Research Article: 2021 Vol: 25 Issue: 3

Thematic Extraction of the Worldwide Economic Financial and Managerial Effects of Covid-1

Diya Guha Roy, Assistant Professor, Goa Institute of Management

Abstract

The research article has derived the thematic analysis from thirty-three Newspaper articles by Nobel Laureates and eminent economists, and financial analysts. The resulting collage of the themes-subthemes identifies the issues that are widely being discussed and floated around the globe for scholarly as well as political consultations. The thematic analysis has consolidated the issues discussed during the first two weeks of April, 2020 in a tabular, coherent manner. The outcome simply gives a clear picture what impending crisis oriented research facilities are required to counteract the precise problems at the peak of this pandemic. The Isolated discussions are often very brief and covers certain problems, or policies. However, this research assemblage itself will help to identify the bigger picture by narrating the primary issues in one explicit pail of information.

Keywords

Covid-19, Coronavirus, Text Mining, Financial Impact, Economic Impact.

Introduction

According to The Union Health Ministry, India, as of on 18 April, 2020 eleven thousand six hundred sixteen people in India got inflicted by coronavirus infection and four hundred fifty-two people succumbed to death. On 17 April, 2020, the WHO (2020) reports that there are 2,074,529 confirmed cases, and the death toll is estimated as 139,378. Amidst the other rumours such as Covid-19 is global bio war tool such as SARS that out broke in China during end of November, 2002 and finally had spread to 26 countries. As SARS spread from the epicentre there were news of new economic ruptures after the bank failures and currency devaluations five years ago. We can see a similar cycle in 2020 when the mass economic initiatives by the World Bank and individual government bodies are being assessed to counteract the economic massacres on the account of reduced manpower and working hours as well as collapse of trade in general. There are ongoing economic negotiations for financial moratoriums to be distributed among various states in India. According to a report by The Times of India Covid-19 will make 195 million full-time jobs or 6.7 % working hours wiped out. There are debates going on about borrowing, lending, credit deferments, economic stimulus packages to combat the upcoming recession etc.

The report by International Labour Organization ILO (2020) classified issues such as solvency, income loss, layoffs, unprotected workers, changes in working hours, annual job losses. workforce displacement, limited access to health services and social protection, looming risk of escalated poverty PTI (2020), policy responses, scarcity public resources as major indexes for the economic deterioration in the present financial quarter. The International Labour Organization ILO (2020) also did a thematic analysis to create a documentation on “Interventions to support enterprises during the COVID-19 pandemic and recovery”.

This article analyses thirty important economics and financial market related newspaper articles by eminent analysts and did a content analysis to identify the main themes and subthemes associated. This research bring paper brings forth the main financial and economic themes at one vessel to be used for future researches by market analysts and researchers.

The value lies in the consolidation of the major setbacks during this pandemic, itemizing them in one list, and thereby essentially creating a vessel where all the peak economic and financial crisis had been accumulated.

Samples

Thirty-Three articles comprising of a total of thirty thousand fifty-nine words were collected from sources such as BBC, The Times, Aljazeera, The Economics Time, The New York Times, The Wall Street, Bloomberg, The Guardian, The Telegraph, The Washington Post, Lancet etc. Most of the Articles were composed by eminent scholars such as Nobel Laureates as well as other famous economists, and financial analysts. The articles talk about the global economic situations due to the outbreak of Covid-19 as well as emphasise the geographical markets such as Vietnam, China, Korea, India, The USA, Europe, The Middle East etc. The articles were collected between first and second week of April, 2020.

Method

A simple analytic consolidation of main themes and associated subthemes were conducted using Nvivo 12 plus software. NVivo 12 is software provided by QSR International, which is effective in analysing the thematic analysis as well as hierarchical clustering using word similarity and Pearson's coefficient (Azeem, 2012). The thirty-three articles comprising of 67 pages and 30059 words were put into a Microsoft word document and analysed for thematic extraction by machine algorithm supported automatic coding.

Results

Initially we “auto-coded” (software algorithm generated coding) the document using NVivo 12. The NVivo software uses a semi-supervised “machine-learning” algorithm to automatically code (Hai-Jew, 2014). Considering the length (67 pages) of the whole document we found the relying on the machine algorithm was more realistic and scientific approach rather than coding it through manual open/axial coding for identification of themes-subthemes. Simultaneously different levels of sentiment analysis were performed using the software as discussed in the following section.

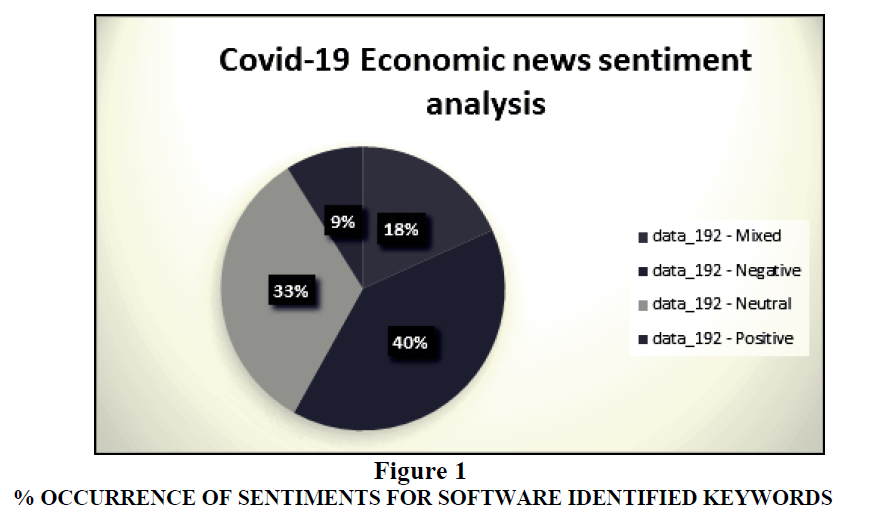

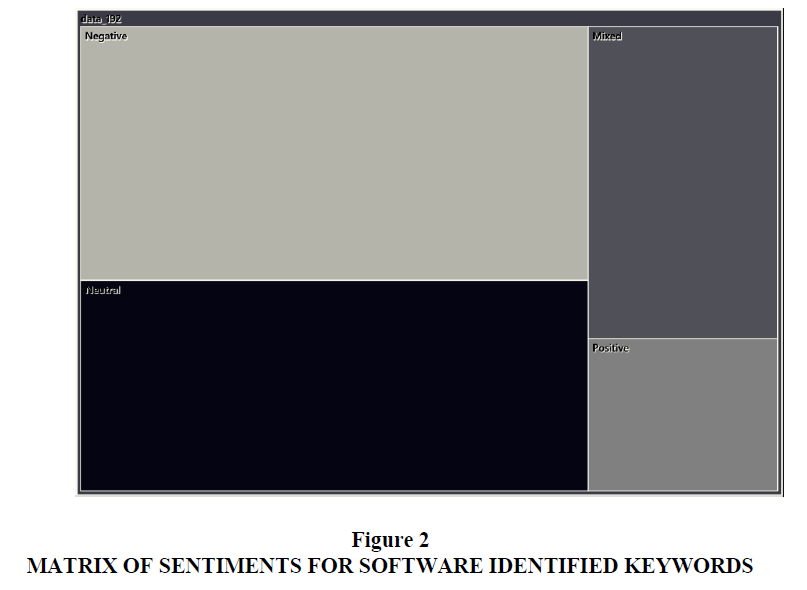

The Sentiment count of identified “auto-coded” words are shown in Table 1. The total number of relevant key words with associated sentiments were 718, out of which only 64 words had positive sentiments associated with them; and 237 words were neutral. 286 of the identified keywords had Negative sentiments, and 131 words reflected Mixed (both positive and negative) sentiments. Therefore, only 9% of total number of identified words had positive sentiments Figure 1. The Neutral and Mixed sentiments were 33% and 18% respectively (See Figure 1). The Negative sentiments occurred for 40% and had the maximum share (Figure 1). Figure 2 explicitly shows the data in Figure 1 in a 2 dimensional matrix for an alternative appeal to the visual pallet.

| Table 1 Number of Coding References for Coded Sentiments | |

| Codes | Number of coding references |

| data_192 | 718 |

| data_192 - Mixed | 131 |

| data_192 - Negative | 286 |

| data_192 - Neutral | 237 |

| data_192 - Positive | 64 |

The main themes with more than 2% occurrences are tabulated in Table 2. The main themes identified are: supply, products, chains, companies, market, payment, unemployment, shocks, consumers, email, systems, coronavirus, online, delivery, debt. Table 3 has given the full list of the themes and associated subthemes. The main themes that appeared for 1% or so are: advertising, growth, benefits, chains, challenge, health, risk, retailers, strategy, credit, services, unemployment, policy, and debt.

| Table 2 % Occurrence of Coded Themes | |

| THEMES | % OCCURANCE |

| supply | 4.53% |

| products | 3.79% |

| chains | 3.41% |

| companies | 3.2% |

| market | 3.07% |

| payment | 2.61% |

| unemployment | 2.51% |

| shocks | 2.43% |

| consumers | 2.36% |

| 2.36% | |

| systems | 2.3% |

| coronavirus | 2.05% |

| online | 2.05% |

| delivery | 2.04% |

| debt | 2.01% |

| Table 3 Themes and Subthemes from the Thirty Three Articles | ||

| Auto-coded Themes | ||

| advertising | growth | products |

| advertising arrangements | economic growth rate | dairy products |

| advertising commitments | economic growth targets | factory production |

| advertising partners | forecast growth | finished product |

| digital advertising | initial growth path | health-relevant products |

| asset | target growth rate | hygiene products |

| asset valuations | health | medicine production |

| equity asset class | global health | product groups |

| risk assets | health conditions | productive activity |

| safe assets | health crisis | scheduling products |

| wide asset classification forbearance | health infrastructure | protections |

| benefits | mental health support | anti-virus protection |

| awarding benefits | public health policies | coronavirus protections |

| core benefit | hit | protective gear |

| unemployment benefits | direct hit | rate |

| capacity | financial hit | economic growth rate |

| adding capacity | hitting manufacturing | household savings rates |

| excess capacity | indirect hit | key interest rate |

| logistical capacities | household | occupancy rates |

| chains | household exposure | policy rates |

| 2016 value chain model | household savings rates | target growth rate |

| fair share | household wealth contracts | recession |

| global value chains | industry | global recession |

| share values | banking industry | last recession |

| supermarket chain | extractive industries | policy recessions |

| supply chains | particular industry | recession risk |

| challenge | theatre industry | recovery |

| challenging categories | infrastructure | recovery cycle |

| challenging proposition | city infrastructures | recovery dynamics |

| current coronavirus challenge | health infrastructure | recovery patterns |

| legal challenge | road infrastructure | recovery strategy |

| major challenge | instructions | response |

| companies | changed payment instructions | bungled response |

| aviation companies | urgent instructions | crisis response |

| big companies | wiring instructions | monetary policy response |

| chinese companies | internet | retailers |

| company guidelines | internet router | bricks-and-mortar retail |

| german company | internet use | electronic retailer |

| gig economy companies | password-protected internet connections | large retailers |

| large companies | legacy | risk |

| lingerie company | macroeconomic legacy | additional transmission risk |

| luxury goods company | microeconomic legacy | recession risk |

| several pharma companies | loan | risk assets |

| tourism companies | bad loans | risk profiles |

| consumers | bank loan repayment | services |

| chinese consumers | loan covenants | backup child care service |

| consumer comfort | past loans | cleaning services |

| consumer confidence correlate | market | delivery services |

| keeping consumers | financial market performance | remote meeting services |

| coronavirus | financial market sell-offs | shocks |

| coronavirus crisis | key markets | demand shocks |

| coronavirus governments | key stock market | economic shock |

| coronavirus protections | market intelligence services portal | exogenous shocks |

| coronavirus strain | market signals | prior shocks |

| coronavirus struggle | market worldwide | supply shocks |

| current coronavirus challenge | wholesale money market | supply-side shock |

| credit | media | shopping |

| corporate credit | media giant | bricks-and-mortar shopping |

| credit intermediation | social media accounts | offline shopping worlds |

| credit spreads | social media content | online shopping |

| crisis | models | store |

| coronavirus crisis | 2016 value chain model | physical stores |

| crisis planning | door-to-door models | store cleaning |

| crisis response | economic model | store closing |

| health crisis | mechanical models | strategy |

| cut | national | post-recovery strategy |

| cut backs | foreign nationals | recovery strategy |

| surprise cut | national concerns | supply |

| temporary pay cuts | national developments | critical supplies |

| damage | national governments | essential supplies |

| actual damage | oil | requisition supplies |

| economic damage | crude oil futures | sufficient supplies |

| structural damage | global oil demand | supply chains |

| debt | mentha oil futures | supply disruption |

| bank holiday | oil importer | supply shocks |

| debt holiday provision | online | supply shortage |

| generous provision | online purchases | three-year supply pact |

| government debt | online sales channels | support |

| delivery | online shopping | fiscal support |

| delivery services | online spaces | mental health support |

| efficient delivery system | transacting online | policy support |

| enabled delivery systems | packaging | taking support |

| home delivery | economic rescue package | systems |

| demand | economic stimulus packages | company systems |

| demand shocks | payment | digital inventory system |

| exogenous demand | changed payment instructions | efficient delivery system |

| global oil demand | paid time-off | enabled delivery systems |

| economy | payment leeway | intuitive reasoning system |

| advanced economies | post-holiday payments | political systems |

| gig economy companies | resumed payments | transmission |

| major economies | temporary pay cuts | additional transmission risk |

| real economy shock | planning | classic transmission |

| crisis planning | plausible transmission channels | |

| 365 email accounts | planned broadcast | transmission mechanism |

| business email interruption scams | post-recovery planning | unemployment |

| internal company email | policy | unemployment benefits |

| phishing email | monetary policy response | unemployment claims |

| goods | policy action | unemployment insurance appeal board |

| ancillary goods chemicals | policy error | unemployment insurance fund |

| luxury goods company | policy interventions | |

| material goods | policy rates | |

| government | policy recessions | |

| government debt | policy support | |

| individual governments | public health policies | |

| national governments | ||

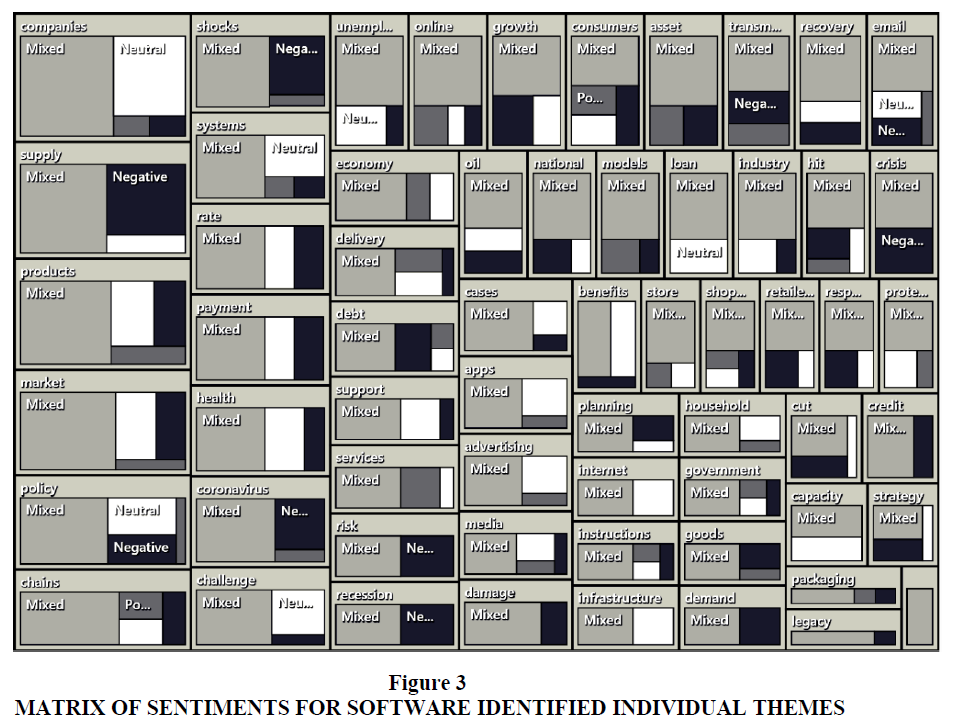

A deep look into Figure 3 will divulge that Mixed sentiments are actually dominating most of the thematic words. For a few words (companies, systems, unemployment, challenge, products, market, benefits, loan, industry, economy, protect, support, delivery, internet, infrastructure, media, advertising, consumers, email, capacity etc.) the Neutral sentiments governed the second biggest chunk after Mixed sentiment. So even when the death toll is rising and it seems that the world is coming to a standstill, the economic measures and media news seem to have kept a neutral and mixed sentiment ambience for the most deeply economically hit sectors. The Negative sentiments are observed for words such as supply, products, coronavirus, payment, rate, stocks, growth, debt, risk, recession, demand, damage, good, retailers, credit, cut, crisis, transmission, national, models, planning, response. A focused review of these words shows that the direct economic and financial components, and the retail industry had been shaken badly and the fear is emanating from and resonating in these domains.

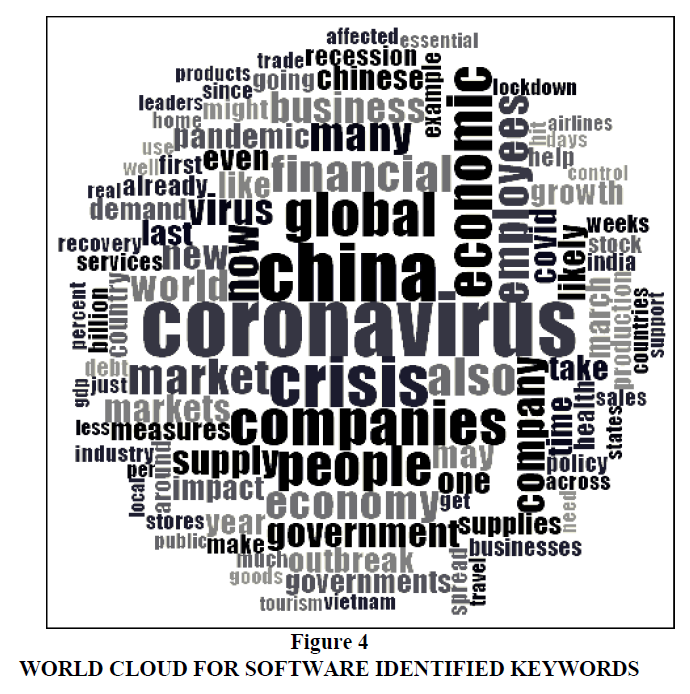

The only holistically positive and mixed sentiments are ruling the following themes: infrastructure, advertising, apps, internet, capacity, loan, and protection. Figure 4 provides the most dominating hundred words in a machine generated basic word cloud.

The reason advertising was seen to be in a mixed and positive zone due to digital applications Table 3. Infrastructure seems to be more of an established component with three sub-components as represented in Table 3: city infrastructures, health infrastructure, and road infrastructure. The loan market shows a better mood due to bank loan repayment, loan covenants, and past loans. The protection key word Table 3 has a better impact as it talks about anti-virus protection, coronavirus protections, and protective gear. However, economic protection is totally neglected. The logistical capacities are the main reason why we had a primacy dominance of mixed feeling and secondary dominance of positive sentiment in the keyword “capacity”.

Discussions

The scope of this article, as stated before, to identify the opportunities during the mightiest pandemic crisis in the last century. The article simply finds the right scope of in-depth research problems for better analytically presented managerial solutions. In this line this research found certain scopes for researchers to target certain issues.

The auto-coded themes and subthemes in Table 3 highlighted a few important points as follows:

1. Growth: The growth is related to forecasting as well as the growth cycle, growth target and rate. There are abundant scopes for research in term of the whole economic cycle at this phase.

2. Assets: The asset (financials) need to be explored more crucially from the point of risk, safe, equity etc. How these have long term individual and collective impact should reach the research community for better management system for future crisis onsets.

3. Chains: The values chain models, global and individual retail chains ask for magnified and micro analysis.

4. Industry: Beyond banking, how the theatre industry is taking the hit is also of concern.

5. Recession: Are the current researchers put adequate weightage of importance for policy recession as the onset of any global war, bio-warfare, and pandemics?

6. Health: How the global health, health crisis, health infrastructure, and public health policies are adequate? Is there gap in the mental health support system?

7. Advertising: How are the advertisement arrangements, commitments are proceeding? How the advertising partners are getting affected due to this pandemic? Is there more scope for digital advertising as the physical advertisements is facing an impediment?

8. Products: The research expresses to specifically pour more focus on the industries such as dairy products, factory production system, health-relevant, medicine, hygiene products. The production activity and scheduling of production system also stood out.

9. Recovery: the text mining specifically pointed towards the recovery cycle, recovery dynamics, recovery patterns, and recovery strategy.

Table 3 also points to the specific possibilities of explorations of various companies affected by the covid-19 pandemic, consumers, retailers, shopping, services that are crucial during the pandemic, and economics facets such as debt, loan, shocks, risk, credit, crisis, cut, supply, demand, unemployment, policy, and payment.

The research itself does not provide any solution, nor it does explore any gap in the current economic analysis. It simply explores the possibilities of certain themes and related sub-themes and point at the major research needs under the spell of the pandemic. This crisis can be a learning phase in industrial 4.0 era in order to control, plan, and find feasible solutions at the quickest time. And the research simply put the major issue, that are observed at this point of time, upfront for concise and precise outlooks at one go for immediate concentration.

References

- Azeem, M., Salfi, N.A., & Dogar, A.H. (2012). Usage of NVivo software for qualitative data analysis. Academic Research International, 2(1), 262-266.

- Hai-Jew, S. (2014). Using NVivo: An unofficial and unauthorized primer. Retrieve from: http://scalar. usc. edu/works/using-nvivo-an-unofficial-and-unauthorized-primer/index.

- ILO (2020). Interventions to support enterprises during the COVID-19 pandemic and recovery. Retrieved from https://www.ilo.org/wcmsp5/groups/public/---ed_emp/---emp_ent/documents/publication/wcms_741870.pdf

- ILO (2020). LO Monitor: COVID-19 and the world of work. Second edition. Retrieved from https://www.ilo.org/wcmsp5/groups/public/@dgreports/@dcomm/documents/briefingnote/wcms_740877.pdf

- Ministry of Health and Family Welfare. Government of India. Retrieved from https://www.mohfw.gov.in/

- PTI (2020). About 400 million workers in India may sink into poverty: UN report. The Economic Times. Retrieved from https://economictimes.indiatimes.com/news/economy/indicators/about-400-million-workers-in-india-may-sink-into-poverty-un-report/articleshow/75041922.cms

- WHO (2020). Coronavirus disease 2019 (COVID-19) Situation Report –88. Retrieved from https://www.who.int/docs/default-source/coronaviruse/situation-reports/20200417-sitrep-88-covid 191b6cccd94f8b4f219377bff55719a6ed.pdf?sfvrsn=ebe78315_6