Review Article: 2023 Vol: 27 Issue: 4

Research Perspectives and Trends of Board Diversity and Corporate Governance: A Review and Bibliometric Analysis

Rinku Mahindru, Masters’ Union School of Business, Gurugram, India

Poonam Sethi, Hindu College, University of Delhi

Nidhi Kapoor, Kalindi College, University of Delhi

Deepti Singh, Moti Lal Nehru College, University of Delhi

Citation Information: Mahindru, R., Sethi, P., Kapoor, N., & Singh, D. (2023). Research perspectives and trends of board diversity and corporate governance: a review and bibliometric analysis. Academy of Marketing Studies Journal, 27(4), 1-21.

Abstract

This research identifies the most pressing problems and emerging trends in board diversity and corporate governance. Bibliographic research has been used to identify 161 articles on board diversity and corporate governance published between 2008 and mid-2022 in the ISI Web of Science database. Based on citations, publications, location, and network importance, the analysis highlights the keywords and the most significant articles and authors. Although there are international studies on board diversity and corporate governance, there needs to be more cross-national cooperation, particularly between academics from developed and developing nations. Gender diversity is the main focus of research on board diversity, while age, nationality, ethnicity, professional background, and cognition are given less consideration.

Keywords

Gender Diversity, Corporate Governance, Board Diversity, Women Directors, Bibliometric Analysis.

Introduction

In today's corporate world, the corporation requires a more diverse boardroom because it offers a range of perspectives and insights(Arenas-Torres, Bustamante-Ubilla, and Campos-Troncoso 2021; Campbell & Minguez-Vera, 2008; Wang, 2020; Yang et al., 2019). In addition to improving the company's reputation, a more diverse board is more effective at finding solutions to problems and drawing inferences (Bin Khidmat, Ayub Khan, and Ullah 2020; Garcia-Sanchez et al. 2022; Gul, Srinidhi, and Ng 2011; Xia et al. 2022). A gender quota for women's representation has been implemented in several nations to promote more diverse boardrooms (Bhatia and Gulati 2021; Ciavarella 2017; Fleischer 2022; Lavin and Montecinos-Pearce 2021; Nguyen, Locke, and Reddy 2015; Singh 2020). In addition, California recently became the first U.S. state to implement a law mandating that all corporations have at least one female director by 2019 and that boards with five or more members have at least two or three female directors (Greene, et al. 2020). Regulatory constraints like these have revived an old debate about how diversity on boards of directors may improve various facets of a company.

When the existing body of research on the issue was examined, the study found considerable gaps in the current understanding of the relationship between board diversity and corporate governance. To properly determine the field's knowledge structure, the board's diversity must be scrutinized. This research fills a void by answering the following research questions (R.Q.s):

RQ1: What are the current publication trend in board diversity and corporate governance publications?

RQ2: Which are the most influential articles on board diversity and corporate governance?

RQ3: What are the most highlighted keywords on board diversity and corporate governance among scholars?

RQ4: Who are the most influential authors on board diversity and corporate governance?

RQ5: What is the citation structure of current research on board diversity and corporate governance?

The study's objectives were accomplished by conducting the search string and extracting the sample literature precisely, using appropriate inclusion and exclusion criteria. A complete bibliometric evaluation followed. We performed citation and co-citation analyses in VosViewer to establish the conceptual framework of the literature on board diversity and corporate governance. The co-citation network is constructed through VosViewer to reveal knowledge clusters and theme movement.

The rest of the study is outlined as follows. Section 2 illustrates the review of the literature of the study, followed by the data and methodology in Section 3. Section 4 details the analysis and findings of the study. Section 5 provides a brief discussion, followed by the study's conclusion in Section 6.

Review of Literature

The extant literature on board diversity finds the impact of board diversity on the firm outcomes occupying center stage. Within this literature, one finds broad definitions of boardroom diversity. Van der Walt and Ingley (2003) see it as a synergistic combination of human and social capital, thus facilitating the governance function of the Board of Directors. What boardroom diversity brings to an organization is something to be examined in the light of standout firms that have gone the extra mile to induct this diversity and have reaped the benefits of multiple perspectives. Adams and Ferreira(2009) note that despite harming firms' financial performance, the impact on governance is positive. Srinidhi et al. (2011) contend that Earnings Quality improves with board diversity. Further, Gul et al. (2011) observed that diverse boards, through more significant public disclosures, affect share price in formativeness positively.

According to Arenas-Torres et al. (2021), gender diversity positively impacted the degree to which corporate governance practices were adopted, the operation of the board of directors, and the protection of shareholders, while national diversity positively impacted the adoption of practices related to risk management. Further, Fleischer (2022), the environment of the German two-tier corporate governance structure does not support the idea of favorable spill-over effects of gender diversity. The number of women on the supervisory board does not influence the number of women on the management board. Human rights and corporate governance measures also improve when more women are represented on boards, as suggested by Beji et al. (2021). According to Oradi and E-Vahadati (2021), companies benefit from having more women in monitoring roles since they are more likely to make conservative and ethical judgments. Despite this, Pandey (2020) discovers that having women on the board correlates with a lower debt cost. He agrees that a minimum number of women on a board is necessary to improve its performance and corporate governance.

Corporate governance and accountability may be improved by increasing the representation of women on boards, as Buertey (2021) argues. Novel evidence on the impact of gender diversity as a governance tool on risk-taking in a social-psychological environment is examined by Wang (2020). According to Halliday et al. (2021), having a diverse board of directors, including women, is beneficial for good corporate governance and the efficiency of a firm. However, advancements in raising the number of women on boards have been sluggish. According to Fang et al. (2020), more women on boards of directors can significantly lower a company's risk and zombie potential. Female chief financial officers' (CFOs') management of finances and quality improvement channels in transparency and corporate governance are primarily responsible for this reduction in zombie potential.

Board diversity has often been propagated and tested for its positive association with improved governance, but there still needs to be more consensuses on its relationship with better financial performance. For example, on the one hand, Campbell and Minguez-Vera(2008), Terjesen et al. (2016), and Francoeur, Labelle, & Sinclair-Desgagné (2008) established a positive relationship between diversity and financial performance, and on the other, Adams & Ferreira (2009); Carter, D’Souza, Simkins, & Simpson (2010); Rose (2007) established a non-significant and antagonistic relationship between board diversity and financial performance.

Several studies have examined how a diverse board might improve a company's bottom line. Positive links between board diversity and firm performance have been established through the mediating effect of firm-related variables such as Firm Innovation, boards' strategic control, corporate social responsibility, firms' reputation, and environmental performance, opening the door for the induction of diversity in the boards as a natural process (Bear, Rahman, and Post 2010; Dezsö & Ross, 2012; Kor, 2006; Miller & Del Carmen Triana, 2009; Nielsen & Huse, 2010; Post, Rahman, and Rubow 2011; Xia et al., 2022).

Recent research has found strong evidence of a clear correlation between gender diversity on boards and performance on a variety of sustainability parameters(Disli, Yilmaz, and Mohamed, 2022). Researchers have also considered the role of environmental variables in shaping diversity (Amore & Garofalo, 2021). Institutional factors such as legislative and corporate governance framework (Terjesen et al., 2016), industry type (Arenas-Torres et al., 2021; Buallay et al., 2022), and firm-specific characteristics such as firm size, network linkages, and strategic orientation (Hillman, Shropshire, and Cannella 2007) have studied into for their impact on board diversity. Grosvold and Brammer (2011) find that a country's institutional framework affects board diversity. Board diversity improves a company's reputation in sectors where it interacts with customers directly, according to research by Brammer et al. (2009). Board diversity is influenced by the company's external business environment, as found by Brammer et al. (2007). An organization's strategy formulation and implementation could benefit more from the coordinated use of many governance mechanisms than from using them alone (Garcia-Sanchez et al., 2022).

Women's representation on corporate boards, according to Campbell (2008) ), may have positive financial effects. Similarly, Mersland and Strom (2009) argue that appointing domestic rather than foreign directors, using an internal board auditor, and leading with a female CEO all lead to better financial results. Moreover, according to Terjesen(2009), the presence of women on corporate boards might affect governance and performance. Women's representation on corporate boards (WOCB) positively affects corporate governance because it leads to a more well-rounded and fair business structure that more effectively allocates resources across employees and more accurately represents the organization's interests as a whole. Frias-Aceituno et al.(2013) also indicate that gender diversity, expansion prospects, and firm size are crucial to effective communication. This impact is consistent across the Anglo-Saxon, Germanic, and Latin types of corporate governance. Bohren and Strom (2010) claim that when there are no board employee directors, directors have significant linkages to other boards, and when gender diversity is minimal, the business produces more fantastic value for its owners. The lack of a correlation between company performance and board independence is not surprising.

Data analysis demonstrates that voluntary initiatives to promote gender diversity, as implemented by corporate governance guidelines, have a positive and significant correlation with the 'closeness' of women to other directors in the network (i.e., their access to information). In contrast, obligatory regulation, such as gender quotas, strengthens women's function as unique 'bridges' connecting sub-networks, enhancing their 'betweenness' centrality, i.e., their control over information (Mateos de Cabo et al. 2022).

Despite these advancements, the benefits of having a diverse board still need to be discovered. The correlation between a diverse board and increased productivity needs to be better understood because research has stalled. The lack of correlation leaves the state of the literature and possible future study directions uncertain.

Data and Methodology

Bibliometric analysis is a well-established quantitative tool for examining the publishing patterns of scholarly works, and it is most commonly employed in library and information science research to examine the publishing trends and patterns of themes under study. As mentioned earlier, the potential research directions around board diversity and Corporate Governance being hazy, the researchers chose bibliometric analysis to uncover the reasons for this inconclusiveness by resorting to bibliometric analysis. WoS is one of the world's most extensive peer-reviewed and authentic scientific literature indexing and abstracting databases. However, the document types covered by this study are limited to articles, proceedings, reviews, and book chapters.

The targeted data were retrieved applying the following search queries in the main searching box of WoS: "Female directors" OR "women directors" OR "gender diversity" OR "Female CEO" OR "Women CEO" OR "board gender diversity" AND "corporate governance." After executing the proceeding query, the following WoS category: "Management, Business, Business Finance, Environment Science, Ethics” was selected. The excluded type of documents was “Proceedings papers." The total results contained 161 records. Each record was double-checked to ensure that the data was accurate. No language filter was implemented during data retrieval, as every record was English. By repeating this method, the correctness of the results was ensured. For data analysis, the researchers utilized M.S. Excel and VOS-viewer software. Table 1 summarizes our search strategy and data retrieval process.

| Table 1 Search Strategy And Data Retrieval Process |

||

|---|---|---|

| Date | Database | Search String |

| 27th May2022 | ISI WOS | "Female directors" OR "women directors" OR "gender diversity" OR "Female CEO" OR "Women CEO" OR "board gender diversity" AND "corporate governance." |

| First Stage Filters | Document Type: Article Language: English | |

| Result | 187 Journal articles in English | |

| Implementing subject area filters from the WOS categories. | ||

| Second stage filter | WOS Categories: “Management, Business, Business Finance, Environment Science, Ethics” | |

| Result | 161 articles from the relevant subject | |

This table outlines the search strategy used in our study.

Analysis and Findings

RQ1 (What is the current publication trend in board diversity?) is discussed by analyzing the publication trend in board diversity and corporate governance using total publications by year, country, Journal, contributing author, and organization.

Publication by Year

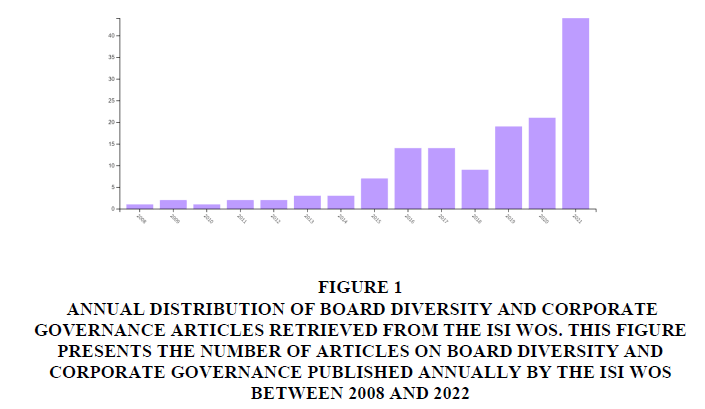

The number of publications on board diversity between 2008 and the beginning of 2022 is depicted in Figure 1. The dramatic increase in publications after 2008 coincides with the enactment of a quota rule in Norway. Countries such as Norway, Spain, France, and Iceland have laws mandating that women comprise at least 40% of boards of directors for publicly traded firms.

Figure 1: Annual Distribution Of Board Diversity And Corporate Governance Articles Retrieved From The Isi Wos. This Figure Presents The Number Of Articles On Board Diversity And Corporate Governance Published Annually By The Isi Wos Between 2008 And 2022.

Publishing Activity by Journal

The 161 articles were published in 72 journals. The journals with the most papers on board diversity and corporate governance are presented in Table 2. “Sustainability”, “The Journal of Business Ethics”, “Corporate Governance: International Review”, and “Gender in Management” are the major journals. The theme of board diversity and corporate governance is part of the broader field of corporate governance, which aligns well with the research interests of these publications.

| Table 2 Top Publishing Journals On Board Diversity And Corporate Governance |

|

|---|---|

| Name of Journal | Number of Articles |

| Sustainability | 20 |

| Journal of Business Ethics | 12 |

| Corporate Governance: An International Review | 9 |

| Gender in Management | 7 |

| International Journal of Finance Economics | 7 |

| Business Strategy and The Environment | 5 |

| Management Decision | 5 |

| Managerial Auditing Journal | 5 |

| Corporate Social Responsibility and Environmental Management | 4 |

| Journal of Cleaner Production | 4 |

| Review of Managerial Science | 4 |

| Sustainability Accounting Management and Policy Journal | 4 |

| British Journal of Management | 3 |

| European Business Organization Law Review | 3 |

| Journal of Business Finance Accounting | 3 |

| Research in International Business and Finance | 3 |

| Academia Revista Latino Americana De Administracion | 2 |

| Accounting and Finance | 2 |

| British Accounting Review | 2 |

| Emerging Markets Review | 2 |

This table shows the top journals publishing articles on board diversity.

Publishing Activity by Author

Our dataset shows 409 writers representing 314 businesses published publications on board diversity and corporate governance. Table 3 provides a listing of the top contributors and organizations. According to the table, Garcia-Sanchez IM has written the most papers (five) on board diversity and corporate governance, followed by Martinez-Ferrero J and Nadeem M, who have each published four articles.

| Table 3 Top Publishing Authors On Board Diversity And Corporate Governance |

|

|---|---|

| Authors | Total publications |

| Garcia-Sanchez IM | 5 |

| Martinez-Ferrero J | 4 |

| Nadeem M | 4 |

| Garcia-Meca E | 3 |

| Ntim CG | 3 |

| Orazalin N | 3 |

| Ahsan T | 2 |

| Ali R | 2 |

| Ararat M | 2 |

| Arenas-Torres F | 2 |

| Bel-oms I | 2 |

| Ben Rejeb W | 2 |

| Ben-Amar W | 2 |

| Berraies S | 2 |

| Bravo F | 2 |

| Bustamante-Ubilla M | 2 |

| Chan SG | 2 |

| Chen SL | 2 |

| De Cabo RM | 2 |

| Elamer AA | 2 |

This table shows the top authors in the area of Board diversity and corporate governance.

Publishing Activity by an Organization

According to Table 4, the Egyptian Knowledge Bank EKB and the University of Otago were the most prolific institutions in this area, publishing six publications apiece, followed by the Universite De La Manouba, the University of Salamanca, and the University of Southampton, each of which published five. In addition, corporate governance and board diversity studies have been conducted on a global scale.

| Table 4 The Most Active Organizations In The Field Of Board Diversity And Corporate Governance |

|

|---|---|

| University/Organisations | Total Publications |

| Egyptian Knowledge Bank EKB | 6 |

| University of Otago | 6 |

| Universite De La Manouba | 5 |

| University of Salamanca | 5 |

| University of Southampton | 5 |

| Brunel University | 4 |

| League of European Research Universities Leru | 4 |

| Solent University | 4 |

| Universidad Politecnica De Cartagena | 4 |

| Universite De Tunis | 4 |

| Universiti Utara Malaysia | 4 |

| University of Portsmouth | 4 |

| Bournemouth University | 3 |

| Ie University | 3 |

| Kimep University | 3 |

| Mansoura University | 3 |

| Queensland University of Technology Qut | 3 |

| University of Sevilla | 3 |

| University of Tasmania | 3 |

| University of Valencia | 3 |

This table shows the top organizations in the area of Board diversity and corporate governance.

Citation Network Analysis

Our second R.Q. seeks to identify seminal works on board diversity and corporate governance by asking, "Which are the most significant papers on board diversity?" To address RQ2, we looked at the interconnectedness of 161 articles through their citation histories. There are several ways to assess a research paper's significance, but citation analysis is the most common. Researchers may build more knowledgeable connections when appropriate credit is given to the sources used. In citation analysis, the number of times other publications reference an article is used as a proxy for its significance.

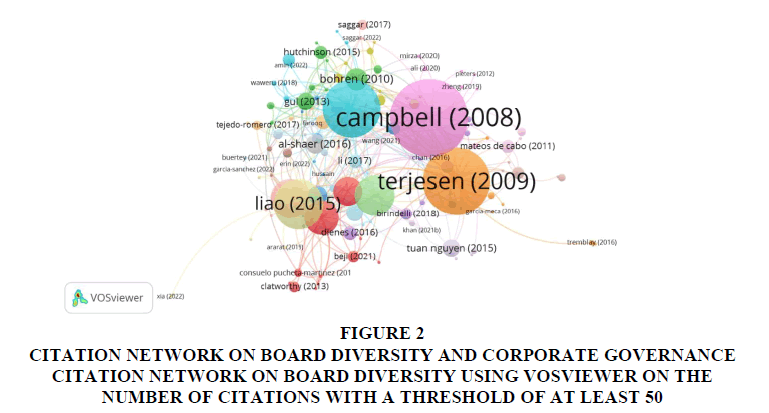

The term "global citations" denotes the number of times a specific item in the database has been cited by other sources, regardless of the subject area. Referencing the network of 161 articles, analysis of the local citations reveals which articles are the most often read. From a worldwide perspective, the most-cited paper is by (Campbell & Minguez-Vera, 2008) ), with 734 citations; (Terjesen et al., 2009), in second place, with 640 citations.

Among the other highly cited are (Liao, Luo, and Tang 2015), with 420 citations, followed by (Rao & Tilt, 2016), with 302 citations, and (Frias-Aceituno et al., 2013)with 289 citations. Figure 2 depicts the nodes in the citation network that have received the most citations. A high number of citations indicate that a specific publication is widely regarded as seminal research in board diversity and corporate governance. Consequently, articles with a more significant total number of citations are more influential on the growth of board diversity and corporate governance as a field.

Figure 2: Citation Network On Board Diversity And Corporate Governance Citation Network On Board Diversity Using Vosviewer On The Number Of Citations With A Threshold Of At Least 50.

Top-10 Highly Cited Articles on Board Diversity and Corporate Governance

Table 5 shows the top ten most mentioned articles. Four of the top ten articles were mentioned more than 400 times. The paper "Gender Diversity in the Boardroom and Firm Financial Performance" by (Campbell & Minguez-Vera, 2008) in the Journal of Business Ethics had the most citations, with 784. The high citation is not unexpected given that researcher interest expanded significantly after 2008, and the field is now wholly researched and understood. The following most referenced article garnered 640 citations: "Women directors on corporate boards: A review and research agenda" (Terjesen et al., 2009) in the Journal "Corporate Governance-An International Review." The third and fourth papers each received 523 and 420 citations, respectively.

| Table 5 Top-10 Highly Cited Articles On Board Diversity And Corporate Governance |

|||||

|---|---|---|---|---|---|

| Ranking | Title | Authors | Source Title | Publication Year | Total Citations |

| 1 | Gender Diversity in the Boardroom and Firm Financial Performance | Campbell and Minguez-Vera(2008) | Journal of Business Ethics | 2008 | 784 |

| 2 | Women Directors on Corporate Boards: A Review and Research Agenda | Terjesen et al.(2009) | Corporate Governance-An International Review | 2009 | 640 |

| 3 | Does board gender diversity improve the informativeness of stock prices? | Gul, Srinidhi, and Ng(2011) | Journal of Accounting & Economics | 2011 | 523 |

| 4 | Gender diversity, board independence, environmental committee and greenhouse gas disclosure | Liao et al.(2015) | British Accounting Review | 2015 | 420 |

| 5 | Board Composition and Corporate Social Responsibility: The Role of Diversity, Gender, Strategy and Decision Making | Rao and Tilt (2016) | Journal of Business Ethics | 2016 | 302 |

| 6 | The Role of the Board in the Dissemination of Integrated Corporate Social Reporting | Frias-Aceituno et al. (2013) | Corporate Social Responsibility and Environmental Management | 2013 | 289 |

| 7 | Board Gender Diversity and Corporate Response to Sustainability Initiatives: Evidence from the Carbon Disclosure Project | Ben-Amar, Chang, and McIlkenny(2017) | Journal of Business Ethics | 2017 | 244 |

| 8 | Performance and governance in microfinance institutions | Mersland and Strom(2009) | Journal of Banking & Finance | 2009 | 244 |

| 9 | Board Attributes, Corporate Social Responsibility Strategy, and Corporate Environmental and Social Performance | Shaukat et al.(2016) | Journal of Business Ethics | 2016 | 188 |

| 10 | Governance and Politics: Regulating Independence and Diversity in the Board Room | Bohren and Strom(2010) | Journal of Business Finance & Accounting | 2010 | 126 |

Keyword and Co-Occurrence Analysis

Co-occurrence and keyword analysis are performed, assuming that the author's chosen keywords accurately reflect the article's subject matter (Comerio & Strozzi, 2019). When two or more keywords appear in the same article, it is called a "keyword co-occurrence," which usually means that the two or more topics are related. For example, RQ3, "Which topics relating to board diversity and corporate governance are the most popular among scholars?" focuses on determining the most frequently used terms among academics in board diversity and corporate governance research. To answer this R.Q., we employ the VOSviewer software's keyword and co-occurrence analysis.

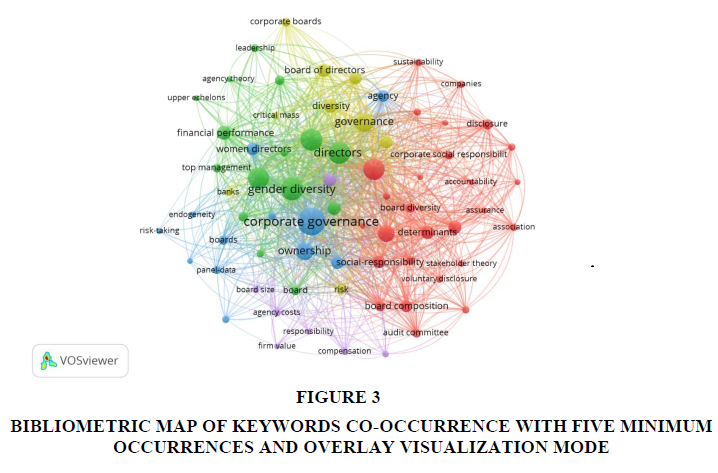

Keywords are descriptive nouns that sum up the essence of a study. According to the bibliometric study, 765 different terms were used in this investigation. VOSviewer was used to assess better the recurrence frequency of specific keywords to depict the Board Diversity and Corporate Governance studies. In Fig. 3, a threshold of 5 keywords was used for a co-occurrence analysis, and 70 items were added to Visualization for analysis.

A link indicates a co-occurrence between two terms. According to the VOSviewer user guide, each link has a strength, represented by a positive numeric number: the more significant this number, the more robust the connection. The overall link strength represents the number of occurrences of a pair of keywords in publications. In Figure 3, the size of the circles corresponds to the frequency of keyword occurrences. The greater the size of the circle, the greater the co-selection of a keyword in board diversity and corporate governance publications. The most potent keywords were "business governance" and "gender diversity." The distance between the two keywords indicated their respective importance and subject similarity. The clustering of circles of the same hue in Table 6 indicated a common theme among these articles. Figure 3 depicts a network of co-keywords illustrating five unique groupings.

| Table 6 Cluster Analysis Of Keyword Occurrence |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cluster 1(27 items) | Cluster 2(15 Items) | Cluster 3(12 Items) | Cluster 4(9 Items) | Cluster 5 (7 Items) | ||||||||||

| Keyword | Occurrence | Total Link Strength | Keyword | Occurrence | Total Link Strength | Keyword | Occurrence | Total Link Strength | Keyword | Occurrence | Total Link Strength | Keyword | Occurrence | Total Link Strength |

| Impact | 58 | 446 | Gender Diversity | 69 | 518 | Corporate Governance | 103 | 708 | Governance | 49 | 391 | Management | 24 | 170 |

| Performance | 39 | 286 | Directors | 62 | 459 | Ownership | 42 | 320 | Diversity | 26 | 174 | Agency Costs | 7 | 54 |

| Determinants | 24 | 195 | Women | 62 | 449 | Board Gender Diversity | 20 | 163 | Board Of Directors | 23 | 178 | Compensation | 7 | 58 |

| Firm | 24 | 203 | Firm Performance | 60 | 436 | Women Directors | 20 | 134 | Gender | 22 | 153 | Board Size | 6 | 44 |

| Social-Responsibility | 21 | 164 | Financial Performance | 25 | 184 | Agency | 18 | 142 | Corporate Social-Responsibility | 20 | 150 | Decision-Making | 6 | 41 |

| Board Composition | 19 | 147 | Female Directors | 23 | 153 | Boards | 12 | 83 | Risk | 13 | 93 | Firm Value | 5 | 38 |

| Disclosure | 15 | 135 | Ethnic Diversity | 13 | 104 | Panel-Data | 9 | 78 | Corporate Boards | 11 | 77 | Responsibility | 5 | 38 |

| Earnings Management | 14 | 105 | Ownership Structure | 12 | 98 | Representation | 7 | 44 | Banks | 7 | 55 | |||

| Board Diversity | 12 | 91 | Board | 11 | 79 | Size | 7 | 58 | Critical Mass | 7 | 49 | |||

| Audit Committee | 11 | 88 | Top Management | 10 | 78 | Endogeneity | 6 | 42 | ||||||

| Quality | 11 | 91 | Leadership | 9 | 55 | Capital Structure | 5 | 38 | ||||||

| Corporate Social Responsibility | 10 | 77 | Agency Problems | 8 | 58 | Risk-Taking | 5 | 25 | ||||||

| Environmental Performance | 8 | 69 | Ceo Duality | 8 | 66 | |||||||||

| Independence | 8 | 71 | Agency Theory | 5 | 32 | |||||||||

| Information | 8 | 67 | Upper Echelons | 5 | 38 | |||||||||

| Institutional Investors | 8 | 57 | ||||||||||||

| Sustainability | 8 | 61 | ||||||||||||

| Voluntary Disclosure | 8 | 66 | ||||||||||||

| Association | 7 | 66 | ||||||||||||

| Companies | 7 | 57 | ||||||||||||

| Accountability | 5 | 41 | ||||||||||||

| Assurance | 5 | 50 | ||||||||||||

| Board Characteristics | 5 | 45 | ||||||||||||

| Board Independence | 5 | 37 | ||||||||||||

| Emerging Markets | 5 | 44 | ||||||||||||

| Stakeholder Theory | 5 | 38 | ||||||||||||

| Stakeholders | 5 | 48 | ||||||||||||

This table shows the five keyword clusters.

Figure 3: Bibliometric Map Of Keywords Co-Occurrence With Five Minimum Occurrences And Overlay Visualization Mode.

The red cluster (Figure 3, cluster 1, upper right, 27 items) consists of terms such as effect, performance, determinants, company, social responsibility, board composition, earnings disclosure, management, board diversity, and audit committee. In the green cluster (Figure 3, cluster 2, bottom right, 15 items), we find terms such as gender diversity, directors, women, company performance, financial performance, female directors, and ethnic diversity, among others. In the blue cluster (Figure 3, cluster 3, center-left, 12 items), we find terms such as corporate governance, ownership, board gender diversity, and women directors. Next, in the yellow cluster (Figure 3a, cluster 4, upper left, nine items), we find terms such as governance, diversity, board of directors, and gender, among others. A second core cluster in purple (Figure 3, cluster 5, seven items) included terms such as management, agency expenses, remuneration, the board size, and decision-making, among others.

We undertake keyword and co-occurrence analysis to investigate the most general keywords in board diversity and corporate governance. Table 7 demonstrates the link and total strength of the ten most frequent terms. It indicates that corporate governance is the most commonly used keyword in board diversity literature. This conclusion is logical, given that board diversity is centered on its usefulness in enhancing corporate governance. The second most often used term is gender diversity, indicating that research on board diversity has primarily focused on the problem of women and their participation on boards. Three of the ten most-used keywords are for gender diversity. Corporate social responsibility has also been a common issue in the literature. As shown in Figure 3, corporate governance and gender diversity are the most prominent nodes in the network, illustrating their respective significance in the field of board diversity. Corporate governance and gender diversity co-occur most frequently, according to Table 7.

| Table 7 The Link And Total Link Strength Of The Top 10 Occurrence Keywords |

||||

|---|---|---|---|---|

| Ranking Order | Keyword | Cluster no. | Occurrences | Total Link Strength |

| Top 1 | Corporate Governance | 3 | 103 | 708 |

| Top 2 | Gender Diversity | 2 | 69 | 518 |

| Top 3 | Women | 2 | 62 | 449 |

| Top 4 | Directors | 2 | 62 | 459 |

| Top 5 | Firm Performance | 2 | 60 | 436 |

| Top 6 | Impact | 1 | 58 | 446 |

| Top 7 | Governance | 4 | 49 | 391 |

| Top 8 | Ownership | 3 | 42 | 320 |

| Top 9 | Performance | 1 | 39 | 286 |

| Top 10 | Diversity | 4 | 26 | 174 |

This table shows the link and total link strength of the top 10 occurrence keywords.

Improvements in corporate governance appear to be the significant objective of studies in this field, but corporate governance and boards of directors rank second. Another rising subject is gender diversity on boards, which is by far the most common study topic in board diversity. These keyword combinations imply that scholars have exhibited a tremendous interest in gender diversity on boards, which is understandable given that gender is the most significant demographic factor constituency. However, this conclusion also shows that other demographic characteristics have gotten less academic attention.

Co-authorship Analysis

To analyze RQ4 and RQ5 (Who are the most influential authors on board diversity and corporate governance, and what is the current state of collaboration involving board diversity and corporate governance?), the present state of collaborations and the most influential authors on board diversity and corporate governance were identified. Collaboration between researchers is the most formally recognized type of intellectual interaction in scientific study. Global cooperation networks enable emerging nations to engage in the usually developed-country-led advancement of knowledge conceptualization. The convergence of many views results in the generation of ideas. Publication of work with several authors is advantageous since it minimizes the possibility of errors and permits contributions from other areas.

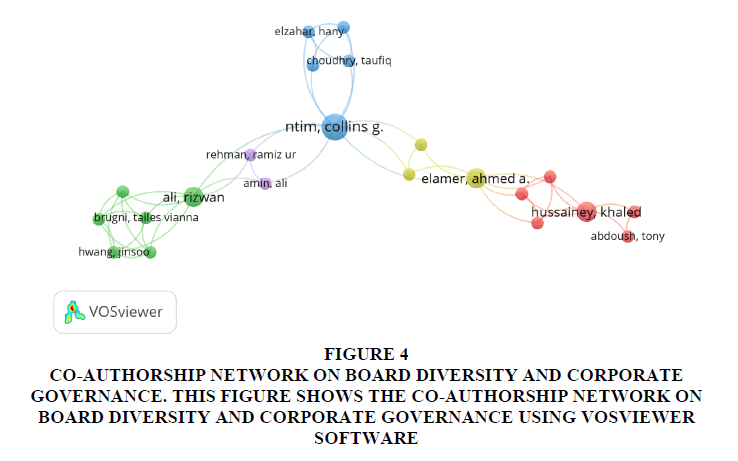

In this part, we examine the level of collaboration between researchers and categorize the most influential writers within the network of scholar collaboration. In terms of joint effort, Isabel-Mara Garca-Sánchez, Jennifer Martnez-Ferrero, Silu Chen, Wanxing Jiang, and Collins G. Ntim from Spain, the United States, China, and England, respectively, are noteworthy writers. The writers in this network are predominantly from the same countries, and most of their collaborations are with each other. This network implies that most research is concentrated on a small number of writers. The co-authorship network may be viewed as a collection of tiny networks that communicate with one another infrequently. Academic collaboration is crucial for making progress on a subject. Hence more global alliances are needed in Figure 4.

Figure 4: Co-Authorship Network On Board Diversity And Corporate Governance. This Figure Shows The Co-Authorship Network On Board Diversity And Corporate Governance Using Vosviewer Software.

Co-citation Analysis

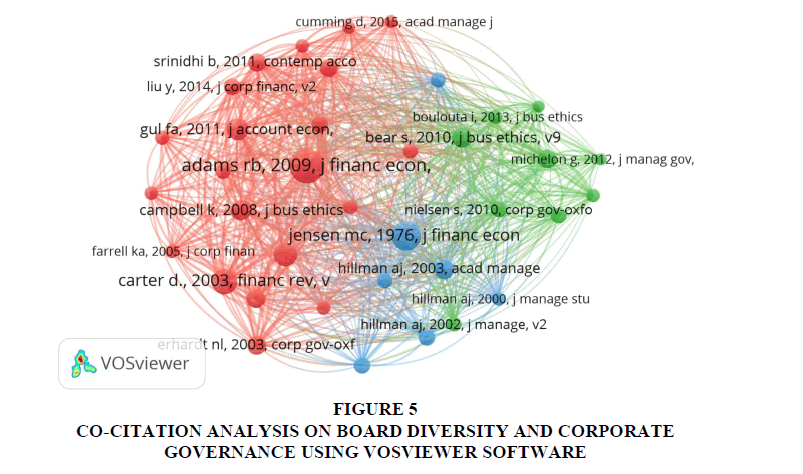

Co-citation refers to the frequency with which two publications are referenced together. Our fifth research question (What is the citation structure of current research on board diversity and corporate governance?) focuses on co-citation to determine the citation pattern of research on board diversity and corporate governance. Co-citation analysis connects two articles represented by nodes when they co-occur in any research publication. When two publications are mentioned together, they are deemed linked as they are likely to cover related topics. As shown in Figure 5, our preliminary research reveals that 37 of the 161 articles are co-cited by other articles within the network.

Figure 5: Co-Citation Analysis On Board Diversity and Corporate GOVERNANCE USING Vosviewer Software.

Discussion

In this section, we discuss the findings of the paper based on its research questions. Firstly, the number of papers on board diversity and corporate governance has increased profoundly, but we cannot ignore the last two years of the pandemic. The impact of the pandemic on research has been surprisingly heartening. As people stayed at home, coveted libraries worldwide gave remote access to all and sundry in their attempt to serve humanity in times of such a massive crisis. As the citadels of elite education opened their corridors to virtual students, the research community gained the extra mile in the process. With no travel to workplaces, working from home allowed everyone to re-prioritize themselves. The researchers could access content hitherto available at exorbitant charges combined with more time. As a result, there has been a surge in publications across nations in 2021(Aviv-Reuven and Rosenfeld 2021; Bhatia et al. 2022; De’, Pandey, and Pal 2020; Raynaud et al. 2021). The increase in the publication explains the unusual number of publications in this area. As researchers, we expect this trend to continue even in 2022 and beyond as research has gained momentum, which may continue.

Further, another important finding of our paper is that most papers focus on gender diversity, which is also reflected in our keyword analysis. The discussions on gender diversity have been trending in academic circles for quite some time, but for corporations to initiate it into the boardrooms is much wanting (Ben-Amar et al., 2017; Brammer et al., 2007; Gul et al., 2011; Halliday et al., 2021; Liao et al., 2015; Mateos de Cabo et al. 2022; Nadeem, 2021; Terjesen et al., 2016). It would be appropriate to mention that Board diversity cannot be taken in isolation from culture, nationality, religious conviction, age, and experience. The palette of diversity can have different shades, and all need to come together to create a picture of meaningful diversity. Moreover, we cannot restrict gender diversity in the current scenario to mean male and female only. Instead, the definitions go beyond and into non-binary genders (Gibson & Fernandez, 2018; Hossain et al., 2020; Ludwig & Sassen, 2022; Papangkorn, Kitsabunnarat-Chatjuthamard, and Jiraporn, 2021).

Conclusion, Future Research Directions & Limitations

Researchers and regulators indicate that studies of board diversity and corporate governance can improve the overall performance of an organization. While authors worldwide have made contributions, our research shows that the networks connecting them are relatively uniform within each country. Additionally, the most significant and distinguished works on the topic were selected. These works have a significant influence that is not necessarily reflected in their global and local citations. Our keyword and co-occurrence analyses indicate that scholars have maintained an emphasis on corporate governance and business performance and the effect of board diversity on these variables. In addition, among demographic indicators, gender has attracted the most attention. However, through a co-citation analysis, we find that only 37 articles out of 161 are co-cited. Thus, this research helps in concluding that in certain parts of the world, diversity has not been practiced, and as academics, it is the responsibility of the intellectual and academic community to bring it into dialogue and hence try to bring it into the mainstream discussion. From there, the community and the government start taking note of these perspectives and turn them into mandatory requirements or, in some other manner, make them enforceable. So overall, board diversity, despite being an essential pillar of good corporate governance, has yet to find due attention from the academic community.

One can expect the trend to catch on only after everyone who matters understands the importance, impact, and utility of walking the talk. We also need to emphasize that even if the evidence supporting diversity and corporate governance remains inconclusive, it cannot undermine the necessity of having diverse Boards. Firstly, the business world should set standards for everyone to follow since gender equality is a principle that applies to all areas of life, including the workplace. It cannot shirk away from ensuring equity and access to every citizen of the society whose resources it utilizes. Further, communities and governments may remain ahead of the curve by making sure both genders are pretty represented in settings where diversity is a priority. To begin with, it should make it mandatory for the firms to follow these practices and later, as it becomes an accepted norm, allow these corporations to experiment with newer ideas of implementation. The concept is ever-changing, and the need to keep the conversation going is essential.

The academic community can contribute by bringing more subject dimensions under its lens, breaking the current trend. Thus, Board diversity, an essential pillar of good corporate governance, must beget the attention of the academic community. While this research has some promising results, we acknowledge that our analysis has limitations due to the exclusion of content from publications not included in the Web of Science database. Choosing from alternative resources is intricate and must adhere to stringent protocols. Additionally, this research examined the development of recently released works. A similar analysis may be performed on other document formats, such as conference papers, to get a complete view of state of the art in this field of research.

References

Adams, Renée B., and Daniel Ferreira. 2009. “Women in the Boardroom and Their Impact on Governance and Performance.” Journal of Financial Economics 94(2):291–309. Doi: 10.1016/j.jfineco.2008.10.007.

Indexed at, Google Scholar, Cross Ref

Amore, Mario Daniele, and Orsola Garofalo. 2021. “Pay Inequality and Gender Dynamics in Top Executive Positions.” Corporate Governance-an International Review 29(6):526–40. Doi: 10.1111/corg.12389.

Indexed at, Google Scholar, Cross Ref

Arenas-Torres, Felipe, Miguel Bustamante-Ubilla, and Roberto Campos-Troncoso. 2021. “Diversity of the Board of Directors and Financial Performance of the Firms.” Sustainability 13(21):11687. Doi: 10.3390/su132111687.

Indexed at, Google Scholar, Cross Ref

Aviv-Reuven, Shir, and Ariel Rosenfeld. 2021. “Publication Patterns’ Changes Due to the COVID-19 Pandemic: A Longitudinal and Short-Term Scientometric Analysis.” Scientometrics 126(8):6761–84. Doi: 10.1007/s11192-021-04059-x.

Indexed at, Google Scholar, Cross Ref

Bear, Stephen, Noushi Rahman, and Corinne Post. 2010. “The Impact of Board Diversity and Gender Composition on Corporate Social Responsibility and Firm Reputation.” Journal of Business Ethics 97(2):207–21.

Indexed at, Google Scholar, Cross Ref

Beji, Rania, Ouidad Yousfi, Nadia Loukil, and Abdelwahed Omri. 2021. “Board Diversity and Corporate Social Responsibility: Empirical Evidence from France.” Journal of Business Ethics 173(1):133–55.

Indexed at, Google Scholar, Cross Ref

Ben-Amar, Walid, Millicent Chang, and Philip McIlkenny. 2017. “Board Gender Diversity and Corporate Response to Sustainability Initiatives: Evidence from the Carbon Disclosure Project.” Journal of Business Ethics 142(2):369–83.

Indexed at, Google Scholar, Cross Ref

Bhatia, Madhur, and Rachita Gulati. 2021. “Board Governance and Bank Performance: A Meta- Analysis.” Research in International Business and Finance 58:101425. Doi: 10.1016/j.ribaf.2021.101425.

Indexed at, Google Scholar, Cross Ref

Bhatia, Monika, Pritpal Singh Bhullar, Dipayan Roy, and Deepak Tandon. 2022. “Board Gender Diversity and the Indian Banking Sector: A Bibliometric Analysis.” Indian Journal of Corporate Governance 09746862221126337. Doi: 10.1177/09746862221126337.

Indexed at, Google Scholar, Cross Ref

Bin Khidmat, Waqas, Muhammad Ayub Khan, and Hashmat Ullah. 2020. “The Effect of Board Diversity on Firm Performance: Evidence from Chinese L Isted Companies.” Indian Journal of Corporate Governance 13(1):9–33. Doi: 10.1177/0974686220923793.

Indexed at, Google Scholar, Cross Ref

Bohren, Oyvind, and R. Oystein Strom. 2010. “Governance and Politics: Regulating Independence and Diversity in the Board Room.” Journal of Business Finance & Accounting 37(9–10):1281–1308. Doi: 10.1111/j.1468-5957.2010.02222.x.

Indexed at, Google Scholar, Cross Ref

Brammer, Stephen, Andrew Millington, and Stephen Pavelin. 2007. “Gender and Ethnic Diversity Among UK Corporate Boards.” Corporate Governance: An International Review 15(2):393–403. Doi: 10.1111/j.1467-8683.2007.00569.x.

Indexed at, Google Scholar, Cross Ref

Brammer, Stephen, Andrew Millington, and Stephen Pavelin. 2009. “Corporate Reputation and Women on the Board.” British Journal of Management 20(1):17–29. Doi: 10.1111/j.1467-8551.2008.00600.x.

Indexed at, Google Scholar, Cross Ref

Buallay, Amina, Reem Hamdan, Elisabetta Barone, and Allam Hamdan. 2022. “Increasing Female Participation on Boards: Effects on Sustainability Reporting.” International Journal of Finance & Economics 27(1):111–24. Doi: 10.1002/ijfe.2141.

Indexed at, Google Scholar, Cross Ref

Buertey, Samuel. 2021. “Board Gender Diversity and Corporate Social Responsibility Assurance: The Moderating Effect of Ownership Concentration.” Corporate Social Responsibility and Environmental Management 28(6):1579–90. Doi: 10.1002/csr.2121.

Indexed at, Google Scholar, Cross Ref

Campbell, Kevin, and Antonio Minguez-Vera. 2008. “Gender Diversity in the Boardroom and Firm Financial Performance.” Journal of Business Ethics 83(3):435–51. Doi: 10.1007/s10551-007-9630-y.

Indexed at, Google Scholar, Cross Ref

Carter, David A., Frank D’Souza, Betty J. Simkins, and W. Gary Simpson. 2010. “The Gender and Ethnic Diversity of US Boards and Board Committees and Firm Financial Performance.” Corporate Governance: An International Review 18(5):396–414. Doi: 10.1111/j.1467-8683.2010.00809.x.

Indexed at, Google Scholar, Cross Ref

Ciavarella, Angela. 2017. “Board Diversity and Firm Performance Across Europe.” SSRN Electronic Journal. Doi: 10.2139/ssrn.3084114.

Indexed at, Google Scholar, Cross Ref

Comerio, Niccolò, and Fernanda Strozzi. 2019. “Tourism and Its Economic Impact: A Literature Review Using Bibliometric Tools.” Tourism Economics 25(1):109–31. Doi: 10.1177/1354816618793762.

Indexed at, Google Scholar, Cross Ref

Dezsö, Cristian L., and David Gaddis Ross. 2012. “Does Female Representation in Top Management Improve Firm Performance? A Panel Data Investigation.” Strategic Management Journal 33(9):1072–89. Doi: 10.1002/smj.1955.

Indexed at, Google Scholar, Cross Ref

Disli, Mustafa, Mustafa Kemal Yilmaz, and Farah Finn Mohamud Mohamed. 2022. “Board Characteristics and Sustainability Performance: Empirical Evidence from Emerging Markets.” Sustainability Accounting Management and Policy Journal 13(4):929–52. Doi: 10.1108/SAMPJ-09-2020-0313.

Indexed at, Google Scholar, Cross Ref

Fang, Jianchun, Giray Gozgor, Chi-Keung Marco Lau, Wanshan Wu, and Cheng Yan. 2020. “Listed Zombie Firms and Top Executive Gender: Evidence from an Emerging Market.” Pacific-Basin Finance Journal 62:101357. Doi: 10.1016/j.pacfin.2020.101357.

Indexed at, Google Scholar, Cross Ref

Fleischer, Dennis. 2022. “Does Gender Diversity in Supervisory Boards Affect Gender Diversity in Management Boards in Germany? An Empirical Analysis.” German Journal of Human Resource Management-Zeitschrift Fur Personalforschung 36(1):53–76. Doi: 10.1177/2397002221997148.

Indexed at, Google Scholar, Cross Ref

Francoeur, Claude, Réal Labelle, and Bernard Sinclair-Desgagné. 2008. “Gender Diversity in Corporate Governance and Top Management.” Journal of Business Ethics 81(1):83–95. Doi: 10.1007/s10551-007-9482-5.

Indexed at, Google Scholar, Cross Ref

Frias-Aceituno, Jose V., Lazaro Rodriguez-Ariza, and I. M. Garcia-Sanchez. 2013. “The Role of the Board in the Dissemination of Integrated Corporate Social Reporting.” Corporate Social Responsibility and Environmental Management 20(4):219–33. Doi: 10.1002/csr.1294.

Indexed at, Google Scholar, Cross Ref

Garcia-Sanchez, Isabel-Maria, Nazim Hussain, Sana-Akbar Khan, and Jennifer Martinez-Ferrero. 2022. “Assurance of Corporate Social Responsibility Reports: Examining the Role of Internal and External Corporate Governance Mechanisms.” Corporate Social Responsibility and Environmental Management 29(1):89–106. Doi: 10.1002/csr.2186.

Indexed at, Google Scholar, Cross Ref

Gibson, Sarah, and J. Fernandez. 2018. Gender Diversity and Non-Binary Inclusion in the Workplace: The Essential Guide for Employers. Jessica Kingsley Publishers.

Greene, Daniel, Vincent J. Intintoli, and Kathleen M. Kahle. 2020. “Do Board Gender Quotas Affect Firm Value? Evidence from California Senate Bill No. 826.” Journal of Corporate Finance 60(101526). Doi: 10.1016/j.jcorpfin.2019.101526.

Indexed at, Google Scholar, Cross Ref

Grosvold, Johanne, and Stephen Brammer. 2011. “National Institutional Systems as Antecedents of Female Board Representation: An Empirical Study.” Corporate Governance: An International Review 19(2):116–35. Doi: 10.1111/j.1467-8683.2010.00830.x.

Indexed at, Google Scholar, Cross Ref

Gul, Ferdinand A., Bin Srinidhi, and Anthony C. Ng. 2011. “Does Board Gender Diversity Improve the Informativeness of Stock Prices?” Journal of Accounting & Economics 51(3):314–38. Doi: 10.1016/j.jacceco.2011.01.005.

Indexed at, Google Scholar, Cross Ref

Halliday, Cynthia Saldanha, Samantha C. Paustian-Underdahl, and Stav Fainshmidt. 2021. “Women on Boards of Directors: A Meta-Analytic Examination of the Roles of Organizational Leadership and National Context for Gender Equality.” Journal of Business and Psychology 36(2):173–91. Doi: 10.1007/s10869-019-09679-y.

Indexed at, Google Scholar, Cross Ref

Hillman, Amy J., Christine Shropshire, and Albert A. Cannella. 2007. “Organizational Predictors of Women on Corporate Boards.” Academy of Management Journal 50(4):941–52. Doi: 10.5465/amj.2007.26279222.

Indexed at, Google Scholar, Cross Ref

Hossain, Mohammed, Muhammad Atif, Ammad Ahmed, and Lokman Mia. 2020. “Do LGBT Workplace Diversity Policies Create Value for Firms?” Journal of Business Ethics 167(4):775–91. Doi: 10.1007/s10551-019-04158-z.

Indexed at, Google Scholar, Cross Ref

Kor, Yasemin Y. 2006. “Direct and Interaction Effects of Top Management Team and Board Compositions on R&D Investment Strategy.” Strategic Management Journal 27(11):1081–99. Doi: 10.1002/smj.554.

Indexed at, Google Scholar, Cross Ref

Lavin, Jaime F., and Alejandro A. Montecinos-Pearce. 2021. “ESG Disclosure in an Emerging Market: An Empirical Analysis of the Influence of Board Characteristics and Ownership Structure.” Sustainability 13(19):10498. Doi: 10.3390/su131910498.

Indexed at, Google Scholar, Cross Ref

Liao, Lin, Le Luo, and Qingliang Tang. 2015. “Gender Diversity, Board Independence, Environmental Committee and Greenhouse Gas Disclosure.” British Accounting Review 47(4):409–24. Doi: 10.1016/j.bar.2014.01.002.

Indexed at, Google Scholar, Cross Ref

Ludwig, Paul, and Remmer Sassen. 2022. “Which Internal Corporate Governance Mechanisms Drive Corporate Sustainability?” Journal of Environmental Management 301:113780. Doi: 10.1016/j.jenvman.2021.113780.

Indexed at, Google Scholar, Cross Ref

Mateos de Cabo, Ruth, Pilar Grau, Ricardo Gimeno, and Patricia Gabaldon. 2022. “Shades of Power: Network Links with Gender Quotas and Corporate Governance Codes.” British Journal of Management 33(2):703–23. Doi: 10.1111/1467-8551.12454.

Indexed at, Google Scholar, Cross Ref

Mersland, Roy, and R. Oystein Strom. 2009. “Performance and Governance in Microfinance Institutions.” Journal of Banking & Finance 33(4):662–69. Doi: 10.1016/j.jbankfin.2008.11.009.

Indexed at, Google Scholar, Cross Ref

Miller, Toyah, and María Del Carmen Triana. 2009. “Demographic Diversity in the Boardroom: Mediators of the Board Diversity–Firm Performance Relationship.” Journal of Management Studies 46(5):755–86. Doi: 10.1111/j.1467-6486.2009.00839.x.

Indexed at, Google Scholar, Cross Ref

Nadeem, Muhammad. 2021. “Corporate Governance and Supplemental Environmental Projects: A Restorative Justice Approach.” Journal of Business Ethics 173(2):261–80. Doi: 10.1007/s10551-020-04561-x.

Indexed at, Google Scholar, Cross Ref

Nguyen, Tuan, Stuart Locke, and Krishna Reddy. 2015. “Does Boardroom Gender Diversity Matter? Evidence from a Transitional Economy.” International Review of Economics & Finance 37:184–202. Doi: 10.1016/j.iref.2014.11.022.

Indexed at, Google Scholar, Cross Ref

Nielsen, Sabina, and Morten Huse. 2010. “The Contribution of Women on Boards of Directors: Going beyond the Surface.” Corporate Governance: An International Review 18(2):136–48. Doi: 10.1111/j.1467-8683.2010.00784.x.

Indexed at, Google Scholar, Cross Ref

Oradi, Javad, and Sahar E-Vahdati. 2021. “Female Directors on Audit Committees, the Gender of Financial Experts, and Internal Control Weaknesses: Evidence from Iran.” Accounting Forum 45(3):273–306. Doi: 10.1080/01559982.2021.1920127.

Indexed at, Google Scholar, Cross Ref

Pandey, Rakesh, Pallab Kumar Biswas, Muhammad Jahangir Ali, and Mansi Mansi. 2020. “Female Directors on the Board and Cost of Debt: Evidence from Australia.” Accounting and Finance 60(4):4031–60. Doi: 10.1111/acfi.12521.

Indexed at, Google Scholar, Cross Ref

Papangkorn, Suwongrat, P. Kitsabunnarat-Chatjuthamard, and Pornsit Jiraporn. 2021. “Gender Diversity and Corporate Governance.”

Indexed at, Google Scholar, Cross Ref

Post, Corinne, Noushi Rahman, and Emily Rubow. 2011. “Green Governance: Boards of Directors’ Composition and Environmental Corporate Social Responsibility.” Business & Society 50(1):189–223. Doi: 10.1177/0007650310394642.

Indexed at, Google Scholar, Cross Ref

Rao, Kathyayini, and Carol Tilt. 2016. “Board Composition and Corporate Social Responsibility: The Role of Diversity, Gender, Strategy and Decision Making.” Journal of Business Ethics 138(2):327–47. Doi: 10.1007/s10551-015-2613-5.

Indexed at, Google Scholar, Cross Ref

Rose, Caspar. 2007. “Does Female Board Representation Influence Firm Performance? The Danish Evidence.” Corporate Governance: An International Review 15(2):404–13. Doi: 10.1111/j.1467-8683.2007.00570.x.

Indexed at, Google Scholar, Cross Ref

Shaukat, Amama, Yan Qiu, and Grzegorz Trojanowski. 2016. “Board Attributes, Corporate Social Responsibility Strategy, and Corporate Environmental and Social Performance.” Journal of Business Ethics 135(3):569–85. Doi: 10.1007/s10551-014-2460-9.

Indexed at, Google Scholar, Cross Ref

Singh, Gagandeep. 2020. “Corporate Governance: An Insight into the Imposition and Implementation of Gender Diversity on Indian Boards.” Indian Journal of Corporate Governance 13(1):99–110. Doi: 10.1177/0974686220930839.

Indexed at, Google Scholar, Cross Ref

Srinidhi, Bin, Ferdinand A. Gul, and Judy Tsui. 2011. “Female Directors and Earnings Quality*.” Contemporary Accounting Research 28(5):1610–44. Doi: 10.1111/j.1911-3846.2011.01071.x.

Indexed at, Google Scholar, Cross Ref

Terjesen, Siri, Eduardo Barbosa Couto, and Paulo Morais Francisco. 2016. “Does the Presence of Independent and Female Directors Impact Firm Performance? A Multi-Country Study of Board Diversity.” Journal of Management & Governance 20(3):447–83. Doi: 10.1007/s10997-014-9307-8.

Indexed at, Google Scholar, Cross Ref

Terjesen, Siri, Ruth Sealy, and Val Singh. 2009. “Women Directors on Corporate Boards: A Review and Research Agenda.” Corporate Governance-an International Review 17(3):320–37. Doi: 10.1111/j.1467-8683.2009.00742.x.

Indexed at, Google Scholar, Cross Ref

van der Walt, Nicholas, and Coral Ingley. 2003. “Board Dynamics and the Influence of Professional Background, Gender and Ethnic Diversity of Directors.” Corporate Governance: An International Review 11(3):218–34. Doi: 10.1111/1467-8683.00320.

Indexed at, Google Scholar, Cross Ref

Wang, Yu-Hui. 2020. “Does Board Gender Diversity Bring Better Financial and Governance Performances? An Empirical Investigation of Cases in Taiwan.” Sustainability 12(8):3205. Doi: 10.3390/su12083205.

Indexed at, Google Scholar, Cross Ref

Xia, Li, Shuo Gao, Jiuchang Wei, and Qiying Ding. 2022. “Government Subsidy and Corporate Green Innovation - Does Board Governance Play a Role?” Energy Policy 161:112720. Doi: 10.1016/j.enpol.2021.112720.

Indexed at, Google Scholar, Cross Ref

Yang, Philip, Jan Riepe, Katharina Moser, Kerstin Pull, and Siri Terjesen. 2019. “Women Directors, Firm Performance, and Firm Risk: A Causal Perspective.” The Leadership Quarterly 30(5):101297. Doi: 10.1016/j.leaqua.2019.05.004.

Indexed at, Google Scholar, Cross Ref

Received: 23-Feb-2023, Manuscript No. AMSJ-23-13255; Editor assigned: 24-Feb-2023, PreQC No. AMSJ-23-13255(PQ); Reviewed: 08-Mar-2023, QC No. AMSJ-23-13255; Revised: 22-Apr-2023, Manuscript No. AMSJ-23-13255(R); Published: 17-May-2023