Research Article: 2020 Vol: 24 Issue: 2

Sustainable Dairy Practices an Insight to Chain Coordination Mechanisms of Unorganized Segment of Dairy Sector in Punjab State

Meenakshi Gupta, School of Economics, SMVD University

Vikas Sharma, Coordinator GK Institute of Training and Research

Abstract

With the liberalization of economy thereby introduction of several globalization and trade liberalization measures and entry of the corporate sector have induced competition in food markets. These have also started undergoing transformation from those based entirely upon the consumption of low-value basic essentials to the emergence of new market segments demonstrating orientation to the consumption of a larger-variety of value-added and processed foods. In the dairy sub-sector this has fostered branding, introduced product diversification, product positioning and product differentiation as well as price discounting for the selective few product lines. Such market dynamics that have emanated from integrated supply chain management practices of the corporate groups/MNCs have also forced producers and marketers in the unorganized segment of the industry to reassess their position and adopt ‘new’ strategies. This study focuses upon the unorganized segment of dairy sub sector that comprises of various types of independently operated firms that supply milk and milk products primarily to urban consumers. Its objectives are to examine how under the influence of ongoing environmental and market dynamics firms align with its immediate upstream and downstream chain partners and coordinate the supply chain from farm to fork for sourcing milk and deliver dairy products, cope up with the seasonal character of industry to sustain business and its profitability.

Keywords

Dairy Industry, Supply Chain, Milk Supplies, Unorganized Segment.

Introduction

Over the years, dairy farming has been a boon for dairy farmers particularly those segments of the society that have been traditionally weak, the small landholders, landless labourers and women. Studies have shown that dairying in rural areas surpassed crop production in terms of profit in marginal, small and medium-sized holdings (Badal & Dhaka, 1998). With the liberalization of economy and entry of the corporate sector dairy farming has started undergoing transformation from those based entirely upon the consumption of low-value basic essentials to the emergence of new market segments demonstrating orientation to the consumption of a larger-variety of value-added and processed dairy products. As a result it has acquired the shape of a fully-fledged industry and emerged as one of the growing industries in India. This industry has positively improved the life of those engaged in this business from farm to fork for sourcing milk and deliver dairy products, directly or indirectly, bringing significant socioeconomic changes. In the dairy sector this has fostered branding, introduced product diversification, product positioning and product differentiation as well as price discounting for the selective few product lines (Bogdan, 2008). Such market dynamics that have emanated from integrated supply chain management practices of the corporate groups/MNCs have also forced dairy producers and marketers in the unorganized segment of the industry to reassess their position and adopt ‘new’ strategies. Keeping this in view, the present study focuses upon the unorganized segment of dairy sub sector that comprises of various types of independently operated firms that supply milk and milk products primarily to urban consumers. Its objectives are to examine how under the influence of ongoing environmental and market dynamics firms align with its immediate upstream and downstream chain partners and coordinate the supply chain from farm to fork for sourcing milk and deliver dairy products, cope up with the seasonal character of industry to sustain business and its profitability (Dhawan, 2015).

Data and Methodology

It has been carried out for Ludhiana and Moga districts of Punjab State. As the thrust of study is on the marketing aspects, so only the commercial milk producers with herd size more than five were selected. The sample comprised of 120 respondents (60 from each district). These milk producers-sellers based on the herd sizes (ranging from 5-23) were classified into three categories i.e., small, medium and large by using cumulative cube root frequency method Table 1A.

| Table 1A: Classification Of Milk Producers Using Cumulative Cube Root Method | ||

| S. No | Herd Size | Category |

|---|---|---|

| 1 | Below 8 | Small |

| 2 | 8-11 | Medium |

| 3 | >11 | Large |

Ten per cent of the producers from each category were randomly selected proportionately to the number of households in different categories. The final selection of the producers from the different categories is given below Table 1B.

| Table 1b: Category-Wise Sample Selected In The Selected Villages | |||

| Category | Total no. of milk producers | No. of milk producer selected | %age |

|---|---|---|---|

| Small | 460 | 46 | 38.33 |

| Medium | 430 | 43 | 35.83 |

| Large | 310 | 31 | 25.84 |

A large number of intermediaries/milk processors are involved in the distribution of milk and milk products from producers to the ultimate consumers. These include several market players such as milk vendors, sweet-makers, creameries/dairies and ice cream parlours. A sample of vendors, sweet-makers and creameries (ten from each district) and ice cream parlours (five from each district) was selected randomly to examine the milk/ milk products marketing pattern.

Data were collected from all the sample respondents for the period on the pre-structured and pre-tested schedules through a personal interview method. From the milk vendors data were collected relating to the quantities of milk handled along with the purchase and sale prices, modes of milk shipment, daily distances covered for milk procurement and its distribution. Those milk vendors who were selling milk to dairies in the towns were selected for the sake of convenience (Gupta, 1992). From the milk processors (sweet-makers, creameries and ice cream parlors) data were collected relating to the quantity of milk handled, milk utilization, milk/milk products’ sales patterns and prices and the expenses incurred on fuel and electricity, labour etc. During the winter period ice cream parlors remain closed in Moga district while in the Ludhiana district few units continue manufacturing. The data were analyzed through Tabular analysis and various statistical tools.

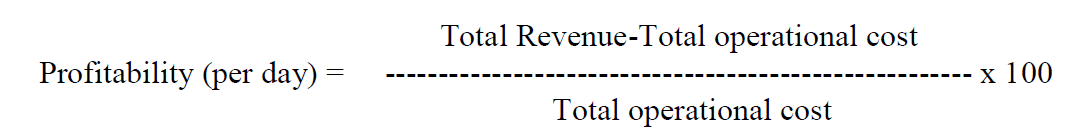

Costs and returns have been worked out for each market player Profitability (per day) over operational cost has been calculated as follows:

Total revenue for vendors was calculated by summing up the product of the daily average quantity sold to different market agents with the corresponding average price received. Total operational cost includes the cost of milk procurement (average daily quantity procured from farmers multiplied by the average procurement price) and the shipment cost (obtained by multiplying the average distance covered per day for milk procurement and distribution with the average cost per km, being calculated by dividing the cost of fuel with the average mileage).

Total revenue of milk processors (dairies, sweet makers and ice cream parlors) was calculated by adding the revenue from sales of milk and milk products to different agents (obtained by summing up the product of average daily quantity sold of each product line with its price). Total operational cost of dairies includes the cost of milk procurement (average daily quantity procured from the farmers multiplied by its average price), cost of fuel & electricity and labour cost (both obtained from the average monthly expenditure by dividing with the number of days) (Gupta & Kaur, 2008).

For the sweet-makers, operational cost includes the cost of milk procurement (average daily quantity procured multiplied by its average price), cost of ingredients (tea leaves and sugar used for making tea); sugar, semolina, ghee and wheat flour used for making sweets). It has been assumed that for making one litre of tea 100 gms of sugar and 25 gms of tea leaves have been used while for 1 kg of sweets 250 gms of sugar, 100 gms of semolina, 200 gms of ghee and 100 gms of wheat flour have been used (Gupta & Sharma, 2009).

Quantities of milk used for the various primary and secondary milk products for the various products are as under:

1. 1 kg curd = 1.2 kg milk

2. 1 kg cheese = 6 kg milk

3. 1 kg cream =10 kg milk

4. 1 kg khoya = 6 kg milk

5. 1 kg ghee = 2 kg cream

6. 1 kg Rasgulla and Gulabjamun = 400 gm khoya

7. 1 Kg Burfi and milkcake = 1Kg Khoya

Operational cost of ice cream parlor units includes the cost of milk and cream procurement (summing up the product of the average quantity daily procured and its average price for each); cost of other ingredients has been assumed to be negligible. The sample ice-cream parlors in Ludhiana districts are selling their own products while in Moga they are selling the products of other firms also like Kwality walls, casino etc.

Results and Discussions

Dairy Farmers

Production, Consumption and Marketable Surplus of Milk

Perusal of the Table 2 revealed that milk production was higher in Ludhiana district (92.83 lts) compared to the Moga district (84.16 lts) and the difference between the two was statistically significant. In contrast, consumption of milk due to larger average family size was higher in the Moga (5.49 llts) as compared to Ludhiana district (4.37 lts) and the difference was statistically significant. With more production and less consumption, the marketable surplus of milk was higher in Ludhiana (88.46 lts) compared to Moga (78.67 lts) district and the difference was statistically significant. Category-wise average daily milk production, consumption and marketable surplus of milk was highest in case of large producers followed by the medium and small sized producers in both the districts. However, difference in production, consumption and marketed surplus in the two districts was statistically significant across the small and large sized producers but not for the medium sized producers.

| Table 2: Average Production, Consumption And Marketable Surpluses Of Milk (Lts/Day) Of The Sample Respondents | ||||||||

| District | Herd Size Category | |||||||

|---|---|---|---|---|---|---|---|---|

| Small | Medium | Large | Overall | |||||

| Qty | %age | Qty | %age | Qty | %age | Qty | %age | |

| Ludhiana | ||||||||

| Production | 54.20 | 100.00 | 71.33 | 100.00 | 152.96 | 100.00 | 92.83 | 100.00 |

| Consumption | 3.77 | 6.95 | 4.51 | 6.33 | 4.86 | 3.17 | 4.37 | 4.71 |

| Marketable surplus | 50.44 | 93.05 | 66.82 | 93.67 | 148.12 | 96.83 | 88.46 | 95.29 |

| Moga | ||||||||

| Production | 43.57 | 100.00 | 76.07 | 100.00 | 132.84 | 100.00 | 84.16 | 100.00 |

| Consumption | 5.24 | 12.03 | 5.23 | 6.88 | 6.01 | 4.53 | 5.49 | 6.53 |

| Marketable surplus | 38.34 | 87.97 | 70.83 | 93.12 | 126.83 | 95.47 | 78.67 | 93.47 |

| Moga v/s Ludhiana (t-values) | ||||||||

| Production | 3.57*** | 1.27NS | 4.37*** | 2.26** | ||||

| Consumption | 2.09** | 1.61 NS | 2.16** | 2.01** | ||||

| Marketed surplus | 4.18*** | 1.43NS | 5.42*** | 2.53** | ||||

NS-non significant

*** Significant at 1 percent level of confidence

** Significant at 5 percent level of confidence.

Milk Marketing Channels and factors Determining Channel Choices Milk marketing channels

Milk producers in the study area sold milk to several market players such as directly to the consumers, milk collection centres of Nestle, PCSs of the cooperative milk union, milk vendors, sweet-makers, creameries etc.

Table 3 revealed that in Ludhiana district major portion of milk was sold to vendors (65%) followed by PCSs of the cooperative milk union (25.63%), Nestle (7.25%), consumers (1.74%) and others (0.38%). In contrast, in Moga district about 90% of milk was collected by Nestle. Other minor market actors included consumers (5.10%), milk vendors (2.01%) and others (2.91%). ‘F’ values indicated that in both districts statistically significant differences existed in the milk disposal pattern of farmer in regard to the various channels. Category-wise analysis revealed that in Ludhiana district, medium and the large sized producers sold more than 70% milk to vendors while the small sized producers sold about half portion of the milk (50.79%) to the PCSs of the cooperative milk union. In Moga district, all sized producers sold more than 80% milk to Nestle being small (82.30%), medium (89.30%) and large (88.84%) sized farmers.

| Table 3:Milk Sales Patterns (Lts/Day) Of The Sample Respondents | ||||||||

| District/Channels | Herd Size Category | |||||||

|---|---|---|---|---|---|---|---|---|

| Small | Medium | Large | Overall | |||||

| Qty | %age | Qty | %age | Qty | %age | Qty | %age | |

| Ludhiana | ||||||||

| Nestle | 5.80 | 11.50 | 2.84 | 4.25 | 10.57 | 7.14 | 6.41 | 7.25 |

| Cooperative societies | 25.62 | 50.79 | 12.60 | 18.86 | 29.81 | 20.12 | 22.67 | 25.63 |

| Vendors | 17.64 | 34.97 | 48.60 | 72.73 | 106.26 | 71.74 | 57.50 | 65.00 |

| Consumers | 1.00 | 1.98 | 2.50 | 3.74 | 1.13 | 0.76 | 1.54 | 1.74 |

| Others* | 0.38 | 0.75 | 0.28 | 0.42 | 0.35 | 0.24 | 0.34 | 0.38 |

| Moga | ||||||||

| Nestle | 32.28 | 84.19 | 64.94 | 91.69 | 115.13 | 90.77 | 70.78 | 89.98 |

| Cooperative societies | - | - | - | - | - | - | - | - |

| Vendors | 1.10 | 2.87 | 1.85 | 2.61 | 1.80 | 1.42 | 1.58 | 2.01 |

| Consumers | 4.21 | 10.98 | 2.22 | 3.14 | 5.60 | 4.42 | 4.01 | 5.10 |

| Others* | 0.75 | 1.96 | 1.82 | 2.56 | 4.30 | 3.33 | 2.29 | 2.91 |

| F-values | ||||||||

| Ludhiana | 11.52*** | 16.41*** | 13.95*** | 16.52*** | ||||

| Moga | 10.47*** | 14.37*** | 9.39*** | 13.61*** | ||||

Others* include sweet makers and creameries FP-flush period; LP-lean period

*** Significant at 1 percent level of confidence.

Producers’ Sale Preferences to the Different Channels Cooperatives

In Ludhiana district, 41.70% of the sample respondents constituting the sample size i.e. 25 milk producers – small (15), medium (5) and large (5) sold milk to the cooperative societies. These producers reported certain reasons for preferring the societies that are presented in Table 4. These included timely payments for milk, standardized measurement and twice milk collection (i.e. both in morning and evening), proper record maintenance, fat testing in presence and supply of various inputs. Category-wise a similar scenario existed for the small, medium and large sized producers.

| Table 4: Sample Respondents Sales Preferences To The Cooperatives | ||||||||

| District/Reasons | Herd Size Category | |||||||

|---|---|---|---|---|---|---|---|---|

| Small(15) | Medium(5) | Large(5) | Total | |||||

| No | %age | No | %age | No | %age | No | %age | |

| Twice milk collection | 15 | 100.00 | 5 | 100.00 | 5 | 100.00 | 25 | 100.00 |

| Timely payments | 15 | 100.00 | 5 | 100.00 | 5 | 100.00 | 25 | 100.00 |

| Standardized measurement | 15 | 100.00 | 5 | 100.00 | 5 | 100.00 | 25 | 100.00 |

| Proper record maintenance | 14 | 93.33 | 5 | 100.00 | 5 | 100.00 | 24 | 96.00 |

| Fat testing in presence | 14 | 93.33 | 5 | 100.00 | 4 | 80.00 | 23 | 92.00 |

| Supply of inputs/services | ||||||||

| Mineral mixture/ Cattle Feed | 7 | 46.67 | 2 | 40.00 | 3 | 60.00 | 12 | 48.00 |

| Medicines, AI services and veterinary doctor |

5 | 33.33 | 2 | 40.00 | 2 | 40.00 | 9 | 36.00 |

| Bonus for good quality milk | - | - | 2 | 40.00 | - | - | 2 | 8.00 |

In Moga, 41 i.e. 68.33% of the sample respondents – small (10), medium (18) and large (13) while in Ludhiana, 10 i.e. 16.67% of the sample respondents – small (5), medium (2) and large (3) sized producers sell milk at the collection centres of Nestle. Reasons reported for preferring this channel have been presented in Table 5. Perusal of the Table 5 revealed that both in the Moga and Ludhiana districts most preferred reasons cited by all the categories of milk producers were the timely payments for milk, twice milk collection, fat testing in presence, proper record maintenance and standardized measurement. This indicated that the MNCs to stay competitive for milk collection extended parallel facilities to the milk producers as the milk cooperatives (Iqubal, 2013). As there is no milk plant of the cooperative union this has encouraged farmers to sell larger quantities of milk to the MNC in the Moga district and also the bordering areas of Ludhiana district. Besides this, at the MNC’s initiative milk producers have largely shifted the livestock from buffaloes to cattle.

| Table 5: Sample Respondents Reasons For Sales Preference To Nestle | ||||||||

| Herd Size Category | ||||||||

|---|---|---|---|---|---|---|---|---|

| District | Small | Medium | Large | Total | ||||

| Ludhiana | No | %age | No | %age | No | %age | No | %age |

| Twice milk collection | 5 | 100.00 | 2 | 100.00 | 3 | 100.00 | 10 | 100.00 |

| Fat testing in presence | 5 | 100.00 | 2 | 100.00 | 3 | 100.00 | 10 | 100.00 |

| Standardized measurement | 5 | 100.00 | 2 | 100.00 | 3 | 100.00 | 10 | 100.00 |

| Proper record maintenance | 5 | 100.00 | 2 | 100.00 | 3 | 100.00 | 10 | 100.00 |

| Timely payments | 5 | 100.00 | 2 | 100.00 | 3 | 100.00 | 10 | 100.00 |

| Supply of inputs/services | ||||||||

| Mineral mixture/Feed | 1 | 20.00 | 1 | 50.00 | 3 | 100.00 | 5 | 50.00 |

| Medicines, AI services and veterinary doctor | 1 | 20.00 | 2 | 100.00 | 2 | 66.67 | 5 | 50.00 |

| Moga | ||||||||

| Twice milk collection | 10 | 100.00 | 18 | 100.00 | 13 | 100.00 | 41 | 100.00 |

| Fat testing in presence | 10 | 100.00 | 18 | 100.00 | 13 | 100.00 | 41 | 100.00 |

| Standardized measurement | 10 | 100.00 | 18 | 100.00 | 13 | 100.00 | 41 | 100.00 |

| Timely payments | 10 | 100.00 | 18 | 100.00 | 13 | 100.00 | 41 | 100.00 |

| Proper record maintenance | 10 | 100.00 | 17 | 94.44 | 13 | 100.00 | 40 | 97.56 |

| Supply of inputs/services | ||||||||

| Mineral mixture/Feed | 7 | 70.00 | 9 | 50.00 | 9 | 69.23 | 25 | 60.97 |

| Medicines, AI services and veterinary doctor |

3 | 30.00 | 5 | 27.78 | 8 | 61.54 | 16 | 39.02 |

| Milking machine | - | - | 3 | 16.67 | 4 | 30.77 | 7 | 17.07 |

Producers’ Sales Preferences to Private Channels

A perusal of the Table 6 revealed that the most preferred reasons to influence producers’ choices for milk sales to vendors were the flexibility in milk quality and timely payments in both the districts while in the Moga district higher sales price was also important. In case of sales to consumers the most important factor in Ludhiana district was the personal relationship followed by higher sales price and timely payments while in the Moga district the most important factor was the higher sale price followed by timely payments and quality flexibility (Gupta, 2004). This indicated that the individual private market actors such as milk vendors and consumers offer convenience milk disposal sources for the milk from the cooperatives and MNC. Besides this, they also offer comparatively higher prices and collect milk from producers’ doorsteps

| Table 6: Factors Determining Channel Choices | ||||||||

| District | Small | Medium | Large | Total | ||||

|---|---|---|---|---|---|---|---|---|

| No | %age | No | %age | No | %age | No | %age | |

| Ludhiana | ||||||||

| Vendors | ||||||||

| Quality Flexibility | - | - | 15 | 100.00 | 13 | 100.00 | 28 | 93.33 |

| Timely payment | - | - | 15 | 100.00 | 12 | 92.31 | 27 | 87.09 |

| Sale price | 3 | 100.00 | 1 | 6.67 | 2 | 15.38 | 6 | 19.31 |

| Personal Relationship | - | - | 1 | 6.67 | - | - | 1 | 3.22 |

| Consumers | ||||||||

| Personal Relationship | 1 | 100.00 | 3 | 100.00 | 4 | 100.00 | 8 | 100.00 |

| Sale price | 1 | 100.00 | 2 | 66.67 | 3 | 75.00 | 6 | 75.00 |

| Timely payment | 1 | 100.00 | 1 | - | 4 | 100.00 | 6 | 75.00 |

| Quality Flexibility | - | - | 2 | 66.67 | 1 | 25.00 | 3 | 37.5 |

| Moga | ||||||||

| Vendors | ||||||||

| Quality Flexibility | 2 | 100.00 | 4 | 100.00 | 2 | 66.67 | 8 | 100.00 |

| Timely payment | 2 | 100.00 | 2 | 50.00 | 3 | 100.00 | 7 | 87.50 |

| Sale price | 2 | 100.00 | 3 | 75.00 | 1 | 33.33 | 6 | 75.00 |

| Personal Relationship | - | - | 1 | 25.00 | - | - | 1 | 12.50 |

| Consumers | ||||||||

| Sale price | 5 | 100.00 | 2 | 100.00 | 4 | 100.00 | 11 | 100.00 |

| Timely payment | 1 | 20.00 | 1 | 50.00 | 3 | 75.00 | 5 | 45.45 |

| Quality Flexibility | 2 | 40.00 | 1 | 50.00 | 2 | 50.00 | 5 | 45.45 |

| Personal Relationship | - | - | 1 | 50.00 | 2 | 50.00 | 3 | 27.27 |

Market Players in Punjab Dairy Industry Milk Vendors

A perusal of the Table 7 revealed that the daily average quantity handled by vendors was 173.60 lts in Ludhiana district compared to 98.52 lts in Moga district being higher by 43.25%. Unit purchase price of milk was also higher in Ludhiana (Rs 14.50/lt) compared to the Moga (Rs 14/lt) district; being higher by 3.44%. A comparison of flush and lean periods indicated that milk quantities procured increased but the average price decreased in both districts during the flush period. However, average purchase prices stayed higher in Ludhiana in the flush season while in the lean season these came closer to that in the Moga district. This might be due to jump in demand for milk from the various segments within/outside the district. It was further revealed that the largest share of the milk handled by vendors went to private dairies followed by consumers and sweet makers in both districts, this being 65.71% and 32% in Ludhiana district while 74.39% and 24.06% in Moga district. Only a negligible quantity of milk was sold to the sweet-makers (Kashish, 2014). Milk sale prices for all the channels except for dairies during the lean season (both equal) were higher in Ludhiana compared to Moga district in both seasons. Vendors in both districts got marginally higher price from sweet–makers and consumers compared to dairies. In Ludhiana district the most preferred modes of transport used by vendors for milk procurement and disposal included bikes (40%) covering an average distance of 23.25 kms, both cycle and bikes (30%) covering an average daily distance of 18.45 kms, only cycle (20%) covering an average daily distance of 12.75 km and Mini autos (10%) covering an average daily distance of 12.75 km. In contrast, in Moga district the most preferred modes of transport used by vendors for milk procurement and disposal included both cycle and bike (50%) covering an average daily distance of 20.63 kms, only bike (30%) covering the average daily distance of 28.8 km and only cycles (20%) covering the average daily distance of 7.80 kms. Thus the milk vendors in Ludhiana district covered an average daily distance of 23.01 kms compared to 20.51 kms in Moga district. This enabled them to sell milk comparatively at the distant markets thereby earn higher prices. It was further discernible that in the Ludhiana district the sample milk vendors were earning comparatively more profit (6.35 %) over operational cost (it includes the cost of milk procurement and transportation cost). Nearly an identical pattern was discernible across the seasons.

| Table 7: Season-Wise Average Daily Milk Procurement And Sales Patterns Of Sample Vendors (Quantity: Lts, Price Rs\Lt) | ||||||

| Particulars | Flush Period | Lean Period | Combined | |||

|---|---|---|---|---|---|---|

| Qty | Price | Qty | Price | Qty | Price | |

| Milk Procurement | ||||||

| Ludhiana | 182.20 | 14.00 | 165.00 | 15.00 | 173.60 | 14.50 |

| Moga | 102.50 | 13.00 | 94.55 | 15.00 | 98.52 | 14.00 |

| Milk Sales Pattern | ||||||

| Ludhiana | ||||||

| Dairies | 119.41 (65.54) | 14.80 | 108.73 (65.90) | 17.40 | 114.07(65.71) | 16.10 |

| Consumer | 58.56 (32.14) | 17.50 | 52.57 (31.86) | 19.00 | 55.56 (32.00) | 18.25 |

| Sweet-makers | 4.23 (2.32) | 17.60 | 3.70 (2.24) | 19.00 | 3.96 (2.28) | 18.30 |

| Moga | ||||||

| Dairies | 77.14 (75.26) | 14.50 | 69.44 (73.44) | 17.40 | 73.29 (74.39) | 15.95 |

| Consumer | 23.70 (23.12) | 17.10 | 23.70 (25.07) | 18.30 | 23.70 (24.06) | 17.70 |

| Sweet-makers | 1.66 (1.62) | 17.20 | 1.41 (1.48) | 18.60 | 1.53 (1.55) | 17.90 |

| Returns over Operational cost (%) | ||||||

| Ludhiana | 3.03 | 9.41 | 6.35 | |||

| Moga | 2.00 | 3.76 | 3.01 | |||

Milk Dairies

A perusal of Table 8 revealed that the average daily quantity of milk handled was 1415 lts in Ludhiana district compared to 1010 lts in Moga district; being higher by 28.62 %. Dairies in both the districts handled larger quantities of milk during the flush season compared to the lean season being higher by 30.55% and 25.24 % respectively. Prices at which milk was procured in the two districts were different during the flush season while these were same during the lean season. Of the total milk procured by the dairies major portion was used as fluid milk and the remaining milk was converted into products like cream, curd and cheese. In Ludhiana district of the total milk (1415 lts) procured, 60.76% of the milk was used as fluid milk followed by curd (17.41%), cheese (14.42%) and cream (7.42%). In the flush season 69% of the total milk (i.e.1242 lts) was used as fluid milk followed by cheese (14.17%), curd (12.67%) and cream (4.17%) while in the lean season only 46.35% of the total milk (859.70 lts) was used as fluid milk followed by curd (25.69%), cheese (18.61%) and cream (9.78%). In Moga district dairies used 50.67% of the milk as fluid milk followed by curd (20.94%), cheese (18.61 %) and cream (9.78%). In the flush season 61.01 % of the milk was used as fluid milk, 17.83% for cheese, 15.36 % for curd and 5.80 % for cream while in lean season 33.89 % was used as fluid milk and 30 % for making curd, 19.87% for cheese and 16.23% for cream. In both the districts milk requirement during the lean period declined for fresh milk and cheese while increased for cream.

| Table 8: Season-Wise Average Daily Milk Procurement, Utilization And Sales Patterns Of Sample Dairies (Quantity: Lts; Price: Rs\ Lt / Kg) | ||||||

| Flush Period | Lean Period | Combined | ||||

|---|---|---|---|---|---|---|

| Particulars | Qty | Price | Qty | Price | Qty | Price |

| Milk Procurement | ||||||

| Ludhiana | 1800 | 14.80 | 1030 | 17.40 | 1415 | 16.10 |

| Moga | 1250 | 14.50 | 770 | 17.40 | 1010 | 15.95 |

| Milk Utilization | ||||||

| Ludhiana | ||||||

| Fluid milk | 1242.00 (69.00) | 477.40 (46..35) | 859.70 (60.76) | |||

| Curd | 228.00 (12.67) | 264.60 (25.69) | 246.30 (17.41) | |||

| Cheese | 255.00 (14.17) | 153.00 (14.85) | 204.00 (14.42) | |||

| Cream | 75.01 (4.17) | 135.00 (13.11) | 105.01 (7.42) | |||

| Moga | ||||||

| Fluid milk | 762.60 (61.01) | 261.00 (33.89) | 511.8 (50.67) | |||

| Curd | 192.00 (15.36) | 231.00 (30.00) | 211.50 (20.94) | |||

| Cheese | 222.90 (17.83) | 153.00 (19.87) | 187.95 (18.61) | |||

| Cream | 72.50 (5.80) | 125.00 (16.23) | 98.75 (9.78) | |||

| Sales of milk products | ||||||

| Ludhiana | ||||||

| Fluid Milk | 1242.00 | 19.60 | 477.40 | 21.20 | 859.70 | 20.40 |

| Curd | 190.00 | 25.00 | 220.50 | 27.90 | 205.25 | 26.45 |

| Cheese | 42.50 | 115.00 | 25.50 | 133.00 | 34.00 | 124.00 |

| Cream | 7.50 | 92.00 | 13.50 | 107.5 | 10.50 | 99.75 |

| Ghee | 1.50 | 160.00 | 0.50 | 180 | 1.00 | 170.00 |

| Butter | 0.50 | 140.00 | 0.25 | 140 | 0.38 | 140.00 |

| Moga | ||||||

| Fluid Milk | 726.60 | 20.10 | 261.00 | 21.80 | 493.80 | 20.95 |

| Curd | 160.00 | 25.00 | 192.50 | 26.70 | 176.25 | 25.85 |

| Cheese | 37.15 | 121.50 | 25.50 | 143.00 | 31.33 | 132.25 |

| Cream | 7.25 | 98.00 | 12.50 | 116.50 | 9.87 | 107.25 |

| Ghee | 1.47 | 160.00 | 0.50 | 175.00 | 0.98 | 167.50 |

| Butter | 0.50 | 140.00 | 0.25 | 140.00 | 0.38 | 140.00 |

| Returns over Operational cost (%) | ||||||

| Ludhiana | 24.82 | 11.04 | 18.72 | |||

| Moga | 25.51 | 10.68 | 19.01 | |||

In Ludhiana district in the flush season 80% of curd, 76% of the fluid milk, 60% of the cheese was sold directly to the consumers and the rest to other retailers such as hotels and restaurants while in the lean season 78% of curd, 74% of the fluid milk and 28.60% of the cheese was sold to consumers and the rest to other retailers. 35.30% of the cream in flush season and 86.20% in the lean season were sold to ice cream parlours. In Moga district 69.39% of fluid milk in flush and 80% in lean season was sold directly to consumers, 80% of curd in both the seasons was sold to consumers and the remaining 20% to other retailers such as hotels and restaurants, 42.26 and 21.60% of cheese in the flush and lean seasons was sold to consumers. Thus an identical pattern was discernible during both the seasons in Moga district for curd while sales of cheese to other retailers were comparatively higher during the lean period. 44.83% and 76% of cream in flush and lean season was sold to other retailers.100% of ghee and butter in both seasons was sold to consumers. This indicated that since dairies sold large share of all the products directly to consumers so demands for the various products lines during both the seasons influenced the milk allocation to the various market segments. The sample dairies were earning marginally higher profits in Moga (19.01%) compared in Ludhiana (18.72%) over the operational cost. This was due to the reason that the labour cost and the fuel cost of the sampled dairies were comparatively lesser in Moga district compared to Ludhiana district. Nearly an identical pattern was discernible in the flush season while in the lean season dairies in the Ludhiana district (11.04 %) were earning marginally higher profits compared in Moga (10.68 %) (Singh & Chandar, 2015).

| Table 9: Season-Wise Average Daily Milk Procurement, Utilization And Sales Patterns Of Sample Sweet-Makers (Quantity: Lts; Price: Rs\ Lt / Kg) | |||||||

| Particulars | Flush Period | Lean Period | Combined | ||||

|---|---|---|---|---|---|---|---|

| Qty | Price | Qty | Price | Qty | Price | ||

| Milk Procurement | |||||||

| Ludhiana | 300 | 17.60 | 280.02 | 19.00 | 290.01 | 18.30 | |

| Moga | 440 | 17.25 | 375.90 | 18.60 | 407.95 | 17.92 | |

| Milk Utilization | |||||||

| Ludhiana | |||||||

| Khoya | 186.63 (62.21) | - | 173.67 (62.02) | - | 180.15 (62.12) | - | |

| Cheese | 45.78 (15.26) | - | 34.16 (12.20) | - | 39.97(13.78) | - | |

| Curd | 31.05 (10.35) | - | 44.35 (15.84) | - | 37.70(13.00) | - | |

| Fluid milk | 20.55 (6.85) | - | 12.41 (4.43) | - | 16.48(5.68) | - | |

| Tea | 15.99 (5.33) | - | 15.43 (5.51) | - | 15.71(5.42) | - | |

| Moga | |||||||

| Khoya | 235.75 (53.58) | - | 217.98 (57.99) | - | 226.87(55.61) | - | |

| Curd | 67.06 (15.24) | - | 72.02 (19.16) | - | 69.54(17.05) | - | |

| Fluid milk | 58.30 (13.25) | - | 28.83 (7.67) | - | 43.57(10.68) | - | |

| Cheese | 45.89 (10.43) | - | 27.67 (7.36) | - | 36.77(9.01) | - | |

| Tea | 33 (7.50) | - | 29.40 (7.82) | - | 31.20(7.65) | - | |

| Sales of milk products | |||||||

| Cheese | 7.63 | 110.00 | 5.69 | 130.60 | 6.66 | 120.3 | |

| Khoya | 31.11 | 110.35 | 28.95 | 120.00 | 30.03 | 115.17 | |

| Sweets | 45.68 | 98.33 | 41.85 | 98.33 | 43.76 | 98.33 | |

| Curd | 24.84 | 25.10 | 35.48 | 26.50 | 30.16 | 25.80 | |

| Moga | |||||||

| Cheese | 7.65 | 112.80 | 4.61 | 134.40 | 6.13 | 123.6 | |

| Khoya | 39.29 | 111.30 | 36.33 | 122.50 | 37.81 | 116.9 | |

| Sweets | 45.00 | 93.33 | 45.00 | 93.33 | 45 | 93.33 | |

| Curd | 53.65 | 25.20 | 57.62 | 26.45 | 55.64 | 25.83 | |

| Returns over Operational cost (%) | |||||||

| Ludhiana | 12.85 | 7.54 | 9.65 | ||||

| Moga | 10.60 | 8.62 | 9.16 | ||||

Figures in parenthesis are percentages to total

Sweet-Makers

Perusal of the Table 9 revealed that the average daily quantity handled by sweet makers was 407.95 litres in Moga district and 290.01 litres in Ludhiana district. It was more in Moga district as compared to Ludhiana district by 28.91%. Average quantity was higher by 31.82% in flush and 25.51% in lean season Milk purchase price in Ludhiana was higher by 2.08% it being 1.99% and 2.11% during the flush and lean seasons. In the Ludhiana district of the total milk procured by the sweet makers only a small fraction (5.68 %) was used as fluid milk and in making tea (5.42%). The remaining was converted into products like Khoya (62.12%), cheese (13.78%) and curd (13%). There was a variation in the quantity of milk utilization for different products in the two seasons. In flush season milk used as fluid milk, Khoya and cheese was comparatively higher while in lean season milk use was comparatively higher for curd. In Moga district, sweet-makers used only 10.68% milk as fresh milk. Sweet-makers used more milk in making Khoya (55.61%) followed by curd (17.05%) and cheese (9.01%). However seasonal patterns over the various products were identical to that in Ludhiana district. This indicated that the demand for various milk products was seasonal in character.

| Table 10: Season-Wise Average Daily Milk Procurement, Utilization And Sales Patterns Of Sample Ice Cream Parlors (Quantity: Lts; Price: Rs\Lt) | ||||||

| Particulars | Flush Period | Lean Period | Combined | |||

| Qty | Price | Qty | Price | Qty | Price | |

| Milk Procurement | ||||||

| Ludhiana | 62.20 | 15.10 | 435.00 | 18.90 | 248.6 | 17 |

| Moga | - | - | 220.10 | 18.60 | 110.05 | 9.3 |

| Cream Procurement | ||||||

| Ludhiana | 1.00 | 90.00 | 7.50 | 110.0 | 4.25 | 100 |

| Moga | - | - | 2.50 | 116.5 | 1.25 | 58.25 |

| Milk Sales Pattern | ||||||

| Ludhiana | 2650.00 (100.00) | - | 18250.00 (100.00) | - | 10450.00 (100.00) | - |

| Own products | 2650.00 (100.00) | - | 18250.00 (100.00) | - | 10450.00 (100.00) | - |

| Consumer | 1054.96 (39.81) | - | 8446.10 (46.28) | - | 4750.53 (43.05) | - |

| Other firms | 1593.18 (60.12) | - | 4033.25 (22.10) | - | 2813.22 (41.11) | - |

| Vendors | - | - | 5951.80 (30.64) | - | 2975.90 (15.32) | - |

| Canteens | 1.85 (0.07) | - | 178.85 (0.98) | - | 90.35 (0.53) | - |

| Products of other firms | - | - | - | - | - | - |

| Moga | - | - | 8950.00 (100.00) | - | 4475 (50.00) | - |

| Own products | - | - | 6266.79 (70.02) | - | 3133.40 (35.01) | - |

| Consumer | - | - | 2686.79 (30.02) | - | 1343.40 (15.01) | - |

| Other firms | - | - | 1178.72 (13.17) | - | 589.36 (6.59) | - |

| Vendors | - | - | 2150.68 (24.03) | - | 1075.34 (12.02) | - |

| Canteens | - | - | 250.60 (2.80) | - | 125.3 (1.40) | - |

| Products of other firms | - | - | 2683.21 (29.48) | - | 1341.61 (14.74) | - |

| Returns over Operational cost (%) | ||||||

| Ludhiana | 0.66 | 60.19 | 31.27 | |||

| Moga | - | 54.95 | 26.42 | |||

Figures in parenthesis are percentages to total

It was further revealed that in both the districts all the sweets were sold to consumers in both the seasons. In Ludhiana district during the flush season 83.24% curd, 72.43% cheese and 5.46% of Khoya was sold to consumers and the remaining 16.76% curd, 27.57% cheese was sold to hotels and restaurants while khoya was utilized in-house for making sweets. Its largest share was used for making milk cake and burfi. During the lean season quantities produced of curd increases while that of all other products declined. In Moga district sweet makers sold comparatively larger shares of curd and khoya to consumers during both the periods while of cheese it was comparatively lesser during the flush period (Meena et al., 2010).

This indicated that the sweet makers, the multi product firms converted milk into several value added products both during the flush and lean periods and over space. Among these, particularly khoya was utilized in house further to convert it to high value products i.e. sweets while curd and cheese met the requirement largely of consumers. The sample sweet makers were earning marginally higher profits in Ludhiana (9.65 %) as compared to Moga (9.16 %) over operational cost. Nearly an identical pattern was discernible in the flush season while in the lean season the sample sweet makers were earning more profit in Moga (8.62%) as compared in Ludhiana (7.54%) over operational cost (Singh et al., 1981).

Ice-cream Parlours

The average quantity of milk and cream handled daily by the sample ice cream parlors was more in Ludhiana district as compared to Moga district Average quantity was higher by 49.40 % and 66.67 % while prices by 1.59 % and 5.58% respectively in the lean season. In the Ludhiana district during flush season i.e. during winter 39.81%of the sales earnings accrued to the parlors through the sales of their products to consumers and 60% to other firms and only 0.07% to canteens while in the lean season i.e. in summer 46% of the earnings was from consumers, followed by vendors (30.64%) followed by other firms (22.10%) and canteens (0.98%). They also gave the discount of 25- 30% to vendors. In the Moga district in the lean season i.e. during summer 70% of the earnings was from the sale of own products and 30% from the sales of products of other firms. The sample ice cream parlors were earning more profit in Ludhiana (31.27 %) as compared to Moga (26.42%) over operational cost in Table 10. Nearly an identical pattern was discernible in lean season (Sarker & Ghosh, 2008). This was a result of no demand during the winter period due to which ice cream parlors remain closed in Moga district

Conclusion

Study revealed that the market giants such as cooperatives (existed earlier) and the MNC (Nestle) have through its integrated marketing initiatives aligned directly with farmers to source major share of milk supplies based upon fat content on priority basis. Dairy farmers sold about 1/3rd milk quantity after meeting their domestic requirements for milk to vendors. Among other firms such as milk vendors, dairies, sweet makers and ice-cream parlours, the latter three focused primarily upon value added product lines. So these firms could exercise individual judgments in total milk allocation to a variety of dairy product mixes during each season. This depended primarily upon the socio economic characteristics of consumers in the target market segments, availability of business networks, physical infrastructure, skilled labour, and etc. as well as seasonal variability in market demands. Relative prices of various product lines reflected the market mechanisms of individual markets and impacted relative profitability of each item thereby milk allocations. All firms in the industry reoriented its business strategies to cope up with dwindled milk supplies during the lean period and sustain profitability. Firms allocated milk to the various products mixes that matched with the seasonal character of industry and consumer preferences. However, compared to the flush period dairy farmers’ profits during the lean season turned negative whereas these remained positive for all other firms, but these stood relatively lower for dairies and sweet makers while higher for vendors and ice cream parlours because of heavy concentration of its demand during this season operating from a Miniscule sized independently operated firms in the unorganized segment of the industry coordinated with its immediate chain partners to source milk supplies and dispose of milk and milk products primarily to consumers.

Since this sub segment of the industry absorbs large chunks of urban and rural population at various levels in the supply chain to meet diverse requirements of urban consumers and copes up with market contingencies through long market learning experiences and stay competitive. It must therefore be strengthened in a predominantly agricultural economy in the emerging economic scenario through various appropriate policy initiatives. This can include capacity building, skill formation and up gradation, extending credit support for building up requisite infrastructure, bringing within the gamut of Food Safety Acts so that it can also induce innovations and grow parallel on equal footing with the major giants.

References

- Badal, P.S., & Dhaka, J.P. (1998). Production, Utilization and Marketing of milk in Bihar: case study of Gopalganj District. Bihar Journal of Agricultural Marketing, 7, 281-85.

- Bogdan, K. (2008). Dairy sustainable development: From production to consumption. In Presentations at the Workshop on Strategy for Vietnam Dairy Industry: Discuss the public and private roles, Hanoi.

- Dhawan, V. (2015). Growth and Performance of Agro Based Industries in Punjab. International Journal of Multidisciplinary Approach & Studies, 2(2). 115-122.

- Gupta, J.P. (1992). Disposal pattern of milk in Punjab. Indian Journal of Dairy Science. 45, 292-93.

- Gupta, M. (2004). Role of women in weaker section economy with Special reference to Dairying-a case study of milk producers belonging to weaker section in Bichpuri block of Agra district(UP) MSc thesis, BRAU, Agra

- Gupta, M., & Kaur, P. (2008). Role of Women in Weaker Section’s Economy with special Reference to Dairying-A case study of Bichpuri Block of Agra District, Indian Journal of Agricultural Marketing, 22(2) 59-64.

- Gupta, M. & Sharma, V. (2009). Indian Dairy Sector Status and Policy Options, Indian Journal of Marketing, India. 39(7), 36-41.

- Iqubal, M.A. (2013). Livestock husbandry and environmental problem. International Journal of Scientific and Research Publication, 3(5), 1-4.

- Kashish, V. (2014). Role of dairying in augmenting income and employment of small holder dairy farmers in Punjab. M.Sc. Thesis (published), Department of Economics and Sociology, PAU, Ludhiana (Punjab).

- Meena, G.L., Jain, D.K., & Chandel, B.S. (2010). Economic analysis of milk production in Alwar district of Rajasthan. Journal of Dairying, Foods and Home Sciences, 29(1), 1-7.

- Singh, B., Singh, R., & Bal, H.S. (1981). Production and pattern of disposal of milk in rural Punjab. Indian Dairyman.

- Singh, R.K.H. & Chandar, A.K. (2015). Impact of dairy cooperatives on income and employment in rural Meghalaya. Indian Journal of Dairy Science, 68, 173-179.

- Sarker, D., & Ghosh, B.K. (2008). Economics of milk production in West Bengal: Evidence from cooperative and non-cooperative farms. East West Journal of Economics and Business, 11(1&2), 132-152.