Research Article: 2024 Vol: 28 Issue: 3

RE Policy Options for India - Enablers and Barriers

Hemant Kumar Kaushik, Indian Institute of Foreign Trade, New Delhi

Sanjay Rastogi, Indian Institute of Foreign Trade, New Delhi

Citation Information: Kumar Kaushik, K., & Rastogi, S. (2024). Re policy options for india – enablers and barriers. Academy of Marketing Studies Journal, 28(3), 1-20.

Abstract

Alternative sources of energy are playing a bigger role in the world's electrical systems as the world shifts to sustainable ones. Energy security, greater energy availability, and positive environment impact are just a few benefits of using RE sources. All across the world, they are easily accessible. The globe is currently undergoing an energy transition as countries move from conventional to non-conventional energy sources. A few of the concerns guiding this shift are air pollution, energy security, climate change, and technological advancements. Governments have responded to this shift by putting in place several approaches to promote renewable energy. The utilisation of RE resources in the power sector and efforts to implement core policies are two areas that are highlighted in this paper's evaluation of the general policies in 42 countries. We also examine the applicability of the most common RE policies in use globally to India. Based on our findings, it is recommended that India adopts a comprehensive strategy encompassing FIT (Feed-in-Tariff), RO (Renewable Obligation), RPS (Renewable Portfolio Standard), Quota system, and concurrent upgrades to the grid infrastructure. This approach aims to facilitate the generation of renewable electricity and supports India in achieving its 2030 sustainability targets.

Keywords

Solar Energy, Policy, Regulations, Renewables, Energy Security.

Introduction

The contemporary emphasis on discovering alternative energy sources is mostly driven by depleting traditional fuels and environment impacts. The obvious solution to lowering CO2 and SOX, NOX that contribute to global warming is non-conventional energy i.e. renewables. The cost of renewable energy (RE) technology is one of the major barrier to the acceptance of non-conventional power production. Further financial and socio-political barriers are other aspects. Regulation, investment encouragements, energy generation targets, power conservation rules, industry-stimulating tactics, and taxation are some of these initiatives. Numerous countries have implemented financial assistance programs to promote investments in innovative technologies that promote the implementation of renewable energy. Numerous financial assistances plan for renewable energy (RE) have been developed and put into practice; these have mostly been seen in American and European settings. According to Marques and Fuinhas (2011), these policies include tradable certificates, feed-in tariffs, incentive taxes, mandated RE objectives (production quotas), and programs that promote investment and R&D.

In India, population growth and economic expansion are the major causes of huge rise in energy demand, which is creating two issues. First, the third-largest country in the world is India, according to the Global Footprint Network (2022). Second, since 2000, there has been a time of strong economic expansion coupled with a growing population that will soon surpass all other populations in the globe. As a result, energy consumption has more than doubled. In 2019, the milestone of nearly universal home access to electricity was achieved, indicating that within a span of less than two decades, over 900 million people gained access to electrical connections. The ongoing industrialization and urbanization in India present significant challenges for the country's energy sector and policymakers (IEA, 2021). Coal, serving as the primary fuel in the energy mix, has played a crucial role in supporting industrial growth and electricity production (IEA, 2021). The surge in vehicle ownership and road transportation has led to a notable increase in oil consumption and imports. While biomass, primarily in the form of fuelwood, contributes to a smaller portion of the energy mix, it remains a prevalent source for cooking purposes (Khanwilkar et al., 2021). Despite recent advancements in expanding liquefied petroleum gas (LPG) penetration in rural areas, approximately 660 million Indians have not entirely transitioned to modern, clean cooking fuels or technologies (Gould & Urpelainen, 2018). Notably, solar photovoltaic (PV) has experienced remarkable growth in popularity. This is attributed to its substantial resource potential, ambitious goals, and rapid emergence as the most cost-effective option for new power generation due to legislative support and technological advancements.

Various Policy Alternatives

The global energy sector is experiencing a transformation as countries worldwide shift towards RE sources. As a result, policymakers are looking for ways to create supportive environments that promote the adoption of RE technologies. There are several policy options that governments can use to support the growth of RE. These are a few of the most popular choices for policies:

i. Feed-in tariffs (FITs) : Producers of RE are given long-term contracts and fixed prices via FITs, a sort of regulatory mechanism, so they can sell their electricity to the grid. By giving investors a secure and reliable market, FITs have proven effective in encouraging the development of RE technology. Germany was one of the first countries to implement FITs in 1991, making Europe one of the first continents to do so (Mabee et al., 2012). Since then, FITs have been used in a number of European countries, including Spain, France, Italy, and the United Kingdom. In compliance with its Renewable Energy Directive, the European Union implemented the Feed-in-Tariff (FIT) program, which requires its members to maintain share of 20% from renewables. To encourage renewables, several South American and North American nations, including Brazil, Chile, and Uruguay, have also implemented Feed-in Tariffs (FITs). The Canadian province of Ontario created its own FIT policy in 2009, following suit. Large-scale solar projects in the area have developed successfully as a result of Brazil's 2015 implementation of the FIT solar energy policy (Wei et al., 2023). Asian countries have promoted the usage of RE sources as well. Japan was a leader in the usage of FITs and put a policy into place in 2003. Now, Taiwan, China, and South Korea all follow a similar stance(Tsai, 2014a). In China, FITs for solar and wind energy were established in 2006. In 2012, China overtake Germany as the leading nation utilising feed-in tariffs. A FIT policy for RE has been in place in South Africa since 2011, and it has been successful in promoting the construction of wind and solar power projects there (Oyewo et al., 2019).

ii. The generation of power from REs is mandatory under the renewable portfolio standards (RPS). The implementation of RPS legislation in the energy mix has been approved by a number of countries throughout the world (Jaccard et al., 2001). The regulatory method has seen widespread use in the US. Some Canadian provinces, notably Ontario and British Columbia, have also passed RPS laws. In Europe, the United Kingdom has enacted the Renewable Portfolio Standard (RPS), which mandates that electricity providers obtain a specific proportion of their energy from renewable sources.

Internationally RPS are in effect in about 50 nations(Heeter et al., 2019). RPS policies have been adopted by a number of countries, including the United States, Germany, Spain, Portugal, China, Japan, South Korea, and Brazil (Energy Agency, 2021). The target percentages for producing RE under RPS regulations range from 20% in Germany to 100% in some smaller countries like Iceland(Energy Agency, 2022).

Brazil has enacted an RPS policy that demands a minimum of 10% of the country's power to be produced from renewables by the year 2025. Although India set a target of 40% by 2030, Russia has set an RPS target of 4.5% by 2024. South Africa's target is 10,000 GWh annually by 2020, while China has set a target of 35% RE by 2030(Energy Agency, 2022).

With targets ranging from 20% to 100% by 2040, the United States has established RPS laws in several states. Germany and UK has established a target of 65% and 30% respectively.

iii. Renewable Obligation (RO) rules compel electricity suppliers to buy a specified number of RE certificates (RECs) or RE from RE generators (Sidhu & Jain, 2021). In the UK, where it is known as the Renewables Obligation, the policy has received widespread adoption. Italy and Poland are two other European nations that have RO rules in place. The policies' approaches and levels of ambition differ, but the overarching objective—to encourage the development of RE sources and lower greenhouse gas emissions—remains the same. In smaller regions like the Scottish Islands, the target percentages for RE generation under RO programmes range from 10% to 100%. In Brazil, RO policy stipulates that power distributors are required to purchase a designated percentage of their energy from renewables, including biomass, small hydro, and wind. By 2023, a goal percentage of 28.5% for RE is set under this policy. The RO policy in Russia mandates that electricity distribution firms buy a specific proportion from renewables. By 2024, a 2.5% RE target is set under this policy whereas in India, this strategy sets a target of 17% for RE by 2022 (Hlalele et al., 2021). However, in China, a 15% RE target is set for 2020. The RE Independent Power Producer Procurement (REIPPP) initiative has been put into place in South Africa. The target percentage for RE under this policy is 18,800 MW by 2030(Li et al., 2020).

iv. Mandatory Market Shares require electricity suppliers to buy a defined portion from renewables. Many nations around the world, including India, have adopted this policy framework. China has enacted a law requiring market share. This strategy sets a target of 35% for RE by 2030. The Electric Power Commercialization Program, a required market share policy, has been put into effect by the Brazilian government (PROINFA) [33]. Brazil has become a global leader in the wind industry, which has benefited from the policy's promotion of the use of RE. The RE Development Program, a similar strategy adopted by Russia, mandates that energy producing businesses obtain a specific proportion of their electricity from renewables. In accordance with this policy, the goal proportion for RE is 4.5% by 2024.

v. Renewable centralised bidding, known as tendering, is a policy instrument used to encourage the development of RE projects. The procedure entails governments or utilities requesting bids from developers to provide RE, selecting the most economical offers, and then concluding contracts for the sale of RE with the highest-scoring bidders(Suarez, 2022). The BRICS nations, United States, United Kingdom, and Germany are just a few nations that have put this process into practise. India has employed the reverse auction approach.

vi. Tax credits and incentives are laws that give financial incentives for investments in RE. These regulations may aid in bringing down the price of RE technology and raising consumer access to them. Several nations, including the BRICS nations, the USA, UK and Germany, have incorporated these credits into their policies (Dogan et al., 2023). Investment tax credits (ITCs) are a crucial tool for advancing the growth of RE projects. For instance, US, Russia, Germany and Brazil has put in place a tax credit system for RE initiatives like solar, wind, and hydro. South Africa and India has implemented accelerated depreciation benefits for RE projects including tax incentives. Germany and China have implemented tax incentives for RE companies, including reduced corporate income taxes and value-added taxes(Behrendt, 2015). The United Kingdom has implemented a system of enhanced capital allowances for RE projects.

vii. Net Energy Metering (NEM) rules enable users to generate their own RE and sell excess electricity back to the grid. NEM is used in Germany at the state level. Distributed solar energy has been developed in China using NEM. The United States has implemented NEM policies in numerous states, some of which have more pro-RE producers’ policies in place. For rooftop solar, India has introduced NEM regulations.

viii. Subsidies - To encourage the installation of RE projects, the government offers capital subsidies to developers of such projects. Capital incentives are available for projects utilizing renewable sources like solar, wind, and hydropower. As per IEA, it is projected that global subsidies for renewable energy would amount to $147 billion in 2020 (IEA, 2021). This amounts to more than 70% of all global subsidies for all types of energy, a rise of 9% from the previous year. With Germany, France, Italy, and Spain offering the highest amounts of financial support, Europe is a global leader in RE subsidies. Germany invested more than $29 billion in RE subsidies in 2020, a 12% increase over 2019. While Italy and Spain each contributed over $8 billion in subsidies, France contributed over $10 billion. With nearly $14 billion in 2020, China is a big player in RE subsidies as well. India is also stepping up its financial support for RE, with 2020 seeing more than $2 billion in subsidies. The United States continues to offer large amounts of support for RE, with over $22 billion in support planned for 2020. This is an increase from the prior year of 21%.

ix. A system of cap-and-trade or a carbon tax are two policy tools known as "carbon pricing" that are used to set tax on GHG releases. Carbon pricing policies can promote the adoption of RE technology and lessen the usage of fossil fuels by placing a price on carbon emissions.

x. Green public procurement laws encourage public institutions to emphasise the procurement of ecologically sustainable goods and services, such as RE technologies(Ahsan & Rahman, 2017). Green public procurement policies can help to raise the demand for RE sources and establish a stable market for investors by offering a market for RE.

Table 1 gives benefits and drawbacks of RE policy, as well as a synopsis of the requirements for its effective implementation.

| Table 1 An Overview of the Benefits and Drawbacks of Different Policy Options | ||||

| Renewable Policy | Conditions necessary for effective deployment | Benefits | Drawbacks | References |

| Feed-in Tariffs (FiT) | Access to financing, capacity building, transparent pricing procedures, a dependable and transparent regulatory environment, stable and assured long-term pricing, and stakeholder involvement | Ensures a fixed price for energy generated, attracts investment, increases energy security, creates jobs, lowers greenhouse gas emissions, and encourages local investment. | High initial expenses can result in increased energy bills for customers, making them more susceptible to political and policy changes. Governments may find it expensive, and not all RE sources may receive incentives. | (Pyrgou et al., 2016; Tsai, 2014b; Winter & Schlesewsky, 2019) |

| Net Metering | Financial accessibility, regulatory system, grid integration accessibility, technical know-how, and monitoring and assessing stakeholder engagement | encourages self-sufficiency, enables the integration of distributed generation, offers financial incentives for the use of RE. cuts down on greenhouse gas emissions and energy costs |

Financial accessibility, regulatory system, grid integration accessibility, technical know-how, and monitoring and assessing stakeholder engagement | (Ramírez et al., 2017; |

| Renewable Portfolio Standards (RPS) | Participation of stakeholders, enforcement measures, and monitoring a strong regulatory structure, specific goals and rules, |

decreases greenhouse gas emissions, diversifies the energy mix, provides jobs, and encourages the use of RE | requires extensive governmental control, could result in higher utility and consumer costs, could be constrained by the availability of resources, and could be opposed by the fossil fuel companies | (“Y. Fang et al., 2022; Farooq et al., 2013; Jaccard et al., 2001; Meng & Yu, 2023; Xin-gang et al., 2020”) |

| Carbon Pricing | Political backing, supervision and analysis, open pricing procedures, stakeholder involvement, | encourages the switch to RE, fosters innovation, lowers greenhouse gas emissions, produces income, and creates jobs | Increased energy costs for customers are possible; they are dependent on political will and may not be as effective in the absence of other policies. may not be well-liked by customers and industry | (Carhart et al., 2022; Shahzad et al., 2023) |

| RE Certificates (RECs | Monitoring and assessment, stakeholder involvement, a trustworthy regulatory framework, and transparent pricing procedures | enhances market efficiency, diversifies the energy mix, creates jobs, encourages the use of RE sources, and decreases greenhouse gas emissions. | May not be effective without complementary policies and guarantee additionality and may not incentivize all forms of RE, may lead to market distortion, | (Gupta & Purohit, 2013; Karakosta & Petropoulou, 2022; Sidhu & Jain, 2021) |

| RE Tax Credits | a strong regulatory environment, tax benefits, community involvement, access to financing, and technological know-how | boosts investment, encourages the use of RE, lowers greenhouse gas emissions, and creates jobs | Governments may find it expensive, it is susceptible to changes in political will and policy, and it may not provide incentives for all types of RE. | (Behrendt, 2015; Dogan et al., 2023; G. Fang et al., 2022; Meng & Yu, 2023; Roth et al., 2020; Xin-gang et al., 2020) |

| Green Public Procurement | Defined goals and objectives, involvement of stakeholders, openness in decision-making, monitoring, and evaluation | creates a market for goods and services utilising RE, lowers greenhouse gas emissions, and encourages innovation. | lowers greenhouse gas emissions, promotes innovation, and creates a market for products and services that use RE. | (Agyepong & Nhamo, 2017; Ahsan & Rahman, 2017; Aldenius & Khan, 2017; Cheng et al., 2018; Krieger & Zipperer, 2022; Rainville, 2017; Sparrevik et al., 2018) |

| Green Banks | Financial resources, technical know-how, involvement of the community, monitoring and evaluation, and stakeholder involvement | promotes energy security, encourages the use of RE sources, and produces jobs and greenhouse gas emissions. | vulnerable to shifts in political will and policy, possibly constrained by resources, and possibly requiring a high level of skill | (Sarangi, 2022) |

| Community RE | Participation of the community, availability of funding, regulatory framework, technical know-how, monitoring, and evaluation | enhances energy security, generates jobs, encourages local ownership of RE projects, and lowers greenhouse gas emissions | It might need a lot of community involvement, encounter legal challenges, and call for a lot of technological know-how. | (“Bianco et al., 2021; Mercer et al., 2020; Renzaho et al., 2021”) |

Policy Analysis of Different Countries in RE Perspective

Comparative comparison of RE adoption policies across nations is a challenging job that necessitates a careful investigation of many variables, including political will, economic conditions, technology advancements, and social and environmental considerations. To identify RE policy and guide prospective adaptation of renewable efforts in new projects or nations, we did a thorough review of the existing state of RE. Table 2 provides a summary of 40 countries selected as a geographical representation of various regions. The analysis involves a review of renewable energy (RE) data for these countries, with a primary focus on the capacity of renewable technologies and the policies implemented by each country for illustrative purposes.

| Table 2 Overview of Renewable Energy Policies, Objectives, and Installed Capacity of Renewable Sources in Various Countries | ||||||

| Nation | Policy | Mechanism | Goal (Primary Energy) | Target (Electricity) | RE Projects Type | RE Projects Installed Capacity |

| India | National Solar Mission; National Wind Energy Mission | Feed-in Tariffs; Competitive Bidding | 40% by 2030 | 50% by 2030 | Solar, Wind, Hydro, Biomass, Geothermal | 96.95 GW (2020) |

| Japan | FiT; RPS | Feed-in Tariffs; Auctions | 22-24% by 2030 | 24% by 2030 | Solar, Wind, Hydro, Biomass, Geothermal | 86.6 GW (2019) |

| South Korea | RPS | Feed-in Tariffs; Auctions | 20% by 2030 | 10% by 2023 | Solar, Wind, Hydro, Biomass, Geothermal | 11.3 GW (2019) |

| Vietnam | National Power Development Plan VIII; RE Development Strategy | Feed-in Tariffs; Competitive Bidding | 15-20% by 2030 | 20-25% by 2030 | Solar, Wind, Hydro, Biomass, Geothermal | 6.5 GW (2020) |

| Thailand | Alternative Energy Development Plan; Power Development Plan | Feed-in Tariffs; Auctions | 30% by 2037 | 20% by 2037 | Solar, Wind, Hydro, Biomass, Biogas | 10.3 GW (2020) |

| Indonesia | National Energy Policy; National Electricity Plan | Feed-in Tariffs; Auctions | 23% by 2025 | 23% by 2025 | Solar, Wind, Hydro, Biomass, Biogas | 1.9 GW (2020) |

| Malaysia | National RE Policy and Action Plan | Feed-in Tariffs; Auctions | 20% by 2025 | 31% by 2025 | Solar, Wind, Hydro, Biomass, Biogas | 4.7 GW (2020) |

| Philippines | RE Act; National RE Program | Feed-in Tariffs; Competitive Bidding | 35% by 2030 | 35% by 2030 | Solar, Wind, Hydro, Biomass, Geothermal | 8.1 GW (2020) |

| Singapore | Solar Nova Programme; RE Integration Demonstrator-Singapore | Competitive Bidding; Net Energy Metering | 33% by 2025 | 28% by 2030 | Solar, Biomass | 260 MW (2021) |

| Germany | RE Act (EEG); Climate Protection Plan 2050 | Feed-in Tariffs; Competitive Bidding | 60% by 2050 | 80% by 2050 | Solar, Wind, Hydro, Biomass | 128.5 GW (2020) |

| Russia | Energy Strategy of Russia 2035 | Feed-in Tariffs; Capacity Mechanisms; Auctions | 4.5% by 2024; 5.6% by 2035 | 1.5% by 2024; 2.5% by 2035 | Wind, Solar, Hydro, Geothermal | 1.6 GW (2020) |

| France | Energy Transition for Green Growth Act | Feed-in Tariffs; Auctions | 23% by 2020; 32% by 2030 | 40% by 2030 | Solar, Wind, Hydro, Biomass | 24.9 GW (2020) |

| Spain | National RE Plan; Integrated National Energy and Climate Plan | Auctions; Feed-in Tariffs | 20% by 2020; 35% by 2030 | 50% by 2030 | Solar, Wind, Hydro, Biomass | 35.5 GW (2020) |

| Italy | National Energy Strategy; National RE Action Plan | Feed-in Tariffs; Auctions | 17% by 2020; 28% by 2030 | 55% by 2030 | Solar, Wind, Hydro, Biomass | 38.5 GW (2020) |

| Sweden | Energy Agreement 2016 | Feed-in Tariffs; Green Certificates | 50% by 2020; 100% by 2040 | 100% by 2040 | Solar, Wind, Hydro, Biomass | 24.3 GW (2020) |

| Denmark | Energy Agreement 2018 | Feed-in Tariffs; Auctions | 33% by 2020; 50% by 2030 | 50% by 2030 | Wind, Solar, Biomass | 8.3 GW (2020) |

| Netherlands | Energy Agreement for Sustainable Growth; Climate Agreement | Subsidies; Auctions | 14% by 2020; 49% by 2030 | 84% by 2050 | Solar, Wind, Hydro, Biomass | 10.6 GW (2020) |

| Norway | Climate and Energy Strategy | Green Certificates | 67.5% by 2030 | 67.5% by 2030 | Hydro, Wind, Biomass | 13.7 GW (2020) |

| Portugal | National RE Action Plan; National Energy and Climate Plan | Feed-in Tariffs; Auctions | 31% by 2020; 47% by 2030 | 80% by 2030 | Solar, Wind, Hydro, Biomass | 13.4 GW (2020) |

| United States | Clean Power Plan; Renewable Fuel Standard | Tax Incentives; Grants; Net Metering | 20% by 2020 | 18% by 2020 | Solar, Wind, Hydro, Biomass, Geothermal | 137.1 GW (2020) |

| Canada | Pan-Canadian Framework on Clean Growth and Climate Change [25,50] | Feed-in Tariffs; Net Metering | 30% by 2025; 80% by 2050 | 90% by 2030 | Wind, Solar, Hydro, Biomass | 28.5 GW (2020) |

| Mexico | General Climate Change Law; Energy Transition Law | Auctions; Net Metering | 35% by 2024; 50% by 2050 | 35% by 2024; 50% by 2050 | Wind, Solar, Hydro, Geothermal, Bioenergy | 8.6 GW (2020) |

| Costa Rica | National Decarbonization Plan | Feed-in Tariffs; Net Metering | 100% by 2050 | 100% by 2030 | Wind, Solar, Hydro, Biomass, Geothermal | 2.8 GW (2020) |

| Jamaica | National Energy Policy | Feed-in Tariffs | 20% by 2030 | 30% by 2030 | Wind, Solar, Hydro, Bioenergy | 70 MW (2020) |

| Brazil | National RE Policy | Auctions; Net Metering | 45% by 2030; 18% by 2029 | 22.5% by 2030 | Wind, Solar, Hydro, Biomass | 170 GW (2020) |

| Argentina | RE Law; National Energy Plan | Auctions; Net Metering | 20% by 2025; 8% by 2017 | 20% by 2025; 8% by 2017 | Wind, Solar, Biomass, Hydro | 2.5 GW (2020) |

| Chile | National Energy Policy; Net Zero Emissions by 2050 | Auctions; Net Metering | 20% by 2025; 60% by 2035 | 20% by 2025; 70% by 2030 | Wind, Solar, Hydro, Geothermal, Biomass | 7.9 GW (2020) |

| Colombia | RE Development Plan; National Energy Policy | Auctions; Net Metering | 10% by 2022; 14.5% by 2027 | 10% by 2022; 14.5% by 2027 | Wind, Solar, Hydro, Biomass | 1.7 GW (2020) |

| Peru | National Energy Policy | Auctions; Net Metering | 5% by 2021; 15% by 2030 | 5% by 2021; 60% by 2030 | Wind, Solar, Hydro, Geothermal, Biomass | 7.2 GW (2020) |

| Uruguay | National Energy Policy; Net Zero Emissions by 2050 | Auctions; Net Metering | 38% by 2024; 50% by 2028 | 38% by 2024; 50% by 2028 | Wind, Solar, Biomass, Hydro | 2.2 GW (2020) |

| Ecuador | National RE Plan; National Energy Efficiency Plan | Auctions; Net Metering | 12% by 2022; 25% by 2035 | 12% by 2022; 25% by 2035 | Wind, Solar, Hydro, Biomass | 0.3 GW (2020) |

| Paraguay | National Energy Plan | N/A | 90% renewable generation; 100% renewable exports | 100% renewable generation | Hydro | 8.4 GW (2020) |

| South Africa | Integrated Resource Plan; National Development Plan | Auctions; Feed-in Tariffs; Net Metering | 18 GW by 2030; 32% by 2030 | 17.8 GW by 2030 | Wind, Solar, CSP, Biomass, Hydro | 3.7 GW (2020) |

| Morocco | Moroccan Energy Strategy 2030 | Auctions; Feed-in Tariffs | 42% by 2020; 52% by 2030 | 52% by 2030 | Wind, Solar, CSP | 2.2 GW (2020) |

| Egypt | Egypt Vision 2030; National RE Strategy | Auctions; Feed-in Tariffs | 20% by 2022; 42% by 2035 | 20% by 2022; 42% by 2035 | Wind, Solar, Hydro, CSP, Biomass | 3.7 GW (2020) |

| Kenya | National Energy Policy; National RE Policy | Feed-in Tariffs; Net Metering | 100% by 2020 (electricity); 10% by 2020 (transport) | 90% by 2020 (electricity) | Wind, Solar, Geothermal, Hydro | 2.8 GW (2020) |

| Nigeria | National RE and Energy Efficiency Policy | Feed-in Tariffs; Net Metering | 20% by 2030 | 30% by 2030 | Solar, Wind, Hydro | 150 MW (2020) |

| Ghana | RE Act 2011; National Energy Policy | Feed-in Tariffs; Net Metering | 10% by 2020; 10% by 2030 | 10% by 2020; 10% by 2030 | Solar, Wind, Hydro, Biomass | 1.6 GW (2020) |

| Ethiopia | Climate-Resilient Green Economy Strategy | Feed-in Tariffs; Net Metering | 17 GW by 2020 | 17 GW by 2020 | Wind, Solar, Hydro | 4.3 GW (2020) |

| Tanzania | National Energy Policy; National RE Policy | Feed-in Tariffs; Net Metering | 50% by 2025; 75% by 2030 | 10% by 2025; 50% by 2030 | Solar, Wind, Hydro, Biomass | 116 MW (2020) |

Germany is a global leader in the use of renewable energy (RE), with its Energiewende policy aiming to establish a fully sustainable, low-carbon energy system (Mabee et al., 2012). The country has set ambitious targets, planning to generate 45% of its power generation from renewables by 2020. Germany's long-term goals include reaching 65% renewable energy by 2030 and 80% by 2050 (Hancock et al., 2021).

In contrast, while China is the world's largest emitter of greenhouse gases, it is also a significant investor in renewable energy. The Chinese government has set a target to derive 35% of its energy from renewables by 2030. In 2020, China already produced 29.4% of its power generation from renewables, with hydropower contributing substantially to this production (Zuo et al., 2020). The US ranks second in the world for greenhouse gas emissions, but it has adopted RE more slowly than many other wealthy nations. RE sources, primarily wind and solar, made up 12% of the nation's total energy consumption in 2020. By 2030, India wants to have 450 GW of RE capacity. Solar energy was the most prevalent source, making up 24% of the nation's total installed capacity in 2020(Energy Agency, 2020). However, there are significant differences in RE statistics and regulations between nations, with some countries, like Germany and China, setting the bar for adoption while others, like the US, lagging. Political will, economic conditions, and social and environmental factors are all important determinants of the success of RE initiatives.

Policy Landscape

We will explore the lessons that can be learned from policy approaches adopted by countries across globe who has the highest share of RE in electricity (World Energy & Climate Statistics – Yearbook 2021), and how they have contributed to their respective RE successes.

Lessons from Norway

Norway is one nation that has promoted RE in a thorough and integrated manner. As a result, the nation's energy transition has had notable benefits, including high levels of RE generation, a decrease in greenhouse gas emissions, and increased energy security. The Feed-in Tariff (FIT) programme has been implemented by the Norwegian government to help finance the construction of RE projects, such as those utilising hydroelectric, solar, and wind energy. The initiative sets a specific rate for per unit of electricity generated from renewables, ensuring that renewable energy projects receive a consistent income for a predefined duration. Investments in RE have been successfully encouraged by the Norwegian FIT programme. For instance, Norway's wind power capacity expanded from 3 MW in 2001 to nearly 4,300 MW in 2021(Norway - IEA, 2022), with most of the growth taking place after the FIT system was introduced there in 2006. A further target established by the government is to produce 67.5 TWh by 2020. Combining hydropower, solar, and wind energy is expected to achievethis target Renewable Energy Agency (2021).. Norway has established a Renewable Portfolio Obligation (RPO) in addition to the FIT programme, which mandates a certain percentage energy generation from renewables. The current RPO aim for Norway is for 28.4% of power output to come from renewable sources by 2025. Like the RPO programme, the RO scheme places the responsibility on energy producers rather than suppliers. Almost 92% of Norway's RE generation will come from hydroelectric power in 2020, making it the dominant RE source in the nation ((Norway- International Energy Agency, 2022). The development of RE, notably in the field of bioenergy, has been successfully encouraged by the Norwegian MMS scheme. Around 7% of Norway's RE production will come from bioenergy in 2020, making up a sizeable share of the nation's total RE output. Moreover, Norway has established a competitive bidding procedure for RE projects, enabling companies to compete for government funding for their initiatives. As a result, there is now more competition in the RE market, which has lowered prices and encouraged innovation. For instance, in 2019, the government used a competitive bidding process to award contracts for 238 MW of new wind generation capacity. Overall, Norway's all-encompassing and integrated strategy for promoting RE has been successful in accelerating substantial advancements towards a future powered entirely by RE. Norway had one of the lowest per-capita greenhouse gas emissions as of 2020, with 98% of electric supply from renewables (International Energy Agency, 2022).

Lessons from New Zealand

To lessen its dependency on fossil fuels, New Zealand has enacted several policy measures for development of renewables. The nation has successfully boosted its RE capacity, and in 2020, it generates 83% more electricity from renewable sources than it did in 2010. For small-scale RE projects like solar and wind, New Zealand has established FITs. The "Buy-back rate," a new FIT programme launched by the New Zealand government in 2018, pays small-scale RE providers for generation and evacuation of power to grid. The IEA (2018) found that FITs, especially for small-scale projects, have been essential in New Zealand's promotion of RE. According to the study, New Zealand's adoption of solar PV systems grew due to the Buy-back rate plan, with installed capacity rising from 3 MW in 2010 to 68 MW in 2018. The "Voluntary Goal" RPS programme, launched in New Zealand, intends to raise the percentage of renewable electricity generation to 90% by 2025. The "RE Goal", a mandated market share programme put in place in New Zealand, calls for energy retailers to acquire up to ninety percent of energy from renewables by 2025. According to a 2016 report by the Energy Efficiency and Conservation Authority (EECA), the RE Target had a positive impact on New Zealand's adoption of RE, especially for large-scale projects. According to the report, the programme increased the number of projects being built using RE, with 900 MW of new RE capacity being added to the grid between 2011 and 2015. Competitive bidding entails putting contracts for RE projects up for auction and awarding them to the lowest bidder. The "Electricity Authority's Electricity Auction," a competitive bidding process used in New Zealand, is used to auction off contracts for new RE projects.

Lesson Learned from Brazil

Brazil is a leading country in RE adoption, and its success is attributed to the various policy approaches it has implemented to promote RE sources. The key policy instruments used by Brazil to promote renewable electric power generation include FIT, Renewable Portfolio Standards (RPS), compulsory market share policies, and competitive bidding mechanisms.

FITs, a critical component in promoting solar power adoption in Brazil, which has seen its installed solar capacity increase from just 11 MW in 2013 to over 8 GW in 2021(Aquila et al., 2017). Brazil's RPS program, known as RE Auctions (LEILÕES), has been particularly successful in promoting wind energy adoption, with the country's installed wind capacity increasing from just 1 MW in 1997 to over 20 GW in 2021(Gouvea, 2012). Brazil has adopted a competitive bidding mechanism that has been successful in reducing the cost of RE, making it more competitive with fossil fuel-based energy.

Brazil's RE capacity has significantly increased, with RE sources up to 47% of total generation in 2020, up from 34% in 2015. This growth in RE capacity has also contributed to reduce emissions by 7.8% between 2005 and 2019 Renewable Energy Agency, (2021).

Lesson Learned from Colombia

Colombia has also established several policy strategies to support the development of RE. The FIT policy has reportedly contributed to Colombian RE investment in research by the International RE Agency (Irena et al., 2018). More than 500 MW of RE capacity have been deployed since the feed-in tariff programme was implemented in 2012, primarily from small hydro and biomass plants According to the study, Colombia received $1.1 billion in investments in RE between 2010 and 2017, the bulk of which went into small hydropower projects. The first RE auction held by Colombia in 2019 resulted in the awarding of contracts for 1.3 GW of projects. (Energy Agency, 2022b). The promotion of RE project deployment and increased percentage of renewables were beneficial outcomes of this auction. A renewable portfolio standard has been put in place in Colombia, requiring energy distributors to buy a specific percentage of RE. Colombia's development of RE has been successfully aided by the RPS mechanism, with the country's percentage of RE in its energy mix rising from 0.5% in 2010 to 6% in 2019(RE Agency, 2021). Moreover, Colombia has adopted tax incentives to encourage the growth of RE sources, including the exemption of RE equipment from value-added tax and the provision of tax credits for investments in RE (Drumond et al., 2021). Colombia has put in place a net metering programme that enables individuals and organisations to produce their own RE and sell extra power back to the grid. This programme has been effective in encouraging the implementation of small-scale RE installations and lowering customer energy bills (International RE Agency, 2020).

RE policy in India: Costs of Water and Electricity

The price of water and electricity varies according to geography, consumption, and tariffs in India. Most urban houses receive piped water from the state or municipal corporations, which is typically priced on a metered basis. State-by-state and city-by-city, the price of water might vary, but on average, it costs about INR 3–4 per 1,000 gallons in India (as of 2021). Water can be very expensive for commercial and industrial uses, though. In India, the price of electricity varies according to the state, the kind of consumer, and the volume of usage. Electricity Regulatory Commissions for states, SERC, in India set for prices of energy , which are normally based on a slab structure with higher rates for increasing levels of use. By 2021, home power in India will cost, on average, INR 5-7 per kilowatt-hour (kWh), with industrial and commercial rates being higher (Tripathi et al., 2016). It is crucial to remember that the government in India extensively subsidises the cost of water and power, especially for household and agricultural consumers. The government is responsible for paying a sizable share of the costs associated with delivering these services, which are frequently much higher than the tariffs levied. However, even with the subsidies in place, challenges persist in India when it comes to ensuring that marginalized communities in rural areas gain access to safe, affordable, and dependable water and energy resources. Water shortages and unstable electricity supply are still problems in many parts of India, and they can have a negative influence on the health, happiness, and economic prospects of the residents. The government has been implementing several approaches for better access, particularly in rural regions, to address these issues. They include initiatives like the “Deen Dayal Upadhyaya Gram Jyoti Yojana” and the “National Rural Drinking Water Program”, which seek to provide rural residents with dependable energy and clean drinking water (Energy Agency, 2021). Generally, even though India's prices for water and electricity are lower than those in many affluent nations, there are still difficulties in guaranteeing dependable and cheap access, especially in rural areas. Initiatives taken by the government to address these issues, such as the promotion of RE, are a crucial step in ensuring equal and sustainable access to these vital services.

RE Development in India

The Indian government has put in place several laws and programmes to encourage the usage of solar power. Following are a few of India's most important government solar energy policies:

A FIT scheme has promoted the growth of solar projects in the nation and assisted in developing a market for solar energy (Energy Agency, 2021). The target of 100 gigawatts of solar energy production by 2022, government initiated the National Solar Mission in 2010 (RE Agency, 2017). Further 40-gigawatt photovoltaic power goal from rooftop solar systems is part of the mission. To further the aim, the government has also put in place several laws and programmes, such as a feed-in tariff for grid-connected solar installations and a subsidy programme for off-grid and decentralised solar applications (Energy Agency, 2021). To encourage the usage of RE in metropolitan areas across the nation, the government developed the Solar Cities programme in 2008. The programme encourages the use of RE technology to make cities more sustainable and less reliant on fossil fuels. Solar Park Scheme, which was introduced in 2014, is to build substantial solar parks all around the nation. According to the plan, the government contributes money to the construction of infrastructure like electricity lines, water supplies, and road links (RE Agency, 2017). The government offers financial assistance for the construction of solar parks, including a 30% capital subsidy for the project's cost and viability gap funding (VGF) to fill the financial gap between the project's cost and the tariff the solar power developer is willing to accept (Umamaheswaran & Rajiv, 2015). The Rooftop Solar Scheme was introduced in 2015 with the intention of encouraging rooftop solar panel installation in residences, workplaces, and structures. In accordance with the programme, the government offers financial assistance to private residences, business and industrial facilities, and public buildings for the installation of rooftop solar panels (Jain et al., 2020). For rooftop solar systems under 3 kW in size and between 3 kW and 10 kW in size, the government will subsidise up to 40% of the benchmark cost and up to 20% of the benchmark cost, respectively. To encourage the use of rooftop solar systems in urban areas, the Rooftop Solar Scheme is integrated with other policies and programmes, such as the Smart Cities Mission and the Atal Mission for Rejuvenation and Urban Transformation AMRUT. Several subsidies have been offered to encourage the use of solar power. They include a programme to subsidise solar applications that are off-grid and decentralised, a capital subsidy for solar power facilities, and a programme to subsidise the installation of rooftop solar panels. The IEA also notes that the RE industry is becoming more cost-competitive and that RE subsidies are increasingly being directed at certain technologies and projects. The agency observes that this pattern is expected to persist, with RE subsidies steadily decreasing over time as the industry becomes more self-sustaining (Altenburg & Engelmeier, 2013). The National Solar Mission also includes a solar Renewable Purchase Obligation (RPO) mechanism that imposes obligations on obligated entities, such as discoms and captive power producers, to obtain a specific proportion of their energy from solar sources. For the power produced by RE projects, the government offers developers a Generation-Based Incentive (GBI)(Energy Agency, n.d.-e). GBI is a per-unit incentive that the developer receives for a set length of time, often the first 5 to 10 years after the project is put into service. Another policy initiative is Accelerated Depreciation. The ability to claim a higher depreciation rate on their investment in RE projects is another benefit available to developers of RE projects. Developers receive tax advantages as a result, which lowers the price of RE projects. The government has established the National Institute of Solar Energy to conduct training programs and research in the sector. Also, the mission seeks to advance the nation's capacity for solar manufacturing (Energy Agency, 2022). The government provides low-interest loans to RE project developers through various financial institutions such as the Indian RE Development Agency (IREDA). The loans are available for both project development and equipment procurement. The GST rate for renewable projects have been lowered from 18% to 5%. The overall cost of RE projects in the nation has decreased as a result (Das Gupta, 2021; RE Agency, 2017)

Current Barriers to India's Building of a Renewable Energy Policy

India has made remarkable growth in the expansion of RE, an emphasis on 450 GW of RE capacity by 2030(Energy Agency, 2021). Around 25% of India's installed capacity as of 2021, or about 94 GW, is made up of RE sources. The growth of RE in India has several potential advantages, such as lowering greenhouse gas emissions, lessening the nation's reliance on fossil fuels and boosting energy security. However, there are still challenges to the continued growth and development of RE in India, including the availability of finance and investment, land acquisition and regulatory issues, and the need for improved transmission and distribution infrastructure. Nonetheless, the government's continued commitment to promoting RE, coupled with increasing private sector investment, suggests that the future for RE development in India is promising. Some of the main constraints include the availability of finance and investment, land acquisition and regulatory issues, and the need for improved transmission and distribution infrastructure. One of the key constraints is the availability of finance and investment for RE projects. Although the Indian government has implemented several regulations and promotions to encourage the development of the field, there remains a need for further private sector involvement and foreign investment. The limited availability of long-term debt and equity financing, coupled with the high cost of capital, can make it difficult for RE projects to secure financing (Energy Agency, 2021). Another major constraint is the availability of land for RE projects, particularly in densely populated areas. Land acquisition can be a lengthy and complicated process, with several regulatory and legal hurdles to overcome. Additionally, there can be resistance from local communities and other stakeholders, which can further delay project development (Asante et al., 2020). The existing transmission and distribution infrastructure in India can also be a constraint for RE development. The country's grid infrastructure is outdated and lacks the capacity to accommodate large-scale RE projects. Additionally, there are technical and regulatory issues related to the amalgamation of intermittent generation from renewables (Energy Agency, 2021). The industry lacks clear standards for RE technologies and equipment, which can lead to variability in performance and reliability. This can lead to increased costs for consumers and can also make it more difficult for RE projects to secure financing (Energy Agency, 2021). Overall, the constraints and challenges facing the RE sector in India highlight the need for continued policy support and investment to drive the growth of the sector. Even though there has been some progress recently, much more work has to be done to address these issues and fully utilize RE in India Table 3.

| Table 3 Infrastructure-Related Institutional Restrictions for Renewable Energy Developments in India | ||

| Barriers | Impact | References |

| Regulatory barriers | Moderate | Ministry of New and RE (2022); REN21 (2021); The World Bank (2021) |

| Institutional capacity | Weak | REN21 (2021); International Energy Agency (2020) |

| Grid infrastructure | Weak | REN21 (2021); International RE Agency (2020); The World Bank (2021) |

| Financing | Moderate | Ministry of New and RE (2022); REN21 (2021); International RE Agency (2020) |

| Public awareness | Weak | REN21 (2021); International RE Agency (2020) |

| Technology | Moderate | Ministry of New and RE (2022); REN21 (2021); International RE Agency (2020) |

| Market technology | Fair | (Energy Agency, 2021) |

| Accessibility to credits | Fair | (Energy Agency, 2021) |

| Technical know-how and data | Present | (Energy Agency, 2021) |

| Commercial expertise | Absent | (Energy Agency, 2021) |

| Knowledge of Socio-economic state | Reasonable | (Energy Agency, 2021; Jain et al., 2020) |

| Transmission network access | Reasonable | (RE Agency, 2017) |

| Utility requirement | Huge | (RE Agency, 2017) |

| Rewards | No | (RE Agency, 2017) |

| Installation cost | Huge | (RE Agency, 2017) |

| Pricing | Normal | (Energy Agency, 2021) |

| Environmental impacts | Positive | (Energy Agency, 2021; RE Agency, 2017) |

| Electricity Tariffs | Varied across states and categories | (RE Agency, 2017; Tiwari & Sharma, 2021) |

| Electricity Usage | Growing rapidly | (RE Agency, 2017; Tiwari & Sharma, 2021) |

Towards a Comprehensive Policy

The creation of an all-encompassing RE policy is essential to the sector's expansion in India. The goal of the policy should be to help with the incorporation of RE into the grid, and establish an atmosphere that is favourable to investment in RE. Here are some key elements that a comprehensive policy for RE in India should include clear targets and regulatory frame work with financial initiative. The policy should establish clear targets, including targets for installed capacity, generation, and investment. The policy should establish a clear regulatory framework for RE, including guidelines for project development, land acquisition, and grid integration. It ought to offer financial rewards, such tax breaks, feed-in tariffs, and aid, to promote investment in renewable energy. This should include investment in research institutions, funding for start-ups, and collaborations with international research institutions. The policy should prioritize the development of energy grid infrastructure to facilitate integration of all source of energy. This should include investments in smart grid technologies, energy storage, and other necessary infrastructure. The strategy ought to incorporate initiatives to promote the use of alternative energy sources and increase public knowledge of the advantages of renewable energy. Public awareness campaigns, monetary incentives for people and companies to convert to renewable energy, and collaborations with the civil society are a few examples of this.

Variables Influencing India's RE Policy

India has made significant progress in the development of RE over the past few years, but there are still several constraints related to infrastructure and institutions that need to be addressed. There is a lack of adequate transmission infrastructure, which hinders the development of RE projects in these areas. It is difficult to integrate renewable energy (RE) into the current power grid, and the nation's grid infrastructure is not yet ready to support large-scale RE integration. Financing access is still a problem, especially for smaller projects and those located in rural places. The regulatory framework is complex, which can make it difficult for project developers to navigate and comply with regulations. Land acquisition is a major challenge, and there is often resistance from local communities and environmental groups. There is a shortage of skilled labour, which can lead to delays and increased. While the Indian government has made significant investments in RE, there is still a need for more comprehensive and sustained support for the sector. The development of energy storage technology is in nascent stage in India, which limits the potential for RE to be used as a reliable source of power. The lack of standardized power purchase agreements (PPAs) can make it difficult for developers to negotiate favourable terms with utilities and other off-takers. Delayed payments by utilities and other off-takers can cause financial strain on RE projects and discourage investment in the sector. Weak enforcement of regulations related to RE can lead to non-compliance and can be a deterrent for investment in the sector. Even though RE has developed significantly in India, more R&D is still required to increase the efficacy as well as affordability of alternative energy technologies. Inadequate policy coordination between the central and state governments can lead to regulatory and administrative delays, which can discourage investment in the sector. The growth of RE in India has been largely dependent on government subsidies, which can create fiscal stress and limit the government's ability to invest in other sectors. The availability of raw materials, such as rare earth metals, can limit the growth of certain RE technologies. Access to data, such as energy consumption patterns and weather patterns, is critical for effective RE planning and project development. However, data availability and quality remain limited in India, which can hinder the development of RE projects. Accurate energy forecasting is critical for effective RE planning, but India's forecasting capacity is still limited, which can lead to inefficiencies and higher costs. Collaborating with other countries on RE research and development can lead to the sharing of knowledge and best practices, but India's international collaboration in the sector is still limited.

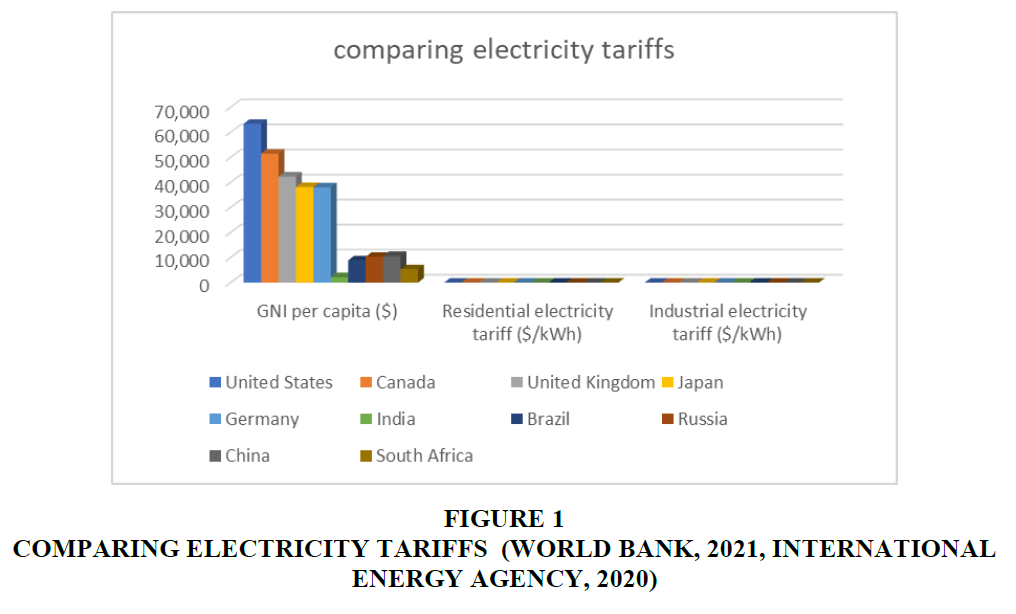

Table 4 and Figure 1 compares the electricity tariffs of various countries with India based on per capita income. It is evident that all countries charge higher rates for households than for commercial consumers; however, in India, the tariff for industrial supply is higher than the tariff for residential supply. It will take an organized, multifaceted effort including a range of players, particularly multinational organizations, corporations in the private industry, government organizations, and the public, to address these problems. India can continue to advance in its RE transition and meet its targets for sustainable development by successfully tackling these issues.

| Table 4 Comparison of the Gross National Income Based on Per Capita and Power Tariffs in India and Developed Nations | |||

| Country | GNI per capita ($) | Residential electricity tariff ($/kWh) | Industrial electricity tariff ($/kWh) |

| United States | 63,420 | 0.13 | 0.07 |

| Canada | 51,480 | 0.13 | 0.07 |

| United Kingdom | 42,370 | 0.21 | 0.12 |

| Japan | 38,170 | 0.23 | 0.12 |

| Germany | 38,030 | 0.31 | 0.16 |

| India | 2,200 | 0.08 | 0.11 |

| Brazil | 8,910 | 0.14 | 0.09 |

| Russia | 10,310 | 0.07 | 0.06 |

| China | 10,660 | 0.08 | 0.07 |

| South Africa | 5,350 | 0.11 | 0.08 |

Figure 1 Comparing Electricity Tariffs (World Bank, 2021, International Energy Agency, 2020)

Conclusion, Limitations, and Future Research

In conclusion, India has made significant progress in promoting RE development through various policy measures, including the National Solar Mission, the National Wind Mission, several state policies and initiatives. The drivers for RE development in India include the need for energy security, environmental sustainability, and economic development. However, there are several barriers to RE development in India, such as regulatory challenges, infrastructure constraints, and financing limitations.

To address these challenges, India needs to adopt a holistic and integrated approach to RE policy, which considers the various drivers and barriers discussed above. This could involve the development of a comprehensive national RE policy, which sets clear targets and policy frameworks for the deployment of RE technologies. It could also involve addressing infrastructure constraints through the development of transmission and distribution networks, and enhancing the financing mechanisms available for RE projects.

However, there are several limitations to the current RE policy options in India, such as limited technology options, inadequate capacity building, and limited public awareness and participation. Addressing these limitations will require sustained efforts from the government, private sector, and civil society. Furthermore, India needs to be conscious of how technology advancements and developments across globe may affect the viability of renewables in the India.

In general, a long-term vision that gives priority to target the nation's intended SDGs while maintaining energy security and economic growth is needed to steer the future course of RE policy in India. India can take the lead in the worldwide transition to RE and help to mitigate adverse impact on climate by successfully addressing the factors that encourage and impede the growth of RE in the nation.

References

Ahsan, K., & Rahman, S. (2017). Green public procurement implementation challenges in Australian public healthcare sector. Journal of Cleaner Production, 152, 181–197.

Indexed at, Google Scholar, Cross Ref

Aldenius, M., & Khan, J. (2017). Strategic use of green public procurement in the bus sector: Challenges and opportunities. Journal of Cleaner Production, 164, 250–257.

Indexed at, Google Scholar, Cross Ref

Altenburg, T., & Engelmeier, T. (2013). Boosting solar investment with limited subsidies: Rent management and policy learning in India. Energy Policy, 59, 866–874.

Indexed at, Google Scholar, Cross Ref

Aquila, G., Pamplona, E. de O., Queiroz, A. R. de, Rotela Junior, P., & Fonseca, M. N. (2017). An overview of incentive policies for the expansion of renewable energy generation in electricity power systems and the Brazilian experience. In Renewable and Sustainable Energy Reviews (Vol. 70, pp. 1090–1098). Elsevier Ltd.

Asante, D., He, Z., Adjei, N. O., & Asante, B. (2020). Exploring the barriers to renewable energy adoption utilising MULTIMOORA- EDAS method. Energy Policy, 142.

Behrendt, L. (2015). Taxes and incentives for renewable energy KPMG International.

Bianco, G., Bonvini, B., Bracco, S., Delfino, F., Laiolo, P., & Piazza, G. (2021). Key performance indicators for an energy community based on sustainable technologies. Sustainability (Switzerland), 13(16).

Indexed at, Google Scholar, Cross Ref

Carhart, M., Litterman, B., Munnings, C., & Vitali, O. (2022). Measuring comprehensive carbon prices of national climate policies. Climate Policy, 22(2), 198–207.

Indexed at, Google Scholar, Cross Ref

Cheng, W., Appolloni, A., D’Amato, A., & Zhu, Q. (2018). Green Public Procurement, missing concepts and future trends – A critical review. In Journal of Cleaner Production (Vol. 176, pp. 770–784). Elsevier Ltd.

Das Gupta, S. (2021). Using real options to value capacity additions and investment expenditures in renewable energies in India. Energy Policy, 148.

Indexed at, Google Scholar, Cross Ref

Dogan, E., Hodžić, S., & Šikić, T. F. (2023). Do energy and environmental taxes stimulate or inhibit renewable energy deployment in the European Union? Renewable Energy, 202, 1138–1145.

Indexed at, Google Scholar, Cross Ref

Drumond, P., de Castro, R. D., & Seabra, J. A. E. (2021). Impact of tax and tariff incentives on the economic viability of residential photovoltaic systems connected to energy distribution network in Brazil. In Solar Energy (Vol. 224, pp. 462–471). Elsevier Ltd.

Indexed at, Google Scholar, Cross Ref

Energy Agency, I. (2020). Energy Policies of IEA Countries - Sweden 2019 Review. www.iea.org/t&c/

Energy Agency, I. (2021). India 2020 - Energy Policy Review. www.iea.org/t&c/

Energy Agency, I. (2021). India Energy Outlook 2021 World Energy Outlook Special Report. www.iea.org/t&c/

Energy Agency, I. (2021). Renewables 2021 - Analysis and forecast to 2026. www.iea.org/t&c/

Energy Agency, I. (2022). World Energy Outlook 2022. www.iea.org/t&c/

Fang, G., Yang, K., Tian, L., & Ma, Y. (2022). Can environmental tax promote renewable energy consumption? — An empirical study from the typical countries along the Belt and Road. Energy, 260.

Indexed at, Google Scholar, Cross Ref

Fang, Y., Wei, W., & Mei, S. (2022). How dynamic renewable portfolio standards impact the diffusion of renewable energy in China? A networked evolutionary game analysis. Renewable Energy, 193, 778–788.

Indexed at, Google Scholar, Cross Ref

Farooq, M. K., Kumar, S., & Shrestha, R. M. (2013). Energy, environmental and economic effects of renewable portfolio standards (RPS) in a developing country. Energy Policy, 62, 989–1001.

Gould, C. F., & Urpelainen, J. (2018). LPG as a clean cooking fuel: Adoption, use, and impact in rural India. Energy Policy, 122, 395–408.

Gouvea, R. (2012). Brazil’s energy divide: Sustainable energy alternatives for the brazilian amazon region. International Journal of Sustainable Development and Planning, 7(4), 472–483.

Indexed at, Google Scholar, Cross Ref

Gupta, S. K., & Purohit, P. (2013). Renewable energy certificate mechanism in India: A preliminary assessment. In Renewable and Sustainable Energy Reviews (Vol. 22, pp. 380–392). Elsevier Ltd.

Hancock, L., Wollersheim, L., Chapman, A. J., & Taeihagh, A. (2021). EU Carbon Diplomacy: Assessing Hydrogen Security and Policy Impact in Australia and Germany.

Heeter, J., Speer, B., & Glick, M. B. (1970). International Best Practices for Implementing and Designing Renewable Portfolio Standard (RPS) Policies.

Hlalele, T. G., Zhang, J., Naidoo, R. M., & Bansal, R. C. (2021). Multi-objective economic dispatch with residential demand response programme under renewable obligation. Energy, 218.

Irena, Iea, & Ren. (2018). Renewable Energy Policies in a Time of Transition. www.irena.org

Jaccard, M., Hepin, C., & Jingjing, L. (2001). Renewable portfolio standard: a tool for environmental policy in the Chinese electricity sector. Energy for Sustainable Development, 5(4), 111–119.

Jain, A., Das, P., Yamujala, S., Bhakar, R., & Mathur, J. (2020). Resource potential and variability assessment of solar and wind energy in India. Energy, 211.

Indexed at, Google Scholar, Cross Ref

Karakosta, O., & Petropoulou, D. (2022). The EU electricity market: Renewables targets, Tradable Green Certificates and electricity trade. Energy Economics, 111.

Indexed at, Google Scholar, Cross Ref

Khanwilkar, S., Gould, C. F., DeFries, R., Habib, B., & Urpelainen, J. (2021). Firewood, forests, and fringe populations: Exploring the inequitable socioeconomic dimensions of Liquified Petroleum Gas (LPG) adoption in India. Energy Research and Social Science, 75.

Indexed at, Google Scholar, Cross Ref

Krieger, B., & Zipperer, V. (2022). Does green public procurement trigger environmental innovations? Research Policy, 51(6).

Mabee, W. E., Mannion, J., & Carpenter, T. (2012). Comparing the feed-in tariff incentives for renewable electricity in Ontario and Germany. Energy Policy, 40(1), 480–489.

Marques, A. C., & Fuinhas, J. A. (2011). Drivers promoting renewable energy: A dynamic panel approach. Renewable and sustainable energy reviews, 1601-1608.

Meng, X., & Yu, Y. (2023). Can renewable energy portfolio standards and carbon tax policies promote carbon emission reduction in China’s power industry? Energy Policy, 174.

Indexed at, Google Scholar, Cross Ref

Mercer, N., Hudson, A., Martin, D., & Parker, P. (2020). “That’s our traditional way as indigenous peoples”: Towards a conceptual framework for understanding community support of sustainable energies in NunatuKavut, Labrador. Sustainability (Switzerland), 12(15).

Oyewo, A. S., Aghahosseini, A., Ram, M., Lohrmann, A., & Breyer, C. (2019). Pathway towards achieving 100% renewable electricity by 2050 for South Africa. Solar Energy, 191, 549–565.

Indexed at, Google Scholar, Cross Ref

Pyrgou, A., Kylili, A., & Fokaides, P. A. (2016). The future of the Feed-in Tariff (FiT) scheme in Europe: The case of photovoltaics. Energy Policy, 95, 94–102.

Indexed at, Google Scholar, Cross Ref

Rainville, A. (2017). Standards in green public procurement – A framework to enhance innovation. Journal of Cleaner Production, 167, 1029–1037.

Indexed at, Google Scholar, Cross Ref

Ramírez, F. J., Honrubia-Escribano, A., Gómez-Lázaro, E., & Pham, D. T. (2017). Combining feed-in tariffs and net-metering schemes to balance development in adoption of photovoltaic energy: Comparative economic assessment and policy implications for European countries. Energy Policy, 102, 440–452.

Indexed at, Google Scholar, Cross Ref

Renzaho, A. M. N., Dachi, G., Tesfaselassie, K., Abebe, K. T., Kassim, I., Alam, Q., Shaban, N. S., Shiweredo, T., Vinathan, H., Jaiswal, C., Abraham, H. M., Miluwa, K. A., Mahumud, R. A., Ategbo, E., Ndiaye, B., & Ayoya, M. A. (2021). Assessing the impact of integrated community-based management of severe wasting programs in conflict-stricken south Sudan: A multi-dimensional approach to scalability of nutrition emergency response programs. International Journal of Environmental Research and Public Health, 18(17).

Indexed at, Google Scholar, Cross Ref

Roth, A., Boix, M., Gerbaud, V., Montastruc, L., & Etur, P. (2020). Impact of taxes and investment incentive on the development of renewable energy self-consumption: French households’ case study. Journal of Cleaner Production, 265.

Indexed at, Google Scholar, Cross Ref

Sarangi, G. K. (2022). ADBI Working Paper Series GREEN ENERGY FINANCE IN INDIA: CHALLENGES AND SOLUTIONS Asian Development Bank Institute. https://www.adb.org/publications/green-energy-finance-india-challenges-and-solutions

Shahzad, U., Sengupta, T., Rao, A., & Cui, L. (2023). Forecasting carbon emissions future prices using the machine learning methods. Annals of Operations Research.

Sidhu, G., & Jain, S. (2021). Centre for Energy Finance Rebooting Renewable Energy Certificates for a Balanced Energy Transition in India.

Sparrevik, M., Wangen, H. F., Fet, A. M., & de Boer, L. (2018). Green public procurement – A case study of an innovative building project in Norway. Journal of Cleaner Production, 188, 879–887.

Indexed at, Google Scholar, Cross Ref

Suarez, C. (2022). Private management and strategic bidding behavior in electricity markets: Evidence from Colombia. Energy Economics, 111.

Tiwari, R., & Sharma, Y. (2021). Public policies to promote renewable energy technologies: Learning from Indian experiences. Materials Today: Proceedings, 49, 366–371.

Indexed at, Google Scholar, Cross Ref

Tripathi, L., Mishra, A. K., Dubey, A. K., Tripathi, C. B., & Baredar, P. (2016). Renewable energy: An overview on its contribution in current energy scenario of India. In Renewable and Sustainable Energy Reviews (Vol. 60, pp. 226–233). Elsevier Ltd.

Indexed at, Google Scholar, Cross Ref

Tsai, W. T. (2014a). Feed-in tariff promotion and innovative measures for renewable electricity: Taiwan case analysis. In Renewable and Sustainable Energy Reviews (Vol. 40, pp. 1126–1132). Elsevier Ltd.

Umamaheswaran, S., & Rajiv, S. (2015). Financing large scale wind and solar projects - A review of emerging experiences in the Indian context. In Renewable and Sustainable Energy Reviews (Vol. 48, pp. 166–177). Elsevier Ltd.

Wei, S., Wei, W., & Umut, A. (2023). Do renewable energy consumption, technological innovation, and international integration enhance environmental sustainability in Brazil? Renewable Energy, 202, 172–183.

Indexed at, Google Scholar, Cross Ref

Winter, S., & Schlesewsky, L. (2019). The German feed-in tariff revisited - an empirical investigation on its distributional effects. Energy Policy, 132, 344–356.

Xin-gang, Z., Ling, W., & Ying, Z. (2020). How to achieve incentive regulation under renewable portfolio standards and carbon tax policy? A China’s power market perspective. Energy Policy, 143.

Zuo, Z., Guo, H., & Cheng, J. (2020). An LSTM-STRIPAT model analysis of China’s 2030 CO2 emissions peak. Carbon Management, 11(6), 577–592.

Indexed at, Google Scholar, Cross Ref

Received: 21-Dec-2023, Manuscript No. AMSJ-23-14297; Editor assigned: 22-Dec-2023, PreQC No. AMSJ-23-14297(PQ); Reviewed: 29-Jan-2024, QC No. AMSJ-23-14297; Revised: 29-Feb-2024, Manuscript No. AMSJ-23-14297(R); Published: 16-Mar-2024