Research Article: 2023 Vol: 27 Issue: 4S

Metaverse in Banking: An Initiative for Banking Transformation from Emerging Country Prospective

Debajani Sahoo, IBS Hyderabad, IFHE University

Smita Ray, IBS Hyderabad, IFHE University

Citation Information: Sahoo, D., & Ray, S. (2023). Metaverse in banking: an initiative for banking transformation from emerging country prospective. Academy of Marketing Studies Journal, 27(S4),1-15.

Abstract

Purpose: Customers can visit a bank virtually through metaverse. This will not only enable remote access to services but also add a human touch.The objective of the present study is to explore the impact of metaversa in different aspect of financial transaction in indian economy. Second to understand how it helps in creating customer technology trust that ultimately develop engagement among customers in banking industry. Design/ methodology: The study used both qualitative and quantitative methods.First focus group interview with bankers and customers explored to understand their perception on metaverse.Survey method used using the judgemental sampling method to collect data from customers those frequently used digital platform for their financial transaction .Structural equation modeling used for data analysis. Findings: The finding of the present study would help the banking industry for further redesigning the banking service that would lead to more delighted experience to customers. The banking industry is having more perceived risk and less trust.So the finding of this study showcased how the metaverse reduced the risk of customers and help in establishing their trust and engagement. Research limitations: Although the implication of metaverse was expected to transform the digital banking system of the country but at the same time it would face some challenges including less awareness among people,increasing frauds in banking industry, and motivation of bank employees towards metaverse. The present study confined only in banking industry with limited sample size, it may extend to other industry with a bigger sample size in future.

Keywords

Metaverse, customerTechnology trust, customer Engagement, Financial and banking Industry.

Introduction

Banks are increasingly attempting to improve and expand their digital footprint. Both national and international banks make massive investments in digitalizing their services so that customer visits to the bank's physical premises can be mitigated to the maximum extent possible. Accordingly, a lot of digital infrastructure investments were made in developing consumer-centric mobile apps that offer services on the go, moving applications to cloud servers, building payment platforms, enabling cryptocurrency stocking and trading, improving cyber security and realigning the back-end architecture to central data warehouse (Ravi,2018;Dubey et al.,2022; Özkaynar,2022). Latest investments in digital architecture centre around artificial intelligence, such as building digital chatbots to address customer queries and using machine learning algorithms to perspicaciously identify customers for upselling, cross-selling and devising strategies to customize services for high-net-worth customers for enabling their long-run retention (Barrera & Shah, 2023).

While these digital initiatives surely improved customer transactional experience, a conspicuous side effect of losing the human touch with customer permeate the entire process. Due to the digitalization of services, many banks downsized their physical locations due to the online rendering of many services that reduced physical customer visits to the bank. Reduction in physical contact with bank employees and bank premises increased emotional detachment from the bank as a brand(Özkaynar,2022). One of the ways where customers are physically away from the bank but still have candid–emotional interactions involves using virtual reality (VR) / augmented reality (AR) technology in rendering services. In VR/AR context, the user interacts with simulated objects in a 3d simulated environment but experiences physical simulations like that of real interactions using special electronic equipment such as gloves and headgear. The highly sophisticated version of VR /AR technology is now available, termed as the metaverse. Metaverse is an augmented reality platform that allows banks to use cutting-edge technology with a human touch that will significantly deepen and personalize customer interaction.

Most of the past studies in this context were done conceptually, such as the role of a metaverse in modern education (Wu and Gao, 2022); banking and financial service (Dubey et al.,2022; Özkaynar, 2022); hospitality and tourism(Buhalis et al.,2022; Gursoy et al.,2022; Filimonau et al.,2022) But how this metaverse will impact customer experience and engagement was not explored much empirically De Franceschi (2022).

The metaverse is defined as a collection of interconnected online locations where people can engage in a variety of social activities like gaming, buying, and going to events, along with the possibility of contributing to creating new social virtual spaces that simulate and enhance the physical world. All of this can happen without leaving the comfort of home. It is opined by many banking and finance experts that the metaverse can bring back emotional attachment and restore the human experience lost in digital channels. Massive investments are being made in the metaverse by leading financial institutions such as JPMorgan and HSBC, which is a testimony to the growth potential of this medium.

The objective of the present study is to explore the impact of metaverse in different aspects of financial transactions in the Indian economy. Second to understand how it helps in creating customer technology trust, engagement among customers in the financial banking industry. The findings of the present study will change the perception of Metaverse. It might be thought of as the Internet's next evolution, offering more varied and connected immersive experiences. A design environment that encourages the repurposing and transition of experiences based on the platform ecosystems of the present and the future. Additionally, transitions within immersive virtual experiences as well as between physical and virtual encounters, will be enhanced. We can generate goods and services more efficiently overall by using simulations to build things in the virtual world that are later converted back into physical artefacts and procedures. The drive toward integration and interconnection of the future won't resemble that of the present.

Theoretical Background and Hypothesis Formulation

Metaverse

The term “Metaverse,” which derives from Neal Stephenson’s 1992 book “Snow Crash,” refers to a three-dimensional virtual environment where “Meta” stands for virtual and abstract and “verse” for the universe. The metaverse is a fictional world where to participate in or replicate real-world interactions. Users communicate with themselves using avatars they have developed. Metaverse is a mixed reality made up of a combination of technologies and trends like AR, head mounted displays (HMDs), the Internet of Things (IoT), an AR cloud, artificial intelligence (AI) and spatial technologies; a persistent, immersive digital environment. An environment of independent yet interconnected networks that will run on some protocols for communications. This environment enables persistent, decentralized, collaborative, interoperable digital content that intersects with the physical world’s real-time, spatially oriented and indexed content. Together, these will give rise to new technologies and trends, forming a complete metaverse solution.

Like banking industry, other industries like Hospitality and tourism management are also going to be affected by involvement of metaverse. The impact of metaverse in hospitality sector can be seen in three phases, i.e. Before visit, during visit and after visit. During these phases, metaverse is going to give enoromous opportunities to hospitality investors, customers, designers, builders, and managers for developing their presence and competitiveness. Before visit metaverse will enable the users to experience hospitality services virtually when real travel is not possible. Users can enjoy ambience and atmosphere through realistic gamification They can gather Information and fact-finding before visiting the hospital. Metaverse also allowed the users to make Assessment of suitability and fitness of services to needs and requirements. Similarly, during visit, metaverse will help the owners to do Planning of daily itineraries, explore local resources for visiting, Use AR for interpretation and understanding and engage with additional knowledge sources to appreciate history or nature. Likewise after the visit, metaverse will allow the users to re-experience places and recharge their memories, re-engage with people, places, resources, cultures, reconnect with service providers and also fellow customers, demonstrate destinations and organization and show them to others and Plan further trips and exploration.

Customer Value in Metaverse

The success of developing and scaling the metaverse as a new business ecosystem is largely dependent on the understanding of customers as well as businesses. Both of them are required to suspend their disbelief that synthetic elements are inherently false (Golf-Papez, Maja et al. 2022).

In case of AR, customers are allowed to use holograms and make holographic trial (product preview or virtual try-on), even if the product is not physically present. From this experience, customers can imagine how a product or service would look in a specific room (e.g., furniture, wall-paint, interior design) or when worn by them (e.g., cosmetics, eyewear, new haircuts). The use of metaverse in banking industry is going to facilitate customers for getting easy access to their statements online, anytime and anywhere they want. This can be really helpful for customers who travel frequently or have busy schedules for which they cann’t physical bank branches regularly (Golf-Papez, Maja et al. 2022).

Social Value in Metaverse

Metaverse is an idea of a hypothetical aways-on 3D network of virtual spaces where people can socialize, interact, connect, learn, work, shop, play, and many more about the convergence of data-driven technologies and immersive technologies. The virtual worlds of the Metaverse are expected to be different from anything that human users have experienced before, incarnating ways of living in believably virtual cities (Allam et al. 2022). Being social being, People are are meeting and communicating through social media. The entry of Metaverse is going to help them by integrating their offline and social networking service (SNS) experiences into one. According to Dwivedi et al. (2022), the applications of the metaverse are categorized into two parts, i.e. “metaverse as a tool” and “metaverse as a target”. ‘Metaverse as a tool’ refers to the metaverse, which is used to solve difficulties and problems in the real world. However, ‘Metaverse as a target’ means to how the metaverse itself can perform actions such as developing the metaverse and generating profits. This applications of metaverse are stand-alone and highly dependent on the virtual environment compared to ‘metaverse as a tool’ Simon (2022).

New forms of digital business assets can develop and speed up programmable economic models through social value. NFTs and blockchains will drive online growth even faster in the next five years. In a scenario where the exchange of value between social factors become common place. the rise of alternate currency and related banking and financial institutions become imminent Singh (2022).

Enterprise Value of Metaverse

Enterprises experimenting with the metaverse can connect, engage with, and incentivize human and machine customers to create new value exchanges, revenue streams, and markets. By implementating metaverse in business, the Enterprises can get benefits such as collecting valuable data about their customer’s preferences and behavior patterns, deepen its connections with customers. By fostering meaningful interactions and creating a sense of community around shared interests and values about their target audience, which will help them to design their messaging and marketing tactics in order to meet the needs and preferences of their customers (Dwivedi et al. 2022). By 2026, 30% of the organizations in the world would have products and services ready for metaverse, up from negligible now – Gartner.

Coming to the banking industry, the metaverse is going to give benefits in terms of conducting transactions and managing their accounts through a virtualized environment. The use of this technology will help the banks to reduce paper waste by allowing users to download or print out digital copies of their banking statements instead of taking physical copies (Dubey, et al.,2022)According to Banaeian Far & Imani Rad, 2020, metaverse will enable the banks to improvise their security measures in order to protect sensitive customer data, such as login credentials and personal details (Allam et al., 2022). Similarly Kiong, 2022 said, banks will be enabled to better predict the spending habits of their customers, which in turn can help them provide more targeted marketing offers and promotions. As a whole, banks can reduce their land waste, food waste, electricity waste, and water waste by using metaverse rather than physical bank branches. Metaverse is going to use smart contracts which will ensure that all terms and conditions of the loan are transparent and fair while helping to reduce fraud and minimize the risk of loan default. So that the entire mortgage process will be faster, easier, more efficient, and more secure than ever before. The use of Metaverse’s secure digital identity system will enable the debit and credit card users to establish their digital identity on the Metaverse blockchain network and then use this ID to make transactions involving cryptocurrency or other assets in a decentralized manner. So that the risk of losing the card and hassle of carrying them can be avoided. According to Franceschi, (2022),the use of metaverse is going to facilitate transparency and accountability as well as remove barriers of multiple currencies and complex banking networks in case of cross-border transactions (Dubey et al. 2022). Examples of early-stage solutions include gaming, virtual collaboration, navigation apps, social media, fungible and non-fungible tokens (NFTs). The metaverse in its maturity have a virtual economy of itself, enabled by digital currencies, NFTs or some other equivalent.

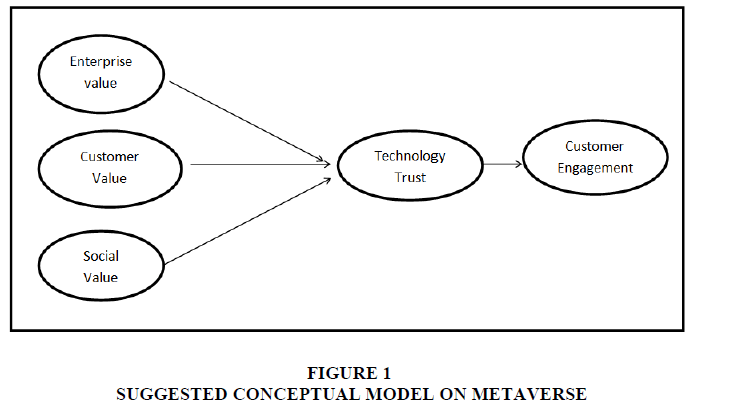

H1: Enterprise value of metaverse has a positive influence on technology trust towards banking service.

H2: Customer value of metaverse has a positive influence on technology trust towards banking service.

H3: Social value of metaverse has a positive influence on technology trust towards banking service.

Customer Technology Trust and Customer Engagement

Any social group's effectiveness, ability to adapt, and even survival, according to Rotter (1967), depend on whether or not trust exists. The idea of trust has many dimensions, is complex, and has many facets, which makes it difficult to define clearly (Rousseau et al., 1998) in this technology era.

Credibility and benevolence are considered critical elements of trust. Credibility refers to a person’s belief that the trustee is capable of doing, whereas benevolence pertains to the inclination of the trustee to prioritize consumers’ interests. The brand attributes and useful information develops customer trust that enforce their engagement towards the brand (Chiu et al., 2010). The increasing role of technology in day-to-day life and people's growing reliance on it on how technology is displacing human-human interactions with human-technology .Researchers are focusing on relationships to find solutions to issues like: Should we trust technology? If so, how can technological trust be measured? This problem appears to be especially important in an era of increased environmental complexity and uncertainty environment related to technological development (Magruk, 2017; Ejdys et al., 2018) like metaverse interface. McKnight emphasises that people's unprecedented reliance on IT technology makes it crucial to have faith ad engage in them.

“Customer engagement (CE) defined as a psychological state that occurs by virtue of interactive, co-creative customer experiences with a focal agent/object (e.g. a brand) in focal service relationships”. Past studies argued that customer engagement can be expressed in various ways, such as positive word of mouth (WOM) about the firm and its employees, participation in a brand’s activities, referral by the recommendations of other customers, and customer voice, suggestions, feedback, and participation in brand communities (Bijmolt et al., 2010). Moreover, customer engagement reproduces cognitive, emotional, and behavioral expressions with customers' interactive and co-creative experiences (Verley et al., 2014).

H4: Technology trust has a positive influence on customer engagement towards banking service.

Methodology

The study was conducted in two phases. In the first phase focus group was conducted with customers and bank employees to know there basic understanding on metaverse and different types of value dimensions to crosscheck with the existing literature. Few dimensions were identified based on the understanding focus group and the existing scale modified as per emerging country context for the second phase of data collection with a new sample.

Measures

To measure the manifest meaning of each hypothesised component, multiple-item measures were used in the survey. These measures were all changed to fit the study situation in question after being adopted from earlier research (Metaverse banking). The content validity of the scale items was subsequently established. As a result, the survey's final questionnaire has forty questions on it.

Five sections of items made up the survey questionnaire. The perception of respondents toward Metaverse banking is captured in the first section. Customer value (Vedaradha & Hariharan, 2018), enterprise value (Dhelim et al., 2015, Dahan et al., 2022) and social value (Dhelim et al., 2015, Dahan et al., 2022) were the three dimensions that made up the higher order Metaverse construct. All of the Metaverse banking items were rated on a seven point Likert scale, with "strongly disagree" equaling 1 and "The six-item survey used to gauge customer technology trust in Metaverse banking was adapted from EJdys, 2018. Thirteen factors make up the measurement of customers' participation with Metaverse banking, which was taken from Verleye et al. (2014). On a seven point Likert scale, these items were scored (strongly disagree = 1 to strongly agree = 7). Last but not least, the poll included demographic questions about customers, such their age, gender, preferred means of transaction, and more.

Sampling

A web-based survey was used to gather replies. A web-based survey is used in the study for a number of reasons. The study needs information that demonstrates how consumers view the metaverse in banking. The survey method is the most effective for these goals since consumer perception reflects what they believe about and how they feel about metaverse banking (Kerlinger, 1973). Additionally, the researchers believed that using this method of data collection would strengthen the reliability of their findings (Kerlinger, 1973). The survey's participants were chosen from India, one of the growing economies.

Two well-known banks from the same nation were chosen for the study's sample frame. The researchers asked these two banks to release their online banking customer info after the sample frame was verified. The goal was outlined, and client information confidentiality was ensured. A request to participate in the survey was extended to 1100 consumers through email after receiving their unique email addresses and customer information. All study participants received assurances regarding their privacy. All participants were given a free lunch coupon after completing the web-based survey as a reward for their active engagement. Respondents were asked to complete a survey on their opinions of Metaverse banking, their trust in technology, and their engagement with Metaverse banking. Following Arnold and Feldman's recommendations, the possible impact of social desirability bias was minimised during the data collection process 1981. 538 timely responses were obtained during data collection, of which 420 were deemed complete and so taken into account during model testing, yielding a response rate of 38%. The demographic information about research participants is shown in Table 1.

| Table 1 Sample Characteristics |

||

|---|---|---|

| Characteristics | Category | Percentage |

| Age (in years) | 18-30 | 45 |

| 31-50 | 39 | |

| 51 and above | 16 | |

| Gender | Male | 63.2 |

| Female | 36.8 | |

| Annual income (in rupees) | Below 8 lakhs | 32 |

| 8-12 lakhs | 43 | |

| 12-16 lakhs | 14 | |

| Greater than 16 lakhs | 11 | |

| Online banking transactions (last 6 months) | less than 3 | 12 |

| 3-6 | 24 | |

| 6-9 | 28 | |

| Greater than 9 | 36 | |

| Most preferred mode of transaction | Online banking | 69 |

| Mobile Banking | 28 | |

| Physical Banking | 2 | |

| Type of Bank | Private Bank | 57 |

| Public Bank | 31 | |

| Foreign Bank | 12 | |

| Last transaction mode | Online banking | 63 |

| Mobile Banking | 32 | |

| Physical Banking | 5 | |

Sample size(n) :420.

63.2 percent of the study participants were men and 36.8% were women, according to a descriptive analysis of the study participants. 45 percent of the respondents were between the ages of 18 and 30 in terms of age. Our respondents' (or their families') average monthly income ranges from Rs. 8 to 12 lakhs. Additionally, 69 percent of our sample favours conducting banking transactions online (Table 1).

Data Analysis and Results

We began by examining a key tenet of the data: the normalcy of the variables. The findings showed that all of the items' skewness and kurtosis estimates fell within allowable limits (Tabachnick & Fidell, 2007), supporting the univariate normality of the items. Second, a common issue is common method variance (CMV) (Meade et al., 2007). If CMV is not first treated, research conclusions may be incorrect (Podsakoff et al., 2003). To evaluate the possible threat of CMV, we employed Harman's single factor test as a result (Craighead et al., 2011). According to the test results, just one factor explained 21.47 percent of the variance across the variables, which is less than the 50% cutoff point for CMV concerns. That CMV is not an issue in the current investigation is confirmed by this.

Confirmatory Factor Analysis was used to assess the psychometric qualities, such as validity and reliability, in more detail (CFA). According to the CFA results, the model fit the data quite well (χ2 = 728.67, df = 589, p =0.102, χ2/df = 1.236, NFI = 0.893, CFI = 0.973, TLI = 0.982, RMSEA =0.01, SRMR = 0.0363). Following this, the items measuring the research constructs' standardised CFA factor loadings (See Table 2) reached the 0.50 threshold (Hair et al., 2010), and the Composite Reliability (CR) for each scale dimension above 0.70, as shown in Table 3. (Hair et al., 2010; Fornell & Larcker, 1981). Additionally, all constructs' estimated Average Variance Extracted (AVE) values were discovered to be greater than the required level, demonstrating convergent validity (Hair et al., 2010). Additionally, the Heterotrait-Monotrait Ratio Criterion (HTMT) relationship was examined (See Table 4). Since the HTMT values were below 0.85, discriminant validity was present (Henseler, Ringle, & Sarstedt, 2015). Overall, the evidence points to the validity and dependability of the scale that was employed in this study.

| Table 2 Standardized Cfa Factor Loadings |

|||

|---|---|---|---|

| Sl. NO. | Parameters | Scale | Loadings (λ) |

| Customer Value(CV) | Vedaradha and Hariharan,2018 | ||

| 1 | Metaverse allows crypto currency for international Transactions(CV1) | 0.719 | |

| 2 | Metaverse allows Stock market transaction In international forum(CV2) | 0.773 | |

| 3 | Metaverse allows Vitual Service:education class/Sports day(CV3) | 0.718 | |

| 4 | Metaverse provides Digi locker security for customer(CV4) | 0.691 | |

| 5 | Real Estate investment in international Market(CV5) | 0.696 | |

| 6 | Individual transaction history(CV6) | 0.726 | |

| 7 | Friendly customer portfolio management(CV7) | 0.669 | |

| 8 | Virtual financial counseling with experts and professionals(CV8) | 0.694 | |

| 9 | sensors and headsets of virtual reality, augmented reality, mixed reality and extended reality through IOT Smart devices(CV9) | 0.730 | |

| Enterprise Value(EV) | Dhelim et al.,2015, Dahan et al.,2022 | ||

| 10 | Metaverse in banking enables SME investors for raising fund(EV1) | 0.732 | |

| 11 | Reusable data: selecting the wrong data and shortens validation time(EV2) | 0.720 | |

| 12 | Metaverse enables digital currency transaction that give lot of freedom for enterprises in transactions(EV3) | 0.665 | |

| 13 | Metaverse enables digital asset trading(EV4) | 0.667 | |

| 14 | Metaverse enhance the virtual reality technologies(EV5) | 0.680 | |

| Social Value(SV) | Dhelim et al.,2015, Dahan et al.,2022 | ||

| 15 | Metaverse enables virtual asset trading. (SV1) | 0.688 | |

| 16 | Metaverse creates virtual learning through multiplayer online games (SV2) | 0.686 | |

| 17 | Metaverse creates an advisory environment(SV3) | 0.621 | |

| 18 | Metaverse simplifies virtual military training(SV4) | 0.678 | |

| 19 | Small transactions can be recorded through the metaverse(SV5) | 0.677 | |

| 20 | Black money circulation in society can be tracked through the metaverse((SV6) | 0.668 | |

| 21 | Geographical barrier can be eliminated through metaverse(SV7) | 0.640 | |

| Customer Technology Trust(TT) | EJdys,2018 | ||

| 22 | The banking metaverse guarantees the anonymity of users (TT1) | 0.740 | |

| 23 | In the metaverse, I can express my opinion about transactions, financial doubts and inuiries without any fear(TT2) | 0.688 | |

| 24 | The banking metaverse ensures the security of my personal data(TT3) | 0.686 | |

| 25 | The banking metaverse is efficient and always works reliably(TT4) | 0.621 | |

| 26 | The banking metaverse is predictable and unchanging (TT5) | 0.678 | |

| 27 | I can rely on the banking metaverse System(TT6) | 0.677 | |

| Customer Engagement(CE) | Verleye et al. (2014) | ||

| 28 | I recommend banking metaverse to people interested in online transaction(CE1) | 0.715 | |

| 29 | I recommend banking metaverse to family and friends(CE2) | 0.640 | |

| 30 | I perform all required tasks on banking metaverse(CE3) | 0.798 | |

| 31 | I help the banking metaverse with those things that are required(CE4). | 0.740 | |

| 32 | I adequately complete all expected behaviors(CE5) | 0.688 | |

| 33 | I fulfill my/their responsibilities to the banking metaverse(CE6) | 0.686 | |

| 34 | I do things to make the personnel’s job easier(CE7) | 0.621 | |

| 35 | I try to help the banking metaverse provider to deliver the best possible service(CE8) | 0.678 | |

| 36 | I let banking metaverse know the ways to better serve my/their needs(CE9) | 0.677 | |

| 37 | I inform the banking metaverse personnel if I/they experience a problem(CE10) | 0.668 | |

| 38 | I let the banking metaverse personnel I know when they give good service(CE11) | 0.720 | |

| 39 | I assist other customers in finding their way within the banking metaverse(CE12) | 0.665 | |

| 40 | I help other customers if necessary(CE13) | 0.667 | |

| Table 3 Cr, Ave And Correlations |

|||||||

|---|---|---|---|---|---|---|---|

| CR | AVE | CV | EV | SV | TT | CE | |

| CV | 0.917 | 0.503 | 0.709 | ||||

| EV | 0.822 | 0.481 | 0.258*** | 0.694 | |||

| SV | 0.902 | 0.480 | -0.003 | -0.300*** | 0.693 | ||

| TT | 0.826 | 0.543 | 0.380*** | 0.385*** | 0.266*** | 0.737 | |

| E | 0.768 | 0.453 | 0.306*** | 0.283*** | 0.243*** | 0.841*** | 0.673 |

Note: CR= composite reliability, AVE= average variance extracted. Values in the diagonal axis represent the square root of AVEs. *** shows significant at 1% level, * shows significant at 10% level.

| Table 4 Htmt Analysis |

|||||

|---|---|---|---|---|---|

| CV | EV | SV | TT | CE | |

| CV | |||||

| EV | 0.249 | ||||

| SV | 0.002 | 0.298 | |||

| TT | 0.379 | 0.384 | 0.271 | ||

| CE | 0.306 | 0.284 | 0.242 | 0.84 | |

Note: Thresholds are 0.850 for strict and 0.90 for liberal discriminant validity. See Table 2 for expanded construct names.

Test of Hypothesis (H1-H4)

To test the hypotheses (H1-H4) using AMOS 25, we employed structural equation modelling (SEM) with maximum likelihood estimation. Customer value, enterprise value, and social value were used as endogenous variables, with technology trust serving as a mediator between the exogenous variables and the customer engagement. The SEM model's fit indices (2 = 723.39, df = 626, p =.002, 2/df = 1.155, NFI = 0.912, CFI = 0.974, TLI = 0.982, RMSEA = 0.021, SRMR = 0.0664) showed that the model was satisfactorily fitted. We then went on to examine the study's hypothesis.

We looked at the estimates, and those that were reported as statistically significant included the consumer value on technology trust (β = 0.326, p < 0.01), enterprise value on technology trust (β = 0.221, p< 0.01), and social value on technology trust (β = 0.367, p< 0.01). Since it did, H1, H2, and H3 were supported. The impact of technological trust on customer engagement was then examined and found to be statistically significant (β = 0.695, p< 0.01). Therefore, it supports H4.

Following Gaskin (2016), we calculated the particular indirect effect of the proposed antecedents (customer value, enterprise value, and societal value) on customer engagement through technology trust. In addition to the effects already mentioned. We used boot-strapping (n = 5000) with replacement to test the indirect estimates in order to examine the same. According to the findings, customer value has a statistically significant indirect effect on customer engagement through technology trust (indirect effect: β = 0.162, p< 0.01), as well as an indirect relationship between enterprise value and customer engagement (β = 0.221, p <0.01) and social value and customer engagement (β = 0.258, p< 0.01) Table 5.

| Table 5 Sem Path Estimates |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Parameters Hypothesis | Estimate | SE | CR | Sig | |||||

| CV→TT H1 | 0.326 | 0.042 | 5.842 | *** | |||||

| EV→TT H2 | 0.221 | 0.053 | -5.12 | *** | |||||

| SV→TT H3 | 0.367 | 0.051 | 7.418 | *** | |||||

| TT→CE H4 | 0.695 | 0.067 | 10.262 | *** | |||||

| Indirect Effect | |||||||||

| Parameters | Estimate | Lower-CI | Upper-CI | Sig | |||||

| CV→TT→CE | 0.162 | -0.217 | -0.098 | *** | |||||

| EV→TT→CE | 0.221 | 0.147 | 0.292 | *** | |||||

| SV→TT→CE | 0.258 | 0.196 | 0.328 | *** | |||||

Note: . Note: CI shows bias-corrected-percentile confidence intervals at 90% level. *** shows significant at 0.01 level.

Conclusion and Managerial Implications

The study's findings confirmed the research model depicted in Figure 1 as well as the theories regarding the connections between customer value, enterprise value, social value, technology trust, and customer engagement with regard to India's metaverse banking. These results were in line with earlier research (e.g., Vedaradha and Hariharan, 2018; Dhelim et al.,2015, Dahan et al., 2022). As shown by significant estimates of the values of trust and trust on the engagement of the metaverse, the extended TAM model in metaverse settings, including different value as antecedents, explained how value influence trust and behaviour towards banking. It also has several significant directions for academics and practitioners.

First, Metaverse revolutionize customer value through client experiences and relationships, leading to improved investor loyalty and better investment outcome.It enables Stock market transaction in international forum;Digi locker security;Real Estate investment in international Market;Individual transaction history and Friendly customer portfolio management.

Second,Whether it's on the CRM front, on the personalisation front or Remarketing, Banks could able to collect a lot of data on their platforms and use it the right way to market to customers, individuals. This helped improve the click through rates and the purchase rates,”.Metaverse Platforms can help in increasing the enterprise value with the Bank CRM team. It provided insights dashboard about their customers and forecast outcomes for smarter decisions.conversation comprehension system with high accuracy and speed to automate email responses and routine request allocation tasks.prediction mechanism to analyse any piece of data either qualitative or quantitative or even from social platforms.A recommendation engine for next best offering to individual customers, whether it is product, content or offer. It helps SME investor for raising fund (Dhelim et al. 2015; Dahan et al, 2022).

Finally, The findings of the present study will enrich the impact of metaversa in creating memorable sensory experience and engagement among bank customers and on banking industry as a whole. The findings of the present study will enrich the impact of metaversa in creating memorable sensory experience and engagement among bank customers and on banking industry as a whole.

Implication from Policy Maker Prospective

Banking is already on our fingertips via mobile phones. The next leap of technology promises to bring a human touch to the digital experience with virtual interactions in the metaverse. Through metaverse customers can visit a bank without actually visiting the bank and Digital banking is set to become bigger, which will not only allow for remote access to services, but add a personal touch.Metaverse, allowing brands and businesses to grow from its physical store into the virtual world.

The comparative study related to the impact of metaverse from other industry (retail, telecom, travel and tourism,manufacturing) would bring generalizability across industries. The finding of the present study woud help the banking industry for further redesigning the banking service that leads to more delighted experience to customers.risk will reduced and enhance customer trust.Compared to other service industry banking industry is having more perceived risk and less trust.So how the metaverse reduced the risk and help in establising trust among customers is the major implications of the study. Artificial intelligence and metaverse are strongly intertwined, and metaverse's use of AI will have a significant impact on the company's employees' productivity, cost-effectiveness, and comfort. The issue of human time, work, and expense can be readily solved in the actual world by deploying artificial intelligence in the Metaverse.

The metaverse technology can bridge the unique potential of social media connectivity and immersive Virtual Reality (VR) and Augmented Reality (AR) technologies. When the interaction between them is creativity unleashed, it promises to transform other related industries. It turns out that AI and Metaverse will improve the banking and finance business performance by cutting various costs. With the use of AI, businesses will become more convenient and efficient. Not just banking and finance services and Businesses, Metaverse will revolutionise the healthcare, retail, gaming services as well, reducing the risk factors involved in the medical treatments. Metaverse can help in changing the way medical industries work by globalizing the medical practices of various countries and reducing the risk factors involved in various procedures. Meta-education, a new model of metaverse-enabled online distance learning, is emerging and 3D virtual It could enable rich, hybrid formal and informal learning experiences on online campuses. Online learning in the Metaverse can break the final barrier between social connections and informal learning. Physical presence in the classroom is no longer a privileged educational experience. Telepresence, avatar body language, and facial fidelity enable equally effective virtual participation. Additionally, the Metaverse Social Mixed Reality enables mixed and active education that fosters deeper and more lasting knowledge beyond geographical limitations. By influencing the way banks interact with their customers, inventing new products and enabling services, the Metaverse can bring enormous improvements to the banking sector if proper awareness created among the customers and marketers. Money was once seen as a tangible paper currency that people exchanged for goods and services (Financial Express, 2022).

In the future, how bankers, architects, and security analysts can identify elements, prevent fraud, and address privacy and data protection concerns while delivering a unique customer experience for future generations addressed through metaverse. The Metaverse will be the next generation playground. The challenge is to leverage its unique capabilities to create a truly immersive user experience for customers accessing their banks digitally. The metaverse is still in its early stages. It's unclear how long it will take to fully develop, or how well it will mimic real life. However, one thing is certain, it could be the next revolution in the world of virtual reality. It can change our perception of internet and social media interactions.

In future, the metaverse is going to be used in numerous applications, such for updating compliance procedures, reducing fraudulent activities, and facilitating cross-border payments, especially from 2023. It can also be used to form digital assets representing fiat currencies or other assets like bonds and commodities. These digital assets can be traded on metaverse’s decentralized exchange, that will offer a high degree of security and transparency. Future studies can be extended in understanding the motives of consumer towards the use of metaverse in different service contexts across different age groups from an emerging country perspective. Further comparisons can be made on metaverse applications in developing and developed countries.

References

Allam, Z., Sharifi, A., Bibri, S. E., Jones, D. S., & Krogstie, J. (2022). The metaverse as a virtual form of smart cities: opportunities and challenges for environmental, economic, and social sustainability in urban futures. Smart Cities, 5(3), 771-801.

Indexed at, Google Scholar, Cross Ref

Banaeian, Far, S., & Imani Rad, A. (2022). What are the benefits and opportunities of launching a Metaverse for NEOM city? Security and Privacy, e282.

Buhalis, D., Lin, M. S., & Leung, D. (2022). Metaverse as a driver for customer experience and value co-creation: implications for hospitality and tourism management and marketing. International Journal of Contemporary Hospitality Management, (ahead-of-print).

De Franceschi, A. (2022). Building the New Infrastructure for the Digital Economy: A Global Challenge. GRUR International.

Dubey, V., Mokashi, A., Pradhan, R., Gupta, P., & Walimbe, R. (2022). Metaverse and Banking Industry–2023 The Year of Metaverse Adoption.

Dwivedi, Y. K., Hughes, L., Baabdullah, A. M., Ribeiro-Navarrete, S., Giannakis, M., Al-Debei, M. M., ... & Wamba, S. F. (2022). Metaverse beyond the hype: Multidisciplinary perspectives on emerging challenges, opportunities, and agenda for research, practice and policy. International Journal of Information Management, 66, 102542.

Indexed at, Google Scholar, Cross Ref

Ejdys, J. (2018). Building technology trust in ICT application at a university. International Journal of Emerging Markets., Vol. 13 No. 5,pp.980-997.

Golf-Papez, M., Heller, J., Hilken, T., Chylinski, M., de Ruyter, K., Keeling, D. I., & Mahr, D. (2022). Embracing falsity through the metaverse: The case of synthetic customer experiences. Business Horizons, 65(6), 739-749.

Kiong, L. V. (2022). Web3 Made Easy: A Comprehensive Guide to Web3: Everything you need to know about Web3, Blockchain, Defi, Metaverse, NFT, and GameFi. Liew Voon Kiong.

Lee, J. Y. (2021). A study on metaverse hype for sustainable growth.International journal of advanced smart convergence,10(3), 72-80.

Lee, L. H., Braud, T., Zhou, P., Wang, L., Xu, D., Lin, Z., & Hui, P. (2021), “All one needs to know about metaverse: A complete survey on technological singularity, virtual ecosystem, and research agenda,”arXiv preprint arXiv:2110.05352.

Simon, E.B. (2022), “The Social Shaping of the Metaverse as an Alternative to the Imaginaries of Data-Driven Smart Cities: A Study in Science, Technology, and Society,” https://www.mdpi.com, July 28.

Indexed at, Google Scholar, Cross Ref

Singh, S. (2022), “Metaverse: The future of (Virtual) reality” www.financialexpress.com, April 6,2022.

Received: 10-Jan-2023, Manuscript No. AMSJ-23-13122; Editor assigned: 16-Jan-2023, PreQC No. AMSJ-23-13122(PQ); Reviewed: 30-Apr-2023, QC No. AMSJ-23-13122; Revised: 28-Mar-2023, Manuscript No. AMSJ-23-13122(R); Published: 07-Apr-2023