Research Article: 2022 Vol: 26 Issue: 2S

Practices In Sustainable Finance: A Neoliberal Marketing Model In Insurance Sector

Silky Vigg Kushwah, New Delhi Institute of Management New Delhi, India

Garima Mathur, Prestige Institute of Management, Gwalior,India

Citation Information: Kushwah, S.V., & Mathur, G. (2022). Practices in sustainable finance: a neoliberal marketing model in insurance sector. Academy of Marketing Studies Journal, 26(1), 1-11.

Abstract

Financial sustainability is becoming increasingly crucial in the corporate world, and in recent years, many firms have taken tremendous measures to embed financial sustainability activities in their business model. Some of the firms utilize financial sustainability practices as one of the marketing tools to build a strong brand image. To understand the role sustainable finance plays in the financial sector, especially the Insurance sector, this paper studies five major private and public sector insurance companies in India and access their best practices, standards and trends in sustainable finance. This study analyses the common practices of the insurance sector towards social and environmental considerations. It also examines the best practice initiatives by these companies to understand the scope and extent of financial sustainability in the Indian insurance sector. The survey method has been used to conduct the study where a self-made questionnaire was administered among top managers of insurance companies in north India. A purposive sampling technique has been used to select the respondents. The results highlight that most insurance companies report sustainable finance activities in their performance reports and embed them in their operations and strategies. Many insurance companies introduced sustainable products with social and environmental consideration, and sustainable finance is considered an important criterion for screening their investments. Some Insurance companies have also intensified the involvement of stakeholders in solving sustainable issues and consider customers concerns. It can be concluded that the Indian insurance sector has taken a path of financial sustainability, and continuous efforts are being made towards social and environmental considerations. These firms are showcasing their small efforts in sustainable finance as a neoliberal marketing tool. Still, there is a long road ahead, and much more can be achieved in this area to reach sustainable finance. This study is useful for many stakeholders of the Insurance sector. The regulators can use the results, especially Insurance regulatory and development authority (IRDA), India, in their policy matters related to sustainable development. It will also be of great interest to all insurance companies to understand the current status of the Insurance sector in sustainable finance and where the gap is, and how it can be filled.

Keywords

Sustainability Development, Sustainable Finance, Corporate Social Responsibility, Insurance Sector.

JEL Classification Codes

A12, G2, G3, M2, Q0,

Introduction

CSR Finance or Financial sustainability is an upcoming concept under sustainable finance. Financial sustainability can be defined as managing the company's funds and risk management products and services in such a way that either promote or guard economic growth, environmental and social well-being. There are many financial institutions internationally and nationally that have adopted practices in the field of sustainable finance.

The companies who follow sustainable finance indulge in responsible business conduct by creating long term values and minimizing investor's risk. They make such investment decision which will enhance ecological and community well-being. They expect more responsible corporate behaviour from all their stakeholders. These companies also integrate environmental and social issues in their business decisions, creating new business opportunities for them. They also keep internal transparency at priority so that communication within the company is clear and strong, resulting in workplace diversity. Such companies put into practice the inclusion of sustainable development in their broad objectives and policies to create a strong relationship with all their stakeholders. The World Bank Group (2014) has defined a sustainable financial system as "A sustainable financial system is stable and creates, values, and transacts financial assets in ways that shape real wealth to serve the long-term needs of a sustainable and inclusive economy along all dimensions relevant to achieving those needs, including economic, social, and environmental issues; sustainable employment; education; retirement financing; technological innovation; resilient infrastructure construction; and climate change mitigation and adaptation" (p.24).

It can be understood that financial stability demands companies to follow such practices, which will not only result in economic prosperity. Still, it will also enhance the stakeholders' well-being by keeping accountability and transparency, delivering responsible financial products and services, growth and development of the employees, making their offices a better workplace, etc. Environmental safety like funding projects for renewable energy, waste treatment etc. Sustainable finance should be taken as means rather than a goal to profit maximization as finance is considered sustainable when it takes environmental, economic, and social issues (Schoenmaker, 2017). In suggesting a road map to sustainable development, The World Bank Group (2014) also identified three types of initiatives for a sustainable financial system for both the public and private sector till 2030. It included market-based initiatives, National Initiatives and International initiatives.

In the Indian context, according to a report by FICCI along with UNEP (2014), there is a great need for sustainable development, especially in the areas of power, agriculture, telecom sector, transport, water and sanitation, food security, climate change, education, eco-systems and health (Robins & Choudhury, 2014). UNCTAD has mentioned that concerning the Indian economy, there must be investment above USD 3.5 Trillion per year till 2030, whereas current investment is only up to USD1 Trillion. This shows that India is lagging far behind the investment requirements. So, it can be seen that sustainable finance has gained momentum in the Indian corporate sector too. There are not many studies on analyzing the sustainable finance activities carried out by the Indian corporate sector to the best of our knowledge. Moreover, there are no such studies specifically on the Insurance sector in India. The current study is the first attempt to explore the sustainable finance practices adopted by the Indian financial sector with a special focus on the insurance sector.

The next section of the study gives the Material Studied followed by Methods and Techniques. The next section provides the Results and Discussion, which is further followed by the Conclusion section.

Research Methodology

After going through extensive literature, it is witnessed that there is a dearth of research in the areas of sustainable practices in the insurance sector. The current section tries to compile all substantial studies related to sustainable finance. Climate-related threats such as flood, earthquakes have significantly increased protection gaps among insurers (Climate Wise, 2016). This indicates that the public has already started taking care of the future, so it is most likely that they pay due attention to the contributions of companies in sustainable development. Chief Risk Officer, Zurich Global Corporate, Zurich Insurance Group strongly emphasized the role of Insurance in helping people bounce back during environmental catastrophe (Climate Wise, 2016).

The public views organizations from a very different perspective, specifically when it comes to evaluation criteria. Whenever asked, people begin with the criterion of what a company offering to society as a whole in terms of development in different areas. The public also evaluates organizations based on future returns for the society (Hugé, Waas, Dahdouh-Guebas, Koedam & Block, 2013).

The focus on sustainable finance practices increased considerably in the last decades. There is a strong emphasis on improving sustainable finance in almost all sectors. However, the financial sector has been one of the major concerns for enhancing sustainability (Robins & Choudhury, 2015). The significance of disclosures on sustainability is evident by introducing the standards on Corporate social responsibility by ISO (26000) in 2010 (Tamm Hallström & Boström, 2010). The view towards sustainable finance has shifted from the short term to a visionary perspective by creating value (Schoenmaker, 2017). In this course, GRI (Global Reporting Initiatives) plays an important role in deciding reporting framework. Most organizations need to follow these guidelines, whether state-owned, public enterprise, or voluntary (Borglund et al. 2010; Furusten et al. 2012).

It should be noted that sustainability has to be reported timely and in the format prescribed by various agencies. The reporting system should be such that it is based on analytical facts that can be institutionalized easily. Although there are failures in such reporting, like Sustainability reporting, 2011 of Swedish Banker's association stated that 29% of the banks do not report sustainability practices. The situation is not different in another context too. For example, according to GRI (2018), only 7% of public sector companies have reported sustainability practices. Sustainability reporting a systematic, sequential presentation of the issues so as compare past and future progress (INTOSAI Working Group on Environmental Auditing (WGEA), 2011). The reporting includes financial and non-financial information. Financial reporting varies substantially with sustainability reporting (INTOSAI Working Group on Environmental Auditing (WGEA), 2011).

Moreover, writing a sustainability report is a scientific and analytical process rather than an intuitive one. The measures taken must be reported properly. They have further stressed the role of auditing firms in the evaluation of sustainability. The same is evident through the increase in the number of sustainability consultants (Alexius, et al. 2013).

On the other hand, the stakeholders in the financial sector are also not aware of the sustainability issues. The practitioners vary significantly in understanding sustainability practices (Jutterström & Norberg, 2013; Hugé, Waas, Dahdouh-Guebas, Koedam & Block, 2013) and in prioritizing them and these differences hinder capabilities of companies to face changing market conditions (World Bank Group, 2017). Likewise, GRI (2017) indicates that integrating sustainable finance with corporate or business strategy is one of the major criteria for organizational success. At the same time, Global sustainability addresses the issues such as lessening carbon emissions, not exploiting renewal natural resources and considering general human rights in many activities (Jutterström & Norberg, 2013).

Being specific to the insurance sector KPMG Survey (2015) has reported positively about the sustainable finance reporting of the insurance sector. In a survey including G-250 positioning world's largest 250 companies where 8% companies were from Insurance and 4% out of 4500 top companies in terms of revenue worldwide were again from the insurance sector. The KPMG report reflects that insurance companies publish more CR Reports as compared to the global average. The report has assessed the criteria like; Stakeholder engagement, Materiality, Risk, opportunity and strategy, Targets and indicators, Transparency and balance, suppliers and value chain, corporate responsibility governance, according to UNEP (2015), who has given due importance to the insurance sector. The report covers three aspects of Environmental, Social Governance (ESG). The report further suggests that aligning ESG factors with core operations of Insurance will provide sustainability to the insurance sector, and the sustainable insurance sector plays an important role in the sustainable global economy.

Interestingly, an article on the investment sector states that there are mixed performance levels in the insurance sector (Gloria Gonzalez & Lang, 2018). They opine that there are serious lags in making senior officials accountable for sustainable performances in the insurance sector, though the overall accountability increased from 17% in 2014 to 38%. The report further states that sustainability performance is further not linked with paychecks.

In fact, in India, there is great pressure on the adoption of sustainable financial practices. For example, Robins & Choudhury (2015) have emphasized that according to National Voluntary Guidelines on Social, Environmental and Economic Responsibilities of Business (2011) and compulsion according to Companies Act (2013, Schedule VII) regarding CSR have made organization re-think their way of handling sustainable finance.

Research Gap

Sustainable finance is a new concept among Indian financial companies, especially Insurance Sector. After going through the literature and reports, it is observed that not much research work has been conducted in this area. None of the studies is there with Indian context on Sustainable finance, especially in the Insurance sector. The aspect of practices in sustainable finance in Indian Insurance remains unexplored. After going through the literature, it can be seen that there is no systematic research done in this area in India's insurance sector, so this research aims to fill this gap.

Research Questions

After discussing the research gap, we seek to answer the following research questions:

1. Among the best sustainable finance practices worldwide, how many are adopted by Indian insurance companies?

2. What are the Indian insurance sector's practices in Sustainable finance?

Methods and Techniques

The research study is exploratory and descriptive (conclusive) in nature as it tried to explore initially and finally describes the practices of sustainable finance adopted by insurance companies in India. The research is primary, with a survey method being used to collect the data. A self-made questionnaire with a Likert scale is constructed. The questionnaire contains close-ended questions. The study population includes all top management employees of insurance companies prevailing in the central region of India. A purposive sampling technique is used to collect the data. The questionnaire is administered among top management employees of top five insurance companies, both life and general, namely, Life Insurance Corporation of India, Max Life Insurance Company, HDFC Life Insurance Company, ICICI Prudential Life Insurance Company and Tata AIA Life Insurance Company prevailing in central India forsix months from April to September 2020. 225 questionnaires were distributed to the top management employees of the insurance sector, although the response rate is 87%, so 196 questionnaires have been collected, out of them one unfilled questionnaire was discarded and finally 195 responses were used for final analysis.

The self-made questionnaire has two parts, and part one asks for the respondent's personal information like designation, age, gender and qualification. Part two consists of statements measuring the sustainable finance practices followed by insurance companies in India. A five-point Likert scale is used to measure where one indicates never, two indicates rarely, three indicates seldom, four indicates often, and five indicates always. The data is converted into meaningful information by using a couple of tools. As the questionnaire is self-made, it is important to check the validity of the questionnaire. Item to total correlation is used to check the internal consistency of the questionnaire, and the value of r is desirable. Cronbach alpha is used to check the reliability of the questionnaire, and the alpha value is .942 for 23 items. The frequencies and percentage method reflect the sustainable finance practices adopted by insurance companies in India Table 1.

| Table 1 Demographic Description Of Data |

||

|---|---|---|

| Category | N | |

| Gender | Female | 50 |

| Male | 145 | |

| Age | 21-30 years | 23 |

| 31-40 years | 97 | |

| 41-50 years | 78 | |

| Qualifications | Post graduate | 180 |

| Undergraduate | 17 | |

Results and Discussion

The study is conducted to analyze the integration of sustainable finance practices in the insurance sector of India. A survey has been conducted, and a questionnaire is administered among the top insurance employees. The responses are compiled using frequencies and percentage method. The following Table 2 shows the statements of the questionnaire and only the positive responses received in percentage form analyzing the adoption of sustainable finance practices in the insurance sector.

| Table 2 Results Of Sustainable Finance (Sf) Practices In The Insurance Sector |

||

|---|---|---|

| No. | Statements | Always+Often (%) |

| 1 | My company's mission & value statements incorporate sustainability | 91.7 |

| 2 | My company has a sustainable finance board committee & governance framework | 88.5 |

| 3 | My company thinks that sustainable finance is a new business opportunity | 63.1 |

| 4 | My company has sustainable finance units with the appointment of sustainable finance staff | 78.2 |

| 5 | My company has designated senior managers responsible for sustainable finance | 71.7 |

| 6 | My company organizes training and development of leaders and staff on sustainable finance awareness | 58.7 |

| 7 | My company has incorporated sustainable finance into performance contracts, job descriptions and incentive pay | 43.9 |

| 8 | My company uses volunteering for employee personal and professional development and managed as an HR program | 64.1 |

| 9 | My company publishes sustainability reports which report on the sustainability performance across entire operations | 65.2 |

| 10 | My company sets target in environmental and social performance areas and asked for reports | 52.2 |

| 11 | My company screens suppliers based on sustainability purchasing guidelines | 56.5 |

| 12 | My company has developed sustainability-oriented risk management policies and procedures | 76.2 |

| 13 | My company has kept internal ecology programs that minimize resource use or provide compensation for negative environmental impacts through offsets | 54.4 |

| 14 | My company defines stakeholders broadly to include shareholders, staff, customers, community environment and suppliers | 69.3 |

| 15 | My company has a long term partnership with NGOs to tackle significant and pressing social or environmental issues | 74 |

| 16 | My company tries to be the leader in sustainability and creates its sustainable finance brand awareness | 72.9 |

| 17 | My company devotes resources to research and raise awareness of sustainability issues | 67.4 |

| 18 | My company identifies and invests funds in sustainable sectors and firms | 73.9 |

| 19 | My company also creates opportunities for consumers to invest in support of sustainability through their investments | 58.7 |

| 20 | My company invests in research and development for building sustainable finance product to align their sustainable finance values with their products and services | 67.4 |

| 21 | My company is involved in charitable activities like financial inclusion, financial literacy, non-profit capacity building, environmental improvements etc | 76.1 |

| 22 | My company integrates sustainability into the claims process | 54.4 |

The results based on the top managers' responses on sustainable finance practices adopted by their company are discussed in this section. Most of the top managers (90%)of India's insurance sector believe that the company's mission and value statements incorporate sustainability. Many top officials (74%) believe that their insurance company has developed sustainability-oriented risk management policies and procedures. This indicates that organizations have already started setting a system for sustainability risk management. Many of them also think that their stakeholders include shareholders, staff, customers, community environment and suppliers. Half of them believe that their company had kept internal ecology programs to reduce the resource use or compensate for negative environmental impacts through offsets. Many top managers (73%) agreed that their insurance company has long-term partnerships with NGOs to tackle significant and pressing social or environmental issues. Many also agree that insurance companies allocate resources in research and raising awareness about sustainability issues. When it comes to investing funds, maximum insurance companies invest funds in sustainability sectors. The findings also highlight that funds invested in research and development to build sustainable finance products are high in insurance companies (68%). Similarly, these companies are also involved in charitable activities like financial inclusion, financial literacy, non-profit capacity building, environmental improvements etc., as indicated by the top managers.

Only half of the top managers agree that a sustainable finance committee is being formed in the company. The insurance companies are also lagging in assigning responsibility among senior managers as only 56% of officials believe that there are designated senior managers for taking care of sustainable finance. This can be a great issue of concern as most respondents indicated that organizations are not showing much concern for developing leaders through training. Again, only half of the top officials believe that their company tries to lead sustainability and create sustainable finance brand awareness. The findings also reflect that half of the companies are moving forward to integrate sustainability into the claims process.

A surprising finding is that most of the top managers think that their companies do not consider sustainable finance as new business opportunities very often. Only 21% of top managers believe that their companies do take sustainable finance as a business opportunity. Again, in having a dedicated sustainable finance unit along with staff, insurance companies lack significantly. Only 30% agree that there are such units always. Again there is a serious lack in incorporating sustainable finance in HR functions. The top management feels that sustainable finance is not incorporated into a performance contract, job description and incentive pay. The companies are found to be low in setting targets for environmental and social performance too. The findings highlight that few of the insurance companies do it while others do it less frequently. Only 14% of the top managers agree that they always screen suppliers based on sustainability purchasing guidelines.

Moreover, very few top officials (32%) state the publication of sustainability reports. Through the findings, it is also witnessed that there is a lesser orientation towards creating opportunities for consumers to invest in support of sustainability. It also highlights that the companies might be engaged in investing in research to develop sustainable products, yet insurance products offered to customers are still less.

Exploratory Factor Analysis

The statements were tested for validation through EFA (Exploratory Factor Analysis) to find out the underlying dimensions of sustainable finance in Insurance sector. The data has been tested for sampling adequacy and (KMO Value= .796, p=.000) the sample was good enough to proceed with analysis as the pairwise correlation seems to be higher. In fact Kaiser (1974) reflected that the value higher than 0.5 is good indication of correlations between statements. Furthermore, the Bartlett’s test of sphericity (Chi square= 897.7, p=.000) indicated that the matrix is not identity matrix as the value is significant. The EFA was applied through PCA method and varimax rotation was used to bifurcate statements and assign them to most contributing factor. The analysis resulted in to four factors with eigen values over 1 Table 3.

| Table 3 Exploratory Factor Analysis |

||||||

|---|---|---|---|---|---|---|

| Statements | Eigen Value (Cumulative %) | Reliability | Factor 1 | Factor 2 | Factor 3 | Factor 4 |

| 10. My company sets target in environmental and social performance areas and asked for reports. | 25.433 | 0.924 | 0.786 | |||

| 9. My Company publishes sustainability reports which report on the sustainability performance across entire operations. | 0.735 | |||||

| 8. My company uses volunteering for employee personal and professional development and managed as an HR program. | 0.726 | |||||

| 17. My company devotes resources to research and raise awareness of sustainability issues. | 0.681 | |||||

| 18. My company identifies and invests funds in sustainable sectors and firms. | 0.674 | |||||

| 12. My company has developed sustainability oriented risk management policies and procedures. | 0.659 | |||||

| 20. My company invests in research and development for building CSR product in order to align their CSR values with their products and services. | 0.642 | |||||

| 13. My company has kept internal ecology programs which minimize resource use or provide compensation for negative environmental impacts through offsets. | 0.617 | |||||

| 7. My company has incorporated CSR into performance contracts job descriptions and incentive pay. | 0.612 | |||||

| 19. My company also creates opportunities for consumers to invest in support of sustainability through their investments. | 0.604 | |||||

| 22. My company integrates sustainability into the claims process. | 0.477 | |||||

| 21. My company is involved in charitable activities like financial inclusion, financial literacy, non-profit capacity building, environmental improvements etc. | 46.447 | 0.900 | 0.836 | |||

| 15. My company has long term partnership with NGO to tackle significant and pressing social or environmental issues. | 0.785 | |||||

| 14. My company defines stakeholders broadly to include shareholders, staff, customers, community environment and suppliers. | 0.644 | |||||

| 16. My company tries to be leaders in sustainability and creates its CSR brand awareness. | 0.631 | |||||

| 6. My company organizes training and development of leaders and staff on CSR awareness. | 0.610 | |||||

| 5. My company has designated senior managers responsible for CSR. | 0.525 | |||||

| 1. My Company’s mission & Value statements incorporate sustainability. | 60.211 | 0.793 | 0.826 | |||

| 2. My company has CSR board committee & governance framework. | 0.814 | |||||

| 4. My company has CSR units with appointment of CSR staff. | 0.634 | |||||

| 11. My company screens suppliers on the basis of sustainability purchasing guidelines. | 0.536 | |||||

| 3. My company thinks that CSR is a new business opportunity | 68.909 | 0.408 | 0.783 | |||

| 23. My company has built some CSR insurance products. | 0.604 | |||||

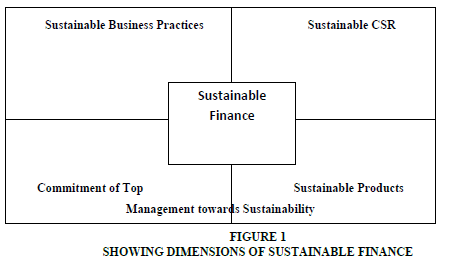

The study resulted into four factors, Factor 1- Sustainable Business Practices; Factor 2 -Sustainable CSR; Factor 3 -Commitment of Top Management towards Sustainability, Factor 4 -Sustainable Products. These dimensions state about the major contributions towards sustainable products. Though through the data ‘Sustainable Products’ were the least important dimension whereas ‘Sustainable Business Practices’ play major role in working out needs for today’s requirements without compromising much from future Figure 1.

If the practices are adopted now both current and future generations will be at advantage. Although the role of company’s initiatives towards financial inclusion, literacy, non-profit charitable activities was considered as major contributor in sustainability through CSR with highest loading value. Among the CSR activities for sustainability environmental initiatives was again considered as big concern. Though the role of top management in taking such initiatives was also caught attention of decision makers.

Conclusion

Financial sustainability is gaining importance among financial companies in recent years. The study tried to understand and analyze the adoption of sustainable finance practices by the top five insurance companies prevailing in India. It can be witnessed that the insurance companies have started incorporating some financial sustainability activities in their company's mission and value and consider it as a new business opportunity for them. It can also be highlighted that these companies are doing research and development on creating sustainable insurance products, policies and procedures. When it comes to investing funds, maximum insurance companies have started investing in sustainability sectors. On the other hand, this study underlines that these insurance companies lack in adopting many of the best sustainable finance activities, to name a few, no dedicated senior staff for sustainable finance activity, not having separate sustainable finance units. So,it is observed that work on financial sustainability in Indian insurance companies is still at a niche stage, and lots of best practices can be incorporated to enhance the scope of financial sustainability in the insurance sector.

It can be concluded that the Indian insurance sector has taken a path of financial sustainability, and continuous efforts are being made towards social and environmental considerations. Still, there is a long road ahead, and much more can be achieved in this area to reach the goal of sustainable finance. This study is useful for many stakeholders of the Insurance sector. The regulators can use the results, especially Insurance regulatory and development authority (IRDA), India, in their policy matters related to sustainable development. It will also be of great interest to all insurance companies to understand the current status of the Insurance sector in sustainable finance and where the gap is, and how it can be filled.

References

Alexius, S., Furusten, S., & Löwenberg, L. (2013). Sustainable banking?: The Discursive Repertoire in Sustainability reports of banks in Sweden. InPaper presented at the 29th EGOS Colloquium, subtheme 20 Sustainable development and financial markets: Connections, Pitfalls and Options. Montreal 4-6 July.

Borglund, T., Frostenson, M., & Windell, K. (2010). Increasing responsibility through transparency.A study of the consequences of new guidelines for sustainability reporting by Swedish state-owned companies, Stockholm.

Bouma, J.J., Jeucken, M., & Klinkers, L. (2001). Sustainable Banking: The Greening of Finance. Greenleaf Publishing Limited, New York.

Furusten, S., Werr, A., & Alexius, S. (2012). Idealist innovations and Emperor's new clothes: CSR and the consultancy sector. What services are offered and by whom?. In28th EGOS Colloquium, sub-theme 50 Management Consultancy: Exploring the Boundaries and Alternatives, Helsinki, 4-8 July.

Jeucken, M. (2001). Sustainable Finance and Banking: The Financial Sector and the Future of the Planet. Earthscan Publications Ltd, London.

Jutterstr, M., &Norberg, P. (Eds.). (2013).CSR as a Management Idea: Ethics in Action. Edward Elgar Publishing.

Kurantin, N.Y. (2011). Integrating Environmental Accounting into Ghana" s Emerging Oil and Gas Economy.Ghana Institute of Management and Public Administration.

Longping, L.L.Z. (2012). The Survey Results of Global Environmental Audit Conducted by WGEA: Analysis and Implications [J].Auditing Research,1.

Robins, N., & Choudhury, R. (2015). Building a Sustainable Financial Systems to Serve India’s Developmental Needs.UNEP inquiry into the Design of Sustainable Financial Systems, Geneva and Federation of Indian Chambers of Commerce and Industry, New Delhi.

Schoenmaker, D. (2017). Investing for the common good: A sustainable finance framework.Brussels: Bruegel,80.

Tamm, H.K., & Boström, M. (2010).Transnational multi-stakeholder standardization: Organizing fragile non-state authority. Edward Elgar.

World Bank Group (2014).World development indicators 2014. World Bank Publications.

World Bank Group (2017). Road Map for a Sustainable financial system. A UN Environment – World Bank Group Initiative. UNEP & World Bank Publications.