Research Article: 2021 Vol: 25 Issue: 6

Prospects and Challenges of Microfinance as A Tool In Poverty Reduction

Meenu Sharma, Research Scholar, Shri Mata Vaishno Devi University, Katra, Jammu

Dr. Meenakshi Gupta, Assistant Professor, Shri Mata Vaishno Devi University, Katra, Jammu

Dr. Roop Lal Sharma, Assistant Professor, Shri Mata Vaishno Devi University, Katra, Jammu

Ajay Kumar Sharma, Research Scholar, Shri Mata Vaishno Devi University, Katra, Jammu

Citation Information: Sharma, M., Gupta., M., Sharma, R.L., & Sharma, A.K. (2021). Prospects and challenges of microfinance as a tool in poverty reduction. Academy of Marketing Studies Journal, 25(6), 1-6.

Abstract

Keywords

Microfinance, Moneylenders, Inclusive Growth.

Introduction

Poverty and unemployment are the two major issues prevailing in developing countries including India. One of the identified Constraints i.e lack of access to financial services makes the people unable to come out of poverty. According to the data given by the planning commission, it was found that 27.5% people living below the poverty line during 2004-2005. In this situation, microfinance proves to be a strong tool for the removal of poverty (Morduch and Haley 2001). To fulfils the basic necessities of the poor during the end of year 2015, the Millennium Development Goals (MDGs) were discovered with great emphasis on extreme poverty and hunger. Microfinance program spread in many developing economies during the last 3 decades and UN declared 2005 as an international year of microcredit. Also, Hussien and Hussain (2003) revealed that there is great emphasis on microfinance for poverty alleviation in Pakistan. Like many other development tools, microfinance do not reach the poor people. The failure of formal and informal organizations to accessibility of credit people who are poor is one of the most important reason to ameliorate poverty.

Keeping this in view, the present study examines the prospects and challenges facing by microfinance institutions in the reduction of poverty.

Status of Poverty in India

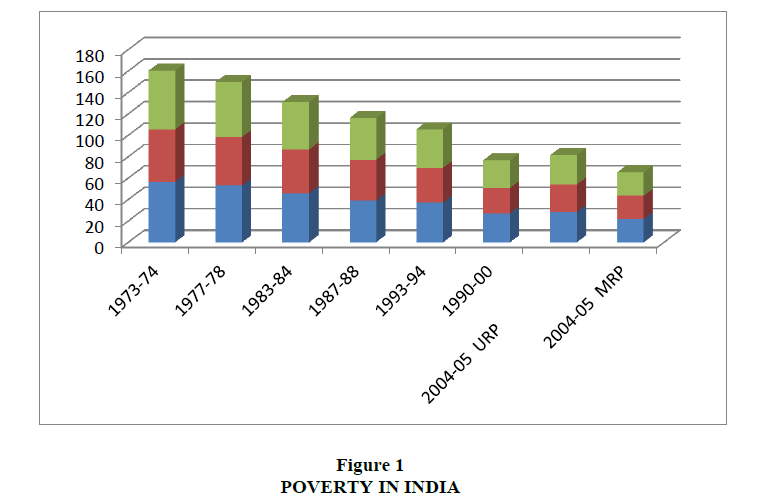

Note: Green lines stands for All India poverty ratio, Red lines stands for Urban sector poverty ratio, Blue lines stands for Rural sector poverty ratio, URP stands for Uniform Recall Period, MRP stands for Mixed Recall Period.

Source: Estimates based on Planning Commission.

During 2004-2005 in India 71% of the people are living in rural areas and the prevalence of poverty is bigger in these areas that affect the entire nation. It was also observed that 36% people are poor in 1963-94 but this percentage falls to 27.5% in 2004-05. Microfinance through self help groups is an important alternative to meet the financial needs of the poor people. A self help group may be officially listed or not listed group commonly composed of 10-20 local men or women having identical social and economic backgrounds, all of your own free will comes in contact with another to save regular small sums of money at regular intervals, to meet their urgent needs on the basis of mutual help. Microfinance Institutions (MFIs) have come out as the main players in the rural areas to provide credit. A microfinance institution provides various financial services to the people who have very low income. Banks and other mainstream financial institutions make available these services to microfinance Institutions (MFIs). There is no clear guess about the number of institutions which provide financial services in the world. It was found that in 101 developing countries there are 1000 microfinance institutions which cover commercial banks, saving banks, lending institutions and non-governmental organizations.

Micro Finance and Poverty Reduction

The wide spread poverty is the most important challenge over the decades. A large portion of world poor population lives in India. The Government of India starts various poverty alleviation programs. However, in spite of various efforts, almost 27% of total population lives below the minimum level. In India, microfinance institutions provide financial services to the poor people who are effective in generating income and better living conditions (Acharya, 2008). Microfinance serves as a catalyst in alleviating poverty and overall progress and development (Bakhtiari, 2006). Microfinance program help the poor by providing self employment opportunities. They also help them to avail various business opportunities. Employment generates income which helps them in the reduction of poverty. Women borrowers constitute more than 80% of the total clients of microfinance program. Microfinance proves helpful in providing savings, credit and various other services to women. It is a bigger step for the safety of women. Women empowers socially, economically and personally due to microfinance. Keeping in view point of the researchers and policy makers, microfinance compels the poor to start their business and this leads to reduction of poverty, empowers women in developing countries, increase opportunity to have better health, education and make network of relationship among poor communities (Khandker, 2005; Westover, 2008). It was also observed that client’s family income, expenditure, employment, productivity of crops and livestock has significantly increased due to the utilization of their borrowed money in different income generating activities. Other factors like client’s age, number of family members, total land size and client’s ethics and moral also has positive impact on their income (Rahman and Ahmed, 2010). In rural areas loans used for productive purposes has larger poverty reducing effects as compared to well settled areas. However, It was observed than in urban areas easy access to micro finance institutions are very helpful in the reduction of poverty than taking loan for productive purposes (Imai, Arun and Annim, 2010). Availability of credit and improved productivity increases income and profit of the households, their welfare and quality of life and this will automatically lead to rural community development (Kotir and Obeng- Odoom, 2009). Silva (2012) revealed that participation in microfinance program benefits the poor. It also has a significant positive impact on those households who have low income. They also find that program participation has less impact on the savings of richer households. The preference to being micro finance client increases among those who are living in rural areas, having larger household size, belongs to a Sinhalese and being a causal worker or self employed. CFPR program developed by BRAC (Bangladesh Rural Advancement Committee) in 2002 reported that beneficiaries were able to generate income from poultry farming and selling the milk of cow or working in own agricultural land reduced the presence of child labor in the household through significant increase in their income, increased their capability for food consumption, ownership of assets and also inculcate a habit of saving among the beneficiaries. It also has a significant impact on their housing conditions, now they have their own rooms with unattached kitchen. It was also found that strong motivation, appropriate planning, hard work, having attention in the business and co-operation among family members results in better economic conditions of the participants and reduction of poverty while lack of motivation, inappropriate planning, no interest in the occupation social barriers, unexpected accidents and non co-operation among family members raise problems in the way of achieving success in the eradication of poverty (Mahmuda, Baskaram and Pancholi, 2014). Al-Mamun et al. (2014) discovered that economic vulnerability decreases among credit program. Access to credit and employment of additional hands increases with the level of output among those respondents who have taken permission from their husbands for taking loans and their business are under their control as compared those who have not taken authorization to borrow. So, Intra –household energy also has a fruitful effect on the generation of employment (Alnaa, 2017). As a result of participation in self-help groups women income raised from Rs.441.71 to Rs. 390.16 per month, employment days also rose from 108 to 119 days per year and the level of financial inclusion increased from 33.44 to 35.93 as compared to the non participants. It was also found that the program has significantly reduced the occurrence of poverty by 0.038 points among the self-help groups participation (Maity and Sarania, 2017). Borrowers in microfinance program were found to be better in livestock, saving schemes, clothing and footwear, education and health of the children, ownership of assets and dwelling related indicators (including living in better conditions) although those who have not borrow were fruitful in terms of using better quality fuel used in cooking and the way of disposing unwanted water (Ghalib, Malki and Imai, 2015).

Issues and Challenges faced by Microfinance In the Reduction of Poverty

Cultural barriers: Many cultural rules and expectations create obstacles in the way of women to avail financial services and make use of loans to run their own business.

Husband’s control over loan: A great part of their loans taken by woman who are married are used by their husbands.

Use of loan for smooth consumption: A large number of people live below the poverty line though they obtain credit both from formal and informal sources. It is due to this reason that 41.7% of the household invested the credit they obtain for consumption smoothing and also to pay other expenses in the household (Kotir and Obeng- Odoom, 2009).

High rate of interest: Microfinance institutions are charging high rate of interest 32 to 48 % than the existing rates in the banks .The lack of ability to get loan at reasonable interest rates is one of the most important challenges for micro business.

Geographical constraints: Geographical problems such as weak network with people living in rural areas, poor administration and information about the area are the big elements (Akhtar, 2007).

High transaction Costs: The process of lending involves large operational costs and dangers associated with information irregularity and virtuous hazards.

Lack of specific skills: Micro finance institutions provides loans to the people who are poor, as microfinance banking is diverse from traditional banking so it needs specific skills which are presently unavailable in Nigeria.

Domestic violence: Access to loan by women creates tension and domestic violence among them. Husbands forced their wife to get loan but women are responsible to repay the loan which they do not use them (Ahmed, 2002).

Non availability of financial services: In developing countries, especially in Africa, most of the people who are poor belongs to the rural areas and agriculture is their main occupation.

People in rural areas are not able to raise their income due to less production which is the result of limited resources for buying sufficient inputs needed for

Loan used for non-productive purposes: Sometimes a poor person utilizes the loan for non-productive purpose such as modification of house, repayment of old debt or to meet their requirements in the society. So, microfinance cannot help in the reduction of poverty

Design of appropriate financial products for the poor: Access to credit and financial services by the poor in order to improve agriculture production, The MFIs financial products are not suitable for agriculture related investment as these products are specified by small loan periods, no grace periods, weekly repayment and small amount of loan.

Lack of Collateral: Microcredit banks generally required collateral for a specified amount of financing. Due to this, only well performing clients get benefitted from these institutions

To fulfill the shortcomings between demand and supply of credit: To fulfil the shortcomings between desire and accessibility of credit is the most important challenge.

Low availability of funds: Small entrepreneurs were poorly financed as a result of various factors such as unsuitable policies of the govt. money lenders charging high rate of interest, small personal savings among people and they also do not have the important document to avail the bank services. In short it is concluded that this low availability of funds is the most important reason for the bad outcome of micro-enterprises. These issues enable the poor to achieve food and living security.

Other challenges: Inappropriate laws and regulations, tough competition, new and different variety of products, profitability, constancy and less controlling capability of microfinance institutions are the numerous challenges faced by micro finance sector in Pakistan. Microfinance institutions face numerous challenges in Mogadishu and they are insufficient capital from donor, Default risk inherited from borrowers, less awareness about the microfinance program by the borrowers, inadequate govt. support and limited management ability of microfinance institutions. The microfinance industry is facing many challenges in Yemen and these are lack of experience, scattered population, cultural barriers and attitude, lack of training and consultation, the constancy of exchange rate, Inflation, inadequate infrastructure and non-availability of market and economic data.

Conclusion

Generating self-employment opportunities is one of the most important means to fight against poverty and solve the problem of unemployment In our country 24 crore people lives below the poverty line. The Scheme of Microfinance program proves useful in raising the poor about the poverty level by providing them Financial and other services. It also helps in mitigating the financial problems of the poor people. Incapability of micro finance institutions in generating large amount of funds is a big challenge in the growth of the micro finance program and due to this these institutions should look for other source of funds. In Short, Microfinance is noticeable in bringing confidence and courage among the poor people.

References

- Acharya, N. (2008). "Microfinance and Rural Poor in Orissa", Micro Finance and Rural Development in India (ed.) S.K Das, et, al, New Century Publication, New Delhi, pp. 8-14. .

- Ahmed, H. (2002), “Financing microenterprises: an analytical study of Islamic microfinance

- institutions”, Islamic Economic Studies, Vol. 9 No. 2, pp. 27-64.

- Akhtar, S. (2007), “Building inclusive financial system in Pakistan”, paper presented at DFID

- & HM Treasury Financial Inclusion Conference, London.

- Al-Mamun, A., Mazumder, M. N. H., & Malarvizhi, C. A. (2014). Measuring the effect of Amanah Ikhtiar Malaysia’s microcredit programme on economic vulnerability among hardcore poor households. Progress in Development Studies, 14(1), 49-59.

- Alnaa, S. E. (2017). Microcredit to Rural Women, Intra-household Power Play and Employment Creation in Northern Ghana. Journal of Interdisciplinary Economics, 29(2), 197-213

- Bakhtiari, Sadeg, (2006). "Microfinance and Poverty Reduction: Some International Evidence", International Business & Economics Research Journal, Vol. 5, No. 12, December pp. 17.

- Ghalib, A. K., Malki, I., & Imai, K. S. (2015). Microfinance and household poverty reduction: Empirical evidence from rural Pakistan. Oxford Development Studies, 43(1), 84-104

- Hussien, M. and Hussain, S. (2003). “The Impact of Microfinance on Poverty and Gender Equity:Approaches and Evidence from Pakistan”. Pakinstan Gender Report Document

- Imai, K.S., Arun, T., & Annim, S.K. (2010). Microfinance and householdpoverty reduction: New evidence from India. World Development, 38(12),1760–1774.

- Khandker, S.R. and Samad, H. (2013). Microfinance growth and poverty reduction inBangladesh:What does the longitudinal data say? Institute of microfinance workinpaper,no.16.Dhaka, Bangladesh. Retrieved 14, October, 2013, fromhttp://www.inm.org.bd/publication/workingpaper/workingpaper16.pdf

- Mahmuda, I., Baskaran, A., & Pancholi, J. (2014). Financing social innovation for poverty reduction: A case study of microfinancing and microenterprise development in Bangladesh. Science, Technology and Society, 19(2), 249-273.

- Morduch, J. and Haley, B. (2001). “Analysis of the Effects of Microfinance on Poverty Reduction”. NYU Wagner Working Paper No. 1014. Retrieved on 2/9/2

- Kotir, J. H., & Obeng-Odoom, F. (2009). Microfinance and rural household development: A Ghanaian perspective. Journal of Developing Societies, 25(1), 85-105.

- Maity, S., & Sarania, R. (2017). Does microfinance alleviate poverty and inequality? Studying self-help groups in Bodoland, Assam. Development in Practice, 27(7), 1006-1019.

- Rahman, M. M., & Ahmad, F. (2010). Impact of microfinance of IBBL on the rural poor's livelihood in Bangladesh: an empirical study. International journal of Islamic and Middle Eastern finance and management.

- Silva, I. D. (2012). Evaluating the impact of microfinance on savings and income in Sri Lanka: Quasi-experimental approach using propensity score matching. Margin: The Journal of Applied Economic Research, 6(1), 47-74

- Westover, J. (2008). The record of microfinance: The effectiveness/ineffectiveness of microfinance programs as a means of alleviating poverty. Electronic Journal of Sociology. Available at:http://www.sociology.org/ejs-archives (accessed 15 February 2016).