Research Article: 2019 Vol: 23 Issue: 3

Trust and Risk Perspectives of High Value Brands

Dr. Mohammed Laeequddin, Symbiosis Institute of Business Management (SIBM) & Symbiosis International (Deemed University) (SIU), India

Dr. K. Abdul Waheed, Institute of Management Technology, Dubai, UAE

Dr. Ramkrishna Dikkatwar, Symbiosis Institute of Business Management (SIBM) & Symbiosis International (Deemed University) (SIU), India

Abstract

Brand trust is considered to be central in brand building, both in the cases of B2C, when customers face risky situations and costly purchases and in B2B where purchases are based on rational decision such as product functionality, quality, price and reliability considering the personality traits and imagery irrelevant. When customers perceive risk in their buying decision they tend to play safe and forgo the perceived benefits. Customers adopt trust as a shortcut to avoid complex decision processes that carry risk. After reviewing 148 research articles from reputed journals on brand trust and brand risk, it was found that, the perspectives of brand trust and brand risk are the same for brand characteristics, brand rationality and brand loyalty. Connecting the literature, a conceptual model was developed for understanding the perspectives of trust and risk of high value brands. The model reveals that risk reduction from brand’s characteristics, rationality, safety and security (structural assurance) builds brand trust, rather than trust building reducing brand risk

Keywords

Brand Characteristics, Brand Rationality, Brand Loyalty, Brand Trust, Brand Risk, Brand Management.

Introduction

In recent years, researchers have started paying attention to brand trust, considering trust between consumer and brand as central to the establishment of a mutually beneficial relationship, purchase behavior, customer satisfaction, brand loyalty and brand equity (Kenning, 2008; Alessandro et al., 2012; Paulssen, et al., 2014; Srivastava et al., 2016). Lau & Lee, (2000) proved that brand trust is a mediating variable which relate brand predictability, brand competency, brand reputation, brand satisfaction and Veloutsou (2015), empirically proved brand trust and satisfaction as antecedents of loyalty in an indirect manner. B2B branding theories are built based on the theories and models originated in B2C contexts. Most brands these days do not exclusively focus on B2C or B2B markets, as they are extension of supply chain links, they simultaneously target both companies and consumers, and sometimes in a sequential manner with B2B2C approaches. Probably, due to this confusion, some scholars have called for more research on brand trust from different perspectives for example, Sichtmann (2007) pointing out that, there have scarcely been any studies analysing sources of brand trust for non-consumers. March (2006) stating that,

“A useful starting point for marketers to develop strategies for encouraging perceptions of trustworthiness and for helping potential customers is to develop sufficient trust to enter into a transactional or longer-term relationship”.

Srivastava et al. (2016) made a point that,

“There has been little research dealing with the diverse sources, and nature of the mechanism, by which brand trust develops, there is a need for comprehensive studies that shed light on the nature of relationships between the varied antecedents and the brand trust”.

When the customer perceives risk with a particular brand in terms of emotions, rationality and safety, there is also a risk to the brand for its reputation and for the introduction of new products, entry into new markets, investor’s willingness. According to Mitchell (1995), Risk has a moderating effect on customers because they are often more inclined to try to avoid a mistake rather than benefit from utility in their buying decisions. For this reason, shoppers may ‘pre-select’ brands for consideration to avoid risk and customers tend to use intuitive judgement to decide whether or not something is risky, which may be affected by previous experiences, the level of involvement, or the price of the purchase (March, 2006). Riegelsberger et al., (2003) mentioned that, a shortcut to avoid complex decision processes when facing decisions that carry risk is to use trust as a device to reduce complexity. Elliott & Yannopoulou (2007) articulated that,

“When customers are facing buying choices of functional brands, that do not involve much risk and the price is low, familiarity is sufficient for their action to choose the brand. When risk and price levels increase, customers seek a safe purchase choice ignoring the brand”.

Matzler et al., (2008) stated that customers with higher levels of risk aversion tend to be more loyal. It seems the perspectives of brand trust and risk are the same and customers perceive them as trust worthy or risky depending the level of risk. Lee & Turban (2001) mentioned that any study of trust without examining the relationship with risk would make it incomplete. The objective of this study was to understand the relationship between brand trust and brand risk. Next section provides concept of brand trust, perspectives of brand trust and risk, further section provides a conceptual model showing the relationship between brand trust and brand risk, finally, paper concludes with directions future research (Williamson, 1979).

Literature Review

Brand Trust and Brand Risk

After going through 148 research articles from reputed journals on brand image, Consumer Based Brand Equity (CBBE), brand loyalty, brand trust, brand risk, we have defined the concept of brand trust and classified the brand trust as follows,

a. Characteristic based brand trust

b. Rationality based brand trust and

c. Institutional based (structural assurance) brand trust

Concept of Brand Trust

Characteristic based brand trust and risk

Researchers have often considered brand as personality and attributed human characteristics to brand and identified a number of antecedents of brand trust. For example, Brand Personality Scale (BPS) of Aaker, (1997) considers five personality dimensions

1. sincerity

2. excitement

3. competence

4. sophistication and

5. ruggedness

Freling & Forbes, (2005) empirically tested the following five personality dimensions and found significant

1. sincerity

2. competence

3. excitement

sophistication

5. ruggedness

Geuens, Weijters, & De Wulf, (2009) proposed five other dimensions of brand personality:

1. responsibility

2. activity

3. aggressiveness

4. simplicity

5. emotionality

Gordon et al. (2016) have empirically proved that brands can have human traits. Trust based on human characteristics basically deals with reliability (Mayer et al., 1995). An integrative model of organizational trust, 1995, benevolence, goodwill (Cumming & Bromiley, 1996), commitment (Morgan & Hunt, 1994), affect, emotions (Rousseau et al., 1998) and company credibility (Keller & Aaker, 1992). Brand trust also comprises of reliability and intentionality (Ballester & Aleman, 2001). Therefore, the characteristics of brand personality are considered to act as antecedents of brand trust.

Matzler et al. (2008) noted risk aversion as an antecedent of brand affect. Viklund, (2003) was also found a “moderately strong” effect of trust on consumer’s perceived risk, and further stated that “if customers perceive high risk and have no trust in an organization, they will be unlikely to enter into any kind of relationship”. In B2B brand trust, areas which are considered as risky are; capacity availability, key customers and suppliers, price fluctuations, quality of product, political environment of supplier, competitor’s actions, and customs regulation.

Matzler et al. (2008) argued that “customers with higher levels of risk aversion tend to be more loyal” as they tend to avoid risk and hence stick to the same product. When a customer perceive reduction in the risk, they tend to become a loyal customer (Sheth & Parvatiyar, 1995). Therefore, the characteristics of brand personality have moderating effect risk taking behaviour with the brand in both the cases of purchasing the branded product and avoiding it, and some customers may stay with brand due to deterrence of risk with avoiding such brands.

Rationality based brand trust

Netemeyer, et al., (2004) identified four primary dimensions related to customer-based brand equity (CBBE), which are rational reasons in nature such as perceived quality, perceived value for the cost, and uniqueness, resulting in willingness to pay a premium price. According to Armstrong, Adam et al. (2014) brands are built based on

“Viewer’s self-interest like a product’s economy, quality and value in market or its performance”.

Garvin, (1987) identified perceived quality dimensions as.

1. performance

2. features

3. conformance

4. durability

5. serviceability

(Petrick, 2002) identified perceived quality dimensions as

1. product consistency

2. reliability

3. dependability

4. superiority

Therefore, rational choice of customer has influence on brand trust in terms of price, quality, value for time and money, availability, convenience, functionality and technology, safety. Hauser & Gaskin, (1984) argued that,

“Customers choose that product which provides the highest utility per dollar”.

In the case of private label brands, price and affordability have an influence on consumer loyalty (Beristain & Zorrilla, 2011). Therefore, the rational reasons such as products functionality, price, quality, features etc. may act as antecedents of brand’s rational trust. Laeequddin, (2009) conceptualised rational reason as threshold level of trust. The brand trust is about how much risk a trustor takes making himself/herself vulnerable to brand by relaying on the brand characteristics, rationality and structural assurance. Hawass, (2013) argued that, under risky and costly purchase choices, role of brand trust becomes important. According to (McAllister, 1995) there must be a rational reason to trust.

However, some researchers also argue that, role of brand trust becomes more vital when the purchasing environment entails risky and costly choices (Hawass, 2013). McAllister’s (1995) research confirms that since trust comes into play in conditions of ignorance of some aspect of the negotiation or interaction there must be a rational reason to trust. Coleman (1990) argues that, social actors calculate the gains which might result from their decision to trust another social actor before they actually make their decision. Williamson (1993) has described some preconditions for calculating trust such as, the affected parties: (1) the affected parties are conscious about array of likely outcomes and their related probabilities of occurrence; (2) the affected parties act to alleviate hazards and increased benefits in cost-effective manner; (3) the affected parties go further with the transaction when expected net gains can be predicted; and, (4) the affected parties will choose a brand for which the largest net gain has been projected. Brands are prone to various forms of attacks such as duplication, counterfeiting, misuse, alteration, tampering and piracy. When brands are attacked, brand owners lose the revenue, market share, reputation, and company suffers damage. Each of these factors can damage brand equity (Wilson et al., 2016). Therefore, the brand price, quality, functionality, features etc. may have moderating effect on brand’s rational risk and customers may stay with brand due to short term gain or avoid such brands (Gyskens, 1996).

Institutional based brand (Structural Assurance) trust

Numerous studies have argued that, overall satisfaction, emotional or psychological bond, repurchase as determinants of loyalty (Bloemer & Kasper, 1995; Fornell, 1992). From the brand characteristics trust perspective, it can be noted that, emotions, psychological bond and overall satisfaction act as antecedents of trust or drivers of trust propensity rather than loyalty builder.

Teng et al. (2005) reported that the warranty of the product is becoming an assurance of the product quality which ultimately increases the loyalty of the customers with the companies. Some researchers are in agreement that products' warranty acts as the sign of the quality, reliability and durability from customers' point of view and helps in making customers loyal to their products (Teng et al., 2005; Lin et al., 2007; Oumlil, 2008) rather than brand personality. According to Liu, (2007) customers now a day perceive various loyalty programs as loyalty incentives in return for their repeated purchases with a firm, as structural Assurance. Zhang (2004) found that displaying reliability assurance seals, such as BBB Online seal and AOL Certified Merchant Guarantee, VeriSign and TRUSTe have a stronger influence on consumers’ willingness to buy across product categories (commodity and look-and-feel products) and other studies suggest a certain degree of effectiveness of seals of approvals. Law aims to protect a producer’s rights in the trademark; such protection is characterized as propertization, for example, The International Medical Products Anti-Counterfeiting Taskforce (IMPACT) which collaborates with governments, organizations, institutions, agencies and associations in combating counterfeit medical products at the national, regional and/or international levels. The United States Food and Drug Administration (FDA). FDA approved brands protects the public health by assuring the safety, efficacy, and security of human and veterinary drugs, biological products, food supplies etc (Sitkin & Roth, 1993).

According to Rousseau et al., (1998), the notion of risk comprises two components: the uncertainty of an outcome and the importance of negative consequences associated with the outcome of a choice. In the case of brand trust, major concern is about the negative consequences associated with the outcome of the brand choice. To handle with unknown risks customers, fall back on external institutional system such as insurance, bank guarantees and depend on formal agreements and contracts. The presence of legal mechanisms is one of the most effective ways to limit the risk emanating from trusting brand and facilitates potential trustor in terms of deciding whether to invest in a brand (Luhmann, 1979). In some situations, the penalties act as buffer to an additional risk that a customer cannot bear and encourage the trustee to act in a trustworthy manner. Institutions do not have any role if customer is unwilling to take risk. One can deduce that institutional systems offers risk mitigation mechanisms which in turn ensures trustworthy behaviour from trustee (brand) and limits rational risks of customer by inducing a third party trust that encourages customer’s loyalty with brands.

Trust and Risk Perspectives of High Value Brands-A Conceptual Model

Synthesising the literature on brand trust and brand risk a conceptual model is developed to understand the relationship between brand trust and brand risk based on the following premises,

1. Trust cannot exist in an environment of certainty (Bhattacharya et al., 1998).

2. Some level of uncertainty is required for trust to emerge (Dasgupta 1998).

3. Trust is defined as willingness to take risk (Mayer et.al., 1995). Willingness to take risk can be considered as propensity to trust.

4. Existence of legal norms (structural assurance) is one of the most effective remedies to confine the risk (Luhmann 1979).

5. Customer’s actors act in a trustworthy manner because of the fear of the consequences of trust violation (Shapiro et al., 1992).

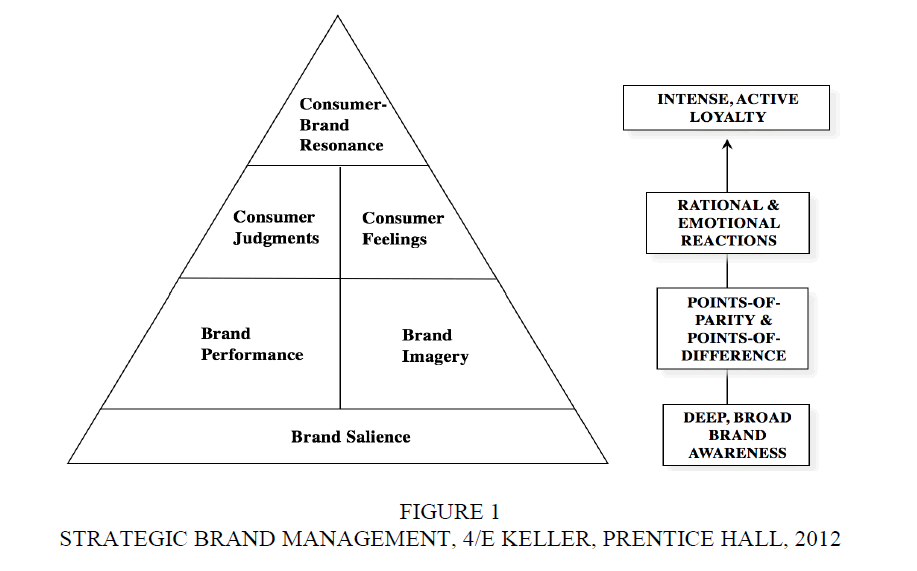

6. As shown in Figure 1 Brand Resonance model that builds brand in series of steps, each of which is dependent upon successful outcome of the previous objective (Keller K. L., 2012)

Keller’s brand resonance model progresses as a sequence of steps starting from brand awareness (knowing brand characteristics) to rational and emotional reactions and finally to brand loyalty, each of which is contingent on successfully achieving the objective of the previous one. Based on the resonance model we have attempted to relate the brand trust and brand risk characteristics, rationality and loyalty due to structural assurance.

In customer - brand relationship, when the customer is totally unaware of brand and uncertain of the outcome of the brand relationship he considers risk as 100% since risk is 100% there can be no reason to trust the brand, therefore, trust will be zero.

When the customer is aware of the brand and having knowledge of brand characteristics and performance for example, as claimed by Garbarino & Johnson, (1999), “past experiences builds trust”. If there is no uncertainty or risk involved with the brand, then risk is zero.

Usually, in customer-brand relationship customers have some knowledge of brand and without perceiving the benefits; customer will not be attracted to the brand. This implies that for purchase behaviour, the customer would already be having certain level of understanding of the brand characteristics such as reliability, credibility, familiarity etc, and state of total ignorance is not possible. Next, there cannot be a total knowledge of the brand, due to a large number of brand characteristics, functionalities, economics and security reasons which are not represented by the brand identity or image. As mentioned in the assumptions of this conceptual model, Bhattacharya et al, (1998) stated that,

“Trust cannot exist in an environment of certainty; some amount of uncertainty is needed for trust to emerge”,

Doney & Cannon, (1997) stated that “customer must have information about the brands past behaviour and promises” and that trust is willingness to take risk Mayer et al. (1995) An integrative model of organizational trust. The level to which the customer would be willing to become vulnerable to brand’s outcome/actions depends on customer’s trust level (Blois, 1999).

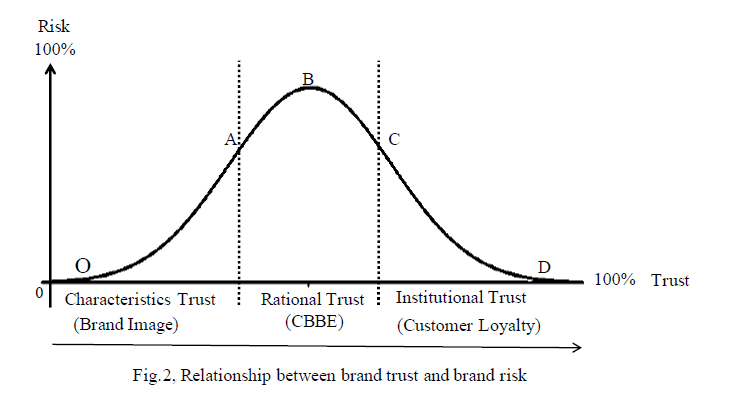

Considering the above assumptions and arguments, we can plot the brand trust and brand risk relationship on X-Y co-ordinates as shown in Figure 2 and observe the pattern as how does the relationship progresses as the brand builds its image, customer based brand equity and customer loyalty over a period of time and experience. To start with let us assume that, there is a total ignorance of brand image then the customer has zero trust (let us take it on x- axis) and if there is a complete brand knowledge, risk is zero (let us take it on y-axis), so the starting coordinates are zero.

As the brand image provides information to customer there would be no complete ignorance and hence customer trust emerges as brand characteristic trust at point ‘O’. As we have noted ‘trust is willingness to take risk’ (Mayer et al., 1995), with increasing trust there is also increasing level of willingness to take risk, this can be depicted on the graph from point ‘O’ to point ‘A’ in figure 2. However, just building any amount brand image that is brand characteristic trust would not result in customer’s rational trust.

Customer purchases the product or service based on rational reasons such as, quality, functionality, social value, affiliation, economics, technology etc. Rational trust leads to customer’s action to purchase or willingness to pay premium (build customer brand equity). Williamson (1993) and Dasgupta (1988) “essentially trust involves a calculative process”, to stay in the relationship, an individual conducts cost-benefit analysis for staying in the relationship.

As customer’s willingness to take risk increases, their rational trust increases simultaneously. However, customer may not take any amount of risk based on brand characteristic and brand rationality due to their threshold level of risk bearing capacity. This can be depicted from point ‘A’ to point ‘B’ in the figure 2. To build trust beyond the threshold level of risk taking capacity, the brand should reduce the perceived risks further to extend the trust. Rational risk reduction can be attained by positive experiences with repeat purchase, reliability and durability from customers' point of view and tends him to be loyal to the brand (Teng et al., 2005; Lin et al., 2007; Oumlil, 2008). Points ‘A’ to ‘C’ represents customer’s rational trust. This region being transactional, it builds customer brand equity (Customer’s willingness purchase or to pay premium). Increasing length of relationship and familiarity will reduce the uncertainty and risk leading to increase in threshold level of partner’s risk bearing capacity. Adobar (2006) has proved a curvilinear relationship between uncertainty and trust through an empirical study. Empirically, Anderson & Weitz (1989) found, that a channel member’s trust in a manufacturer increases with age of relationship, but beyond the bearable limits of vulnerability or calculated risk levels, the members opt for risk control through the institutional systems (Laeequddin et.al., 2009).

Rational reasons such perceived brand quality, value for the cost, and brand uniqueness result in purchase behaviour, the consequences of which yields in customer-based brand equity (CBBE).

For trust to increase beyond point ‘C’ brand risk should reduce further, that would call for structural assurance (institutional trust). According to McKnight et al. (2002) structural assurance promote success through regulations, legal recourse, guarantees. Structural Assurance can increase trustworthiness of vendors and technology (Wingreen & Baglione, 2005). Intervention, such as Government regulations, legal contracts, trade unions involvement, etc. that provides safety and security to the customer reducing the risk and extending the trust in the brand from point ‘C’ to ‘D’. Once the customer develops rational trust, customer may become loyal to the brand with repeat purchases. Researchers from rational perspective suggest that rational factors extend trust beyond characteristic trust thereby reducing the risk.

Structural arrangements create trustworthiness of the brands and the institutional systems reduce risk in the form of security and thereby risk reduction. Risk reduction extends trust beyond point ‘C’ in the figure and extends to point ‘D’. Institutional framework mediate trust in inter-organizational relationship (Bachmann, 2001). Ouchi, (1979) argued that “under high trust situation control system is most appropriate”. From the conceptual model we can note that trust is extended when risk levels are brought down. Customers become loyal with repeated positive experiences of brand characteristics, positive rational reasoning and reduced risks through institutional protective mechanism such as guarantee, warrantee, contracts, government regulations, employer networks etc, when the risk levels are reduced from point ‘C’ to point ‘D’ where risk becomes zero and trust becomes 100%.

Since customers risk levels from point C to D would be very much within the bearable limits and beyond the rational reasons it builds customer loyalty to the brand. The cumulative effect of characteristic trust, rational trust and institutional trust makes the customers loyal to the brand thereby building a comprehensive brand. In other words, eliminating perceived brand risk or reducing rational brand risks can build brand trust and brand trust build brand image, brand equity and brand loyalty. Some studies conceptually considered the evolution of brand equity as a consumer learning process: brand awareness leads to perceived quality and brand associations, which in turn will influence brand loyalty (Buil et al., 2013; Konecnik & Gartner, 2007).The model reveals that risk reduction from brand’s characteristics, rationality, safety and security (structural assurance) builds brand trust, rather than trust building reducing risk. Similar to brand resonance model, brand trust progresses brand in built in series of steps, each of which is dependent upon successful outcome of the previous objective.

Conclusion

Implications for Business Marketing Practice

Major contribution of this paper is that, it depicts the relationship between brand trust and brand risk, and the model explains how at each stage customer’s risk reduction builds trust and offers vital cues to marketer and brand managers for brand building. Lot of branding research revolves around ‘loyalty’ recommending to build brand experience to build brand loyalty, but our model explain the underlying prerequisite of loyalty as risk reduction and structural assurance.

One more contribution of the paper is that, it has addressed the recent call by scholars for in-depth studies that explain the nature of relationships between the varied antecedents and the brand trust. In the literature very few articles were found dealing with the relationship between perceived risk and trust. Trust building is mostly seen in relationship marketing or CRM literature; this paper has attempted to explain ‘trust building’ from risk perspective. Brand trust of high value items is often viewed as complex process as high inherent risk and also some scholars have claimed that understanding trust without examining the relationship with risk would make any study of trust incomplete, we built our brand trust model from risk perspective and removed the complexity of trust building with a suggestion that, risk reduction builds trust, therefore, trust building need not be complex and time consuming.

Direction For Further Research

As we have seen in the literature, trust and risk are interlinked and trust cannot be developed as one-dimensional phenomenon, trust building process has its reference points anchored in risk dimensions. Therefore, trust building process should be studied through brand risk evaluation process. Since risk reduction builds trust, we suggest that the future research on brand building should be taken from risk perspective rather than trust perspective. Since trust is a trustor’s choice, a customer is likely to engage in act of brand trust only when his rational risks are within his bearable limits. Therefore, any amount of characteristic trust building such as reliability, credibility, integrity, emotion, etc. is not going to make trustor vulnerable to risky relationship with brand. Also it is important to note that strong brand image alone does not build trust but the presence of structural assurance (institutional system) that reduces the risk would result in building builds trust. If there are no risks, then structural assurances have no role to play. Hence, brand managers should evaluate various risk perspectives to build brand trust rather than attempting to build various brand characteristics to build brand image or brand identity, brand equity or brand loyalty.

The financial-based brand equity paradigm uses the brand’s financial value as a measure of success and performance and suggest that brand equity describes the asset created by a company’s marketing effort that will “drive future cash flows from the sales of that brand”. The focus of the customer-based brand equity paradigm is the interaction between a customer and the brand, as well as the consequences which yield that interrelationship and defines brand equity as: (a) the total value of a brand as a separable asset when it is sold, or included on a balance sheet, and (b) a measure of the strength of consumers' attachment to a brand; a description of the associations and beliefs the consumer has about the brand that may lead to brand loyalty and subsequently it can build it as a brand asset. A further empirical research can be undertaken to validate this model for various product categories across the customer involvement continuum. An empirical study can also be under taken to understand which are the more significant risk perspectives, brand characteristics, brand rationality or structural assurance.

References

- Aaker, J.L. (1997). Dimensions of brand personality, Journal of Marketing Research, 34(3), 347-356.

- Adobar, H. (2006). Optima trust? Uncertainty as a determinant and limit to trust in inter-firm alliances,Leadership & Organization Development, 27(7), 537-553.

- Alessandro, D.S., Girardi, A., & Tiangsoongnern, L. (2012). Perceived risk and trust as antecedents of online purchasing behavior in the USA gemstone industry?, Asia Pacific Journal of Marketing and Logistics, 24(3), 433-460.

- Andaleeb, S. & Anwar, S.F. (1996). Factors influencing customer trust in salespersons in a developing country, Journal of International Marketing, 4(4), 35-52.

- Anderson, E. & Weitz, B. (1989). Determinants of continuity in conventional channel dyads?Marketing Science, 8(4), 310-323.

- Armstrong, G., Adam, S., Denize, S., & Kotler, P. (2014). Principles of Marketing, Pearson, Australia.

- Arvidsson, A. (2006). Brands Meaning and Value in Media Culture. London & New York: Routledge Taylor & Francis Group.

- Bachmann, R. (2001). Trust, power and control in trans-organizational relations, Organization Studies, 22(2), 337-365.

- Ballester, E.D. & Aleman, J.L.M. (2001). Brand trust in the context of consumer loyalty, European Journal of Marketing, 35(11), 1238-1258.

- Ballester, E.D. (2003). Development and validation of a brand trust scale, International Journal of Market Research, 45(1), 35-54.

- Becerra E.P. & Badrinarayanan, V. (2013). The influence of brand trust and brand identification on brand evangelism, Journal of Product & Brand Management, 22(5-6), 371-383.

- Beristain, J. & Zorrilla, P. (2011). The relationship between store image and store brand equity: a conceptual framework and evidence from hypermarkets, Journal of Retailing and Consumer Services, 18(6), 562-574.

- Bhattacharya, R., Devinney, T.M. & Pillutla, M.M. (1998). A formal model of trust based on outcomes, Academy of Management Review, 23(3), 459-472.

- Blois, C.K. (1999). Trust in business to business relationships: an evaluation of its status,Journal of Management Studies, 36(2), 197-215.

- Buil, I., Chernatony, L. & Martínez, E. (2013). Examining the role of advertising and sales promotions in brand equity creation, Journal of Business Research, 66(1), 115-122.

- Chaudhuri, A. & Holbrook, M.B. (2001). The chain of effects from brand trust and brand affect to brand performance: the role of brand loyalty, Journal of Marketing, 65(2), 81-93.

- Chiou, J.S., Droge, C. & Hanvanich, S. (2002). Does customer knowledge affect how loyalty is formed?, Journal of Service Research, 5(2), 113-124.

- Coleman, J. (1990). Foundations of Social Theory, Harvard University Press, Cambridge, MA.

- Cumming, L.L. & Bromiley, P. (1996). The organizational trust inventory (OTI): development and validation, in Kramer, R.M. & Tyler, T.R., Trust in Organizations: Frontiers of Theory and Research, Sage, Thousand Oaks, CA, 302-330.

- Dasgupta, P. (1988). Trust as a commodity, in Gambetta, D.G., Trust, Basil Blackwell, New York, NY, 49-72.

- Deutsch, M. (1958). Trust and suspicion, Journal of Conflict Resolution, 2, 265-279.

- Doney, P.M. & Cannon, J.P. (1997). An examination of the nature of trust in buyer-seller relationships, Journal of Marketing, 61(2), 35-51.

- Elliott, R., & Yannopoulou, N. (2007). The nature of trust in brands: a psychosocial model, European Journal of Marketing, 41(9/10), 988-998.

- Freling, T.H. & Forbes, L.P (2005). An empirical analysis of the brand personality effect, Journal of Product & Brand Management, 14(7), 404-413.

- Garvin, D.A. (1987). Competing on the Eight Dimensions of Quality, Harvard Business Review, 65, 101-109.

- Geuens, M., Weijters, B. & Wulf, K.D. (2009). A new measure of brand personality, International Journal of Research in Marketing, 26(2), 97-107.

- Geyskens, I., Steenkamp, J.B.E., & Kumar, N. (1998). Generalizations about trust in marketing channel relationships using meta-analysis. International Journal of Research in marketing, 15(3), 223-248.

- Gordon, R., Zainuddin, N. & Magee, C. (2016). Unlocking the potential of branding in social marketing services: utilising brand personality and brand personality appeal, Journal of Services Marketing, 30(1), 48-62.

- Gučvremont, A., & Grohmann, B. (2013). The impact of brand personality on consumer responses to persuasion attempts, Journal of Brand Management, 20(6), 518-530.

- Gyskens, I., Steenkamo, J.B., Scheer, I., & Kumar, N. (1996). The effect of trust and interdependence on relationship commitment: an Trans -Atlantic study, International journal of Research in Marketing, 13(4), 303-317.

- Hauser, J.R., & Gaskin, S.P. (1984). Application of the Defender Consumer Model, Marketing Science, 3, 327-351.

- Hawass, H.H. (2013). Brand trust: implications from consumer doubts in the Egyptian mobile phone market, Journal of Islamic Marketing, 4(1), 80-100.

- Heide, J.B., & Weiss, A.M. (1995). Vendor consideration and switching behaviour for buyers in high-technology markets, Journal of Marketing, 59, 30-41.

- Keller, K.L., & Aaker, D.A. (1992). The effects of sequential introduction of brand extensions, Journal of Marketing Research, 29(1), 35-50.

- Kenning, P. (2008). The influence of general trust and specific trust on buying behaviour, International Journal of Retail & Distribution Management, 36(6), 461-476.

- Konecnik, M. & Gartner, W.C. (2007). Customer-based brand equity for a destination, Annals of Tourism Research, 34(2), 400-421.

- Laeequddin, M., Sardana, G.D., Sahay, B.S., Waheed, K.A. & Sahay, V. (2009). Supply chain partners? trust building through risk evaluation: the perspectives of UAE packaged food industry, Supply Chain Management: An International Journal, 14(4), 280-290.

- Lau, G.T., & Lee, S.H (2000). Consumer?s Trust in a Brand and the Link to Brand Loyalty, Journal of Market Focused Management. 4, 341-370.

- Lee, K.O. & Turban, E. (2001). A trust model for consumer internet shopping, International Journal of Electronic Commerce, 6(1), 75-91.

- Lin C.Y., Kuo T.H., Huang Y.C., Lin C., & Ho L.A. (2007). The warranty policy under fuzzy Environment, International Journal of Quality & Reliability Management, 24(2), 191-202.

- Lippert, S.K. & Swiercz, P.M. (2005). Human resource information systems (HRIS) and technology trust, Journal of Information Science, 31(5), 340-353.

- Liu, Y. (2007). The long-term impact of loyalty programs on consumer purchase behavior and loyalty, Journal of Marketing, 71(4), 19-35.

- Luhmann, N. (1979). Trust and Power, John Wiley & Sons.

- Luk, S.T.K., & Yip, L.S.C. (2008). The moderator effect of monetary sales promotion on the relationship between brand trust and purchase behavior, Journal of Brand Management, 15(6), 452-464.

- March. S.H. (2006). Can the building of trust overcome consumer perceived risk online?, Marketing Intelligence & Planning, 24(7), 746-761.

- Matzler, K., Grabner-Krauter, S. & Bidmon, S. (2008). Risk aversion and brand loyalty: the mediating role of brand trust and brand affect, Journal of Product & Brand Management, 17(3), 154-162.

- Mayer, R.C., Davis, J.H. & Schoorman, F.D. (1995). An integrative model of organizational trust, Academy of Management Review, 20(3), 709-734.

- McKnight, D.H., Choudhury, V., & Kacmar, C. (2002). Developing and validating trust measures for e-commerce: An integrative typology. Information Systems Research, 13(3), 334-359.

- Michalos, A. (1990). The impact of trust on business, international security, and the quality of life, Journal of Business Ethics, 9, 619-638.

- Mitchell, V.W. (1995). Organisational risk perception and reduction: a literature review, British Journal of Management, 6, 115-133.

- Morgan, R.M. & Hunt, S.D. (1994). The commitment trust theory of relationship marketing, Journal of Marketing, 58(3), 20-38.

- Netemeyer, R.G., Krishnan, B., Pullig, C., Wang, G., Yagci, M., Dean, D., Ricks, J. & Wirth, F. (2004). Developing and validating measures of facets of customer-based brand equity, Journal of Business Research, 57(2), 209-224.

- Oliver, R.L. (1999). Whence Consumer Loyalty, Journal of Marketing, 63, 33.

- Ouchi, W.G. (1979). A conceptual framework for the design of organizational control mechanisms,Management Science,25, 833-884.

- Oumlil A.B. (2008). Warranty planning and development framework: a case study of a high-tech multinational firm, Journal of Business & Industrial Marketing, 23(7), 507-517.

- Pappu, R., Pascale, G.Q. & Cooksey, R. (2005). Consumer-based brand equity: improving the measurement- empirical evidence, Journal of Product & Brand Management, 14(3), 143-154.

- Paulssen, M., Roulet, R. & Wilke, S. (2014). Risk as moderator of the trust-loyalty relationship, European Journal of Marketing, 48(5/6), 964-981.

- Petrick, J.F. (2002). Development of a Multi-Dimensional Scale for Measuring the Perceived Value of a Service, Journal of Leisure Research, 34,119-134.

- Puto, C.P., Patton, W.E. & King, R.H. (1985). Risk handling strategies in industrial vendor selection decisions, Journal of Marketing, 49, 89-98.

- Rempel, J.K., Holmes, J.G. & Zanna, M.P. (1985). Trust in close relationships, Journal of Personality and Social Psychology, 49(1), 95-112.

- Riegelsberger, J., Sasse, M.A. & McCarthy, J.D. (2003). The researcher?s dilemma: evaluating trust in computer-mediated communication, International Journal of Human-Computer Studies, 58, 759-781.

- Rousseau, D.M., Sitkin, S.B., Burt, R.S. & Camerer, C. (1998). Not so different after all: a cross discipline view of trust, Academy of Management Review, 23(3), 393-410.

- Shapiro, D. Sheppard, B.H, & Cheraskin, L. (1992). Business on a handshake,Negotiation Journal, 8(4), 365-377.

- Sheth, J.N. & Parvatiyar, A. (1995). Relationship marketing in consumer markets: antecedents and consequences, Journal of the Academy of Marketing Science, 23(4), 255-271.

- Sichtmann, C. (2007). An analysis of antecedents and consequences of trust in a corporate brand, European Journal of Marketing, 41(9), 999-1015.

- Sitkin, S.B. & Roth, N.L. (1993). Explaining the limited effectiveness of legalistic remedies for trust/ distrust,Organization Science, 4(3), 367-392.

- Small, M.W. & Dickie, L. (1999). A cinematograph of moral principles: critical values for contemporary business and society, Journal of Management Development, 18(7), 628-638.

- Srivastava, N., Dash, S. B., & Mookerjee, A. (2016). Determinants of brand trust in high inherent risk products: The moderating role of education and working status. Marketing Intelligence & Planning, 34(3), 394-420.

- Sung, Y. & Kim, J. (2010). Effects of brand personality on brand trust and brand affect, Psychology & Marketing, 27(7), 639-661.

- Teng S.G., Ho S.M., & Shumar D. (2005). Enhancing supply chain operations through effective classification of warranty returns. International Journal of Quality &Reliability Management, 22(2), 137-148.

- Veloutsou, C. (2015). Brand evaluation, satisfaction and trust as predictors of brand loyalty: the mediator-moderator effect of brand relationships, Journal of Consumer Marketing, 32(6), 405-421.

- Veloutsou, C., Christodoulides, G. & de Chernatony, L. (2013). A taxonomy of measures for consumer-based brand equity: drawing on the views of managers in Europe, Journal of Product & Brand Management, 22(3), 238-248.

- Viklund, M. (2003). Trust and risk perception in Western Europe: a cross-national study, Risk Analysis, 23(4), 727-738.

- Williamson, O.E. (1979). Transaction Cost Economics: The Governance of Contractual Relations,The Free Press,New York,NY.

- Williamson, O.E. (1993). Calculative ness, trust, and economic organization, The Journal of Law and Economics, 36(1), 453-486.

- Wilson, J.M., Grammich, C. & Chan, F. (2016). Organizing for brand protection and responding to product counterfeit risk: an analysis of global firms, Journal of Brand Management, 23(3), 345-361.

- Wingreen, S.C., & Baglione, S.L. (2005). Untangling the antecedents and covariates of e-commerce trust: Institutional trust vs. knowledge-based trust. Electronic Markets, 15(3), 240-260.

- Zaheer, A. & N. Venkatraman. (1995). Relational Governance as an Inter organizational Strategy: An Empirical Test of the Role of Trust in Economic Exchange,Strategic Management Journal, 16, 373-392.

- Zand, D.E. (1972). Trust and managerial problem solving, Administrative Science Quarterly, 117(2), 229-239.

- Zhang, H. (2004). Trust-promoting seals in electronic markets: Impact on online shopping decisions. Journal of Information Technology Theory and Application, 6(4), 29-40