Research Article: 2019 Vol: 23 Issue: 4

Success of Malls in an Emerging Market: An Evaluation beyond Huffs Model

Subhendu Dey, Indus Business Academy

Jayanta Banerjee, CHRIST (Deemed to be University)

Bibhutesh Nayak, Hitachi Solutions India Pvt. Ltd.

Abstract

Purpose: Modern day shopping malls are increasingly becoming an inseparable part of residents of urban India. The increase in the number of malls in the recent past reflects the growing demand for malls in the country. However, a large number of shopping malls in India are under-performing. Hence, this paper attempts to study the factors that influence selection of a shopping mall over another by consumers in India. A major component of Huff’s Gravity Model is about identification of the best location. In this paper, the researchers have gone beyond only location and distance as a factor for success of malls. Design/methodology employed: A survey of the residents of Chennai, a major city of India, was conducted to assess the reasons behind their selection of a particular mall over another. A total of 200 usable responses were obtained from five shopping malls in Chennai, with the help of a pre-structured questionnaire. KMO and Bartlett’s Test has been used to check for the applicability of factor analysis, and then the core factors arrived at. Findings: Parameters like distance, presence of multiplex and supermarkets having an impact on the number of footfalls have been studied. This paper concludes that age is a significant factor for visits to malls, and also influences the frequency to visit the mall; while distance is a significant factor in the choice of malls, presence of multiplex helps increase footfalls in the malls independent of the distance from residence. The two factors that drive customers to malls are ‘Entertainment and other facilities’ and ‘Mall atmospherics’. Research limitations/implications: The sampling frame for this research was limited to consumers visiting five malls in Chennai. Though the findings of the study are interesting, these cannot be generalised to all emerging markets or to other cities of India. The nonâÂÂprobability sampling method used in this study may have led to biases in selection of respondents. Future researchers may utilize random sampling methods to ensure generalisability of results. Future research should also consider a broader demographic profile representing multiple geographical locations in India and other countries, given that consumer’s shoppingâÂÂrelated perceptions and expectations are likely to differ across different countries and cultures. Practical and Social implications: This study provides a platform to understand the attitudes of Chennai customers towards shopping malls. National and international mall developers may look at these factors while developing malls in India. Also, there are approximately 14 million retail outlets in India which operate from floor space less than 500 sq. ft. These outlets along with mall developers can greatly benefit from this study. Originality/value: The data indicated the primacy of certain shopping motives over others in explaining why respondents visited shopping malls. The results of this study have several implications that should be of benefit to the retailing industry, and mall management, specifically.

Keywords

Customer Expectations, Mall Atmospherics, Mall Attractions, Mall Environment, Retail Marketing, Shopping Malls.

Introduction

Organised shopping malls emerged as a form of retailing during the 50's and 60's of the last century. Standalone retail outlets were slowly replaced in up market areas with swanky malls which offered greater shopping experience along with convenience. Modern day malls provide customers an experience of shopping from a variety of merchandisers of apparels, food, grocery etc., along with entertainment and leisure under a single structured roof with on-site parking. The success of malls has had a major impact on the retail industry in countries including some developing countries. This paper studied the various factors that drive customers into shopping malls, and the factors that override distance as a reason for non-selection of one mall over another.

In India, the growth in the number of shopping malls is on account of rapid urbanisation of the population and the economic development witnessed over the last two decades. Major cities in India have witnessed an increase in the number of malls reflecting the growing demand for malls in the country. Shopping malls have become a part of the Indian lifestyle with the malls providing opportunities for socialization along with meeting purchase requirements of customers. In Vietnam, another developing country, government monopolized the retail industry between 1954 and 1986. With liberalised policies, retail industry is on a steady growth trajectory with new malls significantly contributing to employment and the economy (Nguyen et al., 2013). Similar is the story of Malaysia, where mega shopping malls have been built in close proximity to residential areas as well as in the more cosmopolitan Kuala Lumpur to cater to the needs of consumers, and visiting shopping malls has become a Malaysian lifestyle (Khong & Ong, 2014). While on one hand the demand for shopping malls is on the rise, on the other, in a highly competitive environment, like the one existing in India, about sixty percent of shopping malls in the major cities of India are underperforming. Among the reasons behind this underperformance are accessibility issues, and smaller catchment areas, which are of specific interest to this study.

Genesis of Malls

In ancient Rome, mall was an area or space of street or Public Square, or portions of same, given to pedestrian traffic. Roots of shopping centre go back to the 10th century. The first public covered shopping centre area - Trajan’s Market was built in Rome. Considered as the world’s oldest shopping mall, this was a multi-level structure building built during the reign of Trajan. In the 15th Century, the concept was adopted by the Persian at Isfahan’s Grand Bazaar also called Qeysarriyeh Bazaar. It is still considered one of the largest covered shopping centres in the world, with more than 58 streets and 4,000 shops. This concept of covered shopping complex was adopted by England in 1774 and it was called the Oxford.

In 1916, Market Square was built in Chicago and it was the first planned shopping centre in the world with 28 stores, apartments and offices. North Gate Mall, which started in 1954 in Washington, was the first of the kind of malls that we see today. It is a large structure housing a variety of retail shops and services in an enclosed shopping centre surrounded by a parking area. This was the first generation of modern malls which consisted of shopping complex, retail outlets, and food courts with parking.

Literature Review

Success of a mall depends on the number of customers that visit the mall. Footfall and ultimate conversion to sales are important for the success of a mall. With the number of malls increasing, a number of researches defining the various factors driving consumers to the malls and consumer’s attitudes have been studied. Gambo & Ismail (2016) studied four architectural factors that attract consumers to shop in a mall. The factors were location, facilities and services provided, aesthetics and design, and qualities of structures constructed in the mall. The study found distance to be an important factor for the selection of a mall, and hence recommended developments of shopping malls close to residential houses. Banerjee & Dasgupta (2010) in their research based study mentioned that a consumer’s preference for a shopping mall over another in Kolkata, one of the four metro cities of India, cannot be attributed to any one single factor. According to their findings, the selection is based on a combination of various factors that draws consumers to the malls. Distance of the mall from home, along with the location of the mall is an extremely important factor for the selection of a shopping mall. The study also mentioned about consumer preferences for stand-alone stores in places that had dearth of malls, as people avoid travelling longer distances to shop at shopping malls.

Kushwaha et al. (2017) in their study also found that consumers usually avoid travelling long distance and hence prefer going to shopping malls near to their residence or work place. For studying the consumers of a specific profile, Rousseau & Venter (2014) investigated the buying behavior of consumers older than 55 years in Port Elizabeth shopping malls and found that distance and accessibility are major factors impacting the visit of such consumers. Similar findings have been observed by researchers in the past as well. In 2012 Walmart took over 51 per cent share in Massmart, South Africa. The company had stores in prominent locations which were easily accessible to customers. Walmart took a strategic decision to acquire stakes in the company for its locational advantage and for Massmart’s presence in 12 other African countries (Nandonde & Kuada, 2016). Myers & Alexander (2007) also established location as a motivation for expansion of retailers. Bucklin (1971) spoke about time and distance that consumers travel having an influence on their willingness to shop. In other words, people are more likely to travel shorter distance when possible. Jackson et al. (2011) mentioned locational convenience, along with hygiene factors and entertainment features as important factors in developing young consumer’s attitude toward mall attributes. Bozdoğan (2015) mentioned "good location" as among the most important factors of a shopping malls’ success.

As the store distance increases, footfall to that store decreases due to a phenomenon known as distance decay. A customer located in a rural area may prefer to travel a greater distance to shop in a big retail outlet or a mall located in a city. The reverse is also true, where a customer may prefer to travel a shorter distance to buy from a small store (Forslund, 2015). Huff’s Gravity Model helps in planning scenarios to identify the best location and the appropriate size of the store to attract a good number of shoppers (Huff, 1963). Gravity model is based on the assumption that certain location or group of customers within a radius are drawn to the mall particularly on the basis of variables such as distance, market population etc. Bennett (1995) has defined that this model is used to analyze store location potentiality. This model is widely used to define the location of the shopping center. Nelson (1958) mentioned that selecting an optimal location for the mall plays an important role as it is the factor that drives the customers and gives it a competitive advantage. Bucklin (1971) pointed out that people are attracted to larger places to do their shopping, but the time and distance they travel influence their willingness to shop anywhere. In other words, people are more likely to travel shorter distance when possible. Bodkin & Lord (1997) in their research suggested that the main criteria for choosing a mall, is the convenience of the location and service offered by the mall.

Telci (2013) on the other hand argued that while location is an important factor, researchers have shifted their attention towards other characteristics - both for shopping malls and shoppers to determine mall shopping behaviour. A study by Singh & Sahay (2012) on the factors that influence consumer’s preference towards shopping malls, with reference to the city of Coimbatore in India, talked about identical tenant-mix in most of the Indian malls, and how most of the Indian malls invariably have a hypermarket, a multiplex, a department store, a food-court and various brand outlets. Srivastava (2008) explains the changing scenario of Indian retail. Food, groceries and multiplex contributed to 52% of sales in malls. Malls with multiplex, food courts, and recreational area for children are becoming the one stop area for family outings. Certain external and internal variables influence the selection of malls and shopping behaviours of consumers, and they feel the presence of theatres in malls as an added feature (Anuradha, 2011). Through various entertainment events, consumers are provided with a reason not only to visit the shopping malls, but also to visit them more often. In a study, Martin (2009) showed that shopping malls with multiplexes, food courts, and play areas for children are becoming the centres for family outings. The study also mentioned about teenagers giving more importance to socialization. Khare (2012) studied Indian consumer’s involvement with malls that would help shopping mall developers, managers and stores in those malls to position their products and services based on the preferences of Indian consumers. Consumer’s involvement influences the time that they spend in the shopping malls, which could have a direct impact on increased sales.

Apart from this, shoppers also get fascinated towards factors like discounts and sales schemes. It attracts consumers to buy even if the need may be minimal at that moment. Discounts are generally associated to certain factors towards which the human brain has strong stimuli. In the brain, a function called dopamine plays a major role in the reward-motivated behavior. Dopamine secretion compels consumers to buy more out of fear that the same product or brand may not be available at the low price in future. This has given marketers a chance to analyze the opportunity to influence consumers. Retail stores operating in malls use discounts, loyalty cards, price-offs and freebies as promotional tools (Khare et al., 2014). Ashraf et al. (2014) stated the effectiveness of combinations of promotional strategies like entertainment. Some researchers have also suggested that promotional strategies of retail stores have a positive impact on sales and mall visits. Success factor of large shopping malls in the retailing sector revolves around consumer satisfaction. Among the factors impacting consumer satisfaction are atmosphere of the mall, location, refreshments, promotional activities and merchandising policy (Anselmsson, 2006). Mall atmospherics also plays an important role in the selection of malls. Michon & Jean (2003) used eight, 7-point semantic differential items to measure consumer’s perceptions of the shopping mall environment, to study how relaxed, comfortable, cheerful, colourful, stimulating, lively, bright, and interesting the mall environment was. Rajagopal (2008) has focused on the impact of overcrowding in the shopping mall looking into shopping conveniences and shopping behaviours. This study revealed that shopping mall ambience and shopping satisfaction effectively become a measure of consumer’s attraction; and ambience of shopping malls, assortment of stores, sales promotions and comparative economic gains in malls attract higher consumer traffic. Singh & Sahay (2012) found ambience, convenience for shopping and promotions to be the most important factors that motivate Indian consumers to visit shopping centres. Shopping mall atmosphere moulds the consumer’s perception, which in turn influences consumer’s emotional responses (pleasure and arousal) and approach of companion’s behaviour (Zhuang et al., 2006).

Another reason behind the success or failure of a shopping mall to generate footfalls is the efficiency through which the supply chain is aligned to give operational leverage. Investments made in infrastructure does not pay off if retailers cannot forecast demand and procure the right goods in adequate quantity at the right time (Hübner et al., 2013). High level of performance management with appropriate customer support and service also makes a mall popular with shoppers (Forslund, 2015). One researcher identified the importance to private labels or retailer’s brands and the associated price difference it offers as a major reason for increased footfall. Burt & Davies (2010) in their research paper concluded that retailer’s brands offer standardised quality and offers greater quantity compared to national brands. Retailer’s brands contribute more profits as channel incentives are minimum or non-existing and influence a malls success.

The Need for this Study

In emerging markets like India, every street still has the small grocery stores which have been very popular primarily because of their proximity to the buyer’s residence. Over the last decade, such stores are increasingly coming under pressure from the shopping malls, especially in the major cities. As compared to all other countries in the world, India has the highest density of retail outlets. It is also important to understand the background of Chennai to appreciate the reason behind taking up this research. Chennai, India’s fourth largest city, is a busy industrial metropolis with many IT companies. The city has a mixture of technology, hardware manufacturing, and healthcare industries. Chennai is India's second largest exporter of IT and ITES. A major chunk of India's car manufacturing industry is based in and around the city. The increased number of employability and modernization of lifestyle of people has increased the demand for modern shopping malls in the city. Among the major cities in the country Chennai witnessed the highest absorption of mall supply at 0.95 million sq. ft. in the first half of 2018, and is expected to increase its number of malls by 33 percent by the end of 2019. Organized retail sector in India also provides the largest employment after the agricultural sector. Though this sector is playing a major role in the growth story of the country, not many good research studies specific to metro cities in India have been done in this area. Past studies have looked at the success parameters of malls in the developed nations. It is also important to note that not all malls are doing well in India. This paper studies the factors that influence selection of a shopping mall over others by consumers in India. One of the major components of Huff’s Gravity Model is about identification of the best location for a mall to attract shoppers, which is also one of the important objectives of the current study. However, the researchers also felt the need to go beyond only location and distance as a factor for success of malls. From the literature survey it became clear that very few studies on this subject have been done in the emerging markets, and hence this research seeks to address this gap.

The research has been done in two stages. Secondary research provided the researchers with the attributes that determine the choice for a mall and primary data has been collected from consumers visiting various malls in Chennai. The objectives of the research were to find if:

RO1: Distance of respondent’s residence from a mall impacts the motivation to visit the mall.

RO2: A luxurious multiplex in a mall increases the probability of reducing distance as a significant criterion for selection of a mall.

RO3: Presence of supermarkets plays an important role in attracting consumers to shopping malls.

RO4: There exist specific factors that drive customers into malls.

In India with traffic congestions in cities being very high, distance of malls could be a strong motivating factor for choosing one mall over another. It was also pertinent to study if there is some other motivating factor that overrides the distance factor, considering that distance is a significant criterion for selection of malls. Apart from these, factors responsible for attracting customers could be seen as motivators in the selection of a mall over another, and hence the given objectives were studied.

Methodology

In this study, quantitative techniques have been used to achieve the research goals and objectives. To study the objectives, required data were collected from primary as well as secondary sources. Primary data was collected from customers by personal interview method with the help of a pre-structured questionnaire. The questionnaire included demography related questions, multiple choice questions, open ended questions and a set of associated factors in the mall on a 5 point Likert Scale. Out of 248 responses collected, 200 were found to be usable, and have been considered for this study. Of the usable 200 respondents, 48 were females and the remaining 152 males. 119 responses were taken during different times on weekdays, while the remaining 81 were taken on weekends. Responses were collected at the entrance of the ground floors from 5 major malls situated in different locations of the city - north-west (Forum Vijaya Mall), south-east (Phoenix Market City), south-central (Chennai Citi Centre), central (Express Avenue) and west (AMPA Skywalk) of Chennai at various times in the day. These malls are separated by distances ranging from as low as 4 km to a maximum of 12 km.

The process of selection of sample was done in two stages. In the first stage, the malls were selected. There are 12 malls in Chennai, out of which 5 have been considered for this study. The selection of malls was done based on two parameters - (i) the total mall space, and (ii) the number of consumers visiting the malls. In the second stage consumers visiting these malls were selected based on the convenience of the researchers.

Results and Analysis

This section presents the analysis done on the data obtained from the survey and the results obtained.

RO1: Distance of respondent’s residence from a mall impacts the motivation to visit the mall.

H0: Motivation to visit a particular mall is not dependent on the distance of the mall from the residence.

H1: Motivation to visit a particular mall is dependent on the distance of the mall from the residence.

Using pivot-table, a comparison of number of visits versus a range of distance travelled to the mall was done. Table 1 show that the maximum number of visits (110) is when the mall is 0-5 km away from the residence. A sizeable proportion (54) is in the 5-10 km range. Beyond these there are relatively few visitors. Null Hypothesis is rejected, which means that distance is a motivating factor for selection of a mall.

| Table 1: Impact Of Distance On Frequency Of Visits | |

| Distance (in Km) | No. of Customers |

|---|---|

| 0-5 | 110 |

| 5-10 | 54 |

| 10-15 | 16 |

| 15-20 | 10 |

| 20-25 | 7 |

| 25-30 | 2 |

| 55-60 | 1 |

RO2: A luxurious multiplex in a mall increases the probability of reducing distance as a significant criterion for selection of a mall.

H0: A luxurious multiplex is not a significant criterion to override distance as a demotivating factor for selection of a particular mall.

H1: A luxurious multiplex is a significant criterion to override distance as a demotivating factor for selection of a particular mall.

A chi square test of independence for those who gave a rating of 5 for luxurious multiplex versus those who did not give a rating of 5 was done to test this objective. Do the proportions in the various distance travelled categories differ significantly? If they don’t differ then distance is not a criterion and customers will travel different distances to malls having better multiplex. Four out of the seven distance categories have been considered in Table 2 and Table 3.

| Table 2: Importance Of Multiplex Over Distance | |||||

| Distance (in Km) | Factors | Grand Total | |||

|---|---|---|---|---|---|

| 2 | 3 | 4 | 5 | ||

| 0.3-5.3 | 2 | 3 | 33 | 76 | 114 |

| 5.3-10.3 | 7 | 45 | 52 | ||

| 10.3-15.3 | 1 | 13 | 14 | ||

| 15.3-20.3 | 2 | 12 | 14 | ||

| 20.3-25.3 | 2 | 2 | 4 | ||

| 25.3-30.3 | 1 | 1 | |||

| 55.3-60.3 | 1 | 1 | |||

| Grand Total | 2 | 3 | 45 | 150 | 200 |

| Table 3 : Chi Square Test Of Independence | |||||

| Distance travelled | fo | fe | fo-fe | (fo-fe)2 |  |

|---|---|---|---|---|---|

| 0.3 – 5.3 | 0.66 | 0.75 | -0.09 | 0.0081 | 0.0108 |

| 5.3 – 10.3 | 0.865 | 0.75 | 0.115 | 0.013225 | 0.01763 |

| 10.3-15.3 | 0.93 | 0.75 | 0.18 | 0.0324 | 0.0432 |

| 15.3-20.3 | 0.5 | 0.75 | -0.25 | 0.0625 | 0.0833 |

The value of the Χ2 test statistic is the sum of the squared and scaled deviations and is equal to 0.15493. The degree of freedom for this test is (r-1)*(c-1) =3. The critical Χ2 value for 5% significance level is 0.351846. Since our test statistic value does not exceed the critical value we do not reject the null hypothesis. In other words the requirement for a luxurious multiplex is independent of the distance travelled to the mall.

RO3: Presence of supermarkets plays an important role in attracting consumers to shopping malls.

H0: Presence of supermarkets is not a significant motivator for selection of a particular mall.

H1: Presence of supermarkets is a significant motivator for selection of a particular mall.

A very small proportion of respondents who have answered that they use the supermarket. We can test if the proportion is greater than 0.5. Only four people out of two hundred have indicated that they go to the mall for the sake of visiting the supermarket. This proportion is 0.02 or 2% only. But if we consider the factor, the number of customers who feel the requirement of supermarket is high. 112 respondents feel that the presence of grocery in mall is required but definitely not a crowd puller factor. Hence, we do not reject the null hypothesis.

RO4: Factors Influencing Customers into Malls.

Various factors that drive customers into malls have been studied and factor analytic techniques used to describe variability among observed variables in terms of fewer unobserved variables called factors. The unobserved variables are modeled as linear combinations of the observed variables. On the basis of the response received, data was loaded to the SPSS for analyzing 14 criteria that were considered to be reasons for customers to visit malls. For this study, principal component analysis where the factors produced are conceptualized as being linear combinations of the variables has been used. Customers were asked to indicate the factors that they feel important by putting a tick mark (√) on a scale of 1-5 where “1 meant least important”, “2 meant less important”, “3 meant neutral”, “4 meant important” and “5 meant most important”. Table 4 shows the percentage response of the respondents in each of those levels.

| Table 4: Percentage Response For Various Factors | |||||

| Factors | 5 | 4 | 3 | 2 | 1 |

|---|---|---|---|---|---|

| Ambience | 46.00 | 40.50 | 13.00 | 0.50 | - |

| Walkthrough | 41.50 | 42.00 | 15.50 | 1.00 | - |

| Air conditioner and ventilation | 36.50 | 41.50 | 20.50 | 1.50 | - |

| Presence of International Brands | 41.00 | 38.00 | 18.50 | 2.50 | - |

| Presence of Local Recognized Brands | 35.00 | 44.00 | 19.50 | 1.50 | - |

| Presence of Recreational Facilities | 24.12 | 52.26 | 18.09 | 5.03 | 0.50 |

| Convenience for Parking | 44.00 | 38.00 | 16.00 | 2.00 | - |

| Food Court | 39.50 | 43.50 | 14.50 | 2.50 | |

| Standalone Restaurants | 43.50 | 43.50 | 12.00 | 1.00 | |

| Clean Restrooms | 26.00 | 45.5 | 24.00 | 4.50 | - |

| Luxurious Cineplex | 75.00 | 22.50 | 1.50 | 1.00 | |

| Presence of Hypermarket | 30.50 | 25.50 | 4.00 | - | 40.00 |

| Traffic Management and Security | 30.00 | 48.00 | 20.50 | 1.50 | - |

| Occurrence of Concert and Events | 28 | 44 | 23.50 | 4.50 | |

KMO and Bartlett’s Test

To find the suitability of the data for factor analysis Kaiser-Meyer-Olkin Measure of Sampling Adequacy (KMO test) which indicates the proportion of variance in the variables which is common variance, i.e. which might be caused by underlying factors is done. High values (close to 1.0) generally indicate that a factor analysis may be useful with the data. If the value is less than 0.5, the results of the factor analysis probably won’t be very useful. Since from Table 5 it is seen that the KMO test value of 0.924 is more than 0.5, it is therefore concluded that we can go for factor analysis. From the Bartlett’s Test of Sphericity also it is observed that the chi-square value is very high i.e. 2011.314 and the significance level is less than 0.05, therefore factor analysis can be applied.

| Table 5: Kmo And Bartlett's Test | ||

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy | 0.924 | |

| Bartlett's Test of Sphericity | Approx. Chi-Square | 2011.314 |

| df | 91 | |

| Sig. | 0.000 | |

Communalities

Having established that factor analysis can be applied, one certainly cannot expect that the factors will extract all variance from our items; rather, only that proportion that is due to the common factors and shared by several items. Therefore, the proportion of variance of a particular item that is due to common factors (shared with other items) is called communality. The other task in applying this model is to estimate the communalities for each variable, that is, the proportion of variance that each item has in common with other items.

The proportion of variance that is unique to each item is then the respective item's total variance minus the communality. Initial communalities are estimates of the variance in each variable accounted for by all components or factors. Extraction communalities are estimates of the variance in each variable accounted for by the factors in the factor solution. Small values indicate variables that do not fit well with the factor solution, and should possibly be dropped from the analysis. In this case we are considering all 14 variables in Table 6.

| Table 6: Communalities | ||

| Initial | Extraction | |

|---|---|---|

| Ambience | 1.000 | 0.823 |

| Walkthrough | 1.000 | 0.829 |

| Air Conditioner and Ventilation | 1.000 | 0.523 |

| Presence of International Brands | 1.000 | 0.740 |

| Presence of Local Recognized Brands | 1.000 | 0.628 |

| Presence of Recreational Facilities | 1.000 | 0.658 |

| Convenience for parking | 1.000 | 0.700 |

| Food Court | 1.000 | 0.746 |

| Standalone Restaurants | 1.000 | 0.611 |

| Clean Restroom | 1.000 | 0.683 |

| Luxurious Cineplex | 1.000 | 0.425 |

| Presence of Hypermarket | 1.000 | 0.606 |

| Traffic Management and Security | 1.000 | 0.611 |

| Occurrence of Concerts and Events | 1.000 | 0.607 |

Extraction Method: Principal Component Analysis

Total Variance Explained

Table 7 shows all the factors extractable from the analysis along with their eigenvalues, the percent of variance attributable to each factor, and the cumulative variance of the factor and the previous factors. The first factor accounts for 35.642% of the variance, and the second 30.001%. The 2 factors together explain for 65.644% of the variance in factors influencing customers to visit malls. To get better factor scores, factor rotations is needed. For this purpose we have used varimax. The varimax rotation method encourages the detection of factors each of which is related to few variables. It discourages the detection of factors influencing all variables.

| Table 7: Total Variance Explained | |||||||||

| Component | Initial Eigenvalues | Extraction Sums of Squared Loadings | Rotation Sums of Squared Loadings | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | |

| 1 | 8.049 | 57.494 | 57.494 | 8.049 | 57.494 | 57.494 | 4.990 | 35.642 | 35.642 |

| 2 | 1.141 | 8.150 | 65.644 | 1.141 | 8.150 | 65.644 | 4.200 | 30.001 | 65.644 |

| 3 | 0.755 | 5.392 | 71.035 | ||||||

| 4 | 0.678 | 4.840 | 75.875 | ||||||

| 5 | 0.642 | 4.584 | 80.459 | ||||||

| 6 | 0.499 | 3.562 | 84.020 | ||||||

| 7 | 0.481 | 3.435 | 87.455 | ||||||

| 8 | 0.374 | 2.670 | 90.125 | ||||||

| 9 | 0.337 | 2.408 | 92.533 | ||||||

| 10 | 0.301 | 2.147 | 94.680 | ||||||

| 11 | 0.267 | 1.904 | 96.584 | ||||||

| 12 | 0.186 | 1.325 | 97.909 | ||||||

| 13 | 0.148 | 1.056 | 98.966 | ||||||

| 14 | 0.145 | 1.034 | 100.000 | ||||||

| Extraction Method: Principal Component Analysis | |||||||||

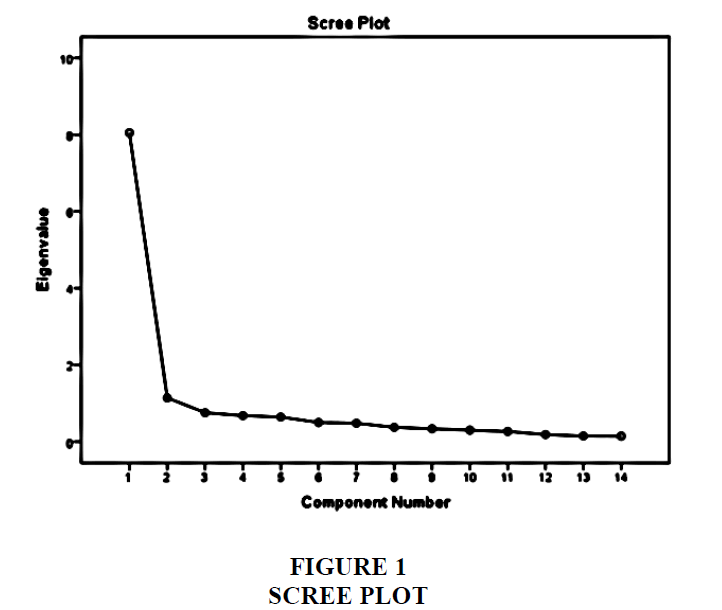

Finding the Number of Factors

In order to choose the number of factors, we use Cattell’s scree test. We have used this test as opposed to Kaiser’s eigenvalue rule since Kaiser Criterion sometimes retains too many factors, though it does quite well under normal conditions. The scree plot is a graph of the eigenvalues against all the factors. The graph is useful for determining how many factors to retain. The point of interest is where the curve starts to flatten. It can be seen that the curve begins to flatten between factors 2 and 3, and hence for our study we find that only two factors can be retained in Figure 1.

Identification of the Core Factors

The Rotated Factor Matrix represents the rotated factor loadings, which are the correlations between the variables and the factors. The factor column represents the rotated factors that have been extracted out of the total factor. These are the core factors, which have been used as the final factor after data reduction. According to the grouping of the factors, each group of factors is named which will represent the grouped factor and represent the factors (Luo, 2014).

Table 8 gives the correlation of the variables with each of the extracted factors. Usually, each of the variables is highly loaded in one factor and less loaded towards the other factors. To identify the variables, included in each factor, the variable with the value maximum in each row is selected to be part of the respective factor. The values have been highlighted in each of the rows to group the 14 variables into 2 core factors.

| Table 8: Rotated Component Matrix a | ||

| Component | ||

|---|---|---|

| 1 | 2 | |

| Ambience | 0.266 | 0.867 |

| Walkthrough | 0.213 | 0.885 |

| Air Conditioner and Ventilation | 0.418 | 0.590 |

| Presence of International Brands | 0.563 | 0.650 |

| Presence of Local Recognized Brands | 0.572 | 0.549 |

| Presence of Recreational | 0.703 | 0.404 |

| Convenience for parking | 0.829 | 0.112 |

| Food Court | 0.785 | 0.361 |

| Standalone Restaurants | 0.665 | 0.412 |

| Clean Restroom | 0.657 | 0.501 |

| Luxurious Cineplex | 0.560 | 0.334 |

| Presence of Hypermarket | 0.280 | 0.726 |

| Traffic Management and Security | 0.755 | 0.202 |

| Occurrence of Concerts and Events | 0.650 | 0.430 |

| Extraction Method: Principal Component Analysis Rotation Method: Varimax with Kaiser Normalization |

||

| a. Rotation converged in 3 iterations | ||

Names of the Factors

The variables that have been included into each core factor have been named as given in Table 9.

| Table 9: Factors Identified | ||

| Factor | Variables Included | Names of the Factor |

|---|---|---|

| 1 | Luxurious Cineplex | Entertainment and other facilities |

| Presence of Recreational Activities | ||

| Convenience for parking | ||

| Food Court | ||

| Standalone Restaurants | ||

| Clean Restroom | ||

| Traffic Management and Security | ||

| Occurrence of Concerts and Events | ||

| 2 | Ambience | Mall Atmospherics |

| Presence of Local Recognized Brands | ||

| Walkthrough | ||

| Air Conditioner and Ventilation | ||

| Presence of International Brands | ||

| Presence of Hypermarket | ||

Conclusions and Implications

For malls to succeed, they should consider the suggestions that have been made in this paper. In India travelling distance for a mall in big cities with high traffic density, is an area of concern, but people tend to travel if they are provided with better physical facilities and entertainment attractiveness. The study also revealed some interesting facts. A large part of Chennai customers visit malls on weekends and mostly once a week. Multiplex in the malls is a good strategy to increase footfalls in the malls. Presence of supermarkets in shopping malls do not impact increased footfall. The two factors that drive customers to malls are ‘Entertainment and other facilities’ and ‘Mall atmospherics’.

This research has helped in exploring the Chennai market where it is observed that people give more importance to entertainment and atmosphere. These two factors act as the main reasons to choose a mall. This study aims at providing the researchers a platform to understand the Chennai customer’s attitudes towards malls and gives scope to other researchers to understand the factors involved in a customer’s selecting a mall. International mall developers may look at these factors while developing malls in India.

Future Research

The sampling frame for this research was limited to the residents of Chennai. The findings of the study, though interesting cannot be generalized to all populations of other countries or even to all Indian cities. Future researchers may take up studies on other cities in India, and also in other countries. In this research, convenience sampling has been used, mainly because of paucity of time. Future researchers may use a probability sampling method to ensure generalizability of the results. The factors impacting motivation levels of customers are limited to only distance, and the presence of multiplex and supermarkets. Future research covering wider aspects is desirable. Further research may be done for international mall developers, who may use these findings while developing malls in India or in other countries of the world.

References

- Anselmsson, J. (2006). Sources of customer satisfaction with shopping malls: a comparative study of different customer segments, International Review of Retail Distribution and Consumer Research, 16(1), 115-38.

- Anuradha, D. (2011). Customer shopping experience in malls with entertainment centres in Chennai, African Journal of Business Management, 5(31), 12391-12324.

- Ashraf, M.G., Rizwan, M., Iqbal, A., & Khan, M.A. (2014). The promotional tools and situational factors’ impact on consumer buying behaviour and sales promotion, Journal of Public Administration and Governance, 4(2), 179-201.

- Banerjee, M. & Dasgupta, R. (2010). Changing Pattern of Consumer Behavior in Kolkata with Advent of Large Format Retail Outlets, IUP Journal of Marketing Management, 9(4), 56-80.

- Bennett, P.D. (1995). Dictionary of Marketing Terms, Second Edition, Chicago, IL, American Marketing Association, 287.

- Bodkin, C., & Lord, J. (1997). Attraction of power shopping centres. The International Review of Retail, Distribution and Consumer Research, 7(2), 93-108.

- Bozdoğan, D. (2015). Mall Revisited: Current Trends and Pedagogical Implications, World Conference on Technology, Innovation and Entrepreneurship, Procedia-Social and Behavioral Sciences, 195, 932-939.

- Bucklin, L.P. (1971). Retail Gravity Models and Consumer Choice: A Theoretical and Empirical Critique, Economic Geography, 47(4), 489-497.

- Burt,S., & Davies,K. (2010). From the retail brand to the retail‐eras a brand: themes and issues in retail branding research.International Journal of Retail and Distribution Management,38(11/12), 865-878.

- Forslund,H. (2015). Performance management process integration in retail supply chains.International Journal of Retail and Distribution Management,43(7), 652-670.

- Gambo, N. & Ismail, R. (2016). An evaluation into the architectural factors attracting customers to Malaysian shopping malls, Journal of Business and Retail Management Research, 11(1), 138-153.

- Hübner,A.H., Kuhn,H., & Sternbeck,M.G. (2013). Demand and supply chain planning in grocery retail: an operations planning framework.International Journal of Retail and Distribution Management,41(7), 512-530. doi: 10.1108/ijrdm-05-2013-0104

- Huff,D.L. (1963). A Probabilistic Analysis of Shopping Center Trade Areas.Land Economics,39(1), 81.

- Jackson, V., Stoel, L. & Brantley, A. (2011). Mall attributes and shopping value: differences by gender and generational cohort, Journal of Retailing and Consumer Services, 18(1), 1-9.

- Jean, C.C., & Michon, R. (2003). Impact of Ambient Odors on Mall Shoppers’ Emotions, Cognition, and Spending: A Test of Competitive Causal Theories, Journal of Business Research, 34(3), 191-197.

- Khare, A. (2012). Influence of mall attributes and demographics on Indian consumer’s mall involvement behavior: An exploratory study, Journal of Targeting, Measurement and Analysis for Marketing, 20(3-4), 192-202.

- Khare, A., Achtani, D., & Khattar, M. (2014). Influence of price perception and shopping motives on Indian consumer’s attitude towards retailer promotions in malls, Asia Pacific Journal of Marketing and Logistics, 26(2), 272-295.

- Khong, K.W., & Ong, F.S. (2014).Shopper perception and loyalty: a stochastic approach to modelling shopping mall behaviour, International Journal of Retail & Distribution Management, 42(7), 626-642.

- Kushwaha, T., Ubeja, S. & Chatterjee, A.S. (2017). Factors Influencing Selection of Shopping Malls: An Exploratory Study of Consumer Perception, Vision, 21(3), 274-283.

- Luo, J. (2014). Integrating the Huff Model and Floating Catchment Area Methods to Analyze Spatial Access to Healthcare Services. Transactions in GIS, 18(3), 436-448.

- Martin, C.A. (2009). Consumption Motivation and Perceptions of Malls: A Comparison of Mothers and Daughters, Journal of Marketing Theory and Practice, 17(1), 49-61.

- Myers,H., & Alexander,N. (2007). The role of retail internationalization in the establishment of a European retail structure.International Journal of Retail and Distribution Management,35(1), 6-19.

- Nandonde,F.A., & Kuada,J. (2016). International firms in Africa’s food retail business-emerging issues and research agenda.International Journal of Retail and Distribution Management,44(4), 448-464.

- Nelson, R.L. (1958). The selection of retail locations. New York: F. W. Dodge Corporation.

- Nguyen,H., Wood,S., & Wrigley,N. (2013). The emerging food retail structure of Vietnam.International Journal of Retail and Distribution Management,41(8), 596-626.

- Rajagopal. (2008). Growing Shopping malls and Behavior of Urban Shoppers, Journal of Retail and Leisure Property, 8(2), 99-118.

- Rousseau, G.G. & Venter, D.J.L. (2014). Mall shopping preferences and patronage of mature shoppers, SA Journal of Industrial Psychology, 40(1), 1-12.

- Singh, H. & Sahay, V. (2012). Determinants of shopping experience, International Journal of Retail and Distribution Management, 40(3), 235-248.

- Srivastava, R.K. (2008). Changing retail scene in India, International Journal of Retail and Distribution Management, 36(9), 714-721.

- Telci, E.E. (2013). High shopping mall patronage: is there a dark side?, Quality and Quantity, 47(5), 2517-2528.

- Zhuang, G., Alex, S.L., Tsang, N.Z., Fuan, L., & Nicholls, J.A.F.(2006). Impacts of situational factors on buying decisions in shopping malls, European Journal of Marketing, 40(1/2), 17-43.