test, the P value is less than 0.1 will be considered as heterogeneity; in the I2 test, the I2 value is greater than 40% will be considered as heterogeneity. For meta-analysis, when the values of P > 0.1 and I2 ≤ 40% are satisfied simultaneously, the homogeneity among the studies is better, and the fixed effect model is adopted; otherwise, the random effect model should be adopted when there is considerable heterogeneity among the studies. Taking the relationship between perceived usefulness and intention to use as an example, the results of the meta-analysis show P < 0.001 and I2 = 99.1%. Therefore, the random effect model is chosen for the study. All P values for heterogeneity testing in this study are 0.000, except that the correlation between perceived intention to use and usage is 0.011. All I2 values are greater than 73%.

Data Analysis and Results

The 61 papers eventually selected consist of representation from 22 countries with publications in 33 journals having more than 15 research models with sample sizes ranging from 80 to 2500. The total number of studies, sample size, weighted-average value of β, and meta-analysis results (P value, I2 value, and Z-value) of the 22 relationships are summarized in the table given below, Tables 1 and 2.

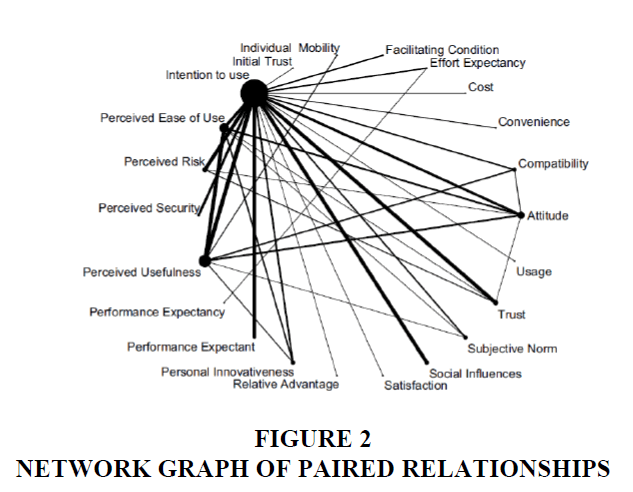

A network graph is also created using Stata to illustrate these relationships (see Figure 2). The link thickness in the graph represents the total number of studies involved, while node size represents the number of studies combined from all relationships the node is involved. It is easy to see that the links among perceived usefulness, perceived risk, social influence, trust, perceived ease of use, and continuance intention to use are relatively thick, indicating that the relationship between these factors and consumers’ intention to use are strong and evidenced in many studies Figure 2.

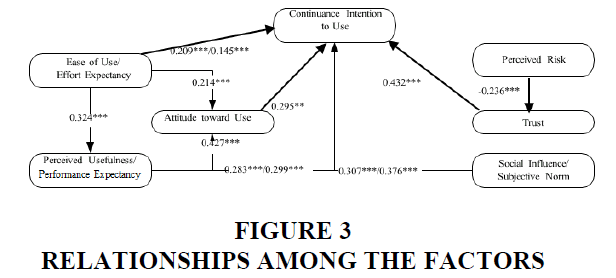

There is more heterogeneity among the influencing factors and continuance intention to use for I2 value of above 90% based on quantitative tests with random model. Among all the factors influencing perceived usefulness, perceived ease of use is the major factor that has more consensus that other factors. This is also indicative from 19 papers that found significantly positive correlations between perceived usefulness and perceived ease of use. Meanwhile, subjective norm is weakly correlated with perceived usefulness, with a wider confidence interval (SN-PU, 95% CI = − 0.01 to 0.854), indicating a lower credibility. Perceived risk (PR) is the only factor negatively associated with Continuance Intention (CI) to use mobile payments. The remaining factors are all positively correlated.

Additionally, more than 20 papers have analysed mobile payment continuance intention through perceived usefulness, perceived risk and social influence indicating that these factors are the main variables for determining mobile payment continuance intention among consumers. The factors influencing the consumer’s attitude towards mobile payments include perceived usefulness, perceived ease of use, perceived risk, and trust. Perceived usefulness, perceived ease of use and trust are significantly positively correlated to attitude, which means consumers’ attitudes towards mobile payments are largely affected by these three factors, whereas perceived risk is significantly and negatively correlated to consumers’ mobile payment attitude

The main factors influencing perceived ease of use are personal innovativeness, subjective norm and trust. However, the personal innovativeness factor is more often used to analyze perceived ease of use, while other influencing factors are not often used by researchers. The table shows that the main factor that influence performance expectation is effort expectation (P=0.000 <0.05), but the factor influencing consumers’ trust is significantly and negatively correlated with perceived risk.

A relationship diagram is created to help illustrate the relationships among these factors, as discussed below Figure 3. In this diagram, the number on each link is the value of β, which measures the relationship between two factors.

Conclusion anf Future Research Directions

Overall, it is found in this meta-analysis study that there has been a high level of consensus among researchers in the past decade about the key factors affecting consumers' mobile payment continuance intention. These key factors, including perceived usefulness, perceived risk, social influence, trust, and perceived ease of use, have significant impact on consumers’ intention to continue using mobile payment. In other words, these factors positively affect consumers’ spending patterns and consumption habits. While our meta-analysis supports most findings revealed in previous studies, there are also occasions where previous findings cannot be supported. For example, our meta-analysis result does not suggest a consensus that compatibility has a significantly positive influence on consumers’ attitude toward mobile payment; our meta-analysis result also does not suggest a consensus that the perceived usefulness of mobile payment was significantly affected by the subjective norm factor.

The practical implications of the above conclusions are that to encourage consumers' adoption of mobile payment, especially in Western countries like the USA, the factors such as perceived usefulness, perceived risk, social influence, trust, and perceived ease of use must be carefully designed and incorporated into mobile payment products and marketing campaigns. Spending habit is challenging to change. However, spending patterns can be adapted through careful designs and awareness training.

This study has some limitations that future studies should address. The literature selected in this study did not include dissertations or conference papers, only papers published in referred academic journals were included. Based on the sample we collected in this study, some factors or relationships were eliminated during the statistical process. Future studies may find some of these factors or relationships worthy of studying when more new samples become available. In addition, there was no control group used. The current study is a meta-analysis with a single group. Different opinions exist about the proper meta-analytic technique for single-group meta-analysis research.

Besides the limitations discussed above, given that consumers’ intentions and behaviors can also be affected by culture or regulations, future research may consider including culture and regulatory environment as separate factors to study. Hofstede’s dimensions of national culture, including individualism/collectivism, masculinity/femininity, uncertainty avoidance, power distance, and a long-term orientation, can be a good starting point to identify the relevant cultural factors to study.

References

Agarwal, R., & Prasad, J. A. (1998). Conceptual and operational definition of personal innovative- ness in the domain of information technology. Information Systems Research, 9(2), 204–215.

Ajzen, I. (1985). From intentions to actions: A theory of planned behavior. Action control (pp. 11–39). Berlin: Springer.

Indexed at, Google Scholar, Cross Ref

Baptista, G., & Oliveira, T. (2016). A weight and a meta-analysis on mobile banking acceptance research. Computers in Human Behavior, 63, 480–489.

Indexed at, Google Scholar, Cross Ref

Barkhordari, M., Nourollah, Z., Mashayekhi, H., Mashayekhi, Y., & Ahangar, M. S. (2017). Factors influencing adoption of e-payment systems: an empirical study on Iranian customers. Information Systems and e-Business Management, 15(1), 89–116.Bauer, R. A. (1960). Consumer behavior at risk taking. Chicago, IL, 384–398.

Berry, L. L., Seiders, K., & Grewal, D. (2002). Understanding service convenience. Journal of Marketing, 66(3), 1–17.

Bhuasiri, W., Zo, H., Lee, H., & Ciganek, A. P. (2016). User acceptance of e-government services: Examining an e-tax filing and payment system in Thailand. Information Technology for Development, 22(4), 672–695.

Indexed at, Google Scholar, Cross Ref

Bowman, N. A. (2012). Effect sizes and statistical methods for meta-analysis in higher education. Research in Higher Education, 53(3), 375–382.

Cheng, Y.H., & Huang, T.Y. (2013). High speed rail passengers’ mobile ticketing adoption. Transportation Research Part C: Emerging Technologies, 30, 143-160.

Chen, X., & Li, S. (2017). Understanding continuance intention of mobile payment services: An empirical study. Journal of Computer Information Systems, 57(4), 1–12.

Choi, Y., & Sun, L. (2016). Reuse intention of third-party online payments: A focus on the sustain- able factors of Alipay. Sustainability, 8(2), 147.

Cocosila, M., & Trabelsi, H. (2016). An Integrated value-risk investigation of contactless mobile payments adoption. Electronic Commerce Research and Applications, 20, 159–170.

Indexed at, Google Scholar, Cross Ref

Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly, 13(3), 319–340.

Davis, F. D., Bagozzi, R. P., & Warshaw, P. R. (1989). User acceptance of computer technology: A comparison of two theoretical models. Management Science, 35(8), 982–1003.

DeLone, W. H., & McLean, E. R. (1992). Information systems success: The quest for the depend ent variable. Information Systems Research, 3(1), 60–95.

Duane, A., O’Reilly, P., & Andreev, P. (2014). Realizing M-payments: modelling consumers’ will ingness to M-pay using smart phones. Behavior and Information Technology, 33(4), 318–334.

Di Pietro, L., Mugion, R.G., Mattia, G., Renzi, M.F., & Toni, M. (2015). The integrated model on mobile payment acceptance (IMMPA): an empirical application to public transport. Transportation Research Part C: Emerging Technologies, 56, 463-479.

Fishbein, M., & Ajzen, I. (1975). Belief, attitude, intention and behavior: An introduction to theory and research. Philosophy & Rhetoric, 41(4), 842–844.

Indexed at, Google Scholar, Cross Ref

Francisco, L. C., Francisco, M. L., & Juan, S. F. (2015). Payment systems in new electronic environments: Consumer behavior in payment systems via SMS. International Journal of Information Technology & Decision Making, 14(02), 421–449.

Indexed at, Google Scholar, Cross Ref

Gao, L., & Waechter, K. A. (2017). Examining the role of initial trust in user adoption of mobile payment services: an empirical investigation. Information Systems Frontiers, 19(3), 525–548.

Glass, G. V. (1976). Primary, secondary, and meta-analysis of research. Educational Researcher, 5(10), 3–8.

Hoehle, H., Zhang, X., & Venkatesh, V. (2015). An espoused cultural perspective to understand continued intention to use mobile applications: a four-country study of mobile social media applica tion usability. European Journal of Information Systems, 24(3), 337–359.

Hunter, J. E., & Schmidt, F. L. (2004). Methods of meta-analysis: Correcting error and bias in research findings(2nd ed.). Thousand Oaks: Sage Publication.

Kapoor, K. K., Dwivedi, Y. K., & Williams, M. D. (2015). Examining the role of three sets of innovation attributes for determining adoption of the interbank mobile payment service. Information Systems Frontiers, 17(5), 1039–1056.

Indexed at, Google Scholar, Cross Ref

Keramati, A., Taeb, R., Larijani, A. M., & Mojir, N. (2012). A combinative model of behavioural and technical factors affecting ‘mobile’-payment services adoption: an empirical study. The Service Industries Journal, 32(9), 1489–1504.

Khalilzadeh, J., Ozturk, A.B., & Bilgihan, A. (2017). Security-related factors in extended UTAUT model for NFC based mobile payment in the restaurant industry. Computers in Human Behavior, 70, 460-474.

Indexed at, Google Scholar, Cross Ref

Kim, C., Mirusmonov, M., & Lee, I. (2010). An empirical examination of factors influencing the intention to use mobile payment. Computers in human behavior, 26(3), 310-322.

Indexed at, Google Scholar, Cross Ref

Lu, Y., Yang, S., Chau, P.Y., & Cao, Y. (2011). Dynamics between the trust transfer process and intention to use mobile payment services: A cross-environment perspective. Information & management, 48(8), 393-403.

Ooi, K.B., & Tan, G.W.H. (2016). Mobile technology acceptance model: An investigation using mobile users to explore smartphone credit card. Expert Systems with Applications, 59, 33-46.

Indexed at, Google Scholar, Cross Ref

Ozturk, A.B. (2016). Customer acceptance of cashless payment systems in the hospitality industry. International Journal of Contemporary Hospitality Management.

Shin, D.H. (2009). Towards an understanding of the consumer acceptance of mobile wallet. Computers in Human Behavior, 25(6), 1343-1354.

Tan, G.W.H., Ooi, K.B., Chong, S.C., & Hew, T.S. (2014). NFC mobile credit card: the next frontier of mobile payment?. Telematics and Informatics, 31(2), 292-307.

Indexed at, Google Scholar, Cross Ref

Upadhyay, P., & Jahanyan, S. (2016). Analyzing user perspective on the factors affecting use intention of mobile based transfer payment. Internet Research.

Yang, Q., Pang, C., Liu, L., Yen, D.C., & Tarn, J.M. (2015). Exploring consumer perceived risk and trust for online payments: An empirical study in China’s younger generation. Computers in Human Behavior, 50, 9-24.

Indexed at, Google Scholar, Cross Ref

Yang, S., Lu, Y., Gupta, S., Cao, Y., & Zhang, R. (2012). Mobile payment services adoption across time: An empirical study of the effects of behavioral beliefs, social influences, and personal traits. Computers in Human Behavior, 28(1), 129-142.

Indexed at, Google Scholar, Cross Ref

Zhou, T. (2011). The effect of initial trust on user adoption of mobile payment. Information development, 27(4), 290-300.

Indexed at, Google Scholar, Cross Ref

Received: 29-Oct-2022, Manuscript No. AMSJ-22-12773; Editor assigned: 01-Dec-2022, PreQC No. AMSJ-22-12773(PQ); Reviewed: 20-Dec-2022, QC No. AMSJ-22-12773; Revised: 03-Jan-2023, Manuscript No. AMSJ-22-12773(R); Published: 10-Jan-2023