Research Article: 2022 Vol: 25 Issue: 3S

State Tax Sovereignty and Constitutional Transfers: Implication for Regional Development

Cordelia Onyinyechi Omodero, Covenant University Ota

Michah Chukwuemeka Okafor, Michael Okpara University of Agriculture

Citation Information: Omodero, C.O., & Okafor, M.C. (2022). State tax sovereignty and constitutional transfers: Implication for regional development. Journal of Legal, Ethical and Regulatory Issues, 25(S3), 1-11.

Abstract

The need for regional development has motivated this study. This study examines the effect of states taxing rights and constitutional transfers on the six geopolitical regions in Nigeria. The studies covers a period from 2000 to 2020 and obtain data on state independent tax revenue, constitutional transfer, share of revenue from Value Added Tax (VAT), grants and regional development from the Central Bank of Nigeria Statistical Bulletin, 2020 edition. The data obtained on the variables mention are analyzed using the multiple regression method of analysis which provides empirical evidence that state independent tax efforts and share of federally collected VAT revenue have significant positive impact on regional development in Nigeria. On the contrary, constitutional allocations and grants do not have material effect on regional progress. The recommends amendment to the Nigerian revenue sharing formula in the favour of states. Furthermore, states are encouraged to embark on innovative projects that are capable of attracting both foreign and local grants for the expansion regions. This study also considers the widening of the horizon of the states’ taxing powers while corruption should be eradicated.

Keywords

Taxing Powers, Legal Transfers, Fiscal Autonomy, Political Process, Regional Development, Grants.

JEL Classification codes

D72, H71, H77, O18

Introduction

Fiscal decentralization is a major idea in public finance theory and a frequent policy approach in public sector transformations (Yushkov, 2015). Fiscal federalism is a broader notion that refers to the public sector's vertical financial structure, with revenue and spending allocated to multiple levels of government and a framework of fiscal transfers (Oates, 1999). The traditional theory of fiscal regionalization analyzes the public sector's three primary goals: financial sustainability, fiscal discipline, and wealth distribution (Musgrave, 1959; Oates, 1972). According to Musgrave (1959), the national government should be in charge of economic and financial stabilization and redistributing wealth, whereas subnational government-regional and local authorities-who are nearer to community members and have more relevant data on their priorities, should optimize the effectiveness of public service delivery within their territories. Following the postulation of Musgrave (1959) financial liberalization in federal states implies that income and spending responsibilities-the authority to levy and collect taxes, as well as independently select the focal areas of costs-are moved from the federal to the regional and local government levels. By implication, subnational governments that offer necessary facilities are scrutinized by their constituency and so have motivations to implement regulatory frameworks that are in the best interests of the public (Tiebout, 1956). Delegation of authority may also benefit government and market systems by favoring private activity.

Thus, financial liberalization is a technique of federal systems and may be seen as a sufficient prerequisite of the latter because a vertical economic model of the public sector is meaningless without some amount of fragmentation. Absence of fiscal devolution suggests that all incomes, power and tasks are concerted at the central level of government. In reality, the convergence of these variables may promote learning, innovation, and rivalry in the supply of community consumer goods and services, therefore encouraging long-term productivity expansion. Decentralized provision of public goods has always been viewed as an essential avenue for promoting regional economic growth. The classic theoretical premise is that state municipalities are more effective at distributing public resources than the federal government because they have better knowledge and stronger incentives to get things right. For starters, because they are closer to the community, local governments will likely offer the things that people consider as most important for their well-being (Oates, 1999; Tiebout, 1956).

Despite the numerous benefits of fiscal devolution system of administration, Prud'homme (1995) and Tanzi (1995) put forward that fiscal decentralization, can be hazardous in some situations. Severe horizontal financial rivalry may result in increased regional disparities and horizontal fiscal asymmetries. Furthermore, the quality of governance at the local and regional levels in some nations is problematic especially in the presence of poor competencies of personnel, embezzlement, and poor governance. Hence, it becomes doubtful if subnational governments can attain high effectiveness of public service delivery. Another issue with decentralization is subnational governments' failure to completely absorb cross-regional spillover, which casts doubt on the theoretical results obtained in classical works of federal systems (Oates, 1972). In times of crisis, socioeconomic stability becomes difficult since the national government lacks adequate funding to strengthen the economy, but dominant provincial authorities may have divergent, and sometimes conflicting, fiscal policy goals. Redistribution of wealth does not function either under absolute autonomy or under partial devolution. Typically, resources are dispersed disproportionately across areas (at least in large federal states). Excessive fragmentation makes macroeconomic stability and wealth redistribution virtually impossible to achieve (Yushkov, 2015).

The purpose of fiscal decentralization in Nigeria is to promote regional development among the 36 states, including the Federal Capital Territory (FCT) of Abuja. Nigeria has 36 states and 774 local governments, and they all produce internal money in addition to the monthly allotment from the Federation Account. The Federation Account was created under Section 162 of the Federal Republic of Nigeria (FRN) Constitution of 1999. The federation account is one into which all revenue received by the federation's government is remitted. The incomes from personal income tax paid by members of the Nigerian Armed Forces and Police Force, as well as inhabitants of the Federal Capital Territory and foreign affairs staff, are not included. The Niger Delta area receives a 13 percent derivation allowance from the oil income, while the overall distribution to the states is 26.72 percent of the total funds in the Federation Account. The states additionally receive a 35 percent cut of the federal Value Added Tax (VAT). According to the second schedule part II of the Federation of Nigeria's 1999 constitution, the fiscal sovereignty of the state government involves the collection of levies such as personal income tax (except personal income tax of the armed forces, police, residents of Abuja, FCT, external affairs and Non-residents).

Others are: direct (self and government) assessment and withholding tax (individuals alone); capital gains tax (individuals only); stamp duties (instruments executed by individuals only); and inheritance tax (individuals only). Pools betting and lotteries, gaming and casino taxes; road taxes; business premises registration and renewal levy; development levy (individuals only); registration fee for naming streets in state capitals; right of occupancy fees in state capitals; and taxes from markets in which state financiers are involved. Notwithstanding this massive revenue, no municipal supply or infrastructure exists to support the revenue allocations and tax independence. This is why fiscal openness has become so imperative in Nigeria's public sector. Fiscal transparency necessitates that the government should carry out all parts of budgeting duties with openness, trust, fundamental values, and ethical standards in order to ensure that nothing is concealed from the public (ICAN, 2019). The aim of this research is to elucidate the consequences of states taxing authority and their relevance of statutory distribution to regional social growth.

Literature Review

Yushkov (2015) studied the theoretical and empirical relationship between fiscal decentralization and economic development. The study was an empirical examination of Russian regions from 2005 to 2012 which revealed that inappropriate spending devolution within the area was substantially and adversely connected to regional economic growth when it was not supported by the appropriate amount of resource disintegration. Regional reliance on intergovernmental fiscal transfers from the federal center, on the other hand, is positively related with economic growth. Lozano and Julio (2016) examined the favorable impacts of fiscal decentralization on regional economic growth in Colombia following the adoption of the Political Constitution in 1991. The study employed fiscal decentralization indicators, two of which are based on expenditure and tax autonomy and two on expenditure and revenue sharing. The empirical technique entailed selecting an appropriate estimate for the panel data approach, the augmented mean group estimator, which allowed unidentified antecedents proposed by the research to be incorporated to slightly longer response variable. The findings supported the favorable relationship between fiscal decentralization and economic growth throughout Colombian regions. It also suggested that the transfer of fiscal functions to subnational governments aided economic progress.

Amusa & Mabugu (2016) investigated the role of fiscal decentralization in regional inequality. The study analyzed panel data from South Africa's 234 municipalities from 2003 to 2012. In the context of South Africa's local government, the findings revealed a substantial link between fiscal decentralization and inequality. From 2005 to 2014, Bartlett et al. (2018) studied the link between fiscal decentralization and local economic development in Serbia. The study employed a cross-section time-series regression model with local economic development as the dependent variable, as proxied by the local employment rate. The findings indicated that public spending had a favorable influence on local economic growth, with an emphasis on education. Fiddin et al. (2018) examined the impact of cash transfers and the spillover effect across regions on regional GDP, income disparity, and central government tax revenue for certain years. The study utilized a panel data collection of 33 provinces from 2007 to 2016. The cash transfer was included as an independent variable in the regression to assess the impact of fiscal decentralization on the three variables. The findings disclosed that revenue sharing on taxes had a beneficial influence on regional GDP, including spillover effects from neighbors and Central Government Tax Revenue, but revenue sharing on environmental assets had a negative effect.

Setiawan & Aritenang (2019) investigated the influence of fiscal decentralization on Indonesian productivity growth. The study relied on lag values and overlooked the possibility of spatial dependence across areas. The study discovered that fiscal decentralization had a substantial influence on economic performance with a three-year lag, suggesting that public budgeting would have a major impact on improving economic performance three years later. Furthermore, the research demonstrated that districts with matching economic success were found close, indicating the existence of geographical dependency. Cahyadi (2019) used both the theoretical and empirical method to assess the relationship between fiscal decentralization and economic development. To reflect the multifaceted nature of fiscal decentralization, the study employed five decentralization metrics. Using data from the lowest level of government and the most recent data available in Indonesia from 2010 to 2017, the findings revealed that fiscal decentralization was strongly and negatively connected to economic growth.

Since 1992, the great majority of Central and Eastern European countries increased the amount of fiscal autonomy because Decentralization of spending was more important than revenue decentralization in EU members Belarus, Georgia, and Ukraine (Pasichnyi et al., 2019). Thus, Pasichnyi et al. (2019) used panel data to study the link between the appropriate amount of fiscal decentralization and economic development in 27 advanced and emerging nations in Europe from 1992 to 2017. Revenue decentralization was shown to be related with lower growth rates, but spending decentralization marginally strengthened the economy. The study found that the entire decentralization metric had a negative impact on growth, although the connectivity was weak. Also, the empirical research revealed that population structure and sustainability played a vital role in ensuring economic progress.

Jin & Rider (2020) constructed two equations to assess the influence of fiscal decentralization policies on economic growth of China and India by applying a growth equation and an equalization equation. Using panel data from China and India from 1985 to 2005, the authors estimated two-step GMM simultaneous equations models. The study discovered that investment autonomy had a negative and significant impact on short-run economic growth in both China and India at conventional levels. Omodero & Adeyemo (2020) examined the influence of local government income streams on capital investment in Nigerian Local Government Councils from 1998 to 2018. According to the findings, only constitutional allocations from the federal and state governments had a substantial and beneficial influence on local government capital infrastructure performance in Nigeria.

Inadequate income and accessibility to suitable cost accounting have resulted in disparities and ineptitude of public services and economic growth at the grassroots (Nantharath et al., 2020). In the light of this assertion, Nantharath et al. (2020) looked at the impact of fiscal decentralization on Thailand's economic development from 2004 to 2017. The research approach employed a cross-panel data analysis across five provincial areas, taking into account income decentralization, spending decentralization, transfer reliance, and vertical fiscal inequality as growth-influencing components. The research showed empirical evidence of beneficial impacts of revenue decentralization, transfer dependence, and vertical fiscal mismatch on regional economic growth across five regions using Panel Fully Modified Least Squares (FMOLS) and Panel Dynamic Least Squares (DOLS) regression methods. The study also discovered that spending devolution had a detrimental influence on regional economies; however the degree of relevance was low.

Ewetan et al. (2021) investigated the role of state responsibility in Nigeria's battle against graft. Fiscal decentralization, according to the study, failed to promote justice due to lax standards and inadequate bureaucratic quality. Van (2021) examined the influence of provincial and district tax independence and lateral remittances on regional inequalities in GDP per head using a sample of 30 Organisation for Economic Co-operation and Development (OECD) countries from 1995 to 2011. The study found that the negative marginal impact of transfers on inequalities lessened and finally became positive as subnational governments became more transfer dependent. The study also revealed that independently produced tax income and vertical remittances were shown to be possible facilitators of regional unification. According to the findings, subnational tax autonomy should be extensive enough to allow less developed areas to build their own income base and catch up with their more affluent peers.

Materials and Method

This study investigates the impact of state governments’ tax sovereignty and constitutional transfers on regional development. Nigeria is made up of six (6) regions/geopolitical zones hosting the 36 states including the FCT. The Table 1 below depicts the regions and the states domiciled in them accordingly.

| Table 1 Nigeria’s Geopolitical Regions And States Within The Regions |

||

|---|---|---|

| S/N | GEOPOLITICAL REGIONS | STATES INSIDE THE GEOPOLITICAL REGIONS |

| 1. | North Central | 1. Benue 2. Kogi 3. Kwara 4. Nasarawa 5. Niger 6. Plateau 7. FCT |

| 2. | North East | 1. Adamawa 2. Bauchi 3. Borno 4. Gombe 5. Taraba 6. Yobe |

| 3. | North West | 1. Jigawa 2. Kaduna 3. Kano 4. Katsina 5. Kebbi 6. Sokoto 7. Zamfara |

| 4. | South East | 1. Abia 2. Anambra 3. Ebonyi 4. Enugu 5. Imo |

| 5. | South South or Niger Delta Region | 1. Akwa Ibom 2. Bayelsa 3. Cross River 4. Rivers 5. Delta 6. Edo |

| 6. | South West | 1. Ekiti 2. Lagos 3. Ogun 4. Ondo 5. Osun 5. Oyo |

Source: Research findings, 2021

The study covers a period from 2000 – 2020 and uses secondary form of data gathered primarily from the Central Bank of Nigeria Statistical Bulletin, 2020 edition (Table 2).

| Table 2 Variables Description And Source |

||

|---|---|---|

| Variable | Description | Source |

| RDVT | Regional development cost | CBN Statistical Bulletin, 2020 edition |

| SGCT | State Government Constitutional Transfer | CBN Statistical Bulletin, 2020 edition |

| SGTS | State Government Tax Sovereignty | CBN Statistical Bulletin, 2020 edition |

| SVAT | State Share of Value Added Tax (35% of total VAT) | CBN statistical bulletin, 2020 edition |

| GRNT | Grants received by the State Governments | CBN Statistical Bulletin, 2020 edition |

The multiple regression model applied in this study is as presented below:

RDVT=f (SGCT, SGTS, SVAT, GRNT) (1)

Where: RDVT=Regional development cost; SGCT=State Government Constitutional Transfer; SGTS=State Government Tax Sovereignty; SVAT=State Share of Value Added Tax; GRNT=Grants received by State Governments.

The above well-designed formula is denoted mathematically as follows:

Where: Y1=Regional development cost; X=Determinant of Regional development; X1=State Government Constitutional Transfer; X2=State Government Tax Sovereignty; X3=State Share of Value Added Tax; X4=Grants received by State Governments.

β=Determines the connection between the autonomous variable X and the reliant variables Y, or the regression gradient/slope, which measures the amount of change in Y correlated with a unit change in X.

α=Constant; X1-X3 = Regression coefficients; μi = Error term.

On the a priori, we expect; X1 > 0, X2 > 0, X3 > 0, X4 > 0.

Data Analysis and Explanation

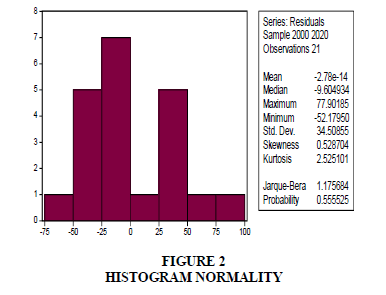

Table 3 contains a statistical breakdown of all the factors utilized in this investigation. RDVT, SGCT, SGTS, SVAT, and GRNT have mean values of 165, 1315, 463, 277, and 101, respectively. The median comparable values for RDVT, SGCT, SGTS, SVAT, and GRNT, on the other hand, are 218, 1354, 509, 275, and 89. The RDVT, SGCT, SGTS, SVAT, and GRNT minimum values are 5, 251, 38, 31, and 18 respectively. The standard deviation numbers show a smaller dispersion, implying that the data collection converges towards the mean values. For RDVT, SGCT, SGTS, SVAT, and GRNT, these values are 140, 640, 295, 194, and 60, respectively. Accordingly, there is evidence of somewhat positive skewness for RDVT, SVAT, and GRNT (0.23, 0.42, and 0.57). The skewness for SGCT and SGTS is moderately negative. Kurtosis results reveal that the data distribution is normal and falls within the permissible range of 1-3. The p-values for Jarque-Bera are higher than 5% for all variables, indicating that the data sets for this study are normally distributed. The result of histogram normality in Figure 1 confirms this finding.

| Table 3 Descriptive Statistics |

|||||

|---|---|---|---|---|---|

| RDVT_N_BILLION | SGCT_N_BILLION | SGTS_N_BILLION | SVAT_N_BILLION | GRNT_N_BILLION | |

| Mean | 165.4286 | 1315.220 | 463.3836 | 277.5702 | 101.4762 |

| Median | 218.0000 | 1353.741 | 509.3000 | 275.5746 | 89.00000 |

| Maximum | 412.0000 | 2273.577 | 801.2875 | 699.0000 | 224.0000 |

| Minimum | 5.000000 | 251.5700 | 37.78850 | 30.64380 | 18.00000 |

| Std. Dev. | 140.3854 | 640.0123 | 295.2909 | 194.2105 | 60.35695 |

| Skewness | 0.230702 | -0.100757 | -0.247625 | 0.418560 | 0.571891 |

| Kurtosis | 1.707453 | 1.768128 | 1.386848 | 2.195883 | 2.301100 |

| Jarque-Bera | 1.648125 | 1.363353 | 2.491592 | 1.178953 | 1.572112 |

| Probability | 0.438646 | 0.505768 | 0.287712 | 0.554618 | 0.455638 |

| Sum | 3474.000 | 27619.61 | 9731.056 | 5828.975 | 2131.000 |

| Sum Sq. Dev. | 394161.1 | 8192316 | 1743935 | 754354.0 | 72859.24 |

| Observations | 21 | 21 | 21 | 21 | 21 |

Source: Authors’ calculation, 2021

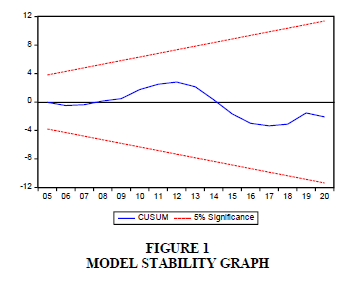

The following investigations were carried out in this study to validate the use of the regression model: serial correlation test using the Breusch-Godfrey Serial Correlation LM Test, stability test using the Ramsey RESET test, and normalcy test using Histogram normality. Table 4 shows that the p-values for each test are larger than the 5% criterion of significance. As a result, the model employed in this investigation is stable, normal, and devoid of serial correlation, as evidenced by the Durbin-Watson result in Table 6.

| Table 4 Investigative Tests |

|

|---|---|

| Type of Test | P-value |

| Ramsey RESET Test | 0.58 |

| Breusch-Godfrey Serial Correlation LM Test | 0.19 |

| Jarque-Bera P-Value | 0.56 |

Source: Authors’ Calculation, 2021.

Somehow, autonomous variables employed in a research can be inter-related, implying that the same factors are utilized to measure an element's reaction. To avoid such a scenario, a multi-collinearity test is recommended to identify such interrelated variables and remove those with the greatest Variance Inflation Factor (VIF). In this regard, the result in Table 5 shows that multi-collinearity does not exist in this study, since the VIF of all autonomous variables is less than the benchmark value of 10 (Gujarati & Porter, 2009).

| Table 5 Test Of Multi-Collinearity |

|||

|---|---|---|---|

| Variance Inflation Factors | |||

| Coefficient | Uncentered | Centered | |

| Variable | Variance | VIF | VIF |

| SGCT_N_BILLION | 0.000666 | 19.92292 | 3.666253 |

| SGTS_N_BILLION | 0.005403 | 22.69537 | 6.329492 |

| SVAT_N_BILLION | 0.015008 | 23.91821 | 7.605601 |

| GRNT_N_BILLION | 0.025438 | 4.940482 | 1.245083 |

| C | 728.3410 | 10.27521 | NA |

| Sample: 2000 2020 | |||

| Included observations: 21 | |||

Source: Authors’ calculation, 2021

Table 6 displays the regression result, which reveals that the Durbin-Watson is 1.6. This implies that there is no autocorrelation. The correlation coefficient in Nigeria is 97.6 percent, indicating a significant link between regional growth and fiscal decentralization. Nonetheless, RSquared data show that the fiscal decentralization components used in this analysis explain 95.2 percent of the differences in Nigerian regional growth. The Adjusted R Squared, which is not anticipated to be greater than R2, aids in understanding the influence of each additional predictor variable in a research. In this study, the Adjusted R Squared is 93.1 percent, which is less than the R2. As a result, the predictor variable mix is normal and has no effect on the study's ultimate outcome. The F-Statistic result is 46, while the p-value is 0.000, which is well below the significance level of 0.05. As a consequence, the result is statistically significant, and the model is appropriate for the research. Furthermore, the predictor factors have a significant and positive effect on the response variable. It is also worth noting that the emergence of a blue line between the borders of the red dotted lines in Figure 2, which depicts the model stability result, implies that the regression model utilized in this study is static.

| TABLE 6 Regression Result |

|||||

|---|---|---|---|---|---|

| Dependent Variable: RDVT_N_BILLION | |||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. | |

| SGCT_N_BILLION | -0.0076 | 0.0386 | -0.1973 | 0.8464 | |

| SGTS_N_BILLION | 0.20475 | 0.07291 | 2.80844 | 0.0139*** | |

| SVAT_N_BILLION | 0.42829 | 0.12572 | 3.40666 | 0.0043*** | |

| GRNT_N_BILLION | 0.03231 | 0.16374 | 0.19731 | 0.8464 | |

| C | -39.727 | 39.6646 | -1.0016 | 0.3335 | |

| R-squared | 0.95201 | Mean dependent var | 165.429 | ||

| Adjusted R-squared | 0.93144 | S.D. dependent var | 140.385 | ||

| S.E. of regression | 36.7587 | Akaike info criterion | 10.3217 | ||

| Sum squared resid | 18916.8 | Schwarz criterion | 10.6699 | ||

| Log likelihood | -101.38 | Hannan-Quinn criter. | 10.3973 | ||

| F-statistic | 46.2852 | Durbin-Watson stat | 1.64664 | ||

| Prob(F-statistic) | 0 | 0 | |||

| Sample: 2000 2020 | |||||

| Included observations: 21 | |||||

Source: Authors’ calculation, 2021; *** Significant @ 5% level.

The independent factors in Table 6 were examined separately to determine the extent to which each one influences regional growth in Nigeria. Table 6 shows that State Government Tax Sovereignty (SGTS) has a t-statistic of 2.8 and a p-value of 0.01. This finding suggests that SGTS has a statistically significant positive influence on the development of Nigeria's six geopolitical zones. Similarly, the states' share of VAT revenue (SVAT), which accounts for 35% of total VAT income in Nigeria, has a t-statistic of 3.4 and a p-value of 0.00. As a consequence, at the 5% level of significance, the finding suggests that SVAT has a substantial beneficial influence on RDVT as well. On the contrary, the State Constitutional Transfer has a negligible negative influence on RDVT, whereas GRNT has a negligible positive impact on RDVT.

Recommendation

The research investigates the influence of state sovereign tax authority and statutory transfer on regional growth in Nigeria. This study proved highly useful since Nigeria's six geographic zones have voting rights and taxation capabilities, as stipulated in the second schedule of the Federal Republic of Nigeria's 1999 Constitution. The practice of fiscal decentralization in Nigeria was legalized under the provisions of the Federation of Nigeria's 1999 constitution's second schedule part II. As a result, states have the constitutional right to collect a specific amount of taxes, as well as 26.72 percent of the revenue standing to the credit of the federation account and 35 percent of all federally collected VAT revenue and other revenues such as grants. It is critical to realize that legal states' access to these funds is intended to allow them to carry out various forms of regional development and effective public service delivery in all of the states within the six geographical zones. By extension, no state is to be excluded. However, according to the findings of this research, state government constitutional transfer has a detrimental impact on regional growth. According to Ewetan et al. (2021) this bad consequence is due to graft in the Nigerian political system. It is also worth noting that state taxing powers and a portion of VAT income go a long way toward improving the regions, but grants alone are insufficient to boost regional expansion.

Conclusion

We propose that Nigerian regions begin to embark on creative initiatives that would attract both domestic and foreign funds. To produce enough income for the growth of all states, taxation powers should be expanded. Most significantly, the constitutional allocation mechanism should be reconsidered in favor of states in order to improve public service delivery and financial empowerment at the regional level.

Acknowledgement

The authors show gratitude to the administration of Covenant University Ota, Ogun State, Nigeria for the open access support of this research output.

References

Amusa, H., & Mabugu, R. (2016). The contribution of fiscal decentralization to regional inequality: Empirical results for South African municipalities. Economic Research Southern Africa.

Bartlett, W., Dulic, K., & Kmezic, S. (2018). The impact of fiscal decentralization on local Economic developmentin Serbia. Lex localis-Journal of Local Self-Government, 18(1), 143-163.

Indexed at, Google Scholar, Cross Ref

Cahyadi, E.D. (2019). Fiscal decentralization and economic growth in Indonesia. Jurnal Ilmiah Administrasi Publik, 5(3), 320-327.

Indexed at, Google Scholar, Cross Ref

Ewetan, O.O., Osabohien, R., Matthew, O.A., Babajide, A.A. & Urhie, E. (2021). Fiscal federalism and accountability in Nigeria: An ARDL approach.Journal of Money Laundering Control, 24(2), 361-373.

Indexed at, Google Scholar, Cross Ref

Fiddin, E., Pardamean, J.G.R., & Geniusa, A. (2018). The impact of fiscal decentralization on Economic variables: Evidence from Indonesia’s Provinces. National Symposium on State Finance.

Gujarati, D.N., & Porter, D.C. (2009). Basic econometrics. Boston: McGraw-Hill Irwin.

ICAN (2019). Public sector accounting & finance. Published by the institute of chartered accountants of Nigeria, Lagos, Nigeria.

Jin, Y., & Rider, M. (2020). Does fiscal decentralization promote economic growth? An empirical approach to the study of China and India. Journal of Public Budgeting, Accounting & Financial Management.

Indexed at, Google Scholar, Cross Ref

Lozano, I., & Julio, J.M. (2016). Fiscal decentralization and economic growth in Colombia: Evidence from regional-level panel data. Cepal Review, 119, 66-82.

Musgrave, R. (1959). The theory of public finance. New York: McGraw – Hill.

Nantharath, P., Laochankham, S., Kamnuasilpa, P., & Kang, E. (2020). Fiscal decentralization and Economic growth in Thailand: A Cross – Region Analysis. International Journal of Financial Research, 11(1), 147 – 156.

Indexed at, Google Scholar, Cross Ref

Oates, W.E. (1972). Fiscal federalism. New York: Harcourt Brace Jovanovich.

Oates, W.E. (1999). An essay on fiscal federalism. Journal of Economic Literature, 37(3), 1120-1149.

Indexed at, Google Scholar, Cross Ref

Omodero, C.O., & Adeyemo, K.A. (2020). Capital expenditure of local government in Nigeria: A preferment of financial autonomy. Academy of Accounting and Financial Studies Journal, 24(S1), 1-10.

Pasichnyi, M., Kaneva, T., Ruban, M., & Nepytaliuk, A. (2019). The impact of fiscal decentralization on economic development. Investment Management and Financial Innovations, 16(3), 29-39.

Indexed at, Google Scholar, Cross Ref

Prud’homme, R. (1995). The dangers of decentralization. World Bank Research Observer, 10(2), 201–220.

Indexed at, Google Scholar, Cross Ref

Setiawan, F., & Aritenang, A.F. (2019). The impact of fiscal decentralization on economic Performance in Indonesia. IOP Conference Series: Earth and Environmental Science, 340, 012021.

Indexed at, Google Scholar, Cross Ref

Tanzi,V.(1995). Fiscal federalism and decentralization: A review of some efficiency and macroeconomic aspects. The World Bank Research Observer,10, 295-307.

Tiebout, C.M. (1956). A pure theory of local expenditures. Journal of Political Economy, 64(5), 416-24.

Indexed at, Google Scholar, Cross Ref

Van, R.P. (2021). Does subnational tax autonomy promote regional convergence? Evidence from OECD countries, 1995-2011. Regional Studies, 55(2), 234-244.

Indexed at, Google Scholar, Cross Ref

Yushkov, A. (2015). Fiscal decentralization and regional economic growth: Theory, empirics, and The Russian experience. Russian Journal of Economics, 1(4), 404-418.

Indexed at, Google Scholar, Cross Ref

Received: 30-July-2021, Manuscript No. JLERI-21-6424; Editor assigned: 02-Aug-2021, PreQC No. JLERI-21-6424(PQ); Reviewed: 24-Aug-2021, QC No. JLERI-21-6424; Revised: 27-Dec-2021, Manuscript No. JLERI-21-6424(R); Published: 03-Jan-2022