Review Article: 2024 Vol: 28 Issue: 1

Unveiling the Digital Services Experience to Wealth Customers: With Special Reference to State Bank of India - An Imperial Banking base of Indian Economy

Vikas Singh, United University

Neema, United University

Richa Singh Dubey, Indian Institute of information Technology, U.P

Priya Shah, Indian Institute of information Technology, U.P

Citation Information: Singh, V., Neema, Singh Dubey, R., & Shah, P. (2024). Unveiling the digital services experience to wealth customers: with special reference to state bank of india - an imperial banking base of indian economy. Academy of Marketing Studies Journal, 28(1), 1-10.

Abstract

Prologue: Wealth-Customers’ Service is a premium and exclusive service meant for SBI’s high net-worth customers. The paper is an attempt to study the outcomes of services on being digitalized. Classified Literature Review: Literatures contending HNI customers; followed by outcomes marked after services being digitalized; international experiences implemented and digitalization experiences by HNIs. Objectives: Primarily to get digitalized services reviewed, along with the concerns of HNIs. Methodology: Ex-post-facto practice exercised, using exclusive questionnaires provided to the HNI clients and dedicated bank officials. Conclusion: Dramatic and affirmative variations noted on services being digitalized.

Keywords

Wealth-Customers, High Net-Worth Individuals (Hnis), Digitalization, Wealth-Hub Services.

Introduction

Digitalizing Economies: A Prologue

The International Institute for Management Development (IIMD) in one of its research projects, intended for measuring the capacity and readiness of world economies to adopt and explore digital technologies for economic as social transformation in the different areas of economic activities. Also, rated the World Digital Competitiveness. India stepped 44th in the year 2022, registering elevation from 46th a year before. Denmark stood first followed by USA.

Press Information Bureau (PIB), 2023 released that during last five years, various easy and convenient modes of digital payments, including Bharat Interface for Money-Unified Payments Interface (BHIM-UPI), Immediate Payment Service (IMPS), and National Electronic Toll Collection (NETC) have registered substantial growth and have transformed digital payment ecosystem by increasing person-to-person (P2P) as well as person-to-merchant (P2M) payments. BHIM UPI has emerged as the preferred payment mode of the citizens and has recorded 803.6 crore digital payment transactions with the value of ? 12.98 lakh crore in January 2023. This success story began a decade ago when 86.6 per cent of payments were made through cash in India in the financial year reported as per the statistics in 2012 (Ravi, 2017).

Thus, realizing the scope of having a cashless economy, initiatives for the digitalization of economic services began with (Singh & Malik, 2019).

It was marked that with the digitalization of products and services so offered, there has been a dramatic change in customer preferences. Not only frequency but the quantum has registered a remarkable change. A treat to avail any online buying followed digital payment got quashed with the participation of people.

This resulted, in new digital financial technologies like FinTech got emerged, with new innovative offers. Broadly, FinTech is an umbrella term for innovative technology-enabled financial offers and the business models that accompany those services (Mention, 2019).

HNI – An Affluent Segment

As mentioned, after experiencing the success of being cashless, through digitalization and FinTech, the State Bank of India, debuted with a premium banking service for selected premier customers (to be called as HNIs - High Net-worth Individuals or Wealth Customers). The beginning was done with conventional mode of services, though services provided to them were exclusive and premium. And in the gradual course, to add worth to the same, services got digitalized. This was the outcome of the confidence gained in past.

Commonly all HNIs were above the threshold, thus were the premium. But not all were had an organized origin and handling the transactions with contemporary means. It was challenging to pursue them to get registered for exclusive services. And it was practically, more challenging to bring them to opt for the digitalized services.

For having a clear-cut understanding of the status of an HNI a standard definition needs to be referred. A HNI or a Wealth Customer as defined by the Wealth Business Unit, State Bank of India vide e-Circular (CDO-2019-20), SBI-Wealth (earlier as SBI Exclusif) will be allotted to a customer having a wealth base of rupees thirty lakhs, with regard to the investment made into the bank, irrespective of the formats of their accounts held, namely savings, fixed-deposits, term-deposit receipt, special term-deposit receipt, mutual fund, and alike products available.

With the target to reach out more than 5,000 premier banking customers, (State Bank of India 2022) after making a success pilot run, launched its Wealth Hub (a separate units to serve HNIs) first in Delhi and then in Mumbai. Having a blue-print to cover around 37 centers across the nation the bank launched its premier service (Gupta & Roy, 2016).

Presently, SBI’s Wealth Management Services are offered at 74 major centers across the country through a network of 172 Wealth Hubs and five e-Wealth Centers (SBI’s Annual Report, 2022). A notable jump from 37 centers to 172 centers within a half-decade registers an increase of approximately 365%. This signifies acceptability of the high-end services and dedication of the service-providers to an extent and making the product, a brand.

Literature Review

An exhaustive post-mortem exercise carried out of the literatures available on wealth-customers. Wealth management is a portfolio-management advisory service that combines other financial services to address the needs of affluent clients. It is an exclusive segment which is growing at a rapid pace across the globe. As stated above a success of 365% in a short span speaks about its viability. With a large population being upgraded to the higher strata of income levels year-on-year, the potential for Wealth Services is expanding day by day in the nation.

According to the scope of this paper, variety of previous studies were explored and finally categorized them into four key sub-themes:

1. A Promising Segment – Basic Indicators,

2. Digitalization Outcomes,

3. Services to HNI: International Experiences,

4. Technology Focused Wealth Management.

5. Present Challenges

A Promising Segment – Basic Indicators

Cafe-Mutual (2016), a mutual fund knowledge portal, contended that India being home to 2.36 lakh HNIs and the same population is expected to grow by 135% to reach 5.54 lakh by 2025. The prediction is based on the fact that, the total number of HNIs in India grew by 55% from 1.52 lakh in 2007 to 2.36 lakh in 2015. The proclamation is based on, ‘India 2016 Wealth Report’, a report released by the New World Wealth. The same was based largely due to the strong performance in sectors like construction, financial services, IT, BPO and healthcare sectors.

Capgemini’s World Wealth Report (2018) showed India’s HNI population grew at the fastest rate in the world at over 20 per cent in 2017 to 2,63,300 from 2,18,600 in 2016. Their cumulative wealth grew to $1067.1 billion in 2017 from $877 billion in the previous year. Although India’s economic performance was found to be strong in 2017 but decelerated from 2016 levels. The wealth generation was supported by a strong equity market, with market capitalization expanding by 51.3% in 2017 against 3.1% in 2016.

Wealth managers stated that many HNIs were seen using the liberalized remittance scheme (LRS) route to buy stocks of foreign companies on foreign stock exchanges and to acquire overseas properties. Risk appetite among HNIs seems to be shifting from traditional mutual funds to alternative products (Economic Times, 2019).

Digitalization Outcomes

Lohana & Roy (2021), concluded that a significant demographic impact was found among the respondents on the customer usage in digital banking. Whereas, no significant impact of gender and marital status were reported for the same. It revealed useful insights into consumer’s usage and satisfaction with the prevailing digital services.

Siby (2021), in his study analysed using a primary data from Ernakulam district of Kerala to study the consumer perception of digital payment methods on the basis of demographic characteristics. Correlation and ANOVA were used to analyse the data and found that there was no significant variance in consumer perception of digital payment methods even in times of COVID pandemic based on the key demographic characteristics.

Mohd & Pal (2020) made a study on consumer perception on digital transactions and they found that there was a hike in the use of digital payment transactions due to sorted technology and compatible policies.

Pai (2018) conducted a study on consumer perception towards digital services found that though digital payment modes were on the rise, but people still had certain reservations for making online payments. That may be due to knowledge gap in digital-handling and cyber threat.

Services to HNI: An International Experience

In order to gain a confidence to promote digitalization for wealth customers, international lessons and learnings were jotted down. Worldwide acceptable practices allow a nation to experiment with any novel practice.

An international learning came out from research-work done on a Taiwan based bank by Lin et al (2021) to determine the factors that influence services to high-net-worth customers. The methodology followed was based on a hybrid approach by integrating the fuzzy logic and Decision-making Trial and Evaluation Laboratory (DEMATEL) methods to identify the most influential criteria affecting the performance of wealth management banks in Taiwan during the 2019–2020. One of the four dimensions, namely service quality was concentrated upon. And it was found that out of all, the order of influence carried ‘service quality’ was on the top. It was marked that customized investment information in-service quality is most important.

In a research work carried to hunt for the brand value propositions for Indian Banking Customers, the results prove that while self-expressive benefits drive the choice of going for the foreign banks, functional benefits are important for all types of banks (Moorthi, 2017).

Yiyao (2012), a news reported from China-Daily, wrote in one of his articles that survey done in the country a decade before it was found that HNI customers look forward to tailor made and novel services. It was found in his study that a substantial number of high-net-worth customers were not satisfied with the traditional form of services. The survey pooled some 700 individuals across 29 cities in the country reported. A substantial majority was found to be dissatisfied.

Further, he reported in his article, based on the survey was jointly published by Minsheng Bank Corp and McKinsey & Co. showed that in China about 40 percent of customers are dissatisfied with what their present private banks provide for them. As a result, roughly fifty percent of HNI also allocate just 20 percent or less of their investable assets to their main bank, the survey found. Thus, digitalization increased the scope not only for the banks but resulted as readily acceptable by clients as well.

Technology Focused Wealth Management

The Imperial Bank of Indian Economy has transformed the wealth management services by launching new technology and customer dream-based initiatives known as “SBI WEALTH”. This service got awarded as the Best Brand of 2021 by the Economics Times. It offers 360-degree view of the financial and investment scenario handled by expertise team reported in Economic Times, September 2022.

Presently, Wealth Business is dominated by a few Private Sector Banks, Foreign Banks, and Broking Business Firms. Against this backdrop, SBI entered the foray of Wealth space in January, 2016 by launching first Wealth Business Centre at Bengaluru under the brand name. SBI-Wealth has shown exponential growth in terms of Investment AUM (Assets Under Management) and clients during Financial Year 2021-2022.

The AUM has increased from INR 8,592 Crore to INR 14,317 crore, and the number of Clients increased from 2,55,196 to 2,97,246. The AUM of Clients also increased from INR 2,07,167 Crore to INR 2,52,061 Crore for the same period. SBI Wealth has been chosen as one of the Best Brands of 2021 by The Economic Times (ibid, SBI’s Annual Report, 2022).

The bank came up with new-fangled services catering its special customers. This included:

E-Wealth HUBS - Remote Model: A first-of-its kind ‘e-Wealth Centre’ equipped to facilitate all financial needs including Balance Enquiry, Fund Transfer, Investment Portfolio, opting Mutual Fund Schemes, just over a quick call/video conferencing with a Relationship Manager.

Digital Self-Service: A new-age avenue of managing finances on-the-go through future-ready Internet & Mobile Applications that enable Trade Transactions, Trending Updates, Market Information, Holistic review of Investments, Portfolio Tracking, etc. all at client’s fingertips. SBI is consistently adopting new initiatives and technique to attract premium customers and to become leader.

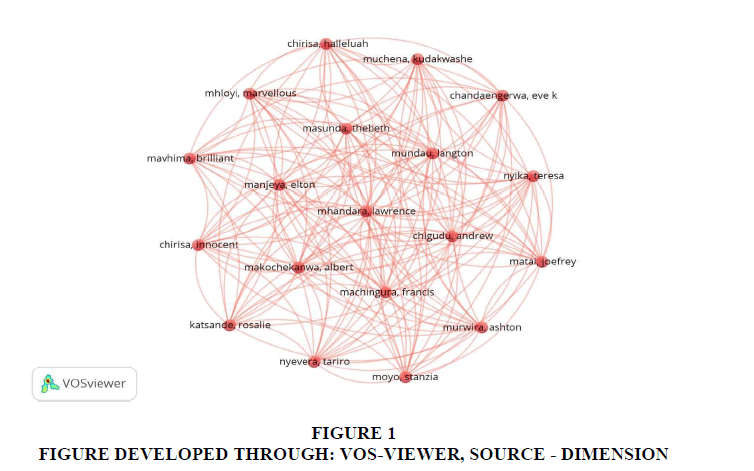

Bibliometric Coverage

A network visualization map has been created by Vos-viewer along with the data extract from dimensions sites on the subject-matter to draw a bibliometric study. For the same, minimum one document of an author got considered with minimum one citation. On making the analysis it is observed that the map shows clusters containing 19 items Figure 1.

Present Challenges

Retail banking worldwide is countering a stimulating conditioning. The constituents (customers) have a plethora of banking, wealth planning, and portfolio management choices from the digital banks (Kaur et al. 2021). The same proves to be innovative banking services that are transforming the future of banking with hassle-free, borderless, financial solutions. To make themselves to be part of the competition, traditional banks have to come up with a strong base to customer relationship management (CRM) strategies.

That is the only weapon to battle the competition and even to boost customer satisfaction and retain loyal customers (Gokmenoglu 2020, and Viviani et al. 2021).

A remarkable challenge to serve the HNIs originates from the behavioral issue. A moderate impact of overconfidence bias has been found amongst the investors. The influence of overconfidence bias in stock investment with respect to forecasting of the stock price movements, overtrading, over-analysis and overreaction. Thus, a sincerity and a mature movement is the challenge that banks need to take care (Parthi et. al. 2022).

Customer Satisfaction is one of the vital and sensitive, customer-based performance metrics widely used by firms worldwide (Gupta, 2006). An indigenous Customer satisfaction Index need to be developed in India to attract the customers to vail an unhindered banking service and to resolve also their issues (Rajendra et. al. 2020).

Customer Satisfaction Index (CSI) is one such customer-based measurement system which involves estimating, monitoring, and improving the performance of businesses. It complements conventional measures such as productivity and price indices (Fornell et al., 1996)

Objective of the Study

The paper intends to work on overall review of about the services provided to SBI’s High Net-Worth Customers. Focusing on the portfolio management, accessibility, and security, to understand the customers acceptability for the said issues. Also, to hunt into how digitalization can help in acquiring and retaining the premium customers. More the ease digital service would be, better experience would give extended business.

The paper also intends to explore the possible technological initiatives which may be implemented. Likewise, chat-box facility, pop-up message to flash on prospective HNI customers’ mobile, dedicated technical support. The must extract of the paper is to know about the experiences of service-providers, the dedicated staff (RM) for wealth customers. And lastly, to find out the digital knowledge gap of premium customers to handle their wealth account.

Design & Data Collection

It is a research design that paves a model and direction to the research, yielding favorable results therefrom. It provides a glue that holds the research project together. Design choices about instrument, data analysis, and construct validation and many more factors affects the conclusions (Sackett & Larsen, 1990).

Research Design

The present research-work, an ex-post-facto design. This type of research endeavor is known as an after-the-fact study. Here exploration starts after the fact has already occurred, without tempering with the existing findings. It is the most suitable design to be considered. As authors have intended to explore the viability and profitability of one of the premium products of the bank. Existing, SBI-Wealth Service, carrying tenure of almost a decade has registered a success. But this paper will hunt into its adequacy of the existing services to the clients. For examining the service quality and its gap-adequacy, a study is performed through questionnaires. Two questionnaires were developed for data collection.

First questionnaire, entitled as SBI Wealth – For Clients (A feedback from HNI Customers): It especially focusses on the issues relating with the service qualities provided to HNI Customers where responses were collected directly from HNI customers. Issues like, reliability, responsiveness, access to the service, creditability and many other vital points have been focused in this questionnaire.

Second questionnaire, entitled as SBI Wealth - For RMs (An interaction with Relationship Mangers): Here real-time experience has been drawn from the respondents, being an exclusive service provider, Relationship-Manager of the Wealth Hub. They responded on the service issues & concern countered by them after contacting the clients personally. In both the questionnaires, Five Point Likert Scale was used

Data Collection

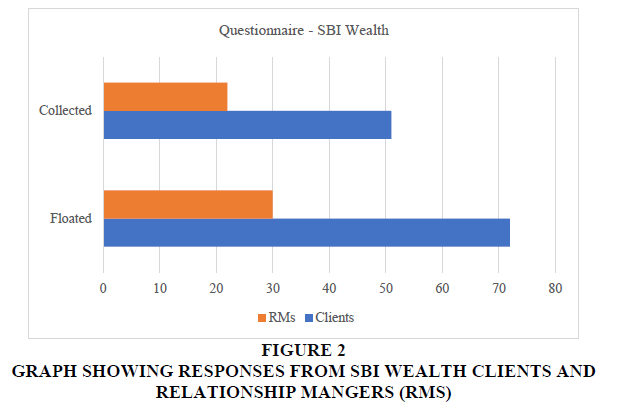

As mentioned, the Primary Data have been collected through the questionnaires. Face Validity of the same has been checked by having experts’ opinion, comprising of bankers and related officials. Spread sheets were used to analyze the data collected through feedback Figure 2.

Apart from the above primary sources, secondary data were also concentrated. SBI Reports, Official-notifications, Official website of the Bank, Research Papers were mainly referred for the same. All data were collected within the geographical boundaries of the district, Prayagraj. Technically, the region selected is an exclusive known as Prayagraj Module (Zone).

Questionnaire 1 - Outcomes of Responses from Clients

Though the numbers of actual HNI clients connected with SBI-Hub of Prayagraj district ranges to 900. All HNI clients do not get registered in the digitalization drive. So, the clients registered and well connected with the relationship manager of the branch were approached. And out of the clients approached, 70% of the clients responded to the questionnaire completely.

Looking into the busy-schedule of HNIs only six questions were drafted apart from having an open-ended question, for inviting suggestions from the HNI Clients. Questions were exclusively based on customer-satisfaction, service-gap, user-friendly-service, concerns, security-service, knowledge-gap issues related with digitalization. Five Point Likert Scale was used. High scale responses only have been highlighted below:

Outcomes of Responses Received from SBI-Hub (Relationship Manager): Questionnaire 2

Here, again six confirmatory questions were drafted apart from having an open-ended question, inviting experiences and observations from the relationship managers. Questions were exclusively drafted to confirm from the banking-staff about the services to HNI-customers and their issues. Five Point Likert Scale was used. High scale responses only have been highlighted:

Open-Ended Question – Suggestive

Responses received from staff and wealth customers were satiating. They both also came out with several suggestions. The suggestions of the HNI clients and experiences of the bank-officials have been collected and summarized below:

Collective Observations: Digitalization Experience to Wealth Management Clients

1. Based on the feedback received through the open-ended question, some observations have been made regarding futuristic technology which may be required for managing wealth management transactions/business with more ease. It may also help in acquiring more premium customers.

2. New Account Opening & existing client onboarding process should be done digitally instead of current practice of manual account opening & onboarding.

3. It was submitted that the ongoing traditional method is time-taking. It should be done instantly on the same say. Pop-up message for eligible wealth customers should be displayed on INB (internet banking), which will also extend customers count of wealth of the bank. RMs may be given view access to the banking software from where they can access and provide the basic information about client’s account without going to his Service Manager.

4. Also, the wealth-customers should get relatively extended priority in all service requests and deliverables. For example, cheque books meant for wealth customers must be branded accordingly and dispatched instantly.

5. Further, technical issues faced by them, if any must be resolved by the technical team on priority basis. The wealth platform or app should have an interactive chat box, where client can interact anytime with his relationship manager, or can also do video call for any advisory needed, fund suggestions or portfolio management to be flashed/pop-up in the app/INB portal according to client's risk profile.

6. Some obvious and biased responses were also received, like unwarrantedly not liking of few of the bank-policies by the clients. It is to be noted that on being enquired the clients respond that they have not researched or have done any comparative analysis with services of the other banks, thus such reposes have not been made part of the outcome.

7. Also, the bank-officials have informally stated (verbally) that in order to compete with other banking services for HNIs, State Bank of India need to make certain changes. Though the changes are not so easy but those will bring the business and will result increase in the clientage.

Removing the Informal Concern-Gap

Keeping in mind the informal submissions made by the bank-officials, and so-called biased submissions of the client, the research extended to have a comparative analysis of the same services available in a digitalized mode with the other banks.

This part of the paper would remove even the gap and excuse of not highlighting the concerns, irrespectively shown by the respondents.

A Comparative Study of Digitalized Services by Other Banks, not available at SBI

Digital products being offered by other wealth management companies (banks) which are not available with SBI.

a. Citi Bank has different video chat system, where they can easily login through their mobile, also they can send various forms digitally to their RM to process.

b. Paytm Money provides bouquet of products, comparison of funds and full details of every fund. Other banks relationship-mangers can open account digitally through their phones or TABs. They can do some basic non-financial transactions like updating of Aadhaar, modification in account

c. I-View at ICICI Bank or view rights in the banking systems from officials can provide basic documents to clients like bank statement, interest certificate, TDS certificate, etc.

d. IndusInd Bank offers account opening through video KYC. Customer is not required to visit branch in this process. Now SBI has also started account opening through video KYC.

e. HSBC offers a Digital Security Key which is used for OTP based transactions

f. Wealth Management Firms provide complete holding across stocks, insurance, mutual-funds

g. HDFC Bank and AXIS Bank offer online mutual fund transactions in internet banking for NRI priority customers, so that customers can easily purchase and redeem mutual funds through internet banking.

h. Client on boarding process is fully digitalized in few other banks.

i. All wealth customers should be allowed to apply for credit card, Multi currency card, locker booking through internet banking, which is currently available with other wealth management companies.

Discussions

Private banking customers have very exclusive requirements regarding the diversification of their portfolio management. For them it is quite concerning that how they will conservatively preserve their earnings from getting taxed and to have least disclosures unlike to traditional investment plans (Mylonakis, 2009). Working in the same directions all banks in India started catering the concerns. SBI Wealth started serving to the concerns with a killer instinct.

HNI Customers are Satisfied with Wealth Hub Services of the Bank

SBI Wealth Clients receive privileged services from a dedicated unit of the Bank, SBI-Hubs. They experience the personalized services provided by the SBI-Hubs. As stated, they get an exclusive, executive to counsel and advice, known as Relationship Managers. A hi-tech Wealth Lounge, to stay and get their queries settled. Service at the door-step, makes the scheme more attractive. Such personalized and at ease service with a rich portfolio of the product itself, satiate them a lot. But the need of a client still perpetuates and high expectations decides their retention.

Customers Perceive Benefits over Risk in the Digitalization in Wealth Management

Also, even though after having a high-end service profile, HNI customers carry an inherent risk. Digitalization is not a new-normal to all the clients. Still substantial numbers avoid to have the transactions using digital media. The threat of virtual movement, insecurity, market-frauds deprive them from using the technology. Quick and spontaneous service make the customer to access the same anytime-anywhere. The customers, without any hitch avail the services. Above all the security feature make it more reliable for the customers.

Conclusion

Digitalization always plays a vital role in wealth management. And considering current situation, its importance has increased manifold. Digitization helps in making organization cost effective and simple. It helps organization stay competitive in the market space. It reduces workload on front office or sales force.

The role of the Wealth Managers will change dramatically in the next few years. Keeping up with new technology and staying relevant to the next generation of investors are the twin factors that define the wealth management industry today. Not only will clients expect better engagement tools, but advisors will be serving ever more clients and for lower fees. Wealth Managers will have to prove the value of their experience and insight to help clients stay on the track for what really will matter in their financial lives. For that, they will have to rely on advancements in automation, analytics, and artificial intelligence.

Through investment in innovation and digitization, wealth managers will not only enhance efficiency through automation but also future proof their businesses by upgrading client touch points and overhauling their value propositions.

References

Capgemini (2018). World Wealth Report 2018, Retrieved on March 9, 2023 from, https://www.capgemini.com/wp-content/uploads/2018/06/Capgemini-World-Wealth-Report.pdf

Fornell, C., Johnson, M.D., Anderson, E.W., Cha, J., & Bryant, B.E. (1996). The American Customer Satisfaction Index: Nature, Purpose, and Findings. Journal of Marketing, 60(4), 7-18.

Gokmenoglu, K. K., & Amir, A. (2021). The impact of perceived fairness and trustworthiness on customer trust within the banking sector.Journal of Relationship Marketing,20(3), 241-260.

Gupta, K. & Roy, S. (2016). SBI unveils wealth management service SBI Exclusif. Mint Digital Newspaper. Retrieved on April 5, 2023 from,https://www.livemint.com/Companies/SnvnIxot0H6WgsIegPLQBN/SBI-unveils-wealth-management-service-SBI-Exclusif.html

Gupta, S., & Zeithaml, V. (2006). Customer Metrics and Their Impact on Financial Performance. Marketing Science, 25(6), 718-739.

Kaur, S. J., Ali, L., Hassan, M. K., & Al-Emran, M. (2021). Adoption of digital banking channels in an emerging economy: exploring the role of in-branch efforts.Journal of Financial Services Marketing,26, pp. 107-121.

Lohana S. & Roy D. (2021). Impact of Demographic Factors on Consumer’s Usage of Digital Payments. FIIB Business Review - Sage Journal, (Nov.) 2021.

Indexed at, Google Scholar, Cross Ref

Mention, A.L.(2019).The Future of Fintech,Research-Technology Management,62(4), p. 63

Mohd., S & Pal, R. (2020). Moving from cash to cashless economy: A study of consumer perception towards digital transactions. International Journal of Recent Technology and Engineering. Vol. 7, (1), pp. 1-13

Moorthi, Y.L.R.andMohan, B.C.(2017). Brand value proposition for bank customers in India.International Journal of Bank Marketing, Vol. 35 No. 1, pp. 24-44.

Indexed at, Google Scholar, Cross Ref

Mylonakis, J. (2009). Private banking services, private banking customers' profile and their investment behavioral preferences.Banks & bank systems, 4, (1), pp. 37-44.

Oberoi R. (2019), Look where HNIs are parking money amid equity, debt market uncertainty. The Economic Times. Retrieved on April 6, 2023, from https://economictimes.indiatimes.com/markets/stocks/news/look-where-hnis-are parking-money-amid-equity-debt-market-uncertai7nty/articleshow/69213278.cms

Pai, A. (2018). Study on Consumer Perception towards Digital Wallets. International Journal of Research and Analytical Review (IJRAR). Vol. 3, Issue 5, pp. 385-391.

Ravi, C. S. (2017).Digital payments system and rural India: A review of transaction to cashless economy.International Journal of Commerce and Management Research, 3(5),169–173.

Sackett P.R. & Larsen J.R. (1990), Research Strategies and Tactics in Industrial and Organizational Psychology. Handbook of Industrial and Organizational Psychology, p. 418.

Siby, K.M.(2021).A Study on Consumer Perception of Digital Payment Methods in times of COVID Pandemic.International Journal of Scientific Research in Engineering & Management, Vol. 05, No. 03, p. 12.

Singh, R., & Malik, G. (2019). Impact of Digitalization on Indian Rural Banking Customer: With Reference to Payment Systems.Emerging Economy Studies,5(1), 31–41.

Indexed at, Google Scholar, Cross Ref

State Bank of India (2022). Setting New Standards in Banking Excellence: SBI’s Annual Report. Retrieved on April 23, 2023, from https://sbi.co.in/documents/17836/29141285/SBI_Annual_Report_2022.pdf

Viviani, J. L., Komura, A., & Suzuki, K. (2023). Integrating dynamic segmentation and portfolio theories for better customer portfolio performance.Journal of Strategic Marketing,31(1), 140-153.

Indexed at, Google Scholar, Cross Ref

Yiyao W. High-net-worth individuals - want better banking. Retrieved on March 24, 2023 from, http://en.people.cn/90778/8069401.html

Received: 06-Jul-2023, Manuscript No. AMSJ-23-13767; Editor assigned: 07-Jul-2023, PreQC No. AMSJ-23-13767(PQ); Reviewed: 26-Sep-2023, QC No. AMSJ-23-13767; Revised: 03-Oct-2023, Manuscript No. AMSJ-23-13767(R); Published: 15-Nov-2023