Research Article: 2019 Vol: 20 Issue: 1

The Resilience of the Tunisian Economy after the 2011 Revolution

Saoussen Ouhibi, University of Sfax in Tunisia

Abstract

Keywords

Revolution, Tunisia, SVAR.

Introduction

The resilience concept, which occupies an important place in the current research, is used to lead debates on the climate change, social protection, sustainable development and macroeconomic development. It is followed by an overview of the major concepts associated with resilience, including vulnerability and can be used to analyse risks. To understand and analyse these two terms, some authors established some definition catalogues (Cannon, 2006; GallopI'n, 2006). The emerging countries’ economies became a leading player on the scene of the concept of vulnerability and resilience. In other words, these countries are vulnerable to such attacks. The 2007 financial crisis led to a slowdown of the economic activity, the rise of the global financial volatility and the spread of the factors that identify the degree of resilience of the different economies.

Despite the fact that the direct links between revolutions, the democratic transition and the economy are the subject of a current debate, various authors argue that, in the long-term, these events can have a significant impact on the economy, which significantly affects the countries’ developing achievements.

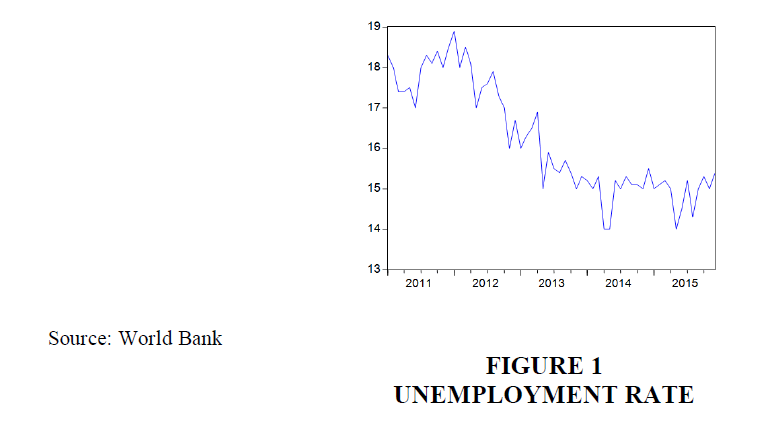

These global economic problems have been aggravated by the immediate negative impact of the 2011 revolution which was characterized by a long period of uncertainty and instability in Tunisia. During this period, Tunisia became the epicentre of a wave of political, social and economic transitions in the region. As a result, the country is going through a period of profound transformation that created new challenges and opportunities, especially for the Tunisian economy. The revolution and the political transition that followed had a political impact and involved some significant challenges for the country. Indeed, political risk classifications remained quite resilient with strong macroeconomic tampons before the revolution. Through this difficult period, the Tunisian economy showed a significant resilience both domestically and internationally. In this transitional context, Tunisia encountered many difficulties at the level of production capacity, the investors’ confidence, local insecurity and economic activity, especially the industry and tourism. Moreover, Tunisia signed a standby agreement with the IMF for multilateral and bilateral financial support, which helps it overcome its most urgent funding needs. However, the increase in the unemployment rate and the weakness of foreign direct investment in the country had an impact on liquidity, foreign debt, exports, inflation and economic growth. In this context, the rise of the unemployment rate is an indicator of resilience of the Tunisian economy and a huge macroeconomic imbalance and fragility. In fact, the rise of the unemployment rate in Tunisian was 18.3%, in 2011 against 12.5% in 2006. This growth shows the country’s resilience.

Although direct links between unemployment rates and economic growth of a country are not clear, various authors argue that the unemployment rate and inflation are also considered appropriate resilience indicators and can have a long-term significant impact on an economy's (Romain & Lukas, 2008), John (2015), Lino et al., (2006)).Which affects the achievement of developing countries in a significant way?

There are several motivations for this study. First, it shows the vulnerability of the Tunisian economy. Second, it examines the effect of the Tunisian revolution on the macroeconomic indicators. Therefore, the main objective of this article is to examine the vulnerability of the Tunisian economy. For this reason, our approach is devoted to the theoretical analysis of the resilience and vulnerability of the Tunisian economy after the 2011 revolution and the empirical analysis based on a SVAR model while considering the unemployment shock as exogenous.

Analysis Of The Tunisian Economy Resilience

Economic vulnerability is defined as the risk for a country to be permanently affected by recurrent exogenous shocks. More and more research shows that vulnerability and instability are obstacles to growth, poverty reduction and sustainable development. According to Mahutin et al. (2010). Vulnerability is intensified by development problems, such as endemic poverty, poor governance, macroeconomic shocks, and limited access to capital, infrastructure and inadequate technologies, degradation of ecosystems and complex disasters and conflicts.

The meaning of resilience differs between disciplines. For example, in terms of disasters, it is defined as the overall capacity of preventing disaster, including their prevention and mitigation. In the ecology discipline, resilience refers to the ability to absorb and recover from the occurrence of a hazardous event of an ecosystem. Cannon (2006) defines vulnerability as the propensity of the elements exposed to the experience of negative effects in case of a shock danger. More specifically, vulnerability is defined as the tendency of having negative shocks whereas resilience is the ability to cope with the negative effects. According to GallopI'n (2006), vulnerability is a combination of the response sensitivity, exposure and capacity.

1) Sensitivity is an internal property of the system, which refers to the extent to which a system is likely to be affected by an internal or external disturbance.

2) Exposure: it refers to the measure in which the system is in contact with a disturbance.

3) Response capacity: it is the ability of the system to respond or face the disturbance.

A country is said to be vulnerable when there is a risk of a bad development in the long term due to the persistence of exogenous factors. On the other hand, resilience is the ability of a country to face negative shocks. Christophe et al. (2012), defined resilience in terms of sensitivity to damage. Vulnerability indicators can be used to assess the weaknesses of a country. The indicators include the macroeconomic variables that indicate potential risks. John (2015), states that the unemployment rate and inflation can be considered heavily affected by the economic policy variables and therefore can be used as good indicators of the economy resilience.

Actually, Tunisia encountered some growing economic problems, which were aggravated by the immediate negative impact of the 2011 revolution which was accompanied by a long period of uncertainty and instability. During this period, the Tunisian economy encountered various difficulties caused by the political instability in the country and the governance problems, including corruption, government efficiency and accountability. The advent of democracy, freedom and good governance led to the liberation of initiatives, the stimulation of domestic and foreign investment and the expansion of economic activity (ADB, 2012). Moreover, the direct and indirect effects of the conflict in Libya have aggravated the Tunisian economic situation because Libya is one of the most important economic partners of Tunisia. Actually, Libya is the first Tunisian partner in the Maghreb and the Arab world and the fifth on the world level. According to the CBT (2011), the national economy suffered a backlash caused by the political, security and social post-revolution instability and the impact of the war in Libya.

In the wake of a particularly restrictive political and social environment, the Tunisian economy has been marked by a slowdown of economic growth since 2011, this is reflected in a difficult social environment, pending for local and foreign investors, lower tourism and export revenues, a deficit in the trade balance, a rise of unemployment and inflation rates All these factors are likely to weigh on the Tunisian economy.

Unemployment, which is one of the major macroeconomic imbalances, is particularly linked to the dynamics of an aggregate demand, the evolution of the transformation of economic structures and technical progress. The unemployment problem will not be solved quickly because the active Tunisian population is growing and newcomers to the labour market are adding to the stock of people already unemployed. However, even more important, due to the impact of the revolution on the production capacity, on the investors’ distrust and on the local insecurity, the economic activity is expected to decline in the short term, especially in the industry and tourism sectors. In addition to the destruction of the existing jobs, this situation could seriously hinder job creation in the coming months.

In 2011, the Tunisian economy had too high inflation levels reaching almost 6.4% due to the effect of the wage increase, depreciation and high international food and fuel prices that would be passed on to the domestic prices despite the high level of the subsidies.

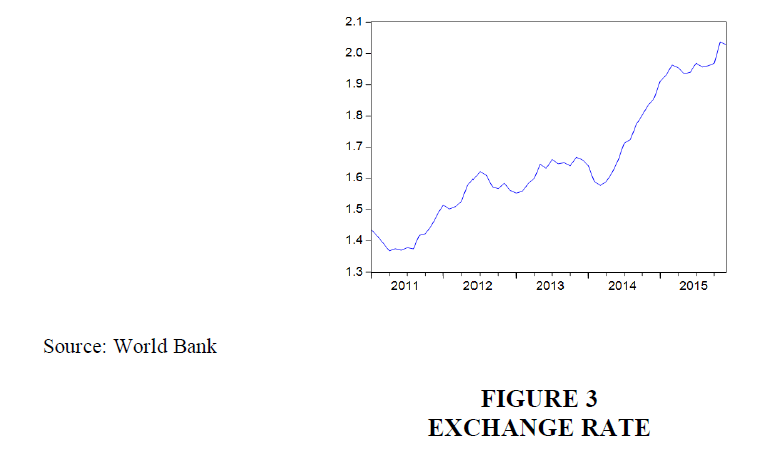

Moreover, the recent disruption has led to a depreciation of the national currency against the U.S. dollar and the Euro by the fact that the currency is injected in an economy or a system that has a low productivity. In fact, the depreciation of the dinar would have several impacts on the national economy. At the level of foreign trade, this depreciation has positively affected the exports insofar as it improved the price competitiveness of the Tunisian products. At the level of inflation, the depreciation of the dinar has generated inflation whereas on the level of debt, it has negatively impacted the debt services.

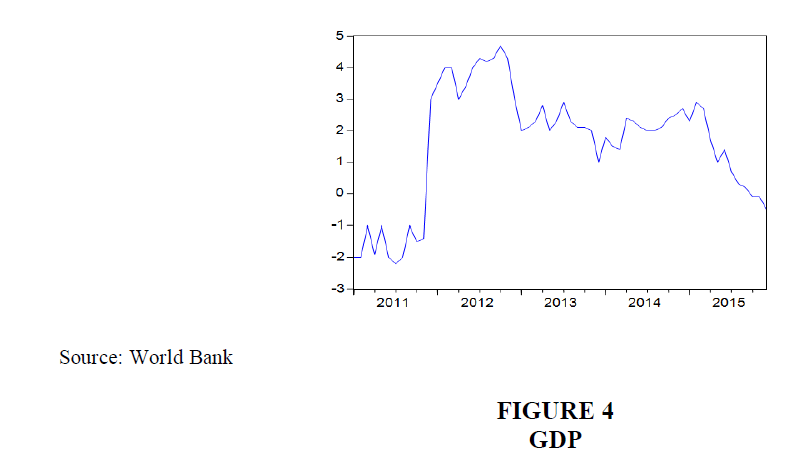

The Tunisian revolution marked the beginning of the Arab spring and engaged the country in a process of transition to democracy with a negative economic growth and a rising unemployment rate. Actually, the analysis of the 2011-2015 period showed that economic growth increased rapidly from -1.9% (2011) to 4.1% (2012), before falling to 2.9% (2013), 2.7% (2014) and 1.9% (2015) (World Bank). The GDP growth was affected by a decline of the demand for tourism services, a disruption of the economic activity and a shrinking of foreign direct investment. However, pressures weighed on the pace of the economic activity and financial balances in connection with the disturbances that impeded the production activity and the exports of goods and services.

In fact, economic growth recorded by Tunisia in the wake of the revolution was resilient. The years (2011-2015) were the worst years on the economic and social level. They were characterized by substantial declines in the majority of the activity sectors, such as the accumulation of deficits, debt, unemployment, inflation, etc.... Although Tunisia is facing a number of challenges in the current economic context, transition is also a unique opportunity to liberate the economy from the administrative rigidities which had previously obstructed its development and to implement reforms that create the right conditions for private initiative and for business.

Empirical Literature Review

Nowadays, vulnerability and resilience are at the heart of the research debate. The literature on risk and vulnerability of the 1970s and 1980s had a significant influence on the general documentation about vulnerability (Prowse, 2003). There has been a wave of empirical research on the analysis of vulnerability and resilience which govern the management frameworks of the natural disaster, poverty and vulnerability risks.

To analyse the relationship between poverty, vulnerability and resilience, Sonia & Bishawjit (2013). Showed that the poor were more vulnerable and suffered significantly higher economic, physical and structural losses. However, this strong vulnerability has not necessarily led to a low resilience, because this proportion of the population had a greater ability to endure the shock compared to their non-poor neighbours.

Resilience is more influential in the development and reduction vulnerability sectors, such as social protection, the reduction of disaster risk and the adaptation to the climate change Christophe et al. (2012). In this context, the objective of this study is to critically assess the benefits and limits of resilience. The review of this article can help better integrate the ecological links between the vulnerable groups and the environmental services, contribute to a more adequate targeting of the vulnerable groups and show that resilience has significant limitations.

A key element in the literature on the assessment of vulnerability comes from the literature the management of disasters, ecology and risks, which are caused by the climate change, as well as of the socio-economic field. However, the empirical understanding of the socio-economic resilience and its relationship with economic growth is limited. Kenichiro et al. (2012). Used macroeconomic data to analyse the relationship between the socioeconomic factors and the degree of economic slowdown after the crisis. The preliminary results of the correlation analysis imply that the expansion of exports, the inflation rates, the dependence on imports of fuels and exports of manufactured goods can explain the economic resilience of the major developed countries, such as (Germany, Japan and the United States). These authors studied the determinants of economic resilience through an analysis of macroeconomic data (GDP deflator, government expenditure (% of GDP), net exports of manufactured goods). The results also showed that there is a significant negative correlation between the exchange rate and net exports of manufactured products (% of GDP), especially for the main advanced countries. Similarly, this result indicates that countries that depend on exports of manufactured goods tend to have a greater fall of their GDP after the crisis. This finding may be explained by the worldwide imbalances.

John (2015), analysed resilience on the basis of the macroeconomic variables (the ratio of fiscal deficit to GDP, the unemployment rate, the inflation rate and the ratio of external debt to GDP). He showed that resilience indicators could be possibly used to measure the progress made for the improvement of resilience in a given country or compare countries to one other to help target the resources where they are the most needed and most efficient.

With the SVAR model, Vincent & Cédrick (2015) showed that the Congolese economy was resilient to exogenous shocks over the study period due to a restrictive monetary policy (positive demand shock), infrastructure projects and initiatives in the agricultural sector (positive supply shock), unemployment, inflation, economic transformation In this study, the main considered external shock is the price change of copper which affects exports, international reserves and the exchange rates. This suggests that the Congolese economy would be vulnerable to exogenous shocks during the 2009-2014 periods.

Barritto (2009) investigated the factors that best explain the vulnerability of the countries where economic losses due to natural disasters have the biggest impact. This author applied multivariate statistical techniques in order to identify the principal components explaining the countries’ features and explore the main identifiable clusters of economies sharing similar characteristics.

Methodology and Data

Data

To understand the effects of the unemployment rate volatility on the macroeconomic variables of the Tunisian economy, the frequency is monthly data covering the period 2011- 2015.

The choice of these variables is justified by the fact that an external shock of the Unemployment Rate (UR) first affects the Industrial Production Index (IPI), the Gross Domestic Product (GDP), inflation (INF) and the Exchange Rate (ER). The following variables are taken into account:

The Unemployment Rate

It represents the ratio of the number of the unemployed to the labor force. The choice of the unemployment rate, as an indicator of resilience, is justified by its increase, which reached 18% in 2011.

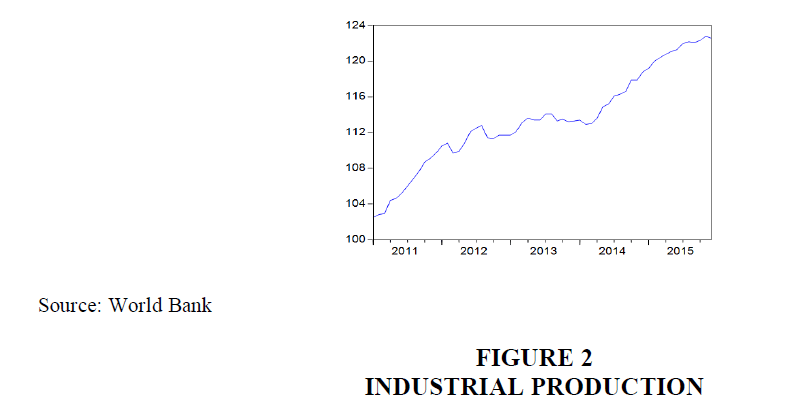

The Industrial Production Index

It is a macroeconomic indicator which enables to track the evolution of industrial activity. It is common in literature to use this index as a "proxy" of the economic activity (IMF, 2007).

Real Effective Exchange Rate

The exchange rate is the standard variable used to study the foreign exchange market in a context of an open economy.

Gross Domestic Product

The annual growth rate of the GDP is an instrument of the economic activity.

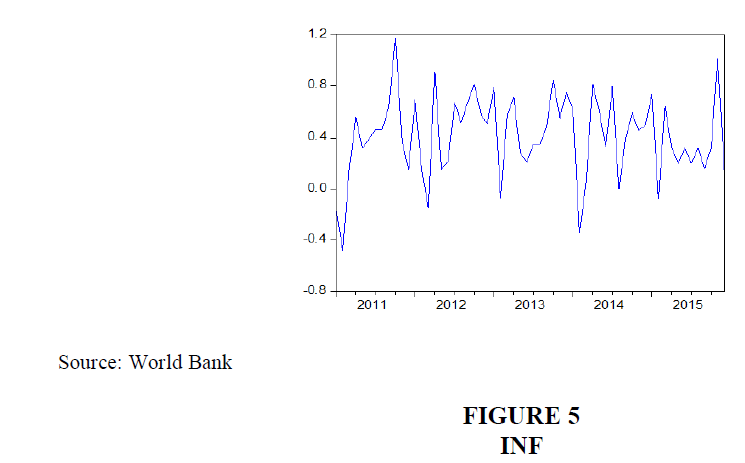

Inflation

Being measured by the consumer price index, inflation reflects an increase of the general level of prices of goods and services in an economy over a period of time.

Methodology

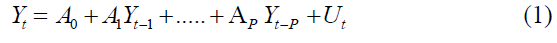

In order to analyse the resilience of the Tunisian economy, we used the structural vector auto-regressive model (SVAR). The vector auto regression methodology (VAR) was firstly introduced in 1980 by Sims, as a valid alternative to traditional macroeconomic models. The VAR is an econometric model used to capture the dynamics of the interaction between several time series. All variables are processed symmetrically and the dependent variable in each equation is explained by all the variables in the model. In most VAR studies, the structural shocks are identified by imposing a structure on the dynamics interactions between contemporary variables using the Colicky decomposition.

As indicated above in the prior paragraph, Sims (1980) and Bernanke (1986) was developed the SVAR (structural vector auto-regressive) model. In the last few years, SVAR models have become a useful tool in the analysis of the mechanism transmission and economic fluctuations. The structural form of the model focuses on identifying constraints in the short and long terms. In this case, the unexpected variations in each economic indicator to the system are structural; they reflect the particularities of economic structures of the studied countries.

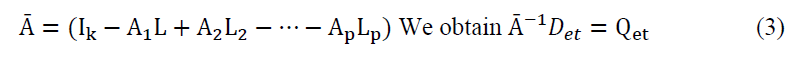

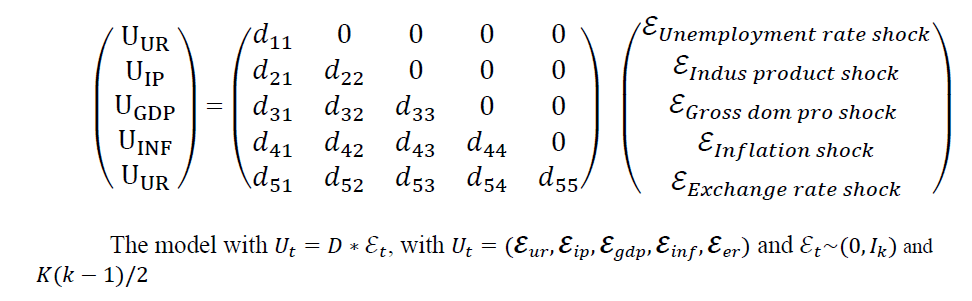

A standard VAR representation is used to generate the results which are summarized using impulse responses and forecast error variance decomposition. In this paper, we used the impact of unemployment rate shocks on the macroeconomic variables by estimating a SVAR model. To the end, the VAR is represented as follows:

WithYt= (UR,GDP, IPI, INF,ER) vector of endogenous variables.

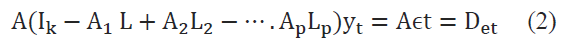

The VAR model can be rewritten:

Pre-multiplying the inverse of equation (2) by

With Q is the long-term matrix response to shocks.

Hence, the reduced-form VAR is obtained by multiplying both sides of equation (2) by

This has the following recursive structure:

Results and Discussion

On the basis of the theory, we choose between both types of the SVAR and the SVECM models which are closely related: To choose between two models, first the data stationary properties were examined. An Augmented Dickey–Fuller test (ADF) is used for this purpose. In case the variables are considered I(0), the SVAR is preferred and estimated. However, if the variables turn out be I(1), we cannot proceed by estimating the SVAR in the differences, because there may be a linear combination of the stationary variables.

Stationary Tests

In the first econometric approach, an Augmented Dickey-Fuller test (ADF) and a unit root test were conducted to detect non-stationary in a series. To study the stationary of the data in level, we have conducted unit root tests on the variables in level.

| Table 1: Adf Test In Level | |||

| Variables | Without trend and with constant | With trend and constant | With trend and constant |

|---|---|---|---|

| Unemployment rate | -1,069188 | -2,159907 | -1,129296 |

| Inflation | -7,448094* | -7,359425* | -1,057155 |

| Ind prod | -1,249568 | -1,924008 | 4,734076 |

| Gross domestic product | -2,026813 | -1,680100 | -1,359197 |

| Exchange rate | 0,859051 | -2,039410 | 3,179014 |

The results of the Augmented Dickey-Fuller tests showed that the variables; unemployment rate (UR), industrial production (IP), the gross domestic product (GDP) and the exchange rate are not stationary. When there are unit roots, we shall proceed to the ADF test in first difference. The ADF test is performed for the time series taken in first difference in order to study the second order integration hypothesis.

| Table 2: Adf Test In First Difference | |||

| Variables | Without trend and with constant | With trend and constant | With trend and constant |

|---|---|---|---|

| Unemployment rate | -1,069188 | -2,159907 | -1,129296 |

| Inflation | -7,448094* | -7,359425* | -1,057155 |

| Ind prod | -1,249568 | -1, 924008 | 4,734076 |

| Gross domestic product | - 2,026813 | -1,680100 | -1,359197 |

| Exchange rate | 0,859051 | -2,039410 | 3,179014 |

In fact, the variables are not co-integrated because the track and the maximum value statistics are lower than the critical values at 5% threshold. Therefore, the SVAR model estimation will be applied. The number of p delays retained is the one that minimizes or maximizes the criteria of Schawarz (SIC), Hannon-Quinn (HQ), Final Predictor Error (FPE) and the LR. The appendices show that the number of delays in the model is two.

Causality Study

The identification of the causal relationships between the macroeconomic variables enables a better understanding of the economic phenomena and at the same time, the implementation of an optimized economic policy. Therefore, the causality concept of developed by Granger is used.

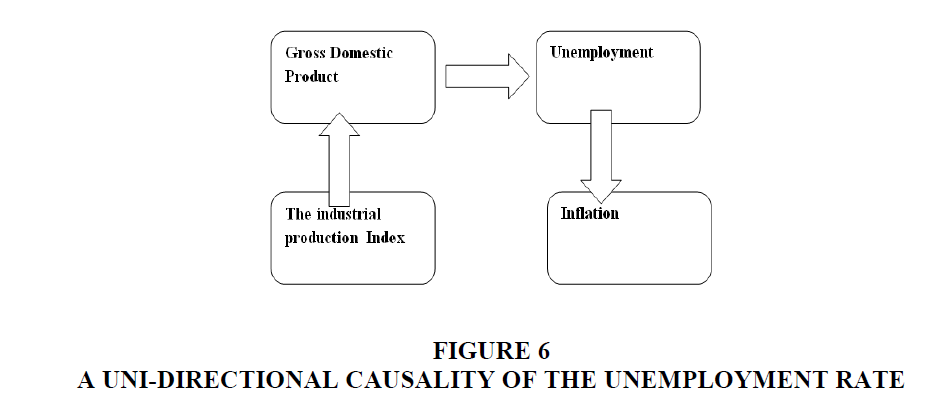

The results are presented in the appendices and summaries in the following figure:

The figure shows a uni-directional causality of the unemployment rate (CH) to inflation (INF); from the gross domestic product (GDP) to unemployment rate; and indices of industrial production (IPI) to gross domestic product (GDP).

Analysis of the Impulse Response Functions

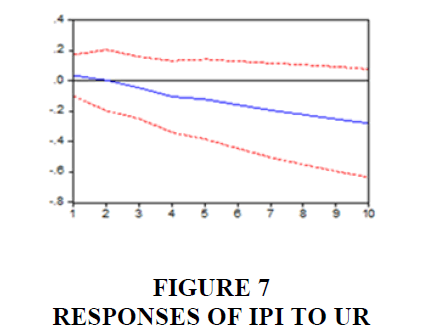

The main shock in this article is that of unemployment. In fact, the increase of the unemployment rate is one of the resilience factors of the Tunisian economy. The analysis of the impulse response function shows that the shock of unemployment reflects a depreciation of the industrial production throughout the study period.

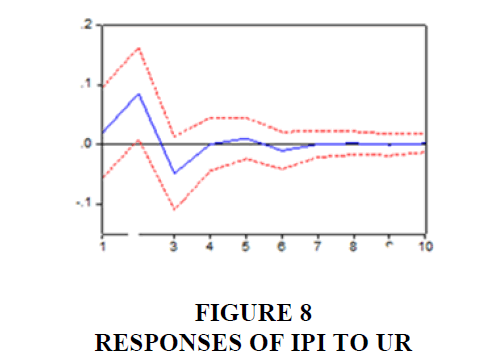

The response function of a shock to the unemployment rate inflation generated growth during the first two periods and depreciation during the third period. This result is consistent with what was presented by studies, such as that of Johnson et al. (2006). In fact, these authors showed that the response of inflation to the unemployment shock depends on the extent to which the shock is expected on the persistence of the shock and the degree of imperfections in the credit markets.

It is well known that unemployment and inflation, as two major players in the economy, are affected directly by the population, technology and economic growth. Many economists showed that the rise of the unemployment rate reflects the future risk of the inflation rate increases and threatens economic growth Marc (2004). Moreover, if inflation rises, the monetary authorities will tend to reduce the interest rates to lower inflation. A reduction of the interest rate can stimulate economic growth and reduce unemployment.

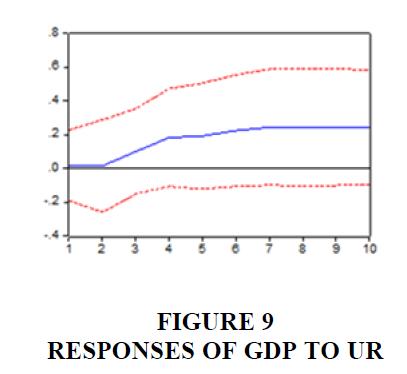

The shock of unemployment shows a low ascent of GDP for the entire study period. Given that the Tunisian economy recorded a low economic growth during the 2011/2015 period, the unemployment rate continued to increase. In fact, a negative shock of the unemployment would weakly affect economic growth. This result is consistent with that of the study of Linda Levine (2013), which showed that the low unemployment rates are usually accompanied by GDP growth rates. As a consequence, the main objective of the economy decision-makers is to reduce unemployment and raise the GDP growth rate.

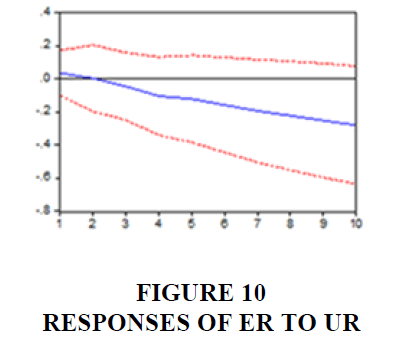

The exchange rate responds to the unemployment rate shock by depreciation. This depreciation can be explained by the trade deficit, the decline in government revenues and the limited intervention of the central bank in the foreign exchange market.

In fact, the depreciation of the exchange rate generates a budget deficit, a decline in tourism receipts and FDI, a rise in public spending and inflation. Moreover and according to IMF, this depreciation has a significant positive effect on exportation. This means that the decrease of exportation can improve the price competitiveness of Tunisian products.

The unemployment affects inflation, industrial production and economic growth. This suggests that the Tunisian economy is vulnerable to exogenous shocks during the examined period.

The Decomposition of the Error Variance

Based on the functions of the impulse responses, the decomposition of the prediction error variance shows the importance of the various shocks by determining the proportion of the variation of each variable attributed to the shock (Lack and Lenz, 2000). The decomposition of the prediction error variance is intended to calculate for every innovation its contribution to the error variance in percentage.

Conclusion

Unpredicted events, such as revolutions, political instability, disasters can affect the national economies and a country's development achievements. The revolution and the political transition that followed had a political impact and posed significant challenges to Tunisia. However, political risk classifications remained rather resilient with strong macroeconomic buffer before the revolution although the increase in current account deficits and low foreign direct investment in the country had an impact the liquidity, external debt and unemployment in recent years.

In this way, the article focuses on a detailed review of the resiliency of the economy post revolution Tunisian and a study of macroeconomic data caused by the revolution in 2011 which shows resilience factors, such as unemployment. Another important aspect taken into account in this study is whether the impact of an unemployment shock is a resiliency factor on the macroeconomic indicators (inflation, GDP, industrial production). The empirical results showed that an unemployment shock affects inflation, the industrial production and economic growth. This suggests that the Tunisian economy would be vulnerable to exogenous shocks over the considered period.

The recent political unrest increased the existing tensions in the region because the economic conditions of the majority of the Arab countries were already under the challenge of the rising food prices, energy, high unemployment and corruption rates and weak economic reforms. In this context, the IMF (2014) report on the Economic prospects, as part of the strengthening of the resilience of the African economies, insist on the adoption of measures and effective reforms favouring good governance, transparency and accountability. These measures and reforms would support economic stability, strengthen fiscal institutions and identify the fiscal space needed to ensure an improvement of the living standard. In this context, various strategies to support employment were implemented by Tunisian associations with a set of local and State support, cooperation and international organizations. The measures implemented were also encouraged by successive Governments which were not able to offer an employment policy that can deal with the rise of unemployment.

Future research should also focus on the resilience in front of exogenous shocks, such as revolutions, wars, terrorism and natural disasters, which should be seriously dealt with in future studies. However, we believe that this research provides empirical results which are useful for the understanding of this type of national and elastic economy as well as in the choice of the economic policies in order to increase resilience.

Appendix

Appendix 1: Co-integration Test

| APPENDIX 1: Cointegration Rank Test (Trace) | ||||

| No. of CE | Eigenvalue | Trace Statistic | Critical Value | Prob |

|---|---|---|---|---|

| None * | 0.460584 | 54.67871 | 47.85613 | 0.0100 |

| At most 1 | 0.156576 | 18.87719 | 29.79707 | 0.5018 |

| At most 2 | 0.133519 | 9.000620 | 15.49471 | 0.3653 |

| At most 3 | 0.011798 | 0.688350 | 3.841466 | 0.4067 |

|

||||

| No. of CE | Eigenvalue | Trace Statistic | Critical Value | Prob |

| None * | 0.460584 | 35.80152 | 27.58434 | 0.0035 |

| At most 1 | 0.156576 | 9.876569 | 21.13162 | 0.7562 |

| At most 2 | 0.133519 | 8.312271 | 14.26460 | 0.3478 |

| At most 3 | 0.011798 | 0.688350 | 3.841466 | 0.4067 |

Appendix 2: Causality Test

| Appendix 2: Causality Test | ||||

| Null hypothesis | Obs | F-statistic | Propability | |

|---|---|---|---|---|

| INF does not Granger Cause UR UR does not Granger Cause INF | 58 | 1.76567 3.28940* | 0.1810 0.0450 | |

| IPI does not Granger Cause UR UR does not Granger Cause IPI | 58 | 1.46323 0.90064 | 0.2407 0.4124 | |

| GDP does not Granger Cause UR UR does not Granger Cause GDP | 58 | 2.33124* 1.58790 | 0.1071 0.2139 | |

| ER does not Granger Cause UR UR does not Granger Cause ER | 58 | 2.29962 2.01897 | 0.1102 0.1429 | |

| IPI does not Granger Cause INF INF does not Granger Cause IPI | 58 | 0.69458 0.65885 | 0.5038 0.1550 | |

| GDP does not Granger Cause INF UR does not Granger Cause GDP | 58 | 0.65885 0.88539 | 0.5216 0.4186 | |

| ER does not Granger Cause INF INF does not Granger Cause ER | 58 | 0.63541 0.08458 | 0.5337 0.9190 | |

| GDP does not Granger Cause IPI IPI does not Granger Cause GDP | 58 | 2.79713 0.62238* | 0.1700 0.0505 | |

| ER does not Granger Cause IPI IPI does not Granger Cause ER | 58 | 3.93237 5.56497 | 0.1256 0.0064 | |

| ER does not Granger Cause GDP GDP does not Granger Cause ER | 58 | 1.17081 0.26412 | 0.3180 0.7689 | |

References

- Christophe, B., Rachel, W., Andrew, N. & Mark. D. (2012). Resilience: New utopia or new tyranny? Reflection about the potentials and limits of the concept of resilience in relation to vulnerability reduction programmes, IDS Working Paper.

- GallopI`n, G. (2006). Linkages between vulnerability, resilience and adaptive capacity. Global Environmental Change, 16, 293-303.

- Jarocinski, M. (2010). Responses to monetary policy shocks in the east and the west of Europe: A comparison, Journal of Applied Econometrics, 25, 833-868.

- John, M.U. (2015). Comprendre la résilience économique, revue congolaise de politique économique.

- Johnson, D., Parker, J. & Souleles, N. (2006). Les dépenses des ménages et les reimbursements d'impôt sur le revenu de l'année 2001, Economic Review.

- Kenichiro, M., Takeshi, N. & Satoshi, F. (2012). Statistical evidences of national economic resilience using macroeconomic data before and after the global financial crisis. The Empirical Economics Letters, 11(10).

- Lane, P. & Milesi, G.M. (2010). The cross-country incidence of the global crisis. CEPR discussion paper, no. 7594.

- Linda, L. (2013). Economic growth and the unemployment rate, Congressional Research Service.

- Lino, B., Gordon, C., Stephanie, B. & Nadia, F. (2006). Conceptualizing and measuring economic resilience, Economics Department, University of Malta.

- Mahutin, A., Yvon, H., Aline, T. & Florence, L. (2010). Adaptation et résilience des populations rurales face aux catastrophes naturelles en Afrique subsaharienne, revue économique.

- Marc, L. (2004). A changing natural rate of unemployment: Policy Issues. Washington, DC: Congressional research service. 1589-1610.

- Romain, D. & Lukas, V. (2008). Résilience économique aux chocs: Le rôle des politiques structurelles, Revue économique de l'OCDE 2008/1 (n° 44).

- Sims, C. (1980). Macroeconomics and Reality, Econometrica, 48, 1-48.

- Sonia, A. & Bishawjit, M. (2013). The poverty-vulnerability-resilience nexus: Evidence from Bangladesh. Ecological Economics, 96, December 2013, 114-124.

- Vincent, N. & Cédrick, T.M. (2015). Vulnérabilité économique et résilience: Comment la RDC résiste ! Revue congolaise de politique économique, 1, Numéro 1.