Research Article: 2023 Vol: 27 Issue: 1

Women Empowerment in Digital India and the Kerala Knowledge Economy

Manoj PK, Cochin University of Science and Technology

Lakshmi, Cochin University of Science and Technology

Sruthy Krishna, Cochin University of Science and Technology

Reni Sebsatian, Cochin University of Science and Technology

Citation Information: Manoj, PK., Lakshmi, Krishna, S., & Sebsatian, R. (2023). Women Empowerment In Digital India and the Kerala Knowledge Economy. Academy of Marketing Studies Journal, 27(1), 1-11.

Abstract

Given the vast potential of Information and Communication Technology (ICT) for bringing in innovations in business processes, thus leading to better quality services at lower costs, and also effective marketing of products through social media, like, electronic Word of Mouth (e-WOM), this paper suggests promotion of ICT for rural development and women empowerment in India. Citing global and national success stories, the case of Kerala State in Indian union has been focused in this paper, pointing out the favorable policy measures like ‘Digital India’ at the national level and ‘Kerala Knowledge Economy’ at the State level. So, income generating initiatives by women should be encouraged so as to empower them particularly with extensive ICT integration. As micro Enterprises (ME) of women run through collective efforts like Self-Help Groups (SHGs) could empower them, models like SHG-Bank Linkage Programme (SHG-BLP) are successful for States like Kerala with vast network of SHGs of women, banking network and tele-density.

Keywords

Women Empowerment, ICT, Social media, eWOM, eCRM, Mobile Banking.

Introduction

Diverse kinds of problems faced by women can be mitigated to a large extent by empowering them and making them ‘stand in their own legs’ by ensuring regular earnings from their own initiatives. Women-run businesses, like, Micro Enterprises (MEs) of women managed collectively, through Self-Help Groups (SHGs) could ensure women empowerment especially the rural poor. Very fast proliferation of Information and Communication Technology (ICT) with its tremendous potential for bringing about faster, qualitative and low cost business process and that too in an ‘as you like it’ manner for the discerning new generation customers has added another dimension to women empowerment initiatives and rural transformation. Successful experiences of linking SHGs with banks, viz. SHG-Bank Linkage Programme (SHG-BLP) in India, particularly in South Indian States like Kerala indicate the vast potential of collective initiatives of women. If ICT is integrated then that would give a competitive edge for women’s initiative like MEs in this globalized regime AJ & Manoj (2013).

Empowering women and enhancing their confidence by reducing their dependence on other family members, and hence ensuring their own ‘say’ in familial decisions would lead to their higher status in the family and society. Besides, this leads to their economic (financial) and even political empowerment as they deal more with the general public while running own businesses. Here, ICT plays the role as a great ‘enabler’ by dramatically enhancing the quality of service while at the same time reducing operating costs, thus ensuring greater competitiveness in the market.

The advent of social media and diverse delivery channels like Electronic Word of Mouth (eWOM), management practices like Electronic CRM (eCRM) etc. indicate the extensive use of ICT for marketing of products – both services and manufactured products, across the globe. In India, the ‘Digital India’ policy at the national level and the added thrust on ICT integration across the nation. In Kerala State in particular, the governmental policy is that of transforming the State into a ‘Knowledge Economy’ and a Kerala Knowledge Economy Mission (KKEM) has already started functioning in the State Manoj (2016b). Often, Civil Society Organizations (CSOs) play a vital role in floating SHGs under them, nurturing them and empowering their member-women through such SHGs. The case of Kudumbashree in Kerala, a Govt. of Kerala (2021) (GOK) project, is a classic example worldwide Ali & Manoj (2020).

Review of Literature

A report by Asian Development Bank (ADB) 2015 has noted the vital need for gender mainstreaming with reference to its study on Kerala Sustainable Urban Development Project launched in Kerala State in India. Keller and Mbwewe (1991) have observed that women empowerment is "co-operation whereby women become prepared to organize themselves to assemble their own certainty, to avow their self-ruling right to make choices and to control resources which will assist with testing and discarding their own coercion". Another view on women empowerment is that of Kabeer (2001) whereby it must involve "the augmentation in people's ability to make fundamental life choices in a setting where this limit was as of late denied to them". Self-administration and empowerment being somewhat similar, the past is a static state and thus quantifiable by most State Level Bankers (2010) available indices, while the latter is an incredible cooperation and change as time goes on, and not so successfully quantifiable Jejeebhoy (2000) Manoj (2016c). There may be diverse factors affecting women empowerment and these differ from metropolitan people to the masses. A study by Manoj (2008) ‘Learning from Cross-country Experiences in Housing: A Micro Finance Approach for Inclusive Housing in India’ in Journal of Global Economy, has noted the vast potential of housing microfinance (HMF) to empower the poor through providing housing Hazarika (2011).

World Bank (2001) in its report has noted the articulation ‘sexual direction consistency’ as similar to correspondence under the law and also value of voice. Since sexual direction esteem considers women and men to have separate priorities and tastes, consistency of results demands assorted treatment of individuals’ (Reeves and Baden, 2000). Empowerment can be taken as the feeling that activates one’s own psychological energy to achieve one’s goals (Indiresan, 1999). A study by Manoj (2009)[14], Emerging Technologies and Financing Models for Affordable Housing in India published by the Directorate of Public Relations and Publications, CUSAT has explained diverse types of financing facilities for empowering the poor through houses affordably. A study by Manoj (2017a)[17],‘Determinants of profitability and efficiency of old private sector banks in India with focus on banks in Kerala state: an econometric study’ in International Research Journal of Finance and Economics, has analyzed the factors influencing banking performance which include, inter alia, ICT-use as a key factor. A study by Manoj (2010a) [18], “Financial soundness of old private sector banks (OPBs) in India and benchmarking the Kerala based OPBs: a ‘CAMEL’ Approach” in American Journal of Scientific Research, has ranked the financial soundness of private banks in India using the CAMEL model; high-tech banks have relatively high ranks. A study by PK (2013) [19], “Potential of micro enterprises in women empowerment: A critical study of micro enterprises run by women under the Kudumbashree Programme in Kerala” in International Journal of Business Policy and Economics has noted that MEs run by Kudumbashree women could empower the member-women. An empirical study by Manoj P.K and Neeraja James (2014)[20], ‘Unorganised Labour in Housing Construction Sector in Kerala Nasar & Manoj (2013a): An Empirical Investigation of Human Rights Issues and other Problems’ in International Journal of Scientific Research, has noted the employment potential of housing. A study by Dr. Manoj P.K.(2013)[21], ‘Prospects and Challenges of Green Buildings and Green Affordable Homes: A Study with Reference to Ernakulam, Kerala’ in Global Research Analysis, has noted the need for eco-friendly housing for sustained economic growth Nasar & Manoj (2013b). A study on ICT’s role in financial inclusion by Pickens (2009) [22] has noted the vast potential of common ICT-tool, mobile phone, for financial inclusion. Piyali Ghosh and Geethika (2006)[23] have pointed out the retention strategies for Indian IT industry. A study by P.K. Manoj (2004) [24], ‘Dynamics of Housing Finance in India’ in Bank Quest has noted the need for housing the poor in India for sustained economic growth Ghosh (2006).

A study by Manoj (2007) [25], ‘ICT industry in India: A SWOT analysis’, in Journal of Global Economy has discussed in detail pros and cons of India’s ICT industry. Another study by Manoj (2010b) [26], ‘Environment-friendly tourism for sustainable economic development in India’, in International Journal of Commerce and Business Managaement has noted the vital need for promoting eco-friendly tourism in India for the sustained economic growth. A study by Manoj (2010c) [27], ‘Impact of technology on the efficiency and risk management of old private sector banks in India: Evidence from banks based in Kerala’, in European Journal of Social Sciences has noted the key role of ICT for better performance and customer service by banks. A paper by Manoj (2011) [28], “Just in time (JIT) inventory management for enhanced operational efficiency: an ‘Indianised JIT’ strategy for an agro machinery manufacturing unit in Kerala”, in European Journal of Technology and Advanced Engineering Research, has noted the key relevance of JIT in this globalised era. A study by Manoj (2012a) [29], ‘Information and communication technology (ICT) for effective implementation of MGNREGA in India: An analysis”, in Digital Economy in India United Nations (2016) : Security and Privacy has noted key role of ICT in MGNREGA execution. A paper by Nasar & Manoj (2015) [30], ‘Purchase Decision for Apartments: A Closer Look into the Major Influencing Factors’ in IMPACT International Journal of Research in Applied, Natural and Social Sciences, has pointed out that price, quality, and location as the major influencing factors. A paper by P.K. Manoj (2016a) [31], ‘Determinants of sustainability of rural tourism: a study of tourists at Kumbalangi in Kerala, India’, in International Journal of Advance Research in Computer Science and Management Studies, has noted that better infrastructure, like, internet and ICT-based tools are essential for sustainability of Kerala tourism. A study by James & Manoj (2014) [32], ‘Relevance of E-Banking Services in Rural Area – An Empirical Investigation’, Journal of Management and Science, has noted the need for digital banking to accelerate rural development and women empowerment. A study by and Manoj & Viswanath (2015) [33], ‘Socio-Economic Conditions of Migrant Labourers- An Empirical Study in Kerala’ in Indian Journal of Applied Research has noted the need for improving the living conditions of migrant workers, and that housing sector can accelerate employment creation and economic growth. A study by William George A.J & Manoj (2012b) [34] ‘Customer Relationship Management in Banks: A Comparative Study of Public and Private Sector Banks in Kerala’ International Journal of Scientific Research, has noted the high-tech private banks are ahead of public banks in customer service and effective use of CRM Manoj (2010d).

A study by Manoj (2018) [35], ‘Bank Marketing in India in the ICT Era: Strategies for Effective Promotion of Bank Products’ in International Journal of Advance Research in Computer Science and Management Studies, has underscored the need for ICT-integration by banks. A study by Manoj (2016a) [36], ‘Real Estate Investment Trusts (REITs) for Faster Housing Development in India: An Analysis in the Context of the New Regulatory Policies of SEBI’ in International Journal of Advance Research in Computer Science and Management Studies, the need for new financing models like REITs in India for Manoj (2010e) faster growth of housing sector and the economy has been noted. A study by Manoj (2017b) [37], ‘Electronic CRM & ICT-based banking

services: An empirical study of the attitude of customers in Kerala, India’ in International Journal of Economic Research has noted the positive effect of E-CRM on banks’ performance. Study by Nasar & Manoj (2015) [38], ‘Customer satisfaction on service quality of real estate agencies: An empirical analysis with reference to Kochi Corporation Area of Kerala State in India’ in International Journal of Management, IT and Engineering, has noted the service quality aspects of real estate agents in Kerala. A study by Manoj (2015a) [39], ‘Socio-Economic Impact of Housing Microfinance: Findings of a Field based Study in Kerala, India’ in International Research Journal of Finance and Economics, as pointed out the positive impact of housing micro finance (HMF) on the poor; and in his another study, Manoj (2015b) [40], “Deterrents to the Housing Microfinance: Evidence from a Study of the Bankers to ‘Bhavanashree’ in Kerala, India” in International Research Journal of Finance and Economics, the deterrents to HMF are discussed along with remedial strategies Manoj (2010f). A study by Manoj (2015c) [41], ‘E-CRM: A Perspective of Urban & Rural Banks in Kerala’, International Journal of Recent Advances in Multidisciplinary Research, has compared E-CRM effects among rural and urban customers, and suggested E-CRM strategies. A study by S Rajesh & P.K. (2015) [42] ‘Women Employee Work-life and Challenges to Industrial Relations: Evidence from North Kerala’ in IPASJ International Journal of Management has noted the utmost need of work-life balance (WLB) for healthy industrial relations and hence better industrial productivity. Studies by Manoj, P.K. [43-44] on affordability of housing has highlighted the need for scientific cost management, and in Manoj, P.K.[45-48] the need for modern philosophies like CRM, ICT-integrated Social banking, modern HRM, FMS etc. were suggested, ICT being an imperative now Joju et al. (2015a).

In view of the foregoing, the relevance of SHG-BLP along with ICT adoption for women empowerment sought to be studied closely, such studies being scare in India, especially in Kerala Manoj (2015d).

Relevance and Significance of the Study

Balanced and equitable economic development is possible with women’s active participation, and they should also get their ‘due share’ in the development process; because then only the development process becomes complete, meaningful and hence sustainable in the long run. But, even though women constitute nearly half of the global population, perform almost two-third of the total work and produce half of the food products in a country; they get only one-third of the compensation and own one-tenth of the pro Joju et al. (2015b) perty in the country. This situation paints the pathetic plight of women and in a country like India they are vulnerable. Even in a more progressive State like Kerala in India, women face many disparities and discriminations. But, when they join together and start their own enterprises under some umbrella like SHGs or JLGs, they get their own identity, own earnings and savings etc. This leads to their all-round empowerment, whether personal, familial, social, economic, political, or the like. This in turn raises their self-confidence, familial and social status, and ultimately results in sustained economic growth of the nation. ICT and its vast potential has added another key dimension to this empowerment model, particularly when ICT is being encouraged by the Governments worldwide, as it is competitive tool also. The case of India (Digital India era) and the State of Kerala in India (Knowledge Economy focus) are no exceptions to this general trend. Despite the vast progress in women’ initiatives like the SHGs under Kudumbashree, the poverty alleviation Parekh (1953) programme under the Govt. of Kerala (GOK), a lot needs to be done in this ICT era where ICT integration Manoj (2019c) is the new normal across the globe. The huge remittances by the NRKs into Kerala are to be deployed more meaningfully in the State Joju et al. (2017a).

Objectives and Methodology

This papers aims to (i) study the influence of SHGs in empowering the women, especially through ICT adoption, (ii) study the trend in ICT adoption in rural development and women empowerment with special reference to Kerala State in India, and also to find avenues wherein women can use their collective efforts through models like SHG-BLP and (iii) suggest measures for effectively Lakshmi & Manoj (2017a) empowering the women, especially the rural women, through ICT-enabled initiatives and hence to ensure balanced and equitable national economic growth, based on the findings of this study Joju et al. (2017b).

The data used are primarily the secondary data from authentic sources like the reports of the RBI, the publications of State and Union Governments, IMF, ADB, NABARD, etc. This study is descriptive-analytical, and is exploratory too. Basic statistical tools are used for data analysis Joju et al. (2017c).

ICT for Women Empowerment Progress of EShakti Initiative

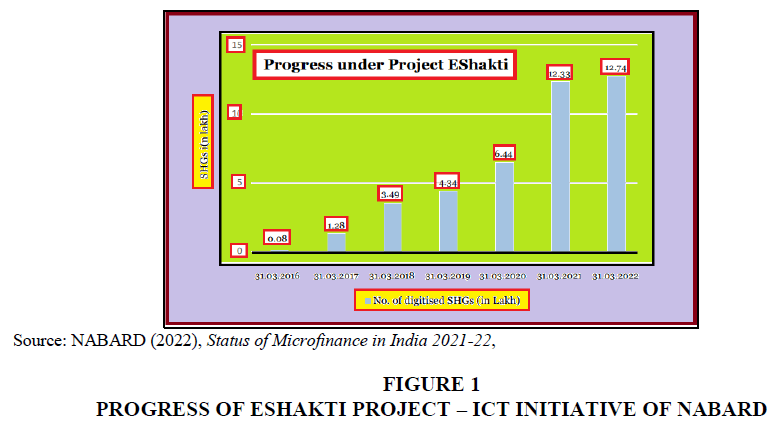

One of the most significant ICT initiatives through SHGs in India is the EShakti project for the digitalization of SHGs in 2015 in two villages in India Manoj (2019b). It was initiated by the Microcredit and Innovations Department, NABARD Manoj (2016b). At the end of FY 2022 EShakti project could onboard 12.74 lakh SHGs thus supporting 146 lakh members from 1.73 lakh villages in India, spread over 281 districts. EShakti could bring about significant rise in the number of bank-linked SHGs in India. The progress of EShakti for the period FY 2016 to FY 2022 is shown in Figure I.

As of 31 March 2022, due to the digitization of 12.74 lakh SHGs (as of FY 2022), the number of SHG-BLP accounts increased from 4.92 lakh (39 percent of digitized groups) prior to launching EShakti to as high as 7.17 lakh post the launch of EShakti (56 percent of digitized groups). Also, SMS alerts are being served to SHG member-women on their banking deals, and till date alters in 10 different local languages could be launched, thus boosting the confidence of rural women. It may be noted that ICT is a great an enabler (facilitator) that provides to a large extent the basic elements underlying women empowerment and that too cost-effectively. Manoj, P.K. (2012) [19] has observed the potential of micro enterprises (MEs) to empower women in Kerala State, India Lakshmi & Manoj (2017b).

In fact, EShakti project could gain global attention. It s won the 2019 ADFIAP Outstanding Project Award under the category of Financial Inclusion. Besides, there is positive mention regarding this project in ‘The ‘BRICS Digital Financial Inclusion Report, India, 2021’ as an interventions by India for enabling digital financial inclusion in India, amongst the BRICS nations Manoj (2019a).

Huge Growth Prospects of Digital Banking in India: Scope for Women Empowerment

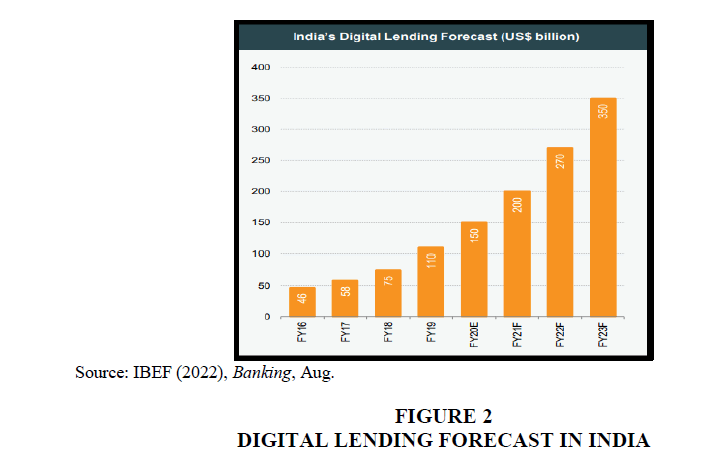

Empirical studies at the global level, like, the one by Pickens (2009) [22] done at Philippines has noted the crucial role played by a very popular ICT device (viz. mobile phone) in providing banking services to the unbanked masses, the rural poor. In the Indian context, a Kerala-based study by Neeraja & Manoj (2014) [32] has noted the positive impact of E-banking on the rural populace especially rural women and has suggested for expanding E-banking in rural areas. Digital lending forecast for India suggests vast growth prospects of digital lending in India. (Figure II). The extant policy of the Govt. of India (GOI) is that of creating a Digital India. So, there is focused attention on promoting ICT integration in every field across India, including the banking sector. Thus, the digitization in Indian banking has been on the rise. The case of rural banking is no exception as is noted from the digitization of SHGs (through EShakti project, for instance). The ever-growing digital footprint in India is clear from the huge project amount of USD 270 Billion as of FY 2022 which is projected to reach USD 350 Billion by FY 2023. Figure 2.

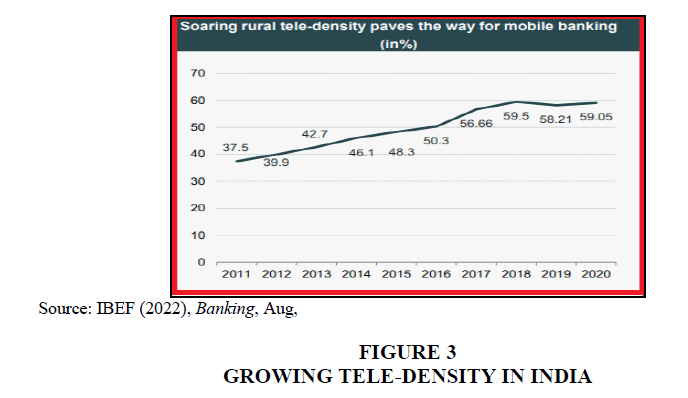

Given the vast potential of micro enterprises (MEs) in empowering women is evidenced from the experience of MEs under the Civil Society Organisation (CSO) promoted by the Govt. of Kerala (GOK) viz. Kudumbashree which is renowned worldwide for its successful track record in empowering the poor women in Kerala. It is expected that digital lending to micro, small and medium enterprises (MSMEs) in India would reach USD 100 Billion by the year 2023. This situation is particularly suitable in the Kerala context in this ICT era where the policy of the GOK is to transform the Kerala State into a Knowledge Economy. Even today, the Kerala economy is much more advanced than most of the other States in India owing to its full literacy, notable achievements in the educational front, higher status of women in Kerala society. In fact, in Kerala State alone, women outnumber the men in the State’s population, unlike other States in India. Global experiences (Philippines, for instance) suggest that a very simple and extremely popular digital device like a mobile phone Pickens (2009) [22] could greatly contributing towards banking services to the unbanked rural masses. So, ICT’s tremendous potential in the financial inclusion front need not be overemphasized. Rural Kerala is particularly suitable for ICT-based banking services (E-banking) as per an empirical study done by Neeraja & Manoj (2014) [32] in Kerala. It may be noted that ever-increasing tele-density is a positive factor contributing towards the rapid growth of rural banking and various pro-women ICT tools, including mobile phones. Rural women are growingly using popular ICT-based devices like mobile phones. Use of such devices will go up in the future because the tele-density is fast gaining momentum in India. In fact, India’s tele-density has grown by a CAGR 5.17 percent during the period 2011 to 2020. Figure 3.

By way of using this growing network of telecommunication facilities the commercial banks (CBs) in the country and the central bank of the country viz. the Reserve Bank of India (RBI) as well as the different telecom service providers in India are making earnest efforts towards extending the digital banking services in the unbanked rural areas of India, through modern banking channels like mobile banking. In fact, the rural tele-density in India has reached as high as 59.05 percent in 2020. This situation ensures ample opportunities to the rural women to avail the formal sector banking services for their personal and business needs. As rural women utilize the modern ICT-based tools (eg. mobile phones) for business purposes such as running their own enterprises like MEs, either by self or through SHGs, they become empowered because of higher earnings leading to their economic (financial) empowerment, and also higher status in their families including in familial decision-making process leading to familial empowerment. Besides, they get better role in the society, thus leading to higher social status (social empowerment) as they play the role of entrepreneurs of business units like women-run MEs, and so on. Above all, as they deal more with the public at large their public speaking ability improves and resulting in the possibility of attaining higher political empowerment too. In short, ICT acts as an effective enabler or facilitator for all round empowerment of women; familial, social, economic, political, etc. It is worth noting here that the majority of the elected women representatives in Panchayati raj institutions in Kerala are members of the world-renowned poverty alleviation mission under the GOK viz. Kudumbashree (literal meaning: ‘prosperity of the family’). This shows the vast potential of SHGs, especially the ICT-integrated ones, in political empowerment of women IBEF (2022).

Technology for Empowering the Rural Economy and Women: The Road Ahead

It is widely recognized that for overall development of an economy, there must be balanced growth between the rural and urban areas, i.e. the growth should be devoid of rural-urban divide. Likewise, male-female divide (gender divide) should not be allowed in the growth process, and so also all other kinds of divides based on religion, caste, etc. Or, the growth process should be equitable and devoid of all kinds of divides. Extensive use of ICT by the poor and the marginalized, including the women especially rural women, acts as a great enabler that ensures equal opportunities for all. This aspect is particularly relevant now when the ICT-based tools, devices and services are all the more cheap, given their constantly falling prices. For instance, the simplest device, Mobile phone, is affordable even to a poor rural woman. In short, ICT can play a key role in rural transformation, women empowerment etc., thus ultimately leading to balanced and sustainable economic growth.

Women-run MEs, like, hotels run by Kudumbashree women in Kerala can garner better business from the discerning new-generation tourists, both domestic and foreign, if they adopt modern ICT tools in their business processes, say, for online bookings, reservations etc. Only through ICT adoption can any business, including the initiatives of women SHGs, can survive and grow. As already noted, global experiences indicate the immense potential of a small ICT-based device like mobile phone, as observed in Philippines. Pickens (2009) [22]. In the Indian context also, especially in the Kerala State context, ICT-integration can do wonders in the empowerment of women, rural development etc.; as ICT acts as an enabler of successful businesses, especially those run by rural women, the marginalized, and even the physically challenged, etc. Figure 4.

Now Governments, both at the Union and States (like, Kerala, for instance) accord top priority for promoting women-SHGs as well as digitization of SHGs (eg. EShakti project). Thus, ICT-based interventions at all levels is the new normal today. But, here also there should be special consideration to industries and segments having vast linkages, or those having multiplier effects, such as housing, tourism, small scale industries etc. For example, women’s initiatives in the housing sector like PHIRA (Productive Housing in Rural Areas) promotes housing and also ensure income generating units adjacent to the houses. Similar is the case of ecotourism, responsible tourism etc. which can ensure employment to women and other marginalized like tribal people National Housing Bank (2011).

Suggestions and Concluding Remarks

Concluding this paper, it is suggested that (i) measures toward providing financial literacy to women apart from minimum level of general education should be taken up by the State and Union Governments, and (ii) SMS alerts in more number of regional languages (ten languages are available as of FY 2022-end) should be initiated, (iii) ICT awareness camps be held frequently by the banks and Governmental bodies so as to equip rural people, including women, to use various ICT-based services, (iv) internet facilities and tele-density be further expanded to rural areas, including tribal settlements, (v) added thrust on E-Governance at all levels, both at the Central and State levels be initiated, (vi) ICT-based kiosks in rural areas to provide instantaneous information on weather, prices of agricultural commodities etc., and regular training to rural peoples also; etc.

Diverse kinds of issues faced by women must be tackled holistically through engaging them in public activities, particularly income generating units such as MEs. This in turn should invariably through high ICT integration too, wherever feasible, given the immense potential of ICT. The Governmental policies at the Central and State levels are in favor of ICT promotion. The latest move is to promote Digital Banking Units (DBUs) throughout India to dovetail with the ongoing ‘Digital India’ initiative at the national level. At the Kerala State level too, Kerala Knowledge Economy Mission (KKEM) is being promoted in full swing by the GOK. Let us hope that ICT would prove to be an effective tool for women empowerment and rural development in India in the days to come, and hence the balanced, equitable and sustainable growth of the whole economy.

References

AJ, W.G., & Manoj, P.K. (2013). Customer relationship management in banks: A comparative study of public and private sector banks in Kerala.Management,2(9).

Ali, O.P., & Manoj, P.K. (2020). Impact of Falling Price of Rubber-A Case Study of Kothamangalam Taluk in Ernakulam District.Indian Journal of Economics and Development,16(1), 118-124.

Indexed at, Google Scholar, Cross Ref

Asian Development Bank (ADB) (2015),Gender Mainstreaming Case Study India: Kerala Sustainable Urban Development Project

Ghosh, P. (2006). Retention strategies in the Indian IT industry.Indian Journal of Economics and Business,5(2), 215.

Govt. of Kerala (2021), Economic Review, Kerala State Planning Board, Thiruvananthapuram.

Hazarika, D. (2011). Women empowerment in India: A brief discussion.International Journal of Educational Planning & Administration,1(3), 199-202.

IBEF (2022), Banking, New Delhi, India – 110 001.

James, N., & Manoj, P.K. (2014). Relevance of E-Banking Services in Rural Area–An Empirical Investigation.Journal of Management and Science,5, 1-14.

Joju, J., Vasantha, S., & Manoj, P.K. (2015a). E-CRM: A perspective of Urban and Rural Banks in Kerala. International Journal of Recent Advances in Multidisciplinary Research,2(09), 0786-0791.

Joju, J., Vasantha, S., & Manoj, P.K. (2015b). E-CRM: A perspective of Urban and Rural Banks in Kerala.International Journal of Recent Advances in Multidisciplinary Research,2(09), 0786-0791.

Joju, J., Vasantha, S., & Manoj, P.K. (2017a). Electronic CRM & ICT-based banking services: An empirical study of the attitude of customers in Kerala, Indaia.International Journal of Economic Research,14(9), 413-423.

Joju, J., Vasantha, S., & Manoj, P.K. (2017b). Financial technology and service quality in banks: Some empirical evidence from the old private sector banks based in Kerala, India.International Journal of Applied Business and Economic Research,15(16), 447-457.

Joju, J., Vasantha, S., & Manoj, P.K. (2017c). Future of brick and mortar banking in Kerala: Relevance of branch banking in the digital era.International Journal of Civil Engineering and Technology,8(8), 780-789.

Lakshmi, L., & Manoj, P.K. (2017a). Rural customers and ICT-based bank products: A study with a focus on Kannur district co-operative bank and Kerala Gramin bank.International Journal of Economic Research,14(14), 423-434.

Lakshmi, M.P., & Manoj, P.K. (2017b). Service Quality in Rural Banking in North Kerala: A Comparative Study of Kannur District Co-operative Bank and Kerala Gramin Bank.International Journal of Applied Business and Economic Research,15(18), 209-220.

Manoj, P.K. (2007). ICT industry in India: a swot analysis.

Manoj, P.K. (2008). Learning From Cross Country Experiences In Housing: A Micro Finance Approach For Inclusive Housing In India.

Manoj, P.K. (2009). Emerging Technologies and Financing Models for Affordable Housing in India.Directorate of Public Relations and Publications, Cochin University of Science and Technology (CUSAT), Kochi, Kerala, April.

Manoj, P.K. (2010a). Benchmarking Housing Finance Companies in India: Strategies for enhanced operational efficiency and competitiveness.European Journal of Economics, Finance and Administrative Sciences,21, 21-34.

Manoj, P.K. (2010b). Determinants of profitability and efficiency of old private sector banks in India with focus on banks in Kerala state: an econometric study.International research journal of finance and economics,47, 7-20.

Manoj, P.K. (2010c). Environment-friendly tourism for sustainable economic development in India.International Journal of Commerce and Business Managaement,2(2), 139-147.

Manoj, P.K. (2010d). Financial soundness of old private sector banks (OPBs) in India and benchmarking the Kerala based OPBs: a ‘CAMEL’approach.American Journal of Scientific Research,11, 132-149.

Manoj, P.K. (2010e). Impact of technology on the efficiency and risk management of old private sector banks in India: Evidence from banks based in Kerala.European Journal of Social Sciences,14(2), 278-289.

Manoj, P.K. (2010f). Prospects and Problems of Housing Microfinance in India: Evidence from “Bhavanashree” Project in Kerala State.European Journal of Economics, Finance and Administrative Sciences,19(19), 178-194.

Manoj, P.K. (2011). Just in time (JIT) inventory management for enhanced operational efficiency: an ‘Indianised JIT’strategy for an agro machinery manufacturing unit in Kerala.European Journal of Technology and Advanced Engineering Research,2(1), 29-39.

Manoj, P.K. (2012a). Information and communication technology (ict) for effective implementation of mgnrega in india: An analysis.Digital Economy in India: Security and Privacy, First Ed., Serials Publications, New Delhi–110,2.

Manoj, P.K. (2012b). Potential of micro enterprises in women empowerment: A critical study of micro enterprises run by women under the Kudumbashree Programme in Kerala.International Journal of Business Policy and Economics,5(2), 1-16.

Manoj, P.K. (2015a). Deterrents to the Housing Microfinance: Evidence from a Study of the Bankers to ‘Bhavanashree’in Kerala, India.International Research Journal of Finance and Economics,138, 44-53.

Manoj, P.K. (2015b). Deterrents to the Housing Microfinance: Evidence from a Study of the Bankers to ‘Bhavanashree’in Kerala, India.International Research Journal of Finance and Economics,138, 44-53.

Manoj, P.K. (2015c). Socio-Economic Impact of Housing Microfinance: Findings of a Field Based Study in Kerala, India.International Research Journal of Finance and Economics,137, 32-43.

Manoj, P.K. (2015d). Socio-Economic Impact of Housing Microfinance: Findings of a Field Based Study in Kerala, India.International Research Journal of Finance and Economics,137, 32-43.

Manoj, P.K. (2016a). Bank marketing in India in the current ICT era: Strategies for effective promotion of bank products.International Journal,4(3), 103-113.

Manoj, P.K. (2016b). Determinants of sustainability of rural tourism: a study of tourists at Kumbalangi in Kerala, India.International Journal,4(4).

Manoj, P.K. (2016c). Real Estate Investment Trusts (REITs) for Faster Housing Development in India: An Analysis in the Context of the New Regulatory Policies of SEBI, 4 (6) Int’l J.Adv. Res. Comput. Sci. Manag,152.

Manoj, P.K. (2017a). Construction costs in affordable housing in Kerala: relative significance of the various elements of costs of affordable housing projects.International Journal of Civil Engineering and Technology,8(9), 1176-1186.

Manoj, P.K. (2017b). Cost management in the construction of affordable housing units in Kerala: A case study of the relEVAnce of earned value analysis (EVA) approach.International Journal of Civil Engineering and Technology (IJCIET),8(10), 111-129.

Manoj, P.K. (2018). CRM in old private sector banks and new generation private sector banks in Kerala: A comparison.Journal of Advanced Research in Dynamical and Control Systems,10(2), 846-853.

Manoj, P.K. (2019a). Competitiveness of manufacturing industry in India: need for flexible manufacturing systems.Int J Innov Technol Explor Eng,8(12), 3041-3047.

Manoj, P.K. (2019b). Dynamics of human resource management in banks in the ICT era: A study with a focus on Kerala based old private sector banks.Journal of Advanced Research in Dynamical and Control Systems,11(7), 1667-1680.

Manoj, P.K. (2019c). Social banking in India in the reforms era and the case of financial inclusion: Relevance of ICT-based policy options.Journal of Advanced Research in Dynamical and Control Systems,11(7), 1654-1666.

Manoj, P.K., & James, N. (2014). UnorganisedLabour in Housing Construction Sector in Kerala: An Empirical Investigation of Human Rights Issues and other Problmes.International Journal of Scientific Research, 93-97.

Manoj, P.K., & Viswanath, V. (2015). Socio-economic conditions of migrant labourers—An empirical study in Kerala.Indian Journal of Applied Research,5(11), 88-93.

NABARD (2022), Status of Microfinance in India 2020-22, Mumbai,India.

Nasar, K K., & Manoj, P.K. (2013a). Customer satisfaction on service quality of real estate agencies: An empirical analysis with reference to Kochi Corporation Area of Kerala State in India.International Journal of Management, IT and Engineering,3(6), 213.

Nasar, K.K., & Manoj, P.K. (2013b). Customer satisfaction on service quality of real estate agencies: An empirical analysis with reference to Kochi Corporation Area of Kerala State in India.International Journal of Management, IT and Engineering,3(6), 213.

Nasar, K.K., & Manoj, P.K. (2015). Purchase decision for apartments: a closer look into the major influencing factors.International Journal of Research in Applied, Natural and Social Sciences,3(5), 11-38.

National Housing Bank. (2011). Trend and Progress of Housing in India.

Parekh, H.T. (1953). Reserve Bank of India" Trend and Progress of Banking in India"(Book Review).Indian Economic Journal,1(2), 192.

Pickens, M. (2009). Window on the unbanked: Mobile money in the Philippines.

PK, D.M. (2013). Prospects and Challenges of Green Buildings and Green Affordable Homes-Concept: A Study with Reference to Ernakulum, Kerala.

Rajesh, S., & PK, D. (2015). Women Employees work life and challenges to Industrial Relations: Evidence from North Kerala.IPASJ International journal of Managment (IIJM), 3, 5,6.

State Level Bankers. (2010)’ Committee (SLBC)-Kerala, Vital Banking Statistics,.

United Nations. (2016). Digital Financial Inclusion. International Telecommunication Union (ITU), Issue Brief Series,

Received: 30-Sep-2022, Manuscript No. AMSJ-22-12687; Editor assigned: 03-Oct-2022, PreQC No. AMSJ-22-12687(PQ); Reviewed: 17-Oc-2022, QC No. AMSJ-22-12687; Revised: 03-Nov-2022, Manuscript No. AMSJ-22-12687(R); Published: 25-Nov-2022