Research Article: 2022 Vol: 26 Issue: 4

Performance of Mutual Funds In India: Comparative Analysis of Small-Cap and Mid-Cap Mutual Funds

Prasad Kandi V.S., Koneru Lakshmaiah Education Foundation

Karanam Harshitha, Koneru Lakshmaiah Education Foundation

Atluri Dhyan, Koneru Lakshmaiah Education Foundation

Citation Information: V S Prasad Kandi., & Harshitha. K & Dhyan. A. (2022). Performance of mutual funds In India: Comparative analysis of small-cap and mid-cap mutual funds. Academy of Marketing Studies Journal, 26(4), 1-10.

Abstract

The performance evaluation of mutual funds in India, with a focus on small-cap and mid-cap funds, is the subject of this study. The performance of the selected mutual funds of India is analysed using a sample of 20 funds with ten each during a nine-year period, from 2013-2014 to 2021-2022. Statistical methods such as Beta, Standard deviation, Sharpe Ratio, Treynor's Ratio, and Jenson Alpha are utilized for performance evaluation as well as data analysis. We can conclude that, among other financial instruments, mutual funds offer the lowest risk and highest return to investors.

Keywords

Small-cap mutual funds, Midcap mutual funds, Performance evaluation, Sharpe Ratio, Treynor’s Ratio, Jenson Alpha, Risk and Return.

Introduction

A mutual fund is a belief that collects cash from numerous traders who proportion a not unusual place funding goal. Then, it invests the cash in equities, bonds, cash marketplace instruments, and different securities. Each investor owns units, which constitute a part of the holdings of the fund. The profits or profits generated from this collective funding is sent proportionately among the traders after deducting positive expenses, via way of means of calculating a scheme`s internet asset cost. Small-cap agencies are people who have a marketplace capitalization of much less than Rs. 5000 crores, those agencies are tremendously smaller in length and feature tremendous increase ability, the small-cap price range deliver character traders a part over the institutional investor. This is due to the fact institutional traders favour to buy large-cap shares because of their balance whilst traders hoping for competitive returns will spend money on those price range and medium cap agencies have a marketplace cap of Rs.5000 crores and much less than Rs. 20,000 crores and those small-cap, large-cap is calculated via way of means of multiplying marketplace capital without a of shares. Mid-cap shares generally tend to offer traders more increase ability than large-cap shares, however, with tons much less volatility and chance than small-cap shares and Midcap price range permit traders to preserve an assorted portfolio of those styles of shares without problems and cost-effectively.

Review of Literature

Maheswari (2021) By comparing the corporate and national sectors. It can be observed that the corporate sector proved to be more profitable than the national sector. This is achieved due to rapid development in the corporate sector, like rapid development in technology, introduction of new schemes, the introduction of new benefits to the customers, etc. Also, digitalization has helped the corporate sector to grow rapidly Mohan & Prasad (2016). Hence, we can conclude that investing in the corporate sector can ensure more returns for the investments made. And by investing in mutual funds, one can get optimum returns with low risk Lalshah (2021).

This examine explains the overall performance of the constant-earnings mutual price range. Here an instance of Canadian constant earnings price range earlier than for the duration of and after the 2008 international monetary disaster. It is found that once the recession, traders are cooking for approaches to diversify their systematic risks. In the case of the Canadian constant-earnings price range, extra returns and Dollar fund suggest that invested price range extensively underperformed inside the bond markets for the duration of the exam duration. Also, it's far found that the overall performance of the price range is extra relatable for the duration of the marketplace downtown. Also, the consequences suggest institutional traders did poorly for the duration of this monetary disaster, which also can be found in the case of risky structures in greenback funds. In the case of the greenback, funds want in constant-earnings price range, there's a fantastic fee for the duration of the recession, which indicates an influx of price. Hence, the research suggests the returns have been better during the pre- disaster duration. And at the same time, there's an Additionally inside the overall length of the holdings of Canadian earnings price range. Also, the research strengthens the view that flows have been better during the disaster duration than for the duration of the disaster. The correlation between the adjustments is inside the constant earnings price range. These 3 intervals aren't mentioned. Hence, institutional traders can use those findings to construct an allocation method for the duration of intervals of distress. At the same time, this research provides a clean photograph of the monetary surroundings and depicts a degree of variety in returns, assisting the enterprise of debt price range correct information Luminita et al. (2020)

This examine makes a focus on the younger monetary markets of relevant and eastern Europe with the focal point in the 3 decided on cases, particularly Romania, Slovakia, and Hungary. The capital markets of those international locations are studied are the overall performance and dangers related to the mutual finances in the inventory exchanges. The equipment to examine mutual fund assessment with inventory marketplace assessment is statistical documentation and statistical empirical research. This equipment provides an explanation for that there are similarities and variations within the overall performance threat courting for mutual finances and inventory exchanges among 3 international locations for the given duration. Also, this research facilitates contributing to present understanding of younger and growing monetary markets, which, in any other case, are much less studied. Hence, via, we will finish those mutual finances are overall performance inventory markets, particularly at some point of economically tough periods. Funds directors can use the above-derived end at the same time as dividing their property into portfolios and advertising their finances to investors Abdelkadev etal. (2020)

This examine investigates empirically the overall performance of outstanding multi capital and large-cap budget in India for a duration of five years from 2013 to 2018. This research paper shows that mutual fund schemes below the above-stated classes have generated returns over the duration with affordable risk. Hence, we are able to properly finish that multi and large-capital budget is a very good funding choice for investors. The customers of those empirical findings are investors, traders, speculators, and administrators of mutual budgets. These effects may be utilized by future researchers to increase and radiate their research Shivam (2021) This research looks at equity mutual funds in India with varying fund earnings (Deepa & Ramasubbian, 2019). It primarily focuses on the risk and returns performance of chosen equity funds. The goal is to examine the financial performance of the schemes using statistical metrics such as Jenson, alpha, and standard deviation, among others. This research was conducted among 15 funds out of which 10 funds performed well despite the highly volatile market. This research concluded that risk ratios of funds are vital before investing as it helps investors to make an informed investment decision. Hence, we can conclude that parameters like Sharpe ratio, Jenson Alpha, and beta should be considered while funding in mutual funds other than NAV and overall returns so that reliable performance of mutual funds can be ensured.

Ratisgh & Shruti (2017) This study explains that investors can certainly get double-digit returns if they invest in large and midcap funds for a longer period. In the case of midcap funds, one can achieve higher returns with the apparent risk associated with it. In the case of small investors who are interested in funding in mutual funds to achieve high returns, they should hold a beneficial ratio of mutual cap funds of both large and mid-cap in a portfolio. A mix of each price range can create balanced and optimized profits and well-creation over a period Derbali et al. (2020).

Need of The Study

Mutual fund institutions play a dynamic role in economic development. A well-established mutual fund is a key factor for economic growth in many developed countries. By analysing various mutual funds performances, it is to understand in detail the factors that help a particular mutual fund to get a greater return as compared to others. Also, by performance

analysis, investors can know the market trends and provide various suggestions to investors regarding making investments in different funds. Also, by analysing performance of various mutual funds in small-cap and mid-cap, we can draw conclusions about the markets that have more scope for profits and returns. Later, investors can also judge the various risks that can be associated with investors in a particular mutual fund. Hence, by performance analysis of various mutual funds in India, investors can make an informed decision by knowing the current prices, risk, and return of funds.

Objective

To analyse comparative performance of the selected mutual funds of small-cap and mid-cap in India majorly on risk and return basis.

Methodology

The secondary data is primarily used in the study. Some of the sources of such data include articles, books, reports, and websites. In this study, data for a period of nine years, i.e., 2013- 14 to 2021- 22 is taken and performance is evaluated for the selected mutual funds of small-cap and mid-cap in India. In this study, we have taken data from 10 small-cap funds and 10 mid-cap funds of mutual funds. The data of the above-selected companies includes the data about all the parameters selected for evaluating performance is evaluated for the selected mutual funds of small-cap and mid-cap in India. The data of the above-selected companies includes the data about all the parameters selected for evaluating the performance of small-cap and mid cap mutual funds with the evaluation methods of beta, standard deviation Treynor’s ratio, Sharpe ratio, and Jenson alpha and the data is collected and summarize by analysis with the help of risk -return grid.

Small-Cap Mutual Fund

Small-Cap Funds invest in all firms with a market capitalization of less than 250 million. These companies` stocks might potentially double or even triple in value in a very short period of time. To ensure that you do not miss out on the gains, it is recommended that you include a small portion of the top small-cap mutual funds in your investment portfolio. When it involves small-cap funds, what actually subjects are how they carry out in enduring markets or while markets are in a downturn. In a downturn, the best small-cap fund managers stand out. Investing in small-cap shares is a process that is perfected by fund managers over time.

Mid Cap Mutual Fund

Mid cap budgets are a sort of fairness mutual budget that invests inside the inventory of mid-sized groups. According to the norms, groups which might be ranked from a hundred and one onwards until 250, primarily based totally on their marketplace capitalization, are classified as mid-cap groups.

A multi-cap fund is an assorted fairness fund which invests in groups of all sizes. The portfolio blend in a multi-cap fund can also additionally consist of a few blue-chip groups at the side of mid groups or even small cap groups. Whereas mid-cap budgets are simply confined to making an investment in mid-cap groups. Mid Cap Funds typically generally tend to supply marketplace-beating returns over a protracted term. However, in a brief to medium period, they may underperform. So, buyers want to be organized to invest in the event that they need to gain from this fund category.

Relative Performance of the MIDCAP Mutual Funds

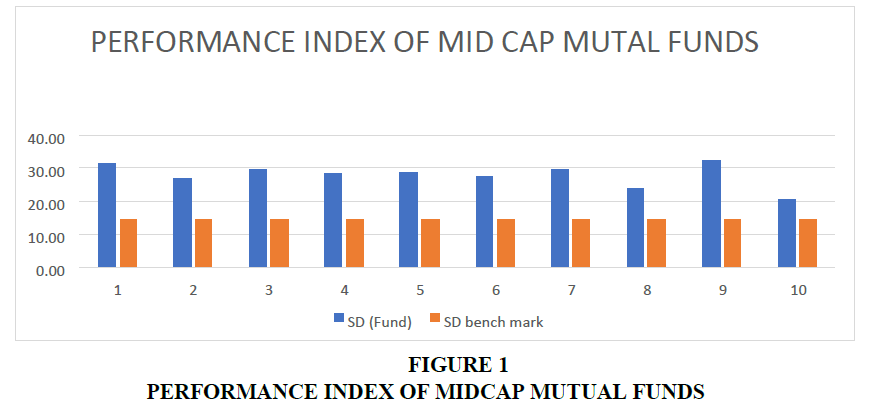

From the above analysis, we can observe the performance of various mid-cap funds that are selected for the study. The returns are calculated yearly using risk-adjusted measures such as mean, standard deviation, beta, Sharpe ratio, Treynor ratio, and Jensen's alpha, with BSE-200 as the benchmark for all the chosen mutual funds, as shown in Table-1. The figure 1 represents the performance of all such funds in a bar graph.

| Table 1 Performance Of Mid-Cap Mutual Funds |

|||||||

|---|---|---|---|---|---|---|---|

| S. No | Name of Mutual Fund | Mean Return (%) |

SD (Fund) |

Treynor's | Sharpe | Jensen | Rank |

| 1 | Edelweiss Mid Cap Fund | 24.54 | 31.55 | 10.04 | 0.59 | 4.07 | 1 |

| 2 | HDFC Midcap Opportunities Fund | 21.17 | 26.84 | 10.36 | 0.59 | 3.82 | 8 |

| 3 | ICICI Prudential Midcap Fund | 21.55 | 29.73 | 9.18 | 0.52 | 2.27 | 7 |

| 4 | Invesco India Midcap Fund | 23.65 | 28.18 | 10.72 | 0.63 | 4.74 | 3 |

| 5 | L&T Midcap Fund | 21.78 | 28.69 | 9.84 | 0.55 | 3.21 | 6 |

| 6 | SBI Magnum Midcap Fund | 22.46 | 27.58 | 11.05 | 0.60 | 4.79 | 5 |

| 7 | Tata Midcap Growth Fund | 22.99 | 29.93 | 9.82 | 0.57 | 3.43 | 4 |

| 8 | Taurus Discovery Midcap Fund | 19.08 | 24.09 | 9.23 | 0.54 | 1.97 | 10 |

| 9 | UTI Midcap Fund | 23.82 | 32.28 | 9.91 | 0.55 | 3.73 | 2 |

| 10 | Quant Midcap Fund | 18.21 | 20.67 | 12.85 | 0.59 | 4.76 | 9 |

| BSE 200 | 13.84 | 14.41 | |||||

Source: Author computation.

From the above analysis, we can consider the benchmark comparison as a significant tool for measuring performance of various mutual funds. It also indicates the efficiency of fund managers in producing better results for their respective portfolios in comparison to the existing market portfolios. By closely observing the above table we can derive a conclusion EDELWEISS Mid Cap Fund (G) (24.54 percent), INVESCO India Midcap Fund (23.65 percent), and UTI Mid Cap Fund (12.24 percent) are the top three Medium Cap Mutual Funds outperformed according to the mean values and funds which are least two is TAURUS Discovery Midcap Fund (19.08 percent) and QUANT Midcap Fund (18.21 percent) underperformed. Further the table shows mean values of all medium cap funds are higher than the benchmark value of consisting 13.84 percent.

The tools that used to measure difference between individual mutual funds from the average expected return calculated from certain period is the standard deviation. From table 1 we can observe that UTI Midcap Fund stood above all the existing mutual funds with the highest value of 32.28(SD). Also, the earlier discussed mutual fund with the highest SD shows that the mutual fund is highly volatile and also earns a high return per unit of risk. The second highest EDELWEISS Mid Cap Fund (G), (31.55). TATA Midcap Growth Fund (29.93), L&T MIDCAP FUND (28.69). The mutual funds of the standard deviation are all higher than the benchmark values of 14.41. This indicates the relatively high risk and high volatility and the higher return per unit of risk. Also, the Standard Deviation is a tool that tells us how far the mutual fund portfolio's performance differs from expected Results, based on the fund's past performances. From data, we can say that the companies are of high risk as their expected return is largely varying with the standard deviation.

Treynor's ratio usually tells how much a particular mutual fund earns above the risk-free funds that are exiting the market. from the above table, we can see that QUANT Mid Cap Funds (12.85) which is the highest among the companies says that this fund gives more return when invested than the risk-free return bonds in the market. And followed by SBI Magnum Mid Cap Fund (11.05), INVESCO India Mid Cap Fund (10.72). thus, we can say from the above table that all companies are performing well in terms of returns as compared to risk-free bonds in the market whereas ICICI Prudential Mid Cap Fund (9.18) is the least performing among the companies and investors are less likely to invest in such companies as their return is lesser when compared.

Sharpe Ratio usually tells how much an investor can earn by investing in the higher-risk mutual fund. From the above table, we can see that INVESCO India Mid Cap Fund (0.63) has highest Sharpe ratio which implies that this company gives investors a higher return when a higher risk is taken by the investor. This is followed by SBI Magnum Mid Cap Fund (0.60) and so on. Whereas ICICI Prudential Midcap Fund stood last among companies which implies that this company offers less return for the risk taken by the investor in that company.

According to rank allocation, top three ranks are EDELWEISS Mid Cap Fund (G), UTI Midcap Fund, INVESCO India Midcap Fund. Also, some mutual funds which are ranked the least have outperformed the market but comparatively less performance than the above companies. Figure 1 shows a bar diagram that indicates the performance of various midcap mutual funds. By taking into consideration all the parameters of mutual funds like Jenson alpha,

Sharpe ratio and Treynor’s ratio and their average we can observe that EDELWEISS Mid Cap Fund (G), scored highest. By this, we can conclude that companies whose ratios are significantly more in almost all parameters should be considered while making investment decisions.

Relative Performance of the Small-Cap Mutual Funds

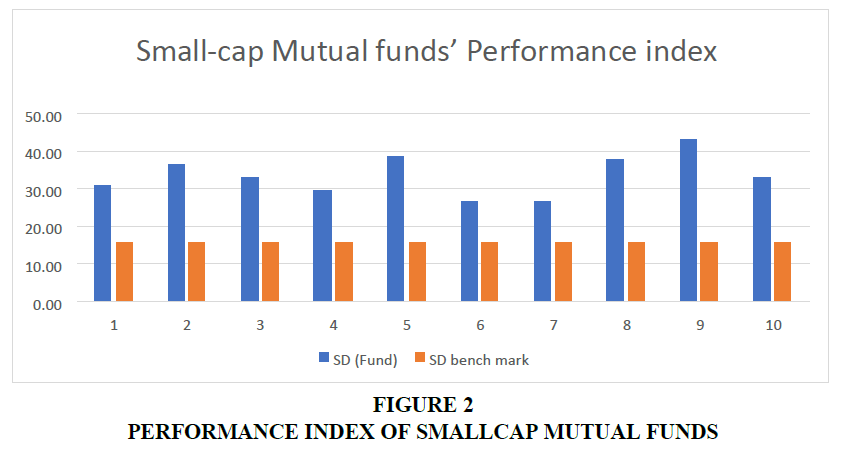

We can see the performance of numerous small-cap mutual funds that were chosen for the study of this paper from the above analysis. Returns are calculated annually for all the selected mutual funds using descriptive statistics and risk-adjusted measures such as mean, beta, standard deviation, Treynor ratio, Sharpe ratio, and Jensen's alpha, with the BSE-500 as the benchmark. In a bar graph, figure 2 depicts the performance of all such funds.

From the above analysis, we can consider the benchmark comparison as a significant tool for measuring the performance of various small-cap mutual funds. It also indicates the efficiency of fund managers in producing better results for their respective portfolios in comparison to the existing market portfolios. By closely observing the above table we can derive a conclusion that NIPPON India Small Cap Fund (G) (29.9 6per cent), DSP Small Cap Fund (26.60 percent), and KOTAK Small Cap Fund (25.06 per cent) are the top three performers from the Small Cap Mutual Funds whose performance as per mean values is highest among the selected companies. The last least funds are ICICI Prudential Small Cap Fund (20.05 percent) and ICICI Prudential Index Fund (19.98 percent). The above table also explains the mean values of all medium cap funds are higher than the benchmark value of 14.03 percent.

One of the tools that are used to measure variation between mutual funds from the average expected return calculated over a certain period is the standard deviation. From table 2 we can observe that SUNDARAM Small Cap Fund really performed well in all the schemes with the highest value of 43.11(SD). Also, the earlier discussed mutual fund with the highest SD shows that the mutual fund is highly volatile and earns a high return per unit of risk. The HSBC Small Cap Equity Fund (G) ranks second (38.59). DSP Small-Cap Fund (37.93), Nippon India Small-Cap Fund (36.35). The index fund standard deviations are all larger than the benchmark value of 14.41. This reflects the schemes' comparatively high risk and volatility, as well as their higher return per unit of risk. In other words, a standard deviation is a metric that shows how far your mutual fund portfolio's return deviates from the predicted return based on the fund's past performance (Agarwal & Mirza, 2017). From the data, we can say that the companies are of high risk as their expected return is largely varying with the standard deviation.

| Table 2 Relative Performance Of Small-Cap Mutual Funds |

|||||||

|---|---|---|---|---|---|---|---|

| S. No | Name of Mutual Fund | Mean Return (%) | SD (Fund) | Treynor's | Sharpe | Jensen | Rank |

| 1 | Aditya Birla Sun Life Small Cap Fund | 20.93 | 30.8 | 9.2 | 0.48 | 1.89 | 8 |

| 2 | Dsp Small Cap Fund | 26.6 | 36.35 | 11.44 | 0.57 | 6.13 | 2 |

| 3 | Franklin India Small Cap Fund | 23.85 | 32.81 | 10.76 | 0.54 | 4.52 | 5 |

| 4 | Hdfc Small Cap Fund | 22.21 | 29.32 | 10.61 | 0.55 | 3.94 | 7 |

| 5 | Hsbc Small Cap Equity Fund | 22.82 | 38.59 | 8.17 | 0.44 | 0.27 | 6 |

| 6 | Icici Prudential Small Cap Fund | 20.05 | 26.55 | 10.19 | 0.53 | 2.98 | 9 |

| 7 | Icici Prudential Index Fund | 19.98 | 26.49 | 10.07 | 0.53 | 2.83 | 10 |

| 8 | Nippon India Small Cap Fund | 29.96 | 37.93 | 12.01 | 0.63 | 7.94 | 1 |

| 9 | Sundaram Small Cap Fund | 23.39 | 43.11 | 7.72 | 0.4 | -0.71 | 4 |

| 10 | Kotak Small Cap Fund | 25.06 | 32.84 | 11.13 | 0.58 | 5.3 | 3 |

| BSE 500 14.03 15.75 | |||||||

Treynor's ratio usually tells how much a particular mutual fund earns above the risk-free funds that are exiting the market. from the above table, we can see that NIPPON India Small Cap Fund (12.01) which is the highest among the companies says that this fund gives more return when invested than the risk-free return bonds in the market. And followed by DSP Small Cap Fund (11.44), KOTAK Small Cap Fund (11.13). Thus, we can say from the above table that all companies are performing well in terms of returns as compared to risk-free bonds in the market whereas SUNDARAM Small Cap Fund (7.72) is the least performing among the companies and investors are less likely to invest in such companies as their return is lesser when compared.

Sharpe ratio usually tells how much an investor can earn more by investing in the higher-risk mutual fund. From the above table, we can see that NIPPON India Small Cap Fund (0.63) has the highest Sharpe ratio which implies that this company gives investors a higher return when higher risk is taken by the investor. This is followed by KOTAK Small Cap Fund (0.58) and so on. Whereas SUNDARAM Small Cap Fund (0.40) stood last among companies which imply that this company offers less return for the risk taken by the investor in that company Muralidhar, (2021).

According to rank allocation average method, the top three ranks are NIPPON India Small Cap Fund (G), DSP Small Cap Fund, KOTAK Small Cap Fund. Also, some mutual funds which are ranked the least have outperformed the market but comparatively less performance than the above companies. Figure 2 shows a bar diagram that indicates the performance of various small-cap mutual funds Shalini & Dauly (2012).

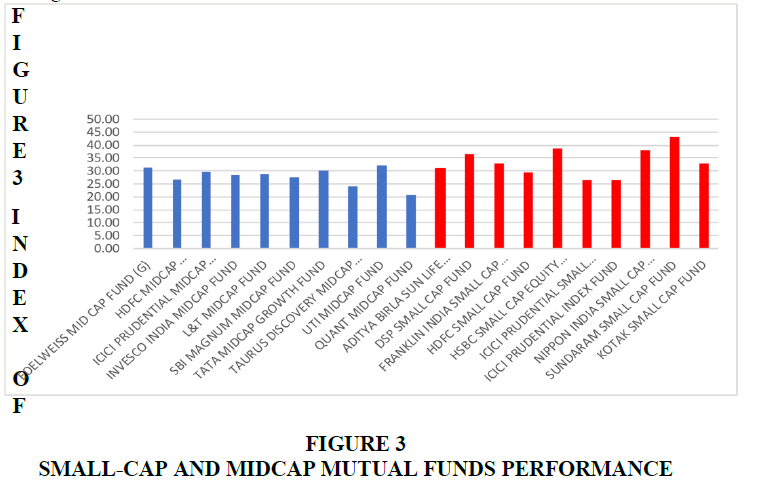

By taking into consideration all the parameters of mutual funds like Jenson alpha, Sharpe ratio, and Treynor’s ratio and their average we can observe that NIPPON India Small Cap Fund (G), scored highest. By this, we can conclude that funds whose ratios are significantly more in almost all parameters should be considered while making investment decisions Figure 3.

By observing the performance index of small-cap and mid-cap mutual funds we can conclude that the first top 3 categories are undertaken by the small-cap mutual funds.

Risk Return Grid of Small-Cap and Mid Cap Mutual Funds

Table 3 displays the Risk-Return Grid of Selected Sample Funds 20, i.e., Mid Cap Funds 10, Small Cap Funds, in which 0 funds are in the high risk/high return group and all 20 funds are in the high return/low risk, low return/low risk, and low return/high-risk categories, respectively. Among the risk-takers, those who invest in mutual funds are risk averters. The most ideal fund is the fund that gives a higher return but lesser risk to choose for an investor investing in the mutual funds. It is found that twenty funds (Small-cap and Midcap funds) fall under this category, i.e., in the second quadrant Prasad & Prasad (2012).

| Table 3 Risk Return Grid Of Small-Cap And Mid Cap Mutual Funds |

|||

|---|---|---|---|

| Return | High | II | I |

| Rp = Rm, dp < dm Low Risk and High return (20) Nippon India small-cap fund, dsp small-cap fund, Kotak small-cap fund, Sundaram small-cap fund, franklin India small-cap fund, Edelweiss mid-cap fund, HSBC small-cap equity fund, UTI mid-cap fund, Invesco India mid-cap fund, Tata midcap fund, Hdfc small-cap fund, SBI magnum midcap fund, L&T midcap fund, Aditya Birla SunLife midcap fund, ICICI prudential midcap fund, HDFC midcap opportunities fund, ICICI prudential index fund, Quant midcap fund, Taurus discovery midcap fund. |

Rp = Rm, dp > dm High risk and High Return (0) |

||

| Low | Rp < Rm, dp < dm Low Risk and Low Return (0) |

Rp = Rm, dp < dm High Risk and Low Return (0) |

|

| III | IV | ||

| Low | High | ||

| Risk | |||

Based on the study, it can be determined that all mutual funds are low risk and high return. This means that small-cap and mid-cap mutual funds have outperformed the market in terms of returns. And no funds have underperformed whether it is a small-cap or mid-cap funds of mutual funds but by observing the first top 5 categories placed are small-cap mutual funds. Hence, we can say that small-cap funds are comparatively profitable in both the long term and short term. Also, the returns earned by small-cap mutual funds are higher than the mid-cap mutual funds Tripathi & Japee (2020).

Conclusion

Based on the complete analysis, we can conclude that all the small-cap and mid-cap mutual funds carry minimal risk and a stable high returns assurance by outperforming a good performance and providing growth. The intermediaries in the investment business i.e., Fund houses indirectly act as a bridge between the public and private corporate sectors hence, these are significant engines for mobilizing resources between common investors and corporates. The main advantages of mutual funds are that unlike a lot of other investment vehicles, it helps you create a diversified and balanced portfolio.

Hence, we can safely conclude that by the comparative index of both mutual funds of mid-cap and small-cap, the small-cap mutual funds are a good investment option for the investors who are attracting huge investment interest and exponential growth potential.

References

Agarwal, S., & Mirza, N. (2017). A study on the risk-adjusted performance of mutual funds industry in India.Review of Innovation and Competitiveness: A Journal of Economic and Social Research,3(1), 75-94.

Indexed at, Google Scholar, Cross Ref

Deepa, M. P., & Ramasubbian, H. (2019). A Comparative Study on Performance of Equity Mutual Funds.Asian Journal of Management,10(3), 229-231.

Indexed at, Google Scholar, Cross Ref

Derbali, A., Elnagar, A. K., Jamel, L., & Ltaifa, M. B. (2020). Performance of Mutual Funds: A Comparative Study of Prominent Multi Capital and Large Capital Funds.Management & Economics Research Journal,2(4), 27-44.

Luminita, N., Florentin, G.T., & Armenia, A. (2020) - Performance risk analysis on mutual funds versus stock exchanges in young financial markets, Journal of International Studies, 13(1), 279-294.

Maheswari, Y. (2021). Performance evaluation of select mutual funds in india. Available at SSRN 3959872.

Indexed at, Google Scholar, Cross Ref

Mohan, V. K., & Prasad, K. S. (2016) Performance Of Exchange Traded Funds A Comparative Analysis Of Index Etfs And Index Funds In India.

Shalini, G., & Dauly, B. (2013) - A study on mutual funds in India (2013), International Journal of Scientific & Engineering Research, 4,5, May-2013.

Muralidhar, D.D K. (2021). A Study on Operating Performance Evaluation of ICICI, HDFC and Nippon India Mutual Funds. Nveo-natural volatiles & essential oils Journal| NVEO, 5753-5764.

Prasad, K. V., & Prasad, C. S. V. (2012). Performance of selected mutual funds (A comparative study on public and private balanced and sector funds).Asian Journal of Research in Social Sciences and Humanities,2(9), 267-278.

Tripathi, S., & Japee, D. G. P. (2020). Performance Evaluation of Selected Equity Mutual Funds in India. GAP GYAN-A Global Journal of Social Sciences.

Received: 10-May-2022, Manuscript No. AMSJ-22-11906; Editor assigned: 11-May-2022, PreQC No. AMSJ-22-11906(PQ); Reviewed: 25-May-2022, QC No. AMSJ-22-11906; Revised: 27-May-2022, Manuscript No. AMSJ-22-11906(R); Published: 28-May-2022