Review Article: 2022 Vol: 26 Issue: 6

Microfinance A Way to Rural Development

Priya Sharma, Vivekananda Institute of Professional Studies

Citation Information. Sharma (2022). Microfinance a way to rural development. Academy of Marketing Studies Journal, 26(6), 1-11.

Abstract

Development is the process of the overall growth of a region and is defined as a long-term process of structural societal transformation (Sage, 2007). It is majorly characterized as a long-term process that includes transformations in variegated fields which that in turn affect the structure of the society in some manner. Rural development is the advancement of rural areas through long-term processes. United Nations defined rural development as a process of bringing change among rural communities from the traditional way of living to a progressive way of living (Chauhan, 2014). This paper describes rural development, the essentials of rural development, and the role of microfinance in rural development. Secondary data has been used for the research.

Keywords

Rural Development, Self Help Groups, Micro Finance, Micro Finance Delivery Models.

Introduction

About 65% of the total population of India resides in rural areas and lacks basic amenities. They have a low standard of living due to low income. Lack of facilities and opportunities hamper their development. Thus, to promote rural development they must have access to financial and non-financial services. Microfinance is considered to be a strong poverty alleviation tool and this is quite effective to improve the living conditions of rural poor and promote rural development.

Rural Development

Rural areas are the ones that are scarcely populated and have lower levels of facilities available. These areas are usually far from cities and towns in the intensity of service availability and socio-cultural situations. Rural areas generally have agriculture as the primary occupation and hence their economies are based on the same. Logging, mining, oil and gas exploration, or tourism may be listed as other occupations. The levels of both facilities like education, legal services, libraries, etc., and utilities like water, sanitation, electricity, public transport, etc. are of very low levels when compared to the urban and semi-urban areas Chauhan (2014).

The rural population in India reported an increase of 9 percent from Census 2001 to Census 2011. It increased from 74.3 crores to 83.3 crores in the 10-year gap. However, the proportion of the rural population in the total population declined from 72.19 percent to 68.84 percent Census of India (2011). Moreover, the growth rate of the population for the rural areas reported a fall of 5.9 percent in 2011 from 18.1 percent in 2001 whereas urban areas reported a hike of 0.3 percent in 2011 from 31.5 percent in 2001 Census of India (2011). For the first time, a significant fall in growth was reported even for rural areas of EAG (Empowered Action Group) states Census of India (2011). Although a huge sum of money is given separately to the EAG states, the facts show no impact of the same. Unorganized rural development can be cited as the reason for the same.

Development is the process of the overall growth of a region and is defined along-term the term process of structural societal transformation Sage (2007). The issues of development of agriculture, socio-cultural environment, improvement of conditions of people, etc. are all mushroomed under a single term of rural development. Rural development is hence a multi-dimensional concept that is complex to be defined. In a country like India where the majority of the population (68.84 percent) resides in the rural areas, rural development is of utmost importance for the overall development of the country Census of India (2011).

Requirements for Rural Development

Education

Education is the first of the many focus areas that need special attention. Education has been deemed important for the development of rural areas. The impacts of education are not restrained to the individual’s development but it also has indirect impacts. Literacy brings along with its lower fertility rates, improved conditions on the health front, and enhanced sanitation practices. Literacy also increases access to information sources and involvement levels in social and economic events.

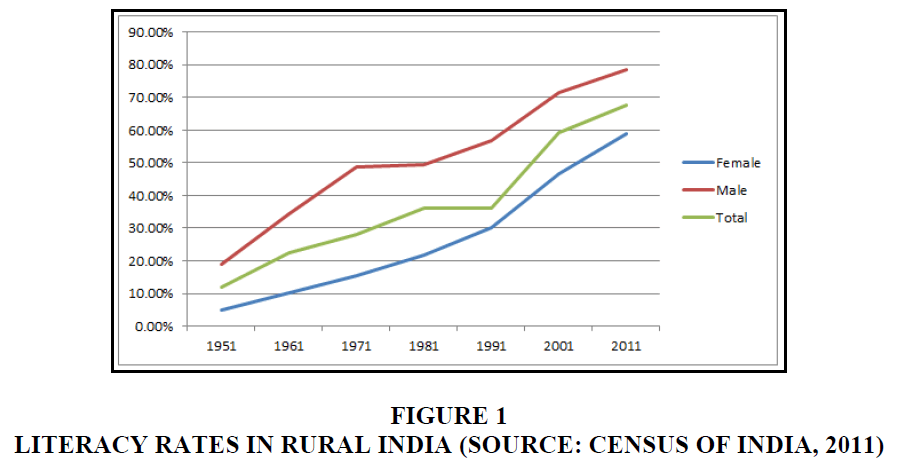

The literacy rates in rural India have seen an improvement of 10.2 percent from 58.7 percent during Census 2001 to 68.9 percent during Census 2011. The improvement in the rural areas has been better than the overall levels and much better than in the urban areas. The males (78percentent) reported a higher literacy level than the females (58.7 percent) in the rural areas in 2011. But the good part is that the growth of literacy from 2001 to 2011 has been more for the rural females (+12.7 percent) than the rural males (+7.9 percent) Census of India (2011) Figure 1.

Figure 1 Literacy Rates in Rural India (Source: Census of India, 2011)

Information and Communication Technology

The development of information and communication technologies is the second concern that can lead to rural development if addressed Planning Commission (2007). In today’s era, which is dominated by technology, it also affects the access to information and in turn economic, social and cultural actions. Many countries in the developed world and some in the developing world have established Information and Communication Technologies (ICT) systems. ICTs are information-handling tools – a varied set of goods, applications, and services that are used to produce, store, process, distribute and exchange information for the development of the country. The umbrella term of ICTs includes the old and new technologies, the old ones being radio & television and the new ones being computers & wireless technologies Chitla (2012). ICTs are important for government and firms alike. It helps both entities to manage themselves and connect with people in a better way.

ICTs need to intervene at three levels to ensure rural development. One, they need to ease the reach of information or the information access. This will enable people to be more acquainted with all they need to know and all they need to learn. Next is to improve the E-Governance services (World-bank report, 2005). E-Governance has been found a successful venture for the public sector. From grievance redressal and imparting public information to users for payment of bills, ICTs have left their mark on every field.

Market Access

Market access is important for both agricultural and non-agricultural activities. Members of rural households or any kind of households for that matter play the role of both producers and consumers in a market. The prospects of interaction that they get in the market space provide them with diverse livelihood options. People belonging to the rural areas pan-world complain about a lack of market access as the reason for their backward standards of living IFAD (2014). The success of the green revolution can be seen as an example of market access affecting rural development. The parts with better road connectivity and developed infrastructure system were the ones that got the most out of the revolution Singh & Sinha (2003), p. 128). In India rates of return to, road building has been estimated to be around 25%. It is reported that the rural people unlike their stereotyped image are quite interactive in the markets when given a chance. Poor quality of roads, unorganized storage facilities, and problems in accessing information have been seen as roadblocks in road blocks in achieving market success IFAD (2014).

Energy Technology

Energy technology also has an eminent part in rural development. Energy technology aims to bring about sustainable development so its role in the rural context is sustainable rural development. Rural energy systems should focus on promoting self-sustained economic growth. Human Development Index (HDI) has three critical dimensions of development: equity based on a marked increase in access of the poor to energy services, empowerment based on strengthened endogenous self-reliance, and environmental soundness. Energy technology is expected to make energy more accessible and reliable unreliability is also expected to strengthen the rural poor through the provision of self-reliance (Reddy, 2008, p. 196). Therefore, the promotion of energy technologies is very important for accomplishing the rural development objective (United Nations, 2003, p. 9-10).

Micro Finance

The dearth of finance is another and one of the most vital components of rural backwardness. Microfinance can help in dealing with this problem. Microfinance needs support and provides the same to all the other components essential for enhancing rural development. Microfinance helps in escalating the levels of employment and hence realizing the true potential of human resources. It also brings forth the role of SHGs and cooperative societies. These organizations not only provide credit but also render help in other forms. Micro-credit, as a pre-condition, promotes saving in rural areas. The microfinance institutions being the connection between the formal financial structure and the rural people help in binding the latter to a more organized sector. Microfinance also gives the power to the beneficiaries to make more informed, just, and wise decisions. The role of microfinance in poverty alleviation and women is also very crucial Kumari & Malathi (2009), p. 2-4).

Various success stories of Microfinance institutions and the Self-Help Groups can be seen. In Nagpur and its surrounding regions in Maharashtra, 87 percent of the rural areas didn’t have a proper defecation system and had to resort to open spaces. The women of the region, although desired to get closed spaces for defecation, we’re unable to get the same due to financial and technical problems. The NGO linked with NABARD that noticed the problem came out for their support. They created a project to help them get technical support at a lower cost and to access loans for the same. NABARD approved the project and so far the concerned NGO (Nageswara Charitable Trust) has extended loans to over 3000 SHG members. This has helped in better hygiene and sanitation facilities for the SHG members and also their up liftment on social levels NABARD (2012-13).

Microfinance Delivery Models

Basic Self-Help Groups

Self-help groups are medium-sized groups generally having 10 to 20 members strong. Usually, these groups comprise rural women and hence act as a medium for them to voice their opinions and help themselves. The group not only provides financial help but also psychological help. They can talk to other group members, share their experiences, and exchange ideas on various issues, social as well as personal. Self-Help groups choose their leaders as per consensus. These groups are built to assist at the grass-root levels.

Once the group becomes capable enough to stand up in situations on its own is when it becomes eligible for external help. A well-working group gets external help in the form of linkages with banks and other financial intermediaries. The linkages can be direct or indirect and accordingly SHG models have been divided into the following sub-categories Gurusamy (2009), p. 307-313).

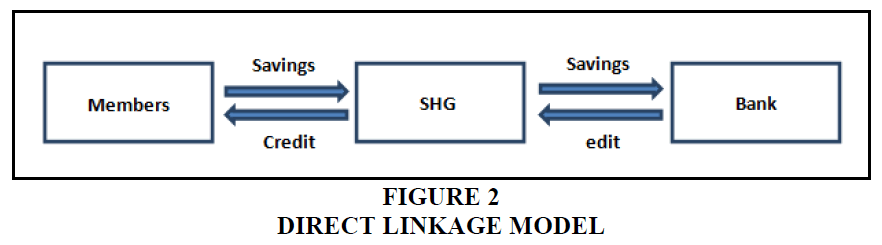

Direct Linkage Model

In the direct linkage model, the SHGs are connected to the banks directly. Either side, the fund flows from the members to the banks through the SHGs, be it the transfer of savings or loans. The bank here performs the role of a Self-Help Group Promoting Institution (SHPI).

The diagrammatic framework of the model is represented below Figure 2.

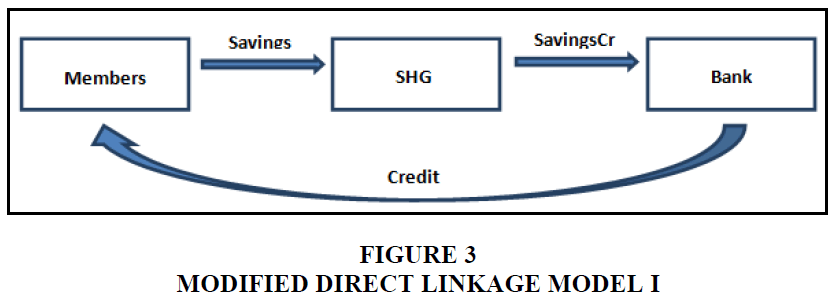

Modified Direct Linkage Model I

Under this model, the savings chain remains intact. The Self-Help Groups have the responsibility of selecting the members to be given loans and it is still morally responsible for the payback of loans. The only thing that changes is that the credit to individuals is provided by the banks directly and not through the SHGs Gurusamy (2009), p. 307-313; Singh & Srivastava, (2009). The diagrammatic framework is as below Figure 3:

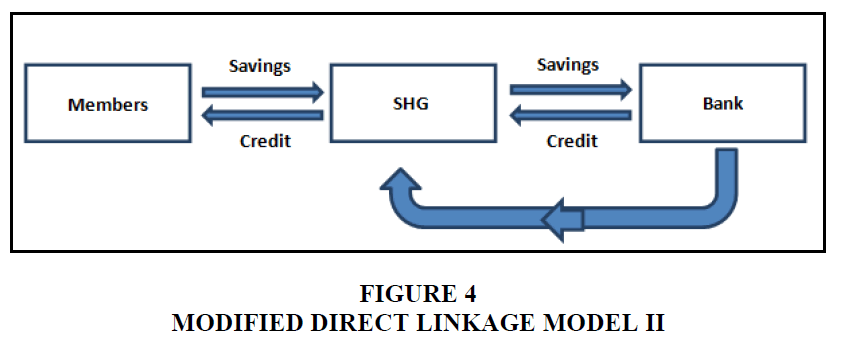

Modified Direct Linkage Model II

Under this model, although the financial linkage is like the general Direct Linkage Model, the responsibility for the formation, monitoring, and stabilization of the group lies with the NGOs which then act as the Self-Help Groups Promoting Institution (SHPI) Gurusamy (2009), p. 307-313; Singh & Srivastava (2009) Figure 4.

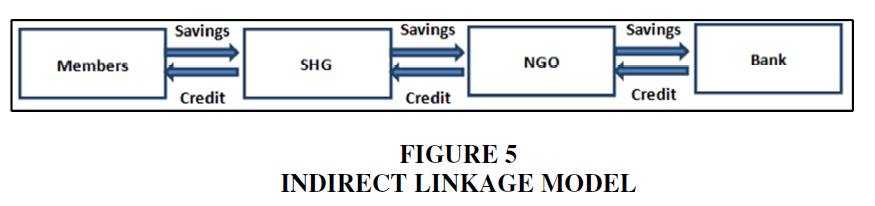

Indirect Linkage Model

This model is an extension of the Direct Linkage Model I. in the latter the NGOs acted as SHPIs but didn’t have any financial role in the process. However, in the indirect linkage model, the NGOs also play the role of financial intermediary. All the funds that flow back and forth from banks to the group members pass through both the NGOs and SHGs.

The diagrammatic framework is as follows Figure 5:

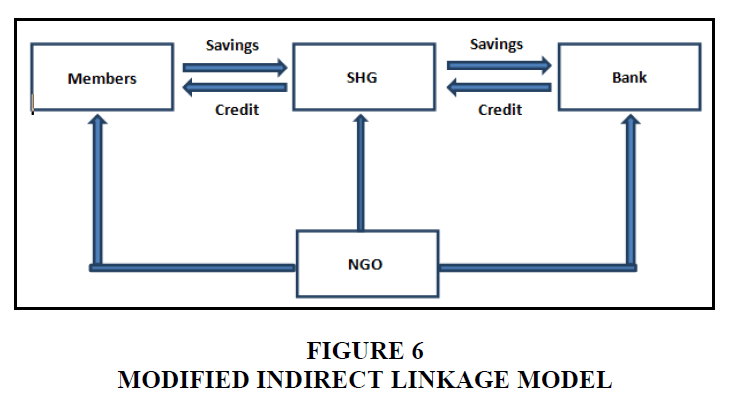

Modified Indirect Linkage Model

Under this type of model, other than the flow of funds in the form of savings and credit, the flow of other services also takes place. The NGOs and other organizations that are willing to help the groups provide their services in the form of obtaining raw materials, help in training providence, technological & otherwise, consultancy provision, etc. are also included in the structure Gurusamy (2009), p. 307-313; Singh & Srivastava (2009). The diagrammatic representation is as under Figure 6.

The Federated Self-Help Group Approach

Despite being highly efficient the SHG approach does have certain flaws. Firstly, the banks can address only one group at a time, and hence, it takes them too much time to address a large number of groups. Secondly, the groups may or may not be registered as an organization. These and certain other flaws of individual SHGs can be counterfeited by the formation of federations that represents all the groups under it. The federation as an apex body over the groups is registered under the Societies Registration Act Gurusamy (2009), p. 307-313; Nasir, 2013).

The structure of a federation is usually three-tier. The Self-Help groups lie at the bottom of the structure and are headed by the clusters. The clusters comprise two members from each SHG body under it who attend the monthly meetings. The Federation lies at the top of the structure and is the apex body that exemplifies the whole membership World Bank (2005). The cluster level is hence the mediator between the SHGs and the federation and hence has a very vital role to play. Moreover, the formation of area-wise clusters makes the part of the federation easier and decentralized Gurusamy (2009), p. 307-313).

The role of the federation is to help SHGs in accessing funds from external sources as well as from within the group. It also has to take care of the idle money and help in channelizing the money to the groups in need and also in recovering and payback of loans. Other than the financial help the federation also has to assist the groups with whatever other help they may need in the form of training or raw material procurement eAll in all-all the federation has to promote the SHGs that are under it along with promoting new ones to grow up Gurusamy (2009), p. 307-313).

Rural Industries Promotion SHG Framework

The rural industries are seen suffering a lot as a result of globalization. They have two backdrops because of globalization. One is the competition they face because of the introduction of the economy to the globalized world and the second is the lack of facilities that they faced while production just intensifies in its effects. Thus, to cope with these negative effects, this model provides the rural industries with a package of services. The main objective of this framework is to create structures that cater to the needs of women in specific Gurusamy (2009), p. 307-313).

The Urban Cooperative Banking Model

This type of model is made for women who can save minimal amounts during a month and have no or very less amount of collaterals to produce. The scrutiny of loan applications under this model is done based on the capability of the members to save and their motivation for the same. The members should be proactive in saving money and their entrepreneurial idea should be viable. Another benefit for the members in this model is that the repayment schedule is flexible and can even be reconsidered if the need be. The only physical condition is that the member needs to open a savings account with the credit-providing institution. The loans that are provided are for three reasons majorly, for working capital, buying tools for the trade, and capital investment Gurusamy (2009), p. 307-313; Nasir, 2013).

The Cooperative Solidarity Group Model

Under this model, the solidarity groups are formed by women of 5 to 15 member strength. Usually, the members belong to the same area and have been residing there for five years at the least. The loans are given by the companies to the members after an inspection of their poverty status, their general financial behavior, and other vitals. The members eligible for loans are suggested by the groups but authorized by the loan provider. The groups also need to be registered by the loan providers before the provision of loans Gurusamy (2009), p. 307-313).

The Cooperative networking Framework

Under this model, the beneficiaries are the thrift cooperatives of women and men. These cooperatives are further divided into smaller groups for better execution of loan disbursement and repayment. Not all, but some of these groups are registered under the APMACS Act 1995. This gives them greater flexibility and independence. These cooperatives also form federations geographically. The heads of these cooperatives comprise the General Body of the Association Gurusamy (2009), p. 307-313).

The Cooperative Grameen Hybrid Model

Under this model, the practicing societies are registered under the APMACS Act. They are generally known as Mutually Aided Cooperative Societies or mutual benefit societies. As the name suggests these societies work for the benefit of the individuals that lie under their umbrella. There are 10 to 15 Joint Liability Groups (JLGs) that are covered under these societies. The loan taken by any single member of a group is the joint liability of all the other members of the group along with the loan-taker. The apex body in this structure i.e. a branch is a composition of 8 to 10 societies (unregistered). Different types of savings are available to the members of the groups under a branch. Thrift deposit which ranges from Rs. 20-200 per month per number, a recurring deposit under which members can deposit every month and get 12 to 15 percent interest on it and fixed deposit schemes are available Gurusamy (2009), p. 307-313).

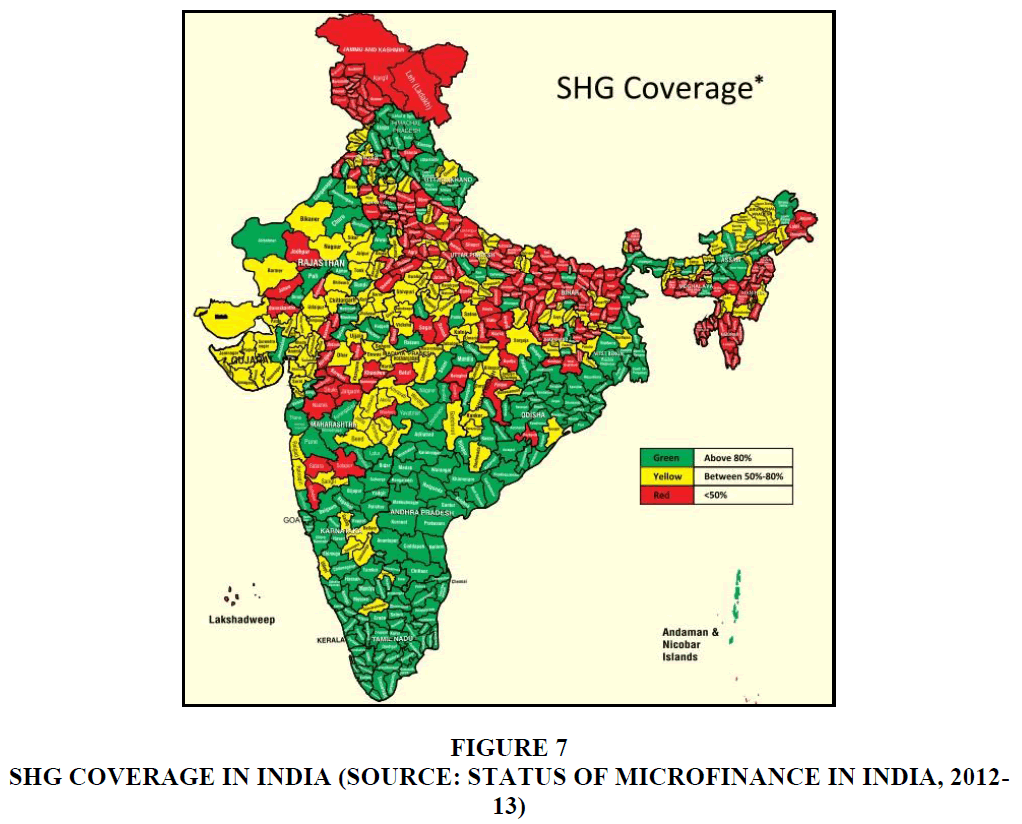

They are allowed only one loan at a time but it can be for varied purposes like hospitalization, emergencies, occupational emergencies, etc. Loans are provided under certain conditions in this model Gurusamy (2009), p. 307-313) Figure 7.

On having a look at the data available for the Status of the Microfinance sector in India we see that currently, the coverage of SHGs in India is more in the southern region of the country. On the other hand, most of the western region had median coverage and the east-central had low coverage of SHGs. As can be seen in the following map of India, majorly all the southern states have more than 80 percent of the potential SHGs turned into savings-linked SHGs. The problem areas in terms of SHG coverage area in the state of Bihar, Uttar Pradesh, and Jammu & Kashmir. In these states, maximum regions have less than 50 percent coverage. The state of Rajasthan and Maharashtra had median levels of coverage with a lot of regions having 50 to 80 percent coverage (Figure 7) ESCAP (2003).

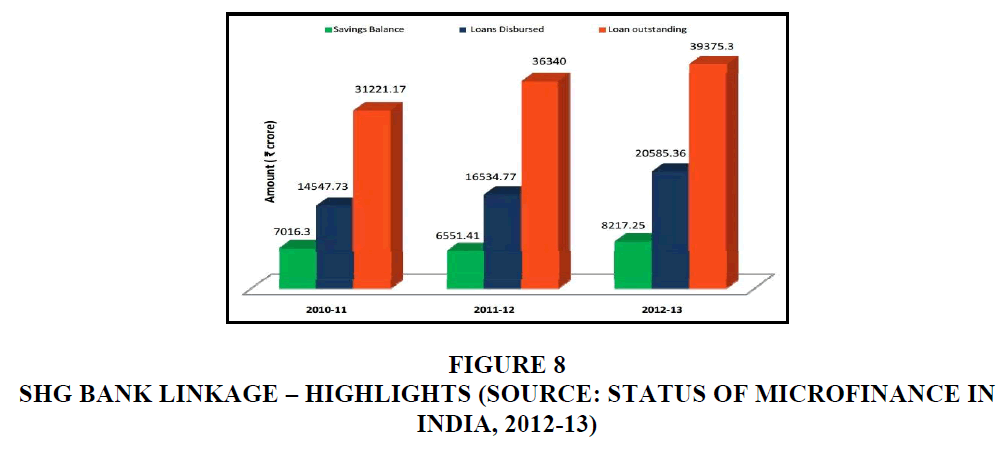

The overall progress of SHG Bank Linkage for 3 years from 2010-11 to 2012-13 was as follows Table 1:

| Table 1 SHG-Bank Linkage Progress (Source: Status of Microfinance in India, 2012-13) | |||||||

| Particulars | 2010-11 | 2011-12 | 2012-13 | ||||

| No. of SHGs (lakh) |

Amount (Rs. Crore) | No. of SHGs (lakh) |

Amount (Rs. Crore) | No. of SHGs (lakh) |

Amount (Rs. Crore) | ||

| SHG Savings with Banks as on 31 March |

Total SHGs | 74.62 | 7016.30 | 79.60 | 6551.41 | 73.18 | 8217.25 |

| % of Women Groups to Total |

81.7% | 75.5% | 79.1% | 77.9% | 81.1% | 79.3% | |

| Loans Disbursed to SHGs during the year |

Total SHGs | 11.96 | 14547.73 | 11.48 | 16534.77 | 12.20 | 20585.36 |

| % of Women Groups to Total |

85% | 86.8% | 80.4% | 85.5% | 85.1% | 86.7% | |

| Loans Outstanding against SHGs as on 31 March |

Total SHGs | 47.87 | 31221.17 | 43.54 | 36340.00 | 44.51 | 39375.30 |

| % of Women Groups to Total |

83.2% | 83.7% | 83.8% | 83.8% | 84.4% | 83.3% | |

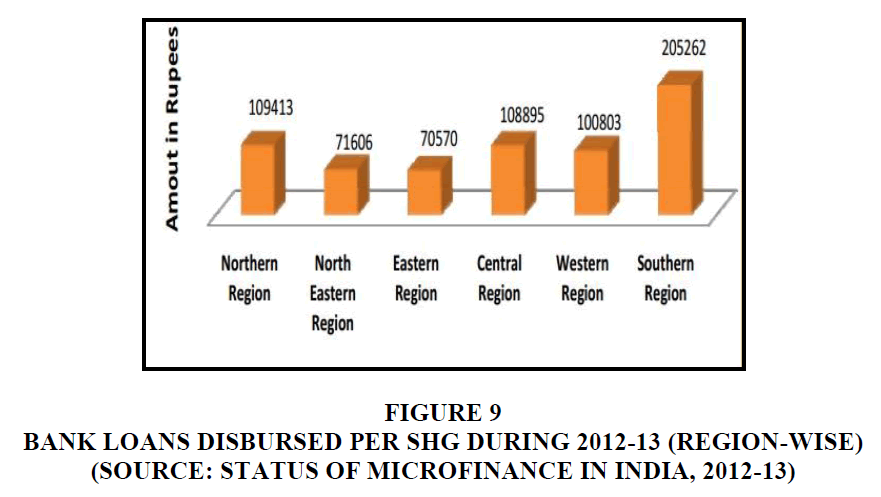

As can be seen through the data given in the table, there were 74.62 lakh SHGs in India in the year 2010-11 which was 7.3 percent more than last year. This number saw an increase of 6.7 percent in the next making the figure reach 79.6 lakh figure in 2011-12. However, the number of SHGs reported a fall of 8.1 percent in the next year making the figure 73.18 lakhs Malik et al Dc (2008). (2010). Nonetheless, the number of loans disbursed reported a continuous increase from the year 2010-11 to 2012-13. It increased from 14547.73 crore rupees to 20585.36 crore rupees Figure 8 and 9.

Figure 9 Bank Loans Disbursed per SHG during 2012-13 (Region-Wise)

(Source: Status of Microfinance in India, 2012-13)

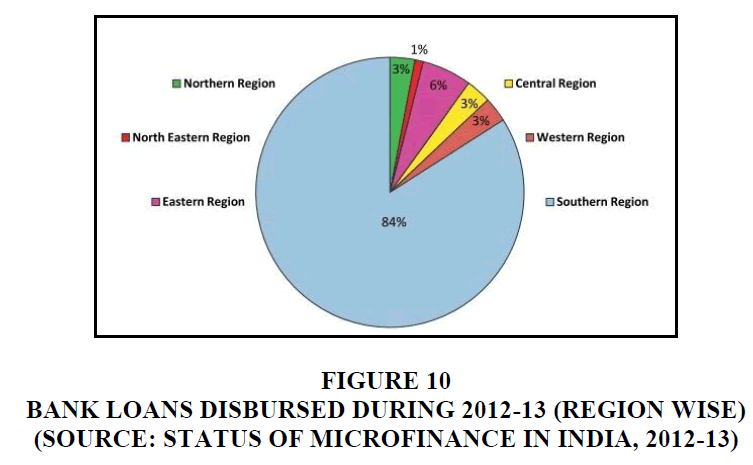

The regional distribution of the loans disbursed by banks during 2012-13 is shown in the graph that follows. 84 percent of the total loan disbursed by banks to SHGs in the country is in the southern region. The Eastern region stands second in the tally forming 6 percent of the total followed by the Central, Northern, and Western regions at 3 percent. The bank loan per SHG was reported to be at Rs. 2.05 lakh for the southern region, which was the highest followed by the northern region at Rs. 1.09 lakh. The detailed tallies can be seen in the graph below Figure 10.

Figure 10 Bank Loans Disbursed during 2012-13 (Region Wise)

(Source: Status of Microfinance in India, 2012-13)

The progress under MFI-Bank Linkage Programme can be seen through the data below. It is evident from the data that the confidence of customers in Microfinance institutions had dropped considerably from 2009-10 to 2011-12. Both the figures for the number of Microfinance Institutions and the number of loans given reported a fall during this period. The amount of loan disbursed decreased from 10728.5 crore rupees in 2009-10 to 8448.96 crore rupees in 2010-11 and further low to 5205.29 crore rupees in 2011-12. The number of Microfinance institutions also fell from 779 in 2009-10 to 465 in 2011-12. However, the confidence of the customers was re-installed in the year 2012-13. The amount of loan disbursed reported an increase of 50.6 percent making the figure reach 7839.51 crore rupees Table 2.

| Table 2 MFI-Bank Linkage Progress (Source: Status of Microfinance in India, 2012-13) | ||||||||

| Particulars | 2009-10 | 2010-11 | 2011-12 | 2012-13 | ||||

| No. of miss |

Amount (Rs. Crore) | No. of miss |

Amount (Rs. Crore) | No. of miss |

Amount (Rs. Crore) | No. of miss |

Amount (Rs. Crore) | |

| Loans disbursed by banks to MFIs |

779 | 10728.50 | 471 | 8448.96 | 465 | 5205.29 | 426 | 7839.51 |

| Loans outstanding against MFIs as on 31 March |

1659 | 13955.75 | 2315 | 13730.62 | 1960 | 11450.35 | 2042 | 14425.84 |

| Fresh loans as % age to Loans outstanding |

76.9% | 61.5% | 45.5% | 54.3% | ||||

Conclusion

India has a large population residing in rural areas and has requirements such as education, energy technology, information technology, market access, and microfinance. Various micro finance delivery models and success stories have been discussed. The status of microfinance in rural India has been described and its contribution to poverty alleviation has been ascertained.

References

Census of India (2011).RURAL URBAN DISTRIBUTION OF POPULATION - Provisional Population Totals.Census of India

Chauhan, A., (2014). Need for Rural Development in India for Nation Building.Asian Mirror- International Journal of Research.1 (1)

Chitla, A. (2012). Impact of information and communication technology on rural India. IOSR Journal of Computer Engineering, 3(2), 32-35.

Dc, N. (2008). Re-discovering Rural Development: A Reflection on Potential and Prospects. Sarup & Sons.

ESCAP, U. (2003). Guidelines on the integration of energy and rural development policies and programmes.

Gurusamy. (2009). Indian Financial System, 2E.Tata McGraw-Hill Education.

IFAD (2014).Markets for Rural Poor.

Kumari, A., &Malathi, N. (2009).Micro-credit and Rural Development.Micro-credit and Rural Development.Deep and Deep Publications. . 1-10.

Malik, M.A., Jumani, N.B., Safdar, M., & Ghazi, S.A. (2010). Role of Non-Formal Basic Education in Rural Development in Punjab.

NABARD (2012-13). Status of Microfinance in India, National Bank for Agriculture and Rural Development.

Planning Commission. (2007). Report of the steering committee on micro finance and poverty alleviation. Eleventh five year plan (2007-12), Development policy division.

Sage (2007). What is development?. International Development Studies.

Singh, S.R., &Srivastava, M.P. (2009).Micro-finance: Scope and Linkages with Faster and Inclusive Growth. Micro-credit and Rural Development.Deep and Deep Publications. 309-324.

Singh, S., &Sinha, S.P. (2003).Strategies for sustainable rural development.Deep and Deep Publications.

World Bank. 2005. Information and Communication Technologies for Rural Development

Received: 29-Jun-2022, Manuscript No. AMSJ-22-12273; Editor assigned: 04-Jul-2022, PreQC No. AMSJ-22-12273(PQ); Reviewed: 18- Jul-2022, QC No. AMSJ-22-12273; Revised: 26-Aug-2022, Manuscript No. AMSJ-22-12273(R); Published: 02-Sep-2022