Case Reports: 2021 Vol: 25 Issue: 1

Topiwala Theatres: Market Research for Revenue Maximization and Demand Forecasting using Sample Survey

Dr. Prem Prakash Dewani, Associate Professor of Marketing, Indian Institute of Management, Lucknow, India

Abstract

This case discusses an important issue in market research and service pricing in a small town. A real estate businessman Mr. Topiwala has started thinking of his business expansion. Around one and half years in advance of the launch of the service, he is considering to invest in a chain of multiplexes in his hometown, Paonta Sahib in Himachal Pradesh, India. To check the viability of the business, Mr. Topiwala has to forecast the revenue, right pricing of the movie ticket along with demand for eatables etc. His partner’s key concern (who will be investing with the business) becomes increasingly complex as he considers the intricacies of ticket pricing and other means to generate revenue. The case discusses application of qualitative enquiry along with quantitative research techniques to forecast the demand of the movie tickets. Case also discusses the issues related to sampling, pre-testing, along with validity and reliability in market research.

Keywords

Pricing, Demand Forecast, Breakeven Analysis, Sample Survey.

Introduction

While taking a flight from Mumbai to Delhi at 8.am in the morning on 17th august 2020, Mr Topiwala, a real estate businessperson in Paonta Sahib, (a small town in the Sirmaur district of Himachal Pradesh, India), was mulling over the thought of business expansion after his meeting last evening with a close friend from the entertainment industry, who had shared some interesting profitability facts. He had been thinking of his business expansion for long, as the idea of multiplexes, seen in metro cities like Mumbai always stuck him. Having understood real estate well, investing in multiplexes would be natural progression, according to him. Moreover, in Paonta Sahib, there weren’t any multiplexes yet, and even if he started, it won’t be until 1.5 years from now, but he still could have the first movers’ advantage if he did well. He also knew that he would not have comparative data but he had to keep in mind the reference data he got from his friend in the entertainment industry. He knew for sure that the pricing from single screen to multiplex will be considerably difference, yet to make it a success, he could look at other means of revenue generation (Chowdhury, 2011).

Although the idea seemed exciting to Mr. Topiwala, he was having a hard time to decide whether he should go ahead with his plan to open a multiplex in the town, with no prior experience of the movies industry, its ticket prices, etc., and the fact that it was going to be a very different from selling real estate. He was also pondering over, how to convince his partner Mr Krishna Bhawsar, who was also a real estate businessman, to move ahead with this plan.

Mr. Topiwala was well aware that to start with, he will have to do some revenue forecasting to formulate a suitable business model for the movie theatre to check its business feasibility. There is not a single theatre in the town. Local people, who want to watch a movie, have to travel to Dehradun city, 50 Kilometres away from town, which is hectic, costly and time consuming. This demand-supply gap kindled the idea of opening a multiplex theatre in the town. If successful, the model could be replicated in other adjoining towns in Uttrakhand State in India.

Town: Paonta Sahib

Paonta Sahib is a small town of Himachal Pradesh State in India, on the banks of Yamuna River. It is situated on the border of Himachal Pradesh and Uttarakhand. It is well known for the Paonta Sahib Gurudwara, one of the oldest gurudwara1 in India. The town was founded by 10th Sikh guru – Guru Govind Singh and has linkages with Sikh leader Banda Bahadur. There is huge gathering of pilgrims and tourists on weekends from nearby cities like – Delhi, Chandigarh, and Dehradun etc (Aguilera-Castro & Virgen-Ortiz, 2016).

It is one of the major industrial town in Himachal Pradesh, with major industries like – cement industry (Cement Corporation of India, Rajban), Power generation & Renewable energy, Pharmaceuticals (Sun Pharmaceuticals, Mankind Pharma Limited, Zee laboratories), Textiles (Malwa Cotton, Spining mills of Oswal Group), Chemical and food (B R Foods ltd.). A small town Sataun, outskirts of Paonta Sahib, is also known as the Asia’s biggest limestone market. Town has the population of 158,290 with a distribution of 25,270 as urban population and rest as rural population. Population constitute 53% as the male and 47% as the female. Paonta sahib has the literacy rate of 76% resulting in an increase in the average wage income from year to year. (average income see Table 1).

| Table 1 Response Rate by list of Mailings | ||||

| Income | Mail Qty | List cost per thousand names | Undeliverable | Net Response |

| Poanta Sahib Residents, census tract | 3000 | 4000 | 300 | 790 |

| Individual and seasonal Ticket buyers | 1600 | 120 | 25% | |

| College individual and group buyers | 810 | 75 | 72% | |

| Parent buyers (family size of 2-4) | 500 | 35 | 53% | |

| Senior Citizens and Visitors | 90 | 9 | 18% | |

The town has 10 schools, a dental college, a nursing college, an engineering college (Himachal Institute of Technology) and one management institute- Indian Institute of Management, Sirmaur. The youth of the town are the major chunk of target market for the movie theatre. Considering the industries, and a growing urban population, it always surprised visitors and newcomers, how much distance people had to travel for cinema. With the towns close proximity to cities like Delhi, an increasing literacy rate, the demand for means of entertainment was increasing (Donthu & Gustafsson, 2020).

Indian Cinema Industry

In the 20th century, Indian cinema (popularly known as Bollywood) along with Hollywood and Chinese film industry became global enterprises. In terms of annual output, Bollywood ranks first, followed by Nollywood (Nigerian film industry), Hollywood and Chinese film industry. On average, India produces more than 1500 movies annually in different languages. Indian movie industry consists of various regional movie industries like – Bollywood (Hindi films), Tollywood (Telugu & Tamil films), Malayalam movies and Bhojpuri. The Indian movie industry earned overall revenues of $1.86 billion (INR 93 billion) in 2017. It increased to $3 billion (INR 150 billion) in 2019. In 2018, India had a total box office collection of $1.6 billion, the fourth largest in the world. Indian movies have been screened in more than 90 countries.

In India, three-fourths of the ₹130 billion film industry's revenues come from the box office ticket collections. Recently, single screen movie theatres have been shutting down at an alarming rate. While the number of multiplexes is increasing at a steady rate, adding 150-200 screens every year, and single screens have been shutting at twice of that rate. Five years ago, there were over 12,000 screens, out of which now just about 10,000 are left in India. In 2018, growth in box office revenues screeched to a halt. While in 2019, it is expected to improve. This is simply because there are not enough screens around. There are many reasons lurking behind the severe condition of single screen theatres. Some of the reasons being not able to match the glitz of multiplexes, relatively sub-par standards, low-ticket prices, high taxes, rampant piracy and lack of government support (Cepel et al., 2020).

The main source of movie industry revenue is multiplex theatres. The increasing rate of multiplexes are well supported by increasing number of shopping malls in metro cities and 2 tier cities. The initial growth that came from metro and large cities is now plateauing. Recently, the multiplex chains' growth is dedicated to consolidation, rising ticket prices and higher contribution by food & beverage sales and advertising. During last five years, the number of Indians, watching movies has fallen consistently - from 82 million in 2014 to just about 78 million in 2019. According to a Rentrak report, Mumbai, Delhi and Uttar Pradesh account for over 60 per cent of the total revenue for Hindi movies, largely because functional screens are concentrated in northern part of the country (India). Piracy is a common problem of the industry, leads to potential losses to the industry.

Available Secondary Data and Existing Research

To be successful, Topiwala multiplex needs to find out the target customer base and a prime location for the multiplex where there is plenty of customer footfalls, like a shopping mall or a famous local market. Digitization is creating exciting opportunities across the broadcasting value chain and providing more and more of choice to consumers. Broadcasters are leveraging the lower cost of digital delivery to expand the market by focusing on regional and niche content. Topiwala also wants to involve a market researcher, Sagar Pathan, to do market research about the customer base and narrow down the interests of the customers about the ambience, movie, sound system and type of snacks they like to have while watching movie (First Citizen Bank, 2020).

Topiwala being local to the town is well aware of the market, which would be supported by the Sagar’s research findings. Research conducted in Paonta Sahib and nearby towns, revealed that around 10% of the customers surveyed, like to watch movies in theatre and around 29% of them would link to watch movies on television. To retain the customers, various television channels started broadcasting latest movies just a few weeks after the release of the movie. He also knew that large chunk of customers are the students of local colleges. But the most concerning issue for Topiwala is that this segment is not employed and that’s why he has to be more cautious on pricing the ticket (Hayes, 2017).

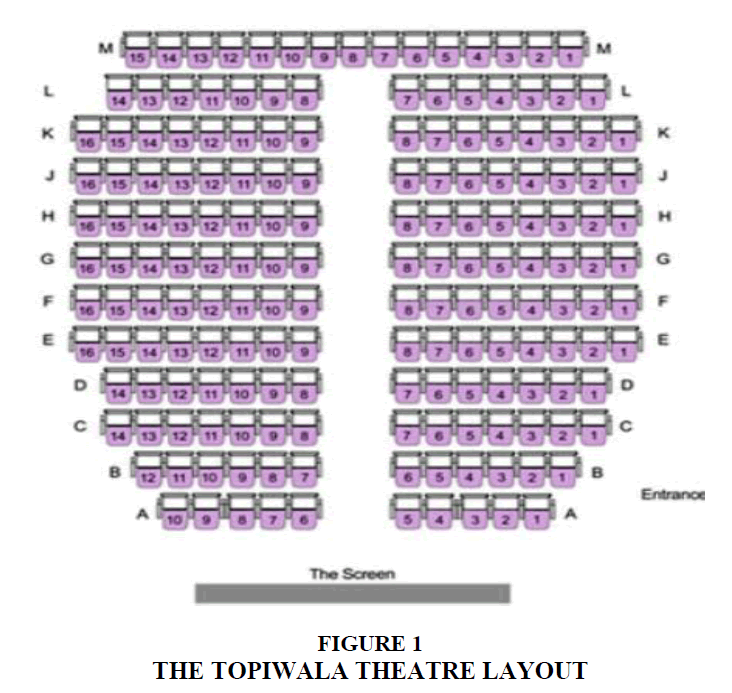

To design the ticket pricing, Topiwala had to find out what the local customer base wants to watch and what price they are willing to pay for the movie. He also needs to examine the data from the survey done by a national research that examined the characteristics of spectator audiences for the Bollywood, Hollywood, 3D and Tollywood movies, Figure 1.

Topiwala wanted more than a generic research and supporting evidence of the local journalist. To guide him, he needed a detailed, methodologically rigorous survey on which he would build a better pricing strategy. He needs to tailor the offerings based on knowledge of the local market, where the regional audience has been clearly segmented and analysed in advance. Without it, it would be like flying by the seat of their pants (Argo et al., 2008).

Survey Design

Topiwala felt his primary research objective parameter was relatively simple: he wanted to predict the number of people who would come to watch the movies they are screening and how much they can charge for it. Even though Paonta Sahib was a small town, the task was not easy. The identification of prospective viewers for the movies they would screen, must be explored in terms of demographics and personal attributes like age, education, income, and previous movie visits Table 2.

| Table 2 Selected Findings from Survey, 2018 | |||||||||

| A. Total Percent Exposed During Past Year by Education | |||||||||

| Hollywood | Bollywood | Theatre | Others | ||||||

| College Graduate | 17% | 1% | 2% | 14% | |||||

| Some College | 24% | 1% | 4% | 0% | |||||

| High School Graduate | 12% | 2% | 2% | 1% | |||||

| Some High School | 29% | 2% | 5% | 10% | |||||

| B. Income Composition of Audiences of 4 alternatives | |||||||||

| Income | Hollywood | Bollywood | Theatre | Others | Total | ||||

| < ₹50,000 | 1% | 9% | 1% | 1% | 12% | ||||

| ₹50,000 - ₹1,00,000 | 5% | 25% | 3% | 2% | 34% | ||||

| ₹1,00,000 - ₹2,50,000 | 8% | 30% | 5% | 2% | 45% | ||||

| ₹2,50,000 - ₹5,00,000 | 2% | 11% | 1% | 1% | 15% | ||||

| Above ₹5,00,000 | 1% | 3% | 0% | 0% | 4% | ||||

The survey process began during the January 2020. With some previous inputs from his friend in Mumbai, Topiwala personally conducted few meetings and along with his team approached other movie theatre owners in the nearby city of Dehradun. This gave Topiwala some crucial insights, which increased the understanding of this business and gave him some approaches taken by other businesspersons in similar ventures. Some Observations are as follows:

1. Most theatres impressed that they must price the seats based on competitor based pricing and other substitutes for the theatre. “The price perception between a theatre here or in Dehradun shouldn’t vary a lot, they wouldn’t have to travel the extra 50 kms” shared a businessperson.

2. Another businessperson shared enthusiastically “…major part of our revenue comes from the sale of snacks, rent to the shops inside the theatre and arcade games.” Every other businessperson, pressing on the critical importance of these kiosks or snack stores, corroborated this statement. They are sold with a significant markup in the prices and thus formed a critical part of the survey.

3. Another person disclosed that he earned major revenue from a bundling approach to tickets and selling tickets as gift card options to corporates as corporate events or price distribution. He bundled various tickets of current and upcoming movies. The number of movies were not very clear, Topiwala made it a point to include it into the survey and parse more into this single vs. bundled ticket approach, and how much can it affect the revenues. However, contribution of the bundled ticket was not much in total revenues, sales from the peripheral kiosks, tip the balance into favor of bundling tickets.

Topiwala realized and understood that the profit margins from snacks and other items sales is very significant with profit margins as depicted in Table 3. The trade-offs between giving discounts on the tickets and earning more revenues from food items should be under the research flag.

| Table 3 Pricing Matrix | |||||||

| Price per ticket | |||||||

| Ticket Type | <₹40 | ₹60 | ₹80 | ₹100 | ₹150 | ₹200 | ₹300 |

| Single | |||||||

| Couples | |||||||

| 4-5 tickets | |||||||

| 10 tickets | |||||||

| Excursions (20+) | |||||||

Team’s President and General Manager Navdeep Daaruwala, was busy with the operational and regulatory aspects of pursuing this venture. He wanted to address all legal and operational issues and was sidestepping on analysing the survey. He did give his input on some related issues of this venture but that increased the size of the survey to a point where Mr. Topiwala had to intervene. Mr. Topiwala along with his partner Krishna Bhavsar were resolute on the point that questions on the survey should be relevant and should not be counterproductive. The three major criteria were as follows: clarity of the questions, ease of data structuring & modelling and information maximization (Gachuhi, 2020; Rahman & Mendy, 2019).

For this survey, the online channel was chosen, as most of the customers in the target segment used the online channel in order to gather information regarding movie timings and prices. A sample of 3000 people from the target segment were chosen wherein they could win free movie tickets for 3 months upon filling the form. Data collected from the survey would immediately be inserted into the model and results would be available after 10 days of the initial mailing. For this around ₹12000 were put aside (Xinhua, 2020).

Mr. Sagar Pathan took the responsibility of initial survey testing as he copied the mail to a small part of target segment for the venture along with scrutinizing the ease of filling the survey. Interesting insights were revealed from the initial testing as some questions were modified while others were removed based on being too confusing or being irrelevant.

It also exposed the fact that some people were interested in buying the multi-movie tickets package instead of buying tickets for a single movie.

Developing the Sample

Mr. Topiwala was finished with the questionnaire design by INSERT DATE. The two main segments identified for the survey was price sensitivity and footfalls in various movie-screening patterns. Peripheral questions included the seat preference in the theatre, concessions and individual details of respondent.

The mailing list of 3,000 was drawn from a simple web registration of respondents with incentives including assured discounts and free tickets. The average price offset for getting the email-id was ₹4000 per 1000 people. These people belonged to the potential target segment of the business and thus people in the list were relevant in the survey. The survey started on INSERT DATE and got 709 usable responses in prescribed time. The responses were majorly made by people under the age of 23 (72%) vs. the young parent’s population (53%), and this response was expected (Lu et al., 2020).

Analysis of Results

Tabulation of the survey results was analysed and Topiwala supplemented it by making a pricing matrix with parameters being ticket prices and ticket offer being on the X-axis and Y-axis respectively Table 4. Using this data, the optimal prices were calculated and were placed in the chart Table 4. The prices of competing theatres and other peripheral industries were used to take as reference price in the matrix shown in Table 4.

| Table 4 Survey Questionnaire and Response Distributions | |||

| 1. Gender | |||

| Male | 67% | ||

| Female | 33% | ||

| 2. Age Group (in years) | |||

| < 18 | 27% | ||

| 19 – 25 | 25% | ||

| 25 – 35 | 32% | ||

| Above 35 | 16% | ||

| 3. Number of children within age group of 5 – 16 living with you | |||

| None | < 1% | ||

| One | 24% | ||

| Two | 55% | ||

| Three | 15% | ||

| More than three | 5% | ||

| 4. What is your educational qualification? | |||

| High School | 58% | ||

| College degree | 32% | ||

| None | 10% | ||

| 5. Family Income | |||

| < ₹50,000 | 12% | ||

| ₹50,000 - ₹1,00,000 | 34% | ||

| ₹1,00,000 - ₹2,50,000 | 45% | ||

| ₹2,50,000 - ₹5,00,000 | 15% | ||

| Above ₹5,00,000 | 4% | ||

| 6. Questionnaire | Responses | ||

| Yes | No | Not Sure | |

| Do you watch movies in theatres? | 38% | 60% | 2% |

| In the past year, have you attended a movie in theatre? | 28% | 72% | 0% |

| Have you ever purchased a season ticket online? | 23% | 77% | - |

| 7. What would you prefer for watching movie in theatre? Select one | |||

| Not attend at all | 21% | ||

| Probably go alone | 11% | ||

| Probably go with a friend | 60% | ||

| Probably go with family | 5% | ||

| Probably take the group (10+ people) | 2% | ||

| 8. If you were to go alone, what would you be willing to pay? (max amount) | |||

| < ₹ 40 | 0% | ||

| ₹ 60 | 2% | ||

| ₹ 80 | 5% | ||

| ₹ 100 | 13% | ||

| ₹ 150 | 31% | ||

| ₹ 200 | 27% | ||

| ₹ 300 | 22% | ||

| 9. If you were to go with a friend, 2 tickets package, what would you be willing to pay? | |||

| < ₹ 40 | 1% | ||

| ₹ 60 | 2% | ||

| ₹ 80 | 3% | ||

| ₹ 100 | 19% | ||

| ₹ 150 | 36% | ||

| ₹ 200 | 34% | ||

| ₹ 300 | 5% | ||

| 10. If you were to go with family, what would you be willing to pay? | |||

| < ₹ 40 | 1% | ||

| ₹ 60 | 7% | ||

| ₹ 80 | 23% | ||

| ₹ 100 | 28% | ||

| ₹ 150 | 25% | ||

| ₹ 200 | 15% | ||

| ₹ 300 | 1% | ||

| 11. What would you be willing to pay, for a Gold class seats? | |||

| Nothing more | 24% | ||

| 10% more | 48% | ||

| 25% more | 19% | ||

| 50% more | 9% | ||

| 12. How much do you expect to spend on snacks, and beverages? | |||

| Nothing more | 10% | ||

| < ₹50 | 45% | ||

| ₹50 - ₹100 | 40% | ||

| ₹100 - ₹200 | 4% | ||

| > ₹200 | 1% | ||

Topiwala ensured to keep in mind that his real goal was to maximize profits through both ticket income and snacks and beverages sold at kiosks counter, and therefore the price of the tickets had to be at par with the competition. While focussing on revenue, he knew that he had to bring down the fixed expenses and it may take some time for the theatre to start making actual revenue (Xinhua, 2020).

Keeping that in mind, he started thinking ways by which he could convert some of the fixed costs to variable costs. He understood that maybe he could allocate a certain percentage of the fixed costs centres to variable cost. This would help him scale up and make expenses in proportion to the business growth. Some of the areas he could think of converting into variable costs were, outsourcing the sales, marketing, advertising, digital media agency work and market research and mailing lists. This would also cut down the requirements of the staff that would have to be hired and thus bring down some proportion of the fixed cost. This would also allow him to focus on the service quality, smooth operations and successful running of the kiosks counters and bringing in the right movies mix for the theatre. Kiosks could be rented out, which will help bring down some rental costs, but that will require to ensure sufficient footfall to the theatres Table 5.

| Table 5 Estimated Annual Operating Expenses, Topiwala Theatres | |

| Fixed Expenses | In INR |

| Staff Salaries | 16,00,000 |

| Rent | 22,00,000 |

| Office Expenses | 2,34,000 |

| Market Research & Mailing lists | 52,000 |

| Advertising, Sales & Marketing | 3,00,000 |

| Total Fixed Expenses | 43,86,000 |

| Revised Fixed Expense after moving some costs to Variable | In INR |

| Staff Salaries | 16,00,000 |

| Rent | 22,00,000 |

| Office Expenses | 2,34,000 |

| Total Fixed Expenses | 40,34,000 |

Conclusion

Topiwala has thought about it and still many questions unanswered. What should be the ticket price that can generate profitable revenue in such a small town? He is also concerned about the success of multiplex once it is opened. To assure the success, he is also pushing the idea of food court within the multiplex premises in order to increase the footfall. Do the costs of opening a food court outweigh the benefits associated with it?

References

- Aguilera-Castro, A., & Virgen-Ortiz, V. (2016). Model for developing strategies specific to sme business growth. Entramado, 12(2), 30-40.

- Argo, J.J., Dahl, D.W., & Morales, A.C. (2008). Positive consumer contagion: Responses to attractive others in a retail context. Journal of Marketing Research, 45(6), 690-701.

- Cepel, M., Gavurova, B., Dvorský, J., & Belas, J. (2020). The impact of the COVID-19 crisis on the perception of business risk in the SME segment. Journal of International Studies.

- Chowdhury, S.R. (2011). Impact of global crisis on small and medium enterprises. Global Business Review, 12(3), 377-399.

- Donthu, N., & Gustafsson, A. (2020). Effects of COVID-19 on business and research. Journal of Business Research, 117, 284.

- First Citizen Bank. (2020). An initiative of the Government of Trinidad and Tobago Coronavirus (COVID -19) business support, retrieved from https://www.smeloan.tt/help/ on 30.12.2020

- Gachuhi, L. (2020). SME’s Agribusiness Challenges & Solutions in Africa. Exceller Books.

- Hayes, A.F. (2017). Introduction to mediation, moderation, and conditional process analysis: A regression-based approach. Guilford publications.

- Lu, Y., Wu, J., Peng, J., & Lu, L. (2020). The perceived impact of the Covid-19 epidemic: evidence from a sample of 4807 SMEs in Sichuan Province, China. Environmental Hazards, 1-18.

- Rahman, M., & Mendy, J. (2019). Evaluating people-related resilience and non-resilience barriers of SMEs’ internationalisation. International Journal of Organizational Analysis.

- Xinhua (2020). Thai central bank prolongs debt moratorium for SMEs amid COVID-19, retrieved from http://www.xinhuanet.com/english/2020-10/18/c_139448009.htm on 30.12.2020