Research Article: 2022 Vol: 26 Issue: 5S

Post-Crisis Management: Covid-19, Public Policy& Impact on the Corporate Strategy

Venkateshwara S. Gajavelli, Institute of Management Technology, Nagpur

Citation Information: Venkateshwara, S.G. (2022). Post-crisis management covid-19, public policy& impact on the corporate strategy. Academy of Marketing Studies Journal, 26(S5),1-10.

Abstract

The Coronavirus within a short span of time has done enough to disrupt the global supply chains, investor sentiments, financial markets, and economic activity on a massive scale. The global economy of the entire world has been hamstrung and lies in tatters. Further, hundreds of millions of workers are being locked up in homes and face pay cuts and lay-offs if there is no respite in the fear pandemic. The viral wave moving across continents taking a massive toll as governments fight an unfamiliar and unanticipated fight against the virus, companies shutting operations, and normal life coming to a screeching halt. The COVID-19 crisis is catastrophic as we are unequipped to deal with the magnitude of the challenges thrown at us and severe time constraints to get equipped with the medical machinery to fight it. The baffled governments globally initiated rapid action but failed to have any bearing on the financial markets or ameliorate the situation in any way, except the lock-downs that potentially scuttle any efforts in ramping up capacities to effectively tackle the lethal virus, apart from colossal economic and societal costs. This exploratory study attempts to review and evaluate the unusual virus to humankind, its economic and policy effects, and suggest some practical policy prescriptions to tide over the public health-cum-economic crisis. The first and second sections bring out the uniqueness of the COVID19-triggered health emergency and accordingly set the objectives of the study and methods used. The third and fourth sections evaluate the socio-economic and financial fallout of the crisis and the unprecedented fiscal-monetary stimulus strategies resorted to globally. The fifth section specifically focuses on the highly populated Indian economy and the visionary ways of the largest ever fiscal-monetary impetus in the backdrop of a potentially high fiscal deficits scenario. The sixth section evaluates the impact on the Corporate Sector and success tactics of the FMCG & Pharmaceutical sectors. The last section essentially weighs various policy actions, impacts, and a few recommendations for policy effectiveness, besides conclusions.

Keywords

Pandemic, Socio-Economic crisis, Governance, Fiscal-monetary Mix, Macroeconomic Policy Response.

Introduction

‘Think the unthinkable’ has become a new mantra in organizations across the 21st-century essentials of management and presently the world has a real problem in hand to test its mettle. The Coronavirus or Covid-19 within a short span of about three months has done enough to disrupt the global supply chains, investor sentiments, financial markets, and the economic activity on a massive scale and in a manner unparalleled in global financial history. The global economy of the entire world has been hamstrung and lies in tatters. Global stock market indices jumping off the skyscrapers and the mountain cliffs. No one is traveling anywhere, planes are stranded, and cruise ships have become floating junk in sea waters. And not to mention hundreds of millions of workers being locked up in homes and face pay cuts and lay-offs if there is no respite in the fear pandemic. The viral wave moving across continents taking a massive toll as governments fight an unfamiliar and unanticipated war against the virus, companies shutting operations, and normal life coming to a screeching halt Alpert (2021).

The clue lies in untested waters and the problem mainly being biological in nature rather than the predictable man-made disasters like the Credit Crisis of 1772, the Great Depression of the 1930s, the OPEC Oil Price Shock of 1973, the Black Monday of 1987, the Asian Crisis of 1997 and the recent period’s Global Financial Crisis (GFC) of 2007-09 Belke (2018). The Covid-19 crisis is catastrophic as we are unequipped to deal with the magnitude of the challenges thrown at us and severe time constraints to get equipped with the medical machinery to fight it. The baffled governments globally initiated rapid action but failed to have any bearing on the financial markets or ameliorate the situation in any way, except the lock-downs that potentially scuttle any efforts in ramping up capacities to effectively tackle the lethal virus, apart from colossal economic and societal costs Belke (2018).

Objectives of Study& Methodology

The present study has a specific set of objectives as delineated below:

1. To understand the nature of the global pandemic crisis – why is the virus issue so unique?

2. To examine the macroeconomic effects of the pandemic crisis, and evaluate the size and rationale of various fiscal and monetary policy responses on the part of governments of various affected economies.

3. To analyze the impact of the crisis on corporate marketing strategies - the FMCG and pharmaceutical sectors.

4. To suggest some practical and effective policy actions both at the economy-level and industry level to tide over the post-pandemic crisis.

As delineated in the above objectives, the study gathered information from secondary sources, focusing more on the initial impact of the pandemic from 2020 to 2021. The analysis is confined to the first round of government stimulus. An effort is made to systematically assess the policy responses and their efficacy in achieving the targeted policy goals and the tradeoff associated with them. Further, to understand how such stimuli impact sectors and their market growth?

Covid-19 Crisis: Economic, Financial, and Societal Fallout

The spreading new virus could make the world economy shrink during Q1 of 2020 for the first time since the Global Financial Crisis of 2007 and the looming recession can be as bad as or even worse, according to various international agencies and think tanks including International Monetary Fund(IMF). Further, the Organization for Economic Cooperation and Development (OECD) predicts that the international economy is still estimated to grow overall during 2020 and possibly rebound in 2021. However, OECD lowered its forecasts for global growth in 2020 by half a percent and cautioned this figure could go as low as 1.5 percent if the virus lasts long and spreads widely Masciandaro et al. (2021).

Apart from the considerable human calamity the virus has wrought, with reported deaths crossing 35000 and infected reaching the 750000 mark worldwide, the global economic prospects remain subdued and turned very complex to ascertain. The last time the global economy declined on a quarter-on-quarter basis was at the end of 2008 and in 2009 when a shock to the global financial system and the melt-down caused mayhem for businesses across the world triggering corporate bankruptcies including that of 165 years old Layman Brothers, mass lay-offs and job losses Gajavelli & Gargi (2020).

The second-largest market China’s reduced production is hitting Asian economies particularly hard including India and more so the businesses around the world that depend on this global manufacturing behemoth. The impact of Covid-19 is bound to be much higher than past outbreaks of Severe Acute Respiratory Syndrome (SARS-CoV) with a high fatality rate that affected almost 17 nations and mostly mainland China and Hong Kong. Because the global economy now has become substantially inter-connected and obviously China plays a far bigger role in global GDP, merchandise, tourism, and commodity markets including those of metals and demand for crude oil globally.

The EU estimates show that the virus has already cost Europe billions in Euros this year in tourism revenue alone mainly due to the drop in the number of Chinese tourists. Further, given the severity of the impact in Italy, France, Spain, the UK, and the rest of Europe and most importantly now the U.S. and even India leading the worst affected, it’s quite possible things can only get worse for the global economy and financial market stability.

India Inc., with more than 2500 Covid-19 cases with deaths reaching 50 and a 21-day lockdown is already feeling the heat with production disruptions in many sectors, loss of income, and a fall in exports as international borders shut down. Now experts say that expectations of shallow recovery in 2020 from the 2019 slow-down have been now dashed. We only bet our hopes on the recent Union Government and RBI stimulus of record booster to salvage the economic and social fall-out.

Massive Welfare Stimulus Globally in the Last One-and-Half Century

The response from the leadership across the continents – Europe, USA, China, India, and the whole host of affected countries around the globe – has been remarkably proactive running into tens of trillions of dollars trying to shore up markets and medical infrastructure, spending capacity and to help supports the worst affected sectors, industries and MSMEs.

No doubt, the economy, and businesses can be worked on after dealing with the virus-related health crisis in a systematic manner. Economies and market sentiment recover given India’s strong macroeconomic fundamentals, once we start gradually gaining control of the virus. Certainly, it is not social distancing or isolation that is needed, but it is to be understood as safe physical distance and social cooperation for everyone’s survival and hygiene of the highest order as we need to maintain the societal fabric and bond intact to fight the virus effectively. But till the time 12 to 18 months away to have a vaccine arsenal in our medical ammunition machinery to fight the virus, we need to work with aggressive positive spirits and the resolve of utmost order to follow the directives that come from Government and health experts more importantly, social conscience and collective accountability.

An Assessment of India’s Fiscal and Monetary Policy Responses

Given the magnitude of the problem in a country of 1.3 billion people, the response of the government has to be manifold. These measures obviously warrant discretionary steps that go beyond the mounting debts and fears of fiscal deficits (Fiscal Responsibility and Budget Management Act, 2003) There is also growing evidence that experts now strongly feel the Reserve Bank of India (RBI) has to go for extraordinary financing of the deficits to face the unprecedented macroeconomic uncertainty. There are ways in which an optimal level of “seigniorage” can be arrived at without experiencing harmful inflationary pressures. The money financing part of the fiscal program (MFFP) is a variant of a helicopter drop, which is an expansionary fiscal policy that is financed by an increase in the economy’s money supply (Buiter 2014; Bernanke 2016; Aggarwal and Chakraborty 2019) Table 1 below.

| Table 1 Covid-19 Fiscal Package 2020: an Illustrative Mapping with Demand for Grants (Rs. in Crores) | ||||||||

| Sl. no | Scheme/ Program Beneficiary | Ministry / Department | 2018 Actual |

2019 Budget |

2019 Revised |

2020 Budget |

Relief Package Est. (Crores) | Comments |

| 1 | PM Jan DhanYojana (cash transfers to savings account of women) | Ministry of Finance -Dept. of Financial Services | 0 | 0.01 | 0 | 0.01 | 30,600 | |

| 2 | Ujjwala (clean fuel to low income households - LPG subsidy | Petroleum and Natural Gas | 3,200 | 2,724 | 3,724 | 1,118 | 13,000 | |

| 3 | Cash transfers to Senior Citizens, Widows & Physically Handicapped | - | - | - | - | - | 3,000 | |

| 4 | Food subsidy | Consumer Affairs, Food and Public Distribution | 1,01,327 | 1,84,220 | 1,08,688 | 1,15,569 | NA | Cost of three months off-take of Cereals and Pulses |

| 5 | PM-KISAN(Income support transfer to farmers) | Agriculture& farmers’ welfare | 1,241 | 75,000 | 54,370 | 75,000 | 17,500 | Only front-loading of expenditure |

| 6 | NREGA (employment guarantee scheme) | Rural Development | 61,815 | 60,000 | 71,001 | 61,500 | NA | No Additional Expenditure now |

| 7 | Self Help Group - Loans | NA | Banks expected to lend more | |||||

| 8 | Employer’s Provident Fund (EPF) | EPF regulation to be amended to allow higher non-refundable withdrawal | NA | No expenditure | ||||

| 9 | Organized Sector-PF 24% of salary | Govt. will pay 24% of salary to EPF for next 3 months, of those with salary less than 15K working in establishments with less than 100 employees | NA | Involves expenditure | ||||

| 10 | Health Insurance | Insurance cover of 50 Lakh for govt. health workers fighting Covid19. | NA | Involves expenditure for paying premium | ||||

| 11 | Construction workers | Building and Construction Workers Welfare Act | 31,000 | 31,000 | (max if States spend whole) | |||

| 12 | District Mineral Fund(DMF) | National Mineral Policy/Act | 35,925 | 35,925 | (max if States spend whole) | |||

| Total | 1,70,000 | |||||||

Similarly, Central Banks across the world are injecting billions of liquidity as a way to maintain demand by keeping the cost of funds attractive to borrowers and through various monetary incentives involving various sectors including those of the worst affected SME segment Tables 2 & 3.

| Table 2 Covid-19 Monetary Policy Response in India, 2020 | ||

| Policy Response Policy Change Effect / Impact | ||

| Policy Rate | Repo rate reduced to 4.4 by .75 bps Reverse Repo rate reduced by .9 bps |

With an inflation target at 4%, India is close to a zero interest rate. |

| Liquidity | 1. Cash Reserve Ratio (CRR) cut by 100 bps to 3 2. Targeted Long Term Repo Operations (TLTRO) of 3 years tenor 3. Marginal Standing Facility (MSF) increased to 3% of Statutory Liquidity Ratio (SLR) |

Infusion of 3.74 Lakh Crore liquidity |

| Widening of Monetary Policy Rate Corridor | The corridor raised to 0.65 from 0.5 | Makes it less attractive for banks to park funds with RBI, nudging them to lend more. |

| 1. Moratorium on term loans & working capital loans for 3 months 2. Implementation of NSFR deferred by 6 months 3. Deferment of last tranche of capital conservation buffer |

Eases the balance sheet of banks while regulatory forbearance provides relief to borrowers. | |

| Regulatory Easing | ||

| Review of the limits of monetization | Reviewed the limits of Ways and Means Advances to State Governments and Union Territories by 30% | To the increase fiscal space of subnational governments through alternative models of “financing” the deficits. |

| Table 3 How Governments Reacted to Covid-19 Pandemic Globally? (In us Dollars), 1st Round of Stimulus Globally | ||

| Country | Fiscal Stimulus | Financial Market Stimulus |

| United States | 2 Trillion | Reduced interest rates to near zero |

| Euro-zone-Including Germany& France | 210 Billion | 810 Billion in the securities purchase |

| Japan | 276 Billion | 147 Billion in all for the purchase of exchange-traded funds, corporate bonds, commercial paper, and lending programs for commercial banks. |

| China | 15 Billion | 211.5 Billion in liquidity |

| India | 22.5 Billion | 46 Billion in liquidity |

| Australia | 46.3 Billion | 25 Bps cut in interest rate |

| New Zealand | 12 Billion | 50 Bps cut in interest rate |

Impact on Corporate Sector: Tactics of FMCG & Pharmaceutical Sector

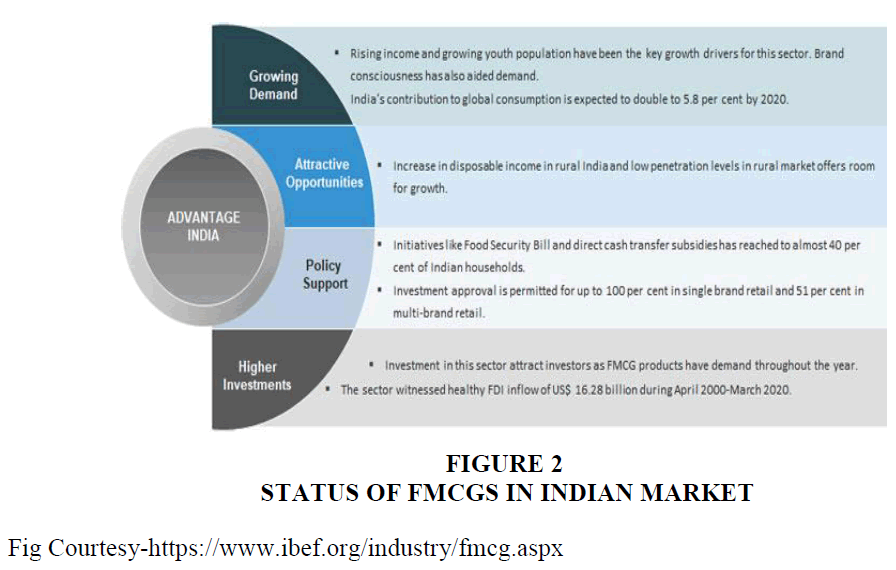

The two business sectors which have a maintained score amidst the blue days are – Fast-moving Consumer Goods (FMCG) and Pharmaceutical Sector (FS) Table 3. The prime reason behind their well-maintained score is the utility of products they deal in. Lockdown imposed by the government forced the business sectors to shut down their brick-and-mortar stores. The first phase of Lockdown announced the closure of the Market. Considering the needs of the populace, the Government drafted a few relaxation norms. Stores selling the necessary products were allowed to open for customers. The Pandemic’s fright attracted the customers to the FMCG & Pharmaceutical sector. This inclination brought in a flight for both sectors. An effort is made below to explore how the inclination became a stroke of luck for these sectors.

Successful Marketing Strategies of the FMCG & Pharmaceutical Sector

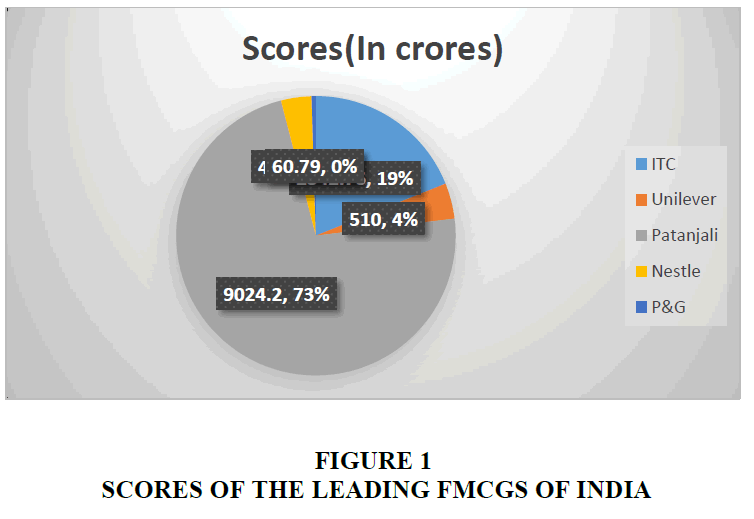

The FMCG sector has always been successful in attracting customers because of the nature of products that falls under the category Jose et al. (2020). Also, it has a wide spectrum of choices for its target population. The sector has limited barriers in the entry and exit procedures which bring in a whooping competition. Both Innovation and Imitation hold an equal chance of winning the game here. Many Imitative products become stars despite the leading innovative products because of Brand Equity. This tells how active a marketer should be to survive in this sector. Techniques need to be re-framed and executed so that they hold a distinct position and pride in the market. The FMCG sector in particular has responded to the challenges posed by the Pandemic in a very impressive way Figure 1.

Some of the tactics utilized by the leading Indian brands to maintain their scores are:

Reframing Promotional Campaigns: The Pandemic has obliged the customers to consume products that satisfy the real need of the hour. This stood as a challenge for this sector. Therefore, for a select category of products under this sector the brands set forth to track a tactic for their survival amidst the blue days. With the aim of maintaining a clean-cut score, the marketers conducted an in-depth survey and elected the ways of presenting the same product as a prime necessity in the same market. The commonly incorporated tactics for executing this idea was ‘reframing their existing Promotional Campaigns’ to persuade the customers once again. In this process, the marketers have utilized both emotional and fear appeals. They tried to consider the important information circulated by the medical bodies on boosting the immune system. Thus, with the hope of penetrating into the minds of the target population, marketers reframed their promotional campaigns Galí (2020). The information shared in the campaign regarding a product had an important bottom line and i.e. ‘If you consume this product your immunity will be boosted directly or indirectly.’ This trick indeed worked for many products under different brands. The bitter truth of the present market is that most of the customers indulge in emotional buying than rational buying. This brought in numerous opportunities for the sector to maintain its score. Secondly, the use of Comparative Advertising and Ambush Marketing can also be witnessed. They are considered powerful tools in a market where the target population can be persuaded with the help of emotional and fear tactics Priyaranjan & Pratap (2020).

1. Adding to the existing Product Line: There are brands that have a well-pronounced Brand Loyalty in the market they are operating. Further, Their Brand Equity can also be utilized for attracting customers to their new add-ons. The pandemic prevailing has horrified the people undoubtedly but interestingly this has been considered an important opportunity by a few leading conglomerates to introduce new products. Hence, they developed new products (imitative and innovative) for their existing customer base to enhance their score.

2. Converting Cash Cows into Stars: Prior to the Pandemic there still existed products in this sector that were very useful and had the potential to become the stars of the market. But such products were unsuccessful in the market because the customers didn’t realize the need. With the experts focusing on certain aspects to rule over COVID 19, these products were projected by the marketers once again in the market. There was no change in the promotional campaigns. This time the customers were attracted to them because they were in real need.

3. Reframing Unique Selling Proposition (USP): In order to win the minds of the customers or to convert a customer into a consumer, the prime ingredient required is developing the Unique Selling Proposition. The Pandemic has opened avenues for certain brands to reframe their old USP in order to generate cash inflows. A few brands from this sector were successful in doing the same and hence they didn’t run losses. The USP can be reframed by demonstrating the Brands competitive advantage over other alternatives. The Marketers can also custom the points of difference to outshine in the competitive arena.

4. Use of e-commerce- Though the Government allowed the functioning of Brick and Mortar models selling FMCG Products, the customer traffic was not impressive in the initial days. The availability of such necessary products on popular e-commerce sites boosted customer traffic. This brought ease for the customers residing in metro cities mostly. Another tactic accompanying this was the freedom to use plastic money and virtual payment systems. Together with this tactic too resulted in a grand success.

Fig Courtesy-https://www.ibef.org/industry/fmcg.aspx

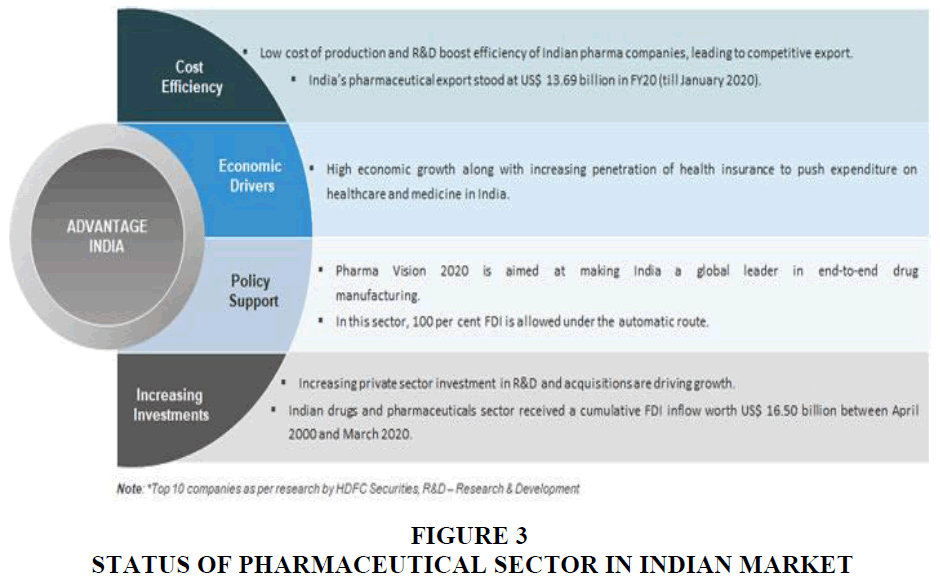

The Pharmaceutical Sector too well- maintained its score despite Pandemic Blues. The reason behind it was the utility of the products it deals in. This sector holds a significant position in the Indian as well as Global Market Figure 2

Fig Courtesy- https://www.ibef.org/industry/pharmaceutical-india.aspx.

The pharmaceuticals sector didn’t shrink rather the COVID-19 precautions identified by the medical experts surged the sector. It brought in healthy customer traffic which contributed to its stable score. Compared to the FMCG Sector the pharmaceutical didn’t face such challenges. Hence it didn’t employ too many marketing tactics. The only tactic utilized by this sector to boost itself is Repeat Advertising. This excluded the need of incorporating changes in the campaign or product structure. It is basically a planned recap of the products for the target audience. The customers were informed how such products can be beneficial to either boost their health or rescue them from any health emergency Figure 3.

Conclusion

China being authoritarian is back to work, but it takes time to bring that normalcy. Here in India with its own democratic institutions and processes certainly achieve normalcy and it is in the hands of 1.3 billion Indians and could only come from how effectively we contain the virus and its spread. The government and its agencies are doing their best to handle the situation and challenges of looming lay-offs and crashing markets. Apart from the quantum of stimulus – both fiscal and monetary - what matters in salvaging the crisis is how that money is spent and on whom? There are sectors like big corporates, small businesses, retail, construction, and most importantly Micro, Small& Medium Enterprises (MSMEs) that are worst affected. Also since it is a health crisis the situation warrants a prudent public policy initiative to boost the healthcare sector and take every possible action to support the front-line workers such as healthcare personnel and security forces. These measures necessarily include financial, legal, and infrastructural support systems. However, this is also a challenging time and the country certainly win the Covid-19 fight if all segments of the society understand the gravity and work together on the action front.

Globally most affected economies are somehow not able to contain the spread of the virus and the fatality rates effectively. Until a moment of hope and relief comes, global financial markets continue to slide and remain in a state of sharp volatility in the immediate short-term to medium-term. We might end up with a scenario of Domestic Institutional Investors (DIIs) buying more in the short-term to medium-term and Foreign Institutional Investors (FIIs) returning once there is certainty on the outlook front, as India’s long-term fundamentals remain robust. Although the reported new infections have been on the decline in China, the weak market momentum is bound to remain everywhere since the current situation is not like the previous down-turns. This essentially warrants a specific set of policy levers to tackle the current situation. Experts have already realized that the crisis has scuttled the global supply chains severely constraining the aggregate supply (GDP) and depressing aggregate demand (AD), mainly on account of slow business resumptions and labor shortages across the board, including MSMEs and several services. That way the policy response has to be very aggressive and specific to the segments, sectors, and industries and the social strata adversely affected by the virus. Further, in situations like these, it is always the fiscal policy that works quickly and effectively given the time lags of 12 to18 months associated with central banks’ monetary stimulus initiative. Besides, the multiplier (k) impact of government sending is always higher and more effective in adding to GDP, than any other measures.

Business is one intrepid game of profit and loss. The marketers of the FMCG sector together with the Government should be superlative players. The sector is presently the fourth largest sector in India. Its growth amidst the pandemic blues should be applauded. India stands as the third-worst. Anticipating the growth of this sector, the government should frame certain policies for the present economic situation, keeping in view the trends in virus spread and the potential toll on the economy, incomes, and spending ability of people. With the limited prospects, India can still start developing prudent policies for effectively controlling the virus and equally for fast growth of the economy. The ongoing episodes from the market demonstrate the essence of both sectors for boosting the GDP. The drop of 23.9% in the GDP can be reversed significantly if the Government tries to consider the importance of both Rural and Urban Markets and take suitable measures. There has been no trace of uniformity in the rural markets during this phase, resulting in a decline. To retain the win-win position and to maintain uniformity, the sectors need to formulate customized tactics for the markets of different states. This execution will require proper synchronizing with the Government and cooperation.

Apart from the mentioned sectors, the other important sectors couldn’t have a balanced score until the last quarter, September 2020. They faced losses forcing them to halt until the spread is controlled. For boosting the economy of a country all the sectors equally need to be in sound health. The contemporary situation demands a solution also from the government. The efforts taken by the individual sectors didn’t seem to be cup-winning ones. Hence to restart such sectors alongside the atypical strategies coordination from the Government will be required to compensate for the losses suffered by various sectors and segments of the population during this pandemic phase. It can also be predicted that the sectors will regain their previous status after the new normal end. To conclude, it’s the effectiveness of the policy interventions globally on the one hand and on the other how countries gear up and ramp up the medical infrastructure and sensitize the public to contain the spread of the virus that mainly determine the megatrends across the macroeconomic picture and the state of financial market stability in future. Until then and way forward for government policy levers is to be very effective in terms of timing, quantum, and targeting of the beneficiaries and sectors. Further, in these special times, it is prudent to inject money into the pockets of the spenders than depending heavily on indirect liquidity measures.

References

Alpert, G (2021): U.S. COVID-19 stimulus and relief https://www.investopedia.com/government-stimulus-efforts-to-fight-the-covid-19-crisis-4799723.

Belke, A. (2018). Helicopter money: should central banks rain money from the sky?. Intereconomics, 53(1), 34-40.

Indexed at, Google Scholar, Cross Ref

Belke, A. (2018). After the bazooka a bonanza from heaven:" Helicopter money" now?(No. 18-02). ROME Discussion Paper Series.

Bernanke, B. (2016). What tools does the Fed have left? Part 3: Helicopter money. Brookings Blogs, 11(4).

Buiter, W. H. (2003). Helicopter money: irredeemable fiat money and the liquidity trap.

Gajavelli, V.S., & Gargi, S. (2020): Beating the Pandemic Blues: Clean-cut Scores of FMCG and Pharmaceutical Sectors, SME World Asia, pp. 36-39.

Galí, J. (2020). Helicopter money: The time is now. Mitigating the COVID Economic Crisis: Act Fast and Do Whatever, 31, 31-39.

Jose, J., Mishra, P., & Pathak, R. (2020). Fiscal and monetary response to the COVID-19 pandemic in India. Journal of Public Budgeting, Accounting & Financial Management.

Indexed at, Google Scholar, Cross Ref

Masciandaro, D., Goodhart, C., & Ugolini, S. (2021). Pandemic recession and helicopter money: Venice, 1629–1631. Financial History Review, 28(3), 300-318.

Indexed at, Google Scholar, Cross Ref

Priyaranjan, N., & Pratap, B. (2020). Macroeconomic effects of uncertainty: a big data analysis for India.

Received: 17-Apr-2022, Manuscript No. AMSJ-22-12110; Editor assigned: 02-May-2022, PreQC No. AMSJ-22-12110(PQ); Reviewed: 16-Jun-2022, QC No. AMSJ-22-12110; Revised: 20-Jun-2022, Manuscript No. AMSJ-22-12110(R); Published: 24-Jun-2022