Review Article: 2021 Vol: 25 Issue: 3S

The Performance of Banking Sector In Post Reform Era In India

Roop Lal Sharma, Shri Mata Vaishno Devi University, Katra

Sandeep Bhougal, Shri Mata vaishno devi university, katra

Ajay Kumar Sharma, Shri Mata Vaishno Devi University, Katra

Citation Information: Sharma, R.L., Sharma, A.K., & Bhougal, S. (2021). The performance of banking sector in post reform era in India. Academy of Marketing Studies Journal, 25(S3), 1-7.

Abstract

The study evaluates the comparative performance of (Public Sector Banks)PSBs with respect to (Private Sector Banks ) PvSBs, over the period 2000-01 to 2012-13. The five financial ratios are used and the analysis of relative performance of PSBs and PvSBs is done with the application of t-statistic and comparing the means of respective banks group. When the performance of PSBs is analysed relative to PvSBs, the difference is significant between two groups and PSBs are doing better on only two parameters i.e., Net Interest Income (NII)/Total Assets (TA) and Provision & Contingencies (P&C)/Total Assets (TA). However, in the rest of the three parameters viz. Intermediation Cost (Int. cost)/Total Asset (TA), Non-Performing Asset (NPA)/Total Asset (TA) and Net Profit (NP)/Total Asset (TA), PvSBs perform better, The performance of PvSBs is better than that of PSBs as can be concluded on the basis of initial stage of analysis. But after the last part of analysis is done, it can be concluded that the performance of PSBs during post reform era is not inferior as is often heard in public discourse, instead it is fair to suggest that PSBs are catching up with PvSBs when an appropriate comparison is attempted.

Keywords

Performance, Parameters, Financial Ratios.

Introduction

A well developed, organized, planned and viable banking system is necessary for developing economies so that it can occupy a crucial role in the process of socio-economic transformation as well as act as a catalyst to economic growth. The importance of banking institutions is left rather deeply in the developing economies like ours, as these economies are usually short of capital. Financial sector reforms as the part of economic reforms were initiated in 1991, broadly speaking the objective of the reforms package were three fold:-

1. Liberalization of all markets by quickening the process of deregulation.

2. Increasing competitiveness in all sphere of economic activity.

3. Ensuing financial/fiscal discipline in all agents by it the public or private sector, promoting an accelerated growth of the economy.

The banking sector of the economy has received focus in recent times due to the trend towards deregulation. The banks during the post nationalization (1969) era diverted their attention from class banking to mass banking. But many problems cropped up such as inter-region inequality in bank operations, mounting over dues, willful default, increased political interference, deterioration of customer services, red tapism, neglect of supervision, declining efficiency and profitability. There was serious concern about the performance of public sector banks. Most of which became unprofitable, undercapitalized and burden with unsustainable level of non-performing assets. Now there are 27 public sector banks (PSBs) in India. On the financial front, the performance of public sector banks was not found to be satisfactory. Due to this, the public faith in banking has been declining. Customer services with scowl are synonymous with Indian banking. In view of the extreme volatility and as a part of financial sector reforms, the government appointed Narasimham Committee under the chairmanship of M. Narasimham ex-governor of Reserve bank of India, in August 1991, to address the problems and suggest remedial measures. The committee submitted its report in November 1991 and made various recommendations which were implemented in April 1992 by the Government of India. These are as follows:

1. Gradual Reduction of Cash Reserve Ratio (CRR) & Statutory Liquidity Ratio (SLR)

2. Phase wise deregulation of interest rates of deposits and advances.

3. Liberalize policies towards foreign banks.

4. Liberalization of branch licensing policy to allow more branches according to the market needs.

5. Introduction of capital adequacy norms of 8%.

6. Transparent prudential and Income recognition norms to bring out the true position of banks loan portfolio and to arrest its deterioration.

7. Allowing public sector banks to access the capital markets to raise equity.

8. Deregulation of entry of new private banks in 1992-93.

The recommendations of the Narasimham Committee-I in 1991 provided the blue print for the first-generation reform of the financial sector. The period 1992-97 witnessed the laying of the foundations for reforms in the banking sector. While the first generation reforms were underway. Cataclysmic changes were taking place in the world, economy, coinciding with the movement towards global integration of financial services. Against such backdrop, the report of the Narasimham Committee-II in 1998 provided the roadmap for the ‘second generation’ reform process.

The second Narasimham Committee with Mr. M. Narasimham as the chairman was constituted on 26 December 1997 to review the record of banking reforms since 1991 and to suggest measures of further strengthening of the banking sector of India.

The Narasimham Committee-II has examined the second generation of reforms in terms of three broad interrelated issues: (i) action that should be taken to strengthen the foundation of the banking system, (ii) streamlining procedures, upgrading technology and human resource development and (iii) structural changes in the system. With the Narasimham Committee I & II a considerable ground has been covered putting in place a financial system which can meet the requirements of a more competitive and open economy.

Private sector banks (PvSBs) have come to play a significant role in the economic development of our country. Since, 1993, twelve new private sector banks have been setup. UTI Bank Ltd., is the first private bank of India opened in 1994, Indus-Ind bank Ltd. is the second. To safeguard the interests of commercial banks of private sector, these banks have established an organization named private Sector banks Association (PSBA-1995)on the lines of Indian banks Association (IBA).An element of private share holding in public sector banks has been injected by enabling a reduction in the government shareholding in public sector banks to 51%. As a matter, step towards enhancing competition in the banking sector, foreign direct investment in the private sector banks is now allowed up to 74 percent, subject to conformity with the guidelines issued from time to time. The efficiency with which these banks perform their operations is extremely crucial for not only the banking and financial sector but also the real sector.

Different aspects of bank’s performance under the reform process can be discussed under different trends like quantitative expansion, mobilization of deposits, profitability, capital adequacy, non performing assets, etc,. For example, during the post reform era, deposit mobilization was impressive, reflected from the per capita deposit, but bank deposit as percent of GDP at current prices remained constant. The credit deposit ratio has decline from 61% in 1991-92 to 55% in 1997 which followed slight improvement in 2nd phase of reforms and increased to 58.5% in 2000-01. The post reform era witnessed an improvement of bank’s profitability. As percent to total assets, the gross profit increased to 1.58% in 1997-98 from .94% in 1992-93 and net profit increased to 0.77% in 1997-98 from a negative figure of .99% in 1992-93. The average percentage of NPAs to total advances for 27 public Sector banks (PSBs) declined from 23.2% in 1992-93 to 16% in 1997-98, 12.4% in 2003-04 and 8.20% in 2006-07 (Yojana, 2007).

All these figures reflect that India has made a good start with financial sector reforms, but there is still a long way to go creating an efficient financial sector for sophisticated modern economy.

Review of Literature

Rammohan (2003), in another paper evaluates the performance of PSBs consequent to dis-investment by comparing the returns to PSB stocks with return to the sensex. He does soon an unadjusted as well as risk adjusted basis. He also computes the relative returns of private sector banks with respect to the sensex and uses these to compare public and private sector bank performance. He find that PSBs stocks performance on the average was not significantly different from that of the sensex or from that of private sector bank’ stocks. Koeva (2003) finds that even though nationalized banks appear to be less profitable than private and foreign banks, ownership is not the key determined of efficiency and profitability. She identifies the main determinants of intermediation costs as operating costs, priority sector lending, non-performing loans, investment in government securities and the composition of deposits.

Kumbhakar & Sarkar (2003) use a cost function approach to find that deregulation has not yet yielded efficiency gains in general, though private banks have increased profitability by expanding output, Koeva (2003) finds that profitability declines with concentration in India; however there is little empirical evidence that this relationship need remain consistently positive overtime in general (Smirlock, 1985) or that causality need only be in one direction (Berger, 1995). This is because while concentration can lower the costs of collusion and generate monopoly rents. It can also be the result of greater efficiency (Brozen, 1982) or equity enhancement through retained earnings (Berger, 1995). The correct measurement of competition therefore becomes Important.

Subhash, (2004)1 in his paper made a comparison of performance among three categories of banks-public, private and foreign-using physical quantities of input and output and comparing the revenue maximization efficiency of banks during 1992-2000. The findings show that PSBs performed significantly better than private sector banks but not differently from foreign banks. The conclusion points to a convergence in performance between public and private sector banks in the post reform era, using financial measures of performance.

However, it is necessary to be clear about what we regard as output and input in the present study. As Wykoff (1992) pointed out the issue of whether deposits are to be regarded as input or output remains unresolved. If bank deposits are regarded as input and there are no associated outputs, then it is not clear why deposits spend so much time and effort to travel to banks to give them these free inputs. If deposits are output then it has to be explained why their nominal prices have been comparatively stable and even falling in real times over the years? This would imply that banks have to undertake to make these outputs cheap it is not clear why? Mukerjee et al. (2001) adopting the intermediate approach uses as output are the following: Consumer loans, real estate loan investment, total non-interest income. As input they use the following: transaction deposits, non transaction deposits equity labour and capital.

Ramasastri, Achamma Samuel (2004)2 in their study, attempts to compare the behaviour of interest and non-interest income of schedule commercial banks in India for the period from 1997-2003. They examined whether non-interest income has helped in stabilizing the total income of schedule commercial banks in the country.

They concluded that the average return on interest income as a proportion of total assets of all schedule commercial banks declined gradually from 3.45 percent in 1997 to 2.83 percent in 2003. Due to declining return possibilities from interest income sources banks are switching over to a non-interest earning sources and concluded that average return on non-interest income has increased from 169 in 1997 to 2.28% in 2003.

To conclude it can be said that majority of the studies are too aggregative and if some where disaggregation is achieved methodological problems are there. Studies have been done either in the production function approach or in the ratio analysis approach. This kind of approach is parametric and can find the effects of Mis-specification of functional form with inefficiency. As an alternative to it, few studies have used the programming model that is non-parametric and population based and hence is less prone to this type of specification error. Hence, the performance evaluation at a disaggregated level is relatively a less researched area and there seems to be an ample scope for the same.

Financial Ratios

The five financial ratios are used for comparison of performance:

(i) NII/TA = Net interest income (Spread) / Total Assets

(i i ) INT COST/TA = Intermediat ion cost /Total Assets

(i i i ) P&C/TA = Provisions and Cont ingencies/Total Assets

(iv) NP/TA = Net Profi t /Total Assets

(v) NPA/TA = Non-Performing Assets/Total Assets

Time Period

In the fi rst two year of deregulat ion, the profi tabi l i ty of Publ ic and Private sector Banks were severely impacted by the new account ing and prudent ial norms and the consequent cleaning up of balance sheets. Accordingly, the fi rst two years of deregulat ion are not taken into account and compari son is made over the period 2000-01- to 2012-13.

Methodology

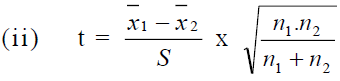

The averages for each of these rat ios for the ent i re per iod for the two categories of banks – Publ ic Sector Banks (PSBs) and Pr ivate Sector Banks (PvSBs) are computed and compared by using the t -stat ist ic.

T-statistic

To test the signif icance of the di f ference between means of two independent samples (as the case considered here say PSBs a nd PVBs) the steps given below to be fol lowed:

(i) Nul l Hypothesis

Where  = mean of 1 x series

= mean of 1 x series

= mean of 2 x series

= mean of 2 x series

n1 = number of observat ions in 1 x series

n2 = number of observat ions in 2 x series

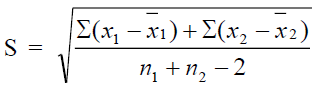

(iii) Standarddeviation‘S’

here deviat ion taken f rom actual mean.

(iv) Degreesoffreedom‘V’

V = n1 + n2 – 2

(v) The computed value of t is compared wi th table value of t at 5% level of signi ficance for n1 + n2 – 2 degrees of f reedom. If calculated value of t is less than table value of t , then hypothesis is accepted and di fference is insigni ficant .

If calculated value of t is greater than table value of t , then hypothesis is rejected and dif ference is significant .

Nul l Hypothesis

There is no signi ficant di ff erence between two sample means Then t -test is done and resul ts are as given in the tables. The calculated value of t is compared wi th the table value of t .

Time per iod f rom 2000-01 to 2012-13 in Table 1.

| Table1 Comparison of Performance of Public Sector Banks and Private Sector Banks | |||

| S. No. | Public Sector Banks | Private Sector Banks | T-Statistic |

| Spread (NII)/TA | 2.80 | 2.71 | 2.05 |

| Intermediation Cost/TA | 2.41 | 1.93 | 3.93 |

| Non performing Assets/TA | 2.39 | 1.29 | 3.08 |

| Provision & Contingencies/ TA | 1.15 | 1.21 | 0.61 |

| Net Profit/TA | 0.77 | 1.20 | 3.47 |

The table reveals the mean values of each of the five financial rat ios in case of both PSBs and PVBs. The values of T-stat ist ic are given in the third column.

In this case, for degree of freedom (V) = 24 at 5% level of significance, the table value of t = 2.06. Here the table value is less than the calculated value of t and thus nul l hypothes is is rejected and there is signi ficance dif ference between mean values.

The table value of t (2.06) is less than int . Cost /TA (3.93), NPA/TA (3.08) and NP/TA (3.47) . Only in case of NII/TA (2.05) and P&C/TA (0.61), the table value (2.06) is greater; here the nul l hypothesis is accepted. This impl ies that in case of three rat ios, there is significant dif ference in the mean values of two groups. It is only in case of NII/TA and P&C/Ta, the di f ference between mean values is insigni ficant (means almost some pe r formance of the PSBs and PVBs).

Conclusion

On comparing the performance (by comparing the mean values of both bank groups, in case of each ratio), we find that Public Sector Banks (PSBs), on the rest of three parameters, PVBs perform better NII/NA. The only parameter on which PSBs does better is the provisions and contingencies/Total Assets.

It brings out the conclusion that there is a significance difference between the performance of Public Sector Bank and Private Sectors Banks in the post reform era.

References

- Agarwal (2000), “Merger and Acquisition of commercial Banks in Indian Content,” I.B.A. Bulletin, April-May.

- Ahluwalia, M.S (2001), “Second Generation Reforms in Banks:Major issue”, paper presented at the Bank Economists conference, New Delhi, January.

- Ahuja, Kanta (1997), “The Banking Sector after the Reforms”. The Indian Economic Journal, Vol. 4 No. 4, April – June, pp 1-8.

- Alka Ghosh (2007), “Indian Economy – Nature and Problem”, World Press, Calcutta.

- Amandeep (1983), “Profits and profitability in commercial Banks in India,” Economic and political weekly, vol. 18 (Nov. 26)

- Ammanaya, K.K. (1992), “Towards more Remunerative Development of credit for Banking Profitability. Banking for Better Profitability”, Macmillan Indian Limited, New Delhi.

- Anand, S.C. (1998), “Is priority sector lending still a drag on profitability”? IBA Bulletin, A Journal of Banking Published by the Indian Banks Association; vol XV, No. 4, April, PP-6-11.

- Angadi and Devraj (1983), “Profitability and Productivity of Banks in India”, Economic and Political Weekly, Vol. 18 (Nov. 26).

- Bala, Indu (2001), “Trends and Impact of Non-Performing Assets on the profitability of Public Sector Banks”, Social Science Research Journal, Vol. 9, No. 1, pp. 158-163.

- Banker, R.D., Chang, H. and Cooper, W.W. (1996), “Simulation Studies of Efficiency, Returns to Scale and Misspecification with Non-linear Function in DEA”, Annals of operations Research, V. 66: 233-53.

- Basu, Dipankar (1995), “The outlook for the State owned banks in a more competitive environment”, IBA Bulletin, Vol. XVII, No. 5, May, pp. 8.

- Basu, S.K. (1971), “A Review of Current Banking Theory and Practice”, Macmillan Indian Press, Madras.

- Bhattacharya, A., Lovell, C.A. and Sahay, P. (1997), “The impact of Liberalization on the Productive Efficiency of Indian Commercial Banks,” European Journal of operational Research, 98, pp 332-345.

- Bhattacharyya, A and S.C. Kumbhakar (1997), “Changes in Economic Regime and productivity Growth: A study of Indian public sector Banks,” Journal of comparative Economics 25, 196-219.

- Chang, Roberto and Andres Velasco (1999), “Liquidity Crises in Emerging Markets : Theory and Policy”, NBER Working Paper 7272.

- Charnes, A., W.EW. Cooper and E. Rhodes (1978), “Measuring the Efficiency of DMUs”, European Journal of Operations Reseach, Vol. 6.

- Reddy, Y.V. (2001): “Financial sector Reforms: an update,” Address at the 53rd Annual General meeting of the Indian Banks Association and the 13th Annual General meeting of the bank’s sports Board on March 15, 2001 at Mumbai.