Original Articles: 2017 Vol: 21 Issue: 1

Post-switching Behavior: Bottom of the Pyramid (Bop) Stockpiling as a Result of Sales Promotion

James Lappeman, University of Cape Town

Titi Kabi, University of Cape Town

Hannah Oglesby, University of Cape Town

Olivia Palmer, University of Cape Town

Abstract

Understanding brand switching behaviour enables companies to attract new consumers, win back lost ones and ultimately strengthen the relationship consumers have with brands. Sales promotions have been identified as a key driver for consumers switching brands and use a significant share of the total marketing expenditure. Whilst a fair amount of research has been conducted on the effect of sales promotions on brand switching behaviour, limited research has been conducted on the behaviour that follows once consumers have switched brands. This study identifies consumers’ post-switching behaviour, specifically the likelihood to stockpile after a consumer has brand switched in the understudied South African Bottom of the Pyramid market. Positive significant relationships were identified between all the constructs and it was found that the type of sales promotion did not moderate the relationship between sales involvement and brand switching. Brand switching did, however, mediate the relationship between sales involvement and stockpiling.

Keywords

Sales Promotions, Brand Switching, Stockpiling, Coupon, Price Discount, Competition, Bottom of the Pyramid (BOP), South Africa

Introduction

Sales promotions form an integral component of any business’s marketing communication strategy (Sun, Neslin & Srinivasan, 2010; Müllerová, 2011). Sales promotions essentially use incentive-based methods in an attempt to directly stimulate consumer buying behaviour in order to generate immediate sales (Raju, 1992). According to Nielsen (2014), consumer product companies spend approximately $1 trillion per year on promotions. The use of sales promotions are especially crucial in the highly competitive fast moving consumer goods industry, where different techniques of sales promotions help to tap into new segments and increase the size of their customer base (Obeid, 2014). Despite the widespread research conducted on sales promotions and its effect on brand switching, limited research has been conducted on the behaviours that result after consumers have decided to switch brands. Post-switching behaviours include increased purchases, repeat purchases as well as stockpiling.

As most customer loyalty models have their roots in developed countries, a call has been made for marketing practitioners and researchers to develop scales relevant to BOP consumers (Makanyeza, 2015). At present, there have been multiple warnings to be cautious when applying research findings across the income divide (Pentz, Terblanche & Boshoff, 2013; Douglas & Nijssen, 2003; Simpson & Lappeman, 2017).

Brand Switching

Studies have identified that even the most loyal of consumers display brand switching behaviour (Hans, Hoyer & Inman, 1996; Ehrenberg, 1988; Trivedi & Morgan, 2003). The studies that show how much pressure is placed on the loyalty concept is growing. Shukla (2004) found evidence that brand attrition is growing every year as a result of marketplace saturation and Kusek (2016) even declared loyalty dead. While this declaration is arguably premature, companies have a great need to understand the motivation for consumer propensity to switch brands since they spend a significant amount of time, money and effort investing into brand building (Vani, Babu & Panchanatham, 2010).

A study by Mazursky, labarbera and Aiello (1987) utilised self-perception theory to analyse consumer brand switching behaviour. The study identified intrinsic and extrinsic motivations as the two facets that drive brand switching. A wide variety of products play an important role in the intrinsic motivations for brand switching and the resulting behaviour can be the consequence of either curiosity or attribute satiation (Sheth & Raju, 1974; mcalister & Pessemier, 1982; Ryan & Deci, 2000; Inman & Zeelenberg, 2002).

Sales Promotion

Although intrinsic motivation is clearly an important type of motivation, most of the activities people partake in are not intrinsically motivated, but rather extrinsically motivated (Ryan & Deci, 2000). A study by Van Trijp, Hoyer and Inman (1996) stated that many brand switches occur not because they are intrinsically rewarding but because they are key to attaining or avoiding another purchase or consumption goal (extrinsic motivation). Sales promotions are a widely used extrinsic means to create switching behaviour (Mazursky et al., 1987; Shukla, 2004; Kahn & Louie,1990). Mazursky et al. (1987) further stated that individuals who face tight financial constraints are more easily swayed by extrinsic motives to switch such as sales promotions.

Post-Switch Stockpiling

The post-switching behaviour for this study focuses on stockpiling. According to Ndubisi and Chiew (2006), when a consumer purchases more of a product than they would have in the absence of a promotion, they are less likely to purchase a competitor’s product (as they are temporarily taken out of the marketplace for that product). Bell, Chiang and Padmanabhan (1999) found that the nature of a product category determines whether a consumer is likely to stockpile or not. Raju (1992) previously revealed that the magnitude of a sales promotion had an effect on consumers’ behaviour to stockpile and offering a discount of a larger degree was more likely to induce stockpiling. As a result, this study investigated whether the type of sales promotion had an effect on consumers’ likelihood to switch brands and then stockpile. Since storability of a product also facilitates stockpiling behaviour (Raju, 1992), this study focused on the storable product category of skincare.

Bottom Of The Pyramid (Bop) Consumer Behaviour

SouthAfrican BOP Consumers

The Bottom of the Pyramid (BOP) is a term now commonly used to explain the poorest but largest socio-economic population group. In recent years, the BOP has attracted much attention due to the sheer size (4 to 5 billion people) and its estimated US$ 1.3 trillion buying power (Prahalad & Hammond, 2002; Pitta, Guesalaga & Marshall, 2008; Simanis & Duke, 2014). The BOP has received a growing level of interest among researchers (Kolk et al, 2013), although many gaps in understanding BOP consumer behaviour exist (Makanyeza, 2015).

Research shows significant complexity when observing BOP consumer loyalty due to resource constraints and trust (Blattberg, Briesch & Fox, 1995; Simanis, 2012; Kwon & Kwon, 2007). For example, a study by Kumar and Singh (2008) identified income as playing the most influential role on affecting brand choice within the BOP segment. According to Kumar and Singh (2008), low-income consumers look for value for their money but often not at the expense of an unknown brand. Kumar and Singh (2008) also state that as the income of a consumer increases so does their preference towards specific brands. Gerald (2011) also found BOP consumers to be likely to brand switch because they are convenience seekers.

Although estimates vary, at least 35-70% of South Africa’s population is considered BOP, where this market has been reported to be worth US$ 40million (Chipp, Corder & Kapelianis, 2012, World Bank Group, 2016, Mahajan, 2014, Simpson & Lappeman, 2017)

South African BOP Responsiveness to Three Types of Sales Promotions

A large portion of South African BOP consumers travel to the nearest supermarket once a month to purchase their groceries in bulk (D’Haese & Van Huylenbroeck, 2005). These consumers are therefore likely to be responsive to sales promotions and possibly stockpiling, as they intend on buying large amounts of goods (Variawa, 2010) and are not as financially constrained as they are towards month end (Anderson, 2006; Skenjana, 2013). Three specific types of sales promotions that are relevant to the South African BOP market have been used in this study. The promotions are coupons, price reductions and competitions.

Coupons

According to Leibtag and Lynch (2007), coupons are used within the BOP market because they help persuade low-income consumers who are price sensitive to experiment with new products and brands, and ultimately even switch their brand loyalty. Coupons are easily available and redeemable at all of South Africa’s main low-cost retailers and Nielsen recorded South Africa as distributing approximately 100 million coupons, with 11% of them actually being redeemed (Foxall, 2014).

Price Reductions

BOP consumers worldwide are actively seeking out price reductions, and South Africa is no different (mcneill, et al., 2008). Consumers are more likely to purchase their first choices in the beginning of the month when income is received, but once BOP consumers get to the middle of the month, price reductions become even more attractive as a means to promote brand switching (Durham, 2013).

Competitions

According to South African consultancy livemoya (2014), competitions as a sales promotion technique bring about value and a sense of community and culture to consumers’ lives. A brand competition can be a sweepstake, which gets consumers to submit free entries into a lucky draw to win prizes or giveaways, or a contest, where consumers interact with the brand and perform various activities (Kotler and Armstrong, 2015). BOP consumers often do not have the budget to try new brands and so competitions allow them to have a personal experience with the brand and experiment for no additional costs, which is something essential for marketing practitioners to implement.

The South African Personal Care Industry

Personal care items form a significant part of South African BOP monthly expenditure (UUISM Majority Report, 2012). Like other emerging markets, South Africa has experienced growth in the personal care industry through increased penetration (Durham, 2013). In 2011, the South African personal care industry maintained double digit growth in terms of volume (Euromonitor, 2012). The storable nature of skincare products (body soap, body lotion) makes them an ideal subject to study stockpiling behaviour (Bell et al., 1999).

Research Question

The following research question was formulated: What is the effect of sales promotions on Bottom of the Pyramid consumers’ brand switching behaviour and their likelihood to stockpile once they have switched brands within the skincare category?

To achieve this, the study proposed the following primary objectives:

To determine the effects of sales promotions on Bottom of the Pyramid consumers’ buying behaviour in the skincare category.

The following secondary objectives are derived from the primary objective:

? To determine the effects of sales promotions on brand switching behaviour in the Bottom of the Pyramid market in the skincare category.

? To determine the likelihood of the Bottom of the Pyramid market to stockpile once they have switched brands within the skincare category.

? To determine whether the type of sales promotion affects the relationship between sales promotions and the brand switching behaviour of the Bottom of the Pyramid consumer buying behaviour in the skincare category.

? To determine whether brand switching influences the relationship between sales promotion and stockpiling for the Bottom of the Pyramid consumer when buying in the skincare category.

Once marketers have a better understanding of the effects of sales promotions on brand switching and the likelihood to stockpile once they have switched brands, it will be easier to attract new customers and retain existing ones.

Conceptual Framework

Sales Promotions as an Extrinsic Motivation to Switch Brands

Sales promotions enhance the product value by providing a benefit that goes beyond the product’s functionality and they also directly stimulate consumers’ motivation to switch brands (Müllerová, 2011). Literature suggests that sales promotions tend to have more of an influence on consumers with a high preference towards a brand compared to that of consumers with a low brand preference (Sun, Neslin & Srinivasan 2010; Müllerová, 2011). A study by Mei-Mei et al (2006) states that brand switchers are those consumers who are most influenced by sales promotions and that brand loyal consumers in contrast are influenced by the brand image (Mei-Mei et al., 2006).

According to research by Omotayo (2011) sales promotions make consumers more price sensitive in the long-run, and can devalue a brand as price acts as a value indicator. According to Obeid (2014), repeated price promotions can increase the likelihood of brand switching as consumers specifically seek out deals. A study by Nagar (2009) revealed that the product category in which a promotion takes place also influences the switching behaviour of consumers. Alford and Biswas (2002) found that income was an important factor influencing the price consciousness of consumers and therefore their brand switching behaviour when confronted by a price promotion. Additionally, products that exist in a higher competitive industry where there are a close number of substitutes were shown to experience higher degrees of brand switching behaviour as they are more influenced by other competitors to alter their price offerings (Raju, 1992). This study therefore proposes the following hypothesis:

H1 Sales involvement positively affects consumers brand switching behaviour.

The literature above has outlined that sales promotions are known to cause post-switching behaviours such as increased purchases, repeat purchases as well as stockpiling (Gupta, 1988). The post-switching behaviour that this study aims to focus on is stockpiling and will be discussed in the section to follow.

Stockpiling as a Post-Switching Behaviour

Stockpiling is defined as a purchasing activity in which an individual acquires a large accumulated supply of a good for the future (Ailawadi, Gedenk, Lutzky & Scott, 2007). Stockpiling is not only beneficial from the perspective that it increases consumers’ consumption rates but also from the perspective that it prevents or delays consumers from switching to competitors brands within the marketplace (Ndubisi & Chiew, 2006). A study conducted by Gupta (1988) as well as by Hong, mcafee and Nayyar (2002) suggests that already loyal consumers are more likely to stockpile when their desired brand is on promotion. According to Krishna (1994), brand switchers do not have as strong a desire to stockpile as loyal consumers as they are governed by the fact that there will be some other brand on promotion. In contrast, a study by Ailawadi et.al (2007) found that deal prone consumers and not brand loyal consumers are more likely to stockpile. In addition, when a consumer purchases more of a product than they would have in the absence of a promotion, they are less likely to purchase a competitor’s product as they are temporarily taken out of the marketplace (Ndubisi & Chiew, 2006). Based on the contradictory findings above, this study proposes the following hypothesis:

H2 There is a relationship between brand switching and stockpiling.

The next section will discuss the effects various types of sales promotions have on consumers’ buying behaviour, in particular their brand switching behaviour.

The Effects of Different Types of Sales Promotions on Consumers’ Brand Switching Behaviour

Research suggests that consumers react differently towards different types of sales promotional techniques (Salvi, 2013). A study conducted by Salvi (2013) found that discounts as well as price reductions positively influences consumers’ brand switching behaviour. A study by Nagadeepa, Selvi and Pushpa (2015) suggests that in-store specials and displays were more likely to induce consumers to switch brands, whilst coupons and other out-of-store promotions were more likely to attract loyal consumers of that brand. Nagar (2009) found that free gifts amongst the various forms of sales promotions such as competitions, price discounts, coupons as well as free samples had the greatest effect on influencing consumers to switch brands. It is evident from the above mentioned literature that the decomposition of the effects of different types of promotions may differ and that further research is needed in order to reconcile findings. In light of the insights drawn from the aforementioned literature it can be deduced that sales promotions affect a consumer’s brand switching behaviour, hence, it is proposed that:

H3: The type of sales promotion moderates the relationship between sales promotion and brand

switching.

The following section will address the behaviour of consumers once they have switched brands which resulted through a sales promotion. This section will specifically look at the stockpiling intention of consumers as a post-switching behaviour once they have switched.

The Effect of Brand Switching on the Relationship Between Sales Involvement and Stockpiling

A study compiled by Gangwar, Kumar and Rao (2013) suggested that brand switching consumers were less likely to engage in stockpiling in response to sales promotions than brand loyal consumers. This study explains that brand loyal customers get more benefit from stockpiling than brand switchers due to the fact that they do not intend to make use of future promotions by competing brands (Gangwar et.al, 2013). In addition to this, a study by Teunter (2002) discovered that sales promotions can affect consumer behaviour in the long run as repeated promotional price cuts can lead to brand devaluation. In light of the above, this study proposes the following hypothesis:

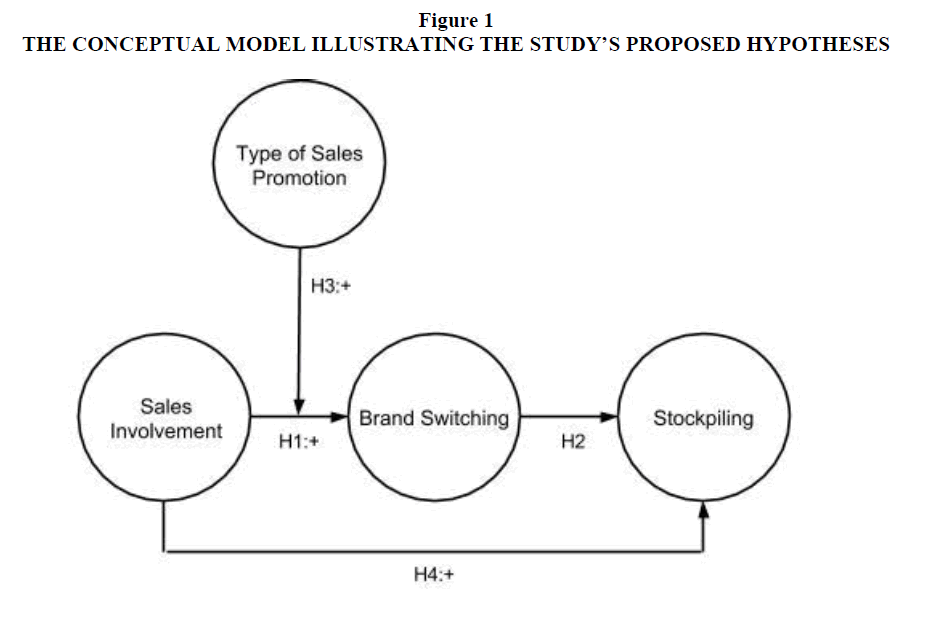

A visual representation of the aforementioned hypotheses is illustrated in the conceptual model below:

Overview of the Data Collection

Sathish, Kumar, Naveen and Jeevanantham (2011) used a descriptive research design method to study the effects of promotion on brand switching within the cellular mobile industry in Hong Kong. Additionally, Vani, Babu and Panchanatham (2010) used a single cross–sectional research design to analyse the effects of promotions on consumer behaviour within the toothpaste product category. Due to the nature of the skincare category being a highly competitive one (Unilever, 2015), this study was based on the research design employed by the aforementioned studies.

Data collection took place in Khayelitsha urban township in Cape Town, South Africa. Khayelitsha was founded in 1983 as a result of the Apartheid regime’s enforcement of various segregation acts and is now one of South Africa’s youngest, and fastest growing townships. Population statistics have been estimated to range from 400 000 to 800 000 people (Coetzer, 2011), where more recent studies estimate a range from 1 million to 1.6million people (Strategic Development Information and GIS Department, 2013). Khayelitsha is located 30 kilometers From the Cape Town city center. Generally females are responsible for household grocery shopping, however to avoid bias results, this study was not limited to females as males occasionally partake in the household’s grocery shopping too (Hatch, Becker & Van Zyl, 2011).

The study used non-probability sampling techniques to sample respondents from Khayelitsha in Cape Town. This method allows respondents to be chosen both arbitrarily or consciously and is generally known to produce reliable estimates (Malhotra, 2010). A sample size of 193 was used for this study. A sample size of this magnitude helped control for the generalization problem associated with convenience sampling (Malhotra, 2010). The study by Sathish et al. (2011) used a sample size of a similar magnitude to examine the effects of promotion on brand switching.

Scale Development

The Cronbach Alpha values for the scales in this study ranged from 0.76 to 0.88, rendering them all reliable.

The first scale used was a 7-item brand switching scale. This scale originated from a larger scale developed by Raju (1980). The scale is called Exploratory Tendencies in Consumer Behaviour Scales (ETCBS) and comprised of 39 items in total (Raju, 1980). The scale measured consumer behaviours such as repetitive behaviour patterns, innovativeness, risk taking, interpersonal communication and brand switching (Raju, 1980). Raju (1980) stated that the items used in each of the categories could be summated to form an overall score for that category. The brand switching scale was therefore taken from the ETCBS scale. Scoring on the Likert scale meant that respondents disagreed with the particular statement, whilst a high score meant the opposite. Two items however, namely questions 9 and 10 were both reversed scale items.

The second scale in the questionnaire was a 6-item scale used to measure consumers’ tendency to buy brands that are on sale and is called ‘Involvement in Sales.’ The scale was used in a study done by Lichtenstein, Ridgway, and Netemeyer (1993). A low response on this scale indicated that respondents were not involved in sales promotions, whilst a high score indicated that they were.

The next scale used a three-item Likert scale to measure a consumer’s attitude towards a specific type of sales promotion. This scale is called Attitude toward the Sales Promotion (Exploration). The scale originated in a study done by Chandon, Wansink and Laurent (2000). For the purpose of this study, this scale was repeated three times relating to three different types of sales promotions namely; coupons, price reductions and competitions. A low score on the three questions regarding the specific type of promotion indicated that a respondent was unlikely to respond to this type of promotion, whilst a high score indicated that they were.

The last scale in this study was used to measure stockpiling. This scale is a two-item scale that was first used in a study by Laroche, Pons, Zgolli, Cervellon and Kim (2003). Scoring high on this scale meant that respondents were likely to stockpile on the brand that they switched to, whilst scoring low meant that they weren’t likely to stockpile. The data collection procedure is a vital aspect for any study. The fieldwork necessary for gathering data from the outlined target population will be discussed below.

Results

The sample of 193 respondents consisted of 51.8% males and 48.2% females ranging from ages 17 to 66 years old. The mean age was 28 years old with a standard deviation of 10.09, indicating that respondents varied significantly in age. The mean household size of the respondents was 4.46 with a standard deviation of 2.1. The household size of the respondents ranged from 1 to 11. Majority of the respondents (53.9) did their monthly shopping towards the end of the month as opposed to the beginning (30.1%) and middle (16.1%) of the month. Respondents were asked to identify which brands of soap and body lotion they considered to be their regular brand. Sunlight (35%) dominated the soap category followed by Protex (22%) and Nivea (28%) dominated the body lotion category followed by Vaseline (19%). Table 1 (Appendix B) illustrates the remaining composition of the preferred brands. The next section will discuss the mean values obtained for the summated scales, as well as their standard deviations.

| Table 1 : Descriptive Statistics Of The Data | |||

| CONSTRUCT | PRODUCT TYPE | MEAN | STANDARD DEVIATION |

|---|---|---|---|

| SALES INVOLVEMENT | Both | 4,23 | 1,65 |

| BRAND SWITCHING | Soap | 3,71 | 1,10 |

| Body Lotion | 3,72 | 1,15 | |

| STOCKPILING | Soap | 3,39 | 1,91 |

| Body Lotion | 3,39 | 1,88 | |

| COUPON | Soap | 3,56 | 1,80 |

| Body Lotion | 4,09 | 1,91 | |

| PRICE DISCOUNT | Soap | 3,83 | 1,88 |

| Body Lotion | 3,50 | 1,91 | |

| COMPETITION | Soap | 4,09 | 1,92 |

| Body Lotion | 3,85 | 1,83 | |

In order to determine the mean and the standard deviations of the constructs, each individual scale was summated. The results for each summated scale are shown in the table below.

All the scales follow a 7-point Likert scale with means that ranged between 3 and 5. On these scales, 3 means ‘somewhat disagree’, 4 means ‘neutral’ and 5 means ‘somewhat agree’. A high standard deviation indicates that the responses differ significantly from the mean value, whilst a low standard deviation implies the opposite. The sales involvement, stockpiling, coupon, price discount and competition scales all had high standard deviations as shown in Table 2 above, whilst brand switching had a low standard deviation.

| Table 2: Cronbach Alphas For Each Construct | ||

| CONSTRUCT | PRODUCT TYPE | CRONBACH ALPHA |

|---|---|---|

| SALES PROMOTION | Both | 0,891 |

| BRAND SWITCHING | Soap | 0,785 |

| Body Lotion | 0,821 | |

| STOCKPILING | Soap | 0,755 |

| Body Lotion | 0,732 | |

| COUPON | Soap | 0,891 |

| Body Lotion | 0,934 | |

| PRICE DISCOUNT | Soap | 0,902 |

| 27 | ||

The summated sales involvement scale obtained a mean value of 4.23, indicating that on average, respondents remained neutral towards the statements regarding their involvement in sales promotions. The summated scale measuring brand switching for soap obtained a mean value of 3.71 and for body lotion, a value of 3.72. On average, respondents remained neutral towards statements regarding switching their brand of soap and body lotion. The summated scale measuring stockpiling for soap and body lotion both obtained a mean value of 3.39, Indicating that on average, respondents tended to somewhat disagree with the statements regarding stockpiling.

The summated scale measuring the respondent's use of coupons when purchasing soap, obtained a mean value of 3.56, whilst body lotion obtained a mean value of 4.09. This indicated that on average, respondents remained neutral towards the statements regarding the use of coupons for purchasing both soap and body lotion. The summated scale for price discount for soap obtained a mean value of 3.83 and 3.50 for body lotion. These mean values indicates that on average respondents remained neutral towards statements regarding purchasing either soap or body lotion due to price discounts. The summated scale for competition as a type of sales promotion for soap, obtained a mean value of 4.09 and for body lotion, a mean value of 3.85. This indicated that on average respondents were neutral towards statements regarding purchasing soap or body lotion due to a competition.

Scale Reliability and Validity

Reliability refers to the degree to which the measurements of the constructs under examination are not affected by random error (Malhotra, 2010). A measure is valid if it measures what it is supposed to measure, and does so without including other factors (Malhotra, 2010). In this study, internal consistency reliability was tested using Cronbach alpha and factor analysis for validity. These tests are discussed below.

Cronbach alpha values

Cronbach alpha was used to assess the internal consistency reliability of the scales used in this study. This was done in order to ascertain whether the constructs used are repeatable (Malhotra, 2010). The traditional cut-off value used in this study in order for the scales to be considered reliable was 0.7. This is an acceptable value as stated by Malhotra (2010). Initially the Cronbach alpha values for brand switching of soap and body lotion were 0.57 and 0.64 respectively, which is below the traditional cutoff value of 0.7. However, when the reverse scale items (questions 10, 11, 34 and 35) were removed the overall reliability of the scale improved. From Table 3 below, it can be deduced that all scales were reliable in that they displayed Cronbach alpha values that exceed the cutoff rate. Therefore all of the scales were approved to be used in this study (Malhotra, 2010).

| Table 3: Bivariate Correlations Test Results | |||||

| Hypothesis | Relationship | Product type | Pearson’s correlation coefficient | P-value | Significant / not significant |

|---|---|---|---|---|---|

| H1 | Sales Involvement→ Brand Switching | Soap | 0.30 | 0.00 | Significant |

| Body Lotion | 0.33 | 0.00 | Significant | ||

| H2 | Brand Switching→ Stockpiling | Soap | 0.24 | 0.00 | Significant |

| Body Lotion | 0.35 | 0.00 | Significant | ||

| All hypotheses were tested at a 1% level of significance (α=0.01) | |||||

| Hypothesis 1 proposed that: | |||||

| H1 Sales Involvement positively affects consumers brand switching behaviour. | |||||

Factor Analysis

The goal of factor analysis is to explain the variance in the observed variables by using underlying latent factors (Habing, 2002). For the sales involvement scale, 1 factor was extracted with an eigenvalue of 3.91, which is greater than 1 as Kaiser’s criterion was used. This factor explained 65.21% of the variation in the data.

For the stockpiling scale for soap, 1 factor was extracted with an eigenvalue of 1.61, which is greater than 1 as Kaiser’s criterion was used. This factor explained 80.41% of the variation of the data. For the stockpiling scale for body lotion, 1 factor was extracted with an eigenvalue of 1.58, which is greater than 1 as Kaiser’s criterion was used. This factor explained 78.87% of the variation of the data.

For the brand switching scale for soap, 2 factors were extracted with eigenvalues of 2.83 and 1.30 which are both greater than 1 as Kaiser’s criterion was used. Factor 1 explained 39.04% and factor 2 explained 20.03% of the variation in the data. Together this explained 59.07% of the variation of the data. The two reverse score items for soap, questions 10 and 11, loaded onto factor 2 whilst all the other questions loaded onto factor 1. For the brand switching scale for body lotion, 2 factors were extracted with eigenvalues of 2.98 and 1.37 which are both greater than 1 as Kaiser’s criterion was used. Factor 1 explained 41.98% and factor 2 explained 20.15% of the variation in the data. Together they explained 62.13% of the variation in the data. The two reverse score items for body lotion, questions 34 and 35, loaded onto factor 2 whilst all the other questions loaded onto factor 1.

For the coupon scale, 1 factor was extracted with an eigenvalue of 2.47 which is greater than 1 as Kaiser’s criterion was used. This factor explained 82.20% of the variation in the data. For the price discount scale for soap, 1 factor was extracted with an eigenvalue of 2.51 which is greater than 1 as Kaiser’s criterion was used. This factor explained 83.59% of the variation in the data. For the competition scale for soap, 1 factor was extracted with an eigenvalue of 2.51 which is greater than 1 as Kaiser’s criterion was used. This factor explained 71.52% of the variation in the data.

For the coupon sale for body lotion, 1 factor was extracted with an eigenvalue of 2.65 which is greater than 1 as Kaiser’s criterion was used. This factor explained 88.29% of the variation in the data. For the price discount scale for body lotion, 1 factor was extracted with an eigenvalue of 2.57 which is greater than 1 as Kaiser’s criterion was used. This factor explained 85.85% of the variation in the data. For the competition scale for body lotion, 1 factor was extracted with an eigenvalue of 2.17 which is greater than 1 as Kaiser’s criterion was used. This factor explained 72.31% of the variation in the data. The following section uses inferential statistics to examine the proposed relationships in this study.

Inferential Statistics

This study aimed to look at the relationship between sales involvement and consumers’ brand switching behaviour, and their intention to stockpile thereafter for both soap and body lotion. Bivariate correlation tests were therefore used to test the relationship between sales involvement and brand switching, as well as between brand switching and stockpiling. Before any relevant tests for correlations could be run, the assumption of normality had to first be tested. To test for normality, a Kolmogorov-Smirnov test was conducted, as the sample size (193) was greater than 50. The null hypotheses for the respective variables, is that they are normally distributed. It was found that all of the scales had a p-value less than 0.05, indicating that the scales were not normally distributed. Subsequently, the skewness and kurtosis values for the constructs were taken into account. All the values for skewness ranged between -1 and 1 and the kurtosis values between -1.5 and 1.5, therefore rendering all the scales normal. As a result it can be concluded that the data is robust enough to conduct non-parametric hypotheses tests. The Pearson’s correlation coefficient test was conducted to test for the correlation between the constructs. The following section discusses how a bivariate correlation test was run to test the relationships between sales involvement and brand switching as well as stockpiling.

Bivariate Correlations Test

The nature of the study required that a bivariate correlations test be run to test the proposed hypotheses. Results can be found in Table 4 below.

| Table 4: Statistical Results Of The Moderating Effect Of Type Of Sales Promotion |

|||||

| PRODUCT TYPE | BETA | P-VALUE | T-STAT | SIGNIFICANT/ INSIGNIFICANT | |

|---|---|---|---|---|---|

| INTERACTION COUPON | Soap | -0.15 | 0.51 | -0.67 | Insignificant |

| Body Lotion | -0.14 | 0.48 | -0.70 | Insignificant | |

| INTERACTION DISCOUNT | Soap | -0.22 | 0.38 | -0.87 | Insignificant |

| Body Lotion | -0.11 | 0.67 | -0.43 | Insignificant | |

| INTERACTION COMPETITION | Soap | 0.22 | 0.35 | 0.94 | Insignificant |

| Body Lotion | 0.38 | 0.10 | 1.67 | Insignificant | |

Hypothesis 1 proposed that:

H1: Sales Involvement positively affects consumers brand switching behaviour.

From Table 4 above, it is seen that the relationship between sales involvement and brand switching behaviour is significant for both soap and body lotion. The null hypothesis, which suggests that no relationship exists between the proposed variables was rejected at a 1% level of significance with a p-value of 0.00 for soap as well as body lotion. Therefore, the research hypothesis, H1, is supported and with correlation coefficients of 0.30 and 0.33, it can be concluded that the relationship between sales involvement and brand switching is positive, but weak for both soap and body lotion respectively. From the above it can thus be concluded that the greater an individual’s involvement in sales promotion, the more likely they are to brand switch for both soap and body lotion. Therefore hypothesis 2 proposed that:

H2 There is a relationship between brand switching and stockpiling.

From Table 4 above, it is seen that the relationship between brand switching and stockpiling is positive for both soap and body lotion. The null hypothesis which suggests that no relationship exists between the proposed variables was rejected at a 1% level of significance with a p-value of 0.00 for soap as well as for body lotion. With a Pearson correlation value of 0.24 for soap and 0.35 for body lotion, the relationship between brand switching and stockpiling is weak, but positive for both product types. It can therefore be concluded that brand switchers do in fact stockpile for both soap and body lotion. The remaining hypotheses relate to the mediation effect of brand switching as well as the moderation effect of the type of sales promotion. In order to test these effects regression test were run. The results from the regression are discussed in the section to follow.

The Moderating Effect of Type of Promotion

A multiple regression model was tested to investigate whether the association between sales promotion and brand switching was moderated by the type of sales promotion. A moderator is a variable that affects the strength and/or the direction of the independent variable and dependent variable (Malhotra, 2010). As established, a number of studies have found that sales involvement is positively related to brand switching (Sun et al, 2010; Müllerová, 2011, Omotayo; 2011). Moreover, Salvi (2013) indicated that the type of sales promotion moderates the link between sales involvement and brand switching. Therefore the following hypothesis was proposed:

H3

The type of sales promotion moderates the relationship between sales promotion and brand

switching.

A sales involvement-by-promotion type (e.g. sales involvement*coupon) interaction term was created for both soap and body lotion. The interaction term along with the two predictors were entered into a simultaneous regression model. From table 5 below it can be seen that the interaction term was insignificant for all three types of promotions for both soap and body lotion, indicating that the type of sales promotion did not moderate the relationship between sales involvement and brand switching for both product types. For this reason, the moderating effect of the type of sales promotion was excluded from the final model.

|

Table 5: Summary Model Fit Results |

||||

| Model Summary | ANOVA | |||

| R2 | Adjusted R2 | F-stat | p-value | |

| Soap | 0.18 | 0.17 | 20.35 | 0.00 |

| Body Lotion | 0.19 | 0.18 | 22.02 | 0.00 |

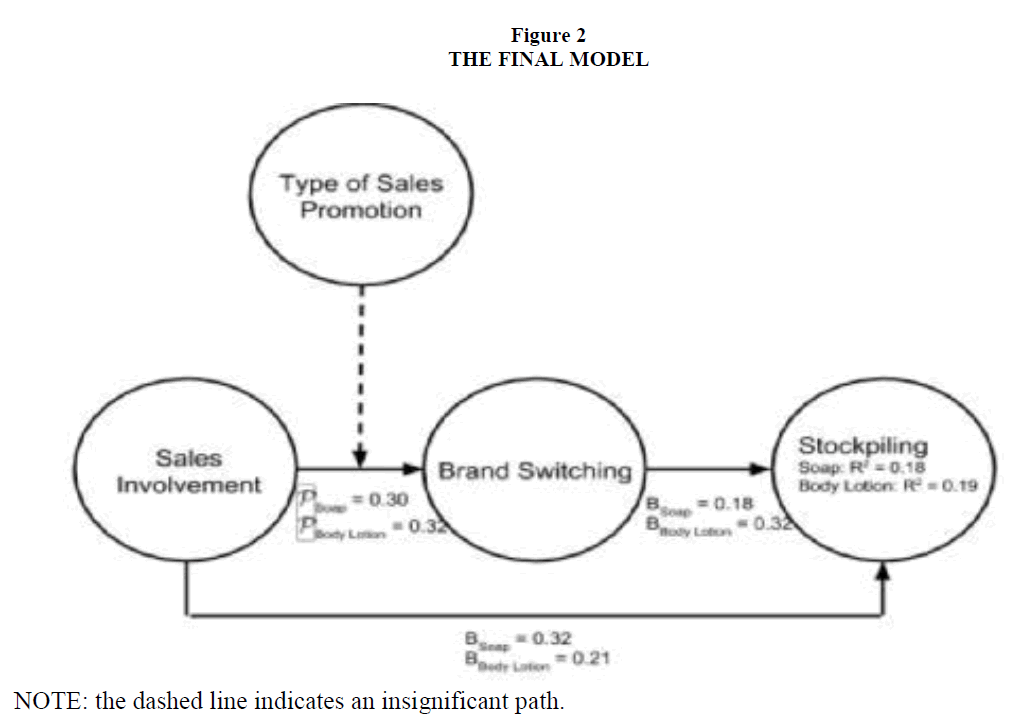

The Final Model

The output in table 6 below shows that the model for soap reports an R2 Value of 0.18, indicating that 18% of the variation in stockpiling is explained by the model. The adjusted R2indicates that, adjusting for including extra variables, the model explains 17% of the variation in stockpiling. TheR2Value of 0.19 for body lotion indicates that 19% of the variation in stockpiling is explained by the model. The adjusted R2 indicates that, adjusting for including extra variables, the model explains 18% of the variation in stockpiling. ANOVA was then run to test the overall significance of the model for both soap and body lotion. From table 6 below, it is seen that with a p-value of 0.00 and F-stat of 20.35 and 22.02 respectively, both the soap and body lotion models are significant. Since both models were significant, the following model equations were proposed:

| Table 6: Statistical Results For Fitted Model | ||||||

| PRODUCTTYPE | BETA | T-STAT | P-VALUE | COLLINEARITY | ||

|---|---|---|---|---|---|---|

| STATISTICS | ||||||

| TOLERANCE | VIF | |||||

| CONSTANT | Soap | 1.04 | 2.65 | 0.01 | - | - |

| Body Lotion | 1.04 | 2.70 | 0.01 | - | - | |

| SALES INVOLVEMENT | Soap | 0.32 | 4.62 | 0.00 | 0.89 | 1.13 |

| Body Lotion | 0.21 | 3.07 | 0.00 | 0.91 | 1.10 | |

| BRANDSWITCHING | Soap | 0.18 | 2.60 | 0.01 | 0.89 | 1.13 |

| Body Lotion | 0.32 | 4.71 | 0.00 | 0.91 | 1.10 | |

Stockpilingsoap = B0 + B1 (Sales Involvement) + B2 (Brand Switching)

Stockpilingbody lotion = B0 + B1 (Sales Involvement) + B2 (Brand Switching)

Multiple linear regression using the forced entry method was then run to test whether sales involvement and brand switching explained a significant amount of the variation in stockpiling for both product types. One of the assumptions for regression is that no perfect multicollinearity may exist in the model (Malhotra, 2010). The VIF statistics in Table 7 below indicates that there is no multicollinearity as all of the scales are closer to 1 than to 10. The Tolerance statistics are also above the 0.2 mark, further indicating the lack of perfect multicollinearity.

Furthermore, based on the output in Table 7 it is seen that both independent variables, sales involvement and brand switching are significant at a 5% level of significance (p-value < 0.05) for both soap and body lotion. The full standardized regression models for both product types are therefore as follows:

Stockpilingsoap = 1.04 +0.32(Sales Involvement) + 0.18(Brand Switching)

Stockpilingbody lotion = 1.04 +0.21(Sales Involvement) + 0.32(Brand Switching)

For soap, Sales Involvement had the greatest influence on stockpiling as the standardized beta coefficient is the largest (0.32). For body lotion, brand switching had the greatest influence on stockpiling as the standardized beta coefficient is the largest (0.32).

The final step in determining the final model involved analyzing the mediation effect of brand switching in the model. A mediating variable transmits the effect of an independent variable on a dependent variable (Mackinnon, Fairchild & Fritz, 2007). For this study three variables namely; sales involvement, brand switching, and stockpiling were analyzed. This study proposed that sales Involvement directly affects their stockpiling behaviour through the mediating cause of brand switching. Therefore the following hypothesis was proposed:

H4 The relationship between sales involvement and stockpiling is mediated by brand switching.

In step 1 (see Figure 2, Appendix C) of the mediation model, the regression of sales involvement (X1) on stockpiling (Y) ignoring the mediator (path c), was significant for both soap and body lotion. For soap, B1 = 0.38, t(191) = 5.74 and p-value = 0.00. For body lotion B1 = 0.31, t(191) = 4.44 and p-value = 0.00. Step 2 of the regression showed that the effects of sales involvement (X1) on the mediator (path a), brand switching (X2), was also significant for both soap and body lotion. For soap, B2 = 0.34, t(191) = 4.93 and p-value = 0.00; and for body lotion B2 = 0.30, t(191) = 4.29 and p-value = 0.00. Step 3 showed that the relationship between the mediator, brand switching (X2) and stockpiling (Y) (path b) was significant for both soap and body lotion. For soap B3 = 0.29, t(191) = 0.42 and p-value = 0.00 and for body lotion B3 = 0.39, t(191) = 5.76 and p-value = 0.00. The last step of the mediation process involved testing all paths in the model. It was revealed that sales involvement (X1) was still a significant predictor of stockpiling for soap B4 = 0.32, t(191) = 4.62 and p-value = 0.00 and for body lotion B4 = 0.21, t(191) = 3.07 and p-value = 0.00. However the value of B4 for soap and body lotion was less than B1 indicating that brand switching (X2) does in fact partially mediate the relationship between sales involvement and stockpiling. From the discussions above, this study proposed the following model.

NOTE: the dashed line indicates an insignificant path.

All of the relationships proposed in this study were significant except for the moderating effect of the type of sales promotion on the relationship between sales involvement and brand switching. The Pearson’s correlation values of 0.30 and 0.32 observed in the model above indicate that the relationship between sales involvement and brand switching was indeed significant for both soap and body lotion. It is important however to note that this relationship was weak.

The next step was to then test the full model with stockpiling set as the dependent variable and sales involvement and brand switching as the independent variables. From the model above, it is seen that holding all else constant, a one unit increase in sales involvement, will increase stockpiling for soap by 0.32. Additionally, holding all else constant, a one unit increase in brand switching, will increase stockpiling for soap by 0.18. For body lotion, holding all else constant, a one unit increase in sales involvement, will increase stockpiling by 0.21. Additionally, holding all else constant, a one unit increase in brand switching, will increase stockpiling by 0.32. The following section will discuss and make concluding remarks based on the results above.

Discussions and Theoretical Implications

Hypothesis 1

This hypothesis proposed that sales involvement positively affects consumers’ brand switching behaviour. The analyses conducted found this relationship to be significant for both soap and body lotion and it was therefore concluded that sales involvement had a positive relationship consumers’ brand switching behaviour. The positive relationship above is supported in a study conducted by Shukla (2004) who found that extrinsic factors such as sales promotions motivated consumers to switch brands. Furthermore, a study by Kahn and Louie (1990) supports this finding. Kahn and Louie (1990) stated that extrinsic incentives did encourage brand switching for short periods of time. BOP consumers are known to actively seek out price reductions due to their financial constraints. A study by Durham (2013) discovered that survivors were only brand loyal when they could afford to be and more likely to purchase their first choices.

Hypothesis 2

Hypothesis 2 of the study proposed that brand switching has a non-directional influence on stockpiling. From the analysis conducted it was found that the relationship between brand switching and stockpiling was positive and weak for both soap and body lotion. This finding is supported by Ailawadi et al. (2007) who found that deal prone consumers and not brand loyal consumers are more likely to stockpile. The respondent’s household size could be a possible reason behind them stockpiling once they have brand switched. The mean value for household size was 4.46, indicating that on average respondents were more likely to buy in bulk to accommodate the number of individuals residing in each household. This finding was further supported by D’Haese and Van Huylenbroeck (2005) who suggested that a large portion of Survivors purchase their groceries in bulk. Furthermore stockpiling allows consumers to take full advantage of the sales promotion and maximise the benefits offered by the promotions.

Hypothesis 3

This hypothesis proposed that the type of sales promotion moderated the relationship between sales involvement and brand switching. The regression analysis found that the interaction term (Sales Involvement*Type of Promotion (e.g. coupon)) was insignificant for both soap and body lotion and thus the type of sales promotion had no moderating effect. This result is in contrast to Dodson, Tybout and Sternthal (1978) who conducted a similar study for margarine and flour. According to these researchers, media-distributed coupons and price discounts significantly impacted a consumer’s decision to switch brands for both margarine and flour (Dodson, Tybout & Sternthal, 1978). The rationale for coupons not affecting an individual's brand switching behaviour could be that coupons require effort to be redeemed (Henderson, 1985). Additionally, competitions require moderate effort in that a consumer's details are necessary to enter the competition and some respondents may not always be willing to share this information, hence this type of promotion did not play a role in the decision to switch brands. The most surprising result was that price discount did not moderate the proposed relationship because such a discount has little to no effort to redeem. Potential rationale for this finding could be that the low price caused by the discount affects an individual's perception of the products quality. This rationale is supported by Obermiller and Wheatley (1984) who found that the price of a product is indeed positively related to the perception of quality of the good, particularly when price is the only information available.

Hypothesis 4

This hypothesis proposed that the relationship between sales involvement and stockpiling was mediated by brand switching. The regression output indicated that the beta score for the relationship between sales involvement and stockpiling decreased from 0.38 to 0.32 for soap and 0.31 to 0.21 for body lotion. It was then concluded that brand switching partially mediated the proposed relationship. This finding is supported by Gangwar et.al (2013) who concluded that a consumer’s brand switching behaviour impacts whether or not they will stockpile once a sales promotion has taken place. One possible explanation for individuals stockpiling in the presence of sales promotions is that the shelf life of both soap and body lotion is stable compared to other perishable goods. A study conducted by (Hoek & Roelants, 1991) found similar results and concluded that individuals were more likely to stockpile washing powder and cereal compared to fruits due to the short shelf life of fruits.

The positive relationship found between sales promotions and stockpiling could also be explained through the community-oriented nature of South Africa’s BOP consumer market. These individuals often practice collectivism in the form of stokvels. The strong presence of communities and stokvels within this market could provide a possible explanation for stockpiling given that these individuals come together and make payments towards a common fund. These funds are then made available for these groups to make bulk purchases with the intention of generating savings. Furthermore, because of financial constraints faced by the BOP market, the bulk buying caused by sales promotions is not always on their preferred brands. This finding further reiterates that brand switching does indeed mediate the relationship between sales involvement and stockpiling. The following section discusses the implications that the results and finding of this study have on marketers.

Managerial Implications

The results of this study revealed that sales involvement was positively correlated to brand switching behaviour, meaning that individuals were fairly exploratory in their shopping behaviour. Essentially, switching brands means that the brand that is being switched to is gaining market share during that period. What marketers should aim to do is maintain this market share by ensuring that the consumers who switched to their brands continue to buy that brand in future. Additionally, results indicate that once brand switching occurred, some consumers stockpiled on the new brands. Marketers should therefore focus sales promotions on goods that are stockpiling friendly for example small in size and non-perishable.

An interesting result obtained from this study is that type of promotion was found to have an insignificant moderating effect on the model in the study. The three different promotion types namely coupon, price discount and competition displayed an insignificant moderating effect for both soap and body lotion. This finding suggests that marketers and brands alike should not place significance on one type of promotion over the other. This is not to say that promotions should be neglected all together. FMCGs should therefore conduct further research into which promotion type suits the BoP market best.

Furthermore, this study gathered that the majority of the respondents conducted their shopping towards the end of the month (53.9%) and beginning (30.1%) with the least (16.1%) doing their household shopping during the middle of the month. It is thus suggested that companies run their promotions towards the end of the month and extend these promotions into the beginning of the next month. Although focusing on beginning and end of month, companies should not neglect mid-month promotions. These promotions should target consumers that are doing replenishment shopping. In addition to this, an interesting finding that was divulged is that a large percentage of males from the sample (51.8%) were responsible for their own household shopping with regards to purchasing both soap and body lotion. This suggests that companies should not discriminate between males and females when promoting either soap or body lotion. Both genders were responsive to sales promotions. This is in contrast to widely held beliefs that females are mostly responsible for household shopping including that of personal care items (LiveMoya, 2014).

Lastly, in each product category, data gathered highlighted that there were dominant brands purchased by a large share of the sample population. Sunlight soap has a dominant share within the market of 35% followed by Protex with 22%. Whilst the dominant brand of body lotion was Nivea with 28% of the market followed by Vaseline with 19%. These brands should continue to promote their products in order to maintain and protect their share of the overall market which is becoming increasingly saturated. Additionally, in order for these leading brands to remain competitive, marketers need to constantly monitor the promotional activities of their competitors. Moreover, FMCGs can use sales promotions to enter new market segments and increase the size of their consumer base.

Limitations and Recommendations for Future Research

First, this study only focused on BOP consumers in Khayelitsha (Western Cape, South Africa). This therefore limits the generalizability of the study across geographical locations such as other township areas and provinces around South Africa. In addition to this, the use of a non-probability sampling to select respondents creates a high risk that the sample may not be representative of the larger target population at hand (Malhotra, 2010).

Second, the study failed to look at the physical attributes of products and the influence this may have on individuals’ stockpiling tendencies. For example a study by Narasimhan, Neslin & Sen (1996) showed that brands that can be easily stockpiled received a higher response from promotions. However, Raju (1992) concluded that bulkiness and perishability both reduces the likelihood of consumers’ stockpiling.

Third, the target population, consisting of lower income consumers in South Africa is characterised as having low literacy rates, especially in English (HDA, 2013). A study by Human et.al (2011) found that the lack of English proficiency amongst respondents accounted for various interviewer biases present in the study such as interviewers providing biased explanations.

Future research could build on the results found in this study through researching the effects of the size of the promotion as well as through the inclusion of other types of promotions. For example, a study by Lowe (2010) has shown that consumers prefer promotions such as price discounts more when it comes to low-brand awareness products. Researchers could thus benefit significantly by examining how individuals with varying degrees of brand loyalty differ in terms of price consciousness and therefore their responsiveness to sales promotions (Kumar & Advani, 2005).

Future research could also help determine whether an individual's level of responsiveness to sales promotions varies during the month. According to the UCT Unilever Institute of Startegic Marketing’s Majority Report (2012; 2014; Simpson & Lappeman, 2017), low-income consumers are often forced out of their loyalty due to their financial constraints and as they become more cash strapped at varying times of the month.

Type of and location of residence has also been found in a study conducted by Blattberg et al. 1978 to be related to an individual’s likelihood to stockpile. This study did not aim to look at residence type which could hold valuable insights for future researchers with regards to South Africa’s BOP market. Similarly, the positive relationship between response to promotions and household size has been the most consistently found according to Mittal (1994). Future research could therefore further examine this relationship between household size and sales promotions responsiveness. This possibility could be expanded to study different product categories. A study conducted by Bell et al. (1999) showed that consumer’s likelihood of stockpiling once exposed to a sales promotion differed across households and product categories.

References

- Aaker D. (1991). Managing Brand Equity: Capitalizing on the Value of a Brand Name. Journal of Marketing, 56(2), 125.

- Ailawadi, KL Gedenk, Lutzky, C & Scott, AN. (2007). Decomposition of the Sales Impact of Promotion-Induced Stockpiling. Journal of Marketing Research, 450-467.

- Ailawadi, KL, Neslin, SA & Gedenk, K. (2001). Pursuing the Value-Conscious Consumer: Store Brands Versus National Brand Promotions. Journal of Marketing, 65(1), 71-89.

- Alford, BL & Biswas, A. (2002). The Effects of discount level, price consciousness and sale proneness on consumers' price perception and behavioural intention. Journal of Business Research, 55.

- Barki, E and Parente, J. (2010). Consumer Behaviour of the Base of the Pyramid Market in Brazil. Getulio Vargas Foundation.

- Bawa, K & Gosh, A. (1999). A Model of Household Grocery Shopping Behaviour. Marketing Letters, 10 (2), 149-160.

- Bell, DR., Chiang, J & Padmanabhan, V. (1999). The Decomposition of Promotional Response: An Empirical Generalization. Marketing Science, 18(4), 504-526.

- Blattberg, R, Briesch, R & Fox, E. (1995). How Promotions Work. Marketing Science, 14(3), 122.

- Blattberg, RC, Buesing, T, Peacock P & Sen S. (1978). Identifying the Deal Prone Segment. Journal of Marketing Research, 15 (3), 369-377.

- Blattberg, RC & Wisniewski KJ. (1988). Modeling Store-level Scanner Data. University of Chicago Marketing Paper.

- Coetzee, M & Oosthuizen, R. (2013). Examining the Mediating Effect of Open Distance Learning Students’ Study Engagement in Relation to Their Life Orientation and Self-Efficacy. Journal of Psychology in Africa, 23(2), 235-242.

- Coetzer, P. (2011). The ultimate BoP Laboratory - A socioeconomic snapshot of Khayelitsha. [Online] Available at: http://www.bop.org.za/BoP_Lab/

- Publications_files/Khayelitsha11.pdf [21 April 2016]

- Chandon, P, Wansink, B & Laurent, G (2000). A Benefit Congruency Framework of Sales Promotion Effectiveness. JM, 64 (4), 65-81.

- Chipp, K, Corder, C & Kanelianis, D. (2013). The role of collectivism in defining the South African Bottom of the Pyramid. Journal of the South African Institute for Management Scientists.

- D’Haese, M & Van Huylenbroeck, G. (2005). The rise of supermarkets and changing expenditure patterns of poor rural household’s case study in the Transkei area, South Africa. Food Policy, 30(1), 97-113.

- Dodson, JA, Tybout, AM & Sternthal, B. (1978). Impact of Deals and Deal Retraction on Brand Switching. Journal of Marketing Research, 15 (1), 72-81.

- Douglas, S P, and E J Nijssen. (2003). "On the use of “borrowed” scales in cross-national research." International Marketing Review, 20(6), 621-642.

- Durham, L. (2013). Beauty is priceless - Or is it? Euromonitor International, 2, 25-28.

- Ehrenberg, ASC. (1988). Repeat-buying: facts, theory and applications. 2nd ed. Griffin, New York: Oxford University Press.

- Euro monitor. (2012). International report on Beauty and Personal Care in South Africa. Euromonitor.

- Foxall, G. (2015). Strategic Marketing Management (RLE Marketing). 2nd ed. Oxon: Routledge.

- Gangwar, M, Kumar, N & Rao, RC (2013). Consumer Stockpiling and Competitive Promotional Strategies. [Online]Available: http://www.isb.edu/faculty/Manish_Gangwar/Consumer%20Stockpiling%20and%20Pro motions.pdf [2015, September 6].

- Garrette, B & Karnani, A. (2009). Challenges in Marketing Socially Useful Goods to the Poor. California Management Review, 52(4).

- Gupta, S. (1988). Impact of Sales Promotion on When, What, and How Much to Buy. Journal of Marketing Research, 25, 342–55.

- Habing, B (2002). Exploratory Factor Analysis. [Online] Available: http://www.stat.sc.edu/~habing/courses/530EFA.pdf [2015, September 4].

- Hatch, G, Becker, P & Van Zyl, M (2011). The Dynamic African Consumer Market: Exploring Growth Opportunities in Sub-Saharan Africa. South Africa: Accenture.

- HDA (2013). Western Cape: Informal Settlements Statement. [Online] Available: http://www.thehda.co.za/uploads/files/HDA_Western_Cape_Report.pdf [2015, September 3].

- Henderson, CM (1985). Modeling the Coupon Redemption Decision. Advances in Consumer Research, 12, 138-143.

- Hoek, J & Roelants, L (1991). Some Effects of Price Discounting on Discounted and Competing Brands' Sales. Marketing Bulletin, 2, 55-59.

- Hong, P, McAfee, RP & Nayyar, A (2002). Equilibrium Price Dispersion with Consumer Inventories. Journal of Economic Theory, 105, 503-517.

- Inman, JJ & Winer, RS (1998). Where the Rubber Meets the Road: A Model of In-store Consumer Decision. Making. Working Paper Marketing Science Institute, 98-122.

- Inman, JJ & Zeelenberg, M (2002). Regret in repeat purchase versus switching decisions: The attenuating role of decision justifiability. Journal of Consumer Research, 29(1), 116.

- Kahn, B & Louie, T (1990). Effects of Retraction of Price Promotions on Brand Choice Behavior for Variety-Seeking and Last-Purchase-Loyal Consumers. Journal of Marketing Research, 3(3), 279-89.

- Kolk, A, M Rivera-Santos, and C Rufín (2013). Reviewing a Decade of Research on the “Base/Bottom of the Pyramid” (BOP) Concept. Business & Society, 1-40.

- Kopalle, PK, Mela, CF & Marsh, L (1999). The Dynamic Effect of Discounting on Sales: Empirical Analysis and Normative Pricing Implications. Marketing Science, 18, 317-332.

- Kotler, P & Armstrong, G (2015). Marketing Principles: Global and South African Perspectives. Pearson.

- Krishna, A (1994). The Effect of Deal Knowledge on Consumer Purchase Behavior. Journal of Marketing Research, 31, 76-91.

- Kumar, S & Advani, J (2005). Factors affecting brand loyalty: A study in the emerging market on fast moving consumer goods. Journal of Consumer Behaviour, 4(2), 251-275.

- Kumar, V & Leone, RP (1988). Measuring the Effect of Retail Store Promotions on Brand and Store Substitution. Journal of Marketing Research, 25, 178-185.

- Kumar, S & Singh, MRP (2008). Brand Aspirations and Brand Switching Behaviour of Rural Consumers: A case study of Haryana [Online]. Available: http://dspace.iimk.ac.in/bitstream/2259/462/1/RM64-04-04.1.pdf%20rel=%27nofollow%27 [2015, March 16].

- Kusek, K. (2016). The Death Of Brand Loyalty: Cultural Shifts Mean It's Gone Forever. Forbes Magazine, July 25, 2016.

- Kwon, K & Kwon, Y. (2007). Demographics in Sales Promotion Proneness: A Socio-Cultural Approach. Advances in Consumer Research, 34, 288-293.

- Laroche, M, Pons, F, Zgolli, N, Cervellon, M & Kim, C. (2003). A model of consumer response to two retail sales promotions techniques. Journal of Business Research, 7 (56).

- Leibtag, E & Lynch, K (2007). Where and How: Low-Income Consumer Food Shopping Behaviour. Oregon: American Agricultural Economics Association.

- Lichtenstein, DR, Netemeyer, RD & Burton, S (1990). Distinguishing Coupon Proneness From Value Consciousness: An Acquisition- Transaction Utility Theory Perspective. Journal of Marketing, 54-67.

- Lichtenstein, DR, Ridgway, NM & Netemeyer, RG.(1993). Price Perceptions and Consumer Shopping Behaviour: A field Study. Journal of Marketing Research, 234-245.

- LiveMoya (2014). Marketing to the low-income consumer [Online]. Available: http://www.livemoya.com/livemoya-news/marketing-to-the-low-income-consumer/ [2015, March 16].

- Lowe, B (2010). Consumer Perceptions of extra free Product Promotions and Discounts: The Moderating Role of Perceived performance risk. Journal of Product & Brand Management, 12 (7), 496-503.

- Makanyeza, C (2015). An Assessment of Reliability and Validity of the Attitudinal and Behavioral Typology of Customer Loyalty in a Developing Country: Evidence from Zimbabwe . Mediterranean Journal of Social Sciences 6, no. 1, 310-318.

- Mariole, VP & Elina, BD (2005). Sales promotion Effects on Customer Based Brand Equity. International Journal of Market Research, 47(2), 172-204

- Mazursky, D, LaBarbera, P & Aiello, A. (1987). When Consumers Switch Brands. Psychology & Marketing,20 (4), 17-30.

- McAlister, L & Pessemier, E (1982). Variety Seeking Behavior: An Interdisciplinary Review. Journal of Consumer Research, 9(3), 311-322.

- McNeill, LS, Fam,K & Chung, K (2008). Chinese Consumer Preference for Price Based Sales Promotion Techniques – the Impact of Gender, Income and Product Type. ANZMAC, 1-7.

- Mei-Mei, L, Man-Tsun, C, Ka-Leung, M & Liu, W (2006). The Brand Loyalty of Sportswear in Hong Kong. Journal of Textile and Apparel, Technology and Management, 5 (1), 1-13.

- Mittal, B (1994). Bridging the Gap Between Our Knowledge of 'Who' Uses Coupons and 'Why' Coupons Are Used. Working Paper Marketing Science Institute, 94-112.

- Montaner, T (2011). Consumer Response to Gift Promotion. Journal of Product & Brand Management, 20 (2), 77-89.

- Müllerová, L (2011). The Effectiveness of Sales Promotion in the FMCG Sector. Prague.

- Nagadeepa, C, Selvi, T & Pushpa A (2015). Impact of Sale Promotion Techniques on Consumers’ Impulse Buying Behaviour towards Apparels at Bangalore. Asian Journal of Management Sciences & Education, Vol. 4(1), 116-124.

- Nagar, K (2009). Evaluating the Effect of Consumer Sales Promotions on Brand Loyalty and Brand Switching Segments. The Journal of Business Perspective, 13(4), 36-45.

- Narasimhan, C, Neslin, SA & Sen, SK (1996). Promotional elasticities and characteristics. Journal of Marketing, 60 (2), 17-30.

- Ndubisi, NO & Chiew,TM (2006). Awareness and Usage of Promotional Tools by Malaysian Consumers: The Case of Low Involvement Products. Management Research News, 29, 28-40.

- Nielsen (2014). Cracking the Trade Promotion Code [Online]. Available: http://www.nielsen.com/us/en/insights/news/2014/cracking-the-trade-promotion-code.html [2015, April 15].

- Obeid, MY (2014). The effect of sales promotion tools on behavioral responses. International Journal of Business and Management Invention, 28-31.

- Obermiller, C & Wheatley, J (1984). Price effects on choice and perceptions under varying conditions of experience, information, and beliefs in quality differences. Advances in Consumer Research, 11, 453- 458.

- Omotayo, O (2011). Sales Promotion and Consumer Loyalty: A Study of Nigerian Telecommunication Industry. Journal of Competitiveness, 1-12.

- Pentz, C, N Terblanche, and C Boshoff (2013). Measuring Consumer Ethnocentrism in a Developing Context: An Assessment of the Reliability, Validity and Dimensionality of the CETSCALE. Journal of Transnational Management 18(3), 204-218.

- Prahalad, CK & Hammond, A (2002). Serving the World's Poor, Profitably. Harvard Business Review, 4-11.

- Rajagopal, R (2009). Global shifts in marketing strategy: A new research agenda. Innovative Marketing, 5 (3).

- Raju, J S (1992). The Effect of Price Promotions on Variability in Product Category Sales. Marketing Science, 207-220.

- Raju, PS (1980). Optimum Stimulation Level: Its relationship to Personality, Demographics, and Exploratory Behaviour. Journal of Consumer Behaviour, 7, 272-82.

- Ryan, RM & Deci, EL (2000). Intrinsic and Extrinsic Motivations: Classic Definitions and New Directions. Contemporary Educational Psychology, 25, 54–67.

- Salvi, P (2013). Effectiveness Of Sales Promotional Tools: A Study On Discount, Price Off And Buy One Get One Free Offers In Branded Apparel Retail Industry In Gujarat. ELK Asia Pacific Journal of Marketing and Retail Management, 4(4).

- Sathish, M, Kumar, KS, Naveen, KJ & Jeevanantham, V (2011). A Study on Consumer Switching Behaviour in Cellular Service Provider: A Study with reference to Chennai. Far East Journal of Psychology and Business, 2(5), 71-81.

- Simanis, E (2012). Reality Check at the Bottom of the Pyramid. Harvard Business Review.

- Simanis, E, & D Duke (2014). Profits at the Bottom of the Pyramid. Harvard Business Review.

- Simpson, J, & Lappeman, J (2017). Marketing in South Africa (4th edition), Van Schaik.

- Sheth, JN & Raju, PS (1974). Sequential and Cyclical Nature of Information Processing Models in Repetitive Choice Behavior. Advances in Consumer Research, 1, 348-358.

- Shukla, P (2004). Effect of Product Usage, Satisfaction and Involvement on Brand Switching Behaviour. Journal of Marketing and Logistics, 16(4), 82-83.

- Sun, B, Neslin, S & Srinivasan, K (2010). Measuring the Impact of Promotions on Brand Switching When Consumers Are Forward. Journal of Marketing Research, 59(1), 389-405.

- Teunter, L (2002). Analysis of Sales Promotion Effects on Household purchase behaviour. Erasmus Research Institute of Management [Online]. Available: http: //www.erim.eur.nl [2015, September 5].

- Trivedi, M & Morgan, MS (2003). Promotional Evaluation and Response among Variety Seeking Segments. Journal of Product and Brand Management, 12(7), 408.

- Unilever (2015). View Our Brands [Online]. Available: http://www.unilever.co.za/brands-in-action/view-brands.aspx [2015, April 11].

- UCT Unilever Institute of Strategic Marketing (2012). The Majority Report. Cape Town. University of Cape Town.

- UCT Unilever Institute of Strategic Marketing (2014). Connecting with Survivors. Cape Town. University of Cape Town.

- Vani, G, Babu, M & Panchanatham, N (2010). Toothpaste Brands –A Study of consumer behavior in Bangalore city. Journal of Economics and Behavioral Studies, 27-39.

- Van Trijp, HCM, Hoyer, WD & Inman, JJ (1996). Why Switch? Product Category-Level Explanations for True Variety-Seeking Behavior. Journal of Marketing Research, 33(3), 281-291.

- Variawa, E (2010). Buying behaviour and decision-making criteria of Base of the Pyramid consumers: The influence of packaging on Fast Moving Consumer Goods customers’ brand experience. Pretoria: Gordon Institute of Business Science.