Review Article: 2024 Vol: 28 Issue: 1

Visualising the ′Price−Quality′ Considerations of Indian Truck Market

Abhijit Sarkar, SRM University Sikkim,Gangtok, Sikkim

Diganta Mukherjee, Indian Statistical Institute, Kolkata, West Bengal

Samrat Kumar Mukherjee, Sikkim Manipal University, Majitar, Sikkim

Citation Information: Sarkar, A., Mukherjee, D., & Kumar Mukherjee, S. (2024). Visualising the ‘price-quality’ considerations of indian truck market. Academy of Marketing Studies Journal, 28(1), 1-13.

Abstract

This paper tries to highlight the the ‘price’ & ‘’quality’ considerations of the Indian truck buyers into a structural model. The expected quality, expected price along with the robustness and performance perceptions have been put into the aforementioned structural model to explain the group interactions of various relevant endogenous latent variables among Tata and Ashok Leyland buyers in the Indian truck market. The primary data for this study has been collected from across some important road freight movement hubs of India.

Keywords

Truck, Purchase Decision, SEM, Heavy Truck, HCV, Brand, Truck Operator, Small Fleet.

Introduction

In a relatively fast developing country like India (looking beyond the covid period), it is plausible to expect that proliferation of heavy trucks has happened in the backdrop of certain well established operational benefits of multi-axle trucks (RITES Ltd., 2014) and certain conducive policy decisions by the Indian regulatory bodies (Frost & Sullivan, 2012). It is pertinent to note here that (Londoño-Kent, 2009) on comparing various issues and emerging trends in road – freight transport industries in the US economy found that, as industrialization increases trip lengths increase, medium rigid trucks (typical two axle trucks) lose out to larger trucks that could be the typical multi – axle trucks that may carry freight in between large warehouses/hubs or from warehouse hubs to large distribution points. As a result, large multi-axle trucks have grown popular in the long haulage applications across the country (Jai, 2011) and the market specialists or industry leaders have expressed their growth optimism even after taking into account the effects of the global pandemic (Chaliawala, Shyam, & Thakkar, 2021).

Additionally, for an Indian operator the operational benefit of being able to lawfully carry more weight is substantial as the freight rates are extremely competitive (Dubey, 2015) and a typical truck operator, operating small fleet of trucks (the industry primarily consists of truck operators where almost seventy-seven percent of the owners have a fleet size of less than ten trucks (Raghuram, 2015)) earns very slim profits and thus profitability per truck is very important (Gopal, et al., 2017). Under this backdrop, it was found that various facets of transport business like: ownership patterns, fare & freight rate system, financing, technological up-gradation, legal axle loads, strict actions against overloading incidents have gradually turned the Indian trucking industry to be more conducive for multi axle trucks (AITD; CIRT, 2000), which could carry greater volume of freight with relatively less additional cost and improve the earnings of the transport operator even under conditions of extremely competitive freight rates. The aforementioned study thus puts across the crux of the issue that, if a transporter can legally carry more freight per truck, he has better earnings. As we delve further and explore reports on operational aspects of the cost sensitive Indian truck market, we find indications that the economic growth and the new taxation regime i.e. GST, has made it possible for manufacturing units and logistics handling stake holders to ensure freight is seamlessly (Bhal, 2017) distributed through optimally spread out warehousing hubs that effectively cater to demand centres. In post GST era interstate freight travel does not face any barrier in terms of additional taxation. Thus, an efficient demand-based warehousing approach and substantial improvement in infrastructure shaping up purchase patterns and preferences of the cost sensitive Indian transport operators (Bhattacharjya, 2010). Given these developments, and considering the importance as well as uniqueness of industrial marketing (Cooke, 1986) and importance of making customers realise value of their products (Lindgreen, Hingley, Grant, & Morgan, 2012), it becomes interesting to understand and ascertain the considerations truck owners go through to ultimately buy their livelihood product, i.e., the long haulage truck. This is important for manufacturers as well, since they are constantly in the need to distinguish themselves from the crowd of competitors in a competitive market (Lorge, 1998).

This paper is organised as follows: the literature review section covers relevant scholarly works. However, given the paucity of research focused in this area, various studies conducted by consulting and statutory bodies which look into the changing tonnage preferences among transporters in India have also been referred. This is followed by the section covering methodology and data for the paper in section 3, where the hypotheses of this paper are put forward, nature and type of data used is discussed and an overview of methodology for testing cointegration of the relevant variables provided. Under section in section 4, a brief overview of the production and market scenario of truck market in India in the heavy as well as light truck segments has been provided thereafter the findings are discussed and explained in terms of the hypotheses put forward in Section 3. Finally, in the Conclusion & Future Scope section (section 5), the interpretation and potential effect of the findings as put up in section 4 has been discussed along with future scope of research.

Literature Review

In this section we look into a) Benefits of multi axle trucks or heavy trucks as found in developed markets, b) cost sensitive nature of Indian trucking industry and c) Approaches to truck Purchase with reference to developed markets and India; all of which may help us in identifying underlying gaps in existing literature.

Benefits of Multi Axle Trucks as Found in Developed Markets

Several academicians and professionals have put forward their findings and review of various such documents that highlight multi-axle trucks have various economic/operational and social benefits across different markets. The overall economic growth of a developing economy like India has also boosted its demand structure and need for available truck fleets to move around market loads. This has also positively affected the infrastructure (Malhotra & Mishra, 2019). This improved infrastructure and better quality of trucks generally lead to higher productivity (Hossein Rashidi, 2012). It was observed that (Lumsden, 2004) in his research for European markets, suggested the approach of increasing load capacity of trucks by making trucks longer and heavier. The author argues that in European road and transport conditions, bigger and longer trucks would imply higher efficiency in trucking operations which would also lead to better profitability of the fleets concerned, this study suggests that there seems to be a greater acceptance towards bigger trucks in the industry. This stain of thought seems to be reflected in India as well when MORTH1 raised the permissible gross vehicle weight in various weight classes by 20 to 25 percent (ET Bureau, 2018). In global parlance, (Knight, 2010) after having explored socio-economic effects opined that positive overall benefits could be attributed to the shift towards larger vehicles2 that is taking place in the European road transport (freight) sector. In pre Euro Modular System timeline of Europe too, (Vierth, et al., 2008) had found that it is not cost-effective to use shorter and lighter trucks for long haulage across hilly Nordic European regions of Sweden and concluded that heavier and longer trucks are more efficient even in such terrains.

Even across the Atlantic, it has been observed that, as bigger longer and heavier trucks are being put forward as an operationally viable medium of transport. Extensive studies have been conducted across US and European Union on the various socio-economic, operational & safety aspects issues related to heavy trucks. The study report of (Woodrooffe, et al., 2010) provide an evidence based study which shows that by bringing in appropriate regulations and policy decisions, heavy trucks can reliably and safely provide optimum freight transport performance. The author shows that effective regulatory systems could reliably promote safer and more efficient vehicles by using performance measures to guide policy decisions. On the other hand, in the review of literature by (Mooren, 2014) which covered safety issues and specific aspects that required attention while dealing with transportation through heavy vehicles, it was found in this study that driver involvement and the driver’s orientation towards safety are important factors towards profitable fleet operations.

Beyond the various benefits as opined by various academicians and statutory bodies, it is important that the heavier multi-axle trucks should be able to appeal to transport operators who operate in an extremely competitive and cost sensitive environment. This aspect would be elaborated upon in the next sub section.

Cost Sensitive Nature of Indian Trucking Industry

As bigger and heavier trucks (multi-axles in general) have been found to be operationally viable in global and Indian context. In his research (Raghuram, 2015) highlights that more than 70 percent of freight is carried by road transport in India, and it contributes more than 4.9 percent to the GDP of the country. He emphasises that the transportation system of India should be driven by ‘speed with sustainability’, safety, security and ‘stress-lessness’ (of the drivers).

But in his subsequent studies he went on to emphasise that the biggest challenges in attaining excellent logistics service quality in India is that traditionally it has been price based instead of quality based (Raghuram & Shah, 2004). The authors opined that due to continuous cost push, the ‘supply & demand equilibrium’ that has focused the Indian logistics industry towards that of a disaggregated and semi organised structure wherein quite surprisingly there is a disjoint between truck ownership and marketing of logistical services even under the umbrella of some relatively large trucking companies. Such highly focused price ased dynamics of Indian trucking industry has also been highlighted by (Sriraman, 2006) while discussing competitive nature of the transport industry in the Mumbai Metropolitan region in which the author had considered freight rates, operating costs, industry structure, which were analysed through exhaustive market surveys. It was found that profitability of truck operations have taken a back seat due to increase in average operating cost (mostly fuel) and falling flat freight rates. Under such challenging operating environment, in a Pan-India study (RITES Ltd., 2014) road transportation was found to be very competitively priced; the cost structure of two-axle, three-axle and four/five-axle trucks were listed under various road and terrain conditions. This study demonstrated that multi-axle trucks have better operational viability and the higher the tonnage of the truck the lower is its operational cost per tonne-km in paise.

Meanwhile, the study conducted by (Gopal, et al., 2017), made real life tests through a fleet of multi-axle heavy vehicles in India to understand the positive impact and fuel/operational efficiency of heavy trucks in India. It was reported that the heavy trucks have significant fuel consumption advantages and recommends additional fuel savings along with their respective cost implications. It was further recommended that significant economic and environmental benefits could be attained through better engines, automated gearboxes, low-resistance tyres, aerodynamic designs etc.

However, as pointed out by (McKinsey & Company, 2010), to make ensure that the Indian trucking industry turns into operationally sustainable and competitive, significant changes should be put into regulatory ‘policies’ and ‘actions’ that could improve the existing national expressways and add new expressways in routes with high traffic. Thankfully, this has been largely implemented as per governmental reports (MORTH, 2011) and (MORTH, 2016)3 wherein the importance of efforts to be made in order to minimise stoppages of trucks for checks and toll payments have been highlighted and subsequent policy actions like implementation of GST and FASTag4 have been executed.

Thus, under the changed policy environment and operational challenges in trucking industry, we would move on to observe whether approaches towards truck purchases (by truck operators) have also changed in recent times, in the subsequent section provided below.

Approaches to Truck Purchase with Reference to Developed Markets and India

In continuance to the previous section, it is interesting to note that (Bhattacharjya, 2010) points out that transport operators earn extremely narrow margins in a freight transport industry primarily made of small fleet operators (1-5 trucks), thus cost is a prime consideration behind all operations. The author highlights that India’s economic growth over the last decade or so and the implementation of GST has enabled logistics service providers to optimally put up warehouses in sync with demand centres across geographical locations, manufacturing companies are no more forced to maintain small warehouses in every state for tax optimisation requirements. In such setup, generally the trip lengths for the trucks increase, and it becomes important for the transporters to have trucks in their fleet that can move across large distances and maintain a good turnaround time. It is important to note here that (Frost & Sullivan, 2012) have demonstrated how implementation of GST, favourable regulations, fuel efficient vehicles, and technological advancements could help integrate state economies and boost overall national economic growth. The report reiterates that, given India is catching up fast to global emission regulation trends (implementation of BS6 norms) and on the fiscal policy front states that on implementation of Goods and Services Tax (GST) will pave the way for an efficient, single tax system for movement of goods across the country. It has eliminated (in posteriority) multiple taxes and quotas at inter-state check points and has helped to integrate state economies that has boosted free movement of freight across the country. (Chakraborty, 2016) correctly mentioned that GST can rationalise the investment levels in logistical efforts and capacity, moreover it would reduce multiplicity of documents in interstate movements and caused procedural simplifications through reduced inspection requirements. On a similar note, (Bhal, 2017) had too reiterated the above mentioned studies and maintained that the logistics & supply chain industry in India has benefited from the introduction of GST, and has seen a reduction of 20 to 30 percent of supply chain costs, this has happened as warehouses have moved nearer to the consumption zones.

Quite naturally (Saripalle, 2018) asserts that the logistics sector is one of the key beneficiaries of the new GST structure in terms of cost and time efficiency. Continuing with this line of study, the qualitative study by (Anand Shankar & Krishna, 2018) asserts that despite some possible initial teething problems this tax regime is a boon for the transportation industry as plant to CFA (carrying & forwarding agent) costs, hub warehousing costs and major outbound logistics costs have reduced and it is further expected to reduce. Along with this cost reduction, significant idle time reduction has happened in interstate borders and the average speed of trucks and distance covered per day has increased in comparison to pre GST era. But (Malhotra & Mishra, 2019) adds a word of caution, that the introduction of GST would boost the GDP of India and also improve profitability of the transportation sector, provided that it is effectively implemented by the Indian government.

It is worth noting here that (Bhattacharjya, 2010) pointed that in addition to implementation of GST, significant government spending on infrastructure has aided the process of changeover from numerous (and inefficient) small, distributed warehouses to large capacity concentrated warehousing hubs, numerous Mega Food Parks and Free Trade Warehousing Zones has already begun. The warehousing clusters (Rathi, Bachkaniwala, & Bangera, 2016) and the overall logistics sector in India had been observing year on year growth in the pre-covid times. The distribution and redistribution of freight (raw materials, semi-finished goods and finished market goods) are being facilitated due to substantial economies of transportation & inventory and a pragmatic taxation approach of GST regime. As a result, high demand centres like the cities of Ahmedabad, Delhi-NCR, Mumbai, Pune, Chennai and Bengaluru seem to have been shaping up to form effective hub clusters primarily due to introduction of GST and Make in India Initiatives. Thus, as a follow up to these developments, (Sachitanand, 2019) reports that rationalization of warehousing capacity is helping to proficiently cater to fast growing demand of the Indian markets. This has triggered a consistent year on year growth in Grade A warehouses till the onset of the covid global pandemic.

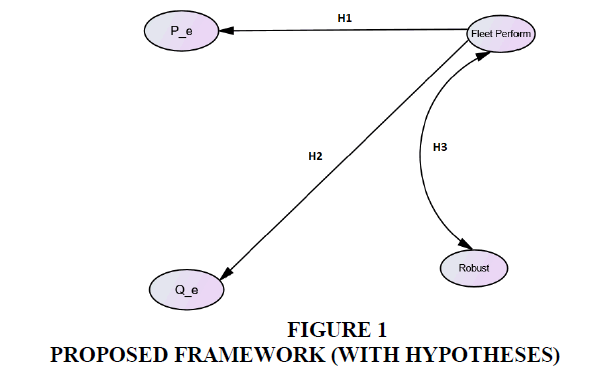

So, as large parcel sizes have been available for intermediate goods and manufactured goods (demand of such goods are again on the rise, correspondingly the transportation activities are also rising in the post covid recovery phase of India as on 3rd Quarter, 2021 (Swamy, 2021)) it should lead to increased popularity of bigger trucks among transporters and third party logistics operators. Also, freight movement (especially interstate) has become easier due to GST. The waiting and idle time at interstate border has been reduced which implies that faster turnaround time of bigger trucks would have relevance for the long-haul truck operators. Thus, in view of the aspects discussed in section 2.1 to 2.3, it is important to know how and with what kind of considerations the Indian truck owner has been purchasing the long-haul trucks. We would discuss various purchase parameters and possible operational expectations that are prevalent when owners (or would be owners) consider while buying the popular brands of Indian trucks, which we would discuss further in Figure 1.

Research Gap & Hypotheses

After perusing through various academic papers, statutory as well as industry reports and various web repositories, we have not observed many researches highlighting the price-quality considerations or robustness in purchase of heavy trucks.

At this phase the interesting research questions we are confronted with are:

1. How does fleet performance affect attitude of Indian truck operators towards Price expectations in general and in terms of the two major Indian truck brands?

2. How does fleet performance affect attitude of Indian truck operators towards Quality expectations in general and in terms of the two major Indian truck brands?

3. How is Fleet Performance correlated to robustness of the trucks in the perception of Indian truck operators in general and in terms of the two major brands Indian truck brands?

To specifically address these research questions as stated above, we now put forward our hypothetical framework to be tested as per an appropriate methodology provided.

The framework, deals with the effect of fleet performance on Price expectations and Quality expectations as also the correlational relationship between fleet performance and robustness.

Given that the Indian truck industry works on very thin margins and high degree of competition, it is natural and plausible that Fleet Performance affect ‘Price expectation’ (P_e) considerations and ‘Quality expectation’ (Q_e) considerations for a truck owner. Thus, to further investigate our aforementioned research questions, we hypothesise as provided below:

H1A: Fleet Performance is positively linked to Price expectations across the Indian truck market.

H1B: Fleet Performance is positively linked to Price expectations among Tata truck owners in India.

H1C: Fleet Performance is positively linked to Price expectations among Ashok Leyland truck owners in India.

H2A: Fleet Performance is positively linked to Quality expectations across the Indian truck market.

H2B: Fleet Performance is positively linked to Quality expectations among Tata truck owners in India.

H2C: Fleet Performance is positively linked to Quality expectations among Ashok Leyland truck owners in India.

Additionally, we also hypothesise that the two aspects of and truck performance and robustness are correlated, as provided below:

H3A: Fleet Performance and Robustness of trucks are correlated across the Indian truck market.

H3B: Fleet Performance and Robustness of trucks are correlated among Tata truck owners in India.

H3C: Fleet Performance and Robustness of trucks are correlated among Ashok Leyland truck owners in India.

Data & Methodology

Data

Primary data has been collected from 171 unorganized transporters (respondents) from 11 cities across India. The cities covered in North Zone were New Delhi and Ghaziabad; in the East Zone the cities covered were Bhubaneshwar, Cuttack, Guwahati & Kolkata; in the South Zone the cities covered were Bengaluru, Chennai and Hyderabad and in the west zone Ahmedabad & Mumbai.

Methodology for Structured Equation Modelling

Structured Equation Models (SEM) is about path models where usually connections are investigated and established between exogenous and endogenous variables. In this case we construct the Structural Model, wherein we first define individual constructs through Likert scale, then develop the overall measurement model through formative constraints (while ensuring unidimensionality and connecting the exogenous and endogenous variables; whether latent or manifest as applicable), thereafter a study is designed to produce empirical results (by avoiding identification problems) and assess the measurement model validity (by ensuring acceptable levels of goodness of fit along with corresponding statistical significance). Then a structural model is specified wherein the existence of hypothesized dependency relationships are identified. The structural model is finally assessed for validity through estimated parameters for the structural relationships and provide empirical evidence relating to hypothesized relationships depicted in the model.

Sample Size

The population of the highly fragmented and extremely large number of transporters have been taken up as infinite population. A Sample size of 171 respondents were covered, as per the determination of sample size and corresponding error levels for a large population, we found the sampling error level to be within the margins of 95% confidence level (as provided in illustration 7, pg. 180 of (Kothari, 2004)). Where, n = 171; e = 0.074; the error for Transporters is found to be ± 7.4

Sampling Method

Primary data has been collected through Stratified Random Sampling, wherein the four zones of the country has been divided into four zones or strata. From each of these strata, cities were selected which are situated on or near the Golden Quadrilateral Road Network or the North – South & East–West Corridors. The selected cities are also known for their high commercial/trading volume and thus had substantial road freight movement. The transporters were further selected within each selected city as per convenience and availability across the eleven cities of India. The data collection was carried out by a reputed market research agency which has been able to achieve limited randomization in selection of respondents. It was ensured that suitable respondents (transporters) catering to inter – zonal and intra – zonal freight routes were adequately represented.

Results and Discussion

The conceptual framework mentioned in Section ‘Research Gap & Hypotheses’, the Price & Quality expectations in relation to the fleet performance (in association with robustness) are discussed in greater detail in this section along with their respective hypotheses.

After considering the relevant manifest variables it was found that a specific set of these variables explained the various hypothetical latent variable based interactions which were put forward in section Research Gap & Hypotheses. It was found that in the structured model, Fleet Performance (in association with robustness) affects the “Price” & “Quality” expectations of the Indian transporters while making purchase of their trucks.

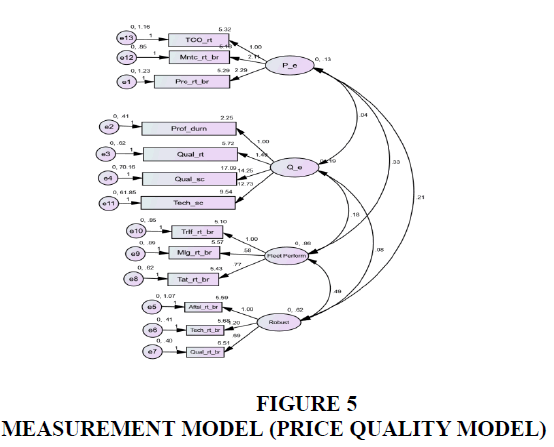

The latent variables Fleet Performance, Robustness and Price Expectation is explained through manifest rating based on various attributes related to a particular brand.

Fleet Performance, is explained by tyre life rating, mileage rating and turnaround time rating. Robustness, is explained by aftersales service rating, simplistic technology rating, general quality rating. Price Expectation, is explained by total cost of ownership, maintenance cost rating, pricing rating.

Whereas, Quality Expectation is explained through profitable duration of operating, importance of general quality, importance of quality while purchasing and importance of simplistic technology while purchasing.

Price-Quality SEM Estimates & Discussion

The reliability aspect of the elements present in the multi-group analysis Price and Quality model were found to have a Chronbach Alpha of 0.657, which proves the model to be reliable.

| Table 1 Measurement Model (Price Quality) |

||

|---|---|---|

| Model Fit Index | Value | Acceptable Value |

| Normed Chi Sq. | 2.702 | = 3 |

| RMSEA | 0.083 | 0.078 – 0.121 |

| NCP | 100.417 | 66.689 – 141.808 |

| CFI | 0.737 | |

The model fit statistics for the measurement model of the SEM for ‘Price and Quality’ considerations are provided in the Table 1 above, it may be noted here that we have used Normalised Chi Square fit as suggested by (Hair, Black, Babin, & Anderson, p. 641). In addition to the normed chi square (minimum sample discrepancy function), three more measures of fit based on population discrepancy i.e., root mean square error of approximation (RMSEA), non-centrality parameter (NCP) and comparative fit index (CFI) . As can be seen in the following diagram for Model Fit Statistic, in terms of all the given parameters the model fit estimates are acceptable.

| Table 2 Model Fit (Price Quality Path Diagram) |

||

|---|---|---|

| Model Fit Index | Value | Acceptable Value |

| Normed Chi Sq. | 2.427 | = 3 |

| RMSEA | 0.066 | 0.058 – 0.074 |

| NCP | 265.487 | 207.010 – 331.662 |

| CFI | 0.737 | |

The model fit statistics for the structural model of the SEM for ‘Price and Quality’ considerations are provided in the Table 2 above, similar to the fit indices for the measurement model, even in case of the structural model, the normed chi square (minimum sample discrepancy function),the root mean square error of approximation (RMSEA), non-centrality parameter (NCP) and comparative fit index (CFI) are all within acceptable limits.

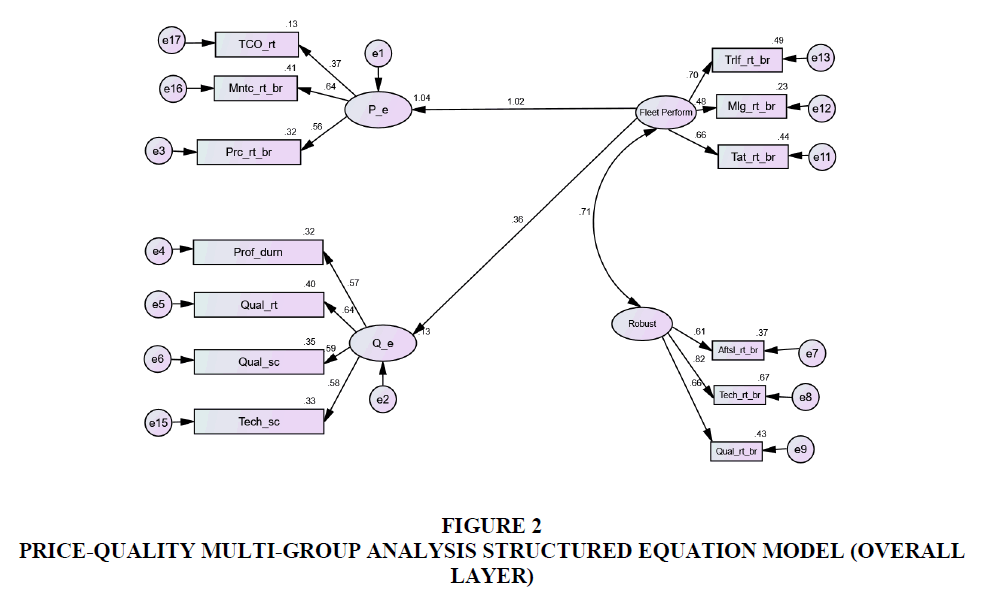

In the subsequent we would discuss the multi-group model estimates (across the Overall, Tata and Ashok Leyland layers) and our hypotheses as put up Figure 2.

The general (irrespective of brand focus, applicable across thetrucking industry) Price-Quality structured equation model demonstrates that the latent endogenous variable “Fleet Performance” positively affects the latent exogenous variables “Price Expectations” (P_e) (1.02, 1.04), to prove hypothesis H1A and “Quality Expectations” (Q_e) (0.36, 0.13), to prove hypothesis H2A; while the other latent exogenous variable “Robustness” (Robust) is strongly correlated to “Fleet Performance” (0.71), to prove hypothesis H3A. It is important to note here that in general, the greater focus is on price expectations, which is expected in a price sensitive industry (Raghuram, 2015). “Fleet Performance” as put up in the above equation, is defined through the manifest exogenous variables of: ‘tyrelife’ (Trlf_rt_br; 0.70, 0.49), ‘turnaround time’ (Tat_rt_br; 0.66, 0.44) and ‘mileage’ (Mlg_rt_br; 0.48, 0.23), so that the trucks in the fleet are able to perform to their maximum operational potential without breaking down (or with minimum downtime) and disrupting his on-time delivery performance. This could ensure that the trucker can reliably cater up to the expected performance limits of the transporter’s clients.

Whereas, “Quality Expectations”, are defined through manifest exogenous variables: general rating based on perception of ‘Quality’ as a desired attribute (Qual_rt; 0.64, 0.40), score denoting the importance of ‘Quality’ while purchasing a truck (Qual_sc; 0.59, 0.35), score denoting importance of simple/easy to use ‘Technology’ while purchasing a truck (Tech_sc; 0.58, 0.33) and ‘Profitable Duration’ of operating a truck (Prof_durn; 0.57, 0.32).

And also, “Price Expectations” are defined through manifest exogenous variables: rating for the ‘maintenance cost’ of the brand of truck purchased (Mntc_rt_br; 0.64, 0.41), rating for the ‘price’ of the brand of truck purchased (Prc_rt_br; 0.56, 0.32) and general rating based on perception of ‘total cost of ownership’ while purchasing a ruck (TCO_rt; 0.37, 0.13). It may also be noted here that the other latent exogenous variable, correlated to “Fleet Performance” is “Robustness”, which is defined through manifest exogenous variables: rating for simple/easy to use ‘technology’ of the brand of truck purchased (Tech_rt_br; 0.82, 0.67), rating for importance of ‘Quality’ of the brand of truck purchased (Qual_rt_br; 0.66, 0.43) used rating for ‘after sales service’ of the brand of truck purchased (Aftsl_rt_br; 0.61, 0.37) Figure 3.

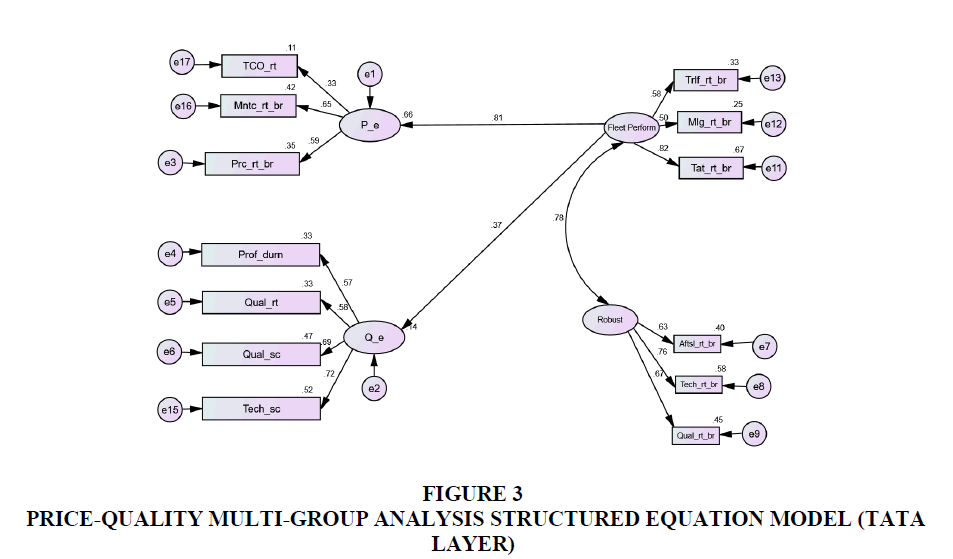

The Price-Quality structured equation model for the Tata Brand of Trucks, demonstrates that the latent endogenous variable “Fleet Performance” positively affects the latent exogenous variables “Price Expectations” (P_e) (0.81, 0.66), to prove hypothesis H1B and “Quality Expectations” (Q_e) (0.37, 0.14), to prove hypothesis H2B while the other latent exogenous variable “Robustness” (Robust) is strongly correlated to “Fleet Performance” (0.78), to prove hypothesis H3B. It is important to note here as well that among Tata buyers, the greater focus is on price expectations, which is consistent with the general market dynamics, as observed in section 4.1.1.

“Fleet Performance” as put up in the above equation, is defined through the manifest exogenous variables of: ‘turnaround time’ (Tat_rt_br; 0.82, 0.67), ‘tyrelife’ (Trlf_rt_br; 0.58, 0.33) and ‘mileage’ (Mlg_rt_br; 0.50, 0.25). It is important to note here that for Tata buyers turnaround time is more important than tyre life as opposed to the genralised model as seen in section 4.1.1, so that the trucks in the fleet are able to perform to their maximum operational potential without breaking down (or with minimum downtime) and disrupting his on-time delivery performance. The Tata buyers want to ensure that their fleets turnaround within acceptable time limits and are not left stranded neither do they have issues in maintaining average speeds.

Whereas, “Quality Expectations” of Tata buyers, are defined through manifest exogenous variables: score denoting importance of simple/easy to use ‘Technology’ while purchasing a truck (Tech_sc; 0.72, 0.52), score denoting the importance of ‘Quality’ while purchasing a truck (Qual_sc; 0.69, 0.47), general rating based on perception of ‘Quality’ as a desired attribute (Qual_rt; 0.58, 0.33) and ‘Profitable Duration' of operating a truck (Prof_durn; 0.57, 0.33). It is important to note here that Tata buyers have typically reported that tecnological complexities and problems have made it difficult for them to ensure uptimes, however an elaborate service network and availability of spare parts ensure non disruptions of transportation services.

And also the “Price Expectations” of Tata buyers are defined through manifest exogenous variables: rating for the ‘maintenance cost’ of the brand of truck purchased (Mntc_rt_br; 0.65, 0.42), rating for the ‘price’ of the brand of truck purchased (Prc_rt_br; 0.59, 0.35) and general rating based on perception of ‘total cost of ownership’ while purchasing a ruck (TCO_rt; 0.33, 0.11).

It may be noted here that, even for Tata buyers as well, the other latent exogenous variable, correlated to “Fleet Performance” is “Robustness”, which is defined through manifest exogenous variables: rating for simple/easy to use ‘technology’ of the brand of truck purchased (Tech_rt_br; 0.76, 0.58), rating for importance of ‘Quality’ of the brand of truck purchased (Qual_rt_br; 0.67, 0.45) used rating for ‘after sales service’ of the brand of truck purchased (Aftsl_rt_br; 0.63, 0.40).

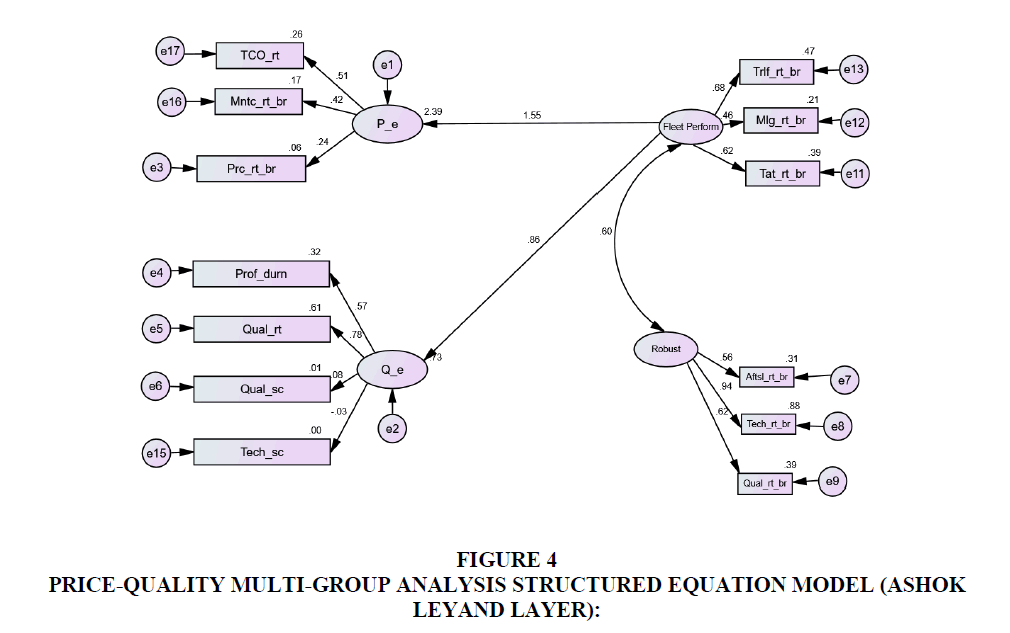

The Price-Quality structured equation model for the Ashok Leyland brand of Trucks, demonstrates that the latent endogenous variable “Fleet Performance” positively affects the latent exogenous variables “Price Expectations” (P_e) (1.55, 2.39), to prove hypothesis H1C and “Quality Expectations” (Q_e) (0.86, 0.73), to prove hypothesis H2C; while the other latent exogenous variable “Robustness” (Robust) is strongly correlated to “Fleet Performance” (0.60), to prove hypothesis H3C. It is important to note here as well that among Ashok Leyland buyers, substantially greater focus is on price expectations, which is higher than the general market dynamics, as observed in section 4.1.1 and also higher than Tata brand buyers as given in Figure 4.

“Fleet Performance” as put up in the above equation, is defined through the manifest exogenous variables of: ‘tyrelife’ (Trlf_rt_br; 0.68, 0.47), ‘turnaround time’ (Tat_rt_br; 0.62, 0.39) and ‘mileage’ (Mlg_rt_br; 0.46, 0.21). It is important to note here that for Ashok Leyland buyers tyre life is more important than turnaround time similar to the genralised model as seen in section 4.1.1 but reverse of what Tata buyers perceive as given in section 4.1.2. The Ashok Leyland buyers feel that the trucks in the fleet should maximise the tyre life and determine fleet performance on the consumption of fuel and tyre (the two major consumables in truck operations) while maintaining an acceptable level of turnaround time, their expectations are acceptable levels of on-time delivery but not at the cost of adversely affecting fuel efficiency and tyre life.

It is noteworthy that, “Quality Expectations” of Ashok Leyland buyers, are defined through manifest exogenous variables: general rating based on perception of ‘Quality’ as a desired attribute (Qual_rt; 0.78, 0.61) and ‘Profitable Duration’ of operating a truck (Prof_durn; 0.57, 0.32). However, score denoting importance of simple/easy to use ‘Technology’ while purchasing a truck (Tech_sc) was found to be insignificant for Ashok Leyland buyers. However rating for simple/easy to use ‘technology’ of the brand of truck purchased (Tech_rt_br), which is one of the manifest exogenous variable for the latent exogenous variable “Robustness” was found to high (incidentally found to be higher than Tata trucks as well), this is discussed in the construction of the latent exogenous variable “Robustness” (discussed in the last paragraph of this sub-section). Also, the score denoting the importance of ‘Quality’ while purchasing a truck (Qual_sc) was found to insignificant as well, for the Ashok Leyland Buyers. But in this case too, under the latent exogenous variable “Robustness”, Ashok Leyland buyer’s rating for importance of ‘Quality’ (Qual_rt_br) of the brand of truck purchased was found to be high.

On the other hand, “Price Expectations” of Ashok Leyland buyers are defined through manifest exogenous variables: general rating based on perception of ‘total cost of ownership’ while purchasing a truck (TCO_rt; 0.51, 0.26), rating for the ‘maintenance cost’ of the brand of truck purchased (Mntc_rt_br; 0.42, 0.17) and rating for the ‘price’ of the brand of truck purchased (Prc_rt_br; 0.24, 0.06). So, in comparison to TCO and maintenance rating over the life cycle of the truck, consideration for upfront price is not a substantial consideration for a typical Ashok Leyland buyer. Which is unlike a typical Tata truck buyer where we had observed that the upfront price was quite a substantial consideration.

It may be noted here that, even for Ashok Leyland buyers, the other latent exogenous variable, correlated to “Fleet Performance” is “Robustness”, which is defined through manifest exogenous variables: rating for simple/easy to use ‘technology’ of the brand of truck purchased (Tech_rt_br; 0.94, 0.88), rating for importance of ‘Quality’ of the brand of truck purchased (Qual_rt_br; 0.62, 0.39) used rating for ‘after sales service’ of the brand of truck purchased (Aftsl_rt_br; 0.56, 0.31).

Conclusion & Future Scope

By successfully proving the appropriate hypotheses for the relevant research question put up in Section 2.4 on how fleet performance shapes the price expectations (as provided through hypothesis H1 (H1A, H1B and H1C)) and quality expectations (as provided through hypothesis H2 (H2A, H2B and H2C) of truck buyers in general (represented by subscript A) and also specifically among the Tata (represented by subscript B) and Ashok Leyland (represented by subscript C) truck buyers has been effectively dealt with. It has also been demonstrated that fleet performance and robustness of the truck are strongly correlated (as provided through hypothesis H3 (H3A, H3B and H3C) of truck buyers in general (represented by subscript A) and also explicitly among the Tata (represented by subscript B) and Ashok Leyland (represented by subscript C) truck buyers. Furthermore, the dynamics of Price and Quality expectations framework has been duly discussed in Figure 4.

To recap, the performance of trucks/fleet of trucks decidedly shapes the long term attitude and shaping of Price and Quality expectations of the truck customer in general, across the industry. Of course the dedicated customers of Tata and Ashok Leyland had somewhat different take on this aspect, also, the combination of manifest variables that build the latent variales and their corresponding interatctions across these two brands also were quite different. As seen in the ‘Results & Discussion’ section, when it comes to ‘easy to use technology’, Tata users were found to be consistent in their attitude towards this manifest variable attribute, whether while purchasing the truck or later while rating the attribute while using the truck.

But Ashok Leyland users while making purchase hardly gave any importance to ‘easy to use technology’ but while rating the same attribute while using the truck, the strength of relationship as well as the proportionate importance were found to be very high (even higher than Tata buyers). Similarly, the overall connection and attributable importance towards ‘Quality’ and ‘Price’ expectations are far higher in case of Ashok Leyland buyers, however the correlation between ‘Fleet Performance’ and ‘Robustness’ is higher among Tata buyers. But it is also true that attitude towards various attributes like ‘tyre life’ and ‘profitable duration’ for operating a truck are similar across the two brands. It would be interesting, to delve into the aspect of “Brand Focus” among truck buyers and how it may shape the emphasis on Quality and Price along with other possible important considerations.

Managerial Implications

This paper may benefit manufacturers of high tonnage trucks (used in onroad application, primarily used in long haul applications) to better understand customer expectations in terms of value required and willingness to pay at a given price level. It may be relevant for the manufacturers to know what product attributes are important and which attributes would be critically important for their “brand” to appeal to various relevant segments of their customer base Apppendix Figure 5.

Appendix

Endnotes

1Ministry of Road Transport and Highways

2Euro Modular System

3Ministry of Road Transportation and Highways

4RFID based automatic toll collection mechanism at Toll Booths of National Highways

References

AITD; CIRT. (2000). Study on Trucking Operations in India - Problems & Potential (Final Report, Volume II). New Delhi: Asian Institute of Transport Development.

Anand Shankar, R.M., & Krishna, B. (2018). A Study on the impact of GST on Goods Transport Agencies (GTA) with refeference to Tamil Nadu. International Journal of Research In Computer Application & Management, 8(9), 17-25.

Bhal, V. (2017). Impact of GST on India’s Infrastructure. Advances in Economics and Business Management, 4(4), 247-251.

Bhattacharjya, S. (2010). Logistics in India - Part 2. KPMG International (Publication No.: 173083).

Chakraborty, P. (2016). Connecting India to Global Value-Chains: The Role of Logistics Services. Journal of Transport and Infrastructure, 19(1), 61-94.

Chaliawala, N., Shyam, A. R., & Thakkar, K. (2021). The Economic Times: E-Paper.

Cooke, E. F. (1986). What is business and industrial marketing? Journal of Business & Industrial Marketing. 1(1), 9-17.

Dubey, R. &. (2015). Sustainable transportation: an overview, framework and further research directions. International Journal of Shipping and Transport Logistics, 7(6), 695-718.

Indexed at, Google Scholar, Cross Ref

ET Bureau. (2018). Government raises load capacity for heavy vehicles by 20-25 per cent.

Frost & Sullivan. (2012). Impact of regulatory trends on commercial vehicle industry in India. Frost & Sullivan.

Gopal, A., Karali, N., Sharpe, B., Delgado, O., Bandivadekar, A., & Garg, M. (2017). Improved heavy-duty vehicle fuel efficiency in India, benefits, costs and environmental impacts. Berkeley, CA (United States): Lawrence Berkeley National Lab.(LBNL).

Hair, J. F., Black, W. C., Babin, B. J., & Anderson, R. E. (2009). Multivariate Data Analysis (7th ed.). Prentice Hall.

Hossein Rashidi, L. &. (2012). Relationship between Economic and Transportation Infrastructure Indicators and Freight Productivity Growth. Journal of Urban Planning and Development, 138(3), 254-262.

Indexed at, Google Scholar, Cross Ref

Jai, S. (2011). India's hot new wheels: Business of running trucks with 12 & 16 wheels.

Knight, I. B. (2010). Assessing the Likely Effects of Potential Changes to European Heavy Vehicle Weights and Dimensions Regulations. Project Inception Report. TRL Published Project Report.

Kothari, C. R. (2004). Research Methodology - Methods & Techniques. New Delhi: New Age Internatinal Publishers.

Lindgreen, A., Hingley, M. K., Grant, D. B., & Morgan, R. E. (2012). Value in business and industrial marketing: Past, present, and future. Industrial Marketing Management, 41(1), 207-214.

Indexed at, Google Scholar, Cross Ref

Londoño-Kent, P. (2009). Freight Transport for Development Toolkit: Road Freight. Washinton DC: World Bank.

Lorge, S. (1998). “Better off branded”. Sales and Marketing Management, Vol 150 No 3, 39-42.

Lumsden, K. (2004). Truck Masses and Dimensions-Impact on Transport Efficiency.

Malhotra, G., & Mishra, S. (2019). Effect of Economic Growth on the Logistics Sector in India.

Indexed at, Google Scholar, Cross Ref

McKinsey & Company. (2010). Building India: Transforming the Nation's Logistics Infrastructure. India: McKinsey & Company.

Mooren, L. G. (2014). Safety Management for Heavy Vehicle Transport: A Review of the Literature. Safety science, 62, 79-89.

MORTH. (2011). MORTH, Govt of India report of the Sub - Group on Policy Issues. New Delhi: Ministry of Road Transport and Highways.

MORTH. (2016). Ministry of Road Transport & Highway - Annual Report (2015-16). New Delhi (India): Ministry of Road Transport & Highways.

Raghuram, G. (2015). An overview of the trucking sector in india: Significance and structure. (Working Paper). Ahmedabad (India): Indian Institute of Management - Ahmedabad.

Raghuram, G., & Shah, J. (2004). Roadmap for logistics excellence: Need to break the unholy equilibrium (Working Paper). Ahmedabad (India): Indian Institute of Management - Ahmedabad.

Rathi, V., Bachkaniwala, H., & Bangera, Y. (2016). India Warehousing Market Report-2016. Mumbai (India): Knight Frank India Pvt. Ltd.

RITES Ltd. (2014). Planning Commission - Total Transport System System Study on Traffic Flows and Modal Costs. New Delhi: Rites Ltd.

Sachitanand, R. (2019). What's behind the sudden surge in demand for warehouse capacity?

Saripalle, M. (2018). Determinants of profitability in the Indian logistics industry. Int. J. Logistics Economics and Globalisation, 7(1), 13-27.

Indexed at, Google Scholar, Cross Ref

Sriraman, S. V. (2006). Competition issues in the road goods transport industry in India with special reference to the Mumbai metropolitan region. New Delhi: The Competition Commission of India.

Swamy, M. (2021). The Times of India. Retrieved from Economic recovery: Impact of second Covid wave starts to wear off:

Vierth, I., Berell, H., McDaniel, J., Haraldsson, M., Hammarström, U., Yahya, M., Björketun, U. (2008). The effects of long and heavy trucks on the transport system: Report on a government assignment. Linköping (Sweden): Statens Väg-och Transportforsknings Institut (VTI).

Woodrooffe, J., Bereni, M., Germanchev, A., Eady, P., Glaeser, K., Jacob, B., & Nordengen, P. (2010). Safety, Productivity, Infrastructure Wear, Fuel Use and Emissions Assessment of the International Truck Fleet: A Comparative Analysis. Paris (France): Joint Transport Research Centre of the OECD & The International Transport Forum.

Received: 09-Jun-2023, Manuscript No. AMSJ-23-13682; Editor assigned: 12-Jun-2023, PreQC No. AMSJ-23-13682(PQ); Reviewed: 26-Sep-2023, QC No. AMSJ-23-13682; Revised: 03-Oct-2023, Manuscript No. AMSJ-23-13682(R); Published: 04-Nov-2023