Research Article: 2025 Vol: 29 Issue: 5S

Role of Finfluencers: Impact on Investment Choices and the Necessity for Regulation

Deepak Pande, Chetana’s Institute of Management & Research, Mumbai, Maharashtra

Citation Information: Pande, D. (2025). Role of finfluencers: impact on investment choices and the necessity for regulation. Academy of Marketing Studies Journal, 29(S5), 1-19.

Abstract

In recent years, the rise of financial influencers, or finfluencers, has significantly transformed the landscape of retail investing. Utilising social media platforms such as Instagram, TikTok, YouTube, LinkedIn, and Facebook, these individuals offer investment advice and strategies. Younger generation often finds it appealing as it is increasingly disengaged from traditional financial institutions . The study examines the profound impact of finfluencers on investment choices among retail investors. It particularly focuses on shaping of risk perception and influencing investment strategies. The finfluencers are often not under regulatory watch. It has become imperative to bring out a robust regulatory framework to protect retail investors. The study explores actionable insights from existing literature. It includes proposals for bringing in transparency as well as licensing. Adopting a mixed-methods approach combining surveys, and econometric model, this study examines the evolving dynamics between finfluencers and retail investors. Ultimately, the study recommends for increasing consumer protection in an evolving digital financial landscape.

Keywords

Finfluencers, Retail Investors, Social Media, Risk Perception, Regulations.

Introduction

The rise of finfluencers has revolutionized retail investing when it utilises the power of social media platforms in reaching out to a younger, tech-savvy audience. The study delves into the profound impact finfluencers leaving on investment choices, risk perceptions, and strategies. It highlights the ethical and regulatory challenges posed by their largely under-regulated influence. It explores the evolving relationship between finfluencers and retail investors. The study aims to provide actionable insights into fostering responsible influence. It also ensures robust consumer protection in a rapidly digitalizing financial landscape.

The Rise of Finfluencers in the Investment Landscape

The social media is restructuring the financial landscape, the role of finfluencers not limited to just sharing tips. They’re redefining millions of investors perceiving risk and making investment choices. It certainly brings about urgent questions about accountability of finfluencers and regulations governing them. The advent of social media has played a crucial role in simplifying access to financial information. It also brings equity in the investment landscape and empower individuals. In the past, they may have felt excluded from the financial markets. The digital era empowered, finfluencers in emerging as pivotal force on social media platforms like Instagram, TikTok, YouTube, LinkedIn, and Facebook. These individuals not only offer financial advice but also investment strategies, and market insights. Generally, younger demographics profile become a target. The reason could be not getting access to financial awareness or education from the conventional financial institutions. Singh & Sarva (2024), this article detailed the rise of finfluencers and their effect on retail investor decisions. It examines the credibility gap between traditional financial advisors and social influencers. Trust, relatability, and transparency emerged as vital factors. The paper argues for the integration of finfluencers in regulated financial education. It highlights the shift in information-seeking behaviour among millennials. The study aligns with global trends in fintech communication.

The Dual Role of Finfluencers and the Imperative for Regulation

The digital connectivity has empowered finfluencers to emerge as major players in structuring retail investors' decision-making processes. The utilisation of social media platforms ensures that individuals providing financial insights and investment advice reach millions within no time. These insights often overlook regulated traditional financial advisory channels. The role of finfluencers is to provide easy access to financial knowledge and empower novice investors. These types of unregulated influence raises suspicion about extension of financial advice without understanding risk profile. The finfluencers could lead to amplifying speculative actions, promote herd behaviour, or disseminate unverified information. It can lead to adversely affecting retail investors' financial well-being. The study has a goal of bridging the gap in understanding the dual role of finfluencers as both enablers and risks associated with the investment ecosystem. The analysis of structuring risk perception and investment strategies, the research contemplates to bring a new perspective. It is about the need for customised regulatory frameworks to enforce responsible financial influence. The research employs a mixed-methods approach. In addition, the study explores the fine balance between utilising the advantages of finfluencers and protecting retail investors in an ever-evolving digitalized financial landscape.

An Impact on Investor Behaviour and Risk Perception

Owing to the significant impact on retail investors, it has become imperative to carry out research on finfluencers. Especially on the aspects of structuring risk perceptions and decision-making. Comprehension of the influence can set the ball rolling for formulating effective regulatory guidelines. It can also enhance financial awareness, and safeguard consumers from spreading unregulated information in a rapidly evolving digital financial landscape.

The impact of finfluencers goes much beyond spreading unregulated information. Retail investors derive the investment behaviour and risk perceptions. Exposure to finfluencer content substantially affects retail investors engaging with financial markets. Elevated interest gets noticed in terms of investments and a heightened willingness to take risks after interacting with these influencers. Nevertheless, this recently discovered easy accessibility to financial advice carries intrinsic risks. This highlighted that finfluencers have the ability to inadvertently create an illusion of security among novice investors. It has the potential to make impulsive decisions and invest in riskier asset classes. Sari & Dwilita (2024), research investigated how financial influencers impact the financial literacy of their audiences. It finds that engaging content can improve awareness and basic financial understanding. However, misinformation remains a risk. The paper emphasizes the dual role of influencers as educators and entertainers. It supports the use of influencer strategies in financial literacy campaigns. The study suggests influencer partnerships for policy outreach.

Ethical Considerations and Regulatory Gaps

Moreover, the potential ethical considerations arising out of finfluencers necessitate critical examination. The traditional financial advisors generally operate under regulatory oversight. Finfluencers typically function with limited or without any formal regulations. Absence of adequate regulations raise doubts about the precision and integrity of the advice being passed on. It contends that the existing regulatory framework is not robust enough to tackle the challenges posed with regard to credibility brought in by this new wave of digital influencers. Retail investors often find themselves vulnerable to misinformation and prospective financial losses.

Ensuring Investor Protection in the Digital Age

Digital platforms are gaining popularity among retail investors for financial advice. It lacks to tackle the risks associated with finfluencer impact. Therefore, it becomes significant for promoting an informed and secure investment landscape. The paper endeavours to consider these dynamics comprehensively. Finally, the aim is to advocate for a comprehensive regulatory framework that can protect retail investors in a digital era.

Research Gaps

A novel contribution would be to develop a comprehensive framework tackling research gaps in finfluencer impact by integrating finance and psychology, The regulatory perspectives to assess alteration of risk perception and investment behaviour. It focuses on longitudinal studies to track strategic effects. The ethical implications of finfluencers accountability become crucial in nature. The cultural differences in various geographies also impact engagement of retail investors for financial advice. An ideal model can offer metrics for behavioural analysis, targeted regulatory policies to protect investors, and insights into demographic-specific vulnerabilities. It provides a collaborative perspective comprehend financial decision-making dynamics in digital-era.

Problem Statement

What way finfluencers impact retail investors' financial decision-making process? What kind of regulations would ensure a responsible influence and protect retail investors’ interest?

Research Objectives

• To analyse the impact of finfluencers on the investment decision-making process of retail investors.

• To assess finfluencers structuring risk perception and investment strategies.

• To explore the necessity for regulating finfluencers in the financial advice sector in the digital-era.

Dependent and Independent Variables

• Dependent Variables: Risk perception, alteration in investment strategy, trading pattern.

• Independent Variables: Level of engagement with finfluencers, consumption of risk-related vs. growth-oriented contents.

Literature Review

Ben-Shmuel, Hayes, and Drach (2024) conducted a study examining the utilization of gendered terminology by financial influencers (finfluencers) in providing investment advice. It underscores how nuanced linguistic variations might influence male and female viewers' perceptions of financial risk. The document highlights implicit biases in content presentation. It indicates that women frequently receive more conservative counsel. The influence of language framing on investment decisions is substantial. The research incorporates a sociolinguistic perspective on the influence of financial influencers. Dasgupta and Chattopadhyay (2020) examined multiple factors affecting retail investor attitude in the Indian stock market. Through the analysis of sentiment indices and market data, they determine that macroeconomic announcements and media substantially influence investor sentiment. Discourse on social media also influences short-term price movements. Their research offers novel evidence corroborating behavioural finance in India. It underscores the emotional and irrational conduct of investors. The research is crucial for comprehending societal influence in Indian markets.

Guan (2022) examined the rise and increasing influence of finfluencers on platforms such as YouTube, TikTok, and Instagram. The report delineates their evolution from simple content makers to significant economic agents. It attacks the deficiency of regulatory oversight. The research underscores the influence of these personalities on retail investor perceptions. The document emphasizes a transition from conventional financial advisors to peer-driven digital influence. It indicates ethical ramifications and the necessity for policy involvement. Hayes & Ben-Shmuel (2024) conducted a sociological study that analysed the cultural and economic narratives created by finfluencers. It situates financial counsel within the larger context of economic interpretation in digital environments. The study contends that investment is becoming redefined as a lifestyle choice. It entails a synthesis of amusement and financial education. The document emphasizes the growing financialization of digital life. The impact of influencers is important in driving this transition.

Jhabak & Shakdwipee (2025) examined India's monetary policy tightening cycle from 2022 to 2023 and its effects on market sentiment. Unexpectedly, markets occasionally reacted favourably to interest rate increases. The research reveals discrepancies in investor behaviour responses. It ascribes abnormalities to collective behaviour and misreading of policy indicators. The paper is crucial for comprehending how individual investors misinterpret intricate economic signals. It demonstrates the necessity for improved financial communication. Kannadhasan (2015) examined the impact of demographic characteristics, including age, gender, and income, on risk tolerance among Indian retail investors. It demonstrates substantial variations in financial behaviour contingent upon individual attributes. Individuals who are younger and better educated exhibit an increased propensity for risk-taking. The research endorses segmentation within financial advisory services. It correlates demographic trends with investing inclinations. The study offers essential information for focusing on digital financial content.

Kedvarin (2022) conducted an empirical study examining the causal impact of finfluencers on asset values, particularly within the cryptocurrency and stock markets. The Granger causality tests reveal substantial relationships between influencer activity and price volatility. The study demonstrates that even minor factors can elicit market reactions. It cautions against market manipulation using social media networks. The research enhances the discussion around influencer responsibility. It advocates for enhanced data ethics and financial literacy. Nadanyiova & Sujanska (2023) examined the influence of marketing by social media personalities on the decision-making processes of Generation Z, particularly on financial decisions. It concludes that Generation Z significantly depends on peer endorsements and social validation. The research highlights the emotional bond between influencer and follower. The trustworthiness of influencers has become a crucial factor. The results are essential for comprehending adolescent financial behaviour. It substantiates the assertion that content creators profoundly influence consumer psychology.

Pflücke (2022) examined the regulatory framework, or absence thereof, concerning finfluencers in Europe. It underscores the possible dangers of disinformation and market manipulation. The essay advocates for unified EU policies for digital financial content. It presents ethical dilemmas about unsubstantiated financial counsel. The research emphasizes customer susceptibility within the digital finance sector. It is crucial for policymaking in influencer-driven financial ecosystems. Prasannan, Rupesh, and Ashok (2025) conducted a study on customer acceptance of AI-driven robo-advisors in the Indian stock market. It concludes that trust, usability, and perceived utility propel adoption. Conventional investors exhibit greater hesitance than technologically adept individuals. The document associates financial technology with evolving investor anticipations. It implies the simultaneous existence of human and AI advisory systems. The study corresponds with overarching fintech trends shaped by digital trust.

Pal Singh, Choudhary, and Rawat (2025) contrasted the efficacy of external influencers with that of internal content providers in digital marketing. It concludes that genuineness and relatability enhance engagement levels. Internal creators are more likely to align with brand ideals. Nevertheless, external influencers augment reach more rapidly. The research is beneficial for companies determining content strategies. It integrates marketing acumen with financial content development methodologies. Semenova and Winkler (2021) examined how Reddit groups generated significant jumps in stock prices, such as that of GameStop. It underscores social contagion as a formidable influence in retail investing. The research demonstrates how decentralized investor networks create collective momentum. It questions the efficacy of financial markets. The article relates meme culture with economic results. It indicates a fundamental change in market reactions to collective mood.

Stock, M. I. S. (n.d.) conducted a study examining the influence of Twitter and Reddit on the power of retail investors. It determines that real-time social media discourse affects trade volume and volatility. The study emphasizes the significance of hashtags and viral phenomena. Retail investors achieve collective bargaining via digital platforms. It examines how digital platforms facilitate equitable access to information. It is essential for comprehending technology-driven retail activism. Zaheer et al. (2025) conducted a study examining customer intentions to invest through online real estate platforms, considering perceived risk. It determines that transparency, platform credibility, and digital literacy affect the propensity to invest. Testimonials on social media significantly influence risk perception. The research indicates that finfluencers can alleviate perceived online risk. It provides insights into platform architecture and communication methodologies. The document is pertinent to the marketing of technology-driven financial products.

Research Methodology

The research employs a mixed-methods approach. It combines quantitative surveys with qualitative interviews to gather comprehensive data on the impact of finfluencers. The study is based on descriptive research design. Both primary and secondary data collection sources have been used for the current study. The study uses non-probability purposive sampling (Investors influenced by recommendations or content from finfluencers and are actively involved in retail investments are selected as sample). The data has been collected from 210 investors as minimum required number is 200 using A-priori sample size calculator, to build the structural equation model at 0.3 effect size, statistical power = 0.9, latent variables = 6, observed variables = 18 and probability level = 0.05. The technique used in the current study is SEM and statistical software used in the current study is SMART PLS.

Data Collection

• Surveys: Conducted a survey among 210 retail investors to assess their engagement with finfluencers and its impact on their investment decisions.

• Interviews: In-depth responses or interviews with 10 finfluencers or financial experts provided insights into their motivations, strategies, and perceptions of their role in influencing retail investors.

The structured empirical/primary data collection of retail investors from 15 cities with varying sample sizes adduced in a tabular format. It includes particulars about the cities, sample sizes, and other relevant data collection steps. The structured questionnaire for retail investor covers attitude, subjective norms, perceived behaviour, trustworthiness of finfluencers, expertise, and behavioural intention. The structured questionnaire seeking responses from finfluencers/financial experts include motivation, content creation, audience engagement, decision influence, ethics and responsibility apart from trends and challenges Table 1.

| Table 1 Empirical Data Collection Overview | |||

| City | Sample Size | Data Collection Method | Date of Data Collection |

| Ahmedabad | 10 | Online Survey | Sep=Oct 2024 |

| Bengaluru | 10 | Google forms | Sep-Oct 2024 |

| Bhopal | 7 | Google forms | September 2024 |

| Chandigarh | 4 | Google forms | October 2024 |

| NCR | 8 | Google forms | October 2024 |

| Hyderabad | 8 | Google forms | September 2024 |

| Indore | 10 | Google forms | September 2024 |

| Jaipur | 5 | Google forms | October 2024 |

| Kolkata | 7 | Google forms | October 2024 |

| Mumbai | 88 | Google forms | Sep=Oct 2024 |

| Nagpur | 7 | Google forms | September 2024 |

| New York* | 6 | Google forms | October 2024 |

| Pune | 25 | Google forms | Sep-Oct 2024 |

| San Francisco* | 7 | Google forms | September 2024 |

| Surat | 8 | Google forms | September 2024 |

| Total | 210 | ||

The online survey includes Non-resident investors who avail the services of finfluencers/financial experts for investments in India Table 2.

| Table 2 Tabular Summary of Data Collection | |

| Aspect | Particulars |

| Sampling Methodology | Random sampling across retail investors in 15 cities. |

| Questionnaire Design | Structured questionnaire with sections on demographics, investment behaviour, influence of finfluencers, perception/trust, and outcomes. Likert scale questions to measure attitudes or perceptions (e.g., Rate the perception/trustworthiness of finfluencers on a scale of 1–5). |

| Data Collection Tools | Online survey platforms (Google Forms), mobile apps for interviews; manual entry if required. |

| Data Cleaning | Removal of incomplete responses; standardize formats; consistency validation. |

| Ethical Considerations | Informed consent; confidentiality through anonymization; voluntary participation; ethics approval. |

Inclusions and Exclusions

The study includes retail investors aged 18 and above, up to 55+ years, who actively use social media platforms or seek investment advice from finfluencers. Professional investors and individuals not engaging with finfluencers are excluded from the scope of this research.

Hypotheses

Ha1: There is a significant impact of attitude of investors towards finfluencers on retail investment choices.

Ha2: A notable influence arises from subjective norms for retail investment choices.

Ha3: A marked influence is evident from perceived behavioral control on retail investment choices.

Ha4: An important impact arises from expertise of finfluencers on retail investment choices.

Ha5: Attribute major effect to trustworthiness of finfluencers on retail investment choices.

Data Analysis and Interpretation

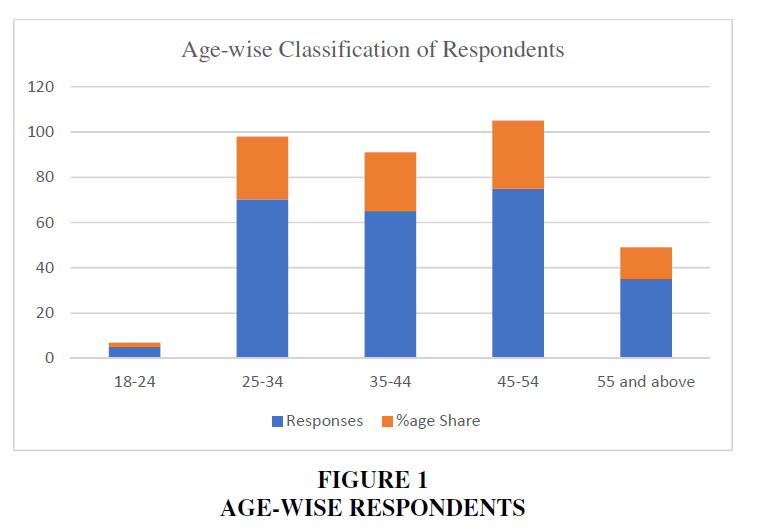

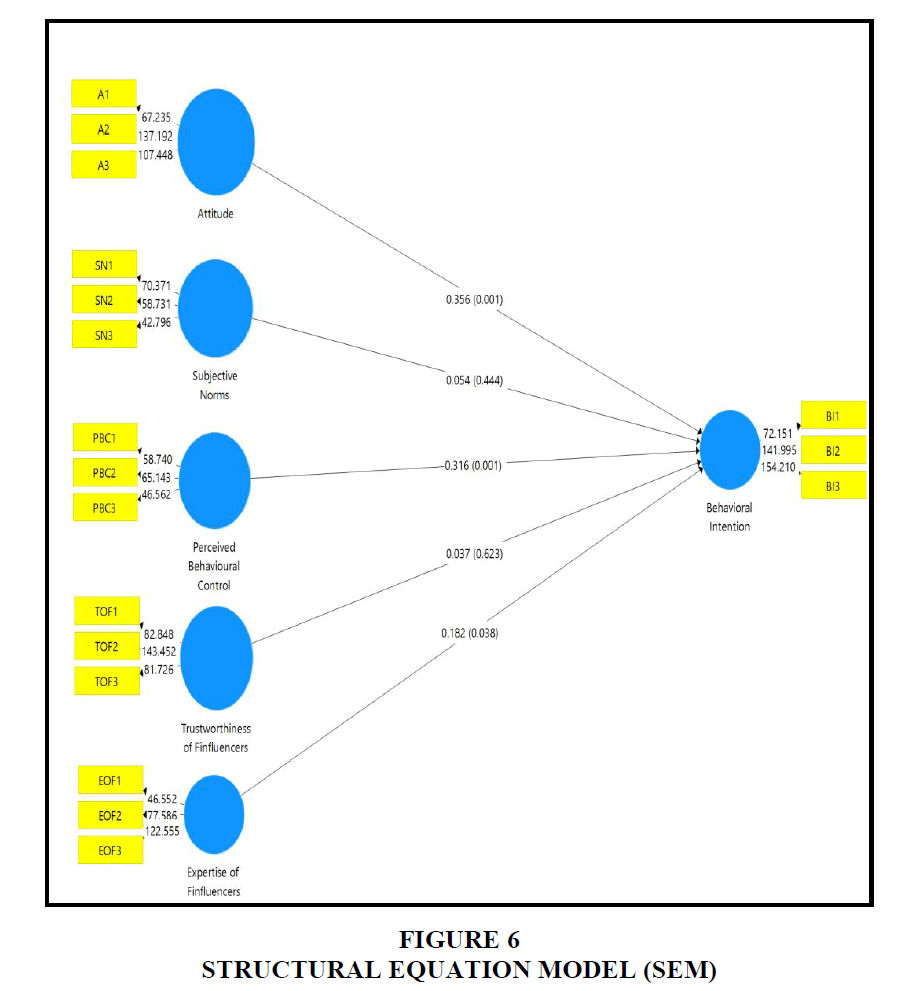

The present study examines the impact of finfluencers on the investment choices of retail investors. Conducted an empirical survey on 250 retail investors, the research attempts to establish the relationship between finfluencers and its impact on investment choices of retail investors Table 3; Figures 1-6.

| Table 3 Age-Wise Classification of Respondents | ||

| Age | Responses | Percentage Share |

| 18-24 | 3 | 1.40 |

| 25-34 | 59 | 28.10 |

| 35-44 | 55 | 26.20 |

| 45-54 | 63 | 30.00 |

| 55 and above | 30 | 14.30 |

| Total | 210 | 100.0 |

Interpretation

In terms of age distribution, the majority of respondents are between 25 and 54 years old. Precisely 30.00% in the 45-54 age group, followed by 28.10% in the 25-34 group and 26.20% in the 35-44 group. The smallest age group is those aged 18-24, comprising only 1.40% of the sample Tables 4-8.

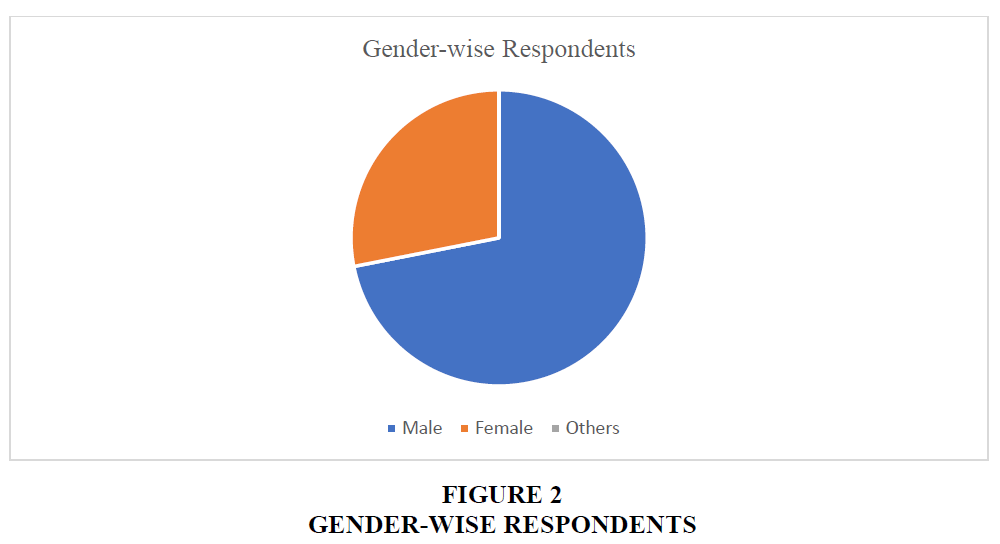

| Table 4 Gender-Wise Classification of Respondents | ||

| Gender | Respondents | %age Share |

| Male | 151 | 71.90 |

| Female | 59 | 28.10 |

| Others | 0 | 0.0 |

| Total | 210 | 100.0 |

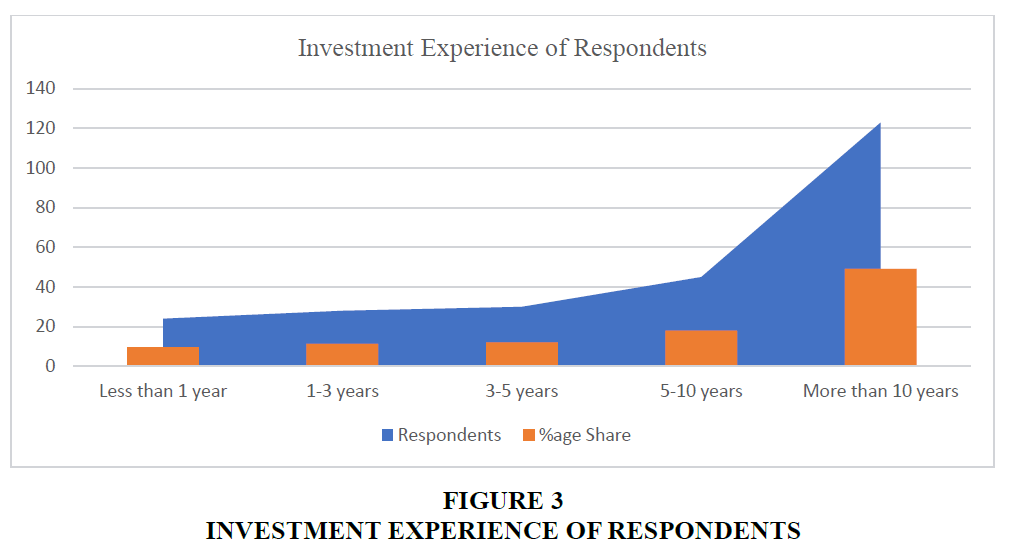

| Table 5 Investment Experience-Wise Classification of Respondents | ||

| Investment Experience | Respondents | %age Share |

| Less than 1 year | 15 | 7.10 |

| 1-3 years | 22 | 10.50 |

| 3-5 years | 21 | 10.00 |

| 5-10 years | 36 | 17.10 |

| More than 10 years | 116 | 55.20 |

| Total | 210 | 100.00 |

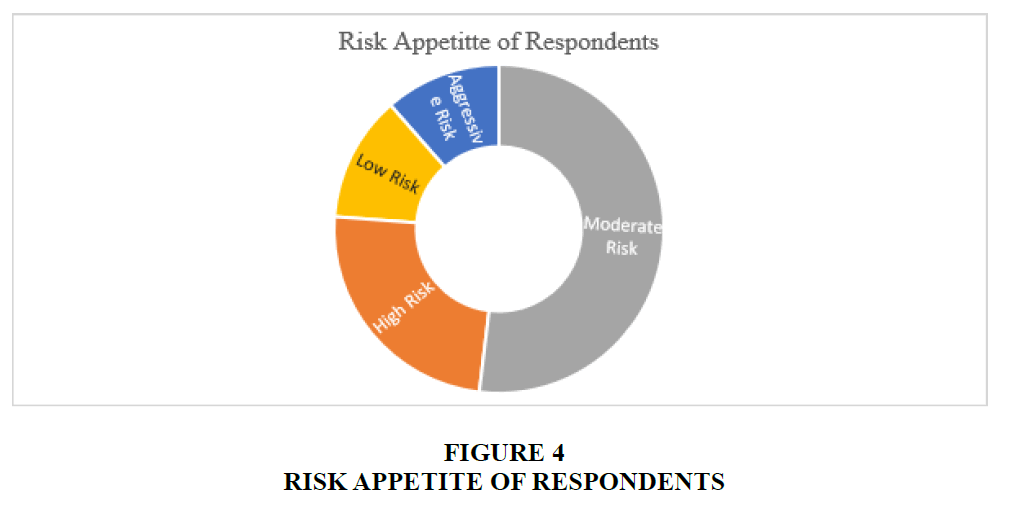

| Table 6 Risk Appetite-Wise Classification of Respondents | ||

| Risk Appetite | Respondents | %age Share |

| Aggressive Risk | 24 | 11.40 |

| High Risk | 51 | 24.30 |

| Moderate Risk | 109 | 51.90 |

| Low Risk | 26 | 12.40 |

| Total | 210 | 100.00 |

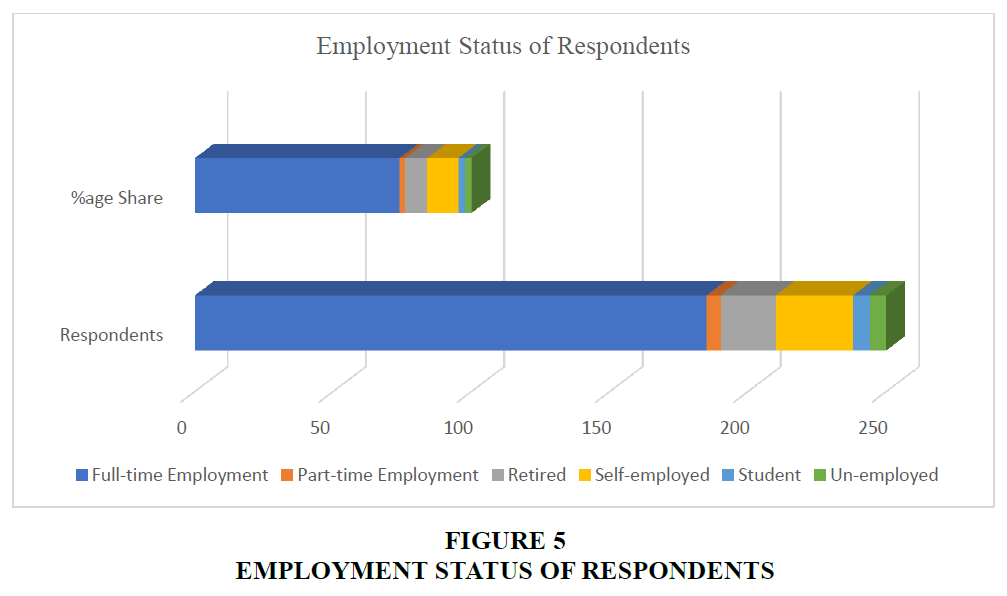

| Table 7 Employment Status-Wise Classification of Respondents | ||

| Employment Status | Respondents | %age Share |

| Full-time Employment | 160 | 76.20 |

| Part-time Employment | 3 | 1.40 |

| Retired | 16 | 7.60 |

| Self-employed | 23 | 11.00 |

| Student | 4 | 1.90 |

| Un-employed | 4 | 1.90 |

| Total | 210 | 100.00 |

| Table 8 Summary of Demographic Profile of Respondents | |||

| Category | Variables | Frequency | Percentage |

| Age | 18-24 | 3 | 1.40 |

| 25-34 | 59 | 28.10 | |

| 35-44 | 55 | 26.20 | |

| 45-54 | 63 | 30.00 | |

| 55 and above | 30 | 14.30 | |

| Gender | Male | 151 | 71.90 |

| Female | 59 | 28.10 | |

| Investment experience | Less than 1 year | 15 | 7.10 |

| 1-3 years | 22 | 10.50 | |

| 3-5 years | 21 | 10.00 | |

| 5-10 years | 36 | 17.10 | |

| More than 10 years | 116 | 55.20 | |

| Risk tolerance | Aggressive risk | 24 | 11.40 |

| High risk | 51 | 24.30 | |

| Moderate risk | 109 | 51.90 | |

| Low risk | 26 | 12.40 | |

| Employment status | Employed full-time | 160 | 76.20 |

| Employed part-time | 3 | 1.40 | |

| Retired | 16 | 7.60 | |

| Self-employed | 23 | 11.00 | |

| Student | 4 | 1.90 | |

| Unemployed | 4 | 1.90 | |

InterpretationBottom of Form

Regarding gender, there is a clear male majority. 71.90% of respondents identifying as the male and 28.10% identifying as the female.

Interpretation

In terms of investment experience, the largest group (55.20%) has over 10 years of investment experience. 17.10% have between 5-10 years, and smaller proportions have 3-5 years (10.00%) or 1-3 years (10.50%) of experience. Only 7.10% have less than 1 year of investment experience.

Interpretation

When it comes to risk tolerance, most respondents (51.90%) are moderately risk-tolerant, followed by 24.30% with high risk tolerance. 12.40% have low-risk tolerance, and 11.40% with aggressive risk tolerance.

Interpretation

In terms of employment status, the majority of respondents (76.20%) are employed full-time, while 11.00% are self-employed. 7.60% are retired, and smaller groups are employed part-time (1.40%), unemployed (1.90%), or students (1.90%).

The tables 9-18 provides summary of demographic and financial information about a sample of 210 respondents.

| Table 9 Reliability and Validity | |||

| Path | Cronbach’s Alpha | Composite Reliability | Average Variance Extracted (AVE) |

| Attitude | 0.942 | 0.942 | 0.845 |

| Behavioural intention | 0.959 | 0.959 | 0.885 |

| Expertise of finfluencers | 0.921 | 0.922 | 0.799 |

| Perceived behavioural control | 0.922 | 0.922 | 0.797 |

| Subjective norms | 0.900 | 0.900 | 0.751 |

| Trustworthiness of finfluencers | 0.952 | 0.953 | 0.871 |

| Table 10 Discriminant Validity | ||||||

| Attitude | Behavioural Intention | Expertise of Finfluencers | Perceived Behavioural Control | Subjective Norms | Trustworthiness of Finfluencers | |

| Attitude | 0.919 | |||||

| Behavioural intention | 0.896 | 0.941 | ||||

| Expertise of finfluencers | 0.883 | 0.841 | 0.894 | |||

| Perceived behavioural control | 0.847 | 0.895 | 0.854 | 0.893 | ||

| Subjective norms | 0.776 | 0.748 | 0.797 | 0.794 | 0.867 | |

| Trustworthiness of finfluencers | 0.795 | 0.753 | 0.810 | 0.806 | 0.737 | 0.993 |

| Table 11 Path Coefficient (Attitude) | |||

| The Path | Beta Coefficient | T-Statistics | P-Values |

| Attitude à Behavioural intention | 0.356 | 3.463 | 0.001 |

| Table 12 Path Coefficient (Expertise of Finfluencers) | |||

| Path | Beta Coefficient | T-Statistics | P-Values |

| Expertise of finfluencers à Behavioural intention | 0.182 | 2.076 | 0.038 |

| Table 13 Path Coefficient (Perceived Behavioural Control) | |||

| Path | Beta Coefficient | T-statistics | P-values |

| Perceived behavioural control à Behavioural intention | 0.316 | 3.347 | 0.001 |

| Table 14 Path Coefficient (Subjective Norms) | |||

| Path | Beta Coefficient | T-statistics | P-values |

| Subjective norms à Behavioural intention | 0.054 | 0.766 | 0.444 |

| Table 15 Path Coefficient (Trustworthiness of Finfluencers) | |||

| Path | Beta Coefficient | T-statistics | P-values |

| Trustworthiness of finfluencers à Behavioural intention | 0.037 | 0.492 | 0.623 |

| Table 16 Summary of Hypothesis Testing | |||

| Path | Beta Coefficient | T-statistics | P-values |

| Attitude à Behavioural intention | 0.356 | 3.463 | 0.001 |

| Subjective norms à Behavioural intention | 0.054 | 0.766 | 0.444 |

| Perceived behavioural control à Behavioural intention | 0.316 | 3.347 | 0.001 |

| Expertise of finfluencers à Behavioural intention | 0.182 | 2.076 | 0.038 |

| Trustworthiness of finfluencers à Behavioural intention | 0.037 | 0.492 | 0.623 |

| Table 17 Summary of Hypothesis | |

| Alternative Hypothesis | Results |

| Ha1: There is a significant impact of attitude of investors towards finfluencers on retail investment choices. | Supported |

| Ha2: A notable influence arises from subjective norms of retail investment choices. | Not Supported |

| Ha3: A marked influence is evident from perceived behavioural control on retail investment choices. | Supported |

| Ha4: An important impact arises from expertise of finfluencers on retail investment choices. | Supported |

| Ha5: Attribute a major effect to trustworthiness of finfluencers on retail investment choices. | Not Supported |

| Table 18 Analysis of the Status of Regulations Governing Finfluencers in Brics Countries | |||||

| Parameter | Brazil | Russia | India | China | South Africa |

| Regulatory body | Comissão de Valores Mobiliários (CVM) | Central Bank of Russia (CBR) | Securities and Exchange Board of India (SEBI) | China Securities Regulatory Commission (CSRC) | Financial Sector Conduct Authority (FSCA) |

| Extant regulations | Limited; informal guidelines exist | Lacks specific regulations | Tightening regulations; some guidelines issued | Strict regulations for financial advertising | Framework under review; no specific rules for finfluencers |

| Disclosure requirements | Mandatory for financial advisors; not for finfluencers | No formal disclosure rules | Guidelines issued; implementation in phased manner | Mandatory disclosures for financial products | Recommendations for transparency; no specific finfluencer rules |

| Content verification | No formal verification required | No structured content vetting | Mandatory in new proposals | Strict scrutiny for financial ads | Encouraged, but not enforced |

| Enforcement mechanism | Limited enforcement; focus on traditional advisors | Weak enforcement | Enhanced scrutiny; cases against non-compliance | Strict penalties for violations | Active monitoring; focus on consumer protection |

| Public awareness initiatives | Limited initiatives | Some efforts to educate | Growing awareness campaigns | Strong governmental initiatives | Various campaigns but a limited reach |

| Impact on retail investors | Mixed; risks remain | High risks due to lack of regulations | Increasing risks; protection measures implemented | High risks but regulated influencers | Increasing awareness, but risks persist |

| Future trends | Potential for formal regulations | Likely to develop specific guidelines | Stringent implementation of regulations | Continued tightening of regulations | Development of a more robust framework anticipated |

Inferential Analysis

As all the values are as per recommended criteria of Hair et al 2013, we can conclude existence of adequate reliability and convergent validity.

As per fornell larcker criteria square-root of the average variance extracted (AVE) for each latent variable should be greater than the correlation between that variable and any other variable. Hence, root of the average variance extracted (AVE) > Correlation. It can be concluded that the constructs are distinct as well as existence of adequate Discriminant validity.

Structural equation modelling, or SEM, is a thorough statistical technique for investigating complex relationships between observable and latent variables. It facilitates researchers to analyse direct and indirect effects, test theoretical models, and assess the overall appropriateness of the model to the data. It is particularly useful for investigating relationships between variables and validating hypotheses in a variety of fields. It also includes marketing research and the social sciences.

Hypothesis Testing

Hypothesis 1

• H0: There is no significant impact of attitude of investors towards finfluencers on retail investment choices.

• H1: There is a significant impact of attitude of investors towards finfluencers on retail investment choices.

Beta coefficient = 0.356, t-statistics = 3.463 and p-value = 0.001

H0 is rejected and H1 is accepted as p (value) < 5% significance level.

Hypothesis 2

• H1: A notable influence arises from expertise of finfluencers on retail investment choices.

Beta coefficient = 0.182, t-statistics = 2.076 and p-value = 0.038

H0 is rejected and H1 is accepted as p (value) < 5% significance level.

Hypothesis 3

• H0: A marked influence is evident from perceived behavioural control on retail investment choices.

• H1: A marked influence is evident from perceived behavioral control on retail investment choices.

Beta coefficient = 0.316, t-statistics = 3.347 and p-value = 0.001

H0 is rejected and H1 is accepted as p (value) < 5% significance level.

Hypothesis 4

• H0: An important impact arises from subjective norms of behavioral intention.

• H1: An important impact arises from subjective norms of behavioral intention.

Beta coefficient = 0.054, t-statistics = 0.766 and p-value = 0.44

Failed to reject H0 as p (value) > 5% significance level.

Hypothesis 5

• H0: Attribute a major effect to trustworthiness of finfluencers on retail investment choices.

• H1: Attribute a major effect to trustworthiness of finfluencers on retail investment choices.

Beta coefficient = 0.037, t-statistics = 0.492 and p-value = 0.623

Failed to reject H0 as p (value) > 5% significance level

P (value) < level of significance 5% indicates a significant impact of attitude, expertise of finfluencers, and perceived behavioural control of behavioural intention. However, there is an insignificant impact of subjective norms and trustworthiness of finfluencers on behavioural intention.

The results indicate that the attitude of investors towards finfluencers, perceived behavioral control, and the expertise of finfluencers significantly influence retail investment choices. The subjective norms and trustworthiness do not influence. Prior studies indicate that an individual's attitude and sense of personal control often play a crucial role in financial decision-making than social pressures or even the perceived reliability of the influencer (Khedmatgozar & Shahnazi, 2018; Thompson & McGill, 2017). This may be owing to investment decisions having inherently high-stakes and investors relying more on their own beliefs and confidence than on perceived trustworthiness or social influences (Leong et al., 2019). Additionally, expertise may provide reassurance about the Finfluencer’s knowledge. It aligns well with studies showing that in finance, technical skills can be prioritized over trust factors. These may be secondary in situations where risk assessment is complex (Lim et al., 2020). Thus, even without trustworthiness and social influence, investors may prioritize attitudes, personal control, and finfluencer expertise when making retail investment choices.

Comparative Analysis

Quantitative data analysed using statistical methods to identify correlations between finfluencer engagement and investment behaviour. Qualitative data from interviews analysed to understand the perspectives of finfluencers.

Findings & Discussions

1. Analysis of data suggests that finfluencers significantly structure retail investors' decision-making process. It is especially through their expertise, attitudes, and influence over perceived behavioural control. Hypotheses testing reveals that investors' attitudes toward finfluencers (β = 0.356, p = 0.001) and their expertise (β = 0.182, p = 0.038) have significant impacts on retail investment choices. Additionally, perceived behavioural control (β = 0.316, p = 0.001) also serves a crucial role. It highlights the significance of personal autonomy and confidence in financial decision-making process. Nevertheless, trustworthiness (β = 0.037, p = 0.623) and subjective norms (β = 0.054, p = 0.440) depict not much significant impact. It suggests that retail investors prefer knowledge and self-confidence over social pressures or perceived influencer reliability.

2. Demographic findings support these behavioural trends. The majority of respondents having over 10 years of investment experience and a moderately high-risk appetite. It indicates a more seasoned and discerning audience. This calibrates well with the research objective of understanding finfluencers structuring risk perceptions and investment strategies. Structural equation modelling (SEM) validates these insights. It demonstrates the robust interplay of variables and reinforcing the necessity to critically examine the finfluencers role in the financial sector.

3. The growing impact of finfluencers is evident on retail investors' financial behaviour. Finfluencers tend to gain confidence of retail investors with expertise and a positive attitude emerging as critical factors. The investors appears to take advantage of actionable insights and align well with their financial goals. In the instant case, the finfluencer's trustworthiness or societal endorsement play a secondary role. Prior studies emphasize the role of technical competence and personal control in investment decisions. Moreover, the minimal impact of subjective norms reflects the high-stakes nature of financial choices. Further, the reliance on personal judgment often outweighs external influences.

4. These findings highlight the necessity for formulating stringent regulations governing the finfluencer space. It addresses one of the research objectives to ensure responsible influence. The absence of significant trust-based impacts elevate susceptibility about the potential for misinformation and conflicts of interest in a limited regulatory environment. Regulators must formulate regulation in ensuring that finfluencers maintain transparency and provide accurate, goal-aligned advice. While their expertise can empower investors, the limited regulations influence retail audiences in a misleading way. It emphasises the need for ethical standards and accountability mechanisms in this rapidly evolving field.

5. Finfluencers greatly influence millennials' investment behaviour, as studies have found. It is true, especially due to their accessibility and capacity to uncoverintricate financial ideas. Because they are frequently digital natives, millennials are more inclined to interact with finfluencers on social media. It makes them a relatable and easy way to get financial advice. This generation appreciates knowledge and authenticity, which is consistent with the findings that attitudes and knowledge have a significant role in retail investment decisions. Investors, especially millennials, may therefore give priority to attitudes, perceived behavioral control, and expertise of finfluencers when making retail investment decisions. That is true even in the absence of trustworthiness and social influence playing a major role.

6. BRICS countries exhibit varied regulatory approaches to finfluencers. It reflects their financial ecosystems. While China enforces strict rules for financial advertising, others like Brazil and Russia lack specific finfluencer regulations, increasing risks for retail investors. India and South Africa are progressing towards robust frameworks. They focus on disclosures and enforcement. Public awareness campaigns remain limited in most nations, It underscores the need for more consumer education. Overall, as finfluencers’ impact grows, countries must adopt standardized guidelines to enhance transparency, protect investors, and ensure accountability. India and China may lead the emerging regulatory trends.

7. Finfluencers significantly influence retail investors by bridging gaps in financial literacy and providing accessible guidance grounded in robust qualifications and practical experience. They choose topics based on real-world financial concerns, regulatory changes, and trending misconceptions. It delivers content through popular platforms like YouTube, Instagram, LinkedIn and Facebook. By engaging directly with their audience and using feedback to refine their advice, they promote informed decision-making. It often leads followers to reassess and improve their investment strategies. Ethical practices, such as transparency and reliance on credible sources, further enhance their trustworthiness and impact.

8. The challenges like information overload, confirmation bias, and regulatory scrutiny persist. Finfluencers adapt by aligning their advice with investor interests and staying compliant with evolving regulations. They emphasize long-term planning, diversification, and the importance of understanding financial products. It empowers retail investors to make sound decisions. With increasing regulatory oversight and demand for credible advice, finfluencers are poised to play an even more critical role in structuring the financial habits of a growing and the diverse audience.

Conclusion

The research comprehensively analysed the impact of finfluencers on retail investors. It demonstrates their significant influence on investment choices. Expertise, attitude, and perceived behavioural control emerged as critical factors. It highlights the value investors place on knowledge and actionable guidance. Millennials, in particular, rely on finfluencers for simplifying complex financial concepts and fostering informed decision-making. The findings underscore how finfluencers shape risk perceptions and investment strategies. It often prioritises alignment with financial goals over trustworthiness or social influences. Additionally, the study explored the necessity for regulation, revealing divergent approaches across BRICS nations. While China enforces strict financial advertising rules, countries like Brazil and Russia lack specific frameworks. It increases risks for investors. India and South Africa are progressing toward robust guidelines focusing on transparency and accountability. In conclusion, finfluencers play a transformative role in financial literacy and decision-making. However, regulatory oversight is essential to ensure ethical practices, protect retail investors, and support responsible influence in this growing domain.

Originality

The research topic is highly original as it addresses the emerging and under-explored phenomenon of "finfluencers" and their transformatory impact on retail investment choices. It is true especially within the context of social media's growing influence. By integrating investor psychology, behavioural finance, and regulatory perspectives. The study provides unique insights into the evolving dynamics of financial advice in the digital era. It focuses on developing economies like India further enhances its novelty by emphasizing the intersection of financial inclusion, technology, and governance.

Implications

The findings of this research hold significant implications for academia, financial practice, policy-making, and societal behaviour. By elucidating the role of finfluencers in shaping investment decisions, the study contributes to the nascent body of literature on digital financial influence. It highlights the psychological and behavioural mechanisms through which retail investors get impacted. It offers a foundation for future research on digital trust, financial literacy, and the ethical dimensions of social media influence.

Research Implications: This study provides a springboard for future scholarly exploration into the interplay between social media influence and financial decision-making. The structural equation modelling (SEM) approach reveals latent variables influencing retail investors. It enables further studies to refine models and explore comparative impacts across demographics, platforms, and geographies. Researchers can build upon this framework to examine longitudinal impacts of finfluencers and their role during varying market conditions. It includes economic downturns.

Practical Implications: From a practice point of view, the findings underscore the need for financial institutions and advisory firms to acknowledge the growing role of finfluencers. Practitioners can utilise this knowledge and promote collaborations with credible finfluencers to disseminate transparent and precise financial education. Moreover, the insights encourage investment platforms to integrate user-friendly content moderation tools. Additionally, it augments educational resources to mitigate the potential for misinformation.

Societal Implications: The societal implications of this study are profound. It emphasises the importance of fostering financial literacy and critical evaluation skills among retail investors. Policymakers can use these findings to advocate for initiatives that promote informed decision-making and safeguard retail investors against biased or harmful content. By addressing the need for regulation in the finfluencer landscape, research calibrates with broader societal goals of ensuring fair and ethical digital environments.

Policy Implications: This study highlights the necessity for regulatory frameworks to ensure that finfluencers adhere to ethical guidelines and maintain transparency regarding affiliations and endorsements. Policymakers can utilize these findings to craft regulations that strike a balance between promoting innovation and protecting investors. For example, introducing mandatory disclaimers for financial advice or mandating certification programs for credible finfluencers could enhance accountability and trust within the digital financial ecosystem.

Research Limitations

1. The sample size of the study has 210 respondents. It limits the generalisability of broader aspects.

2. The collection of empirical data restrict research to 15 cities apart from comparing the prevalent regulations in BRICS countries. It excludes other financial markets.

3. Biases and subjective perception may influence responses by the investors.

4. The dynamic nature of social media evolution and rapid changes in regulation may outdate the findings.

5. The study restricts long-term tracking of finfluencers’ impact on retail investors.

6. Geographical comparisons may not reflect true picture owing to different financial regulations.

7. Since study has focused on retail investors, the professional as well as institutional investors remain unexplored.

Recommendations for Future Research

1. Explore how artificial intelligence and machine learning tools utilized by finfluencers affect the quality and personalization of financial advice.

2. Study how cultural differences influence retail investors' trust and reliance on finfluencers in global markets beyond BRICS countries.

3. Examine the long-term impact of finfluencers on financial literacy and decision-making capabilities of different demographic groups. This may be carried out, especially in underserved populations.

4. Investigate the psychological factors, such as cognitive biases or emotional triggers, that enhance or diminish the effectiveness of finfluencer-driven advice.

5. Assess how the introduction of specific regulatory frameworks impacts the behaviour of finfluencers, the quality of financial advice, and investor outcomes.

6. Evaluate the role and efficacy of different social media platforms in disseminating financial advice and their impact on investor engagement and trust.

7. Investigate potential synergies and conflicts between finfluencers and traditional financial advisors. It examines how they coexist and serve retail investors.

8. Study the role of finfluencers in promoting or discouraging high-risk financial products and strategies. It includes cryptocurrencies and speculative stocks.

9. Explore how finfluencers influence retail investors' preferences for sustainable and socially responsible investments.

10. Analyse the extent to which unregulated finfluencer activities contribute to the spread of financial fraud or misinformation and methods to mitigate these risks.

References

Ben-Shmuel, A. T., Hayes, A., & Drach, V. (2024). The Gendered Language of Financial Advice: Finfluencers, Framing, and Subconscious Preferences. Socius, 10, 23780231241267131.

Indexed at, Google Scholar, Cross Ref

Dasgupta, R., & Chattopadhyay, S. (2020). Stock market drivers of retail investors’ sentiment–facets and new evidences from India. Rajagiri Management Journal, 14(2), 133-154.

Guan, S. S. (2022). The rise of the finfluencer. NYUJL & Bus., 19, 489.

Hayes, A. S., & Ben-Shmuel, A. T. (2024). Under the finfluence: Financial influencers, economic meaning-making and the financialization of digital life. Economy and Society, 53(3), 478-503.

Indexed at, Google Scholar, Cross Ref

Jhabak, P., & Shakdwipee, P. (2025). Counterintuitive Market Responses to Monetary Tightening: An Analysis of India's 2022-2023 Rate Hike Cycle. Kaav International Journal of Economics , Commerce & Business Management, 12(01), 1-6.

Kannadhasan, M. (2015). Retail investors' financial risk tolerance and their risk-taking behaviour: The role of demographics as differentiating and classifying factors. IIMB Management Review, 27(3), 175-184.

Indexed at, Google Scholar, Cross Ref

Kedvarin, S. (2022). How influential are FinFluencers? granger causality between finance influencers and price movements in cryptocurrency and stock markets.

Nadanyiova, M., & Sujanska, L. (2023). The Impact of Influencer Marketing on the Decision-Making Process of Generation Z. Economics and Culture, 20 (1), 68–76.

Indexed at, Google Scholar, Cross Ref

Pal Singh, G., Choudhary, V., & Rawat, G. (2025). Leveraging content economy for growth-external influencers or internal creators?. Journal of Information Technology Teaching Cases, 20438869251317549.

Indexed at, Google Scholar, Cross Ref

Pflücke, F. (2022). Regulating Finfluencers. Journal of European Consumer and Market Law, 11(6), 212-222.

Prasannan, S., Rupesh, S. J., & Ashok, S. P. (2025). Artificial Intelligence & Robo-Advisors Adoption by Customer in Stock Market. Kaav International Journal of Law, Finance & Industrial Relations, 12(01), 16-21.

Sari, P., & Dwilita, H. (2024). The Role of Financial Influencers on Social Media in Shaping People's Financial Literacy. Journal Ekonomi, Manajemen, Bisnis dan Akuntansi Review, 4(2), 5-5.

Semenova, V., & Winkler, J. (2021). Social contagion and asset prices: Reddit's self-organised bull runs. arXiv preprint arXiv:2104.01847.

Singh, S., & Sarva, M. (2024). The Rise of Finfluencers: A Digital Transformation in Investment Advice. Australasian Accounting, Business and Finance Journal, 18(3).

Indexed at, Google Scholar, Cross Ref

Stock, M. I. S. The Impact Of Twitter And Reddit On Power Of Retail Investors And Movements In Specific Stock Prices.

Zaheer, K., Mumtaz, T., Fatima, T., Kamran, M., & Alharthi, M. (2025). Perceived risk & Intention to invest through online real-estate sites. Real Estate Management and Valuation, 2.

Indexed at, Google Scholar, Cross Ref

Received: 16-Apr-2025, Manuscript No. AMSJ-25-15865; Editor assigned: 17-Apr-2025, PreQC No. AMSJ-25-15865(PQ); Reviewed: 21-May-2025, QC No. AMSJ-25-15865; Revised: 30-May-2025, Manuscript No. AMSJ-25-15865(R); Published: 02-Jun-2025