Research Article: 2021 Vol: 25 Issue: 3S

Technology Based Uop Green Bond Reshaping The Issuance

Shaista Alvi, Amity University Dubai

Citation Information: Shaista, A. (2021). Technology based uop green bond: reshaping the issuance. Academy of Marketing Studies Journal, 25(S3), 1-11.

Abstract

The Green Bonds acts as the prime financial instrument designed for the stakeholders to fund the environmental projects and globally uplift the ecological system. This paper invigorates the various stages involved in the traditional complex life cycle highlighting the challenges encountered in the Use of Proceed Green Bonds (UoP) process. The advent of Blockchain technology of distributive ledger technology is the fundamental pillar of Industrial 4.0. Blockchain technology has revolutionized information exchange, data archiving and provides numerous advantages including building credibility and transparency. The paper proposes for decision making a conceptual schema designed on Design Science Research Methodology (DSRM) by adopting Blockchain technology with the product Smart Contract Transaction, Tokenization, and Blockchain Distributive Ledger Technology (DLT) leading to standardized, digitalized, and automated data exchange process transforming the life cycle of UoP. Hence, to evaluate the proposed conceptual schema, the Framework for Evaluation in Design Science (FEDS) is adopted to seek the viability of the formulated artifact.

Keywords

Green financing, Use of Proceeds Green Bonds, Blockchain Technology, Industrial 4.0, DLT, Smart Contract, Hash, Tokenisation, On-chain.

Introduction

Green financing is transforming the financial lending mechanism with numerous financing product options innovated in the digital era, the Green Bonds (GB) seems to be the most in-demand financial product. There is a paradigm shift to work on greener options by firms, governments, and investors. Green financing has become the savior for many countries to validate the importance of the ecology by incorporating eco-friendly covenants, thereby endorsing a positive impact on the natural resources to save the planet. The financial incentives attached to green financing enable the business to achieve financial gains contributing to a better and greener world. Globally the developed and underdeveloped countries have structured a wide variety of financial products in the field of investment, banking, and insurance. The type of products includes debt, equity, and insurance, for example, sustainable /green syndicated/bilateral loans, GB, green equity, climate change insurance, etc.

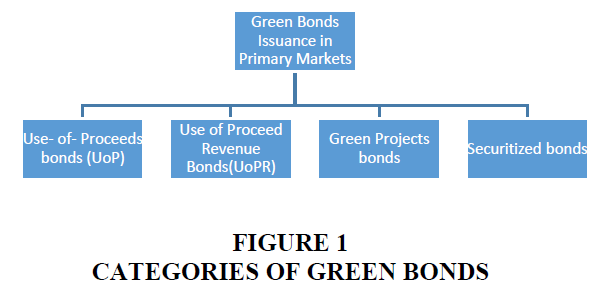

GBs are financial debt instruments issued with a fixed coupon rate to finance/ refinance green projects. GB are mainly divided into four categories based on the usage of cash flow namely ‘Use- of- Proceeds’, ‘Use of Proceed Revenue’, Green Project bonds, and Securitized Bonds Chi et al., (2019) In 2007, the World Bank released the first green bond in the primary market to finance clean energy and energy efficiency projects, in which scientists, financiers, policymakers, development specialists, and investors have essentially worked together by offering new securities in form of Green Bonds to contribute to the environment and greener world SSC/IFC/SECO/CBI. (2021) GB are traded both in the primary market /secondary markets and to give better understanding to investors and issuers, several indices have been established to track the performance of issued GB such as S&P Green Bond Index (SEP), Solactive Green Bond Index, China Bond China Green Bond Index, etc. Each of these Indices has defined the criteria for listing the Green bonds.

The research paper delves into understanding Green financing, its importance, and the various categories of GB. The methodology adopted is to examine and identify the traditional process of issuance of UoP bonds by gathering information from literature review, and market information which enables to highlight the problem areas. Thereafter, the literature review is conducted on the various GB which have been issued on Blockchain in some stages of issuance. Finally, a conceptual framework on Blockchain technology is designed on DSRM and a suggestive model is proposed as a possible solution overcoming the challenges posed by the traditional life cycle of UoP. The model viability is evaluated based on the FEDS research strategy.

Research Objective & Methodology

To put forward that the theoretical framework to be established before the deployment of technology, enabling the reorganization and validation of the information technology. The conceptual system along with the technological systems is acknowledged as a crucial step in materializing the full process development of the process Sandeep Kumar Singh et al. (2021). The methodology adopted for designing the artifact for each of three stages in the UoP Life Cycle is the Design Science Research Methodology (DSRM). To validate the Blockchain-based model the concept of FEDS is followed John Venable et al., (2016). In view that the artifact designed for implementation is stills under the nascent stage, hence the laboratory/scientific testing is infeasible to determine the workability of the module the technique of ‘Technical Risk& Efficacy under FEDS Sandeep, (2021). The real-time use and implementation are not possible as it identifies the technical difficulties in form of controlling variables before software codes are implemented in the software system. Hence the three-step process evolved Step A – Identifying the inefficiencies and perceived solutions by evaluating the literature reviews and available literature/reports of the bond issuance by the stakeholders and the group discussion in form of the unstructured interviews with bankers. Step B- Based on the academic semi-structured interview and also by studying the current issuance of bonds using Blockchain Technology available in reports and literature, an initial framework was designed based on Blockchain Technology. Step C-Semi-structured interviews were conducted in different forums with the bankers and two technocrats for assessing the conceptual system vis- a- vis its perceived efficiency, usefulness, and ease of use. The discussion brought forth the advantage of Blockchain due to limited human interventions that provide trust reduces issuance time and offers transparency. However, it was highlighted that limitations for the conceptual system are based on acceptance of regulatory framework, immunity to the hacking of platform, scalability, and cost-efficiency.

Literature Review

A GB is similar to a conventional bond in terms that it is GB is issued with or without interest and has to be rated for tenure and interest by the credit rating agency. The differentiating feature is that the funds are utilized for special projects which are either for ecological benefits or are environmental. It further has the distinctive attribute, the covenants on the repayment schedule and recourse /no recourse on the issuer. Any issuing organization has to abide by the four standards recording the employment of capital, administering the proceeds of GB, the procedure for assessment of the project by establishing a benchmark, and a system of project appraisal and selection Figure 1.

GB is categorized into four categories as follows: a) UoP bonds–The bond’s proceeds are assigned to green projects with recourse to the issuer. b) Use of Proceed Revenue Green Bonds –The revenue stream generated by the issuing organization is attached as security for the loan, hence it is non –recourse to the issuing organization. c) Green Project Bonds – These are secured by single or multiple green projects with or without recourse to the issuing organization. d) Securitized bonds – The bond is secured by a single or pool of identifying projects, structures, and assets in combination. Chi (2019) et al., the investor while evaluation the investment in GB have a preference for the non-economic factor of GB which includes third-party assessment, green bond principles, CBI certification than the economic factor of bond risk and has more traction from the funders over the bond risk and volatility risk. It is further apparent in the market that green premium is prevalent which means that there is a price difference of the conventional bond compared to GB given that the other terms and conditions remain the same. The evidence from the study indicates that the prevalence of extra cost or green premium is typically for government-issued, investment grade and has standard eligibility criteria et al., (2021). The GB support the project focused on environmental protection, the climate which have increasingly contributed to improving the environment by use of clean energy with the objective of sustainable development particularly decrease in carbon emission Aggarwal (2021). As the traditional GB issuance had inefficiencies in the issuance process, the implementation of Blockchain improves efficiency by standardization of processes, modifying the intermediaries function, and accessibility of information. However, the barriers include legal, regulatory approvals, and access to technology skills Center (2020) Blockchain as an alternative for structuring and facilitating the founding factor of the finance world, i.e. Trust and enumerates relevance includes from issuance, credit rating, compliance to payment, and settlements. The potential hurdles can be legal /commercial and regulators, but as the potential of the technology to have a deeper impact in the future Varma (2019). The author proposes five-level Blockchain architecture to address the complex GB issuance process and implemented it on a private network. Although the architecture was able to provide a solution on the transparency, improved auditing function, increase efficiency resulting in cost-effectiveness, however, the proposed architecture has limitations in terms of security mechanism, implementation of proof of concept, payment, and settlement, and scalability Malamas (2020).

UoP Full Life Cycle

Malamas et al. (2020); SSC/IFC/SECO/CBI; Van et al., (2019); New FinTech applications in bond markets) (2021).

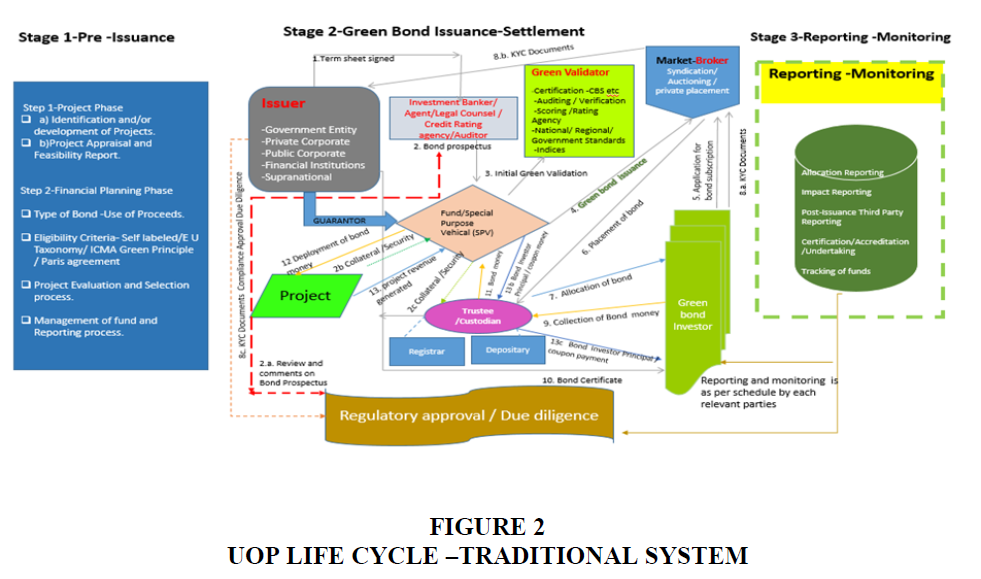

The UOPs are issued wherein the project’s proceeds are assigned to the debt with the recourse to the obligor for the debt obligation. Even though the entire project’s revenue is earmarked for the bond in addition it is guaranteed by the issuer’s financials. The issuer may opt for issuance directly under its entity or Special Purpose Vehicle (SPV) for syndication, auctioning, or private placement. In the case of the issuer directly issuing the UoP, all the cash flow is under the direct control of the Issuer. The issuance of UoP in traditional methodology in the primary market is divided into three stages as follows: Stage One–Pre- Issuance- This stage is mainly when the issuer is deciding on the issuance of the type GB, tenor, expected pricing, jurisdiction, and projects to be developed, the process of selection, evaluation, monitoring, and reporting.

Stage Two –UoP issuance and Settlement –This stage is wherein the third parties are on-boarded for floating the bonds, legal documentation is signed, the UoP are floated in the market, and clearing and settlement of cash flow from/to bond investors are processed.

Stage Three – Reporting and Monitoring –This is an ongoing aspect from the issuance of UoP to appraise the relevant stakeholders on the progress of the project which is both quantitative and qualitative reporting and monitoring. Each of these stages is not necessarily in chronological order and as the process progresses, these stages may run parallel/alternatively or in a sequence which is detailed below.

Traditional System -Stage one –Pre issuance of UoP

At this stage, the issuer is deciding on the issuance of the type of Green Bonds, tenor, expected pricing, jurisdiction, projects to be developed, the process of selection, evaluation, monitoring, and reporting. There are two main subdivisions Figure 2.

Project Phase

Appraisal of the project –Ongoing or New project –The issuer can decide to select an ongoing project for financing to complete the project or has the option of selecting a new project. Project Feasibility-The issuer then engages with the technical experts to assess the technical capability, budget, legality, operational feasibility, and timelines for completion.

Financing Planning Phase

1. Decision on Bond Category –The issuer has to decide based on the projects and other critical criteria which type of bonds to be issued. In case they decided on the UoP category of bond in which case funders have recourse to the issuer along with the project’s proceeds.

2. Compiling issuer information- The issuer has to provide the historical evidence of previously issued bonds, the change of business, the pledging security to be provided for the bond, the financials available according to the proposed jurisdiction of the issuance of the bonds.

3. Eligibility Criteria for UoP - Issuers can designate a bond as green and disclose their qualifying criteria through the bond framework. However, there are some standards which include ICMA Green Bond Principles (GBPs), Paris Agreement, Green Bond indices, sector-specific standards, Sovereign frameworks to EU Taxonomy.

4. Framework for Project Assessment and Selection process- The issuer outlines governance principles and project selection process.

5. Framework for Management of funds and Reporting process- The issuer outlines the metrics for monitoring the finances, use of proceeds, payment and settlement process, reporting tenor, and metrics for reporting.

The traditional bond issuance as per Figure 2 depicts that Stage 1 –Project Phase and Stage 2 Financing Planning Stage.

Challenges in stage 1: As explained above the two steps in which the issuer interacts with various parties and prepares the documentation to be submitted with the application to the Investment bank which then in consulting with other parties legal counsel, Credit Rating Agency and Auditor issues/negotiates confirmed terms sheet. These processes have challenges as they are time-consuming as requiring human intervention and the information is available to limited people, which has to be received from various parties/ sources to review ensuring that the term sheet is agreed upon and signed. The communication between the parties is either by email or paper or chats, hence there is no track of information for the future and /or restricted to the communicators. The process involves the creation, sharing, review, and approval of information between multiple mutually unreliable stakeholders on multiple occasions, resulting in duplication and delays.

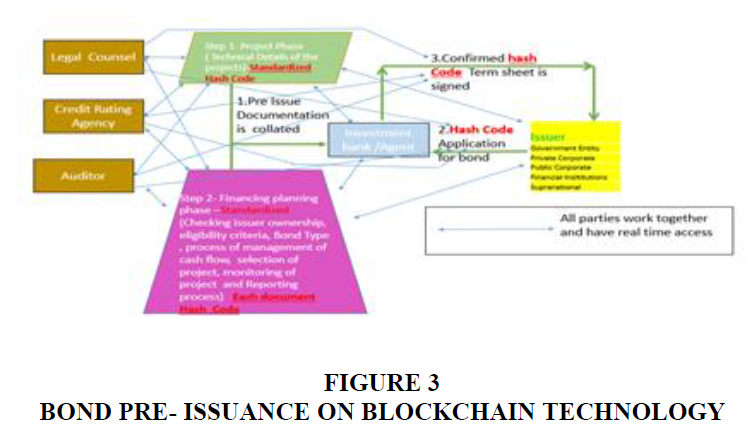

How Can Blockchain address the Challenges in Stage One?

On the Blockchain DLT, all parties have access to the information in real-time and this facilitates review and negotiation in real-time. The document is put through a secure hash algorithm then stores the hash in a block. The parties provide the standard documentation which meets the necessary criteria, therefore, reduces the time consumed in negotiation; therefore, time is saved while preparing documents for bond prospectus and term sheet. Furthermore, all the documents entering and leaving the Blockchain DLT ecosystem are authenticated and validates the documentation. To store multiple documents the hashes can be put into a distributed hash table which is then stored on-chain. As the documentation is easily accessible on the network it provides maximum transparency in document processes – and it is easy to obtain the relevant legal and regulatory approval Figure 3.

Traditional System -Stage Two –UoP Issuance & Settlement Stage

This stage is wherein the third parties are on-boarded for floating the bond, legal documentation is signed, UoP is floated in the market, and clearing and settlement of cash flow from/to bond investor. There is a two-phase process under Stage two which includes the first phase being structuring and second phase Clearing, settlement of UoP.

UoP Issuance

Is the process wherein third parties are appointed i.e., Investment Banker, Credit Rating Agency, Lawyers, Trustee, Custodians, Brokers, etc. for issuance/structuring of bond, management of funds/cash flows, listed /unlisted bonds, and development of projects. The chronological order is as follow.

Phase 1- Structuring of UoP –

The following are steps undertaken in this stage of structuring the bonds:

1. The term sheet is finalized and signed by the issuer in consultation with the Investment banker. The Investment banker appoints various intermediaries.

2. Legal counsel draft the Use- Of –Proceeds Green Bonds prospectus/agreements, Auditor to review financial information, the Credit rating agency rating is on the issuer /SPV/ entity.2.a.Regulatory approval/comment is received on the UoP prospectus.

3. Collateral and security are defined as transferred from project ownership to Fund /SPV/Entity ownership.

4. Documentation is prepared and submitted and registered with custodian /trustees for the beneficial interest of prospect bond investors.

5. Initial Green Validation (optional) depending on the terms and conditions laid while structuring the UoP.

6. The UoP is launched based on agreed market (syndication, auctioning, or private placement), jurisdiction (global or Sovereign) were in its market to various market intermediaries.

7. The UoP investors provide the application for subscribing to the Bond.

8. Based on the application received from UoP investors, the market broker’s information, the trustees /custodian collate the subscription value of the UoPs which is informed to the issuer and the investment banker.

9. Allocation of UoP is by the issuer working together with investment banker trustee /custodian to the market intermediaries and /or UoP investors.8.KYC (Know Your Customer) process /documentation the customer provides the KYC details which include personal identification, enabling to conduct due diligence by the issuer and compliance authorities periodically and ensure compliance with the regulations.

Phase 2 -Clearing, settlement of UoP

The following steps are undertaken for this stage:

10. Collection of UoP funds from the investor in an escrow account maintained by the Trustee/ Custodian.

11. Bond Certificates are registered and issued in favor of the bondholders.

12. The Bond money is released by the custodian based on documentary evidence for the development of the project to the Fund /SPV/Entity.

13. The project is developed or refinanced for completion based on the documentary evidence provided by the relevant project authorities.

14. The project's revenue is generated and collected in Fund /SPV/Entity Debt Service Reserve Account with the Trustee/Custodian. The Bond investors are paid the coupon amount as per the agreed schedule and Bond principal amount at the maturity of the Bond Figure 2.

Challenges in Stage Two

As per the traditional method the various parties work in silos and are striving to reach an agreement with each step in the process is time-consuming and is subject to error, delays, and fraud due to the complexities and the numerous parties involved.

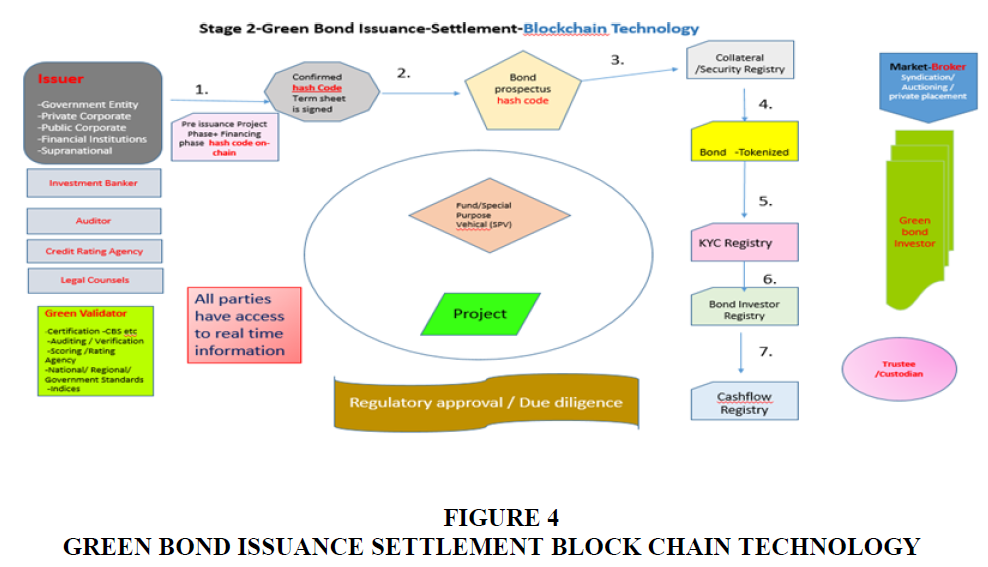

How Can Blockchain Address the Challenges in Stage Two?

To overcome these challenges Block chain technology can be applied as per Figure 4 as follows:

1. Collateral /Security Registry –Digital security is held with details of the ownership.

2. Bond issuance -The issuer tokenizes the digital bond on the Block chain. These tokens can be bought and the owner which gives ownership. As the nature of tokens is that it is divisible hence are available to large investors with ease.

3. KYC-The network includes intermediaries who are licensed and issuer. They are registered on the platform based on government-issued identity documents as well as critical documents.

4. For the Bond investor to subscribe to the KYC registry has to be completed by licensed intermediaries by uploading relevant documents.

5. KYC registry is done on authentication and validation after Compliance approval is provided, the investor is onboarded.

6. Investors can buy the allocated Bonds on payment through token digital currency/ies. The authorized signatory signs the legal contract and it is converted into smart contracts the principle of "if-then" applies which automatically triggers the transaction and runs on the Block chain. The Bond investor registry is recorded and reconciled and is updated after every transaction and has time-stamped.

7. Cash Registry –Cash is Tokenized and Smart Contracts are developed which makes the payment of coupons and principal based on the investor registry. The funds which are allocated for the project development are based on tokenization which is released based on consensus mechanism/ agreed mandatory requirements. Funds are transferred to the beneficiary account by the approved custodian /gatekeepers to accelerate the clearing and settlement process Figure 4. Block chain DLT comes into the role to bring auditable and traceable systems by enabling time-stamped Cryptographic Records, which will be accessed by all members of the network at all the time.

Traditional System -Stage Three –Reporting and Monitoring

This is an ongoing aspect from the issuance of UoP to appraise the relevant stakeholders on the progress of the financed project(s), which has both quantitative and qualitative reporting and monitoring.

A key aspect of UoP is the monitoring and reporting principles, including the Green Mapping Methodology involved. Reporting on relevant impact metrics is defined in the pre-issuance stage, which requires identifying project objectives, indicators, metrics, and monitoring requirements. These reports are on the development and environmental actual and projected impact both qualitative and quantitative. The independent and compliance review is undertaken about the pre-agreed Green Bond framework and the progress is reported on the pre-agreed schedule.

Challenges in Stage Three

In the traditional method of bond reporting and monitoring, information is fragmented with the respective maker and checker of the information, and only when the reports are published do the stakeholders have access to information which are normally historic Figure 2.

How Can Blockchain Address the Challenges in Stage Three?

A. Compliance, audit, and regulatory approval: The auditors, compliance officers, and regulators through the node observation have real-time access to the entire issuance and settlement of UoP. This ensures the investigation and maintenance of records are available for legal, audit, and compliance approvals.

B. The credit rating agency, green validator: With the entire transaction history available and financials on the Blockchain DLT, it is easier for the credit rating agency to access information and provide the rating. The credit bureau gains the access to the data feeds it into its risk model, and verify for themselves that the way the model rated a protocol was accurate. The progress of the project is real-time updates facilitating the green validator certification without the time lag initial and on reporting schedule requirement.

C. Bond investors: Transparency of information, reporting, and monitoring enable the investor to draw confidence in the bond. Investors seek greater transparency while collecting the information on the bonds. These include primarily the use-of-proceeds, project assessment criteria, fund management, and issuer’s reporting on the Green Bond.

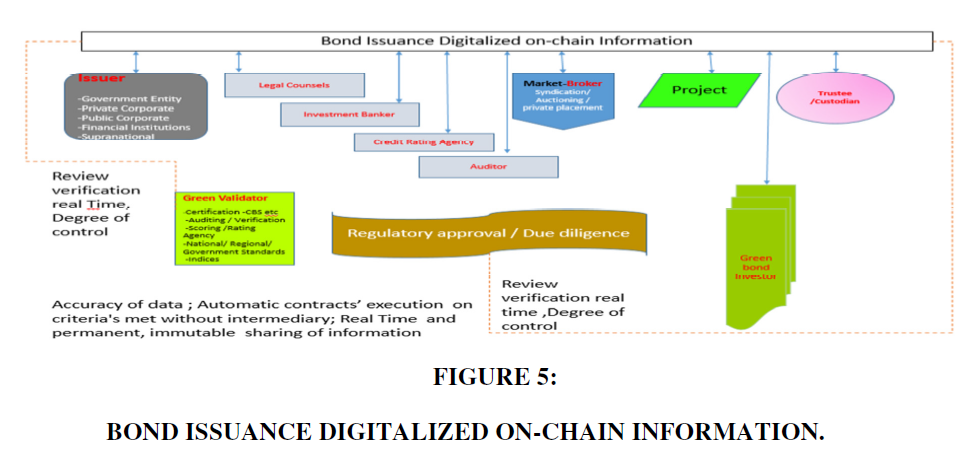

D. Issuer: With the tokenization of the bond and smart contract for settlements, the issuer has real-time information on the investor position. The on-chain reconciliation, clearing, and settlement optimize liquidity management and significantly reduce administrative costs. The streamlined workflow facilitates the issuer for better time & work management Figure 5.

Discussion, Limitation, and Conclusion

Blockchain technology is implanted in the network application wherein the involved stakeholders have access to every required record on the screen at the click of the button. The conceptual model evaluation indicated that the model provides a new dimension that improves the current complex bond issuance. The peer–to–peer monitoring mechanism ensures the accuracy and authenticity of records as all the attention of participants ensures credibility and trust in the records. In addition, the smart contract empowers the parties to transact easily with the characteristics of self-execution. The suggested implementation of Blockchain technology DLT, Tokenization, smart contract to UoP should have a ripple effect on the market. The research has limitations due to time constraints, limited resources, and technical implementation. To implement Blockchain technology, the sovereign states have to come forward for unified regulations involving Central Banks, Legal and Regulatory Bodies thereby enhancing the acceptance of the Blockchain technology legally aligning with the legislation in all the concerned jurisdictions. Further research is suggested to understand the implication on the market players, and also the architectural algorithms on Blockchain Technology to be developed based on the proposed conceptual model for implementation eliminating the traditional challenges posed to UoP. It may be concluded that Blockchain technology is an innovation that is still at a nascent stage of its life cycle, therefore, enormous facets to be explored ensuring the apt permutation & combination to support the end-to-end implementation of Blockchain technology to redefine the life cycle of UoP Green Bond.

References

- Aggarwal, Shalini & Pathak, S. (2021). Green Bonds: A Catalyst for Sustainable Development. Journal of Contemporary Issues in Business and Government. 27. 2633-2651.

- Center, F.S.B. (2020). The Role of Blockchain for the European Bond Market. Medium. https://fsblockchain.medium.com/the-role-of-blockchain-for-the-european-bond-market-ce4ca0362f67#:%7E:text=Blockchain%20technology%20has%20demonstrated%20its%20massive%20potential%20to%20enhance%20the%20current%20outlook.&text=During%20the%20bond%20issuance%2,+process,syndicate%20members%2C%20and%20investment%20banks

- Chi, T., Hieu, L., Hoang, T., Hanh, A., Nguyen, & Chuc A.T. (2019). Sustainable Development of the Green Bond Market: Study Case From Vietnam. 6. 119.

- HSBC. (2019). Blockchain Gateway for Sustainability Linked Bonds. https://www.greenfinanceplatform.org/research/blockchain-gateway-sustainability-linked-bonds

- John V., Jan., P.H., & Richard, B. (2016) FEDS: a Framework for Evaluation in Design Science Research, European Journal of Information Systems, 25:1, 77-89.

- MacAskill, S., Roca, E., Liu, B., Stewart, R., & Sahin, O. (2021). Is there a green premium in the green bond market? Systematic literature review revealing premium determinants. Journal of Cleaner Production, 280, 124491.

- Malamas, V., Dasaklis, T., Arakelian, V., Chondrokoukis, G. (2020) A Block-Chain Framework for Increased Trust in Green Bonds Issuance (2020). Available at SSRN: https://ssrn.com/abstract=3693638 .

- New FinTech applications in bond markets. (2021) (n.d.). https://Www.Icmagroup.Org/. Retrieved July 13, 2021, from https://www.icmagroup.org/Regulatory-Policy-and-Market-Practice/fintech/new-fintech-applications-in-bond-markets/

- Sandeep, K.S., Mamata, J., Diptiman, D., & Suman, D. (2021) A conceptual model for Indian public distribution system using consortium blockchain with on-chain and off-chain trusted data. Information Technology for Development, 27:3, 499-523.

- SSC/IFC/SECO/CBI. (2021) (n.d.). How to Issue Green Bonds, Social Bonds, and Sustainability Bonds. Ifc. Retrievedfrom https://www.ifc.org/wps/wcm/connect/region__ext_content/ifc_external_corporate_

- site/east+asia+and+the+pacific/resources/how+to+issue+green+bonds%2C+social+bonds+and+sustainability+bonds

- Van, D., Wansem, Patrick B.G., Jessen, L., Rivetti, D., (2019). Issuing International Bonds: A Guidance Note (English). MTI Discussion Paper; no. 13 Washington, D.C.: World Bank Group. http://documents.worldbank.org/curated/en/491301554821864140/Issuing-International-Bonds-A-Guidance-Note

- Varma, J.R. (2019). Blockchain in Finance. Vikalpa: The Journal for Decision Makers, 44(1), 1–11.