Research Article: 2018 Vol: 22 Issue: 2

Pricing Orientation of SMEs Auto Repairers Using the Facilities, Transformation and Usage (FTU) Framework

Collins Kankam-Kwarteng, Kumasi Technical University

Abstract

The purpose of this study is to empirically validate the contribution of facilities, transformation and usage scale in pricing formation in the auto and vehicle repairs industry in Ghana. Data were collected from 220 SMEs auto and vehicle repairers across the country using convenience sampling technique. Questionnaire for the study involves a measuring scale of the FTU framework and control variables (business age, business size, business form). The study finds that Facilities, transformation and usage (FTU) relate to the pricing orientations of the vehicle repairs industry. Further study results demonstrate that two variables Facilities and Usage are statistically significant in predicting service pricing orientation of SMEs auto repairers with transformation showing a negative relationship after controlling for business age, business size and business form. On originality, this is the first study of this type that contributes to the development of multi-dimensional scale of services pricing in the small and micro auto repairers sector in the Ghanaian context. The study provides players in the industry with deeper understanding of how to develop and establish services pricing scheme in the industry.

Keywords

Pricing Orientation, SMEs, Facilities, Transformation, Usage.

Introduction

Throughout service marketing literature, researchers have concentrated on the Heterogeneity, Inseparability, Perishability and Standardization (HIPS) framework, which define service characteristics. Many of such studies have also been done in what Idounas and Avlonitis (2005) refer to as the most significant areas of the economy: Banking, transports, insurance, etc. In the Ghanaian service sector, however, the role of the Small and Micro Enterprise (SMEs) auto repairers in the industry cannot be underestimated. The vehicle repairs business in Ghana contributes significantly to the total contribution of the informal sector of the economy. The industry provides jobs to thousands of people, thereby becoming a source of revenue to the government through taxation. One of the critical business factors that can help the sustainability of the industry is the required strategies to generate revenue. Effective pricing orientation is a key component of the revenue generation and long-term survival of small and micro businesses including the auto mechanics. A critical component of service delivery is its characteristics. This has also been defined to include many attributes of the service delivery paradigm, including the Facilities, Transformation and Usage (FTU) dimensions.

The FTU connect to define a new dimension to service characteristics (Moeller, 2008). The FTU dimension explains the importance of customer integration and its effects on service delivery. The customer integration may influence service operations in areas including pricing. One of the difficulties in services marketing operations is setting pricing. Service marketers set price by taking a lot of factors into consideration. The distinctive characteristics of service make the formation of pricing difficult. Researchers have developed series of models and perspectives for the formation of pricing. Kotler (2004) proposes internal and external factors in influencing price formation. Shoemaker and Mattila (2007) explain that the formation of service pricing is influenced by consumer factors and service provider factors. In this study, the facilities available for the service to be delivered, the transformation and the process used to repair the vehicle and the usage are considered to presumably influence the pricing formation of the vehicle repairs by small and micro auto mechanics. The study is important from both theoretical and practical perspectives. The study provides bases for additional research for developing more integrative conceptualization on service pricing and, in particular, explaining the facilities, transformation and usage as the basis in the determination of pricing in the vehicle repairs industry. Practically, the study enables the service providers in the industry to understand the role of facilities, transformation and usage and to develop them concurrently. Because the vehicle repairs is becoming more dynamic and challenging, influenced by technological advancement, a reliable and validated FTU model can provide the businesses with considerable advantages that can help them manage intangible assets in a way that achieves competitive advantage and sustainable business.

Literature Review

Pricing is a significant element in the failure or success of a firm since it contributes to the establishment and maintenance of the image of businesses, ensue competitiveness and profits. Most consumers use pricing to judge goods and services (Rajneesh & Kent, 2003; Amstrong & Green, 2011). Usually, pricing is the basic thrust of a company’s promotional strategy (Farese, Kimbrell & Woloszyk, 1991). Objectives of pricing includes: To improve profitability, to impede the operations of competitors in accepting that the rival company is the price leader, to maintain order in highly competitive markets, to improve market shares and to smoothen the seasonality of consumption (Dwyer & Tanner, 2006). Farese, Kimbrell & Woloszyk, (1991) explain that the objectives of pricing consist of achieving returns on investments, share of the market and meeting competition. Objectives of pricing include profits orientation, sales orientation and status quo orientation (Perreault & McCarthy, 2002).

The propositions of a reliable pricing orientation demands a consideration of cost and demand factors in a highly competitive market (Robert, 2001; Andrea, 2011). A strategic pricing orientation includes a particular method to attain the pricing strategy (Ashok, Carmen & Joice, 2008; Ioannis, 2002). Strategic pricing orientation consists of building clients trust by charging reduced prices on services having a high visible reductions in cost, attracting clients from competing firms by introducing a bundle at a low price, by offering services not offered by competitors and increase share of the market by relying on small consumers attended to by full-line (Dwyer & Tanner, 2006). The process in determining pricing includes monitor the competitors, estimate demand patterns, estimate costs, determine objectives of pricing, determine pricing strategy and set price (Farese, Kimbrell & Woloszyk, 1991).

Fundamental pricing orientations include cost oriented price. This consists of calculating the cost involved or putting a service together and the expenditure involved in running a business. Projected profit margins are then added to the figures to determine a price (McTaggart & Kontes, 1993; Treacy & Wiersema, 1993; Patsula, 2007). It consists of the mark-up price, which is the difference between the stated price of a service and the cost involved; and cost plus price that is; all expenses and cost are estimated and then the required profit is included to determine a price (Holland, 1998; Ball, 2011). Another pricing orientation is demand based. This is used to determine what current customers are determined to pay for consuming a specific service (Cicchetti & Haveman, 1972; Patsula, 2007). The significance of using the approach is the customers’ perception of the value of the product. On the other hand, competitors pricing is about monitoring how competitors set pricing of goods and services (Essel, 1996; Lewis & Shoemaker, 1997; Gale & Swire, 2006). Sales, cost and expenditure influence an organization’s profit (Kaplan, 2006; Roberts, Xu, Fan & Zhang, 2011). The results are that firms usually monitor, estimate and project pricing and sales in line with cost and expenditure (Burnett, 2008). Organizations improve a service by adding new features or improve the material required to enable a justification in high prices (Farese, Kimbrell & Woloszyk, 1991). It is clear that previous researchers in the field of pricing has neglected the important role service characteristics can play in the determination of pricing in an industry such as the small and micro auto repairers.

Service Pricing

Services prices literature is somewhat fragmented. Many of the services pricing methods and models on pricing identified in the literature are more case specific, including leasing services (Grenadier, 1996); maintenance services (Murthy & Asgharizadeh, 1999); data network services (Altman, Brady, Resti & Sironi, 2005) and energy efficiency services. Studies conducted by Schissel and Chain (1991), Groth (1995) and Docters, Reopel, Sun & Tanny, (2004) have also provided general an overview of special characteristics of pricing methods in services. Although the final pricing for services is significant, of equal significance is the processes with which the price was determined (Lancioni, 2005). None of the pricing orientations directly answers the questions: What is the best price for a given service in a particular market at some point? Rather, they provide guidelines on what the influential component in the decision regarding pricing is. Clearly, none of the key pricing orientations is to be used openly, but it is rather to be used as a guiding principle and the basis for pricing negotiation and argumentation, both externally and internally. In providing answers to the questions on determining a suitable pricing system for a service such as vehicle repairs and maintenance, the service characteristics FTU are assumed to play a critical role.

The FTU Framework

There has been limited attention to the micro-nature of service processes and interaction between customers and service providers in the discussion surrounding service-dominant logic. In particular, insights beyond distinguishing co-creation from co-production have been few, although separating and relating the two seems essential to our understanding of the new logic of exchange and value creation. A solution to this was suggested by Moeller (2008), who focused her study on customer integration in service provision by distinguishing the three stage process of providing services which involves available facilities, transformational activities and usage. This framework is referred to as the FTU.

The Facility, Transformation and Usage (FTU) framework according to Moeller (2008) includes three stages of service provision: Facilities, transformation and usage and two types of resources: Customers’ and providers’ resources. The review of the FTU establishes its relevance in the auto repairs and maintenance services industry. The FTU framework starts with facilities. It is the beginning of creating value and consists of all the resources available to the service provider. The resources include equipment and know how or personnel, which need to be available before service delivery can be feasible (Mayer, Bowen & Moulton, 2003).

In the auto repairs industry there are machines, persons and the application of knowhow in the servicing of the vehicles. The resources include human assets, intangibles and tangibles that are available to the organization at a particular point in time (Barney, 1991). This, according to Mayer, Bowen & Moulton, (2003) can equally be described as the processes of assembling services or what Edvardsson, Johnson, Gustafsson & Strandvik (2000) maintained are prerequisite for services. Inasmuch as there is no consumer demand on the service operator’s resource, the facilities remain not used (FlieB & Kleinaltenkamp, 2004). If there are no vehicles to be serviced the auto mechanics’ resources and facilities will remain unused.

Mayer, Bowen & Moulton (2003) describe the second stage of the framework of FTU as transformation. The modification or change found in service has been reiterated before (Hill, 1977; Lovelock, 1983). In general, the transformation may occur in the consumer’s or service operator’s resources. Based on the foundation of the framework, Vargo and Lusch (2008) explain that products from a distribution mechanism for providing service. The transformation of the resources of service operators is known to be an indirect provision of services and the transformation of the consumer’s resources as a direct provision of services (Moeller, 2008). In contrast to manufacturing goods, which involves the operator’s resources only, providers of services are not able to acquire or patronize the entire inputs needed for the transformation processes themselves (Hill, 1977). The principle of input is that the object that is serviced can continue to be owned by the consumer (Hill, 1977). Such consumer resources can be consumers’ physical objects, including vehicles for repairs and maintenance (FlieB & Kleinaltenkamp, 2004). A pricing model for transformation process may add to the knowledge development in the service pricing literature.

The integration of consumers’ resources is usually bound to some consumer operations because otherwise no consumer enquiry can be attached to some consumers’ resources. Through service provision, consumer resource is put together with the service operator’s resources. The combination ends with the transformation of consumers’ resources. The handling and servicing of consumers’ resources within the transformation results in the third part of the FTU model, “usage” (Mayer, Bowen & Moulton, 2003). In the vehicle repairs industry, the combination results of the vehicle and the transformation process of the service provider such as equipment and tools may go a long way to influence the pricing regime. The results of providing services are the consumer’s wish to make use of the transformation that is consumer or operator resources and value for the customers.

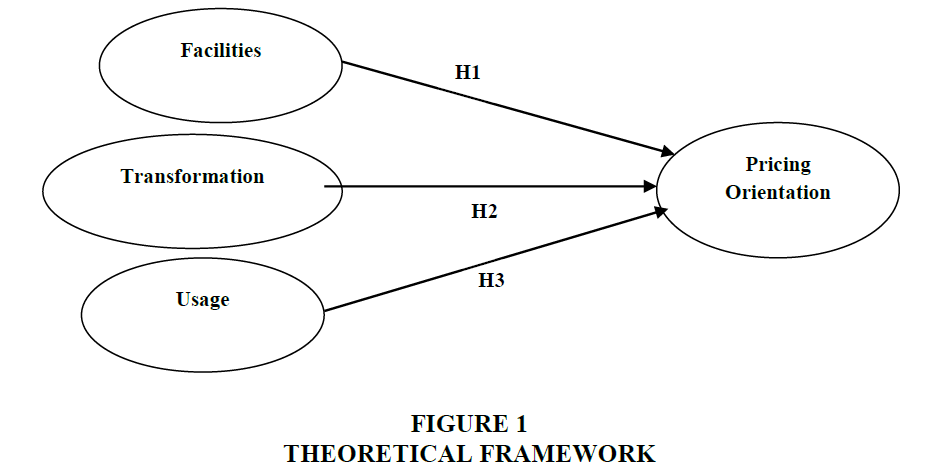

Gummesson (1994) explains that transformation is mostly embodied in a series of different components. Transformation contains components that are either prepared within facilities such as brochure or are involved in co-production by the consumer and the service operator in the period of transforming consumer resources such as a customized offering (FlieB & Kleinaltenkamp, 2004). The facilities stage and the stage of transformation are different in one basic aspect. In contrast to service operator resources, which the operator has at his/her disposal, the operator’s disposal of consumer resource is restricted (Mayer, Bowen & Moulton, 2003; Gummesson, 2004). Thus, the service operator can make consumer autonomous or independent decisions based on his individual resources and process. The combination of consumers’ resources during the provision of service restricts the independency and calls for combined decisions (FlieB & Kleinaltenkamp, 2004). Hence, the inferential definitions are as follows: Services as provision of direct service are activities which include transformation of consumer resources based on objects, persons, goods and/or data. The goods consist of transformation of service operator resource only, which leads to a result exhibiting a distribution framework of the provision of services (Figure 1). Thus based on the information regarding the FTU, the following hypotheses are stated;

H1 Facilities do not have a statistically significant relationship with the service pricing formation of vehicle repairs after controlling for business age, business size and business form;

H2 Transformation does not have a statistically significant relationship with the pricing strategies of the small and micro auto repairs services after controlling for business age, business size and business form;

H3 Usage does not have a statistically significant effects on the pricing formation of the small and micro auto repairs services after controlling for business age, business size and business form.

Methodology

Sample

A target population for the study was limited to the small scale auto repairers in Accra, Kumasi and Tamale. The sample was drawn to ensure that Accra represents the southern part of Ghana; Kumasi represents the middle zone and Tamale for the Northern part of Ghana. This was to ensure a representation of the various small and micro auto repairers scattered across the country. Two hundred and twenty (220) auto repairers were selected, based on the willingness to participate after the design of a quota sample; Accra 80 respondents, Kumasi 80 respondents and Tamale 60 respondents.

Questionnaire Development

The questionnaire for the study was designed to meet the variable specification of the FTU model. Facilities were measured with four (4) items: (a) Skills and knowhow, (b) provider personality, (c) physical environment, (d) type of equipment and tools. Transformation was also measured with four (4) items: (a) Procedure, (b) period used to service the vehicle, (c) nature of the problem and (d) type of vehicle. Usage also had four (4) items scale: (a) Perceived value, (b) perceived outcome, (c) expectation of performance and (d) expected satisfaction. All the twelve (12) items were developed and measured on a 5-point Likert scale of “1” strongly disagree to “5” strongly agree. Pricing orientation as the dependent variable was however considered on a scale of 4 items (demand oriented pricing, cost oriented pricing, competitor oriented pricing and value oriented). The dependent variable items were the central point of this investigation and were measured as the outcome variable using Facilities, Transformation and Usage as the main predictors of pricing orientation formation by the small and micro auto repairers.

Control Variables

The itemize variables which can determine organizational operations such as pricing is very long and they cannot all be studied in a single investigation. However, when testing hypotheses, the variables which might influence and confound analysis, other than those under examination, should be controlled. To this end, three key internal contingencies in this study, namely business size (Kukalis, 1991), business age (Hannan, 1998; Ju & Zhao, 2009) and type of ownership (Durand & Vargas, 2003; Elbanna, 2007) were controlled. Business age was measured as the number of years the respondents has been operating as small scale auto mechanic. Business size was measured as the number of employees or apprentices of the auto servicing firm. Business form was operationalized, using 1) Family Business, 2) Sole Proprietorship; or 3) Partnership for the vehicle repair service businesses. Business age recorded a mean of 12.7690 and a standard deviation of 3.6125. The results show that vehicle repairers who participated in the study have been operating for 9 years and 15 years as shown by the standard deviation. The business size recorded a mean score of 16.2448 and standard deviation of 8.48943.

Internal Consistency and Descriptive Statistics

Reliability coefficients (Cronbach, 1970) are reported for all multi-item scales used in the study. This coefficient alpha indicates the degree to which error variance is present in a scale. All coefficients meet Nunnally and Bernstein’s (1994) criteria for reliability in an exploratory study of this type. To test the fitness of the instrument, Cronbach’s alpha was calculated to measure the internal consistency and reliability of the instrument. The criteria of Cronbach’s alpha for establishing the internal consistency reliability: Excellent (α>0.9), Good (0.7<α<0.9), Acceptable (0.6<α<0.7), Poor (0.5<α<0.6), Unacceptable (α<0.5) (Kline, 2000; George & Mallery, 2003).

The validity and reliability test were conducted on the variables understudy. The variables included facilities-4 items, transformation-4 items and Usage-4 items. The Cronbach’s alpha was shown as; Facilities 0.756, Transformation 0.801 and Usage 0.782. All the variables and the items for the construct exhibited a high internal consistency score. Also, the computed Mean and Standard Deviation of the predictor variables are reported as: Facilities (M=5.6482, SD=1.36664) and Transformation M=5.4554, SD=1.37954 and Usage M=5.432, SD=1.50444.

Correlation Test

A Pearson product-moment correlation test was conducted to know the degree of relationship between the independent variables of Facilities, Transformation and Usage and also between the control variables of business age, business size and business form. The results of the correlation between these variables are shown in Table 1. As it is indicated in the table, there is no statistically significant correlation between all the variables. The correlation coefficient (r), which shows the different relationship between variables, like strong, moderate and weak relation as well also show that there is no relationship between variables because they are not correlated to each other. In this case the values of facilities, transformation and usage show a weak relationship. A further test was conducted using Variance Inflation Factors (VIF) and Tolerance.

| Table 1: Correlation Statistics Of Control And Predictor Variables | |||||||

| Variables | Business age | Business size | Business form | FAC | TRANS | USA | |

|---|---|---|---|---|---|---|---|

| Business age | 1.000 | ||||||

| Business size | -0.080 | 1.000 | |||||

| Business form | -0.001 | 0.052 | 1.000 | ||||

| FAC | 0.047 | 0.063 | -0.039 | 1.000 | |||

| TRANS | -0.046 | 0.116 | -0.013 | 0.067 | 1.000 | ||

| USA | 0.047 | 0.076 | 0.032 | 0.035 | -0.067 | 1.000 | |

*Control variables: Business age=the number years the firm has operated, Business size: The number of employees or apprentice at the shop, Business form: The type of ownership.

*Predictor variables: FAC=facilities, TRANS=transformation, USA=Usage.

Results

A hierarchical multiple regression was used to assess the ability of the three independent variables: Facilities, Transformation and Usage (FTU) to predict pricing formation by the small and micro vehicle repairers after controlling for the influence of business age, business size and business form. Preliminary analyses were conducted to ensure no violation of the assumptions of normality, linearity, multicollinearity and homoscedasticity. A test of collinearity, as shown by the tolerance and the Variance Inflation Factors (VIF), indicated a model fit for the analysis. Tolerance is an indicator of how much of the variability of the specified independent variable is not explained by the other independent variables in the model and is calculated with the formula 1-R squared for each variable. If this value is very small (less than 0.10), it indicates that the multiple correlation with other variables is high, suggesting the possibility of multicollinearity. The results showed a tolerance value of FAC=0.987, TRANS=0.976 and USA=0.984, clearly indicating that there is no possibility of multicollinearity. The value of the VIF is just the inverse of the Tolerance value. VIF values above 0.10 would be a concern and the indication of multicollinearity (Neter, Kutner, Nachtsheim & Wasserman, 1996). The VIF values for the predictor variable shows FAC=1.014, TRANS=1.025, USA=1.016, clearly showing the absence of multicollinearity. To check whether standardized residual case is having any undue influence on the results of the model as a whole, Cook's Distance was also tested. According to Tabachnick and Fidell (2007), cases of Cook’s Distance with values larger than 1 are a potential problem for the model. The Cook’s Distance as shown by the results in the residual statistics indicated MIN=0.000 and MAX=0.055. This means that there are no strange cases likely to influence the model (Table 2).

| Table 2: Coefficients On Factors That Affect Pricing Formation And Collinearity Statistics | ||||||||

| Model | Unstandardized Coefficients |

Standardized Coefficients | t | Sig. | Collinearity Statistics |

|||

|---|---|---|---|---|---|---|---|---|

| B | Std. Error | Beta | Tolerance | VIF | ||||

| 1 | (Constant) | 1.246 | 0.211 | 5.903 | 0.000 | |||

| Business age | 0.004 | 0.010 | 0.031 | 0.377 | 0.707 | 0.994 | 1.006 | |

| Business size | -0.013 | 0.004 | -0.248 | -2.997 | 0.003 | 0.991 | 1.009 | |

| Business form | 0.104 | 0.069 | 0.125 | 1.517 | 0.132 | 0.997 | 1.003 | |

| 2 | (Constant) | 0.721 | 0.302 | 2.384 | 0.019 | |||

| Business age | 0.000 | 0.010 | 0.002 | 0.030 | 0.976 | 0.987 | 1.013 | |

| Business size | -0.014 | 0.004 | -0.269 | -3.406 | 0.001 | 0.967 | 1.034 | |

| Business form | 0.106 | 0.065 | 0.127 | 1.637 | 0.104 | 0.995 | 1.006 | |

| FAC | 0.076 | 0.024 | 0.243 | 3.114 | 0.002 | 0.987 | 1.014 | |

| TRANS | -0.041 | 0.027 | -0.119 | -1.519 | 0.131 | 0.976 | 1.025 | |

| USA | 0.070 | 0.025 | 0.218 | 2.781 | 0.006 | 0.984 | 1.016 | |

| a. Dependent Variable: Pricing | ||||||||

Evaluating The Model

Business age, business size and business form were entered at step 1, explaining 7.6% of the variance in service pricing formation of small and micro auto repairers. After entry of the facilities scale, transformation scale and the usage scale at step 2, the total variance explained by the model as a whole was 19.9%, F(3.133)=5.510, p<0.001 (Table 3).

| Table 3: Model Summary | |||||||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Change Statistics | ||||

|---|---|---|---|---|---|---|---|---|---|

| R Square Change | F Change | df1 | df2 | Sig. F Change | |||||

| 1 | 0.276a | 0.076 | 0.056 | 0.44377 | 0.076 | 3.741 | 3 | 136 | 0.013 |

| 2 | 0.446b | 0.199 | 0.163 | 0.41784 | 0.123 | 6.800 | 3 | 133 | 0.000 |

| a. Predictors: (Constant), Business form, Business age, Business size; b. Predictors: (Constant), Business form, Business age, Business size, FAC, USA, TRANS; c. Dependent Variable: Pricing. |

|||||||||

The three control measures explain an additional 12.3% of the variance in service pricing formation, after controlling for business age, business size and business form responding, R squared change 0.12, F change (3.133)=6.800, p<0.001.

One of the control variables showed statistically significant contribution to the model. Both business age and business form were not statistically significant as their role in the overall model recorded Business age=0.976 and business form=0.104. Only Business size showed a significant value of 0.001. In the analysis for the predictor variables, Facilities scale recorded a statistically significant value=0.002. This meant Facilities (FAC) was significant in predicting the formation of service pricing orientation. Following this result, the null hypothesis was rejected at α=0.05 level and therefore there was a significant relationship between (FAC) and pricing of services (Table 4).

| Table 4: Anovac | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

|---|---|---|---|---|---|---|

| 1 | Regression | 2.210 | 3 | 0.737 | 3.741 | 0.013a |

| Residual | 26.783 | 136 | 0.197 | |||

| Total | 28.993 | 139 | ||||

| 2 | Regression | 5.772 | 6 | 0.962 | 5.510 | 0.000b |

| Residual | 23.221 | 133 | 0.175 | |||

| Total | 28.993 | 139 | ||||

| a. Predictors: (Constant), Business form, Business age, Business size; b. Predictors: (Constant), Business form, Business age, Business size, FAC, USA, TRANS; c. Dependent Variable: Pricing. |

||||||

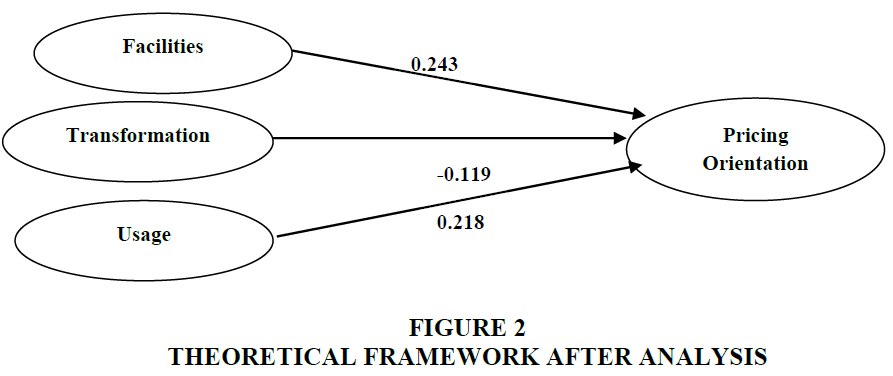

Usage also recorded a statistically significant value=0.006. This is an indication that USA was significantly predicting the formation of services pricing orientation. Considering the fact that there is a statistically significant relationship between the independent variable (USA) and the dependent variable (Pricing orientation), the null hypothesis is therefore rejected at α=0.05 level. However, Transformation was not statistically significant with a value=0.131.This meant Transformation (TRANS) was not statistically significant in predicting formation of service pricing orientation. Because of the insignificance of the relationship between independent variable (TRANS) and the dependent variable (Pricing orientation), the null hypothesis is therefore retained at α=0.05 level (Figure 2).

In the final model in Table 2, one control variable (business size) and two of the three predictor variables (Facilities and Usage) were statistically significant, with the business size recording a higher beta value (beta=-3.406, p<0.001). Facilities recorded a beta value (beta=3.114, p<0.001), whilst Usage recorded beta value (beta=2.781, p<0.001).

Discussion Of Results

The study sought to investigate the critical role of Facilities, Transformation and Usage (FTU) framework in the formation of pricing orientation of SMEs auto repair services in Ghana. The FTU framework was conceptualized as organizational resources that influence operational dimension such as the formation of pricing orientations. The FTU framework, according to Edvardsson, Johnson, Gustafsson & Strandvik (2000) is the prerequisite for services. The findings of this study are therefore expected to confirm this assertion and further establish the FTU as significant organizational capabilities of the SMEs auto repairs industry needed for their operations. The study confirmed that Facilities and Usage have significant and positive effects on the pricing orientation of the SMEs. However, transformation failed to statistically confirm its effects on the pricing orientation of the auto services and repairs. This implies that effective application and implementation of facilities and usage is likely to determine the nature of the pricing orientation of SMEs auto services and repairs in Ghana. This inference supports the studies by Mayer, Bowen & Moulton, (2003) on the usage of customer resources as a key component in service operations, which includes pricing. As internal resources, facilities influence the pricing orientation of SMEs auto repairers through equipment, knowhow or personnel (Mayer, Bowen & Moulton, 2003). Usage improves the direction of the pricing orientation of the auto repairs sector through effective application of the facilities and transformation processes. Even though transformation was found not to influence pricing orientation, its role cannot be underestimated in the combined effects of the FTU framework in the SMEs auto repairs industry in Ghana.

Suggestion For Future Studies

This study has adopted internal capabilities of SMEs’ perspective and has explored service operators’ views and opinions towards the extent to which Facilities, Transformation and Usage factors that influence pricing orientation of auto services. This research explored a series of indicators for defining the FTU framework for measuring SMEs auto repairs pricing orientation. It offers a framework for SMEs auto repairers to implement the FTU applications for measuring effective pricing orientations. Further research might examine how customers evaluate the quality of service received and compare the similarities and differences between how each of the FTU in the service consumption process. Appreciating customers’ expectation and satisfaction levels in the area of the FTU would certainly inform service providers’ decisions and aid survival in a highly informal sector. Future studies can therefore concentrate on the consumer side of the nature of factors that influence the pricing orientation of the SMEs auto repairs industry.

Again, future studies may consider bringing both internal environment and external environment into the discussion of the pricing orientation of the SMEs auto services sectors.

Conclusion

A long series of empirical studies has provided only mixed support for service characteristics and pricing formation. Consequently, the question of whether the FTU framework of service characteristics influences pricing remains unanswered. This study sought to specifically address the role of Facilities, Transformation and Usage (FTU) with an assumption of a positive relationship between the FTU and pricing orientation. The objective of the study is to develop a reliable and valid service pricing scale in the small and micro service sector. This aim is achieved as the study establishes service pricing to be a multi-dimensional scale consisting of the dimensions of the Facilities, Transformation and Usage (FTU) framework with respective sub-dimension items contributing to the significance in the small and micro auto repairs industry. The findings contribute to the service pricing literature in several ways. First, despite the importance of pricing in the strategic activities of small and micro service business, little is known about service characteristics such as Facilities, Transformation and Usage affecting pricing orientation formations. The findings provide support for the viability and performance benefits for pursuing pricing, using service characteristics, especially Facilities and Usage that exhibited a highly statistically significant relationship with pricing formation. The reliance of FTU and their unique sub-variables can enable small and micro auto repairers to become efficient in several areas of their business operations and thus benefit from a suitable pricing determinant in such an unstandardized service industry.

References

- Altman, E.I., Brady, B., Resti, A. & Sironi, A. (2005). The link between default and recovery rates: Theory, empirical evidence and implications. Journal of Business, 78(6), 2203-2227.

- Amstrong, J.S. & Green, K.C. (2011). Demand forecasting: Evidence-based methods. Oxford Handbook in Managerial Economics.

- Andrea, M.B. (2011). Public sector marketing: Importance and characteristics. Journal of Economics Practices and Theories, 1(2).

- Ashok, J., Carmen, S. & Joice, G. (2008). Applying customer relationship valuation. The Journal of Professional Pricing.

- Avlonitis, G. & Idounas, K. (2005). Pricing objectives and pricing methods in the services sector. Journal of Services Marketing, 19(1), 47-57.

- Barney, J.B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99-120.

- Burnett, J. (2008). Core concept of marketing. Zurich, Switzerland; Global Text.

- Cicchetti, C.J. & Haveman, R.H. (1972). Optimality in producing and distributing public outputs. Paper presented at Meetings of the American Economic Association, Institute for Research on Poverty. University of Wisconsin.

- Cronbach, L.J. (1970). Essentials of psychological testing. New York: Harper & Row.

- Docters, R., Reopel, M., Sun, J. & Tanny, S. (2004). Winning the profit game-Smarter pricing, smarter branding. McGraw-Hill, New York, NY.

- Durand, R. & Vargas, V. (2003). Ownership, organization and private firms' efficient use of resources. Strategic Management Journal, 24(7), 667-675.

- Dwyer, F.R. & Tanner, J.F. (2006). Business marketing: Connecting strategy, relationship and learning (Third Edition). Avenue of the Americas, New York, NY, 10020: McGraw- Hill/Irwin.

- Essel, A.E. (1996). Points to consider when pricing a product. Virginia State University. National Small Farm Conference.

- Edvardsson, B., Johnson, M.D., Gustafsson, A. & Strandvik, T. (2000). The effects of satisfaction and loyalty on profits and growth: Products versus services. Total Quality Management, 11(7), 917-927.

- Elbanna, A.R. (2007). Implementing an integrated system in a socially dis-integrated enterprise: A critical view of ERP enabled integration. Information Technology & People, 20(2), 121-139.

- Farese, L., Kimbrell, G. & Woloszyk, C. (1991). Marketing essentials. 15319 Chatsworth Street, Missions Hills, CA: Glencoe Division, Macmillan/McGraw-Hill.

- FlieB, S. & Kleinaltenkamp, M. (2004). Blueprinting the service company: Managing service processes efficiently. Journal of Business Research, 57(4), 392-404.

- Gale, B.T. & Swire, D.J. (2006). Value-based marketing and pricing. Customer Value Inc. 217 Lewis Wharf, Boston, MA 02110 USA.

- George, D. & Mallery, M. (2003). Using SPSS for Windows step by step: A simple guide and reference.

- Grenadier, S.R. (1996). The strategic exercise of options: Development cascades and over building in real estate markets. The Journal of Finance, 51(3), 1653-1679.

- Groth, J.C. (1995). Total quality management: Perspective for leaders. The TQM Magazine, 7(3), 54-59.

- Gummesson, E. (1994). Service management: An evaluation and the future. International Journal of Service Industry Management, 5(1), 77-96.

- Gummesson, E. (2004). Service provision calls for partners instead of parties. Journal of Marketing, 68(1), 20-31.

- Hannan, M.T. (1998). Rethinking age dependence in organizational mortality: Logical formalizations. American Journal of Sociology, 104(1), 126-164.

- Holland, R. (1998). Selling price, gross margin and mark-up determination. Agricultural development centre, Agricultural extension service. University of Tennessee.

- Hill, T.P. (1977). On goods and services. Review of Income and Wealth, 23(4), 315-338.

- Ioannis, K. (2002). Product life cycle management. Urban and regional innovation research unit, Faculty of Engineering, Aristotle University of Thessaloniki.

- Ju, M. & Zhao, H. (2009). Behind organizational slack and firm performance in China: The moderating roles of ownership and competitive intensity. Asia Pacific Journal of Management.

- Kaplan, R.S. (2006). The demise of cost and profit centres. Management control systems (MCS) Working Paper.

- Kline, P. (2000). A psychometrics primer. Free Assn. Books.

- Kukalis, S. (1991). Determinants of strategic planning systems in large organizations: A contingency approach. Journal of Management Studies, 28(2), 143-160.

- Lancioni, R. (2005). A strategic approach to industrial product pricing: The pricing plan. Industrial Marketing Management, 34(2), 177-183.

- Lewis, R. & Shoemaker, S. (1997). Price-sensitivity measurement: A tool for the hospitality industry. Cornell Hotel and Restaurant Administration Quarterly, 38(2), 44-54.

- Lovelock, C.H. (1983). Classifying services to gain strategic marketing insights. Journal of Marketing, 47(3), 9-20.

- Mayer, K.J., Bowen, J.T. & Moulton, M.R. (2003). A proposed model of the descriptors of service processes. Journal of Services Marketing, 17(6), 621-639.

- McTaggart, J.M. & Kontes, P.W. (1993). The governing objective: Shareholders versus Stakeholders. 1-3 Strand London WC2N 5HP United Kingdom.

- Moeller, S. (2008). Customer integration-A key to an implementation perspective of service provision. Journal of Service Research, 11(2), 197-210.

- Murthy, D.N.P. & Asgharizadeh, E. (1999). Optimal decision making in a maintenance service operation. European Journal of Operational Research, 116, 259-272.

- Neter, J., Kutner, M.A., Nachtsheim, C.J. & Wasserman, W. (1996). Applied linear statistical models (Fourth Edition). Chicago, IL: Irwin.

- Nunnally, J.C. & Bernstein, I.H. (1994). The assessment of reliability. Psychometric Theory, 3(1), 248-292.

- Patsula, P.J. (2007). The Entrepreneur’s Guidebook: Patsula Media. Available Online: www.smbtn.com/books/gb46.pdf

- Rajneesh, S. & Kent, B.M. (2003). The effects of time constraints on consumer’s judgments of prices and products. Journal of Consumer Research, 30.

- Robert, M.G. (2001). The resource-based theory of competitive advantage: Implications for Strategy formation. California Management Review, 4(9), 34-71.

- Roberts, M.J., Xu, D.Y., Fan, X. & Zhang, S. (2011). Demand, cost and profitability across Chinese exporting firms. The Pennsylvania State University and NBER.

- Schlissel, M.R. & Chasin, J. (1991). Pricing of services: An interdisciplinary review. The Services Industries Journal, 11(3), 271-286.

- Tabachnick, B.G. & Fidell, L.S. (2007). Experimental designs using ANOVA. Thomson/Brooks/Cole.

- Treacy, M. & Wiersema, F. (1992). Customer information and other value disciplines. Harvard Business Review.

- Vargo, S.L. & Lusch, R.F. (2008). Service-dominant logic: Continuing the evolution. Journal of the Academy of Marketing Science, 36, 1-10.