Review Article: 2019 Vol: 20 Issue: 3

The Effect of Political Intervention of the Government on The Cost Efficiency: Case Study of Iran Banking System

Ali Dehghani, Shahrood University of Technology

Amir Hossein Ghaffari Nejad, University of Semnan

Jafar Abbasi, University of Semnan

Abstract

The purpose of this paper is to investigate the government political intervention in the banking system, seeking to answer the question of whether the continuation of this intervention has been accompanied by cost-efficiency. For this purpose, the efficiency values of Iranian banks have been obtained using the stochastic frontier analysis method in panel data and defining a translog cost function and the trend of the efficiency has been analyzed. The data used for the analysis included the information of 29 state-owned, private and privatized banks which were active in Iran's economy from 2008 to 2016. After estimating the cost function and obtaining the efficiency values, the effect of government intervention on the efficiency has been investigated using the econometric analysis with panel data. Meanwhile, due to the critical conditions of Iran’s economy in the 2010s and its effect on the banking system, some of the variables representing the recession have been considered among the explanatory variables. The results of the estimations indicate that after the currency shock in 2013, the cost efficiency of the banking system was reduced and the government intervention had a negative effect on it. This effect was more severe in the state-owned banks.

Keywords

Government Intervention, Cost Efficiency, Panel Data.

JEL Classifications

G28, D61, C23

Introduction

At the time of the inefficiency of the market system, government intervention in the economy is done with the goal of balancing social costs and benefits. Meanwhile, financial markets as the pillars of the economic life of any country are very important to the governments. Under the condition of inefficiency in financial markets, and especially in the event of financial crises, governments’ Intervention and support are often increased. Government intervention in financial markets is not limited to periods of systematic crises and social turmoil such as the Great Depression. Intervention in financial markets can be a combination of nationalization acts, Bail-outs, voting for directors and takeover during times of crises (Pagano & Volpin, 2001). In the face of crises such as the 2008 US crisis, capital injections are made by the government in the financial sector. Capital injections in the banking sector, as the most important part of financing, usually occur in state-owned or semi-state-owned banks. Capital injections significantly affect the balance sheet and financial statements of the banks which in turn, affect the performance and the efficiency. In order to promote privatization, measures are taken by governments to reduce government debt, increase the efficiency of state-owned companies and promote competition in the monopoly sectors of the economy (Megginson & Netter, 2001). Sometimes, the privatization plan is carried out for political purposes which have higher costs for the society. Besides, privatization may not reduce the government intervention in the post-privatization period than before (Perroti, 1995). Government intervention is such that politicians and bureaucrats can use state-owned companies for their own personal and political goals; they may even encourage private companies to receive state subsidies, thereby increasing the level of their intervention in the economy. But private bank owners are likely to seek to reduce the costs of government intervention in their bank. Also, in the issue of recruitment in a state-owned bank, there is the possibility of intervention and, as a result, political corruption to the benefit of particular groups (Shleifer & Vishny, 1994); however, mentioned corruption can also occur in privately owned banks (Clarke et al., 2005).

1. Contrary to the prevailing belief that intervention is considered to be a factor in reducing the efficiency of the banks, some have seen better performance among the state-owned banks, since the political intervention under reasonable conditions (the existence of a complete market) may be better than the existence of an oligopolistic monopoly structure in the banking sector, even If politicians seek to secure the goals of specific groups and spread their social popularity by increasing recruitment in these banks. In terms of some economic variables such as employment, such intervention may even be better than the market solution (Willner, 2001).

2. This paper attempts to analyze the effect of government intervention on cost efficiency, taking into account the state ownership and the formed crises in Iran’s banking system in the 2010s. The issue of government intervention in Iran’s banking system is beyond the issue of ownership, since the intervention in privatized banks still exists, as in some cases, government financing is carried out solely through the privatized banks. Also, in recent years, the Iran economy’s exposure to stagflation condition, along with the institutional shortcomings of the Iran financial market led to the emergence of wide disruptions in the balance sheet of the banking system, and provided the basis for the mismatch maturities of banks' assets and liabilities. This has led banks to resist interest rates on term deposits set by the central bank. Due to the new resource allocation to meet previous commitments with the past depositors, resulting in the withdrawal of a significant part of the supply resources from the lending cycle, a credit crunch was formed. Therefore, government intervention should be examined in the context of the current crisis and its effect on the cost efficiency of the banks should be considered.

3. This paper is organized in 6 sections. After the introduction, the literature on the research will be reviewed. In the third section, we will examine the status of the government intervention in the banking sector of Iran. The fourth section contains the paper methodology in which empirical models will be introduced to estimate the cost efficiency and analyze the effects of government intervention on the efficiency with an emphasis on the banking system crisis. In Section 5, the results of the estimations and in section 6, conclusion and suggestions will be presented.

Literature Review

Historically, no industry has been subjected to intense intervention by government as much as the financial industry (Haber & Perotti, 2008). Such an approach from the government to the financial sector has been known as "Financial repression," and it is a controversial issue in most countries, especially since the 1970s. Mathieson & Mckinnon (1981) define the term of financial repression as a set of policies aiming at generating income from the financial system through government intervention in pricing and allocating the resources of the granted funds and determining real interest rates. Giovannini & Demelo (1990) also refer to financial repression as a combination of imposed restrictions (price and amount) on the domestic sector and controlling the flow of international capital to reduce the cost of domestic financing and as a source of income for the government. So far, there have been many criticisms of the policies of financial repression and numerous deviations that these policies create in the financial markets. However, many governments in developing countries insist on continuing these policies, under the pretext of increasing investment and economic growth.

In the context of studying the effect of government intervention on banking efficiency, there are various categories on both aspects of government intervention and the use of type of efficiency in studies. The type of government intervention is considered as three general categories in various studies, namely (1) ownership, (2) allocation of credits, and (3) suppressing interest rate. Also, in terms of using the type of efficiency in the studies, regardless of how it is estimated by parametric or nonparametric methods, two general categories can be identified: (1) efficiency in performance and (2) efficiency in production or cost. In most of the empirical studies, the financial ratios of the CAMELS system have been used for the performance variable as an early warning system for assessing the health status of the banking network and each bank in a country. For this purpose, the criteria of capital adequacy, asset quality, management quality, profitability, liquidity, and sensitivity to market risk are considered as indicators of performance evaluation in these studies. Variables such as return on assets (ROA) and return on equity (ROE) are among the most important performance indicators in the field of profitability in the studies. Efficiency in the production or cost is significant, in that the goal of an enterprise is to maximize production or minimize costs, which both approaches will ultimately lead us to the same solution (Henderson & Quandt, 1971).

Several studies have focused on state ownership or the role of privatization in improving efficiency and in their modeling; they have mainly concluded the negative effect of the intervention on efficiency. Most of these studies have introduced ownership as a dummy variable in their model. Studies such as Xiaoqing Maggie & Heffernan (2007); Jiang, et al. (2009), Figueira, et al. (2009); Pasiouras, et al. (2009); Jiang et al. (2013) have estimated the efficiency of the banks positively. In the meantime, few studies such as Berger, et al. (2009); Tecles & Tabak (2010) have found positive effects on the issue of intervention; the main reason for this conclusion is the large size of state-owned banks and the economies of scale.

In the context of government intervention in the allocation of credits, some economists like Mankiw (1986) considered it vital and believe that these credits are guaranteed by the state, so that intervention can be effective in improving efficiency and performance. In this respect, he has extracted the optimal level of effective intervention. But Gale (1989) regards this intervention as a subsidy for the people who are unable to finance their investment and considers it probable to lead to inefficiency. This intervention can be accompanied by an increase in asymmetric information (more adverse selection and moral hazard). Meanwhile, the majority of empirical studies, such as Bokpin (2013); Hryckiewicz (2014); Torres et al. (2016) have analyzed the empirical relations in the context of government intervention in allocating credits in the form of state ownership issue. The results of these studies indicate that banks are inefficient and ineffective. Undesirable performance has been observed in the increasing of non-performing loans and increased financing costs. Therefore, in the area of credit granting, the effect of government intervention has been more severe in the state-owned banks.

The suppression of interest rate as a result of government intervention is one of the measures imposed by legal restrictions, such as the setting of maximum interest rate (Espinosa & Yip, 1996). The advantage of such an action is that the government can distribute its debts at a low interest rate, or even repay them. The suppression of nominal interest rates and the formation of a real negative interest rate will lead to a reduction in the real value of government debt (Reinhart & Sbrancia, 2011). The results of most empirical studies (Hermes & Nhung, 2010; Barrell et al., 2017; Yao & Eugene, 2018) have shown the negative (positive) effect of suppressing interest rates (financial liberalization) on banks' efficiency or performance. They claim that financial liberalization has reduced the effects of the financial crisis on performance. Of course, Hermes & Meesters (2015), by their own modeling, concluded that the positive effect of financial liberalization on the efficiency of the banks is conditional on the quality of regulations and supervision over banks.

Government Intervention in Iran’s Banking System

During several periods, one of the most important challenges facing Iran's economic development has been the government intervention in economic enterprises, among which the banking sector has been no exception. After the 1979 revolution, ownership type of the banks in Iran was changed to state ownership. At that time, if there was a problem in the banking system, the government would overcome the problem with its support and injection of oil revenues. Then, the government planned for the privatization of business enterprises in Iran in order to increase the efficiency of the enterprises, empowerment of the private sector, promotion of competition, expansion of the capital market and downsizing the state. As a result, private banks entered into Iran’s banking system since 2001, and 80% of the shares of the state-owned banks have been gradually transferred since 2006.

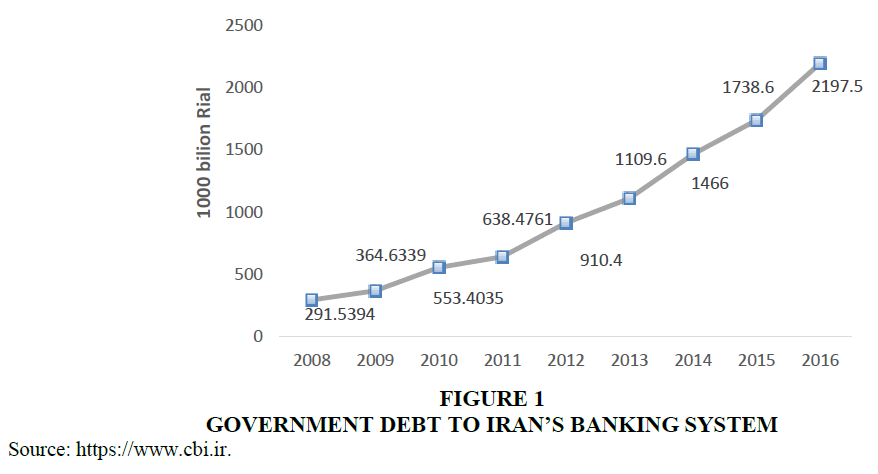

But due to the recession in the 2010s, which resulted from the intensification of sanctions and inappropriate implementation of the distribution system of cash subsidies, the government budget deficit in recent years has been increasing and the government began to finance its budget deficit from the resources of the central bank and other banks. The result was a sharp rise in government debt to the banks and the central bank and so government debt became the major part of the banks’ assets. Since the government has not paid its debt, this part of the assets will actually flow out of production. An investigation of central bank data shows that the government debt to the banking system has increased from 910 billion Rials in 2012 to 2197 billion in 2016, so that the government debt to the banking system during the years 2012-2016 was about 2.4 times higher and its average annual increase rate has been 24%. In Figure 1, the upward trend of the government debt to the banking system is visible.

Figure 1 Government Debt to Iran’s Banking System

Source: https://www.cbi.ir.

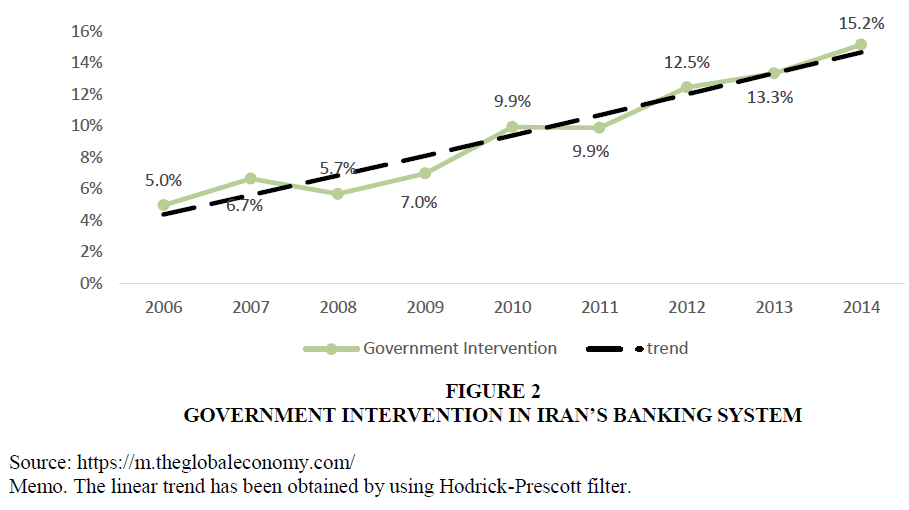

However, in order to investigate the government intervention, given the inflationary situation which Iran has always faced with and two-digit inflation over the past decades resulting in the increase in the value of banking system assets, it is necessary to present the upward trend of the government debt to the banking system in proportion to the assets of the government. Thus, in Figure 2, the trend of the ratio of received credits of the government and state-owned companies from the banking system to the volume of assets is presented as an indicator of government intervention in the banking system. Government intervention in the banking system has been increasing in the course of the review period (according to the latest available information).

Figure 2 Government Intervention in Iran’s Banking System

Source: https://m.theglobaleconomy.com/

Memo. The linear trend has been obtained by using Hodrick-Prescott filter.

Another aspect of the government intervention in Iran’s banking system is the determination of certain interest rates by the Central Bank of Iran, which is sometimes indicative of political preferences rather than economic realities. This action has the effect of eventually endangering the banks and facing them with a significant amount of non-performing loans. Also, due to the higher interest rates on bank loans than interest rates on deposits, some individuals and firms have been motivated in recent years to receive loans from the banks, and then deposit the same in the banks and benefit the difference. As a result, bank loan turned into rent and in the end, many unqualified individuals and firms received bank loans which led to overdue claims. There is another point regarding the determination of certain interest rate by the central bank. In recent years, due to the Iran’s economy facing with stagflation condition and the consequent institutional shortcomings of the Iranian financial markets, large disturbances have emerged in the combination of the balance sheet of the banking system which provided a background for mismatch maturity of the banks' assets and liabilities, and continued the conduct of the Ponzi game. In fact, running the Ponzi game by the banks is because the mortgage loans have not been repaid on the due date and, on the other hand, banks are obliged to pay the interest to the depositors, which in turn, has caused them to be trapped in the Ponzi game. Therefore, the determination of the interest rate on time deposits was accompanied by non-observance of the determined ceiling by the central bank. The continuation of this non-conformity behavior may provide the possibility for disregarding justice in the resource allocation and creating a significant gap between potential and actual growth from the channel of increasing the idle capacity of the economy (Ghaffari nejad et al., 2018).

Therefore, the wide-ranging intervention of the government in the banking system has had many consequences for Iran’s banking system in different aspects, as the financial stability of the system in the future has become a serious challenge for the authorities and researchers in banking industry.

Methodology

Empirical Methodology

The measurement of efficiency in the banking industry has an extensive literature in which various calculation methods have been used. Major studies in this area have applied data envelopment analysis (DEA) and stochastic frontier analysis (SFA) methods. DEA is a nonparametric method that uses data from all samples and solves problems using mathematical programming models. The SFA method is one of the commonly used parametric methods in numerous studies in which the stochastic production function is independently estimated with the statistical parametric method by panel data as well as cross-sectional data. The strengths of the SFA method, such as the consistency with statistical disturbances like the size of the error and other factors outside the control of the enterprise, no need for price information and the possibility of conducting the hypothesis test, have led to the relative advantage of this method in applied studies with econometrics (Coelli, et al., 2005; Lan & Lin, 2003). So far, many studies have been conducted on the subject of the efficiency of the banking industry using both nonparametric and parametric methods. Most of the studies in this area, such as Rangan, et al. (1988); Aly et al., (1990); Kaparakis, et al. (1994); Dietsch & Vivas (2000); Battese, et al. (2000); Fries & Taci (2005); Bonin, et al. (2005); have been conducted with the main goal of calculating efficiency, and usually, the results of two parametric and nonparametric methods have not been the same. Some of these studies, such as Sheldon (1994) & Beccali (2004), have investigated the adaptive comparison of the efficiency of both above-mentioned methods considering the same clarification for inputs, input prices and outputs. The results of the studies about these methods are very different, in that in some studies, the calculated efficiency in both methods is the same while in some other studies, there is significant difference between the results. Despite the extensive use of nonparametric methods, econometricians consider them inefficient in efficiency-based studies. The most important reason for this opinion is the nature of definiteness of these methods, in which the results are very sensitive to the outliers and measurement errors (Cazals et al., 2002). Also, considering that consistency is usually more important than other attributes of estimators in econometrics (Pindyck & Rubinfeld, 1988), most economic studies tend to use methods based on frontier analysis.

Hence, in this paper, the main variable under review is the cost efficiency derived from the stochastic frontier analysis (SFA) method in panel data, which is proposed by Greene (200 YAO,b). In this approach, Greene considered unique intercepts for each cross-section in the stochastic frontier model with panel data, which is unlike the previous models presented in SF approaches by Pitt & Lee (1981); Battese & Coelli (1988). In terms of formula, Greene introduced the following relation:

Yit = αt + X'it β + εit (1)

This model, in comparison with previous models, allows the time varying inefficiency to be separated from the unobservable heterogeneity at any cross-section which is fixed in time, but in Pitt and Lee's model (1981), it was assumed that the inefficiency in all homogeneous crosssections is fixed:

Yit = α + X'it β + εit

εit = υit - uit

υit = N(0,συ2)

uit = N+(0,συ2) (2)

In (2), ui is the inefficiency which is fixed over time, but in the Greene’s model, inefficiency is time varying. Greene estimates the model (1) with two methods for estimating fixed effects and random effects in a model with panel data using the maximum-likelihood (ML) estimator. While the model with random effects in this approach can easily be estimated by simulation methods, estimating the maximum-likelihood of fixed effects requires considering two important issues in relation to models with nonlinear panel data. The first problem is purely computational due to the large dimensions of parametric space. However, Greene showed that the approach of maximum-likelihood dummy variable (MLDV) is computationally possible, even in the presence of a large number of nuisance parameters α_i (N>1000). The second is incidental parameters problem which occurs when the number of crosse-sections is relatively larger than the length of the panels. In such situations with N→∞ and fixed periods (fixed T), Intercepts (constant components) are estimated inconsistently because Ti observations are used to estimate the specific parameter of each cross (Neyman & Scott, 1948; Lancaster, 2002).

As Belotti & Ilardi (2012) have shown, the variance of parameters is affected because of this inconsistency and will lead to inefficiencies in the estimation. It seems that the MLDV approach is only appropriate when the length of the panels is large enough (T≥10). Therefore, model (1) is the most flexible and parsimonious choice among several specifications of time varying models.

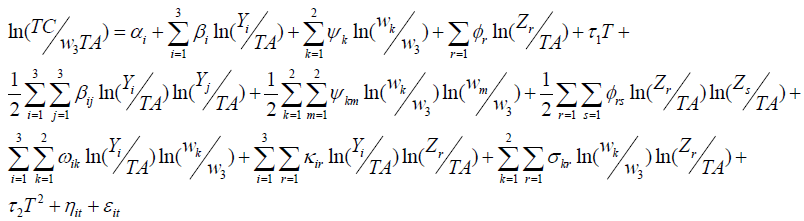

In order to estimate the SFA-based regression, the following trans log cost function has been developed based on the studies of Koutsomanoli-Filippaki, et al. (2013) and Jiang, et al. (2013). Based on the estimation results of this function, the efficiency of Iranian banks is obtainable.

(3)

(3)

In equation (3), TC is the total cost, TA stands for the total assets and Wk are the input prices (w1: price of financial resources; w2: price of labor; w3: price of physical capital). Yi are the outputs and Zr is the quasi-fixed input, in which equity is considered as the quasi-fixed input; besides, net loans and deposits are used as model outputs. T, ηit and εit indicate time trend, inefficiency and random error, respectively and α, β, ψ, Φ, ρ, τ, ϖ, κ and σ are model parameters.

In this paper, the efficiency obtained from the estimation of equation (3) is used as the dependent variable in examining the relationship between government intervention in the banking system and the efficiency of the banks. The empirical model of efficiency effects adapted from the study of Hou et al. (2018) will be considered as follows:

(4)

(4)

In equation (4), the t and i indexes represent time and cross-sections (banks), respectively. The β values are model parameters. The υi ηt and λi indexes indicate unobservable effects in time and cross-sections, respectively. It is assumed that apart from the disturbance (ζit), the equation has a standard normal distribution and lacks serial correlation. Effit as the dependent variable of the model is the efficiency that will be obtained from the estimation of equation (3). The Pintervenit variable is the government political intervention, and GOVit is the dummy variable of the state ownership structure of a bank. Xit is the vector of control variables that represent the bank characteristics; At is the vector of macro variables that contain time series observations and show the environmental effects on the efficiency of the banks.

The source of the data used in this study is the annual statistics published by the Iran banking Institute in which the time period 2008-2016 is considered, according to available data. In the meantime, the information of 29 Iranian private, state-owned and privatized banks have been used. These banks have been selected based on the completeness of their information during the period under review. Furthermore, data on macroeconomic variables have been extracted from the central bank's economic indicators.

In Table 1, the explanatory variables used in estimating the regression equation (4) are presented. The variables introduced in rows 3 to 8 are the bank-specific characteristics and in rows 9 and 10, the macroeconomic variables are presented.

| Table 1 Explanatory Variables Affecting Efficiency | ||||

| Row | Explanatory Variable | Symbol | Theoretical Expectations | |

| Type of Impact | Description of Impact | |||

| 1 | Government political intervention | Pinterven | - | According to available information, the ratio of the volume of claims on the government to the total assets of each bank is used as a proxy of the government political intervention. According to the literature reviewed in the previous sections of the paper, government intervention (getting bank credits by the government) is expected to have a negative impact on the cost efficiency of the banks. |

| 2 | Government political intervention in state-owned banks | GOV × Pinterven | - | The purpose of using Gov dummy variable is to determine whether government intervention in the state-owned banks has a higher negative impact on the efficiency compared to the non-state-owned banks. |

| 3 | concentration on the loan (Herfindahl-Hirschman Index) |

HHI | ? | This variable indicates the concentration on the loan granting in the banking system and is obtained by calculating the sum of the squares of each bank's share of the total banking network loan. It is expected that by concentrating on the loan granting, the cost efficiency of the banks will be higher due to improved bank outputs. However, the impact will be negative under the condition that loan repayments are delayed and turn into non-performing loans. |

| 4 | non-productive assets ratio | NPR | - | This variable is defined as proxy using the ratio of the fixed assets to the total bank assets; possessing high volumes of non-productive assets is an indication of not getting output from these assets. This will challenge the cost efficiency of the bank, since the bank has to use its other limited resources when considering the expenses. |

| 5 | Cost to revenue ratio | COTRE | - | As a measure of profitability, the increase of this ratio will be an indication of reduction in profitability and is expected to have a negative relationship with cost efficiency. |

| 6 | Liquidity ratio | Liq | ? | The ratio of the liquidity to the bank assets has been used in several studies. The increase in the willingness to retain assets in cash results in the decrease of loan granting, thus reducing revenue and efficiency. However, low amounts of this ratio endanger the stability of the financial system, so the monetary authorities set obligations in this regard. Low ratios will also challenge the bank expenses. |

| 7 | Bank size | size | ? | This variable is calculated based on the logarithm of the total assets. It is usually expected that increasing the size of the bank will lead to the economies of scale and have a positive effect on the cost efficiency. However,the large size of the bank will sometimes result in reduced efficiency by creating complexities in the management of the bank. In different studies, three positive, negative and ineffective effects have been obtained. |

| 8 | Non-interest income | NII | ? | This variable indicates the relative importance of the fee-based services. The increase in the share of such revenues is an appropriate source of revenue, given that there is no need to divide them between depositors. However, relying too much on these revenues will deviate the bank from its main mission and lead to inefficiencies. |

| 9 | The inflation rate | INF | ? | Inflation will increase the bank expenses through the channel of the inputs by increasing various types of rates. On the other hand, it will increase revenues by increasing loan interest rates. Therefore, it is possible to consider various effects for it. |

| 10 | The unemployment rate | Unem | - | The rise of unemployment, which is typically the result of a recession in the economy, will lead to an increase in non-performing loans and a decrease in loan demand by reducing the total income of the society. These, in turn, will reduce the cost efficiency of the banks by decreasing the bank outputs. |

Estimation Results

According to the methodology section, the Trans log cost function is estimated using the SFA method in panel data. This model has been estimated using both fixed and random effects according to the Greene's approach (2005a) and the Hausman test has been used to make the final decision about choosing the better method. The results of the Hausman test presented in Table 2 confirm the superiority of the fixed effect method.

| Table 2 Hausman Test Results | ||

| Test | The statistics | Result |

| There are fixed effects | **159.93 | Housman |

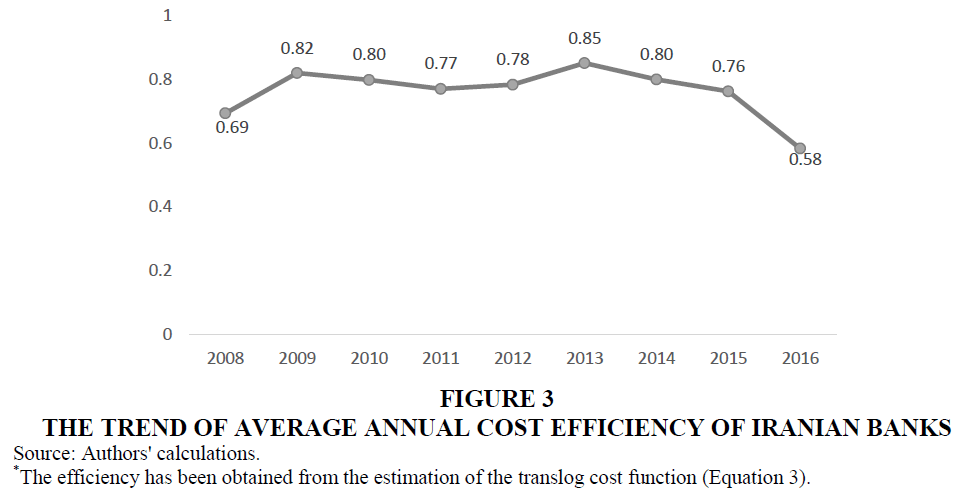

After estimating the equation (3), the cost efficiency of the banks has been obtained. In Figure 3, the trend of average annual cost efficiency of Iranian banks is visible. As shown in Figure 3, during the review period, the efficiency has been on an upward trend from 2008 to 2013 and on a downward trend in the period 2013-2016. This can be attributed to the effects of the intensification of banking sanctions on Iran and the onset of a recession in Iran’s economy since late 2012. The spread of the recession in Iran’s economy, which has been accompanied by a credit crunch in the banking system, has reduced the cost efficiency of the banks due to the disturbances in their outputs.

Figure 3 The Trend of Average Annual Cost Efficiency of Iranian Banks

Source: Authors' calculations.

*The efficiency has been obtained from the estimation of the translog cost function (Equation 3).

In order to estimate the model demonstrating the effect of the government political intervention on the cost efficiency of the banks, the obtained amount of the cost efficiency is used as the dependent variable in the estimation of the equation (4). Regarding the review period 2008-2016, which contains 9 years, there is no need to examine the stationarity of the variables, because stationarity is checked for long periods of time. In Table 3, the results of all the estimations of the relationship between the government intervention and the government efficiency using the fixed effects method are presented. In all the estimated models, the F statistic is significant and indicative of the existence of relationship between the hypothetical explanatory variables and the dependent variable (efficiency). The Significance of F-Leamer also indicates that the cross-sections (banks) are not homogeneous. Hausman statistic is used to test the existence of fixed or random effects in the cross-sections. The significance of Hausman statistic confirms the use of the fixed effects method for the estimation.

| Table 3 Model Estimation Results | ||||

| Variables | Model(1) | Model(2) | Model(3) | Model(4) |

| Pinterven | -4.75824*** | -4.77392*** | -4.8418*** | -4.77565*** |

| Govpin | -5.2473*** | -5.27539*** | -5.42397*** | -6.22008*** |

| HHI | 0.167362*** | 0.184203*** | 0.184852*** | 0.217808*** |

| NPR | -0.961** | -1.00251** | -0.94348** | -0.98473** |

| COTRE | -0.39415*** | -0.33896 | -0.34634 | -0.33145 |

| Liq | 0.252787 ** | 0.271211** | 0.279107** | 0.446448*** |

| Size | -0.01643 | -0.01576 | -0.03351 | |

| NII | -0.27875 | |||

| INF | -0.06566 | -0.06661 | ||

| Unem | -0.02988** | -0.03365** | -0.03649** | -0.04019** |

| Constant | 1.136839*** | 1.292528*** | 1.333101*** | 1.539978*** |

| F_test | 4.08*** | 3.59*** | 3.19*** | 3.75*** |

| F (leamer) | 2.3*** | 2.3*** | 2.27*** | 2.5*** |

| Hausman | 20*** | 23.35*** | 21.3*** | 36.57*** |

Regarding the effect of control variables, the results indicate that in all the estimated models, the concentration index has a positive effect on the cost efficiency of the banks, which means that by increasing concentration on the market, the monopoly power is formed for the banks and this power leads to an increase in the cost efficiency. The nonproductive assets of Iran’s banking system, which increased during the 2010s due to the sanctions and the stagflation condition, have reduced the cost efficiency. The negative effect of the cost-to-revenue ratio refers to the fact that banks with higher efficiency tend to have better cost control while looking for opportunities to increase revenue.

As shown by the results of all the estimated models presented in Table 3, the government political intervention has a negative effect on the efficiency of the banks, and this effect increases for the state-owned banks. These results are contrary to the results of the studies such as Berger, Hassan & Zhou (2009); Tecles &Tabak (2010) that considered the cost efficiency higher in state-owned banks. Therefore, all the estimation results are compatible with the results of most studies, such as Xiaoqing Maggie & Heffernan (2007); Jiang, et al. (2009); Jiang, et al. (2013); Hou, et al. (2018).

The positive effect of the liquidity ratio means that possessing enough liquidity by the bank will not challenge it concerning the expenses. In all the estimated models in which the size of the bank has been used among the explanatory variables, the effect of this variable is meaningless on the cost efficiency. This resulted lack of significance is compatible with the results of the studies such as Berger & Mester (1997); Pi & Timme (1993); which concluded that larger banks would not have any advantage in terms of efficiency. The non- interest income ratio, which is considered as an explanatory variable only in the model (4) in Table 3, has a negative effect on the efficiency, which means that by increasing the share of such revenues, the bank deviates from its main area of activity, and therefore the cost efficiency is reduced.

Furthermore, in relation to the effect of macroeconomic variables, the results showed that the inflation has not had a significant effect on the cost efficiency; indeed, the effects of the inflation on the rate of the use of inputs and the interest rates have offset each other. Especially in recent years in which the central bank has been determined to reduce the inflation and stabilize it at a single digit rate, the inflation has not been an important factor in making macroeconomic decisions. Finally, the negative effect of the unemployment rate indicates the strong influence of the macroeconomic environment on the banks. During the critical years of the 2010s, the widespread recession in all sectors of Iran’s economy, along with the disorders that have emerged in the banking system have resulted in an increase in the unemployment rate (as an indication of the state of recession in Iran) which in turn has led to the reduction of the cost efficiency due to the lower loan demand and the inability of people to repay their loans.

Among the explanatory variables of the estimated models, the three variables of unemployment rate, non-productive assets ratio and non-interest income ratio are all among the variables that have influenced the recession of the 2010s and all of them have negative effects on the cost efficiency.

Model Robustness Checks

In order to check the robustness of the estimated models, they need to be estimated once again by a robust regression method. Robust regression is a form of regression method which is robust and resistant against the outliers. Usually, the differences between these estimations and the initial main estimations lie in the standard deviations of the estimated coefficients and the significance of the coefficients after the change of the values of the standard deviations. The results of the estimations by the robust regression method presented in Table 4 also indicate a negative effect of the government intervention on the efficiency of the banks, and for the majority of control variables, the estimation results are the same as those presented in Table 3.

| Table 4 Results of Model Estimation Using Robust Regression | ||||

| Variables | Model(1) | Model(2) | Model(3) | Model(4) |

| Pinterven | -4.75824*** | -4.77392*** | -4.8418*** | -4.77565*** |

| Govpin | -5.2473*** | -5.27539*** | -5.42397*** | -6.22008*** |

| HHI | 0.167362*** | 0.184203*** | 0.184852*** | 0.217808*** |

| NPR | -0.961** | -1.00251** | -0.94348** | -0.98473** |

| COTRE | -0.39415*** | -0.33896 | -0.34634 | -0.33145 |

| Liq | 0.252787 ** | 0.271211** | 0.279107** | 0.446448*** |

| Size | -0.01643 | -0.01576 | -0.03351 | |

| NII | -0.27875 | |||

| INF | -0.06566 | -0.06661 | ||

| Unem | -0.02988** | -0.03365** | -0.03649** | -0.04019** |

| Constant | 1.136839*** | 1.292528*** | 1.333101*** | 1.539978*** |

Conclusion

In this paper, the cost efficiency of Iran’s banking system (29 selected banks) was investigated. For this purpose, by applying the translog cost function and estimating it based on the Greene's approach (2005), the efficiency values of the banks were obtained for the time period 2008-2016. The average trend of the obtained efficiency values in Iran’s banking system during the mentioned period has been downward, majorly occurred since 2013 following the currency crisis as a result of the sanctions. The aforementioned crisis has led to long-term recession condition, credit crunch and balance sheet disorders in Iran’s banking system. Along with the mentioned crisis, and during this period, the government intervention in the banking system has increased in spite of the privatization of most Iranian banks. As expected, this intervention was much higher in the state-owned banks. Basically, the recession itself will lead to the reduction of government tax revenues, budget deficits, and excessive borrowing from the banking system which includes high intervention. Therefore, if the recession continues, this faulty cycle will be also continuously accompanied by the downward trend of the cost efficiency of the banking network and in the future, it will face the banking system with more severe crises such as bankruptcy.

One of the serious challenges of Iran’s banking system, as determined by the estimation results of two variables HHI (concentration on the loan ratio) and NII (non-interest income) and their positive and negative effects on the cost efficiency, respectively, is the necessity of the Iranian banks’ attention to their core activities, namely granting loans and receiving deposits. In recent years, the increase in the number of enterprises owned by the banks, accompanied by the banks’ increased focus on the non-interest revenues has led to a reduction in the cost efficiency of the banks.

In general, the government political intervention in Iran’s banking system has led to the reduction of the ability of bank managers to achieve efficiency in financial intermediation operations, the reduction of the motivation of managers to minimize costs considering the market volatility, the restrictions for the managers to exploit market information for adopting optimal decisions and finally, rapid changes of managers’ positions which has reduced their responsiveness. Considering the resulting reduction in the cost efficiency that can threaten the financial stability of the banks, Iran's economic stability will also be challenged in the future, because Iran's economic system is bank-centered and more than 80% of the financing comes from this system.

The main suggestion of this paper is the government's serious determination to decrease its intervention by reducing the volume of its ownership in the banking system and reduce the use of bank credits. These should be at the top of the government's economic priorities in order to prevent further reduction in economic stability. For this purpose, new legislation is required by the central bank. As an alternative for government financing, it is the development of the debt market and the use of the market-related securities, rather than borrowing from the banking system that can be used to control the government's excess liquidity in addition to resolving the government deficits. The other alternative is the expansion of the tax system in both efficiency and justice. This can be achieved by optimizing tax rates and focusing on deterrent factors of tax evasion. In Iran, these two alternatives are among the issues that can be seriously discussed and revised in the field of implementation.

References

- Aly, H.Y., Grabowski, R., Pasurka, C., & Rangan, N. (1990). Technical, scale, and allocative efficiencies in US banking: An empirical investigation. The Review of Economics and Statistics, 211-218.

- Barrell, R., Karim, D., & Ventouri, A. (2017). Interest rate liberalization and capital adequacy in models of financial crises. Journal of Financial Stability, 33, 261-272.

- Battese, G.E., & Coelli, T.J. (1988). Prediction of firm-level technical efficiencies with a generalized frontier production function and panel data. Journal of econometrics, 38(3), 387-399.

- Battese, G.E., Heshmati, A., & Hjalmarsson, L. (2000). Efficiency of labour use in the Swedish banking industry: A stochastic frontier approach. Empirical Economics, 25(4), 623-640.

- Beccali, E. (2004). Cross-country comparisons of efficiency: Evidence from the UK and Italian investment firms. Journal of Banking & Finance, 28(6), 1363-1383.

- Belotti, F., & Ilardi, G. (2012). Consistent Estimation of the 'True' Fixed-Effects Stochastic Frontier Model.

- Berger, A.N., Hasan, I., & Zhou, M. (2009). Bank ownership and efficiency in China: What will happen in the world’s largest nation?. Journal of Banking & Finance, 33(1), 113-130.

- Berger, A.N., & Mester, L.J. (1997). Inside the black box: What explains differences in the efficiencies of financial institutions? Journal of banking & finance, 21(7), 895-947.

- Bokpin, G.A. (2013). Ownership structure, corporate governance and bank efficiency: an empirical analysis of panel data from the banking industry in Ghana. Corporate Governance: The International Journal of business in society, 13(3), 274-287.

- Bonin, J.P., Hasan, I., Wachtel, P., (2005). Bank performance, efficiency and ownership in transition countries. Journal of Banking and Finance, 29(1), 31-53.

- Cazals, C., Florens, J.P., & Simar, L. (2002). Nonparametric frontier estimation: a robust approach. Journal of econometrics, 106(1), 1-25.

- Clarke, G.R., Cull, R., & Shirley, M.M. (2005). Bank privatization in developing countries: A summary of lessons and findings. Journal of Banking & Finance, 29(8-9), 1905-1930.

- Coelli, T.J., Rao, D. S.P., O'Donnell, C.J., & Battese, G.E. (2005). An introduction to efficiency and productivity analysis. Springer Science & Business Media.

- Dietsch, M., & Lozano-Vivas, A. (2000). How the environment determines banking efficiency: A comparison between French and Spanish industries. Journal of Banking & Finance, 24(6), 985-1004.

- Espinosa, M., & Yip, C.K. (1996). An endogenous growth model of money, banking, and financial repression (No. 96-4). Working Paper, Federal Reserve Bank of Atlanta.

- Figueira C., Nellis J. and Parker D. (2009). The effects of ownership on bank efficiency in Latin America. Applied Economics, 41(1), 8: 2353-68.

- Fries, S., & Taci, A. (2005). Cost efficiency of banks in transition: Evidence from 289 banks in 15 post-communist countries. Journal of Banking & Finance, 29(1), 55-81.

- Xiaoqing Maggie, F.U., & Heffernan, S. (2007). Cost X-efficiency in China's banking sector. China Economic Review, 18(1), 35-53.

- Gale, W.G. (1989). Collateral, rationing, and government intervention in credit markets (No. w3024). National Bureau of Economic Research.

- Ghaffari Nejad, A.H., Ferdowsi, F., & Mashhadi, R. Factors of Non-Conformity Behavior and the Emergence of a Ponzi Game in the Riba-Free (Interest-Free) Banking System of Iran. World Academy of Science, Engineering and Technology, International Journal of Social, Behavioral, Educational, Economic, Business and Industrial Engineering, 12(1), 67-75.

- Giovannini, A., & De Melo, M. (1990). Government revenue from financial repression (No. w3604). National Bureau of Economic Research.

- Greene, W. (2005a). Reconsidering heterogeneity in panel data estimators of the stochastic frontier model. Journal of econometrics, 126(2), 269-303.

- Greene, W. (2005b). Fixed and random effects in stochastic frontier models. Journal of productivity analysis, 23(1), 7-32.

- Haber, S., & Perotti, E. (2008). The political economy of financial systems (No. 08-045/2). Tinbergen Institute Discussion Paper.

- Henderson, J.M., & Quandt, R.E. (1971). Microeconomic theory: A mathematical approach (No. 330.182 H4 1971).

- Hermes, N., & Meesters, A. (2015). Financial liberalization, financial regulation and bank efficiency: a multi-country analysis. Applied Economics, 47(21), 2154-2172.

- Hermes, N., & Nhung, V.T.H. (2010). The impact of financial liberalization on bank efficiency: evidence from Latin America and Asia. Applied Economics, 42(26), 3351-3365.

- Hou, X., Li, S., Guo, P., & Wang, Q. (2018). The cost effects of shadow banking activities and political intervention: Evidence from the banking sector in China. International Review of Economics & Finance.

- Hryckiewicz, A. (2014). What do we know about the impact of government interventions in the banking sector? An assessment of various bailout programs on bank behavior. Journal of Banking & Finance, (46), 246-265.

- Jiang, C., Yao, S., & Feng, G. (2013). Bank ownership, privatization, and performance: Evidence from a transition country. Journal of Banking & Finance, 37(9), 3364-3372.

- Jiang, C., Yao, S., & Zhang, Z. (2009). The effects of governance changes on bank efficiency in China: A stochastic distance function approach. China Economic Review, 20(4), 717-731.

- Kaparakis, E.I., Miller, S.M., & Noulas, A.G. (1994). Short-run cost inefficiency of commercial banks: A flexible stochastic frontier approach. Journal of Money, Credit and Banking, 26(4), 875-893.

- Koutsomanoli‐Filippaki, A., Mamatzakis, E., & Pasiouras, F. (2013). A quantile regression approach to bank efficiency measurement. Efficiency and productivity growth: modelling in the financial services industry, 253-266.

- Lan, L.W., & Lin, E.T.J. (2003). Measurement of railways productive efficiency with data envelopment analysis and stochastic frontier analysis. J Chin Inst Transp, 15(1), 49-78.

- Lancaster, T. (2002). Orthogonal parameters and panel data. The Review of Economic Studies, 69(3), 647-666.

- Mankiw, N.G. (1986). The allocation of credit and financial collapse. The Quarterly Journal of Economics, 101(3), 455-470.

- Mathieson, D.J., & McKinnon, R. (1981). How to Manage a Repressed Economy. Princeton Essays in International Finance, 145.

- Megginson, W.L., & Netter, J.M. (2001). From state to market: A survey of empirical studies on privatization. Journal of economic literature, 39(2), 321-389.

- Neyman, J., & Scott, E.L. (1948). Consistent estimates based on partially consistent observations. Econometrica: Journal of the Econometric Society, 1-32.

- Pagano, M., & Volpin, P. (2001). The political economy of finance. Oxford Review of Economic Policy, 17(4), 502-519.

- Pasiouras, F., Tanna, S., & Zopounidis, C. (2009). The impact of banking regulations on banks' cost and profit efficiency: Cross-country evidence. International Review of Financial Analysis, 18(5), 294-302.

- Perotti, E. C. (1995). Credible privatization. The American economic review, 847-859.

- Pi, L., & Timme, S.G. (1993). Corporate control and bank efficiency. Journal of Banking & Finance, 17(2-3), 515-530.

- Pindyck, R.S. & Rubinfeld, D.L. (1988). Econometric models and economic forecasts.

- Pitt, M. M., & Lee, L. F. (1981). The measurement and sources of technical inefficiency in the Indonesian weaving industry. Journal of development economics, 9(1), 43-64.

- Rangan, N., Grabowski, R.,Aly, H.Y., & Pasurka, C. (1988). The technical efficiency of US banks, Economics letters, 28(20), 169-175.

- Reinhart, C.M., & Sbrancia, M.B. (2011). The liquidation of government debt (No. w16893). National Bureau of Economic Research.

- Sheldon, G. (1994). Economies, inefficiences and technical progress in swiss banking. In The competitiveness of financial institutions and centres in Europe (pp. 115-132). Springer, Dordrecht.

- Shleifer, A., & Vishny, R.W. (1994). Politicians and firms. The Quarterly Journal of Economics, 109(4), 995-1025.

- Tecles, P.L., & Tabak, B.M. (2010). Determinants of bank efficiency: The case of Brazil. European Journal of Operational Research, 207(3), 1587-1598.

- Torres, S., Schiozer, R. & Vargas, F.G. (2016). Government Interventions in Brazilian Bank Lending: Do Public and Private Banks Compete?. Paper presented at the XVI Encontro Brasileiro de Finanças, Rio de Janeiro.

- Willner, J. (2001). Ownership, efficiency, and political intervention. European Journal of Political Economy, 17(4), 723-748.

- YAO, S.P., & Eugène, K. (2018). Interest Rate Liberalization and Credit Supply to the Private Sector in WAEMU: Evidence from Pooled Mean Group Estimation. Journal of Finance, 6(1), 11-18.