Research Article: 2019 Vol: 20 Issue: 4

The Benefits to the Experiential Learning of Monetary Policy For Native Hawaiian Students

Thomas Scheiding, University of Hawai’i

Pete Cellini, University of Hawai’i

Abstract

In the “Chair the Fed” simulation created by the Federal Reserve Bank, students make monetary policy decisions to achieve low inflation and low unemployment. While this experiential learning activity can potentially be useful for all students to learn about monetary policy, this paper shows that this experiential learning activity could be particularly valuable for Native Hawaiian undergraduate students. Native Hawaiian students, as a whole, enter college with reduced academic readiness in math and reading, struggle to learn when their indigenous culture is not incorporated into the course, and are more likely to be a part of an impoverished household. Consequently, the learning of economics can be particularly challenging for Native Hawaiian students given the extensive use of mathematics and the incorporation of abstract theories. The “Chair the Fed” simulation game provides an experiential learning opportunity that bridges many gaps in learning for Native Hawaiian students. In this paper, students enrolled in a principles of macroeconomics course in the fall semester of 2018 were given a pre-test and post-test on monetary policy and all were exposed to the “Chair the Fed” simulation. The results reveal that Native Hawaiian students particularly benefited from a monetary policy game that could accommodate culturally adapted instruction. Native Hawaiian students who played the “Chair the Fed” game performed 66% stronger in a monetary policy post-test (as opposed to non-Native Hawaiian students who saw no change in post-test scores). The research in this particular case suggests that experiential learning in economics could potentially be valuable for Native Hawaiian students and should be a teaching strategy more widely deployed.

Keywords

Monetary Policy, Economic Education, Macroeconomics, Native Hawaiian.

Introduction

As noted by Vazquez & Chiang (2014), the classroom in economics has been transformed over the past two decades such that the active learning approach is now encouraged and advances in technology have facilitated their use. One example of active learning in economics is the “Chair the Fed” simulation game1. In "Chair the Fed," students are assigned the role of Chair of the Federal Reserve System and work towards achieving the twin goals of reaching the natural rate of unemployment and maintaining inflation at a 2% target over 16 quarters. An under-examined question in the economics education literature is whether students capture an enhanced ability to learn and apply monetary policy through exposure to this engagement activity. A related question to this is whether certain kinds of students particularly benefit from this pedagogical approach. At the University of Hawai'i - West O'ahu, a public university with a student population that is 29% Native Hawaiian, the "Chair the Fed" simulation game was used in a Principles of Macroeconomics course in the Fall semester of 2018 to begin to answer these two questions.

After a description of how monetary policy is typically taught, we outline the unique learning and teaching techniques for Native Hawaiian students. We then describe how the "Chair the Fed" simulation game appeals too many of the generalized aspects of Native Hawaiian student learning. We conclude by describing the pre- and post-test results of monetary policy understanding associated with students playing the game. What is found is that Native Hawaiian students achieved statistically significant learning gains after playing the game. This finding suggests that the increased use of engagement activities could increase Native Hawaiian student learning of monetary policy.

The Teaching of Monetary Policy and the 'Chair the Fed' Game

Monetary policy at the undergraduate level is predominantly taught using New Keynesian-inspired models as is discussed in Duffy & Jenkins (2018). In these models, where there is price and wage stickiness that results in an economy being unable, at times, to achieve full employment, there is an emphasis on the ability of fiscal and monetary policy to stabilize the economy. In the New Keynesian-inspired models, there is a primacy placed on inflation expectations and the role the central bank has on managing these expectations. Although students in upper-level undergraduate economics courses are typically taught a reduced form of the New Keynesian-inspired models that are non-dynamic (an IS-monetary policy model), we know from Azad (2016) that even students in introductory macroeconomic classes are implicitly exposed to New Keynesian principles such as menu costs, efficiency wages, and the Taylor Rule. Students in their introductory macroeconomic courses are also exposed to the structure, institutional goals, and tools of the Federal Reserve Bank. In the classroom discussion of the Federal Reserve Bank, the Bank's dual mandate of stable prices and maximum employment is typically highlighted as is the Bank's methods for adjusting the money supply with particular emphasis given to open market operations and the federal funds rate such as in Steelman (2011). Taken together, the New Keynesian-inspired macroeconomic topics taught to introductory-level classes and the slightly more advanced New Keynesian-inspired models presented in upper-level courses are delivered via lectures, the presentation of current economic data and through commentary on the appropriate central bank behavior at a particular point in time. While traditional lectures and textbook chapters can be useful for some students in a specific kind of classroom setting, the use of classroom experiments, games, and interactive activities can enhance this learning2.

The use of experiments and games in the economics classroom has already been demonstrated to deliver learning benefits to students. These experiments and games help students learn abstract models, demonstrate how economic theory can work and highlight when it does not work, and heighten an understanding of specific economic concepts. Frank (1997), Emerson & Taylor (2010); Dickie (2004); Ball et al. (2006) each found learning gains when experiments were used. Ball et al., (2006) also found that the learning gains from the use of experiments were higher for younger students and for women. How do games improve student learning? Ball et al., (2006) summarize it as follows:

When things get dull in a chemistry class, the instructor can start a fire or blow something up. In economics, we have no interesting chemical reactions to fall back on. Interactive experiments give us a way to capture the attention and imagination of our students, improving the learning experience and enhancing learning3.

This capture of student attention fuels a classroom discussion of the material that translates into the material being retained. Many of the same learning gains that come from the use of experiments in the classroom also extend to games. Grimes & Wiley (1990); Gremmen & Potters (1997) each found that macroeconomic simulations led to improved student performance.

In the “Chair the Fed” game from the San Francisco branch of the United States Federal Reserve Bank, students make decisions to achieve a targeted inflation rate of 2% and a targeted unemployment rate of 5%. The game poses the player with one shock (unexpected) event during their four-year term and the inflation and unemployment variables move twice as fast as reality in response to federal funds rate adjustments. The "Chair the Fed" game is played over 16 quarters. The game begins with a federal funds interest rate set at 4%, unemployment being at 4.68%, and inflation being at 2.11%. With each quarter, students adjust the federal funds rate to achieve the inflation and unemployment targets. As the game proceeds, the player is presented with "news briefs" which either indicate the current policy (such as "policymakers on hold, wait for new data"), describe economic trends and their consequences (such as "tight job market suggests more inflation ahead"), describe market events (such as "Stock Market Crash" or "Dollar Rising Sharply"), and suggest needed monetary policy when appropriate (such as "Fed expected to lower rates to boost economy" and "High real funds rate holds back economic activity"). The player reacts to random shocks in the economy and to movements in the inflation and unemployment rate by increasing, decreasing, or maintaining the federal funds rate and determining the appropriate magnitude of the change. The player is provided access to a list of frequently asked questions that provide information about monetary policy and how to react to certain economic problems as well as a detailed description of their job. The player is informed at the end of the game whether or not they have been re-nominated based on how close the unemployment and inflation rates are to the target.

In Duzhak et al. (2019), usage data is provided for “Chair the Fed” game. They revealed that the game is played about 100,000 times a month, that the game is completed nearly 45% of the time, and that approximately 20% of players ‘win’ the game by being reappointed as chair. From the usage data, Duzhak et al. (2019) found that players are more likely to lower the federal funds rate when faced with unemployment (50%) than raise the federal funds rate when faced with inflation (42%). Moreover, they found that learning seems to be occurring during the game as evidenced by players adjusting the interest rate correctly. When confronted with one of nine possible random shocks, 51% of players change the federal funds rate in the right direction in the first quarter of the shock. By the second quarter after the shock, 66% of players changes the federal funds rate in the correct direction. Finally, the authors found that if the player reads the game’s frequently asked questions, they were more likely to get reappointed. Although all of this usage data highlights the potential for learning happening during the game, no demographic data is collected about the players.

With this description of the “Chair the Fed” game from generalized usage data and evidence that some learning is happening during the game, in the next section we outline the generalized learning techniques of Native Hawaiian students and hypothesize that while all students may learn from playing a game, Native Hawaiian students stand to learn even more from the deployment of such a game.

Native Hawaiian Learning Techniques

Although Native Hawaiians are not a federally recognized group of Native Americans and subsequently are not permitted to establish their own government, the achievement gaps of Native Hawaiians mirror those of federally recognized Native American groups. Overall, Native Americans typically perform 2-3 grade levels below their Caucasian peers in reading and in math4. Moreover, Native Americans are 237% more likely to drop out of school and are 207% more likely to be expelled5. Consequently, only 7 out of 100 Native Americans pursue their bachelor degree (as compared to 34 out of 100 Caucasian peers). These reduced educational outcomes for Native Americans are a consequence, in part, of the poverty conditions experienced in many Native American families. According to Martinez (2014), these reduced educational outcomes are also a consequence of schools being unable to close achievement gaps due to a lack of student engagement and students seeking to learn in a culturally relevant environment.

The National Assessment of Educational Progress finds that Native Hawaiians, in the language arts, mathematics, and science, met educational standards at a lower rate than almost every other subgroup (with the only two exceptions being students in special education programs and those who were English learners)6. Hawaiian students were 24% more likely to not complete high school7. On statewide assessments, only 36% of Native Hawaiian students met the baseline achievement score in the language arts and only 28% met the baseline in mathematics8. With an acceptance of the fact that Native Hawaiian students, like Native Americans, perform poorly in the classroom, the federal Native Hawaiian Education Act authorized the creation of educational programs specifically for Native Hawaiian students (ranging from preschools, literacy programs, special needs students, gifted and talented students, to community-based learning centers). But despite this specified funding allocated specifically to Native Hawaiian students, the National Council of Native American State Legislators concluded:

Even with the help of government programs, most Native Hawaiian students face the same achievement gap as Native students on the mainland. Standardized test scores of Native Hawaiian students who attend public schools fall below national norms, and educational disparities exist in rural areas with significant Native Hawaiian populations. In addition, public schools with large numbers of Native Hawaiian students tend to employ teachers with fewer qualifications, and the turnover rate is high. During the last several years, both public and private schools have experienced a decline in high-achieving Native Hawaiian students or those enrolled in gifted and talented programs. Native Hawaiian students also are overrepresented in special education programs9.

What this suggests is that Native Hawaiian students need more than just additional resources in the classroom. Instead, Native Hawaiian students may need an education that honors their native culture and their unique learning style.

Students that attend tribal and indigenous-focused institutions overwhelmingly agree that their college’s focus on culture and identity is valuable to their education10. A classroom that embraces a native student’s culture is one that increases a student’s self-esteem11. And a culturally relevant classroom for native learners is one where the different (but not deficient) learning styles are embraced12. Native American learners have definite cultural values and traits that influence learning and achievement13. Native American learners prefer classroom activities over abstract, impersonal work and native learners are highly visual, integrative, relational, intuitive, and contextual14. Native American learners tend to learn by observation and demonstration. Native American learners also tend to view math as a spectator sport with no connections seen to their tribal culture15. Native American learners tend to be reflective learners where there is an examination of all sides of an issue as well as a consideration of the implications and solutions related to the problem. And for Native American learners, it is all about collectivism. With these learning styles in mind, there needs to be an alignment of teaching styles.

Although these generalized learning styles pose the real risk that the group is prioritized over the individual, recognition of these generalized learning styles for Native Hawaiian learners does positively influence how a class is taught16. For the economics classroom, what this means is that activities, demonstrations, and cooperative projects that allow time for deliberation of the consequences of actions aids in the instruction of economic concepts. In terms of monetary policy, it is typically taught with a presentation of what the desired economic conditions are and how adjusting the federal funds rate can align the economy to targeted inflation and unemployment rates. However, in a classroom with a large number of Native Hawaiian learners, this teaching style may not promote learning to the extent that individual learners possess the generalized native learning styles. In fact, Native Hawaiian students stand to potentially benefit more from the use of the game in the classroom. In the next section, we connect the two themes of learning gains coming from the use of simulation games and the fact that Native Hawaiian students may benefit from a classroom that embraces their generalized native learning style.

The Use of the “Chair the Fed” Game in a Classroom with Native Hawaiians

The University of Hawai'i-West O'ahu is an indigenous-serving undergraduate institution with 29% of students identifying as Native Hawaiian. In the fall of 2018, a section of ECON 131 (Principles of Macroeconomics) was taught in an in-person format at this institution. Prior to any of the lecture material being provided to students, students completed a monetary policy pre-test on monetary policy. In this pre-test, students were asked eight instructor-generated questions. These questions were:

1. When the Federal Reserve lowers the interest rate, what happens to the money supply?

a. Increases

b. Decreases

2. When the money supply increases, what happens to price levels?

a. Increase

b. Decrease

3. What happens when the money supply increases?

a. Unemployment rises

b. Unemployment falls

4. The inflation rate should be?

Students are presented with a movable scale ranging from 0 to 10 in half-percent increments

5. The unemployment rate should be?

Students are presented with a movable scale ranging from 0 to 10 in half-percent increments

6. What should the Federal Reserve do if the inflation rate is too high?

a. Increase interest rate

b. Decrease interest rate

7. What should the Federal Reserve do if the economy slows down?

a. Increase the interest rate

b. Decrease the interest rate

8. What should the Federal Reserve do if oil prices rise?

a. Increase the interest rate

b. Decrease the interest rate

These eight questions can be categorized into three groups-theoretical, topical, and applied. The first three questions ask students to consider the changes to the money supply when the interest rate changes, changes to the price level when the money supply changes, and changes to the unemployment rate when the money supply changes. These questions build on each other in that the first question deals with the change and the first consequence (the change to the interest rate and to the money supply) and the second and third question deal with the first consequence (the changing of the money supply) and the impact this consequence has on inflation and unemployment. These three questions represent the foundational knowledge of the theory of monetary policy-why changing the interest rate changes affect inflation and unemployment. Questions four and five assess the topical knowledge of the student by determining whether they are aware of what the inflation rate and unemployment rate should be as determined by the Federal Reserve Bank. Questions six, seven, and eight represent an application of monetary policy knowledge. Students are asked in each question how the Federal Reserve should adjust the interest rate when posed with a problem. The first problem is inflation being too high, the second problem is the economy slowing down, and the third problem is oil prices rising. Question six is a direct problem students can be confronted with in the game -- inflation being too high and a need arising to adjust the interest rate to alter inflation. Question seven presents indirect problem students can be confronted with in the game -- students having to use Okun's Law to be able to see the falling GDP through the rising unemployment rate and then needing to adjust the interest rate to adjust the GDP and ultimately the unemployment rate. Question eight presents a possible shock situation students can be confronted with in the game, rising oil prices, and ascertain whether students understand the consequence oil prices have on the economy and on the unemployment rate and inflation rate.

After students completed a pre-test consisting of these eight questions and asking other demographic questions, students were assigned two textbook chapters on monetary policy and received three 80-minute lectures. One of the textbook chapters and one of the lectures covers the structure, duties, and responsibilities of the Federal Reserve Bank. The other textbook chapter and two of the lectures covered monetary policy (with one of the lectures distinguishing expansionary from contractionary policy and the tools at the Bank's disposal and the second lecture serving as a discussion of Federal Reserve actions in economic events of the past and the Bank's influence on the economy). The questions on the pre-test were not directly discussed during class time. After the classroom discussion of monetary policy, students were then provided a link to the game. Students played the game outside of class and recorded whether or not they were re-nominated as Chair of the Federal Reserve (whether or not they won the game). After playing the game, students answered the same eight monetary policy questions and recorded whether they were re-nominated or not.

The assessment of student learning was determined by asking students three types of questions: theoretical (Q1-Q3), topical knowledge (Q4-Q5), and applied (Q6-Q8). A one-sided paired t-test was used to test the null hypothesis that exposure to the Chair the Fed simulator would increase the number of correct responses to these eight questions. A total of 42 students completed the pre-test and post-test. The results of Table 1 are as follows:

| Table 1 Native Hawaiian Students | |||||||

| DEMOGRAPHICS | First Generation College Student | Total | |||||

| Gender | High school | ||||||

| Race | Male | Female | Other | Public | Private | ||

| Native Hawaiian | 3 | 7 | 1 | 10 | 1 | 4 | 11 |

| Non Native Hawaiian | 6 | 25 | 0 | 29 | 2 | 12 | 31 |

| Total | 9 | 32 | 1 | 39 | 3 | 16 | 42 |

The representation of Native Hawaiian students in the course, 26%, was roughly similar to the overall university population where 29% identified as Native Hawaiian.

Across the three groups of questions, the results of Table 2 are as follows:

| Table 2 Mean Number of Correct Answers/Mean Federal Reserve Target Rates | ||||||||||||||

| Theoretical section (Q1-Q3) | The Inflation rate should be? | The unemployment rate should be? | Practical session (QC-Q8) | |||||||||||

| Group | Pretest | Posttest | P-value | Pretest | Posttest | P-value | Pretest | Posttest | P-value | Pretest | Posttest | P- value |

||

| Native Hawaiian | 1.91 | 2.27 | 0.2296 | 2.86 | 2.35 | 0.0358 | 3.05 | 4.06 | 11 | 1.36 | 2.27 | 0.0318 | ||

| Non Native Hawaiian | 1.7 | 1.81 | 0.1111 | 3.05 | 2.55 | 0.0046 | 3.41 | 4.06 | 31 | 1.74 | 1.67 | 0.29988 | ||

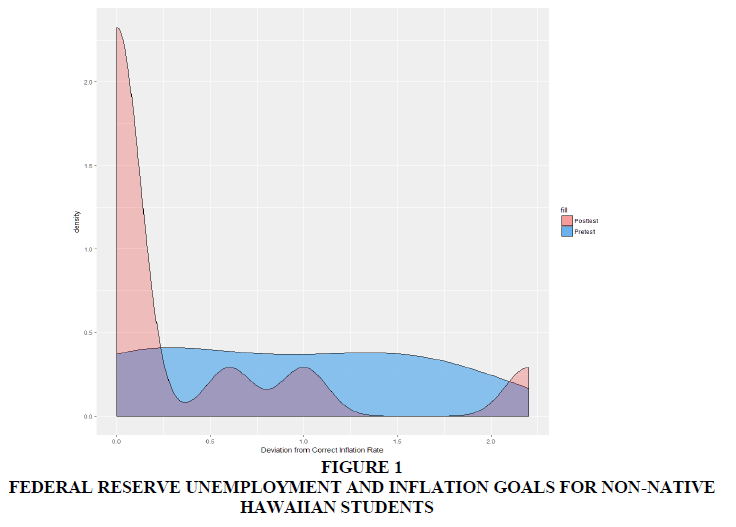

Native Hawaiians experienced a statistically significant increase of 0.91 correct answers between pre and post-test scores in the applied section of the test (p=0.0318). The average number of correct pre-test answers in the applied section was 1.36 compared to the average number of correct post-test responses in the practical section of 2.27. Native Hawaiian students also statistically significantly improved their knowledge of the expected inflation rate set by the Federal Reserve. Pre-test mean absolute deviation from the Fed's standard rate of 2% was 0.86 percentage points. Student answers between the pre and post-test showed a mean decrease of 0.48 percentage points (p=0.0358). What is notable is that the uniform distribution of the pre-test scores almost completely vanishes by the time the post-test is administered in Figure 1.

There was no statistically significant difference between pre and post test score in the unemployment rate knowledge (mean diff=0.96, p=0.0629) theoretical section (mean diff=0.36, p=0.2296).

Non-Native Hawaiian (n=31) students saw no statistically significant changes at the 5% level between the applied and theoretical pre and post-test groups. There were statistically significant reductions in their deviation from the Federal Reserve unemployment and inflation goals for non-Native Hawaiian students. Non-native students improved their mean deviation from the pre-test by -0.62 for unemployment (p<0.01) and reduced mean deviation by -0.51 for inflation (p<0.01).

Discussion

The use of the ‘Chair the Fed’ game in the classroom and the learning gains that we documented as experienced by Native Hawaiians is undoubtedly a result of a complicated and multi-faceted relationship between the game and the student. To highlight the complicated nature of the relationship between a game and a student’s ethnicity, one needs only to look at other studies that examine performance and a student’s demographics. Opstad & Fallan (2010), for instance, found that personality type alone does not affect student performance and that not all females have reduced performance in the economics classroom. A partial picture of the determinants of student performance only begins to develop when the interactions between these two variables were considered and a learning style emerges. As highlighted by Becker (2004), what is taught and how it is taught has an impact on student performance. And as mentioned by (Pang et al., 2006) there is an importance to how learning objects are handled, structured, and presented.

With an awareness of learning styles, instructors can structure the classroom around deep learning activities like these games to make economics accessible to all and foster an approach to learning that strengthens critical thinking and an integration of knowledge with their surroundings. Of course, games like “Chair the Fed” are not the only way to encourage deep learning. Ziegert & McGoldrick (2008) illustrate how service learning can also equip students to ‘think like an economist’ and engage in deep learning. Owen (2007) discusses how the use of computer applications (a lab component) for economics electives serves as a platform for active learning that increases economic understanding. Emerson et al. (2016) find that cooperative learning activities help students with certain personality types more than others. And while Calimeris & Sauer (2015) found learning gains from the deployment of flipped classroom techniques, they remarked that not all students learn effectively in such an environment and ideally would be able to select into such a classroom. And finally, Liverpool et al., (2019) find that group characteristics determine whether collaborative learning will be effective. These studies represent but a few examples of the classroom containing many learning styles to which teaching methods are not equally effective in delivering content.

While this represents the results from only one course and students were exposed to three treatments (lectures, textbook readings, and the game), the results are promising nonetheless. The findings in this paper suggest one more motivation for an instructor deviating from a traditional lecture with the goal being a further understanding of economics in a classroom where diversity among the students is a defining characteristic--diversity in demographics, experiences, abilities, and in personality types that can collectively create different learning styles. And so when it comes to monetary policy, students in all their diversity come into the classroom on the first day likely having heard about “the Fed” or having heard in the news about a decision being made to ‘change the interest rate.” And when the students collectively read the textbook or hear a lecture, they absorb the settled body of knowledge. In turn, they are assessed on how well they absorbed the knowledge. This research highlights that the economics classroom can do more to foster an ‘economist’ state of mind in students. With a recognition and appreciation by the instructor that many learning styles exist in the classroom and recognition that appealing to these learning styles helps students learn deeply the economics and perform better, this research stands as another example of the need to reduce the reliance on the lecture and textbook tools in the classroom.

Conclusion

The use of games in the economics classroom to promote learning is hardly revolutionary. Nor is it revolutionary that learning styles have an impact on how effective different teaching techniques are. What has been less explored is the combination of these two findings. We know that games promote learning by increasing the level of engagement, providing opportunities for the application of knowledge, and highlighting the consequences of certain actions. It stands to reason that the playing of games would differentially benefits groups of students. For classes taught at institutions with a high level of a particular kind of student, such as a gender or ethnic group, exploring the role games play in the learning process may lead to reducing the under-representation of these groups in the profession. In this paper, the learning gains from the playing of the “Chair the Fed” game and being exposed to lectures and textbook readings were documented. What was found was that Native Hawaiian students particularly benefited from this monetary policy game and the other treatments. Native Hawaiian students who played the “Chair the Fed” game and were exposed to lectures and provided textbook readings performed 66% stronger in a monetary policy post-test (as opposed to non-Native Hawaiian students who saw no change in post-test scores). It is reasonable to hypothesize that there are other groups of students with a generalized learning style that would benefit from the use of a simulation game in the classroom.

End Notes

1. http://sffed-education.org/chairthefed/default

2. Dickie (2004). Emerson and English (2016).

3. Ball, Eckel & Rojas (2006), 446.

4. National Caucus of Native American State Legislators (2008).

6. State of Hawaii Department of Education (2018), 20.

9. National Caucus of Native American State Legislators (2008), 10.

16. Price, Kallam, and Love (2009).

References

- Azad, R. (2016). “Plurality in Teaching Macroeconomics.” Retrieved December 12, 2019, from https://pdfs.semanticscholar.org/95ad/c3dd9972aa4383e2ca2d2afdf57e2a572e16.pdf

- Ball, Sheryl B., Catherine C. Eckel & Christian Rojas (2006). "Technology Improves Learning in Large Principles of Economics Classes: Using Our WITS." American Economic Review Papers and Proceedings. 96(2): 442-446.

- Becker, William (2004). “Economics for a Higher Education.” International Review for Economics Education. 3(1): 52-62.

- Calimeris, Lauren & Katherine Sauer (2015). “Flipping Out About the Flip: All Hype or is there Hope?” International Review of Economics Education. 20(1): 13-28.

- Dickie, M. (2004). "Experimenting on Classroom Experiments: Do they increase learning in Introductory Microeconomics?” Unpublished Manuscript, University of Central Florida.

- Duffy, John & Brian Jenkins (2018). “A Classroom Experiment in Monetary Policy.” Retrieved December 12, 2019, from https://pdfs.semanticscholar.org/95ad/c3dd9972aa4383e2ca2d2afdf57e2a572e16.pdf

- Duzhak, Evgeniya, K. Jody Hoff, & Jane Lopus (2019). “Chair the Fed: Insights from Game Usage Data.” Unpublished conference paper. Conference on Teaching and Research in Economic Education (St. Louis).

- Emerson, Tisha & Linda English (2016). “Classroom Experiments: Is More More.” American Economic Review. 106(5): 363-367.

- Emerson, Tisha, Linda English, & KimMarie McGoldrick (2016). “Cooperative Learning and Personality Types.” International Review of Economics Education. 21(1): 21-29.

- Emerson, Tisha & Beck Taylor (2010). “Do Classroom Experiments Affect the Number of Economics Enrollments.” International Review of Economics Education. 9(2): 43-58.

- Frank B., (1997). "The impact of classroom experiments on the learning of economics: an empirical investigation" Economic Inquiry. 35(4):763-.

- Gremmen, Hans & Jan Potters (1997). “Assessing the Efficacy of Gaming in Economic Education.” The Journal of Economic Education. 28(4): 291-303.

- Grimes, Paul & Thomas Wiley (1990). “The Effectiveness of Microcomputer Simulations in the Principles of Economics Course.” Computers & Education. 14(1): 81-86.

- Liverpool-Tasie, Lenis Saweda, Guigonan Serge Adjognon, and Aaron J. McKim (2019). “Collaborative Learning in Economics: Do Group Characteristics Matter?” International Review of Economics Education. 31(1): 1-11.

- Martinez, Donna (2014). “School Culture and American Indian Educational Outcomes.” Procedia – Social and Behavioral Sciences. 116: 199-205.

- National Caucus of Native American State Legislators (2008). Striving to Achieve: Helping Native American Students Succeed. Retrieved May 23, 2019, from http://www.ncsl.org/research/state-tribal-institute/striving-to-achieve-helping-native-american-stude.aspx

- Opstad, Leiv & Lars Fallan (2010). “Student Performance in Principles of Macroeconomics: the Importance of Gender and personality Type.” International Review of Economics Education. 9(1): 76-92.

- Owen, Ann (2007). “Integrating Computer Applications into Economics Electives.” International Review of Economics Education. 6(1): 77-92.

- Pang, Ming, Cedric Linder, & Duncan Fraser (2006). “Beyond Lesson Studies and Design Experiments: Using Theoretical Tools in Practice and Finding Out How they Work.” International Review of Economics Education. 5(1): 28-45.

- State of Hawai'i Department of Education (2018). Every Student Succeeds Act Report for School Year 2017-2018. Retrieved May 15, 2019, at http://arch.k12.hi.us/PDFs/strivehi/2018/999ESSARpt.pdf

- Steelman, Aaron (2011). “The Federal Reserve’s ‘Dual Mandate:’ The Evolution of an Idea.” Economic Brief. Federal Reserve Bank of Richmond. Retrieved December 12, 2019, at https://www.richmondfed.org/publications/research/economic_brief/2011/eb_11-12

- Vazquez, Jose & Eric Chiang (2014). “A Picture is Worth a Thousand Words (at least): The Effective Use of Visuals in the Economics Classroom.” International Review of Economics Education. 17(1): 109-119.

- Ziegert, Andrea & KimMarie McGoldrick (2008). “When Service is Good for Economics: Linking the Classroom and Community through Service Learning.” International Review of Economics Education. 7(2): 39-56.