Review Article: 2023 Vol: 27 Issue: 6S

The Advancing use of Fintech Services among Indian Adults: A Study Using UTAUT Model

Renu Sharma, Guru Gobind Singh Indraprastha University

Trishali Khanna, Guru Gobind Singh Indraprastha University

Shikha Mehmi, Amity University

Citation Information: Sharma, R., Khanna, T., & Mehmi, S. (2023). The advancing use of fintech services among indian adults: a study using utaut model. Academy of Marketing Studies Journal, 27(S6), 1-13.

Abstract

The fintech revolution has been facilitated by the explosion of digital payments in India. Digital form of payment has swiftly replaced traditional cash-based payment systems during the past few decades. In India, this ecosystem has a significant amount of potential to expand. Government of India and RBI supported reforms are intended to increase the digitization and user-friendliness of the country's Fintech growing industry. The objective of conducting this study is to investigate the impact of UTAUT components on the behavior intention of adults to use Fintech services. In this study the primary data is collected through a questionnaire from 246 respondents. The non- probability sampling technique is used in data collection. Software SmartPLS 4 is used to check the validity and reliability of the data and testing the UTAUT model for the use of Fintech services among adults. The result of the study reveals that Social Influence (SI) and performance expectancy (PE) are significantly predicted the behavioral intention to use Fintech services among adults. The behavior intention to use is positively associated with the use behavior of the respondents.

Keywords

Fintech, Digital Financial Services, Adults, Utaut Model.

Introduction

Technology has undergone a fast transition over the past 50 years, which undoubtedly has an impact on all aspects of the economy by significantly strengthening production, quality competitiveness and scientific advances. One of the prominent developments is the provision of financial services through digitalization. The financial services sector is being transformed by the recent, rapid development of FinTech, which includes loan, payment, and investing services. Furthermore, these advancements are continuously evolving the manner through which consumers interact with businesses and each other.

The words "finance" and "technology" are combined to form the phrase "FinTech," which denotes the application of technology to enhance financial activities, including services, goods, or anything linked to finance to clients through simpler and quicker means (Duma & Gligor, 2018).

Digital finance has increased the accessibility of financial services to industries other than finance. Like clean energy, agriculture, transportation, water, health, and education. In addition to facilitating access to financial services, it can improve financial inclusion in an economy. Due to the fact that 50% of people in developing nations own a mobile phone and may readily access digital financial services due to their mobile device (World Bank, 2014).

"Digital access to and usage of formal financial services" is a definition of digital financial inclusion (Lauer and Lyman, 2015). "Increasingly more financial services, such as You can access and receive payments, credit, savings, remittances, and insurance. utilizing digital channels that allow for the storage and exchange of value in digital form without the requirement for paperwork or in-person communication. Mobile financial services, such as Mobile wallets, mobile money and transfers, and mobile banking all play a crucial role in financial services available online."

As per TRAI reports, Internet customers climbed up by 225%, from 238.71 million to 776.45 million. A staggering 228% increase brought the number of rural internet subscribers from 92.18 million to 302.3 million. Urban internet users climbed by 171%, from 175.21 million to 474.11 million. Rural areas are seeing a considerably larger rise in internet subscribers than urban areas. The telecom services sector's gross revenue increased by 8.13%, from Rs. 2,33,815 crores in FY 2013–14 to Rs. 2,52,825 crores in FY 2019–20. The telecom sector's GDP contribution increased from 6.1% in 2014 to 6.5% in 2019. According to media accounts, during the COVID-19 epidemic, the telecom sector facilitated 30% of the GDP.

The theory underlying the expanding notion of financial inclusion suggests that the drive toward financial inclusion has the potential to reduce poverty. For this reason, governments around the world are concentrating on improving financial inclusion because it can reduce poverty and bring about both financial and overall well-being in the lives of these people. The demand side and supply side are the two dimensions on which the financial inclusion framework is based. The demand side deals with customers and their needs and requirements, whilst the supply side deals with financial service providers including banks, financial institutions, FinTech firms, etc. Lack of knowledge, inadequate financial literacy, lack of digital literacy, and restricted access are the key demand-side challenges to providing financial services to the poor.

With the advent of UPI and the PM Jan Dhan Yojana (PMJDY), significant portion of the unbanked population have already plunged the banking system. India has emerged as one of the largest and fastest growing markets in terms of the population of digital consumers as more and more citizens there adopt a lifestyle made possible by digital technology. By 2025, there will likely be 900 million digital users living in India, according to the current trend (KPMG Report 2022). Financial inclusion can be successfully achieved with the use of digital platforms, which will speed up the process. As technology and ICT infrastructure advance, banks are expanding their presence in rural areas and helping the local populace. Even though India has a large and robust financial infrastructure, consumers still need to travel great distances to access bank branches. It may be effective in this situation to use digital technologies to increase financial inclusion.

Emerging data also indicates a plethora of benefits associated with economic development and digital financial inclusion. According to the Global Findex Report 2021, In 2021, 76% of adults worldwide had an account with a bank or other regulated organisation such a credit union, microfinance organisation, or mobile money service provider. From 51 percent of people to 76 percent of adults, account ownership climbed by 50 percent globally between 2011 and 2021. In developing economies, the gender gap in account ownership has shrunk from its long-standing level of 9 percentage points to 6 percentage points at present. The outbreak of COVID-19 upsurged the use of digital payments. The percentage of adults who now use digital payment methods has significantly increased. For instance, more than 80 million adults in India made their first payment to a digital merchant during the epidemic.

This research broadens our understanding of how elders in our culture accept and use digital financial tools. By analyzing behavioural intention toward various technologies in diverse cultural contexts and highlighting findings from other studies, it explores behaviour toward technology adoption. In order to identify elements that affect behavioural intents to utilise technology to govern user bhaviour, several theoretical models have been examined. The Technology Acceptance Model (TAM) (Davis 1989), the Theory of Planned Behaviour (TPB) (Ajzen, 1991), the Theory of Reasoned Action (TRA) (Fishbein and Ajzen 1975), the Combined-TAM-TPB model (C-TAM-TPB) (Taylor and Todd 1995), the Motivational Model (MM) (Davis et al., 1992), the Innovation Diffusion Theory (IDT).

In order to create the UTAUT model, Venkatesh et al. (2003) amalgamated constructs, namely performance expectancy, effort expectancy, social influence, facilitating conditions, behavioural intention to use the system, and usage behaviour.

Performance Expectancy (PE) refers to the degree to which a person expects that using an information system will enable them to perform better.

Effort Expectancy (EE) refers to how simply a person accesses an information system.

Social Impact (SI) refers to how strongly someone feels that adopting new technology can raise their position and prominence within the society.

Facilitating Conditions (FC) refers to how much people believe organizations and technological tools facilitate their usage of information systems.

Behaviour Intention (BI) is the respondent's acknowledgement of the MaaS service without considering the usage and implementation circumstances.

Attitude toward using technology (BU) is the user's willingness and convenience work together to influence usage behaviour.

Review of Literature

(Al-Qkaily, et al., 2022) The purpose of this study is to identify the variables that affect the rate at which digital financial services are adopted using extensive technique of UTAUT2. By collecting data from 270 respondent and analyzed using PLS-SEM. The findings showed that the hypothesized factors—subjective norm, performance expectations, price value, perceived security, and perceived privacy—have a significant and positive influence on behaviour intentions to use digital financial services platforms, while financial awareness was found to moderate some specific relationships.

(Gautam, et al., 2022) This study has made an attempt to examine into the impact of financial technology on the level of digital literacy among residents of Indian states and UTs, taking into account variables like the number of ATMs deployed, the quantity of KCCs, and the number of KCCs. Additionally, the moderating impact of poverty is examined in relation to this connection. The final results demonstrate the various effects of every study component used. An investigation has revealed a negative association between the use of ATMs and literacy rates. Second, there is a positive correlation between the quantity of KCCs and literacy rate as well as between the number of KCCs and literacy rate. The findings also imply that technical infrastructure is the key factor in improving literacy status

(Rauniyar, Rauniyar, & Sah, 2021) the two-dimensional relationship of this study concludes that FinTech services enhance Digital Financial Inclusion and so does financial inclusion promote digital services and the FinTech sector. Despite the fact that FinTech is seen as a critical requirement for the current digital finance environment, there are a number of important concerns that can impede the DFI. One of the main obstacles for DFI is the large population living below the severe poverty line who lacks basic necessities like smartphones and the internet needed to open the door to access to financial services. Additionally, one of the main obstacles to implementing FinTech for DFI is the lack of trust and confidence among clients in using financial e-services as a result of cyberattacks without rigorous regulatory constraints. These obstacles to financial inclusion must be overcome in an effective and efficient manner.

(Beck, 2020) This paper provides an overview of current advancements in technologically driven financial innovation and their impact on financial inclusion. Recent financial advances offer huge opportunities, but they also carry potential concerns.

(Kaur, 2019) Although the Indian fintech ecosystem is still in its infancy, there is a lot of room for expansion. The Fintech business is stimulated by numerous government programmes including Jan Dhan Yojana, UPI, and Aadhaar number. The financial services industry is expected to be disrupted by fintech systems. Regulators, though, must take the lead in this situation. It's critical to structure rules in a way that protects consumers and advances the ecosystem. Opportunities for this industry are being created by India's enormous population, young entrepreneurs, technological advancements, and those who are being introduced to banks through government initiatives.

(Dwivedi, 2019) The researcher has examined the attitudes of organisational working women with particular reference to cities in Northern India. Examined their behaviour with regard to digital financial services, assessments of their financial and digital literacy levels, and their involvement in the financial system and concluded that attitude of organizational working women is positive towards the digital financial services, Behaviour of the organizational working women towards digital financial services are also positive, the financial literacy level of women is also high.

(KANDPAL & MEHROTRA, 2019) Concluded customers are less inclined to accept new technology since they have confidence and trust in the existing banking system. New technologies won't be successful until users are satisfied with security and privacy concerns. Even if it is simpler, it still takes time to gain the clients' trust. and less expensive than conventional techniques.

Objectives of The Study

Assessing the use of digital financial services was the main objective of the questionnaire study conducted among 246 people, aged 35 and above. This study addressed the following two research objectives:

1. To investigate the impact of the UTAUT components - Performance Expectancy, Effort Expectancy, Social Influence, and Facilitating Conditions on adult's behavioural intentions to use digital financial services.

2. To investigate how these constructs are interconnected.

Research Model

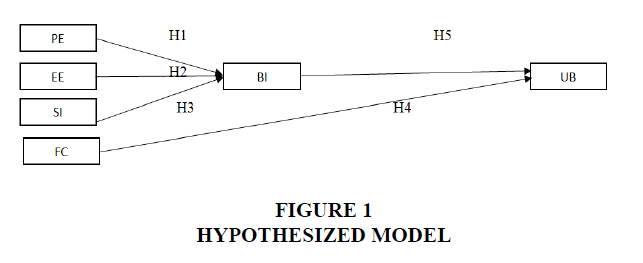

The purpose of this study to assess the strength of the predictors PE, EE, SI and FC on people intention to accept and use financial services. The factors that may influence behavioral intention of the respondents to use financial services are shown in Figure 1.

Performance Expectancy

As per (Venkatesh, Morris, Davis, & Davis, 2003), Performance Expectancy is defined as “the degree to which an individual believes that using the system will help him/her to attain gains in job performance”. Moreover the literature clearly exhibits that performance expectancy has a major significant relationship with intention to use (Wijaya, Cao, Weinhandl, Yusron, & Lavicza, 2022) (Al-Qkaily, et al., 2022), (Nodhoff, et al., 2020), (Gupta & Arora, 2020), (Šumak & Šorgo, 2016) ,(Maillet, Mathieu, & Sicotte, 2015). Thus, based on this background, following hypothesis was proposed:

H1: Performance expectancy positively influence the behavior intention of Indian adults to use financial services.

Effort Expectancy

(Venkatesh, Morris, Davis, & Davis, 2003), defined Effort Expectancy as “the degree of ease associated with the use of the system” Further, Researches clearly demonstrates that Effort Expectancy and Intention to use have significant relationship (Wijaya, Cao, Weinhandl, Yusron, & Lavicza, 2022), (Gupta & Arora, 2020), (Dwivedi, Rana, Clement, & Williams, 2019), (Maillet, Mathieu, & Sicotte, 2015), (Attuquayefio & Addo, 2014). This discussion leads to second hypothesis:

H2: Effort expectancy positively influence the behavior intention of Indian adults to use financial services

Social Influence

(Venkatesh, Morris, Davis, & Davis, 2003), defines Social Influence as “the degree to which an individual perceives the importance of others to believe that he/she should use the new system”. Also, the researches amply demonstrates that the relationship between Social Influence and Usage Intention is highly significant (Wijaya, Cao, Weinhandl, Yusron, & Lavicza, 2022), (Al-Qkaily, et al., 2022), (Singh, Sinha, & Liébana-Cabanillasc, 2020), (Šumak & Šorgo, 2016). In light of this context third hypothesis is proposed:

H3: Social Influence positively influence the behavior intention of Indian adults to use financial services

Facilitating Conditions

(Venkatesh, Morris, Davis, & Davis, 2003), describes Facilitating conditions as “the degree to which an individual believes that an organizational and technical infrastructure exists and will help him/her to use the system”. A substantial significant relationship between Facilitating condition and Usage Intention, as well with Usage Behaviour is further demonstrated by the literature (Nodhoff, et al., 2020), (Gupta & Arora, 2020), (Sobti, 2019), (Šumak & Šorgo, 2016) , (Maillet, Mathieu, & Sicotte, 2015) Accordingly, the fourth hypothesis was put forth in light of this background:

H4: Facilitating conditions directly influence the usage behaviour of Indian adults for financial services.

Behaviour Intention

Likewise, research conclusively indicates a significant relationship between use behaviour and Behaviour Intention (Wijaya, Cao, Weinhandl, Yusron, & Lavicza, 2022), (Purwanto & Loisa, 2020), (Singh, Sinha, & Liébana-Cabanillasc, 2020), (Gupta & Arora, 2020), (Sobti, 2019), (Dwivedi, Rana, Clement, & Williams, 2019), (Šumak & Šorgo, 2016), (Luarn & Lin, 2005). Given this background, the following fifth hypothesis was proposed:

H5: Behavioural intention directly influences the use behaviour of Indian adults for financial services.

Participants

Sample and Measures

For the purpose of this study, primary data has been collected online through Google forms. A Questionnaire was prepared in two sections and sent to 300 people through emails. The first part of the questionnaire was focused on the demographic information of the respondents e.g., gender, age, highest qualification and monthly income. The second part of the questionnaire was focusses on 22 items of six constructs used in the study namely performance expectancy, effort expectancy, social influence, facilitating conditions, behavior intention and use behavior of the respondents for digital financial services. Only 246 complete questionnaires are considered for the analysis in the study. The non-probability sampling technique was used for data collection. The collected data was analyzed using SPSS and SmartPLS 4 software. The study was conducted from August 2022 to October 2022 period.

This study consists of 6 variables with 22 items. The UTAUT model consists of six main constructs, namely performance expectancy (“PE”), effort expectancy (“EE”), social influence (SI), facilitating conditions (FC), behavioral intention (“BI”) to use the financial services, and usage behavior. All the responses are measured on a 5-point Likert scale ranging from 1 – Strongly Disagree to 5 – Strongly Agree.

Table 1 shows the demographic profile of the respondents. Among the 246 total respondents, 39% were males and 61% were female respondents. In terms of age group majority of the respondents were young of 35 -45 years of age group (66% approx.) whereas 17% and 14.6% of the respondents were of the age group of 45-55 yrs. and 55 – 65 Yrs. respectively. However only 6% respondents are having above 65yrs of age. Among 246 respondents, majority of them were graduates (61%), followed by 12th pass (24.4%) and post-graduates (14.6%). In terms of the monthly income of the respondents, majority of them (26.8%) belong to Rs. 20,000 – 40,000 and Rs. 40,000 – 60,000 categories.

| Table 1 Demographic Profile Of The Respondents |

||

|---|---|---|

| Frequency | Percentage | |

| Gender | ||

| Male | 96 | 39 |

| Female | 150 | 61 |

| Age group | ||

| 35-45 | 162 | 65.9 |

| 45 -55 | 42 | 17.1 |

| 55 -65 | 36 | 14.6 |

| above 65 | 6 | 2.4 |

| Highest Educational Qualification | ||

| 12th Pass | 60 | 24.4 |

| Graduate | 150 | 61 |

| Post-Graduate | 36 | 14.6 |

| Monthly Income | ||

| less than 20,000 | 6 | 2.4 |

| 20,000 - 40,000 | 66 | 26.8 |

| 40,000 - 60,000 | 66 | 26.8 |

| 60,000 - 80,000 | 36 | 14.6 |

| 80,000 - 1,00,000 | 36 | 14.6 |

| More than 1,00,000 | 36 | 14.6 |

Source: Primary Data

Data Analysis and Results

This study uses SmartPLS with structure equation model to test the hypothesis and to establish the relationships among variables. The justification of using Smart – PLS is that

(1) It can be used for hypothesis testing even if the distribution is not normal,

(2) It can be used for a small sample size

The descriptive statistics of all items are summarized in Table 2. The demographic variables – gender, age, highest qualification and monthly income are considered to be controlled variable in this study.

| Table 2 Descriptive Statistics |

|||||

|---|---|---|---|---|---|

| Items | Statements | Mean | Standard deviation | Kurtosis | Skewness |

| PE1 | I find the digital financial services useful in my daily life. | 4.537 | 0.666 | 0.048 | -1.131 |

| PE2 | Using the digital financial services increases my chances of achieving things that are important to me. | 4.293 | 0.773 | 0.205 | -0.879 |

| PE3 | Using the digital financial services helps me accomplish things more quickly. | 4.488 | 0.667 | -0.273 | -0.947 |

| PE4 | Using digital financial services platforms could increase my productivity. | 4.439 | 0.664 | -0.496 | -0.779 |

| EE1 | Learning how to use the digital financial services is easy for me. | 4.146 | 0.843 | -0.012 | -0.775 |

| EE2 | My interaction with the digital financial services is clear and understandable. | 4.268 | 0.827 | 0.624 | -1.057 |

| EE3 | I would find digital financial services platforms easy to use. | 4.268 | 0.938 | 0.142 | -1.096 |

| EE4 | It would be easy for me to become skillful at using digital financial services platforms. | 4.317 | 0.922 | 0.527 | -1.235 |

| SI1 | People who are important to me think that I should use digital financial services platforms. | 4.341 | 0.815 | 0.001 | -0.976 |

| SI2 | People who influence my behavior think that I should use digital financial services platforms. | 4.244 | 0.82 | -0.372 | -0.746 |

| SI3 | People whose opinions I value the most will prefer that I use digital financial services platforms. | 4.195 | 0.862 | -0.045 | -0.849 |

| FC1 | I have the resources necessary to use digital financial services platforms. | 4.472 | 0.691 | 0.056 | -1.015 |

| FC2 | I have the knowledge necessary to use digital financial services platforms. | 4.398 | 0.73 | -0.421 | -0.843 |

| FC3 | Digital financial services platforms are compatible with other systems and technologies that I use. | 4.398 | 0.666 | -0.166 | -0.746 |

| FC4 | I can get help from others when I have difficulties using digital financial services platforms. | 4.402 | 0.654 | -0.112 | -0.732 |

| BI1 | I intend to continue using the digital financial services in the future. | 4.415 | 0.826 | 0.242 | -1.164 |

| BI2 | I will always try to use the digital financial services in my daily life. | 4.439 | 0.857 | 1.159 | -1.448 |

| BI3 | I plan to continue to use the digital financial services frequently. | 4.463 | 0.666 | -0.396 | -0.861 |

| BI4 | I foresee that I will use it more in the near future. | 4.61 | 0.62 | 0.701 | -1.351 |

| UB1 | To ease me in doing financial services transactions, I'd like to use digital resources. | 4.463 | 0.719 | 0.267 | -1.092 |

| UB2 | I use digital financial services quite frequently. | 4.463 | 0.719 | 0.267 | -1.092 |

| UB3 | I perform all of my financial services transactions using digital methods. | 4.476 | 0.725 | 1.005 | -1.266 |

Source: Primary Data

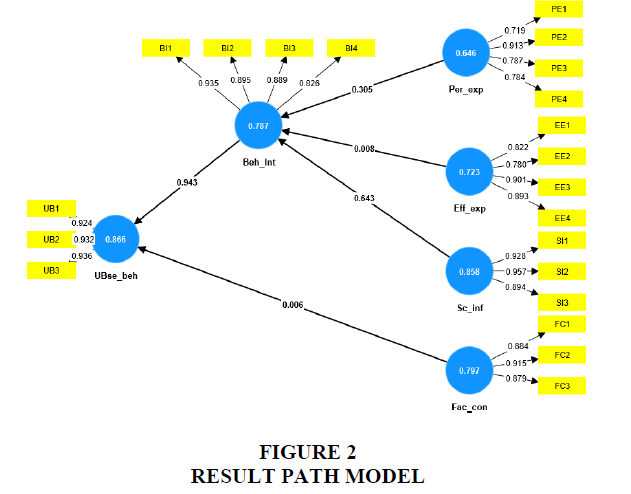

The PLS – SEM consists of a measurement and structure model. The measurement model reveals the factor loadings of each item, internal consistency reliability (Cronbach’s alpha), convergent validity (AVE) and composite reliability (CR). The Reliability and validity of all six constructs used in the model is calculated in SmartPLS4 software and summarized in Table 3.

To assess the reliability and validity of all 6 constructs used in the scale, factor loading, AVE and CR were calculated in SmartPLS4 software and summarized in Table 3. The values of composite reliability (CR) for different constructs used in the study, are ranging from 0.850 to 0.923, and AVE values are ranging from 0.646 to 0.866. The values of Cronbach’s alpha for the six constructs are ranging from 0.819 to 0.923 which are above the cutoff point of 0.7. Both the values of CR and AVE are above the threshold point and acceptable according to the recommendations by Black et al. (2010).

Subsequently, to assess the construct validity of the all six constructs used in this study Confirmatory Factor Analysis (CFA) was conducted and factor loadings of all items except for one item FC4, which were above the cutoff point of 0.6 and proved that there is no issue with the factor loadings (Guo et al, 2018). The item FC4 that has low factor loadings is dropped in the analysis due to poor factor loading.

| Table 3 Confirmatory Factor Analysis |

||||

|---|---|---|---|---|

| Items | factor loading | AVE | CR | α |

| Performance Expectancy | 0.646 | 0.850 | 0.819 | |

| PE1 | 0.719 | |||

| PE2 | 0.913 | |||

| PE3 | 0.787 | |||

| PE4 | 0.784 | |||

| Effort Expectancy | 0.723 | 0.894 | 0.873 | |

| EE1 | 0.822 | |||

| EE2 | 0.78 | |||

| EE3 | 0.901 | |||

| EE4 | 0.893 | |||

| Social Influence | 0.858 | 0.920 | 0.917 | |

| SI1 | 0.928 | |||

| SI2 | 0.957 | |||

| SI3 | 0.894 | |||

| Facilitating Conditions | 0.797 | 0.911 | 0.875 | |

| FC1 | 0.884 | |||

| FC2 | 0.915 | |||

| FC3 | 0.879 | |||

| FC4 | Dropped | |||

| Behavioural Intentions | 0.787 | 0.913 | 0.909 | |

| BI1 | 0.935 | |||

| BI2 | 0.895 | |||

| BI3 | 0.889 | |||

| BI4 | 0.826 | |||

| Use Behaviour | 0.866 | 0.923 | 0.923 | |

| UB1 | 0.924 | |||

| UB2 | 0.932 | |||

| UB3 | 0.936 | |||

PE – Performance Expectancy, EE-Effort Expectancy, SI – Social Influence, FC-Facilitating conditions, BI – Behavioural Intention, UB – Use Behaviour Source: Primary Data

To check the Discriminant validity of the model, Fornell - Larcker criteria is used which suggest that the square root of AVE of all latent variables used in the study should be greater than the correlation coefficients between the other variables. The square root of AVE of all latent variables are shown in the diagonal values in Table 4. As the diagonal values are greater than the correlation coefficient of other variables presented in the table, the variables are therefore considered to have Discriminant Validity.

| Table 4 Discriminant Validity Of The Constructs |

||||||

|---|---|---|---|---|---|---|

| BI | EE | FC | PE | SI | UB | |

| BI | 0.887 | |||||

| EE | 0.401 | 0.851 | ||||

| FC | 0.522 | 0.646 | 0.893 | |||

| PE | 0.716 | 0.432 | 0.507 | 0.804 | ||

| SI | 0.839 | 0.400 | 0.544 | 0.631 | 0.927 | |

| UB | 0.846 | 0.383 | 0.497 | 0.656 | 0.802 | 0.931 |

Evaluating the Structure Model and Hypothesis Testing.

The beta coefficients of the structure model are calculated using SEM, which are displayed in Figure 2 and Table 5.

| Table 5 Direct, Indirect And Total Effect In The Path Model |

||||

|---|---|---|---|---|

| Effect | ||||

| Factor | Determinants | Direct | Indirect | Total |

| Behaviour Intention adjusted Rsq = 0.757 | PE | 0.305 | 0 | 0.305 |

| EE | 0.008 | 0 | 0.008 | |

| SI | 0.643 | 0 | 0.643 | |

| Use Behaviour adjusted Rsq = 0.895 | BI | 0.943 | 0 | 0.943 |

| PE | 0 | 0.288 | 0.288 | |

| EE | 0 | 0.007 | 0.007 | |

| SI | 0 | 0.606 | 0.606 | |

| FC | 0.006 | 0 | 0.006 | |

The result of the study reveals that the proposed model accounted for 75.5% variation in Indian adults’ intention to use Fintech services and 89.5% of the variance in actual usage (which is considered to be high as per. It is also depicted from Table 6 that performance expectancy and social influence are significant predictors of behavior intention of Indian adults to use Fintech services. The concern for raising their status in the society (SI) was the strongest predictor of behavior intention to use fintech services. Although effort expectancy and facilitating conditions are found to be insignificant in predicting intention of Indian adults to use Fintech services. It is also observed that the intention to use Fintech service of the respondents is significantly associated with their usage behavior.

| Table 6 Hypothesis Testing Of Factors Affecting The Use Of Fintech Services |

|||||||

|---|---|---|---|---|---|---|---|

| Hypothesis | Relationship | Path Coefficient | Sample mean (M) | Standard deviation (STDEV) | T statistics | P values | Decision |

| H4 | BI ----> UB | 0.943*** | 0.944 | 0.014 | 65.382 | 0.000 | Accepted |

| H2 | EE ----> BI | 0.008 | 0.01 | 0.03 | 0.262 | 0.793 | Rejected |

| H5 | FC ----> UB | 0.006 | 0.007 | 0.028 | 0.223 | 0.823 | Rejected |

| H1 | PE -----> BI | 0.305*** | 0.308 | 0.041 | 7.478 | 0.000 | Accepted |

| H3 | SI -----> BI | 0.643*** | 0.639 | 0.042 | 15.347 | 0.000 | Accepted |

Significant at 0.01 level.

References

Ajzen, I. (1991). The theory of planned behavior.Organizational behavior and human decision processes,50(2), 179-211.

Indexed at, Google Scholar, Cross Ref

Al-Okaily, M., Alqudah, H., Al-Qudah, A. A., Al-Qadi, N. S., Elrehail, H., & Al-Okaily, A. (2022). Does financial awareness increase the acceptance rate for financial inclusion? An empirical examination in the era of digital transformation.Kybernetes, (ahead-of-print).

Indexed at, Google Scholar, Cross Ref

Attuquayefio, S., & Addo, H. (2014). Using the UTAUT model to analyze students’ ICT adoption.International Journal of Education and Development using ICT,10(3).

Beck, T. (2020).Fintech and financial inclusion: Opportunities and pitfalls(No. 1165). ADBI working paper series.

Dwivedi, Y. K., Rana, N. P., Jeyaraj, A., Clement, M., & Williams, M. D. (2019). Re-examining the unified theory of acceptance and use of technology (UTAUT): Towards a revised theoretical model.Information Systems Frontiers,21, 719-734.

Indexed at, Google Scholar, Cross Ref

Gautam, R. S., Rastogi, S., Rawal, A., Bhimavarapu, V. M., Kanoujiya, J., & Rastogi, S. (2022). Financial Technology and Its Impact on Digital Literacy in India: Using Poverty as a Moderating Variable.Journal of Risk and Financial Management,15(7), 311.

Indexed at, Google Scholar, Cross Ref

Gupta, K., & Arora, N. (2020). Investigating consumer intention to accept mobile payment systems through unified theory of acceptance model: An Indian perspective.South Asian Journal of Business Studies.

Indexed at, Google Scholar, Cross Ref

Kandpal, V., & Mehrotra, R. (2019). Financial inclusion: The role of fintech and digital financial services in India.Indian Journal of Economics & Business,19(1), 85-93.

Kaur, J. (2019). GROWTH POTENTIAL AND CHALLENGES FOR FINTECH IN INDIA.Future of FinTech: Innovative Business Model for Financial Inclusion, 37.

Luarn, P., & Lin, H. H. (2005). Toward an understanding of the behavioral intention to use mobile banking.Computers in human behavior,21(6), 873-891.

Indexed at, Google Scholar, Cross Ref

Maillet, É., Mathieu, L., & Sicotte, C. (2015). Modeling factors explaining the acceptance, actual use and satisfaction of nurses using an Electronic Patient Record in acute care settings: An extension of the UTAUT.International journal of medical informatics,84(1), 36-47.

Indexed at, Google Scholar, Cross Ref

Nordhoff, S., Louw, T., Innamaa, S., Lehtonen, E., Beuster, A., Torrao, G., ... & Merat, N. (2020). Using the UTAUT2 model to explain public acceptance of conditionally automated (L3) cars: A questionnaire study among 9,118 car drivers from eight European countries.Transportation research part F: traffic psychology and behaviour,74, 280-297.

Indexed at, Google Scholar, Cross Ref

Purwanto, E., & Loisa, J. (2020). The intention and use behaviour of the mobile banking system in Indonesia: UTAUT Model.Technology Reports of Kansai University,62(06), 2757-2767.

Rauniyar, K., Rauniyar, K., & Sah, D.K. (2021). Role of FinTech and innovations for improvising digital financial inclusion.Int. J. Innov. Sci. Res. Technol,6, 1419-1424.

Singh, N., Sinha, N., & Liébana-Cabanillas, F. J. (2020). Determining factors in the adoption and recommendation of mobile wallet services in India: Analysis of the effect of innovativeness, stress to use and social influence.International Journal of Information Management,50, 191-205.

Indexed at, Google Scholar, Cross Ref

Sobti, N. (2019). Impact of demonetization on diffusion of mobile payment service in India: Antecedents of behavioral intention and adoption using extended UTAUT model.Journal of Advances in Management Research,16(4), 472-497.

Šumak, B., & Šorgo, A. (2016). The acceptance and use of interactive whiteboards among teachers: Differences in UTAUT determinants between pre-and post-adopters.Computers in Human Behavior,64, 602-620.

Indexed at, Google Scholar, Cross Ref

Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User acceptance of information technology: Toward a unified view.MIS quarterly, 425-478.

Indexed at, Google Scholar, Cross Ref

Wijaya, T. T., Cao, Y., Weinhandl, R., Yusron, E., & Lavicza, Z. (2022). Applying the UTAUT model to understand factors affecting micro-lecture usage by mathematics teachers in China.Mathematics,10(7), 1008.

Indexed at, Google Scholar, Cross Ref

Received: 04-Apr-2023, Manuscript No. AMSJ-23-13423; Editor assigned: 05-Apr-2023, PreQC No. AMSJ-23-13423(PQ); Reviewed: 08-Jun-2023, QC No. AMSJ-23-13423; Revised: 20-Jul-2023, Manuscript No. AMSJ-23-13423(R); Published: 06-Aug-2023