Research Article: 2020 Vol: 21 Issue: 1

Migrant Worker Cash Transfer Effect on Children Education

Hermanto Joesoef Moestopo, University of Dr. Moestopo

Abstract

The motivation of the study is to examine the impact of the migrant worker cash transfer on the children’s school attendance in Indonesia and whether the proportion of school attendance of children receiving cash transfer and proportion of school attendance of children not receiving cash transfer is having the same effect. Methodology and data: The multiple cross-section regression models were applied by using 2SLS and Probit regression method to examine the effect of cash transfer as an exogenous variable, and individual vector, parents, and household as control variables on school attendance of the child as an endogenous variable. The data sourced from Indonesia's Family Life Survey-5 (IFLS-5) year 2014 covering 19 provinces with total observations of 16.024 households obtained from Rand Corporation and field interviews held in 2015. Based on empirical analysis, the main finding is that the cash transfer has a significant positive effect in increasing children school attendance and the expenditure for children education, nevertheless, the children originated from household receiving cash remittance tends to have lower school attendance vis-à-vis children originated from household not receiving the cash transfer. The novelty of this study is the fact that the cash transfer will eventually demotivate children to attend school. As policy considerations, it is advised to anticipate the migration effects when evaluating the effect of cash transfer on children's schooling attendance or when updating migration policies and to improve the availability of facilities and basic infrastructure for school-age children.

Keywords

Cash Transfer, School Attendance, Household’s Expenditure, Education, Children

JEL Classifications

F66, I25, I22.

Introduction

World Bank estimated that the cash transfer flows to developing countries in 2015 were amounted to USD 401 billion in which around 25 developing countries had cash transfer inflows equivalent to more than 10% of their economy (Mirzosaid & Sultonov, 2016). The World Bank report as of November 2017 mentioned that there are 9 million migrant workers who originated from Indonesia. Of that amount, 53 percent is working in informal sectors such as maid and baby sitter, 47 percent is working informal sectors. This phenomenon affects mainly on low skill worker as 60 percent of the worker has not completed high school so that unable to compete for limited jobs with high productivity. The World Bank report also mentioned that in November 2017, 19 percent is working in agriculture, 18 percent in construction, 8 percent in manufacturing, 6 percent as a nurse for elderly, 4 percent in hotel/restaurant, 2 percent as a driver and 0.5 percent working in the cruise ship. The World Bank report also mentioned that cash transfer is contributing to improving the long term life of the migrant worker and their families. This is due to the migrant worker obtained income six-fold higher compared to working at home or domestically. Forty percent of migrant households utilize its cash transfer money for education, 15percent for business investment and more than 20 percent for saving accounts. The Global Knowledge Partnership on Migration and Development (KNOMAD) in its report entitled Migration and Remittances, Recent Developments and Outlook as of April 2018, recorded that Indonesia is part of 10 biggest countries that receiving cash transfer from overseas amounting $9 billion and stand at 10th rank.

The first rank is India with a total amount of $69 billion, China $64 billion, and the third rank is the Philippines $33 billion. The cash transfer obtained by households originated from the migrant worker is part of the strategy for the household to ensure the sustainability of its income. In the short run, the fund is used for consumption such as buying food, clothes, and health needs that enable households to maintain their purchasing power. Whereas if the fund is used for investment financing such as education, in the long run, it will increase household expenditure that will mitigate poverty (Bastagli et al., 2016; Ruiz & Vargas-Silva, 2010).

Cash transfer in our observation is defined as money remitted by child, parent, or spouse domicile in different countries as a proxy of migration. The purpose of migration among others is to secure the income of the migrant worker and their families to stay at home (Stark & Bloom, 1985). The plethora of research showed that cash transfer originated from migrants overseas can increase the number of child entering schools.

In literature at least there are two opinions on how the fund received originated from cash transfer is utilized. First, the fund can be utilized for any needs as that fund received from other sources of income. Second, funds originated from cash transfer received by different socioeconomic backgrounds and different house member, will be used differently (Maitra & Ray, 2003), Weidler et al., 2016). This is due to the constraint such as migration cost; the fund originated from cash transfer is not received by those on the low-income category (Taylor, 1999). The cash transfer received from the migrant worker in overseas has been continuing to increase (Bank Indonesia, 2019). Considering both opines, the question needs to be further analyzed is whether cash transfer originated from a migrant worker from Indonesia is having an impact on education represented by the number of school-age children enrolling in school.

Based on the background abovementioned and data sourced from Household Survey in Indonesia the purpose of this study is to confirm and analyze the effect of cash transfer originated from migrant workers on numbers of children schools attendance. Second, to confirm whether the proportion of school attendance of children receiving cash transfer and the proportion of school attendance of children not receiving cash transfer is having the same effect. The research to explain the impact of cash transfer on school attendance of the child in the primary and secondary schools in the whole country or nationwide to the best of our knowledge is still scanty. A study done is only limited to several rural areas of the province.

The contribution of this study among others is to observe meticulously how significant the effect of cash transfer on household child education in Indonesia that the results of the study will be useful to be utilized as a reference for central government and local government in designing their policies particularly on improving the facilities for education as well as to increase economic growth of the country. Academic wise, this study can be used as a tool for comparative study with other countries such as India, the Philippines, Burma, and other migrant worker contributors.

Henceforth, the paper is structured as follows: the first section of this paper is an introduction to introduce the reader on the role of cash transfer remitted by a migrant worker working overseas for their families left at home.

The second section presents the academic literature review of various theories and study or research related to cash transfer and migration as well as developing hypothesis and leads to develop the formal model for the research in the next section. The third sections discuss the data and variables used to test the model. The fourth section contains the discussion on empirical results of testing the model. The final section draws the conclusion and its implications.

Literature Review

This section discusses the theories and reviews that originated from various researches on the effect of cash transfer.

The previous theories on migration, in general, have not to study cash transfer as separated topics from migration. But the New Economics of Labor Migration (NELM) concludes that the decision to migrate is based on common initiatives specifically between the migrant worker candidate and their families. So, this theory does not opine that the family is the separated entity from the migrant worker candidate. It is regarded as a unity that creates an efficient and flexible relationship among them. Furthermore, the approach is shifting the focus on migration theory on 'individual independence' to depend among others and view migration as 'strategy based on various considerations' and no decision or optimism without limit (Stark & Bloom, 1985). The fund received from cash transfer will be used for improving income, as the fund for new economic activity, and as a guaranty for the precaution motive of loss of income and production failure. The cash transfer originated from the migrant worker is also potent for propelling development dynamics through relaxing of production constraints and investment faced by the household in the underdeveloped countries (Taylor, 1999).

The motive of migrant workers to remit part of their income is based on various factors such as the amount of income, the willingness to distribute their 'hard work' income to their families at home including the easiness of remitting the funds. As Lucas & Stark (1985) stated that there is no theory specifically that is discussing cash transfer comprehensively, but Stark, (2004, 2009) mentioned that the motive of cash transfer is based on three reasons. First, the altruism or caring for the families left at home. Second, for benefitting migrant worker himself or expecting profit or return such as to be invested and to be secured by their families as savings to be used by the returned migrant workers. Third, the combination of both or known as NELM motive whereas the migrant worker and their families is bind by agreement to share the certainty of the sustainability of the income. Two reasons are supporting this motive which is investment and risk. For instance, the education invested by the head of the households for their children will create a higher return for the household instead of investing the funds for their son in law, daughter in law or spouse. The second reason is for a guarantee against the financial and insurance market imperfection by sending a member of their families as diversification of sustainability of family income. For instance, the drought and hostile weather causing harvest failure or unstable prices in rural areas (Taylor, 1999).

Overseas migrant in Indonesia is totally 3.7 million (Bank Indonesia, 2019). A migrant worker from Indonesia is categorized as low skills and working in informal sectors as a maid, and baby sitter. Only a small fraction of them working in plantation or manufacturing sectors as unskilled workers. Mostly working in the Middle East and Southeast Asian countries (BNP2TKI, 2015). The cash transfer from the migrant worker can increase the expenditure of the households but the pattern of the utilization is based on the level of the income category. For those categorized as low income, the cash transfer is used mostly on food consumption. For higher-income households, the fund is used for investment such as education, health, housing, or an increase of household assets (Adams & Cuecuecha 2010). The usage of cash transfer for education and housing are not resulting in an immediate impact on improving the economy of the household of the migrant worker (Taylor, 1999). The international cash transfer is also functioning as an effective informal social safety net (McKay & Deshingkar 2014). (Koechlin & Leon 2007) mentioned that in the early stages of migration only households categorized in the higher income distribution level can migrate as the costs for migration is relatively high. As a result, only those with a higher income are receiving the cash transfer funds. But, as time goes by, the earlier migrant worker will provide information and assistance to the new coming migrant worker that creates a new 'migrant center' overseas. The continuation of the process enables those from low-income distribution category to migrate and receive cash remittance.

McDade (2010) & Hernandez et al. (2012) mentioned that the household receiving cash transfer is having a higher impact on an increasing number of children entering school. This finding is also related to findings by Yang & Martinez (2006) concluding that cash transfer can support households receiving the cash transfer to overcome the 'financial shocks' as experienced during the financial crises in 1997 so it is utilized as an informal safety net.

The effect of migration and cash transfer on the education of the child of the migrant worker is examined by Davis & Brazil (2016); McKenzie & Rapoport (2006). The result of their study concluded that the absence of parent may inhibit the education process but the existence of cash transfer may support their child. The student originated from the migrant household is actively prioritizing the education to reach the prospect of migration in the future. And those coming from ample migrant communities tend to also migrate as their age mature enough to migrate. The indirect effect is that the student does not appreciate the quality of education due to the opine that the skills obtained from education are not sufficient for them for success in migration thus they disregard education albeit receiving cash transfer. Children of 7 to 12 years of age enrolled in school is close to 99% but the higher the level of education, children enrolling to school is deteriorated from 95% for children age 13 to 15 years and decreased to 72 % for those age 16 to 18 years (BPS, 2019).

A study was done by (Bougas, 2016) on children of women migrant workers from Malang, East Java, Indonesia found that their children lose the attention of their parents specifically their mother in rendering motivation for supporting their formal education. Motivation to encourage their children to study is not obtained by their children as their mother working overseas.

A study was done by Basrowi (2020) on migrant worker and former migrant worker in Lampung province-Indonesia concluded that remittances had a positive and significant impact on improving the family's economy, children's education duration, and children's health level.

Other studies conclude that only a small fraction of the cash transfer is used for children's education as major parts of the cash remittance are allocated for consumptive usage.

Based on the review abovementioned the hypothesis developed for the study to be executed is that cash transfer obtained from a migrant worker working overseas has a significant impact to increase the number of children school attendance. This result contradicts the fact that the children's parent left their children for working overseas for the continuation of their children's formal education.

Methodology

This study is based on cross-section data sourced from The Indonesian Family Life Survey (IFLS) fifth wave year RAND Corporation (2014). The study covers 19 of 33 provinces in Indonesia and considers valid to represent nationwide.

The Indonesian Family Life Survey (IFLS) is an on-going longitudinal survey in Indonesia. The sample is representative of about 83% of the Indonesian population and contains over 30,000 individuals living in 13 of the 27 provinces in the country. The map below identifies the 13 IFLS provinces in the IFLS.

The first wave of the IFLS (IFLS1) was conducted in 1993/94 by RAND in collaboration with Demographic Institute, University of Indonesia. IFLS2 and IFLS2+ were conducted in 1997 and 1998, respectively, by RAND in collaboration with UCLA and Demographic Institute, University of Indonesia. IFLS2+covered a 25% sub-sample of the IFLS households. IFLS3, which was fielded in 2000 and covered the full sample, was conducted by RAND in collaboration with the Population Research center, University of Gadjah Mada. The fourth wave of the IFLS (IFLS4), fielded in 2007/2008 covering the full sample, was conducted by RAND, the center for Population and Policy Studies (CPPS) of the University of Gadjah Mada and Survey METRE. The fifth wave of the IFLS (IFLS-5) was fielded in 2014-15. On the fifth wave, the observation is a total of 16.024 households.

The IFLS surveys and their procedures were properly reviewed and approved by IRBs (Institutional Review Boards) in the United States (at RAND) and in Indonesia at the University of Gadjah Mada (UGM) for IFLS3, IFLS4 and IFLS5, and earlier at the University of Indonesia (UI) for IFLS1 and IFLS2. Thus all requirements for consent for adults and children were met and approved by those IRBs before fieldwork could begin.

In 2012, Survey METER fielded a survey-based heavily on the RAND IFLS in the eastern provinces of Indonesia that were not in the RAND IFLS. Though it is not supported by RAND, the IFLS EAST is listed as a sister survey that may be of interest to RAND IFLS users.

It is assumed that each cash receiving household is receiving the exact amount as reported by them during the survey. The household expenditure is used as a proxy for income based on reason as follows, a first high degree of income data losses vis-à-vis expenditure. Second, the low correlation between income and expenditure data. Spearman correlation test is 0.56 indicating that there is a weak correlation between income and expenditure.

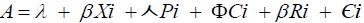

Education in this study is to observe several children age 13 to 18 years which is categorized as ages for mandatory primary and secondary school years. Using probit method that based on studies by Acosta, et al; (2008); Bucheli, et al; (2018) the model is formulated as below,

A representing probability of children school attendance and Xi is an individual vector (dummy of child age, gender, disabled child or not, living with a parent or not), Pi is parent characteristics (father's year of schooling, mother's year of schooling, working mother or not, the mother is head of the family or not), Ci is household characteristics (number of siblings, order of birth, per capita monthly expenditure without cash transfer, and whether household residing in the city or not) and Ri is cash transfer per capita per month.

Parent education is a binary variable of four categories: completed primary school, completed junior high school, completed senior high school and completed college or university degree.

Results and Discussion

In this study, we will see the comparison of household consumption patterns of the household receiving the cash transfer and household not receiving cash transfer.

Table 1 above mentioned explained that the household receiving cash transfer has a higher proportion of education expenditure vis-à-vis the household not receiving cash transfer. This is consistent with the study by Cabegin & Alba (2014); (Mahapatro, et al., 2015); Quisumbing & Minivan, (2010). The age of head of household receiving cash transfer is higher than that of not receiving cash transfer is indicating that the head of the household receiving transfer is no longer productive so it needs to be supported by cash transfer to fulfill their living cost. The table also showing a higher proportion of households residing in the cities vis-à-vis rural areas indicating that the easiness of banking access in the cities for receiving cash transfer from overseas. A higher proportion of the maximum year of schooling of the household member receiving cash indicating that the household member is well educated and has a higher income that enables them to overcome the cost of migrating overseas.

| Table 1 Statistical Descriptive of Household with Cash Transfer and Household without Cash Transfer |

||

| Variables | Receive Cash Transfer | Not receiving Cash Transfer |

| Proportion of food consumption | 0.488 | 0.512 |

| Proportion of education expenditure | 0.086 | 0.055 |

| Proportion of health expenditure | 0.021 | 0.019 |

| Proportion of housing expenditure | 0.135 | 0.136 |

| Proportion of other expenditure | 0.292 | 0.286 |

| Number of family member | 3.216 | 3.470 |

| Children age 0 to 17 years old | 0.986 | 1.199 |

| Adults age 18 t0 59 years old | 1.882 | 2.071 |

| Elderly age over 60 years old | 0.369 | 0.215 |

| Age of head of household | 43.070 | 41.425 |

| Head of male household | 0.781 | 0.899 |

| Maximum year of schooling of household member | 13.274 | 12.049 |

| Live in the cities | 0.752 | 0.669 |

| Number of observation | 2.509 | 4.257 |

Based on Table 2 abovementioned, there is a significant positive correlation between income without cash transfer and education of the head and member of the household. Meaning that the higher the education of the head and member of the household, the higher their income. The positive correlation of male head of household indicating that his income is higher than his female counterpart. The positive correlation of households residing in the urban/city indicating that their income is higher than their counterpart in the rural areas. The positive correlation of retiree/pensioner indicating that the cash transfer received by household serving at least one retiree/pensioner is higher than household without retiree/pensioner. So serving more retire/pensioners will significantly increase the cash transfer received by households they are regarded as unproductive and need to be supported financially. Household containing better household head/member education will receive a higher income. Based on these results, it is concluded that those who are migrating and transferring cash is not originated from the low-income category.

| Table 2 The Correlation Between Characteristics of Household and Income and Between Household and Cash Transfer | ||

| Variables (independent) | Income | Cash Transfer |

| Income | 0.0108*** | |

| Children | -0.0861*** | 0.002 |

| Household Size | -0.1085*** | -0.0161*** |

| Elderly | -0.129*** | 0.0166*** |

| Age head | -0.0139*** | -0.0117*** |

| Male head | 0.0686*** | -0.130*** |

| Primary school | 0.032 | 0.008 |

| Junior high school | 0.0587* | -0.008 |

| Senior high school | 0.258*** | 0.0347*** |

| College/University | 0.692*** | 0.0403*** |

| Urban/City | 0.210*** | 0.0160*** |

| Maximum Year of Education | 0.0380*** | |

| Retired/Pension | 0.0573*** | |

| Constant | 0.469*** | |

| Observations | ||

Source: Calculated based on IFLS-5.

The increase in monthly expenditure based on Table 3 abovementioned is having a positive correlation with education expenditure whereas other proportion of expenditure is not significant. For cash transfer as mentioned by Adams & Cuecuecha (2010), the increase in cash transfer is having a negative significant impact on housing investment whereas significant positive correlation is education expenditure and other utility expenditures such as transportation, durable goods, clothes, etc. Positive results on education expenditure are consistent with other previous studies in other countries whereas cash transfer is mostly utilized for investment including education (Cabegin & Alba, 2014). The result is consistent with the economic theory of permanent income hypothesis-cash transfer is regarded as transitory income. This type of income is not spent on today's consumption but spread along an individual lifetime. The transitory income tends to be used as investment or saving.

| Table 3 Correlation Between Expenditure Proportions and Cash Transfer and Income | |||||

| Variables | Proportion of Expenditure | ||||

| Food | Education | Health | Housing | Other Expense | |

| Cash transfer | -0.123 | 0.246*** | -0.0063*** | -0.272*** | 0.152* |

| Income | -0.037 | 0.0813*** | 0.00098 | -0.00715 | -0.001470 |

| Observations | 13402 | 13801 | 13802 | 13902 | 13502 |

Based on Table 4, Child school attendance is higher for non-receiving cash transfer as a child receiving cash transfer is less supervision from their parent working overseas and tend to left school to also working overseas in the future (Davis & Brazil, 2016) mentioned that the absence of father causing child loose motivation for school and receiving cash transfer will motivate them to become migrant worker too. Acosta et al., 2008 mentioned that cash transfer significantly and negatively affect school child attendance in a rural area in El Salvador, age of child receiving cash transfer is older than that now receiving cash transfer, no difference in a number of an individual between the male and female child, the mother who is also head of household tend to have more opportunity to receive cash transfer probably due to their husband is a migrant worker.

| Table 4 Descriptive Statistic of School Enrollment of Children age 13 to 18 Years Old | |||

| Variable | Cash Transfer | ||

| Not receiving | Receiving | T-stat | |

| School Attendance | 0.889 | 0.433 | 3.829* |

| Age | 15.345 | 15.478 | -7.281* |

| Male Child | 0.527 | 0.528 | -0.043 |

| Disable | 0.035 | 0.022 | 1.676 |

| Father Year of School | 8.657 | 8.458 | 2.543* |

| Mother Year of School | 8.293 | 7.734 | 4.579* |

| Working Mother | 0.437 | 0.532 | -0.447* |

| Mother (Head of HH) | 0.043 | 0.147 | -10.367* |

| Siblings | 0.825 | 0.865 | -1.157 |

| Eldest Child | 0.973 | 0.901 | 9.463* |

| Per capita expenditure (million Rupiah) | 1.140 | 1.012 | 0.722 |

| Residing in Urban/City | 0.597 | 0.554 | 2.679* |

| Residing in Own House | 0.842 | 0.877 | -3.281 |

| Observations | 3.121 | 1.731 | |

Table 5 indicated that school attendance is not dominated by children gender whereas disable child has more significant school attendance as probably that their issues have drawn more attention. Farther year of schooling has a significant and positive impact on increasing child school attendance. This may be due to 'patriarch culture' is still strong in which father is the ultimate decision-maker/ head in the household/family including in children education maters. Working mother and mother as head of house also have a positive significant impact on increasing children's school attendance. Therefore mother's role is also supporting financing and paid other household consumption, so that the children may focus on studying at school without the necessity to help parents make a living.

| Table 5 Correlation of Cash Transfer on Child age of 13 to 18 Years Old School Attendance | ||

| Variable | School Attendance (Probit regression) | |

| Coefficient | Standard Error | |

| Cash transfer (R) | -0.0888** | (0.041) |

| Individual Characteristics (X) | ||

| Age 16-18 years | -0.753*** | (0.041) |

| Male child | -0.047 | (0.059) |

| Disable | 0.633*** | (0.140) |

| Parent Characteristics (P) | ||

| |Father Year of Schooling | 0.0378*** | (0.008) |

| Mother Year of Schooling | 0.017 | (0.008) |

| Working Mother (yes= 1) | 0.576*** | (0.050) |

| Mother |Head of Household (HH) (Yes=1) | 0.144* | (0.084) |

| Household Characteristics (C) | ||

| Siblings | 0.0872*** | (0.033) |

| Eldest Child (Yes=1) | -0.015 | (0.044) |

| Living with parent | -0.758*** | (0.101) |

| Monthly expenditure | 0.009 | (0.032) |

| Living in the Urban/City (Yes=1) | 0.118** | (0.052) |

| Living in own house | -0.007 | (0.033) |

| Constant | 0.780*** | (0.342) |

| Observations | 4.542 | |

Source: Calculated based on IFLS-5

As found in previous topics, the household residing in an urban or city is able to increase children's school attendance. Cash transfer only is not sufficient without the availability of sufficient facilities and infrastructure. This finding is also consistent with the study by Febriany & Suryahadi (2012) and The World Bank (2011).

Conclusion

This research strives to have an in-depth analysis of the effect of cash transfer on child education in Indonesia. The study found that cash transfer has a significant impact on the increase in children's school attendance and education expenditure but the children originated from household receiving cash remittance tend to have lower school attendance vis-à-vis children originated from household not receiving the cash transfer. Referring to the permanent income hypothesis, up to a certain degree the cash transfer is categorized as transitory income. Cash transfer has affected the consumption pattern of the receiving household.

Based on the conclusion abovementioned, the policy recommendation to ensure the benefits derived from cash transfer is effective is by anticipating the migration effects when evaluating the effect of cash transfer on children's schooling attendance or when updating migration policies. The strong positive effect of cash transfer may overcome the negative effect of cash transfer on children's school attendance that eventually will increase cash transfer inflow and increase household investment on children's education. The investment in education can be only effective if followed by the availability of adequate supporting facilities such as basic infrastructure such as the availability of good schools and predominantly in the rural area. Therefore, the improvement and increasing of the number of facilities and infrastructure need to be continuously executed.

The shortcoming of this research is the unavailability of respondent data from the East Indonesia zone whereas it is known that part of migrant workers sending cash transfer is also residing and originated from East Indonesia Zone.

For future study, it is advised to add an interaction variable or utilizing longitudinal data to enable detecting the effect of cash transfer comprehensively.

References

- Acosta, P. (2006). Labor Supply, School Attendance, and Remittance from International Migration: The Case of El Zalvador (World Bank Policy Research Working Paper No.3903). Illinois.

- Acosta, P., Calderon, C., Fajnzylber, P., & Lopez, H. (2008). What is the Impact of International Remittances on Poverty and Inequality in Latin America? World Development, 36(1), 89-114.

- Adams, J.R., R.,& Cuecuecha, A.(2013). The Impact of Remittance and Investment and Poverty in Ghana. World Development, 50, 24-40.

- Bank Indonesia (2019). Statistik Ekonomi dan Keuangan Indonesia. www.bi.go.id.

- Basrowi, (2020). Impact of Migrant Workers to the Family Economic Status, Educational Level, and Child Health. Journal of Research in Educational Sciences, 10 (12), 18-23.

- Bastagli, F., Hage-Zanker, J., Harman, L., Barca, V., Sturge, G., Schmidt, T., & Pellareno, L.(2016). Cash transfers: What does the evidence say? A rigorous review of program impact and of the role of design and implementation features.

- Febriany, V., & Suryahadi, A. (2012). Lessons from Cash Transfer Programs in Indonesia. East Asia Forum, 6-7.

- BNP2TKI (National Agency for Placement and Protection of Indonesia Worker) (2015). Data of Placement and Protection of Indonesian Worker.

- Bougas, M.P. (2016). Analysis of the use of remittance allocation for children's education–case study of 10 districts in Malang Regency. Thesis (manuscript publication). Malang: FEB Universitas Brawijaya.

- Bucheli, J.R.R., Bohara, A.K., & Fontenla, M.(2018). The effect of income on general life satisfaction and dissatisfaction. Social Indicator Research, 95(1), 111-128.

- Cabegin, E.C.A., & Alba M. (2014). More or Less Consumption? The Effect of Remittances on Filipino Household Spending Behaviour. In H.A. Richard and A. Ahsan(Eds.), Managing International Migration for Development in East Asia. pp. 53-58.

- Davis, J., & Brazil, N. (2016). Disentangling fathers’ absences from household remittance in international migration: The case of educational attainment in Guatemala. International Journal of Educational Development, 50, 1-11.

- Hernandez, E., Sam, A.G., Gonzalez0Vega, C., &Chen, J.J. (2012). Does the insurance effect of public and private transfers favor financing deepening? Evidence from rural Nicaragua. Review of Development Finance, 2(1), 9-21. et al. (2012).

- Koechlin, V. & Leon, G. (2007). International Remittance and Income Inequality: An Empirical Investigation. Journal of Economics Policy Reform, 10(2), 123-141.

- Lucas, R.E.B., & Stark, O. (1985). Motivations to Remit: Evidence from Bostwana. Journal of Political Economy, 93(5), 901.

- Mahapatro, S.., Baile, A. James, K.S., & Hutter, I. (2015). Remittances and Household Expenditure Pattern in India and Selected States. Migration &Development, 2324 (September), 1-19.

- Maitra, P., Ray, R. (2003). The effect of transfer on household expenditure patterns and poverty in South Africa. Journal of Development Economics, 7(1), 23-49.

- McDade, Z. (2010). Are Conditions on Cash Transfers Necessary to Inmprove Rural Educations Outcomes? Evidence from Nicaragua. Most. Hernandez et al. (2012).

- Mckay, A., & & Deshingkar, P.(2014). Internal Remittance and Proverty: Further Evidence from Africa and Asia, (March), 1-25.

- Mckenzie, D. and Rapoport, H. (2006). Can migration reduce educational attainment? World Bank Policy Research Working Paper No.3952.

- Quisumbing, A., & Meniven, S.(2010). Moving Forward, Looking Back: the Impact of Migration and Remittances on Assets Consumptions, and Credit, 0388 (September 2015).

- Rand Corporation (2014), Indonesia's Family Life Survey-fifth wave (IFLS-5) Global Knowledge Partnership on Migration and Development (KNOMAD). (2018). Migration and Remittances, Recent Developments, and Outlook.

- Stark, O & Bloom., D.E.(1985). The New Economics of Labor Migration. American Economic Association The New Economics of Migration Author(s):Oded Stark and David E. Bloom Source: Seventh Annual Meeting of the American Economic Association (May, 1985), pp.173-178. Published by American Economic Association Stable URL,75(2), 173-178.

- Mirzosaid, Sultonov (2016). The Russian Financial Crisis and Workers’ Remittances to Tajikistan and the Kyrgyz Republic. Journal of Reviews on Global Economics, 5, 344-353.

- Taylor, J.E. (1999). The New Economics of Labor Migration and the Role of Remittances in the Migration process. International Migration, 37(1), 63-68.

- Yang, D., & Martinez, C.A. (2006). Remittances and poverty in migrants’ home areas: evidence from the Philippines. International Migration, Remittance and the Brain Drain, 81-121.