Research Article: 2018 Vol: 22 Issue: 2

The Empirical Study on Seafood Export Performance in the Mekong Delta, Vietnam

Bang Nguyen Viet, University of Finance Marketing

Buu Le Tan, University of Economics Ho Chi Minh City

Vu Nguyen Thanh, Nguyen Tat Thanh University

Nhan Vo Kim, Tien Giang University

Abstract

Purpose: The purpose of this paper is to define some dominant factors on the performance of seafood export companies in the Mekong Delta in Southern Vietnam conducted by the empirical study. Methodology: This study has been combined qualitative and quantitative research methods. Qualitative research method has been conducted by interviewing 10 exporters and economics experts to modify observational variables that have been used to measure research concepts. Quantitative research has been conducted through direct interviews more than 305 exporters in the Mekong Delta in Southern Vietnam by convenient sampling using a detailed questionnaire to test model and research hypotheses. Collected data was evaluated by means of Cronbach's Alpha reliability analysis, EFA, CFA, and SEM to test and verify suggested models and hypotheses. Result and Conclusion: The results show that: (i) export performance is affected by export marketing strategy, characteristics and capabilities, industry characteristics, management characteristics, relational factors, domestic market characteristics, and foreign market characteristics; (ii) export marketing strategy is affected by characteristics and capabilities, management characteristics. However, the research subject has certain limitations: (i) due to limited resources in conducting research, the sample size consisted of 305 seafood firms; (ii) This study conducted the sampling technique of using direct interview methods from respondents.

Keywords

Export Performance, Export Seafood, Seafood in Vietnam.

Introduction

It is crucial for firms in emerging markets to improve their export performance. There is a dearth of research about firms’ export performance in emerging economies (Leonidou, Katsikeas & Samiee, 2002). In recent years, Vietnam’s exports have been played important roles in economic growth along with consumption, investment and imports. Export growth is shown increasing and relatively stable over recent years (General Statistics Office of Vietnam, 2017). It has contributed to macroeconomic stability such as cutting down the trade deficit, maintaining a trade balance and other international trade agreements. Seafood products are one of the main export commodities in Vietnam. Its turnover in 2016 reached about $7.05 billion which makes up 4.0% of Vietnam’s total export turnover (General Statistics Office of Vietnam, 2017).

Currently, Vietnam ranks in the top three countries of the world (after China and India) for aquaculture production (Ministry of Commerce and Industry of Viet Nam, 2017). However, the plague of drought, salinity intrusion from Southern Central to Delta Mekong provinces and tragic marine pollution (Formosa massive issues) against fishermen in the four central provinces have been concerning to environmentalists. These issues are affecting to seafood farming directly in raw materials and indirectly in the labour sources. Most fishermen can’t easily switch to another occupation as the only skill they know is fishing. In addition, technical barriers and trading protection from importers’ countries have been built up. It seems likely there may be less suitable export marketing strategies for exporters from Vietnam. Seafood exporters may have to suffer very much due to these factors. They may have to look for a niche market for survival.

In international markets where competition is increasing, the requirements for success lie in identifying the factors affecting exports and taking corrective actions (Ayan & Percin, 2005). Therefore, the issue at hanh is to understand and quantify these factors relative to how they might be affected exporters from Viet Nam. On this basis, a number of research implications are proposed to promote fisheries.

Literature Review

With the rapid growth of international business, exports play a key role in many firms’ survival and growth (Chen, Sousa & He, 2016). In order to stay competitive in today’s global market place, it is crucial for firms in emerging markets to improve their export performance (Adu-Gyamfi & Korneliussen, 2013). Exporting is a fundamental strategy in ensuring a firm’s survival or growth and firms may achieve the competitive advantage in international markets with a positive influence on current and future export performance (Navarro, Losada, Ruzo & Diez, 2010).

Export performance was considered a significant and vital element in determining the success of the operations of any business (Nuseir, 2016). Identifying the variables which affect export performance is a strategic movement and has triggered vital interest for export managers, public policy makers and researchers (Moghaddam, Hamid & Aliakbar, 2012). Several publications have already reviewed the literature of exporting comprehensively and have revealed the achievements and limitations of the field (Madsen, 1987; Aaby & Slater, 1989; Gemünden, 1991; Zou & Stan, 1998; Leonidou, Katsikeas & Samiee, 2002; Moghaddam, Hamid & Aliakbar, 2012; Chen, Sousa & He, 2016). Study of Madsen (1987) was the first review study of export performance. Later, researchers such as Aaby & Slater (1989), Gemünden (1991), Zou & Stan (1998), Katsikeas, Leonidou & Morgan (2000), Leonidou, Katsikeas & Samiee (2002), Moghaddam, Hamid & Aliakbar (2012), Chen, Sousa & He (2016).

Export performance is defined as the outcome of a firm’s activities in the export market (Shoham, 1996; Katsikeas, Leonidou & Morgan, 2000; Chen, Sousa & He, 2016), as the extent to which a firm’s objectives, both strategic and financial, with respect to exporting a product to a market, are achieved via the execution of the firm’s export marketing strategy (Cavusgil & Zou, 1994), as the degree to which the firm accomplishes its goals when selling an item to an international business sector (Navarro, Losada, Ruzo & Diez, 2010) and as the outcomes from the firm’s international activities (Jalali, 2012).

There are three ways of measuring export performance: Financial or economic (Zou & Stan, 1998; Katsikeas, Leonidou & Morgan, 2000; Leonidou, Katsikeas & Samiee, 2002), nonfinancial or noneconomic (Zou & Stan, 1998; Katsikeas, Leonidou & Morgan, 2000; Leonidou, Katsikeas & Samiee, 2002) and generic (Katsikeas, Leonidou & Morgan, 2000). Economic (financial) measures focus on sales, profit and market share, while noneconomic (or nonfinancial) measures consist of product, market and other miscellaneous items. Generic measures are evaluated by perceptions or overall export satisfaction (Katsikeas, Leonidou & Morgan, 2000). For this study, the subjective measure of overall export was used.

Marketing Strategy

Export marketing strategy is the means by which a firm responds to the interplay of internal and external forces to meet the objectives of the export venture (Cavusgil & Zou, 1994; Moghaddam, Hamid & Aliakbar, 2012). It involves all aspects of a conventional marketing plan (Cavusgil & Zou, 1994), including: Products, pricing, promotion and distribution (Aaby & Slater, 1989; Cavusgil & Zou, 1994; Katsikeas, Leonidou & Morgan, 2000; Leonidou, Katsikeas & Samiee, 2002; Craig, 2003; Ayan & Percin, 2005; Lages, Jap & Griffith, 2008; Chen, Sousa & He, 2016; Erdil & Ozdemir, 2016).

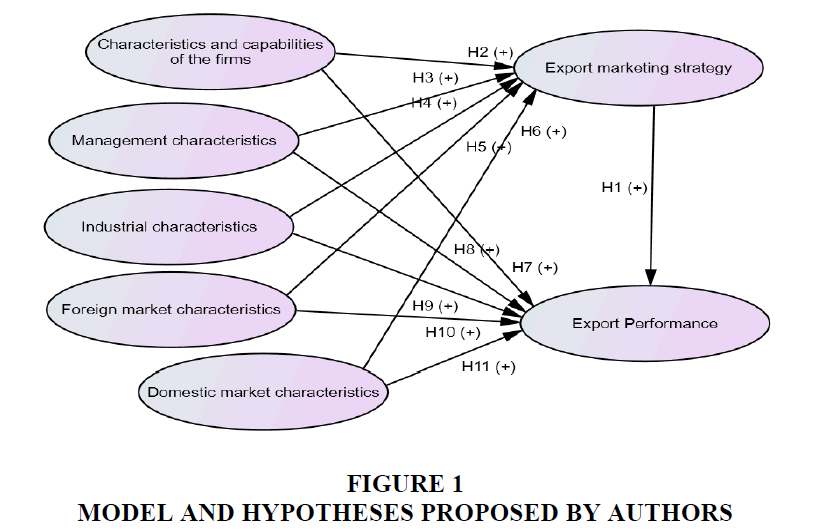

In addition, the results of studies of Madsen (1987); Aaby & Slater (1989); Cavusgil & Zou (1994); Zou & Stan (1998); Katsikeas, Leonidou & Morgan (2000); Leonidou, Katsikeas & Samiee (2002); Ayan & Percin (2005); Lages, Jap & Griffith (2008); Miltiadis (2008), Chen, Sousa & He (2016); Erdil & Ozemir (2016) show: Firms’ export marketing strategies effects on export performance. Therefore, the authors have hypothesized H1 as follows:

H1 : Export marketing strategies of firms effects on export performance (+)

Characteristics and Capabilities of the Firms

The characteristics and capabilities of the firms are very important factors affecting export performance of firms (Zou & Stan, 1998; Chen, Sousa & He, 2016) which include: The firm’s size (Zou & Stan, 1998; Katsikeas, Leonidou & Morgan, 2000; Nazar & Saleem, 2009; Adu-Gyamfi & Korneliussen, 2013; Erdil & Ozdemir, 2016; Chen, Sousa & He, 2016), export experience (Chen, Sousa & He, 2016), international competence (Zou & Stan, 1998), age (Zou & Stan, 1998), the technology (Zou & Stan, 1998; Nazar & Saleem, 2009), foreign contacts and networking (Nazar & Saleem, 2009), export market knowledge (Nazar & Saleem, 2009), export planning (Nazar & Saleem, 2009) and export market orientation (Chen, Sousa & He, 2016). Hence, the authors have hypothesized H2 as follows:

H2: A firm’s characteristics and capabilities effects on export performance (+)

Industrial Characteristics

Industrial characteristics have been identified as having a significant influence on export performance (Cavusgil & Zou, 1994; Zou & Stan, 1998; Chen, Sousa & He, 2016) which include industry’s technological intensity (Cavusgil & Zou, 1994; Zou & Stan, 1998), industry’s level of instability (Zou & Stan, 1998), domestic industrial developments (Chen, Sousa & He, 2016) and technological developments (Chen, Sousa & He, 2016). Therefore, the authors have proposed H3 as follows:

H3 : Industrial characteristics effects on export performance (expectation +)

Management Characteristics

Management is the major force behind the beginning of development, sustenance and prosperity in exporting (Moghaddam, Hamid & Aliakbar, 2012), hence management factors are also crucial to business success (Chen, Sousa & He, 2016). Export managers make decisions and strategies to enhance and expand the overseas market, which will inevitably influence a firm’s export performance (Katsikeas, Leonidou & Morgan, 2000). Management characteristics are attitudinal (Katsikeas, Leonidou & Morgan, 2000; Ayan & Percin, 2005; Nazar & Salem, 2009), experiential (Katsikeas, Leonidou & Morgan, 2000; Ayan & Percin, 2005; Lages, Jap & Griffith, 2008; Nazar & Salem, 2009; Moghaddam, Hamid & Aliakbar, 2012; Adu-Gyamfi & Korneliussen, 2013; Chen, Sousa & He, 2016) and educational of the decision maker in export activities (Katsikeas, Leonidou & Morgan, 2000; Ayan & Percin, 2005; Nazar & Salem, 2009; Moghaddam, Hamid & Aliakbar, 2012). Particularly, managers’ international experience is a key determinant of export performance (Chen, Sousa & He, 2016).

Studies by Zou & Stan (1998); Katsikeas, Leonidou & Morgan (2000); Leonidou, Katsikeas & Samiee (2002); Ayan & Percin (2005); Lages, Jap & Griffith (2008); Nazar & Salem (2009), Moghaddam, Hamid & Aliakbar (2012); Chen, Sousa & He (2016) also have shown that management characteristics have an impact on export performance. Therefore, the authors have proposed H4 as follows:

H4 Management characteristics effects on export performance (+)

Foreign Market Characteristics

Conditions in foreign markets pose both opportunities and threats for the exporter. A firm must match its strengths with foreign market opportunities to negate foreign market threats and to ensure export performance success (Cavusgil & Zou, 1994). Some of the principal foreign market characteristics likely to influence export performance include: Export market attractiveness (Zou & Stan, 1998), export market barriers (Zou & Stan, 1998), procedural barriers, including: Bureaucratic requirements, high tariff and non-tariff barriers (Alt?ntas, 2007); export market competitiveness (Cavusgil & Zou, 1994; Zou & Stan, 1998; O’Cass & Craig, 2003; Alt?ntas, 2007; Chen, Sousa & He, 2016), demand potential (Cavusgil & Zou, 1994), cultural similarity of markets (Cavusgil & Zou, 1994), similarity of legal and regulatory of frameworks (Cavusgil & Zou, 1994; O’Cass & Craig, 2003) and product exposure and brand familiarity in export markets (Cavusgil & Zou, 1994). Particularly, competitive intensity attracts the most interest by researchers (Chen, Sousa & He, 2016). On the other hand, there is negative influence of psychic distance on export performance (Virvilaite & Seinauskiene, 2015).

The studies of Cavusgil & Zou (1994), Gemünden (1991), Zou & Stan (1998), Katsikeas, Leonidou & Morgan (2000); Chen, Sousa & He (2016) have shown that the characteristics of foreign markets have an impact on export performance. Thus, the authors have hypothesized H5 as follows:

H5 Characteristics of foreign markets effects on export performance (+)

Domestic Market Characteristics

Some of domestic market characteristics which impact export performance include: Domestic demand (Chen, Sousa & He, 2016), export assistance, local market characteristics, infrastructure quality, legal quality, institutional environments, domestic market conditions (Zou & Stan, 1998), national export policy (Katsikeas, 1996), and domestic legal constructions (Ayan & Percin, 2005).

Research by Zou & Stan (1998); Gemünden (1991), Katsikeas (1996); Katsikeas, Leonidou & Morgan (2000); Ayan & Percin (2005) and Chen, Sousa & He (2016) showed that the domestic market has an impact on export performance. Thus, the authors hypothesize H6 as follows:

H6 Domestic market characteristics effects on export performance (+)Moreover, the results of studies have shown that export marketing strategies are affected by characteristics and capabilities (Cavusgil & Zou, 1994; O’Cass & Craig, 2003; Erdil & Ozdemir, 2016; Chen, Sousa & He, 2016), industry characteristic (Cavusgil and Zou, 1994; Chen, Sousa & He, 2016), management characteristics (Chen, Sousa & He, 2016), domestic market characteristics (Chen, Sousa & He, 2016) and foreign market characteristics (Cavusgil & Zou, 1994; O’Cass & Craig, 2003; Lages, Jap & Griffith, 2008; Chen, Sousa & He, 2016). Therefore, the authors have hypothesized H7, H8, H9, H10 and H11as follows:

H7: Characteristics and capabilities of firms effects on export performance (+)

H8: Industry characteristics effects on export performance (+)

H9: Management characteristics effects on export performance (+)

H10: Foreign market characteristics effects on export performance (+)

H11: Domestic market characteristics effects on export performance (+)

Methodology

Research Process

This study has combined qualitative and quantitative research methods. Qualitative research method has been conducted by focus group discussions with 10 chief executive officers of seafood firms (02 firms in Ca Mau province, 02 firms in Bac Lieu province, 02 firms in Kien Giang province, 02 firms in Tien Giang province, 02 firm in Ben Tre province) in 05/2017 at meeting room of Statistics Office in Ca Mau province (Viet Nam) to modify observational variables that have been used to measure research concepts. The result has shown that export performance concept is measured by 04 variables, export marketing strategy concept is measured by 04 variables, characteristics and capabilities of the firms concept is measured by 05 variables, industry characteristics concept is measured by 04 variables, management characteristics concept is measured by 04 variables, foreign market characteristics concept is measured by 04 variables, domestic market characteristics concept is measured by 04 variables. All items were measured by using 5-point Likert scale, anchored by 1=strongly disagree and 5=strongly agree. Quantitative research has been conducted through direct interviews (face-to-face interviews) with 350 seafood exporters (chief executive officer or senior executive) in the Mekong Delta region from 06/2017 to 09/2017 by convenient sampling using a detailed questionnaire to test model and research hypotheses.

Data Processing Techniques

Cronbach’s Alpha reliability analysis, Exploratory Factor Analysis (EFA) and Confirmatory Factor Analysis (CFA) were used to assess the scales. And the structural equation modeling (SEM) was used to test model and research hypotheses.

Result And Discussion

Description of Research Sample

Among 350 respondents, 45 people were declined because of too many inappropriate respondents. Data is used by SPSS software 20.0 with 305 valid respondents (included 87.14% in all questionnaires): 143 private enterprises (46.9%), 75 joint stock enterprises (24.6%), 87 other types (28.5%). 61 firms had under 300 employees (20%), 130 firms with 300-500 employees (42.6%), 114 firms with Over 500 employees (37.4%).

The Results Analysis of Scales’ Reliability

The results presented in Tables 1 & 2 show that of the 34 observed variables used to measure research concepts, only the DMC5 (Infrastructure quality) observational variables having a correlation coefficient of less than 0.3 should be eliminated, while the remaining 32 variables satisfy the conditions in the reliability analysis of the scale via the Cronbach’s Alpha coefficient (Cronbach’s Alpha coefficient >0.6 and correlation coefficient-total >0.3, Nunnally & Burnstein, 1994).

| Table 1: Review Of Studies Of Export Performance | ||

| Study | Year | Determinants of Export Performance |

|---|---|---|

| Madsen (1987) | Review of 17 studies from 1964 to 1985. | (i) External environmental factors, (ii) Organizational elements of the business and (iii) Strategic elements of the business. |

| Aaby & Slater (1989) | Review of 55 studies from 1978 to 1988. | (i) External environmental factors; (ii) Enterprise capacity, (iii) Corporation characteristics, (iv) Marketing orientation, (v) Corporation strategy. |

| Gem?nden (1991) | Review of 50 studies from 1964 to 1987. | (i) Company characteristics, (ii) Domestic market, (iii) Corporation governance capacity, (iv) Exporters’ activities and (v) Types of foreign markets. |

| Zou and Stan (1998) | Review of 50 studies from 1987 to 1997. | (i) Export marketing strategy, (ii) Management attitudes and perceptions, (iii) Management characteristics, (iv) Firm’s characteristics and competencies, (v) Industry characteristics, (vii) Foreign market characteristics and (viii) Domestic market characteristics. |

| Katsikeas, Leonidou & Morgan, (2000) | Review of 103 studies in 1990s | (i) Managerial factors, (ii) Organizational factors, (iii) Environmental factors, (iv) Targeting factors and (v) Marketing strategy factors. |

| Leonidou, Katsikeas & Samiee, (2002) | Review 36 studies from 1960 to 2002. | (i) Management characteristics (ii) Organizational factors, (iii) Environmental factors, (iv) Export targeting and (v) Export marketing strategy. |

| Moghaddam, Hamid & Aliakbar (2012) | Review of studies from 1989 to 2009. | (i) Export commitment and support, (ii) Management international orientation, (iii) Management customer orientation, (iv) Perception toward competitiveness, (v) Perception about export threats and opportunities, (vi) Export experience, (vii) Foreign language proficiency and (viii) Education level of manager. |

| Chen, Sousa & He (2016) | Review 124 studies from 2006 to 2014. | (i) Firm characteristics/capabilities, (ii) Management characteristics, (iii) Industry level characteristics, (iv) Country level characteristics (foreign market characteristics and domestic market characteristics) and (v) Export marketing strategy |

| Table 2: Results Of The Reliability Analysis Of Research Concepts | ||

| Concepts | Cronbach’s Alpha | Source |

|---|---|---|

| Export Performance EXP | ||

| EXP1: Perceived export intensity | 0.874 | Zou & Stan (1998), Altintas (2007) |

| EXP2: Satisfaction with overall export performance | ||

| EXP3: Achievement export success | ||

| EXP4: Export market penetration | ||

| Export Marketing Strategy EMS | ||

| EMS1: Product differentiation and quality | 0.843 | Ayan & Percin (2005) |

| EMS2: Promotion | ||

| EMS3: Distribution channel | ||

| EMS4: Price strategies | ||

| Characteristics and Capabilities of the Firms | ||

| CC1:? Firm’s size | 0.862 | Zou & Stan (1998) Chen, Sousa & He (2016) |

| CC2:? Firm’s export experience | ||

| CC3:? Firm’s international competence | ||

| CC4:? Firm’s export planning | ||

| CC5:? Firm’s export market orientation | ||

| Industry Characteristics IC | ||

| IC1: Industry’s level of instability | 0.805 | Zou & Stan (1998) Chen, Sousa & He (2016) |

| IC2: Industry’s technological intensity | ||

| IC3: Domestic industrial developments | ||

| IC4: Technological developments | ||

| Management Characteristics MC | ||

| MC1:? Exporting attitude | 0.831 | Zou & Stan (1998); Ayan & Percin (2005) |

| MC2:? Education | ||

| MC3:? Manager’s professional experience | ||

| MC4:? Manager’s export experience | ||

| Foreign Market Characteristics FMC | ||

| FMC1: Export market attractiveness | 0.843 | Cavusgil and Zou (1994); Zou & Stan (1998) |

| FMC2: Export market competitiveness | ||

| FMC3: Export market barriers | ||

| FMC4: Cultural similarity of the markets | ||

| Domestic Market Characteristics DMC | ||

| DMC1: Domestic demand | 0.855 | Chen, Sousa & He (2016) |

| DMC2: Export assistance | ||

| DMC3: Local market characteristics | ||

| DMC4: Legal quality | ||

| DMC6: Institutional environment | ||

Source: Author?s survey data, 2017

The Results of EFA

The results of EFA presented in Tables 3 and 4 show suggested scales which have satisfied the standard. EFA factors affecting the export performance are respectively extracted into 06 factors corresponding to observe variables from 06 concepts with a total obtained variance of 56.490% at the Eigenvalue of 2.382. EFA export performance results have been extracted into 1 factor with an extracted variance of 72.529% at the Eigen value of 2.901. The EFA results are analysed by Varimax rotation method.

| Table 3: Efa Results Of Factors Affecting Export Performance | |||||||

| Component | |||||||

|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | ||

| CC2 | 0.803 | ||||||

| CC5 | 0.798 | ||||||

| CC3 | 0.796 | ||||||

| CC1 | 0.763 | ||||||

| CC4 | 0.733 | ||||||

| DMC2 | 0.827 | ||||||

| DMC1 | 0.785 | ||||||

| DMC3 | 0.778 | ||||||

| DMC4 | 0.772 | ||||||

| DMC6 | 0.694 | ||||||

| FMC3 | 0.833 | ||||||

| FMC4 | 0.806 | ||||||

| FMC1 | 0.792 | ||||||

| FMC2 | 0.771 | ||||||

| MC2 | 0.808 | ||||||

| MC3 | 0.785 | ||||||

| MC4 | 0.775 | ||||||

| MC1 | 0.752 | ||||||

| IC4 | 0.828 | ||||||

| IC2 | 0.773 | ||||||

| IC3 | 0.754 | ||||||

| IC1 | 0.725 | ||||||

| EMS2 | 0.721 | ||||||

| EMS3 | 0.719 | ||||||

| EMS1 | 0.716 | ||||||

| EMS4 | 0.621 | ||||||

| Eigen value | 3.366 | 3.313 | 2.851 | 2.737 | 2.638 | 2.382 | |

| % of variance | 12.495 | 12.742 | 10.965 | 10.528 | 10.147 | 9.163 | |

| Cumulative % | 12.495 | 25.687 | 36.652 | 47.180 | 57.327 | 56.490 | |

| KMO | 0.882 | ||||||

| Bartlett's Test | Chi square | 3614.069 | |||||

| df | 325 | ||||||

| Sig. | 0.000 | ||||||

Source: Authors? survey data, 2017

| Table 4: Efa Results Of Export Performance | ||

| Component | ||

| 1 | ||

| EXP2 | 0.873 | |

| EXP4 | 0.853 | |

| EXP3 | 0.844 | |

| EXP1 | 0.836 | |

| Eigenvalue | 2.901 | |

| % of variance | 72.529 | |

| KMO | 0.833 | |

| Bartlett's Test | Chi square | 593.426 |

| df | 6 | |

| Sig. | 0.000 | |

Source: Authors’ survey data, 2017

The Results of CFA

The results of composite reliability (Pc) and variance extracted (Pvc) presented in Table 5 shows that all scales meet the requirements for reliability, average variance extracted.

| Table 5: Cfa Results Of Composite Reliability And Variance Extracted | ||||

| Concept | Abbreviation | Observed Variables | Pc | Pvc |

|---|---|---|---|---|

| Characteristics and capabilities of the firms | CC | 5 | 0.863 | 0.558 |

| Domestic Market Characteristics | DMC | 5 | 0.856 | 0.545 |

| Foreign Market Characteristics | FMC | 4 | 0.844 | 0.575 |

| Management Characteristics | MC | 4 | 0.833 | 0.555 |

| Industry Characteristics | IC | 4 | 0.807 | 0.511 |

| Export Marketing Strategy | EMS | 4 | 0.846 | 0.580 |

| Export Performance | EXP | 4 | 0.874 | 0.635 |

Source: Authors? survey data, 2017

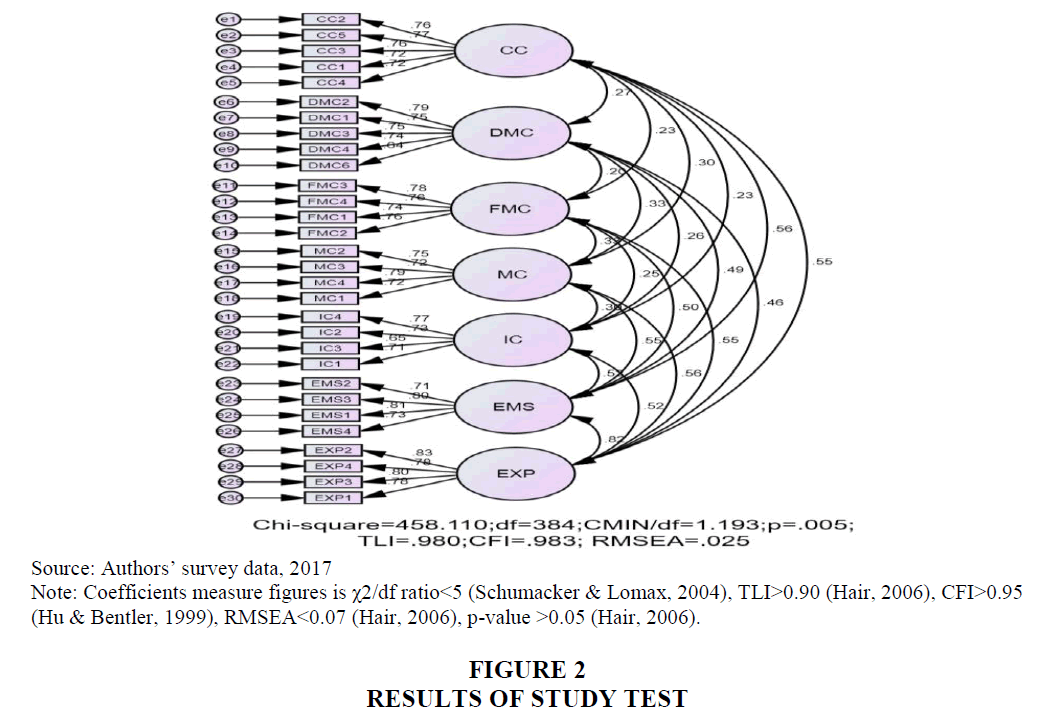

The results of unidimensionality, convergent validity and discriminant validity presented in Figures 1 & 2 and Table 6 showing that the model has Chi2 =458.110, Df=384, Cmin/df=1.193 with p-value at 0.005 was not appropriate due to the size of the sample (only 305 seafood exporters surveyed). However, other appropriate measures such as TLI=0.980, CFI=0.983 and RMSEA=0.025 are consistent. Thus, it is still possible to conclude that this model is consistent with data collected from the market. In addition, the correlation coefficients together with the standard deviations show that they are different from one, according to the concepts of discriminative research. The error of the measurement variables is not correlated; the weights (λi) are greater than 0.5 and statistically significant. Thus, the observed variables are unidimensionality, convergent validity and discriminant validity.

| Table 6: Results Of Unidimensionality, Convergent Validity And Discriminant Validity |

|||||||

| Estimate | S.E. | C.R. | P | Label | |||

|---|---|---|---|---|---|---|---|

| CC | <--> | DMC | 0.084 | 0.022 | 3.862 | *** | |

| CC | <--> | FMC | 0.067 | 0.020 | 3.309 | *** | |

| CC | <--> | MC | 0.083 | 0.020 | 4.104 | *** | |

| CC | <--> | IC | 0.070 | 0.022 | 3.212 | 0.001 | |

| CC | <--> | EMS | 0.163 | 0.025 | 6.584 | *** | |

| CC | <--> | EXP | 0.183 | 0.027 | 6.815 | *** | |

| DMC | <--> | FMC | 0.066 | 0.023 | 2.846 | 0.004 | |

| DMC | <--> | MC | 0.106 | 0.024 | 4.477 | *** | |

| DMC | <--> | IC | 0.092 | 0.026 | 3.620 | *** | |

| DMC | <--> | EMS | 0.166 | 0.027 | 6.106 | *** | |

| DMC | <--> | EXP | 0.178 | 0.029 | 6.057 | *** | |

| FMC | <--> | MC | 0.100 | 0.022 | 4.445 | *** | |

| FMC | <--> | IC | 0.082 | 0.024 | 3.401 | *** | |

| FMC | <--> | EMS | 0.157 | 0.026 | 6.076 | *** | |

| FMC | <--> | EXP | 0.200 | 0.029 | 6.839 | *** | |

| MC | <--> | IC | 0.095 | 0.024 | 4.009 | *** | |

| MC | <--> | EMS | 0.168 | 0.026 | 6.438 | *** | |

| MC | <--> | EXP | 0.196 | 0.029 | 6.814 | *** | |

| IC | <--> | EMS | 0.172 | 0.028 | 6.156 | *** | |

| IC | <--> | EXP | 0.201 | 0.031 | 6.496 | *** | |

| EMS | <--> | EXP | 0.301 | 0.036 | 8.384 | *** | |

Source: Author’s survey data, 2017

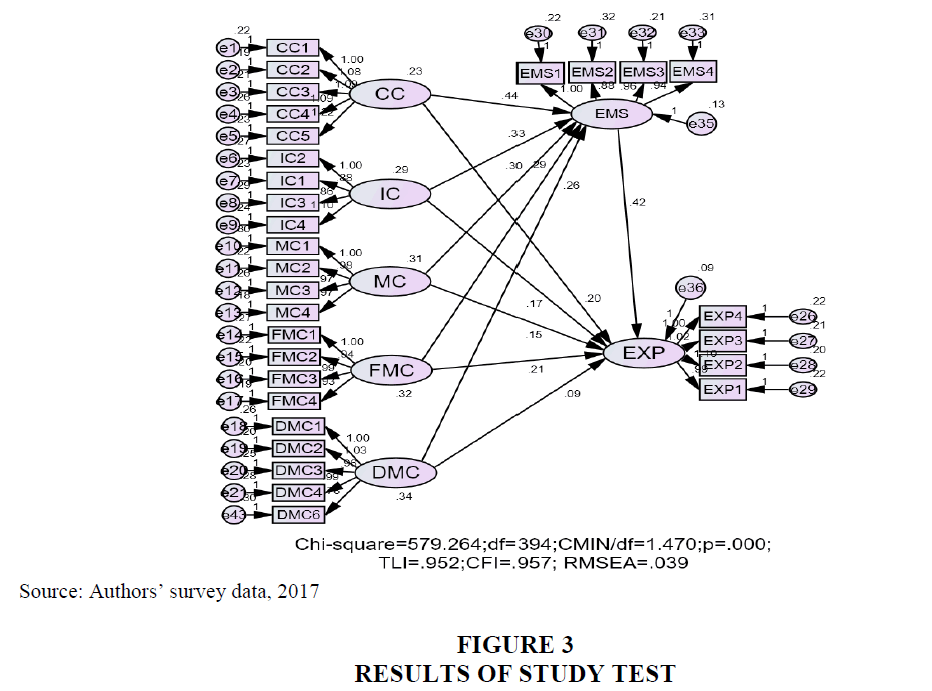

The Results of the Testing Model

The results of the testing model presented in Figure 3 showing that the model has Chi2 =579.264, Df=394 and Cmin/df=1.470 with p-value=0.000 (<0.05) was not appropriate due to the size of the sample (only 305 seafood exporters surveyed). However, other appropriate measures such as TLI=0.952, CFI=0.957 and RMSEA=0.039 are consistent. Thus, it is still possible to conclude that this model is consistent with data collected from the market.

The Results of the Test Hypotheses

The results of the test hypotheses presented in Table 7 show that all hypotheses are acceptable.

| Table 7: Test Hypotheses Test Results | |||||||

| Estimate | S.E. | C.R. | P | Label | |||

|---|---|---|---|---|---|---|---|

| EMS | <--- | CC | 0.444 | 0.069 | 6.405 | *** | H7 acceptable |

| EMS | <--- | IC | 0.327 | 0.061 | 5.329 | *** | H9 acceptable |

| EMS | <--- | MC | 0.296 | 0.058 | 5.065 | *** | H8 acceptable |

| EMS | <--- | FMC | 0.294 | 0.057 | 5.162 | *** | H10 acceptable |

| EMS | <--- | DMC | 0.260 | 0.053 | 4.866 | *** | H11 acceptable |

| EXP | <--- | EMS | 0.423 | 0.089 | 4.776 | *** | H1 acceptable |

| EXP | <--- | CC | 0.202 | 0.066 | 3.048 | 0.002 | H2 acceptable |

| EXP | <--- | IC | 0.171 | 0.057 | 2.994 | 0.003 | H4 acceptable |

| EXP | <--- | MC | 0.153 | 0.054 | 2.862 | 0.004 | H3 acceptable |

| EXP | <--- | DMC | 0.089 | 0.048 | 1.841 | 0.066 | H6 acceptable |

| EXP | <--- | FMC | 0.212 | 0.054 | 3.950 | *** | H5 acceptable |

Source: Author’s survey data, 2017

Discussion And Conclusion

Discussion

Firstly, Export performance of seafood firms are affected by export marketing strategy (EMS), characteristics and capabilities (CC), industry characteristic (IC), management characteristics (MC), domestic market characteristics (DMC) and foreign market characteristics (FMC) as following:

EXP=0.423*EMS + 0.202*CC + 0.171*IC + 0.153*MC + 0.089*DMC + 0.212*FMC

This means that

? When seafood firms have reasonable export marketing strategies through having a product differentiation and quality strategy, promotion strategy, distribution channel strategy and pricing strategy, it will increase the company’s export performance. These factors have the strongest effect on export performance with an estimate of β as 0.423.

? As the attractiveness of foreign markets expands, the rate of competition of the seafood market is substandard. Export barriers for fishery products in foreign markets are going to be lifted and those having cultural similarities to the Viet Nam market will increase export performance with an estimate of β as 0.212.

? When characteristics and capabilities of seafood firms (through size, export experience, international competence and export planning and export market orientation) meet certain standards, the characteristics and capabilities of the business may be fit for exports, which will increase export performance with an estimate of β as 0.202.

? When the fishery market is growing steadily, seafood exporters may put more investment in technological development and the level of competition of low-grade enterprises and the state-oriented fishery development will obviously grow in export performance with an estimate of β as 0.171.

? When Export managers of seafood firms have a good attitude toward exporting, a quality education and experience, export performance will improve with an estimate of β as 0.153.

? Finally, when the subsidiary from the government for fisheries’ export in terms of policy, trade promotion activities for export, access to information on foreign fisheries markets and when the domestic market is less volatile, export performance will increase. This is the weakest factor affecting export performance with an estimate of β = 0.089.

Secondly, Export marketing strategies are affected by characteristics and capabilities (CC), industry characteristics (IC), management characteristics (MC), domestic market characteristics (DMC) and foreign market characteristics (FMC) as follows:

EMS=0.444*CC + 0.327*IC + 0.296*MC + 0.294*FMC + 0.260*DMC

Seafood companies with their characteristics and capabilities, industry characteristics, management characteristics, domestic market characteristics and foreign market characteristics suitable for export performance, all contribute to enhancing their export marketing strategy.

Conclusion

The research has identified and measured factors affecting the export performance of seafood enterprises in the Mekong River Delta. The method has used quantitative research methodology through the survey of 305 seafood firms. These results show that export performance of seafood are affected by many issues such as marketing strategy, characteristics and capabilities, industry characteristics, management characteristics, domestic market characteristics and foreign market characteristics. However, the research subject has certain limitations: (i) Due to limited resources in conducting research, the sample size consisted of 305 seafood firms in Mekong Delta region (Viet Nam). Thus, the results might not be representative large scale nationwide. (ii) This study conducted the sampling technique of using direct interview methods from respondents. Therefore, the reliability of the research scale may have been higher if random sampling would have been utilized.

References

- Aaby, N.E. & Slater, S.F. (1989). Management influences on export performance: A review of the empirical literature. International Marketing Review, 6(4), 7-26.

- Adu-Gyamfi, N. & Korneliussen, T. (2013). Antecedents of export performance: The case of an emerging market. International Journal of Emerging Markets, 8(4), 354-372.

- Ayan, T.Y. & Percin, S. (2005). A structural analysis of the determinants of export performance: Evidence from Turkey. Innovative Marketing, 1(2), 106-120.

- Craig, C.J. (2003). Export marketing performance: A study of Thailand firms. Journal of Small Business Management, 41(2),213-221.

- Cavusgil, S.T. & Zou, S. (1994). Marketing strategy-performance relationship: An investigation of the empirical link in export market ventures. Journal of Marketing, 58(1), 1-21.

- Chen, J., Sousa, C.M.P. & He, X. (2016). The determinants of export performance: A review of the literature 2006-2014. International Marketing Review, 33(5), 626-670.

- Erdil, T.S. & Ozdemir, O. (2016). The determinants of relationship between marketing mix strategy and drivers of export performance in foreign markets: An application on Turkish clothing industry. Procedia Social and Behavioural Sciences, 235, 546-556.

- General Statistics Office of Viet Nam (2017). Statistical handbook of Viet Nam. Statistical publishing house.

- Gemünden, H.G. (1991). Success factors in export marketing. In: Paliwoda S.J. editor. New Perspectives in International Marketing, 33-62.

- Gerbing, W.D. & Anderson, J.C. (1988). An updated paradigm for scale development incorporating unidimensionality and its assessment. Journal of Marketing Research, 25(2), 186-192.

- Hair, J., Aderson, R., Tatham, P. & Black, W. (2006). Multivariate data analysis (Sixth Edition). Prentice-Hall, Upper Saddle River, N.J.

- Hu, L.T. & Bentler, P.M. (1999). Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Structural Equation Modelling, 6(1), 1-55.

- Jalali, S.H. (2012). Export barriers and export performance: Empirical evidence from the commercial relationship between Greece and Iran. South Eastern Europe Journal of Economics, 1, 53-66.

- Katsikeas, C.S., Leonidou, L.C. & Morgan, N.A. (2000). Firm-level export performance assessment: Review, evaluation and development. Journal of the Academy of Marketing Science, 28(4), 493-511.

- Katsikeas, C.S., Samiee, S. & Theodosiou, M. (2006). Strategy fit and performance consequences of international marketing standardization. Strategic Management Journal, 27(9), 867-890.

- Lages, L.F., Jap, S.D. & Griffith, D.A. (2008). The role of past performance in export ventures: A short-term reactive approach. Journal of International Business Studies, 39, 304-325.

- Leonidou, L.C., Katsikeas, C.S. & Samiee, S. (2002). Marketing strategy determinants of export performance: A meta-analysis. Journal of Business Research, 55(1), 51-67.

- Madsen, T.K. (1987). Empirical export performance studies: A review of conceptualizations and findings. In Cavusgil, S.T. and Axinn, C. (Eds.), Advances in International Marketing, JAI Press, Greenwich, CT.

- Ministry of Commerce and Industry of Viet Nam (2017). Report of Import and export of Viet Nam. Publishing House of Industrial and Trade.

- Moghaddam, F.M., Hamid, A.B.B.A. & Aliakbar, E. (2012). Management influence on the export performance of firms: A review of the empirical literature 1989-2009. African Journal of Business Management, 6(15), 5150-5158.

- Navarro, A., Losada, F., Ruzo, E. & Diez, J.A. (2010). Implications of perceived competitive advantages, adaptation of marketing tactics and export commitment on export performance. Journal of World Business, 45, 49-58.

- Nazar, M.S. & Saleem, H.M.N. (2009). Firm level determinants of export performance. International Business & Economics Research Journal, 8(2), 105-112.

- Nunnally, J.C. & Burnstein, I.H. (1994). Psychometric Theory (Third Edition). NewYork: McGraw-Hill.

- Nuseir, M.T. (2016). Analysing the influence of international entrepreneurship on the SMEs exporting performance using structural equation model: An empirical study in Jordan. International Journal of Business and Management, 11(2), 153-163.

- O’Cass, A. & Craig, J. (2003). Examining firm and environmental influences on export marketing mix strategy and export performance of australian exporters. European Journal of Marketing, 37(3/4), 366-384.

- Schumacker, R.E. & Lomax, R.G. (2004). A beginner’s guide to structural equation modelling (Second Edition.) Mahwah, NJ: Lawrence Erlbaum Associates.

- Shoham, A. (1996). Marketing-mix standardization: Determinants of export performance. Journal of Global Marketing, 10(2), 3-73.

- Virvilaite, R. & Seinauskiene, B. (1998). The influence of psychic distance on export performance: The moderating effects of international experience. Procedia-Social and Behavioural Sciences, 213, 665-670.

- Zou, S. & Stan, S. (1998). The determinants of export performance: A review of the empirical literature between 1987 and 1997. International Marketing Review, 15(5), 333-356.