Research Article: 2021 Vol: 25 Issue: 2

Sartaj Electricals Limited: Managing Distributor's Conflict

Syed S. Hasan, Marketing Researcher, Lucknow

Prem Prakash Dewani, Associate Professor, IIM Lucknow

Achint Nigam, (Fellow, IIM Lucknow), Assistant Professor, BITS Pilani

Abstract

Sartaj Electricals Limited (SEL), one of the leading consumer appliances company in India, growing business in international market, has setup its office in UAE.in 2005. The company has looked at the huge potential for water heater markets and with the help of three distributors, it was able to consolidate its position in Instant and Domestic range of water heaters, whereas it was trying to increase its presence in the Industrial Water heater segment, which had the highest growth potential and profitability. Recently, some distribution problems have begun to emerge. SEL felt that it was losing major control over the market and its distributors. Delta Food Industries, which was the customer of Al-Huraiz Enterprises, SEL’s most important distributor in UAE, has approached SEL about selling water heaters directly to them at lower prices than they had been getting from Al-Huraiz. In return the company would place a huge order with SEL, including a large number of industrial water heaters. SEL was excited about the opportunity because the Delta account would provide SEL with more control over its market and it would be a great reference account for promoting SEL to other customers. But Al-Huraiz was strongly opposed because it didn't want SEL taking over a customer that it had developed. All three distributors were very concerned that this was the thin edge of the wedge, and SEL would soon go directly to other Industrial customers. The three were forging an alliance to back up Al-Huraiz stand against SEL. Al-Huraiz was threatening to leave SEL. The firm wanted both the Industrial account and happy distributors. The case discusses that how SEL is managing this conflict with its distributors. Further, case focuses on issues related to goal congruence issues between the manufacturer and the distributor. Case also discusses the role of power in channel management, channel issues in broader strategic context, along with product line management, pricing and implementation issues.

Keywords

Channel Conflict, Channel Relationship, Power in Distributor Relationship.

Introduction

Mahesh Chotrani, UAE Marketing Head of Sartaj Electricals Limited (SEL) had been urged by his supervisor to proceed with a potential sales order from a Delta Food Industries (Food manufacturing facility) for its Industrial water heater range. The Industrial water heater range was costlier and had highly advanced features as compared to Sartaj’s Instant Water Heater and Domestic range of water heaters.

One month ago, Mahesh was asked by Delta Food Industry for permission to buy directly from Sartaj Electricals Limited than from Al-Huraiz Enterprises - SEL’s largest distributor in the United Arab Emirates (UAE). Given the size and potential of the business, Mahesh was excited by the initiative and he entered into discussions with Delta Food Industries after receiving the consent of Al-Huraiz Enterprise. As the deal progressed, however, Al-Huraiz Enterprises has become more and more aggressive in opposing the deal. Al-Huraiz Enterprise General Manager, Vipin Jain, even threatened to reconsider the operations with Sartaj Electricals Limited, if Delta Food Industries is touched. Mahesh was debating whether or not to proceed with the deal. Mahesh could not afford delay. In three months, the distributors were going to Paris to attend the company’s International distributor meet held every year, where they will meet the Senior Management Team of Sartaj Electricals Limited.

Company Background

Sartaj Electricals limited started in 1960, was primarily a manufacturer of water heaters headquartered in Mumbai, Maharashtra. It had then acquired some firms and moved to the business of consumer appliances in 1985. From then, it has been able to grow in this segment. In 2000, SEL divided the consumer products into 3 divisions: Kitchen Appliances (KAP), Domestic Appliances (DAP) and Fans & Lighting (FAL). The company has also recently set up an R & D center in Pune, Maharashtra for creating innovative products. The company has around 10,000 employees with over 50 sales offices across India. The company had planned to grow by 20 percent. There were different ways to segment the consumer products. Sartaj Electricals Limited has used their product type as its segmentation variable.

Kitchen Appliances (KAP)

The Kitchen appliances division was the best performing division. The appliances under this division were mainly used in the kitchen and consisted of Gas Stoves, Mixers, Rice Cookers, Microwaves, Toasters, Electric Kettle and other non-electrical kitchen items. There was a separate sales team for kitchen appliances and the company has been aggressively marketing the products. The launch of induction cooker for example was done on a large scale with an enviable budget. The sale of kitchen appliances was evenly balanced throughout the year with spikes during the festivals as demand increased during the period.

Domestic Appliances (DAP)

Domestic appliances mainly consisted of Water heaters, Room heaters, Room Coolers, Iron and UPS. The sale of most of the products were seasonal and hence supply and sales were predicted based on the experience and past trends. The division has been rapidly growing and good service & installation support by the service centers has been an important factor. The company has been launching new products as per the new need of the customer and market competition.

Fans & Lighting (FAL)

The company had a strong presence in fans and lighting division. The company has recently launched a new range of LED lights for offices and workstations. These were energy efficient and easy to install. Similarly, with a new range of fans for kids by collaborating with Disney has been successful. The Fans & Lighting division has also been actively pursuing government tender and projects. They have been growing at a rapid pace in Tier II and III cities in India.

Water Heaters Products

Water heaters are the appliances used for heating the water to be used for various purposes. The water heater has one inlet (for cold water) and one outlet (for hot water). The storage tank is usually coated with copper or glass and helps in preventing or delaying corrosion and keeping the water hot for a long duration of time. The water heaters category is divided into instant water heaters, storage water heaters and Industrial water heaters. Instant water heaters are usually small water heaters (ranging from 1 - 5 litres), which provide hot water instantaneously. Storage water heaters are usually used in homes (ranging from 5 - 30 litres) for bathing, cleaning clothes and other purposes whereas Industrial storage water heaters are usually large water heaters (ranging from 50 - 500 litres) used by hotels, restaurants and industries.

Markets

UAE has been the second biggest market for water heaters after India followed by Bangladesh. In recent years, however, the traditional market has become saturated. Their small annual sales increases could be attributed to population growth and inflation. The Industrial water heater could be seen as the next engine of growth and contributed higher margin to the company as compared to Instant and domestic water heater ranges in Table 1.

| Table 1 Water Heater Market in 2015 (In Thousands of Units) | ||

| Area | Market size | SEL sales |

| India | 2781 | 687 |

| UAE | 2160 | 258 |

| Bangladesh | 1579 | 88 |

| Total | 6,520 | 1033 |

Price Range and Margins

Sartaj Electricals Limited manufactured over 30 models of water heaters. The company was best known for its instant and domestic storage water heaters range. The management of the company believed that SEL enjoyed three competitive edges: in-house production capability, a well-established channel network and strong brand image. The company was traditionally known in the market as providing the products of “best value”. SEL cost advantage was more obvious in instant water heaters. In the domestic storage water heater, prices were usually 10 percent to 20 percent lower than the major competitors, and in some extreme cases, the price gap could reach 30 percent.

The profit margins varied significantly across different ranges and different markets. Roughly speaking, the Industrial storage water heaters enjoyed higher margins. The Industrial range storage water heaters has a contribution of around 40 percent, Domestic storage water heaters of around 30 percent and Instant water heaters was about 20 percent. The margin in emerging markets was higher than that in developed markets.

Sartaj Electricals Dubai Office

Sartaj Electricals set up its Abu Dhabi office in 2005. The functions performed by the Dubai office included: marketing research and marketing campaigns, administration of distribution channels, technical support and counselling, key account and Industrial customer account management; and identifying partners, in order to develop long-term cooperation initiatives such as joint ventures. Its competitor regarded Sartaj Electricals as an aggressive company in marketing with an enviable budget.

The UAE Marketing Head, Mahesh Chotrani, was in charge of the overall marketing issues, including channel management. He supervised three assistant marketing managers, each in charge of marketing-related issues in one segment. Service Head Saif -Al Bashra was in charge of overall technical & service support to distributors and customers and was highly respected for his ability to solve tough technical problems. He was assisted by two service support regional heads, whose major responsibility was to provide field technical training to customers and distributors. The technical teams were regarded as valuable to customers and distributors, particularly for the Industrial storage water heater category.

Mahesh Chotrani reported to K B Vaidyanathan, Executive Director for Domestic Appliances, who worked in SEL Headoffice in Mumbai. Mr. Vaidyanathan visited the Abu Dhabi office once every three months, each time staying for a number of days. Mahesh Managed the daily marketing issues and operational issues.

Managers’ financial incentives in Sartaj Electricals Limited (including Vaidyanathan, Mahesh and his assistant marketing managers) were typically in the form of a bonus for achieving a unit sales quota. In the Abu Dhabi office, if the annual sales target was met, a bonus equivalent to two months of salary (roughly in the range of 25,000 to 30,000 AED per month for an experienced sales and service engineer) was granted; otherwise no bonus was paid. Additional staff expenses, such as benefits, overtime and travel, cost SEL twice as much as salary expenses. Total compensation and expenses for a SEL engineer in Abu Dhabi was easily three times the comparable figures for an engineer in a UAE company.

The Water Heater Market in UAE

The water heater market has been growing at a steady pace but after 2010, with the setting up of large-scale commercial establishments, such as economic cities, medical cities, hotels, and offices, UAE have been striving to strengthen their non-oil sectors such as residential and hospitality, which in turn has increased the demand for domestic and Industrial water heaters.

The increase in adoption of water heaters has also been a result of continuous water supply across the commercial & residential establishment. Limited maintenance and repair requirements, ease of accessibility and effective protection against firm water were some of the key features, which had positively influenced the product penetration. With an increasing number of competitors and changing lifestyle of consumers, several new features for water heaters had emerged: Smart Display, Digital controlled temperature, Smart Saving mode, Coating technology on tank to prevent corrosion and wifi enable app to control features remotely.

Sartaj Electricals limited has gained penetration in the instant and storage water heater market. It became the price leader in that range, and its market share surged to nearly 14 percent from less than one percent in terms of unit volume. The growth in the domestic storage water heaters range, where SEL price advantage was less obvious, was impressive as well. Its market-share also increased to nearly eight percent from virtually zero. SEL performance in the Industrial range, which was dominated by Ariston, was very disappointing. Despite offering prices10 percent to 20 percent lower than Ariston, SEL claimed a market share of less than three percent. The price competition has grown fiercer. The industrial range became the mainstream market and the demand for industrial storage water heaters with a volume of more than 50 litres was estimated to grow at more than 20 percent for at least the next five years.

Major Competitors

Ariston Thermo

Ariston Thermo is the global specialist in thermal comfort with a unique expertise and cutting edge innovation in heating and water heating products for over 50 years serving more than 150+ countries. Products are higher energy efficient, superior quality & safety checks made to last longer Ariston Thermo is synonymous with comfort, energy efficiency and respect for the environment, thanks to its high efficiency products, its plants in compliance with the most advanced production standards and excellent pre- and after-sales customer support services. Ariston had a wide range of water heaters and was the market leader in Industrial water heaters in UAE.

A. O. Smith

A. O. Smith Corporation is an American manufacturer of both residential and commercial water heaters and boilers and the largest manufacturer and marketer of water heaters in North America.A. O. Smith Middle East supplies a selection of water heaters from several of our global manufacturing plants, offering a product range that best suits our customers need. We are proud to be able to supply a wide range of water heaters for practically any hot water demand. Additionally, since 2010, A. O. Smith has been manufacturing water treatment and air purifying products. These products are gradually being introduced in the markets where A. O. Smith is active.

A. O. Smith commenced export to the Middle East countries in 1970. It has established a distribution network in all Middle East countries. A.O. Smith is a well-known name in GCC and has supplied numerous projects and homeowners with industrial and residential water heaters over the past decades. An office was established in Dubai to better serve the region.

Zenith Water Heater

Zenith Water Heaters are manufactured by Star Industrial products LLC. Established in UAE in 1996.It is the first water heater manufactured in the middle east with Glass Line Technology. Under the astute guidance & leadership of the group chairman H.E. Sheikh Mohammed Bin Rashid Al Nuaimi. The company manufactures & distributes a wide range of water heating systems in the Middle East, Africa & Asian Subcontinent.

Customer Buying Process

Different competitors adopted different sales strategies to access the market. Most water heater manufacturers, however, relied solely on distributors for sales. These companies or manufacturers typically set up a marketing office in UAE (usually in Dubai, Abu Dhabi or Sharjah), to launch marketing campaigns, provide technical service support and manage distribution channels. Ariston was the only water heater manufacturer that has its own direct sales force and a distributor channel as well.

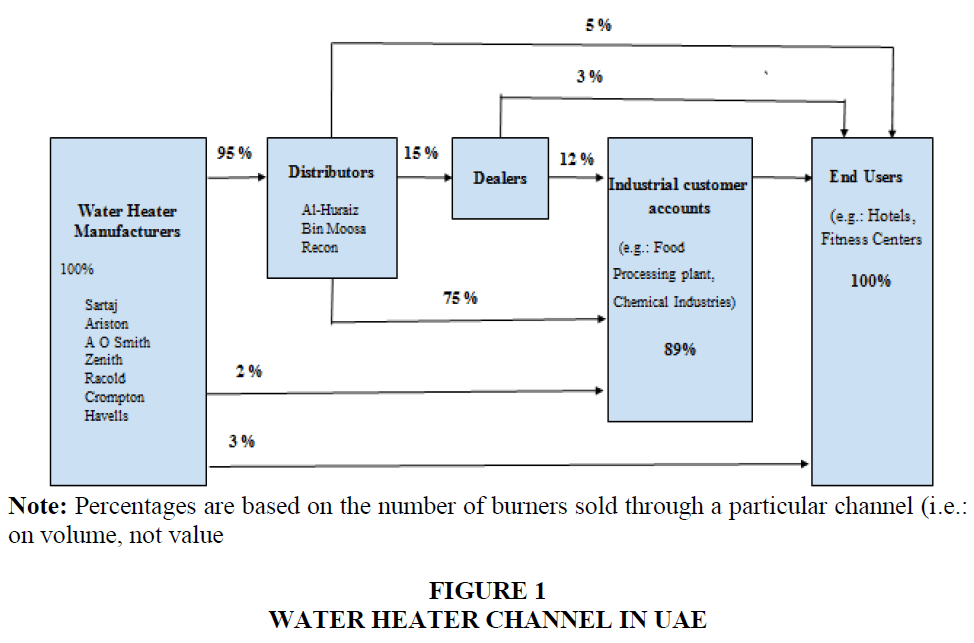

Figure 1 shows the movement of water heaters through channels to the end users. Water heaters sold through distributors were first delivered from the manufacturer to its ‘distributors’ warehouses. The distributors then had the three options: sell to second-tier value added dealers, sell to large Industrial customers (such as hotels, industries or Chemical Boilers, where large water heaters are used) or sell directly to the end users. Although Industrial Customers or end users sometimes tried to bypass the distributors to buy water heaters directly from the producer, companies usually refrained from giving quotations in direct sales, and referred these questions to distributors. Mahesh explained:

Distributors are very sensitive to any signal of a manufacturer’s moving to sell direct to Industrial customers. They know that manufacturer’s always want more control over customers, and more often than not, manufacturers don't fully trust distributors. But on the other hand, manufacturers are very cautious about alienating their distributors, because losing a distributor would make it very difficult for them to achieve their annual sales targets.

Service and spare parts could be another major concern for manufacturers considering selling direct to Industrial customers. Who would do the service and how would spares be provided to Industrial customers? Pricing was also a tough issue in going direct to Industrial customers. In any case, the prices had to be higher than the price charged to distributors, but should they be five percent higher, 10 percent higher or what? What are the appropriate criteria for these pricing decisions?

The buying process for Industrial customers differed from that of end users. Industrial customers usually made their purchasing decisions relatively independently, whereas the decision making process of end user customers normally involved more stakeholders. For an Industrial Customer, who is looking to procure for the organization/ industry, “word of mouth” was very important in deciding which brand of water heater to buy. In 80 percent of the cases, the first step for an Industrial customer in buying the brand of water heaters was to pay “scouting” or “intelligence” visits to other Industrial customers who use the brand they were considering. In some cases, they would also approach the design institutes that usually provided systems engineering, design and consulting services. Then based on the comments from the existing customers and on the frequency of a certain brand of water heater they had seen, they would contact the manufacturers or their distributor/ dealers for preliminary quotations. Using the criteria of price, reputation, service, spare supply, reliability, technical compatibility, personal connections etc., the Industrial customer would focus on one or two candidates and then further screen by examining the Industrial and technical issues. As a final step, they would use various channels and connections to survey the prices.

Usually, the importance of price in the buying decision was in inverse proportion to the volume of the water heater, while the brand image and reputation were positively correlated with output capacity. For the instant water heaters range, the price was by far the most important consideration. In the domestic storage water heater range, the price was still important, but buyers paid equal, if not greater attention to technical compatibility and reliability. Supply of spares, price, and after-sales service were also considerations in making purchasing decisions. For Industrial storage water heaters range, reliability (as indicated by reputation and service) was more important than price. Availability of stock was another important consideration in this segment. While word-of-mouth and scouting trips were still important, design institutes played more important roles. Due to intensified competition, the Industrial customers had recently begun to pay more attention to price.

Segmentation

There was no universally accepted manner of water heater segmentation in UAE. However, the company has divided it into three segments:

Instant water heaters are usually small water heaters (ranging from 1 - 5 litres), which provide hot water instantaneously. Given the average price of AED 1250 per unit, the market size of this segment was around AED 199 million.

Domestic Storage water heaters are usually used in homes (ranging from 5 - 30 litres) for bathing, cleaning clothes and other purposes. The estimated volume was roughly 2,20,000 units in 2015. Given the average price of AED 4,500, the market size was approximately AED 198 million.

Industrial storage water heaters are usually large water heaters (ranging from 50 - 500 litres) used by hotels, restaurants and industries. There were few players in this segment as large upfront investment in capital assets and technology was needed. With an average price AED 32,500, the size of the segment was about AED 221 million.

Sartaj Electricals Limited, Mahesh and Distributors estimated the size for each range of water heaters in Table 2.

| Table 2 Estimated Size of the Ranges of Water Heater Market in UAE (in 2015) | |

| Range | Market Size |

| Instant | 16,77,900 |

| Domestic | 4,21,680 |

| Industrial | 61,320 |

| Total | 21,60,900 |

Sel’s Distribution Network in UAE

Organizational Structure

After setting up its own marketing office in Abu Dhabi in 2005, SEL enlisted three new distributors in UAE. Bin Moosa Trading Co., based in Sharjah, Recon Engineering was based out of Dubai and Al-Huraiz Enterprises was based out of the capital of UAE, Abu Dhabi.

Distributors carried only SEL water heaters and spares. The revenue split between water heaters and spares was roughly 80/20. Besides handling SEL water heater business, Al-Huraiz Enterprises also made and sold room heaters, although the margin on room heaters was far less than that on water heaters, both products produced about the same revenue. The main product line of Recon Engineering was still textile machinery, which accounted for over 90 percent of the annual turnover. The company placed great emphasis on water heaters, however, because the textile industry was regarded as a “sunset industry”. Bin Moosa Trading Co. was the only company whose business was 100 percent SEL water heaters, but it had been looking for other HVAC products for a long time.

Each of the three distributors was assigned exclusive rights to some provinces and signed a contract with SEL stating that selling water heaters in other distributor’s territory was strictly prohibited. Distributors negotiated annual sales budgets with SEL for a specified number of water heaters to be sold in the next calendar year. Distributors fulfilling the budget would be awarded a bonus of one percent of order value in Table 3.

| Table 3 Distributors Performance Statistics in Number of Units Sold - 2015 | ||||

| Al-Huraiz | Bin Moosa | Recon | TOTAL | |

| Instant | 91,434 | 64,575 | 72,618 | 2,28,627 |

| Domestic | 18,396 | 9,093 | 11,928 | 39,417 |

| Industrial | 777 | 1,008 | 1,092 | 2,877 |

| Total | 1,10,607 | 74,676 | 85,638 | 2,58,020 |

Distributors’ Functions

SEL defined three major functions of a water heater distributor in UAE: credit, stock and sales/ service.

Credit Function

Once an order was placed, SEL opened a pro-forma invoice to confirm it. The distributor then opened a letter of credit (L/C) through its bank (the opening bank) to SEL’s bank (the negotiation bank), The purpose of the L/C was to eliminate the credit risk for the manufacturer, because payment was made by the distributor’s bank as soon as the goods were shipped. The L/C opening fee was usually borne by the buyers.

Stock Function

The distributors were required to make a three-month order forecast to SEL. The forecast was adjusted on a monthly basis. The final actual order amount was supposed to vary by no more than 10 percent from the forecast. Experience was very important in making an accurate forecast. Distributors were able to forecast much more accurately for instant and domestic storage water heaters than for the Industrial storage water heaters. It’s a number curve and learning curve matters for the distributors.

The typical order cycle time was about 40 - 45 days for instant and domestic water heaters and at least 60 days for Industrial water heaters. Once the water heaters arrived in UAE, distributors made the arrangements for local transportation and warehouse stock. The distributors needed to anticipate the volume of backlog and the time of delivery carefully, in order to avoid the stock-outs or over-stocking, which resulted in tied up capital. In most cases, the distributors would rather err on the side of the caution because a stock-out would push its customer to the competitors - in many cases and once for all. Although there were over 50 models carried by SEL, the 80/20 law applied here: about 10 major models accounted for over 80 percent of orders.

Distributors were also expected to keep sufficient stock of water heater spares. Given the wide product assortment and unpredictability of the need for spares, however, distributors were reluctant to keep a large number of water heater spares in stock (especially for Industrial water heaters, which had a small customer base).

Mahesh had once been asked by Vaidyanathan about the possibility of setting up a SEL warehouse in Dubai. He estimated the upfront investment would be roughly AED 200,000 with a monthly operation cost of AED 30,000 for a bonded warehouse holding roughly 1200 units of water heaters (inventory value of approximately AED 5 million).

Sales and Service Function

Distributors performed the customer interface function. The technical force of SEL’s Abu Dhabi office handled customer and distributor training, but only rarely did they carry out daily field service. Although some distributors used second tier dealers to perform the sales role, most sales were made by the distributor’s sales forces. According to the contract between SEL and its distributors, the distributors were in charge of providing after-sales service, including installing and starting up of domestic and Industrial water heaters for customers. Service was usually free of charge, regardless of how long the water heaters had been used, but customers had to pay for spares, once the warranty (usually one year) had expired. SEL’s gross margin on spares was approximately 20 percent higher than that on water heaters across all models. In 2010, revenue from spares averaged 25 percent of distributor’s revenue from water heaters.

Pricing

There were primarily four levels of price: Transfer price (in U.S. dollars), base price (in AED), public-listed price (in AED) and actual contract price or transaction price (in AED).

Transfer price (US$)

This was the free on board (FOB) price in US dollars that SEL quoted to the distributors. SEL quoted prices for all models of water heaters at the beginning of the year through a confidential blue book, known as “Distributor Prices''. The prices for all distributors were the same in a specified fiscal year - regardless of the volume. Prices were reviewed annually with adjustments made on all models, based on the inflation rate for the past year.

Base Price/ Landing Price (AED)

This was in reality, the total acquisition cost to distributors in order to have full ownership of a water heater and to have it in stock and ready for sale. The distributors would pay the import duty, value-added tax, shipping and insurance and domestic transportation. The distributor’s price was then converted to base price in local currency AED by multiplying a conversion factor of 5.45. Thus a water heater with a US$100 transfer price would cost the distributor AED 545 the multiple of the exchange rate (AED 3.67 = 1US$) x 1.484. The latter figure accounts for the cumulative effect of charges for shipping and insurance (5%), import duty (15%), value added tax (17%), domestic transportation (3%) and miscellaneous and handling fee (2%) to acquire.

Public Price/ Max. Retail Price (AED)

At the beginning of every year SEL released a public customer price on the market as the guidelines for price.” The prices were in local currency and were a result of “grossing up” the base price by 60 per cent for all models. The public price in local currency of a water heater with a transfer price of US$100 and base price of AED 545 then becomes roughly AED 872.

Contract Price/ Selling Price (AED)

The contract price was the actual transaction price that the distributor reached in a transaction with its customer. Typically, the distributors would give customers a 20 percent discount off the public (list) price. In the early days, there was a consensus between SEL and distributors to keep the discount from the public price to a maximum of 25 percent. There was a tendency, however, for distributors to agree to a discount higher than 25 percent in order to win an order. The more severe competition (particularly in Industrial water heaters), plus the increased frequency of distributors selling outside their own territories, was contributing to the lowered contract prices.

For example, a burner with a transfer price of US$ 100 would have a base price of AED 545. The figure was then grossed up by 60 percent to get the public listed price of AED 872. If a distributor gave a 20 percent discount to the customer, the actual transaction price would be AED 698. This would give the distributor a gross profit of AED 153.

Emerging Issues

Change in Strategy

SEL has begun to diversify in both product and geographic coverage. As described by Mr. Anant Hedge, director of SEL:

The strong position of SEL instant water heater range is almost unshakable. And, we are doing better and better in the domestic water heater storage range. The next thing for us to do is to become a leader in the Industrial range, the most robust and vigorous market. Not everyone is qualified to play in that market, but Gino has all the resources needed to succeed there - people, brand, technology, channel etc. That’s where the largest chunk of profit in water heaters will be. We have been investing heavily in R&D on new Industrial models. Now it's time for harvest.

To deliver on its commitment for the corporate strategy, SEL UAE was assigned the following goals for the next three years.

1. Achieve annual combined sales volume (for all type of water heaters of 15000 units

2. Achieve annual sales of industrial water heaters of over 200 units

3. Optimize the distribution channels, including developing more distributors to cover the areas currently not serviced and giving distributors more marketing and technical support.

4. Develop a minimum of 5 Industrial accounts within 2 years

5. Improve service and spare supply

6. Build the brand image

Distributor Behavior

In recent months, there has been some marked changes in Distributors’ behavior and their attitudes toward SEL. Mahesh Chotrani was facing the same difficult problems more and more frequently.

Demand for Better Terms

The distributors began to bargain more and more fiercely for better prices and lower quota. As well, they were demanding more marketing support, such as Industrial promotion and price promotion, which were usually provided only in extreme cases.

Stolen Sales

There were more complaints from distributors that other SEL distributors were “poaching” sales from them. The price discount in these cases were usually much higher than the agreed maximum level of 25 percent. Besides a disgruntled home territory distributor, the other unfortunate consequence was the lack of service and technical support to new customers.

Reluctant to Stock Industrial Water Heaters

Due to the high cost of industrial water heaters and the difficulty in forecasting demand accurately, distributors were reluctant to keep inventories of industrial water heaters. What frustrated Mahesh most was that the distributors were missing major “windows of opportunity” Some industrial Food Processing plants and Chemical processing plants were, who were Ariston customers, placed contingent orders with SEL, usually in case of stock outs on Ariston Water heaters. SEL distributors, however, were not able to take advantage of these opportunities for penetrating Ariston accounts because they didn't carry inventory of the appropriate SEL industrial water heaters. Mahesh estimated that sales of at least 50 units were lost last year, and the additional opportunity cost was difficult to estimate.

Mahesh was sensed that SEL was becoming more and more the hostage of its distributors. Furthermore, there were no ideal candidates for new or replacement distributors in the current view. In terms of size, only Ariston distributors were financially strong enough to carry the volume of SEL water heaters, but it appeared that they were all satisfied with Ariston and there were no signs that any of them wanted to defect.

Current Problem

Delta Food Industry

Delta Food Industries is located in the Sharjah Airport Free Zone. The food manufacturing facility produces tomato ketchup, tomato paste, sterilized cream, evaporated milk, hot sauce, cornstarch, full cream milk powder and custard powder. The company has an ISO 22000 and ISO 9001:2015 certification and serves a diverse local as well as international clientele in the US, Europe and the Far East.

The company has been expanding rapidly in different parts of UAE by setting up new food manufacturing facilities. The company has an annual requirement of more than 27,000 water heaters of various sizes in 2015 (see Table 4). In 2015, Delta Food Industries bought 7,350 sets of instant water heaters, 1,050 sets of domestic and 63 sets of industrial water heaters. The rest were purchased from SEL competitor’s such as Ariston (it’s main supplier) and AO Smith. Al-Huraiz Enterprises currently allowed Delta an average of 25 percent discount off the public list price. Delta was very typical among the existing 10 industrial customers that SEL has penetrated. Al-Huraiz has been placing much emphasis on Delta and designated five sales/ service engineers out of its sales/ service team of fifty specifically for this account.

| Table 4 Delta Food Industry Water Heater Requirement in 2015 (In Number of Sets) | |

| Range of Water Heaters | Volume |

| Instant | 22,155 |

| Domestic | 3,423 |

| Industrial | 1,491 |

| Total | 27,069 |

The primary purpose of Delta approaching SEL for direct treatment (as an industrial customer) was to obtain better prices. It wanted at least a 10 percent greater discount from SEL. In return, it promised to purchase at least 50 percent of its domestic and industrial water heaters from SEL. Mahesh likes the idea for several reasons:

1. Developing a direct Industrial customer account was one way to combat the increasing bargaining power of distributors. SEL had no direct industrial customer account prior to Delta.

2. It was a very good opportunity to break into a well-entrenched customer (Ariston) in Industrial water heaters, and receive a good reference account, as well.

3. Delta had told Mahesh that it would not increase the purchase of SEL water heaters unless it got directly linked to SEL. In other words, Al-Huraiz Enterprises was not likely to increase its sales to the company under the current status quo.

4. SEL had no Industrial customer from the Food Processing Industry in UAE yet. Success with Delta would make it easier for SEL to develop more businesses in other territories.

But Al-Huraiz Enterprises was adamantly opposed, for two reasons:

1. It strongly believed that SEL should not develop distributors’ existing customers as direct Industrial accounts.

2. The Practice would set a very bad example, which could destroy their confidence in co-operating with SEL.

Mahesh Knew that Al-Huraiz was lobbying SEL other two distributors to back up Al-Huraiz’s stand because he had recently received calls from both Bin Moosa and Recon Engineering asking whether SEL would also develop “similar direct Industrial customers as Delta” in their territories. Vipin Jain was an expert in networking and he knew when it was in the best interest to forge an alliance. Given these circumstances, Mahesh felt that it was almost impossible to over emphasize the importance of this situation. It appeared to Mahesh that he was touching a landmine.

Decision and Conclusion

Mahesh had to decide whether he wanted Delta’s business or not (as an Industrial customer account). He didn't believe Al-Huraiz would really leave SEL, but on the other hand, he also knew Vipin was famous for honoring what he said. Mahesh had to consider several aspects of the overall situation in order to come to a solution:

1. The possible response form SEl other two distributors

2. The message that his decision would send to competitors

3. The attitude of SEL’s corporate management once the issue was put forward in April with Anant Hedge, Director of SEL.

4. Delta’s response

5. Were there any solutions that could save face for both sides?

Last but not least, was Mr. Vaidyanathan willing to take the risk of losing Al-Huraiz, which was accounting for 40 percent of SEL’s UAE revenue? Was achieving control over the distributor the best objective in this case?

Mahesh took out the distribution contract between the SEL and its distributors. It made clear in black and white that “the principal has the right to develop direct Industrial customers in the territory of a designated distributor without getting consent from the distributor.” Theoretically speaking, that was the case, but in reality, the situation might be different. Mahesh knew he needed to give this matter deep thought, but he was well aware that he had very little time to make a choice and take action.