Research Article: 2022 Vol: 25 Issue: 2S

Analysis of Influence of Digital Technologies on Financial Sustainability of Russian Companies

Svetlana Vasilievna Zemlyak, Financial University under the Government of the Russian Federation

Galina Alekseevna Khromenkova, Financial University under the Government of the Russian Federation

Galina Zinullaevna Tishchenkova, Financial University under the Government of the Russian Federation

Citation Information: Zemlyak, S.V., Khromenkova, G.A., & Tishchenkova, G.Z. (2022). Analysis of influence of digital technologies on financial sustainability of russian companies. Journal of Legal, Ethical and Regulatory Issues, 25(S2), 1-14.

Abstract

This article covers the issues of financial sustainability of an enterprise in the modern economy transforming under the influence of digital technologies. The authors study the types and defining characteristics of financial sustainability of an enterprise. The authors raise the issue of studying the relationship between financial sustainability, digitalization and sustainable business development using the example of Russian companies. Particular attention is paid to identifying and managing risks that pose a threat to financial and economic activities of an enterprise. The prospects are outlined for the use of artificial intelligence technologies in diagnosing the state of an enterprise and the Big Data technology in modeling its development. The concept of multi-loop sustainability control is proposed which uses the Big Data technology and contains two groups of control loops. The authors believe that the tasks of further research shall be the study of digital twins and digital logistics networks in the context of financial sustainability of enterprises.

Keywords

Digitalization, Financial Sustainability, Blockchain, Big Data

Introduction

The development of the economy at the present stage is inextricably associated with the processes of globalization affecting almost all spheres of society, such as: political, social, cultural, economic (Kuckertz, 2020; Saadatmand, Lindgren & Schultze, 2019; Sutherland, 2018). The increasing direct introduction of information technologies into the activity systems of financial and economic units leads to the strengthening of communication links, which directly speeds up the processes of development and transformation of the world economic environment and community (Barykin et al., 2020).

The current economic situation can be described by the characteristic features inherent in the current state of the national economy, such as: instability, unpredictability and growing competition with active introduction of digital technologies in all financial and business processes of an enterprise, which affects the relationship of companies with external business partners and affects the financial sustainability (hereinafter - “FS”) of an enterprise. The work (Rodionov, Perepechko & Nadezhina, 2020) identified the parameters that could be used to judge the factors that affect the value and economic security of business entities.

Analyzing the concept of financial sustainability, the authors assert that financial sustainability is a complex characteristic that has external forms of manifestation and depends on a variety of factors including digitalization and sustainable development (Filser et al., 2019; Gh Popescu, 2019). The variety of factors affecting sustainability of a company subdivides it into external and internal, and the variety of aspects of consideration determines the existence of different facets of sustainability.

Materials and Methods

Financial sustainability (FS is the most important characteristic of the financial and economic activity of an enterprise in modern economic conditions, since this indicator is the basic parameter of a corporate strategy.

The concept of financial stability can be viewed from the perspective of sustainable development. One can agree with the work that currently the relationship between financial management and sustainable business development is not fully considered (Al Nuaimi & Nobanee, 2019). The authors agree that the issues of sustainable development should be investigated in the context of digitalization (Alkaabi & Nobanee, 2019; Geng & He, 2021; Santis, 2020; Santis, Incollingo & Citro, 2021; Úbeda, Forcadell & Suárez, 2021). The scientific article (Barykin et al., 2021a) raises the question of sustainability of logistics systems in the context of digitalization. An interesting approach is presented in the articles on sustainability of company finances and the banking sector (Abdul Quddos & Nobanee, 2020; Kim, 2018). Undoubtedly, digitalization is associated with sustainable development, which is shown by the example of the study of problems of development of the Silk Road countries (Geng & He, 2021). The authors agree with the opinion that financial sustainability shall be assessed in the aggregate factor of sustainable development of a company, which follows from the work (Ahsan, Al-GAMRH & Mirza, 2021).

According to the authors, financial sustainability is a certain state of accounts of an enterprise which guarantees its constant solvency. In this case solvency acts as an inherent component of financial sustainability, its external characteristic.

The authors also assert that financial sustainability of an enterprise lies in its ability to function and develop while maintaining the balance of assets and liabilities under conditions of constant transformation of the external and internal environment, which ensure the enterprise’s constant solvency and investment attractiveness within an acceptable degree of risk.

The essence of FS is maintenance of the enterprise’s solvency over time, accompanied by observance of the financial balance between the enterprise’s own and borrowed funds.

Financial sustainability is the guaranteed financial and credit solvency of a company as the result of its activities based on effective formation of financial resources, their distribution and further use. At the same time, financial sustainability is the provision of stocks and assets of an enterprise with its own sources of their formation, while observing an optimal ratio of the company’s own and borrowed funds.

A change in financial sustainability occurs as a result of changes having an internal or external cause, including random ones, caused by mistakes and miscalculations of the enterprise’s management. The sustainability of the financial condition of an enterprise is formed under the influence of the factors of digital transformation in the context of sustainable development. The range of financial sustainability by the nature of its manifestation extends from absolute sustainability as a positive characteristic to a financial crisis which is another boundary value. Financial sustainability of an enterprise can be local or systemic and is an inherent characteristic of activities of the enterprise in question.

The company’s ability to timely make obligatory payments and settlements with counterparties, to finance its activities on an extended basis, to maintain solvency in unfavorable circumstances evidences the sustainability of the company’s financial condition.

Let’s examine the content of each type of enterprise sustainability one by one.

• The internal sustainability is the state of an organization (the structure of production of goods and provision of services, their dynamics), which consistently ensures a high result of the company’s activities. The basis for its achievement is the principle of active and adequate response of the company’s management to changes in the business environment;

• The external sustainability of an organization is inspired by the stability of the external economic environment, within which the company operates, and is achieved by effectiveness of the external environment management, on a national scale;

• The “inherited” sustainability is the result of presence of a certain margin of stability and financial strength of an organization, which has been formed over a number of years and protects the organization from sudden changes in the external environment;

• The overall sustainability reflects the level of efficiency of the investment projects of an enterprise; the level of material and technical equipment, organization of labor and production, management activities; presupposes gaining profit by the organization and effective development of production and economic activities;

• Financial sustainability reflects a stable excess of income received by an enterprise over expenses and such a state of resources that allows an organization to freely manipulate the available funds through their effective use within the framework of a flawless process of commodity production and sale, expansion and renewal of production assets. It reflects the ratio of various elements in the structure of capital, the rate of accumulation of equity capital by the company in the course of current, financial and investment activities, the ratio of immobilized and mobile assets of the organization, the adequacy of provision of stocks and expenses of the company with its own sources of financing.

FS is a consequence of the balanced movement of financial flows of an enterprise, as well as the availability of financial means to ensure current activities of an enterprise over a certain time period. It can be considered as the enterprise’s solvency indicator in the long run.

FS is, on the one hand, an indicator of the amount of resources available to the company, with the help of which it is possible to plan current activities while achieving the required level of flexibility of the financial mechanism by transferring available financial resources between different areas of activities. At the same time, financial sustainability is an indicator of financial risk, allowing to determine the effectiveness of a company in the external environment. In this aspect, financial sustainability correlates with the level of competitiveness of a company. So, financial sustainability, in our opinion, can be considered as a link between the production and marketing strategies of a company, and therefore, can serve as the basis for development of functional strategies of an enterprise in the interrelation of financial sustainability and sustainable development.

Let us consider the dynamics of indicators of financial sustainability of Russian enterprises.

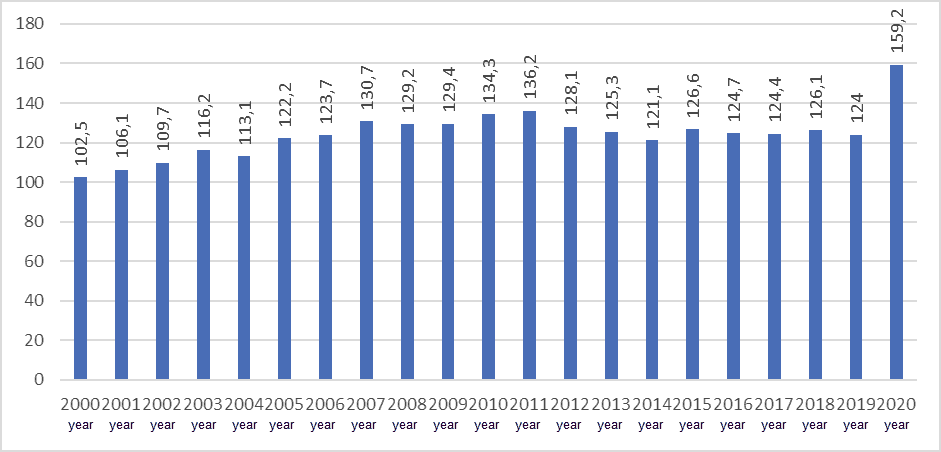

Figure 1 shows the dynamics of the current liquidity ratio of Russian enterprises.

The standard value of the current liquidity ratio is 100% - 250% (or 1 - 2.5). For the period from 2000 to 2020, the current liquidity ratio of domestic enterprises stays within the standard range, i.e., higher than 100. Accordingly, domestic enterprises, on average, are able to settle their urgent liabilities from their own sources. During the study period, insignificant fluctuations of the current liquidity ratio are observed, however, in 2020 the ratio increases significantly, up to 159.2.

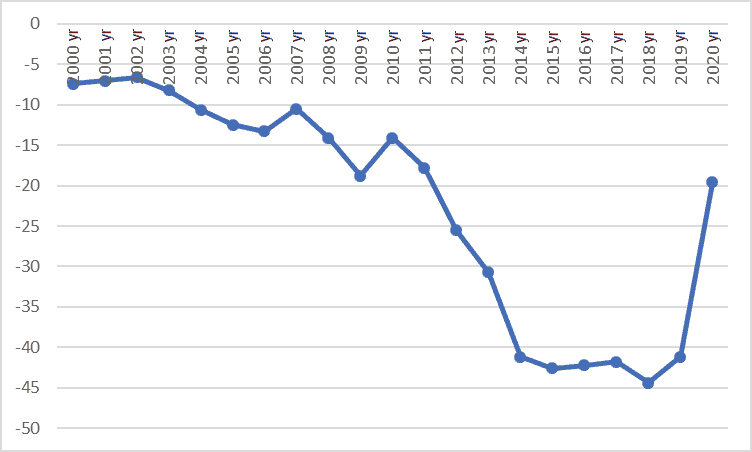

Figure 2 illustrates the dynamics of the ratio of provision of Russian enterprises with their own circulating assets.

The standard ratio of provision with own circulating assets shall be not less than 0.1 or 10%. During the entire study period, the ratio never reaches the standard value and takes only negative values. At the same time, since 2011, there has been a trend towards a decrease in the value of the ratio of own circulating assets: in 2018 it reaches its minimum value. After that, a rapid increase in the ratio begins.

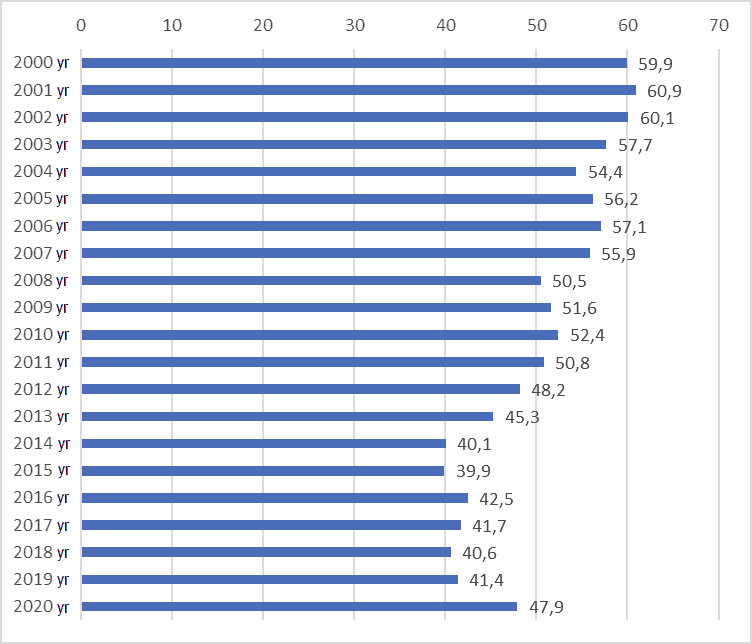

Figure 3 shows the dynamics of the equity ratio of domestic enterprises

The generally accepted standard for the equity ratio is 0.5 (50%) and higher, the optimal value is defined to be 0.6 - 0.7 (60 - 70%). In the world practice, the minimum acceptable value for an enterprise is 30 - 40% of the equity capital in the structure of liabilities. In the period from 2000 to 2011, the average value of the equity ratio meets the national standard, amounting to more than 50%. However, since 2012, the value of the equity ratio has been decreasing and, on average, does not reach the standard value, amounting to 48.2 - 41.4%. In 2020, the value of the equity ratio increases sharply and reaches 47.9%.

So, Russian enterprises, on average, are able to settle their urgent obligations using their own sources. At the same time, the majority of enterprises lack their own circulating assets. In addition, a deterioration in the structure of liabilities of domestic enterprises can be noted: an increase in the share of borrowed funds and a decrease in the share of own funds.

Results

Digital Transformation of the Russian Economy and Innovations

The digital transformation of the economy is a key element in transformation of the economic system of Russia within the framework of the Industry 4.0 concept. At the same time, there is a change in the model of economic management and its transformation into a programmed predictive model. The introduction of digital technologies into all spheres of the economy is fundamentally changing the entire economic structure and transforming digital technologies and related infrastructures into new sources of added value and leading links in development of the economy.

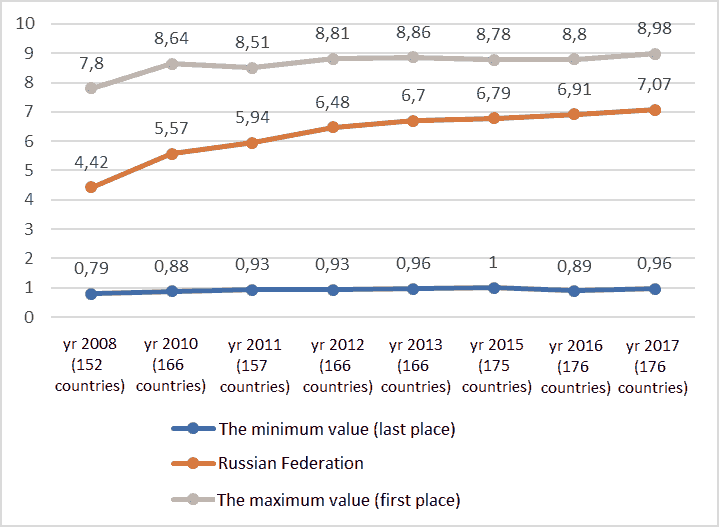

The process of digital transformation of the economy is a vivid example of transition of quantitative changes to qualitative ones. The growth of memory volumes and speed of computing technology allowed creating and effectively using a number of new technologies, which in turn contributed to even more dynamic development of hardware and software of computing systems (Figure 4).

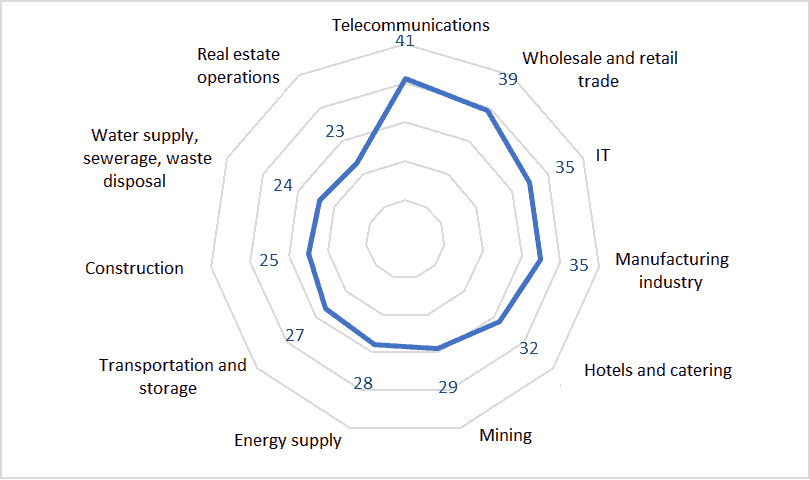

The business digitalization index characterizes the level of use of the broadband Internet, cloud services, RFID technologies, ERP systems, and the involvement of business sector organizations in the e-commerce (Figure 5).

Traditional digital technologies that are widely used in digital economic systems are the Big Data technologies, cloud technologies, neural network technologies, artificial intelligence, additive and 3D manufacturing technologies, Cyber-Physical Systems (CPS), industrial Internet, robotics, sensorics, quantum sensors, industrial analytics, mathematical modeling and forecasting, etc. In the process of digitalization, the principle of Straight-Through Processing (STP) is also implemented, when manual intervention is excluded at all stages of data processing. In addition, when managing economic systems, it becomes possible to quickly, almost instantaneously respond to exogenous changes.

Despite the existing problems, the economy of the Russian Federation has no other way of development other than its digital transformation. This is especially necessary in modern, especially difficult conditions, characterized by significant fluctuations in energy prices on world markets and the international sanctions. All this is a serious challenge both for the economy as a whole and for individual enterprises.

The development of technology provides many opportunities for enterprises, as well as creates threats and obstacles that Russian enterprises will have to face.

Digital transformation of the Russian economy at the macro level, affecting a number of exogenous factors, will naturally have a positive impact on the sustainability of enterprises. Here, it is possible to increase the volume of national income and increase the level of real incomes of the population, stabilize the regulatory legislation and the tax system, reduce inflation and accelerate the payment turnover. But at the same time, it is possible to predict an increase in unemployment among, first of all, the aged population, which has limited opportunities to adapt to the conditions of digital transformation. Simultaneously, negative demographic trends can lead to a shortage of personnel capable of effective work under the new conditions. If no measures are taken to limit the growth of unemployment, a situation may arise of a decrease in the capacity of the domestic market, which will increase competition, especially from enterprises that have digital transformation carried out timely and efficiently.

Digitalization of the economy creates new factors affecting the financial sustainability of an enterprise and its competitive position in the business environment, and allows to use the entire list of advantages of the new technologies era:

1) Coherence of analytical data. In order to form a contact customer environment for exploring and understanding customers, an integrated approach to processing of analytical data is required. This is necessary for drafting and solution of processional tasks, for development and implementation of the set business goals.

2) Integration of technology and automation. In order to automate tasks of any scale, a set of tools and technologies is needed, such as: web analytics, CRM systems, introduction of integrated advertising technologies, and personalized advertising automation.

3) Analysis of results and application of conclusions. The decisions made on the basis of analytics will allow determining the business value of each single interaction with the consumer on the way to direct purchase and further implementation of the obtained data in the light of achieving business goals, in terms of sales and profits.

4) Strategic partnership. The technologies used and introduced are able to independently form an ecosystem. The key to successful collaboration with technology developers and providers is maintaining and securing ownership of the technology being introduced and the data processing.

The use of the Big Data processing technology makes it possible to process and analyze data volumes measured not only in terabytes, but even in exabytes. Of course, exabyte volumes of information in enterprise management systems are unlikely to be formed, but terabyte volumes are also enough to accumulate almost all current information about the financial and production activities of an enterprise. In this regard, it becomes necessary to create new methods of information processing, when instead of collapsing the financial indicators to various criteria, their entire volume is analyzed.

For example, in the well-known five-factor Altman criterion, the following indicators are collapsed: the liquidity indicator (the ratio of the circulating capital to assets), the profitability indicator (the ratio of retained earnings to assets), the sustainability indicator (the ratio of income before taxes and the interest to assets), the solvency indicator (the ratio of the balance sheet price of shares to the debt) and the activity indicator (the ratio of sales volume to assets). When collapsing, for each indicator its own weight ratios are set.

When using the Big Data or neural network technologies, the collapsing of indicators can be replaced by the analysis of their dynamics in a multidimensional factor space. However, such techniques are currently lacking and require development. Therefore, the digital transformation of industrial enterprises opens up prospects for increasing their sustainability based on a more dynamic and effective analysis of the current financial condition, as well as modeling and forecasting financial sustainability with various strategic and tactical management decisions. The analysis of the dynamics of financial and material flows in the production system can become deeper, allowing timely detection of their possible deviation from the equilibrium flow with a simultaneous assessment of financial risks to control the acceptability of their level.

Digital Technologies and Financial Sustainability of Scientific and Production Activities of Russian Companies

Digital technologies are used in the process of introducing innovations and play an important role in the development of the Russian Federation and its regions. Innovations introduced on the basis of digital technologies form and ensure the competitiveness of the economy within the country and in the international market. In the world markets, recently, an increase in market competition and in the cost of raw materials and energy resources is observed. In this regard, Russian enterprises that are engaged in implementation of innovations based on the generation of knowledge and the introduction of digital technologies in the process of interaction between the academic and business environment have a high level of competitiveness, which makes it possible to ensure production efficiency, minimization of the cost of material resources and mobility of technological processes.

Of obvious empirical interest in the process of researching the financial sustainability of scientific and production activities of modern companies is the characteristic of the degree of influence of intensive (volumes of developed, produced and sold high-tech science-intensive products) and extensive (prices of the sold innovative goods) scientific and production factors on the achieved result.

Based on the results of calculation of the economic turnover, it is possible to establish the amount of savings/over expenditure of the circulating capital, defined as the product of the value of a one-day sale of high-tech products and the difference in days of turnover of the current and past time periods:

1) The intensive research and production factor is a calculated and analytical characteristic of the degree of influence of the natural volume of developed, produced and sold high-tech products on the result of the activity of an economic entity:

Where Q0, Q1, – is the volumes of developed, produced and sold high-tech science-intensive products established during the past and current time periods, respectively;

P0 is the price of high-tech science-intensive products produced and sold by an economic entity, fixed as of the previous time period

2) The extensive scientific and production factor provides economic information on the degree of influence of the dynamics and trends in price changes for developed, manufactured and sold high-tech science-intensive products on the scientific and production result achieved by an economic entity:

Where P1– is the price of high-tech science-intensive products developed, produced and sold by an economic entity, fixed as of the current time period.

3) The mutual influence of the intensive and extensive scientific and production factors on the result achieved by an enterprise is calculated as follows:

where  ; – is the cost interpretation of the results of scientific and production activities of an economic entity established in the process of calculation and analytical research, respectively, of the past and present time periods

; – is the cost interpretation of the results of scientific and production activities of an economic entity established in the process of calculation and analytical research, respectively, of the past and present time periods

Any innovation is implemented under certain financial conditions, the combination of which is a set of the innovation investment sources. The innovative activity requires substantial sources of research funding. Insufficient funding is one of the main problems hindering the innovative development of the Russian economy.

In the context of digital transformation, it is possible to propose an algorithm for choosing the sustainable source of financing for an innovative project from three stages:

1) Definition of the required amounts of financial resources.

2) Selection of a funding source based on the availability criterion.

3) Selection of the best financial instruments in the context of digital transformation based on financial sustainability.

The structure of investment sources for projects is very important and creates certain conditions favorable for formation and development of innovative activities. When forming the conditions for investing in innovative projects, it is necessary to take into account both internal (human resources, the need for preliminary scientific research, predicted efficiency and results) and external factors (the level of participation of the state in the investment processes, the stock market, globalization, etc.).

The sustainability of the investment structure of an innovative project shall be carried out continuously and contribute to the improvement of conditions for implementation of innovations. The process of building an effective investment structure for an innovative project under the specific conditions of the economy shall be based on the results of evaluation of effectiveness of all types of available sources.

The main criterion influencing the choice of funds is the financial sustainability of an innovative project. For example, external financing is much more effective than internal financing. Just as important is the ownership structure of an entity implementing the innovative project, as well as the phase of the project, information support of the project, scientific and financial conditions for implementation of the project. Based on the possible investment scheme.

Increasing the financial sustainability of innovative projects shall lead to the growth of the science-intensive technologies market and to the increase in the effective output of the innovative potential.

There is a wide variety of forms and models of formation of the structure of financing innovative activities, which are actively used abroad and have spread in our country. Currently, the main form of financing the innovations development is self-financing with some influence on the economic process from the state. However, since own funds are usually insufficient for development and modernization of production facilities in the context of overcoming the consequences of the global economic crisis, it is necessary to use external financing (borrowed funds).

The tools for supporting scientific research and innovative entrepreneurship are very diverse and can be of both state and non-state nature. In Russia, in the context of digitalization, non-state mechanisms for supporting innovative projects shall prevail.

For example, in addition to traditional sources of financing, which include tax incentives, venture financing, concessional lending, the popularity of forms of investment in innovations that are new for Russia is growing. Such forms are: innovation vouchers, leasing and factoring in innovation activities, attracting private investors. It is also possible to engage non-state pension funds, insurance companies and individuals in the investment of innovative projects, in the processes of financing of innovative developments with comprehensive state support of these processes, the use of various forms of incentives and financing of investment activities, which have proven themselves well in foreign countries.

The authors can prove that the institutionally sustainable and effective development of investment in innovative projects in the Russian Federation on the basis of a systemic and problem-oriented approach shall ensure an increase in the country’s gross domestic product, an increase in efficiency of individual economic entities and an increase in innovativeness as a characteristic of all spheres of life of the population.

Digital Technologies and Financial Sustainability of Scientific and Production Activities of Russian Companies

The authors propose recommendations for optimization of financial sustainability during planning and implementation of innovative projects (Table 1).

| Table 1 Recommendations on Improving the Financial Sustainability of Innovative Projects in Russia |

||

|---|---|---|

| Name of the Project | Sources of Investment Used | Recommendations on Improving the Financial Sustainability of Innovative Projects |

| 1. Development of technologies and mastering of serial production of a new generation of sealing and fire-retardant materials for general industrial use | Own (100%) | Attraction of third-party investments (up to 100%) - including funds from private investors, foreign investments and bank loans (up to 50%) |

| 2. Development of technologies and mastering of production of devices and equipment for the nanotechnology | Own funds (70%) and subsidizing by the region (30%) | Attraction of third-party investments (up to 100%) - including funds from private investors and bank loans (up to 80%) |

| 3. Introduction of industrial production of metallic materials with a twofold enhancement of the most important performance properties | Own funds (55%) and borrowed funds (45%) | Attraction of third-party investments (up to 60%) Increase in the share of borrowed sources - up to 50% |

| 4. Increasing the efficiency of solid waste recycling on the basis of modern domestic technologies and equipment with producing of secondary raw materials and marketable products | Own funds (90%) and a grant from the Government of St. Petersburg (10%) | Attraction of third-party investments (up to 90%) - including funds from private investors and bank loans (up to 50%) |

| 5. Development and mastering of production of a family of highly efficient combined cycle power plants | Own funds (50%) and equity financing (50%) | The investment structure is acceptable. Attraction of borrowed sources is possible - up to 10-20% |

Optimization of financial sustainability of an innovative project implemented on the basis of digital technologies expresses such a ratio of funding sources, which provides the most effective relationship between the profitability of own and borrowed sources of investment in an innovative project.

Improving financial sustainability of innovative projects is possible depending on the specific economic conditions of individual enterprises.

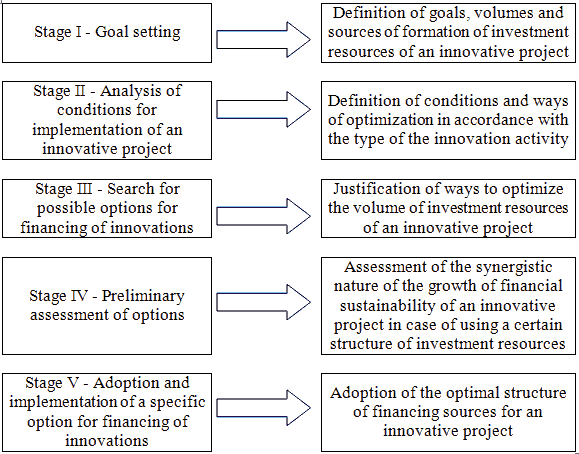

A scheme of improvement of financial sustainability of innovative activities shall consist of five stages (Figure 6).

The process of improving the financial sustainability of an innovative shall should be carried out according to the following three stages:

A. Focus on the proportional ratio of own and borrowed sources, taking into account the specifics of the economic activity of the enterprise implementing the innovative project, as well as the conditions for prevention of bankruptcy;

B. Improving the structure of sources of innovations investment according to the criterion of maximizing profits and minimizing risks associated with development and implementation of an innovative project;

C. Orientation on ensuring the increase in effects for partner enterprises and enterprises in the region in terms of the return on investment in the long term.

At the first stage, the effectiveness of a project is assessed from the economic point of view as well as of the feasibility of its implementation and its compliance with the innovative goals of the enterprise. Next, it is necessary to form the amount of investment resources in accordance with the investment needs of the project. When agreeing on compliance of the structure of financial sources for implementation of an innovative project according to the optimization criteria, it shall be checked whether the chosen structure meets the required volume of investment resources. Taking into account the existing approaches to optimization of the structure of the invested capital, it is advisable to undertake complex measures.

Thus, in order to effectively manage the sustainability of an enterprise in the context of digital transformation of the economy, it is necessary to combine forecasting the state of the enterprise with monitoring and diagnosing its real state. This can be accomplished on the basis of the concept of multi-loop sustainability control.

The financial sustainability of an enterprise is ensured by multi-loop management. The whole variety of control loops can be divided into two groups. The first group includes model-based control loops. They provide stochastic simulation of production and sales of products, taking into account the uncertainty of exo- and endogenous factors and parameters, including anthropoentropy, and determine the probabilistic criteria for maintaining sustainability.

In the second group of control loops, a subsystem of complex diagnostics operates, which, based on monitoring of exo- and endogenous factors and parameters, assesses the current real sustainability and provides a short-term forecast of maintaining or loss of sustainability under the current operational management and strategic direction of the enterprise.

When there are any disruption tendencies detected in one of the sustainability control loop groups, a complex of operational control actions or strategic decisions aimed at preventive elimination of such a tendency to the loss of sustainability shall be developed. In this case, measures are developed to reduce the anthropoentropy and the methods of the theory of limitations are used to identify the weak points of the production system.

In the first group of control loops based on a stochastic simulation model, taking into account the uncertainty of exo- and endogenous factors and parameters, including anthropoentropy, probabilistic criteria for maintaining sustainability and predicted endogenous indicators are determined in the context of enterprise development in case of implemention of the selected complex of operational control actions or strategic decisions. In this case, the prediction of values of endogenous parameters is carried out as well as their further comparison with the achieved real values after expiration of the period of waiting for results. In case of a significant discrepancy between the forecast and the real state, a search for new options of control actions at the operational or strategic level takes place.

In the second group of control loops, a subsystem of complex diagnostics monitors exo- and endogenous factors and parameters, as well as assesses the current real sustainability and provides a short-term forecast of maintaining or loss of sustainability under the new option of operational management and new strategic decisions.

Next, the actions of the third item of the conceptual algorithm are performed and the control cycle is repeated. For operation of both groups of control system loops, a unified database of control actions of tactical and strategic levels, exo- and endogenous factors, parameters and diagnostic indicators, based on the use of the Big Data technologies, is used.

Thus, in the context of digital transformation of the Russian economy, for maximum efficiency at enterprises, this process shall cover all areas of activity. Here, additional opportunities arise for maintaining and increasing the sustainability of operation and development of an enterprise, as well as new problems associated with expenditure of resources for digital transformation, the dangers of hacker attacks and destabilization of enterprise management. Therefore, an urgent area of research is the solution of the aforementioned problems, since at the moment there is no alternative to digital transformation for the further development of the Russian economy and for preservation of the economic sovereignty of Russia.

Discussion

The authors propose to discuss a separate problem that is important for ensuring the sustainability of Russian enterprises. The authors believe that such a problem is the timely detection of tendencies to disruption of sustainability. It can be demonstrated that in the context of digitalization, an earlier time frame for detecting tendencies to sustainability disruption allows an enterprise to save time to undertake adequate measures. In this case, the availability of a modern diagnostic system at Russian enterprises allows timely detection of tendencies to disruption of financial sustainability. The authors would like to draw attention to the fact that in the context of digital transformation of an enterprise, a number of new opportunities appear for such diagnostics, also based on modern information technologies, such as Big Data, artificial intelligence, etc. This system shall diagnose both the potential of an enterprise and its current activities, as well as predict changes in its state that may lead to the loss of sustainability. The authors believe that it is especially important to ensure the operation of such a diagnostic system in an uncertain and unstable environment.

The Big Data processing technologies also make it possible to monitor the equipment available at the enterprise and quickly control its physical deterioration, and the analysis of the market situation and technical progress in development and production of the equipment used will allow detecting or predicting its obsolescence. All this will also contribute to increasing sustainability, of course, provided that there is a financial opportunity for timely renewal or modernization of equipment. The authors believe that the tasks of further research shall be the study of digital twins and digital logistics networks (Barykin et al., 2021d, 2021b, 2021c) in the context of financial sustainability of enterprises.

Conclusion

Creation of a modern production facility with innovative technologies and equipment which allows not only to flexibly change the assortment, but also to change the organizational and technological structure of production without significant expenses, can significantly increase the sustainability potential of an enterprise. However, here, one shall not equate the sustainability potential and the innovation potential, since the costs of financial and other resources of an enterprise required to create the innovative potential can generally lead to a decrease in sustainability. This is aggravated by the fact that innovative restructuring of production requires a certain, and sometimes quite long, period of time during which the volume of production can decrease, as a result of which a tendency to disruption of sustainability can also appear. At the same time, after creation of the innovative potential, the sustainability of an enterprise naturally increases, but only provided that this potential is effectively implemented in a constantly changing external environment with significant uncertainty. In order to effectively implement the sustainability potential, not only modern, effective management is needed, covering all levels of the enterprise management system, but also modern marketing is needed for constant monitoring and forecasting of demand for manufactured products to correspondingly change the assortment, which also requires introduction of modern information technologies. However, the effectiveness of management and marketing can be reduced due to human error.

Another area of effective use of the benefits of digital transformation for financial sustainability of an enterprise is the field of marketing. This area opens up a number of new opportunities: the Internet of Things, the Big Data technologies, the use of artificial intelligence for marketing research, etc. All of these areas of digital transformation will undoubtedly have a positive impact on marketing effectiveness, which will help to enhance sustainability of an enterprise.

In the context of changing external environment, sustainability of an enterprise can only be ensured in the form of dynamic stability, when the production system has the ability to maintain its basic functional parameters and to develop. Changes in exogenous factors can be very significant and cause corresponding changes in endogenous factors, which in turn will contribute to the restoration of the necessary production parameters. However, we shall not forget that there is always some limiting or critical threshold for the change in exogenous factors, at which, eventually, the loss of sustainability occurs. Therefore, the task of sustainability management is to increase this threshold level.

Thus, the digitalization of the economy also affects the enterprise and requires a high degree of adaptability while maintaining a certain level of stability and sustainability.

Under the conditions of digital transformation of industrial enterprises, it is necessary, when choosing management decisions at the strategic and operational levels, to take into account the change in the influence of exo- and endogenous factors on the sustainability of an enterprise in the new conditions of digitalization in order to use the advantages of the digital economy and the fourth industrial revolution to increase the sustainability of operation and development of industrial enterprises.

Funding

The article has been prepared based on the results of studies supported by budgetary funds in accordance with the state order for the Financial University under the Government of the Russian Federation on the topic «Analysis of the impact of digital technologies on the financial stability of Russian companies».

References

Abdul Quddos, M., & Nobanee, H. (2020). Sustainable capital structure: A mini-review. SSRN Electronic Journal.

Ahsan, T., Al-GAMRH, B., & Mirza, S.S. (2021). Economic policy uncertainty and sustainable financial growth: Does business strategy matter? Finance Research Letters. Elsevier Inc. 102381.

Alkaabi, H., & Nobanee, H. (2019). A study on financial management in promoting sustainable business practices and development. SSRN Electronic Journal.

Barykin, S.E. (2021a). Sustainability of management decisions in a digital logistics network. Sustainability, 13(16), 9289.

Barykin, S.Y. (2021b). Developing the physical distribution digital twin model within the trade network. Academy of Strategic Management Journal 20(1), 1–24.

Barykin, S.Y., Bochkarev, A.A., Dobronravin, E., & Sergeev, S.M. (2021c). The place and role of digital twin in supply chain management. Academy of Strategic Management Journal, 20(2), 1–19.

Barykin, S.Y., Kapustina, I.V., Kirillova, T.V., Yadykin, V.K., & Konnikov, Y.A. (2020). Economics of digital ecosystems. Journal of Open Innovation: Technology, Market, and Complexity, 6(124), 16.

Barykin, S.Y., Smirnova, E.A., Sharapaev, P.A., & Mottaeva, A.B. (2021d). Development of the Kazakhstan digital retail chains within the EAEU E-commerce. Academy of Strategic Management Journal, 20(2), 1–18.

Filser, M., Kraus, S., Roig-Tierno, N., Kailer, N., & Fischer, U. (2019). Entrepreneurship as catalyst for sustainable development: Opening the black box. Sustainability (Switzerland) 11(16).

Geng, Z., & He, G. (2021). Digital financial inclusion and sustainable employment: Evidence from countries along the belt and road.Borsa Istanbul Review. Elsevier Ltd, 21(3), 307–316.

Popescu, C.R. (2019). Corporate social responsibility, corporate governance and business performance: Limits and challenges imposed by the implementation of directive 2013/34/EU in Romania. Sustainability (Switzerland), 11(19).

Kim, J. (2018). Collaborative leadership and financial sustainability in local government. Local Government Studies. Routledge, 44(6), 874–893.

Kuckertz, A. (2020). Bio economy transformation strategies worldwide require stronger focus on entrepreneurship. Sustainability (Switzerland), 12(7).

Al Nuaimi, A., & Nobanee, H. (2019). Corporate sustainability reporting and corporate financial growth. SSRN Electronic Journal.

Rodionov, D., Perepechko, O., & Nadezhina, O. (2020). Determining economic security of a business based on valuation of intangible assets according to the International Valuation Standards (IVS).Risks, 8(4), 1–14.

Saadatmand, F., Lindgren, R., & Schultze, U. (2019). Configurations of platform organizations: Implications for complementor engagement. Research Policy. Elsevier, 48(8), 103770.

Santis, S. (2020). The demographic and economic determinants of financial sustainability: An Analysis of Italian Local Governments. Sustainability, 12(18), 7599.

Santis, S., Incollingo, A., & Citro, F. (2021). How to manage the components of financial sustainability in local governments. Journal of Management and Sustainability, 11(2), 111.

Sutherland, E. (2018). Trends in regulating the global digital economy. SSRN Electronic Journal, 1–29.

Úbeda, F., Forcadell, F., & Suárez, N. (2021). Do formal and informal institutions shape the influence of sustainable banking on financial development? Finance Research Letters, 102391.

Zemlyak, S.V., Sivakova, S.Y., & Nozdreva, I.E. (2021). Risk assessment model of government-backed venture project funding: The case of Russia. Journal of Legal, Ethical and Regulatory Issues, 24(S1), 1–12.

Received: 30-Dec-2021, Manuscript No. JLERI-21-8941; Editor assigned: 02-Jan-2022, PreQC No. JLERI-21-8941(PQ); Reviewed: 14-Jan-2022, QC No: JLERI-21-8941; Revised: 23-Jan-2022, Manuscript No. JLERI-21-8941(R); Published: 30-Jan-2022